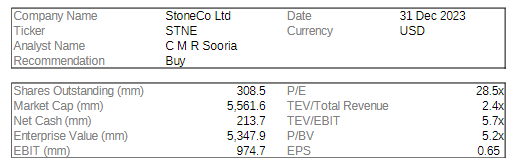

Initial Report: StoneCo (STNE), 43% 5-yr Potential Upside (EIP, Sooria CMR)

Sooria believes that Stone presents itself as an attractive growth stock trying to combine financial services and software in order to make merchants more productive

Summary

With a 22% potential upside, Stone presents itself as an attractive growth stock trying to combine financial services andsoftware in order to make merchants more productive. Experienced management team with previous success businessesin the same payments industry. Gained efficiency while also investing in several areas to better serve clients, such asenhancing customer service and integrating its financial services platform to POS and ERP solutions in strategic verticals,which opens a key cross-sell opportunity. A strong disruptor in Brazil’s payments industry, they have a large and growing TAM, whosenetwork effects helps to generate more value for the company, and is set to further secure market share.

Overview

Stone is a leading provider of financial technology solutions in Brazil with its revenue doubling in 2022 andbeing up 44% yoy

Stone’s business activity comprises two segments: financial services, which make up 85% of Stone’s revenue,and software, which is mainly used to help SMBs in Brazil develop and expand

Brazil’s fast growing e-commerce market has a large market size of $24 billion and is expected to reach acombined transactional value of $79 billion by 2024

Covid-19 has helped increase adoption of digital transformation by MSMBs and FinTechs like Stone, PagSeguroand Cielo are the big players who are paving the way for these MSMBs to digitalize

Thesis

Stone can capitalise on the large total addressable market of more than 13.5 million MSMBs. With Stonecurrently holding 11% of the market share in payments, there is huge potential for Stone to grow

Stone leveraging on its ecosystem generates more value and allows it to compete more effectivelyby creating anetwork effect amongst its software and thus reducing reliance on third-party companies

Stone is able to improve their market position via its curated M&A strategies that enhance value creation formerchants and boost revenue growth

Take rate expected to remain resilient despite competition, as Stone leverages its hyper-local distributionmodel to forge closer ties with merchants and provide dedicated service based on individual needs

Key concerns

Credit lending issues could potentially resurface due to unfavourable macroeconomic conditions as they re-enterthe credit market. As Stone has experience dealing with credit risk and losses in the past, these issues can bemitigated through a more careful approach to the credit market

Ever-changing regulatory landscapeposes a significant risk to Brazilian fintech players. It can be mitigatedthrough careful considerations of the impactat the early stages of proposal as well as through participation in the Central Bank’s public consultations

Valuation

12m projected target price: USD 21.92. 22% potential upside

Business overview

Stone was launched in 2012 (SeekingAlpha, 2022)

Mission is focused on empowering our clients to grow their businesses and help them conduct commerce and run their operations more effectively (Stone, n.d.)

They make the offer of financial services fairer for Brazilian retailers, supporting each one of them in their entrepreneurial journey

Products and services

Stone’s products and services form an ecosystem that form the financial backbone of SMBs in Brazil

Their main business segments include:

Financial services accounts for 85% of 4Q22 revenue and consists of Tag, credit lending, digital banking, and financial payment solutions (Stone, 2022)

As Stone is a merchant acquirer, Tag generates revenue through merchant discount rates (MDR) for their payment processing services

Credit services that Stone offers differentiates itself from competitors by offering a full self-service experience that allows customers to monitor their loans without the bureaucracy of traditional banks (Stone, 2019)

Digital banking contains in-house built technology with direct integration with the Central Bank’s backbone (Stone, 2018)

Third-party verification services used to check and confirm client’s customer information and receivables discounting attained through using their funds to settle payments that have been registered under Stone’s financial payment solutions

Software is further split into Core and Digital software

a. Core

Enterprise resource planning (ERP) software which allows companies to manage and integrate the essential parts of their services, helping them run their business through a single system. As this software is commoditised, Stone differentiates itself from its competitors through close relationships with their clients, educating them on its benefits and implementation of their software (Stone, 2018)

POS software used to empower SMBs in the food service market (Stone, 2018)

Cloud-based API driven ERP platforms built to serve an array of services and retail businesses for more sophisticated SMBs (Stone, 2019)

QR Code gateways that not only offer more security in transactions, but also convenience for clients (Stone, 2020)

