Initial Memo: AutoZone (AZO), 46% 3-Year Potential Upside (Louis TEE EIP)

Louis believes that AZO’s dominance in the US and share expansions in Mexico and Brazil would boost its SSS growth relatively higher than AZO’s competitors.

Linkedin | Louis Tee

BUY AutoZone (NYSE: AZO) at an attractive 46% upside

Executive summary: AutoZone (NYSE: AZO) – A Defensive Growth Play

AutoZone (NYSE: AZO) is a compelling investment in 2024. It is the largest retailer of aftermarket automotive parts in the US, in a countercyclical sector which remains stable during economic downturns.

AZO is a leader in consumer aftermarket automotive parts sales. Furthermore, the average age of vehicles is increasing given the recent high interest rates which discouraged new car sales. This leads to a stronger demand for replacement parts for vehicles.

There is a huge growth opportunity in AZO’s commercial business segment in which AZO acts as the supplier to repair garages, dealers, service stations, and fleet owners. AZO currently has less than 5% of the market share in the US and plans to achieve share gains in this highly fragmented market.

Despite risks from the rise of electric vehicles that have simpler car components compared to internal combustion (ICE) vehicles, AZO remains a compelling business with its strong presence in emerging markets such as Mexico and Brazil.

Company Overview

Business Segments & Revenue Drivers

AZO is a retailer and distributor of automotive replacement parts & accessories, mainly in the US (6,300 stores) and with a growing presence in Mexico (740 stores) and Brazil (100 stores). In short, AZO sells aftermarket vehicle parts and does not derive any revenue from repair or installation services.

1st line of revenue: DIY store [B2C] (72% of total revenues)

Each store has automotive replacement parts & accessories products for cars, sport utility vehicles, vans, and light-duty trucks.

These products consist of new or remanufactured automotive parts, maintenance items, accessories, and non-automotive products. Most of AZO’s products are in-house private label brands, which includes the highly successful family of Duralast brands. This allows for value choices with high quality. This private label strategy allows AZO to differentiate from its competitors while winning in margins with lower-priced supplies.

Customer base – Autoparts retailers such as AZO serve a unique customer with key characteristics:

Customers do not know exactly when their car part will be spoilt until it is spoilt or close to failure. They therefore will drive straight to an autopart store such as AZO to immediately fix it. This unique characteristic makes autopart aftermarket retailers extremely defensive to online e-commerce players as customers do not want to waste time waiting for the part to be delivered. Customers want car parts now, not in 1-2 days.

As each problem is highly intricate, an AZO store staff will guide and help the customer fix his/her car. The staff-to-customer relationship is extremely important in the autopart business as each problem requires a well-trained staff with the right subject matter knowledge to solve customers’ car issues.

Customers targeted are usually vehicles that are seven years old and older, or “AZO’s kind of vehicles”; these vehicles are generally no longer under the original manufacturers’ warranties and require more maintenance and repair than newer vehicles.

As a result of the above “spoil-and-repair” effect, AZO stores are positioned in high visibility areas with high traffic and easy access to allow AZO’s stores to generate their own traffic without needing a lot of marketing expenses.

2nd line of revenue: Commercial Program [B2B] (26% of total revenues)

Offered in most DIY stores, AutoZone provides a commercial sales program which provides: 1. Delivery of parts to local, regional and national repair garages, dealers, service stations, fleet owners and others, as well as, 2. Commercial credit.

Commercial clients, such as repair garages, frequently require quick stock-ins as they lack a vertically diversified supply chain. They therefore seek AZO to provide the necessary car parts to service a mechanic that needs the car part immediately.

This commercial business segment (B2B) is reigniting AZO’s growth story after its high growth in its B2C DIY stores. There has been an acceleration of organic growth in this B2B segment as AZO has been training its staff to deepen relationships with mechanics and repair garages (clients). The commercial clients also share the same unique profile as DIY customers as the end-clients of the commercial program are ultimately the same.

In the US, 90% of DIY stores offer Commercial Program services. In Mexico and Brazil almost 100% offer Commercial Program services.