Customer engagement and CRM solutions to support clients’ growth by increasing recurrence and attracting new clients through a simple and customizable software solution (Stone, 2018)

b. Digital

Order management system (OMS) which provides an e-commerce platform designed to improve the omnichannel shopping experience, helping them receive orders while managing their inventories across physical stores in an integrated manner (Stone, 2020)

LinxPay, a customer-focused distribution and service model with modular services that enable customers to choose which features to consume (Stone, 2020)

Stone Digital Hub which provides integration with digital channels, serving as a platform for social media, marketplace, and e-commerce services (Stone, 2019)

Team strength

Founders André Street and Eduardo spent over a decade working in the electronic payment and payment processing fields in Brazil. Together, they

Founded ‘Braspag’ in 2004. A company that specialized in payment processing for e-commerce in Latin America

Founded and sold several companies like SaltPay, who recently gathered $500m in their latest VC in 2022 (PitchBook, 2022), and SieveGroup among others (Stone, n.d.)

Closed their previous business and built Stone with their combined knowledge. Stone was born in 2012 and in 2013, they won the acquirer license

Pedro Zinner recently took over as CEO of Stone in 2023 after having been CEO of Eneva and Parnaíba Gás Natural, both Brazilian energy generation companies (Stone, 2023)

This change of leadership aims to bring a fresh perspective to the table while continuing the cycle of expansion and innovation for Stone

Market landscape

Brazil is the fifth largest fintech market in the world, and largest in Latin America (ITA, 2023)

In the last four years, the smartphone penetration in Brazil has increased from 66.96% to 77.8%, with more gains projected in the coming years (Seeking Alpha, 2023)

Brazil’s e-commerce market has a large market size of $24 billion, with online spending making up 3% of retail sales (The Motley Fool, 2021)

Brazil e-commerce market is growing fast, achieving a 16% yoy increase in 2021, and by 2025, the market is expected to grow by 95% and reach a combined transactional value of $79 billion (ITA, 2023)

Micro and Small-Medium Businesses (MSMBs) account for 98.5% of all legal entities in Brazil and 27% of the country’s GDP (Seeking Alpha, 2023)

Many of these MSMBs rely on legacy systems and traditional payment methods

COVID-19 pandemic has helped to increase the adoption of digital transformations, as they seek to widen their distribution channels, and make payments more seamless for tech-savvy consumers (PaymentNext, 2020)

The market is concentrated with the main players like Stone, PagSeguro, Cielo, Redecard and Getnet who are paving the way for these MSMBs to digitalize and bridge the gap (Goldman Sachs, 2022)

Thesis

1. Huge TAM and growth trend sets the stage for Stone to capitalise

Despite the current high-interest rate economy, Stone has the stage set to grow based on the macroeconomic view

Stone currently only has 11% market share in payments in Brazil

Addressable market of more than 13.5 million MSMBs in the country (Stone Earnings Transcript 3Q22, 2022)

The SME market generated TPV of R$500 billion in 2017, and is only set to grow, which is a huge segment to target (Goldman Sachs, 2018)

Industry set to grow by a CAGR of 25% until 2025, estimated by the Americas’ Market Intelligence, sets a strong runway for Stone to grow along with it (Seeking Alpha, 2023)

E-commerce sector is taking an increasing share of retail sales in Brazil, with Mordor Intelligence projecting it to grow at a CAGR of 10.23% until 2027 (Seeking Alpha, 2023)

Stone can expect to provide more Fintech-as-a-Service to these marketplaces and ecommerce platforms (Stone Earnings Release 2Q21, 2021)

This advocates for Stone’s potential as a growth stock, and it is expected that future trends will follow, which will help Stone’s growth trajectory

2. Stone has been one of the key disruptors in the industry and has the potential to continue doing so

Pre-2010, Brazil was dominated by a very concentrated banking system known for catering to the affluent community in the country

Post 2010, emergence of Fintech and payments companies have helped mobile money accounts/bank accounts reach an all-time high of 84% in 2021 (Seeking Alpha, 2023)

Introduction of the PIX system in Nov 2020 by the Central Bank revolutionized the landscape

Offered instant money transfers free-of-charge, or at a very reasonable cost

Rapid adoption allowed Fintech companies to offer attractive instant transfer options to Brazilians who were unbanked/underbanked (Seeking Alpha, 2023)

An estimated two-thirds of the population currently use Pix (OMFIF, 2023)

Stone, along with other companies like PagSeguro and MercadoLibre have been cornerstones in revolutionizing the Fintech landscape after regulatory changes in 2013

Disrupting the market duopoly held by Cielo and Redecard (Seeking Alpha, 2018)

Recent margin trends suggest that they’re becoming more efficient amid positive monetization trends (Seeking Alpha, 2023)

They have disrupted the landscape by first introducing hardware and software solutions for POS sales businesses

Grew inorganically with their acquisition of Linx to value-add to their software offerings (Stone, 2020)

Stone also plans to resume credit origination in the coming year, which could boost take rates, and drive better-than-expected profitability (Goldman Sachs, 2023)

Their banking engagement has been gaining traction and it is expected that client deposit base will expand (Goldman Sachs, 2023)

Data accessed by Stone through managing merchants' payments offerings could potentially allow them to underwrite credit (Goldman Sachs, 2022)

Stone is set to further disrupt the landscape by expanding their target segment to not only SMEs, but also the micro-business segment

It is expected for Stone to gain share in the coming years as they continue disrupting legacy practices, older technologies and incumbent players in the industry empowering merchants with technology and offering a hyper-local experience and continue gaining more market share over its competitors, as they did in 3Q22

3. Stone leveraging on its ecosystem generates more value and allows it to compete more effectively

To set itself apart from its competitors, Stone has created its own network of software that works hand in hand with each other to form an “ecosystem” of sorts, increasing its self-sustainability while reducing reliance on third-party corporations for services. A brief outline of the evolution of its ecosystem is as such:

2018:

Stone invested in Collact, a CRM software used for customer engagement

This loyalty program helps their clients retain customers while continuously selling more, thus increasing Stone’s revenue (Stone, 2018)

2019:

Stone unveiled stoneCredit, a credit solution with transparent pricing and an open banking API

Allows them to enter the credit lending market and not just banking (Stone, 2019).

They then proceeded to launch Ton which focused on Customer Acquisition Cost (CAC) efficiency and differentiated services

It is also an ecosystem of banking services, cash-in and cash-out, and financial products (Stone, 2019)

2020:

Stone enhanced their ecosystem further by investing in Vitta, a Healthtech company which offered health plans tailored for SMBs as a broker and plan administrator

It was the pioneer of 24/7 telemedicine in Brazil (Stone, 2020)

Not only was this investment very synergistic with their clients, the Healthtech market had a very large and underpenetrated TAM in Brazil, meaning that Stone would be at the forefront of it

They then expanded Ton, doubling its client base and thus decreasing their average CAC significantly by 3Q20

2021:

Stone then proceeded to partner with Banco Inter, Brazil’s first 100% digital bank (Stone, 2021)

Unlocking value to Stone by connecting Stone merchants to InterShop, an online marketplace under Banco Inter, while leveraging on Inter’s funding capabilities to further drive efficiency on Stone’s offerings and giving Inter’s clients access to new investments (Stone, 2021)

The creation and expansion of this ecosystem has led to a network effect for Stone, allowing for greater outreach and attraction of customers and clients alike, thus generating even more revenue for them and allowing Stone to compete more effectively with other competitors in its market.

4. Curated M&A strategy enhances value creation and revenue growth

Stone’s previous M&As like Mundipagg in 2019, Equals and Superpag in 2018 are testimony to the fact that their M&A strategy helps increase its reach and therefore, increasing their market share (Stone Earnings Release 2Q21, 2021). Their acquisition of Linx, for $1.28 billion, was one of the largest deals involving a tech firm in Brazil (ZDNET, 2020).

Stone acquired Brazil’s leading technology company, Linx, on 11th August 2020 to expand its presence in the retail market and provide more comprehensive solutions adding more value to its clients (Stone, 2020)

With the acquisition, Stone integrated Linx's software and expertise in the retail industry into its existing payment solutions to create a more holistic offering for merchants

The rationale behind the acquisition is to capture Linx’s 70,000 clients and provide them with Stone’s services increasing Stone’s customer base as well (Stone, 2020)

The acquisition enables Stone to use Linx’s solutions to penetrate the SMB software market and meet the needs of smaller merchants which is an added revenue source

The enlarged group aims to offer merchants the tools to adapt to an omnichannel world using the digital solutions of Linx and Stone’s fintech-as-a-service platform differentiating them from their competitors attracting more merchants (Stone, 2020)

Therefore, the acquisition of Linx has been paramount as it has led to significant growth in the retail market and has aided Stone to capture a higher consumer base which positively impacts their revenue. Most importantly, it adds value for the merchants which helps Stone retain their clients.