In the FY 2023 annual report, the President and CEO mentioned that AutoZone’s US Commercial Program business remains as the top strategic priority for growth. It grew 8.7% in 2023, but slower than the 26.5% growth in 2022.

AZO’s Commercial Program has only less than 5% market share in the US in this big and growing industry.

AZO managed to grow average weekly sales from $15,500 in 2022 to $16,000 this year.

3rd line of revenue: Others – E-commerce and ALLDATA (2% of total revenues)

E-commerce – AutoZone also sells its automotive hard parts, maintenance items, accessories and non-automotive products through its website to consumers and commercial customers.

ALLDATA - AutoZone sells its ALLDATA brand automotive diagnostic, repair and shop management software through its website www.alldata.com.

Costs / Strategic initiatives

Distribution Centers

Distribution Centers (DC) play an important role in AZO. They have made significant investments to enhance their supply chain efficiencies by investing in and building new DCs.

AZO will be opening 2 new DCs in the US by early 2025 equipped with new technologically advanced facilities to improve store in-stock positions and enhance abilities to match demand and supply.

Mega Hub Strategy

AZO uses its physical stores as storage spaces called “Hubs”. In 2023, there are currently 98 US mega hubs and 210 US hubs.

A hub allows the company to carry ~50,000 SKUs, which is double the size of a typical store.

A Mega hub allows the company to carry ~80,000 to 110,000 SKUs.

These hubs ensure efficient stockouts, which leads to market share gains.

AZO plans to have 200 US mega hubs and 300 US hubs.

These strategies aim to efficiently match supply with demand given the large focus on Commercial customers that require more SKUs at a frequent rate. The hub strategy also aims to lower SG&A expenses given that newer hubs are equipped with better technology such as RFID and stock-keeping technologies.

Management’s Strategic Focuses on the Future

Store Count Growth (both DIY [B2C] and Commercial Program [B2B])

AZO has been a growth story of expanding new stores in new regions to capture market share. Over the past 20 years from 2004 to 2023, AZO’s store expansion has been impressive with almost about 200 new stores opened every year.

In 2024, AZO plans to continue growing their stores in the future, with 200 new stores in the US and Mexico, including 40 new stores in Brazil in 2024.

Commercial Segment Growth

Aim to become the commercial aftermarket auto part supplier's largest player in the US.

Leverage on in-house private label “Duralast” brand, which is highly successful from the build-up of sales, reputation, and customer awareness from its DIY segment.

Competitor Analysis

Competitor-based – The aftermarket sector has a very stable base of competitors for a long period

AZO mainly competes with O’Reilly, Advance Auto Parts in the US, as well as CarParts.com which sells online.

Competition has been pretty stable and not a whole lot of new or changing strategies from competition, due to the defensive, maintenance-driven “spoil-and-repair” demand nature of aftermarket vehicle parts.

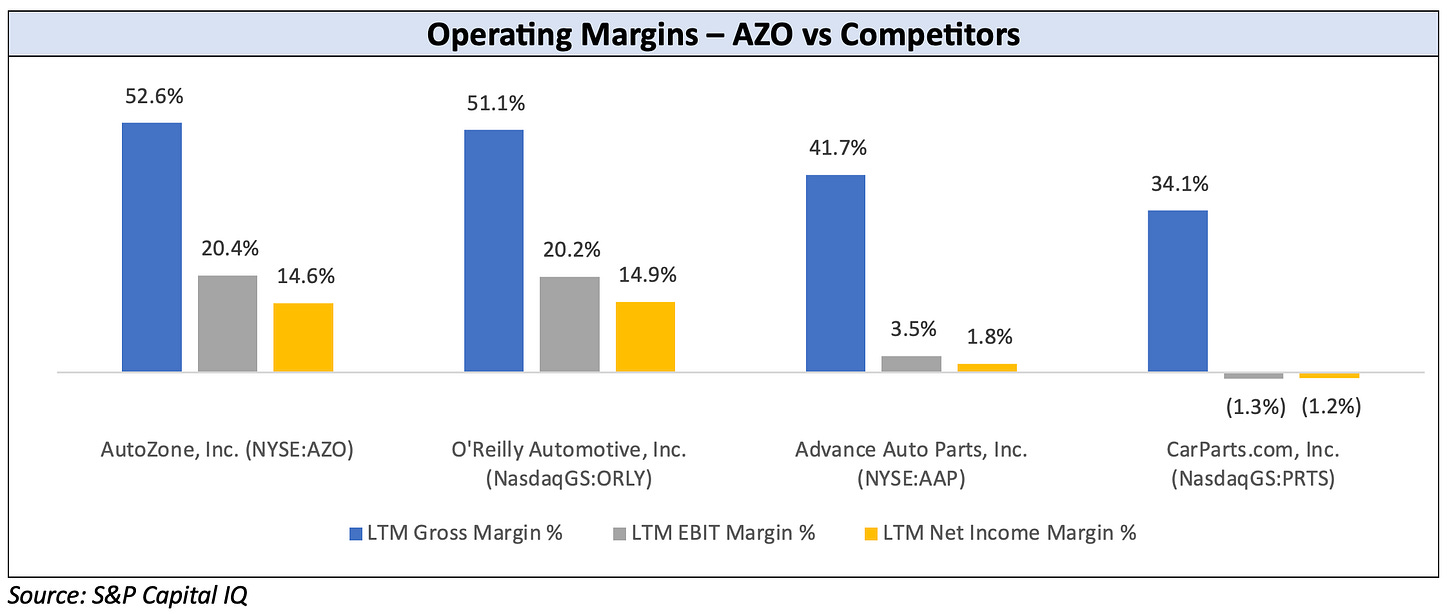

Operating structure – AZO is the clear leader with the highest margins

AZO is a clear leader in terms of gross margins, EBITDA margins, and EBIT margins.

Gross margins – AZO’s management has been highly successful in ensuring prudent sourcing of supplies. Its 52.6% gross margin can be attributed to its high reliance on its in-house private label brands such as its highly successful family of Duralast brands.

EBIT margins – AZO saw its EBIT margin expand from 19% to ~20%+ over the past ten years, attributed to IT and automation investments as well as building more hubs/mega hubs for supply-chain efficiencies. As a result, SG&A as a % of sales decreased from 33-34% in 2014 to 32.1% in 2023.

Economic Moat

AZO's biggest economic moat lies in its extensive sales network across the US which is bolstered by its massive supply-chain network and private-label brands

AZO’s dominance is built on a sprawling network of over 6,000 stores in the US which provides convenience for customers in need of quick auto parts with immediate availability. O’Reilly has ~5,600 stores and Advanced Auto Parts has ~4,800 stores in the US.

The combination of AZO’s dominant store position and its massive inventory (~80,000 to 110,000 SKUs) and efficient supply chain, makes AZO the first choice for customers to rely on.

Investment Thesis

1. Defensive positioning amidst an unfavourable economic backdrop in 2024 and beyond:

The nature of AZO’s demand is countercyclical – as the economic growth weakens, unemployment rises, and real disposable wages decline – hence, consumers push back new car purchases during an economic downturn. As a result, used car numbers will increase after a recession which leads to more customers needing repairs and maintenance of their older cars.

As seen in the 2008 Great Financial Crisis and the 2020 Covid Pandemic, AZO’s same-store sales (aka organic sales that are created in existing stores), grew the following years post-recession by high single digits to mid-teens.

The COVID-19 pandemic in 2020 caused new car sales in 2020-2022 to dwindle, making the average age of vehicles in the US rise to an average of 13.1 years for cars, and 12.2 years for light trucks.

As a result, I am projecting that AZO’s SSS growth in 2024E to 2026E to grow at 3.1 to 3.4%, which is slightly higher than its pre-covid SSS growth trend from 2016 to 2019. In my opinion, I believe my projections are slightly higher than the street as I think AZO’s dominance in the US and share expansions in Mexico and Brazil would boost its SSS growth relatively higher than AZO’s competitors.

2. Aggressive store count expansions in Mexico and Brazil – I expect these emerging countries to contribute to AZO’s sales with a CAGR of ~10%:

AZO’s management aims to open 200 new stores annually in Mexico and Brazil by 2028, up from ~70 new stores annually in 2023.