Key concerns

1. Ever-changing regulatory landscape

The Brazilian Fintech industry is directly impacted by the regulations imposed by the Central Bank of Brazil

The regulatory changes kickstarted in 2009, and have continued through to 2023 with the recent caps on prepaid card interchange fees to 0.7%

The new regulation saw fintech stocks take a fall, with PagSeguro Digital shares down 9.5% in midday trade

The caps were introduced by the Central Bank to “increase the efficiency of the payments ecosystem, encourage the use of cheaper payment instruments, enabling the reduction of costs for stores to accept these cards” (Reuters, 2023)

This uncertainty in regulatory changes poses a significant risk to Brazilian fintech players

Nevertheless, these regulatory changes can also be viewed in positive light as is the case for Stone, as it set thestage for newer entrants into the industry (Goldman Sachs, 2018)

Stone’s management had stated in the Q3 earnings call that the cap on prepaid card interchange fees will benefit EBT by about R$100-200mn in 2023, while the exact impact will depend on competitive dynamics (Goldman Sachs, 2022)

As such, the risks of regulatory changes can be mitigated through careful considerations of the impact at the early stages of proposal as well as through participation in the Central Bank’s public consultations

2. Credit lending issues could potentially resurface

In 2021, Stone invested in Gyra+, a credit lending fintech platform, in hopes of expanding their credit product expertise and establish a stronger footing in the segment (Stone Press Release, 2021)

Disrupted supply chains and the significant volatility in global financial markets resulted in the temporary or permanent closure of many of Stone’s clients’ stores and facilities, contributing to the rise in default rates (Stone, 2021)

The surging inflation and aggressive Central Bank interest-rate hikes and the impending recession caused delinquencies to soar, incentivizing Stone to pause its MSMB credit product in 2021 (Financial Review, 2022)

The increase of non-performing loans had contributed to the huge losses of income in Q3 2021

These factors, along with one of its investments going awry, caused Stone’s stock to fall significantly (34%) in 2021 (NASDAQ, 2021)

In 2023, the tightening interest rate environment of Brazil may pose a problem for Stone on their growth trajectory and credit lending segment

It has been projected that the current six-year interest-rate high of 13.75% could be here to stay for a longer period as the Central Bank tries to combat rising inflation (Reuters, 2023)

This makes it harder for Fintech companies, such as Stone, to offer competitive rates on loans while maintaining their margin (Bloomberg, 2022)

Difficult for fintechs to pass on cost of borrowing to consumers, especially those in lower income groups

Slowing economic growth currently leads to lower demand for loans and higher loan delinquency rates (Financial Times, 2022)

As Stone looks to re-enter the credit lending market, the existing macroeconomic conditions mirror the aforementioned risks. They will be looking to determine the extent of scaling the credit solutions according to their risk appetite and the macroeconomic conditions, but these risks could be mitigated through a careful and tailored approach

Valuation

For the purposes of valuing Stone’s target price, the following 5 companies were used as comparables:

o WEX Inc. (NYSE:WEX)

o Cielo S.A. (BOVESPA:CIEL3)

o Shift4 Payments, Inc. (NYSE:FOUR)

o PagSeguro Digital Ltd. (NYSE:PAGS)

o DLocal Limited (NasdaqGS:DLO)

While PagSeguro and Cielo are direct competitors of Stone, DLocal, Shift4 Payments and WEX have a similar business model to that of Stone’s despite operating in jurisdictions outside of Brazil

While Stone’s take rates are expected to improve with its increase in product offering and credit lending business picking up, DLocal’s take rates are also expected to increase with its expansion into other regions like Africa and

Asia (Goldman Sachs, 2022)

Hence, with DLocal having similarities with Stone in terms of growth prospects and PagSeguro and Cielo operating in the same Brazil market as Stone, Stone’s multiple would be closest to the NTM forward P/E ratios between these 3 companies

For the purposes of the valuation, NTM forward P/E ratios were favoured over TEV ratios as cash and debt are determined by the receivables discounting business as opposed to operational factors, and as a result do not reflect the company’s capital structure (Goldman Sachs, 2018)

Using NTM Forward P/E mean, the 12m projected target price is USD 21.92, presenting a 22% upside

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.