Mexico – Attractive operating margin structure with a good product-market fit

Mexico offers AZO incremental margin gains due to its lower wage rates.

In Mexico, cars are a lot older than US cars, and Mexican-manufactured vehicles tend to break down faster and more easily. AZO recognizes this product-market fit along with a fragmented aftermarket retail market to allow it to capture more white spaces in the Mexican regions.

AZO has seen massive growth in sales per store in Mexico from 2019 to 2023 as it scaled its SKUs and offered commercial programs to customers.

Brazil – Investment phase, ramping up store count aggressively

In the latest quarter earnings call by AZO’s management, it is noted that AZO is still losing money in Brazil as it is still in an investment phase as they are aggressively ramping up store count.

In Brazil, vehicles are ostensibly smaller compared to Mexico and US vehicles. Most Brazilian vehicles are 1.4 litres instead of a typical 2 litre vehicle. AZO believes that this creates a tailwind for Brazilian vehicles to break down more often as vehicles are often overused over their engine capacities.

Valuation

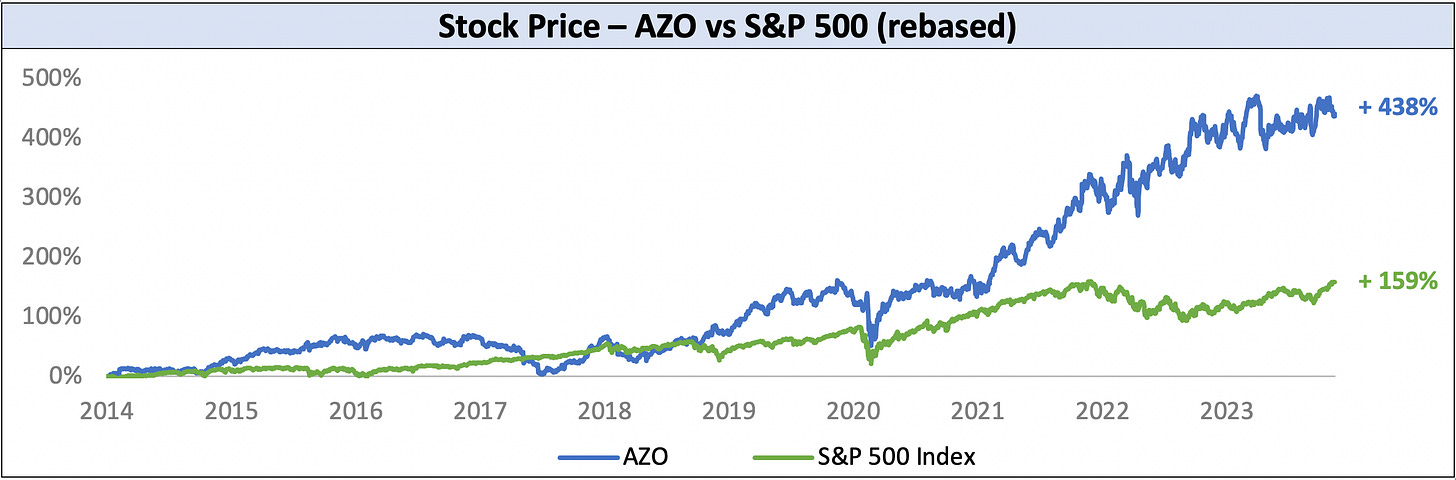

Recent Stock Price Movement

AZO stock had bled 5% in December attributed to consumer pullback in Commercial segment tyre repair centres due to maintenance deferral of big-ticket items due to an industry-wide softer discretionary performance. I believe this is seasonal as AZO’s management along with its competitors mentioned a warmer winter in December (bad for the afterpart sector as cars are more prone to breakdowns in colder temperatures).

Forward Multiples

Owing to AZO’s December share price correction, its P/E ratio has declined to a current of 16.65x, which is below its 3-year historical forward P/E of 17.80x. I believe AZO equity is currently attractively priced relative to its peers as well as to its historicals.

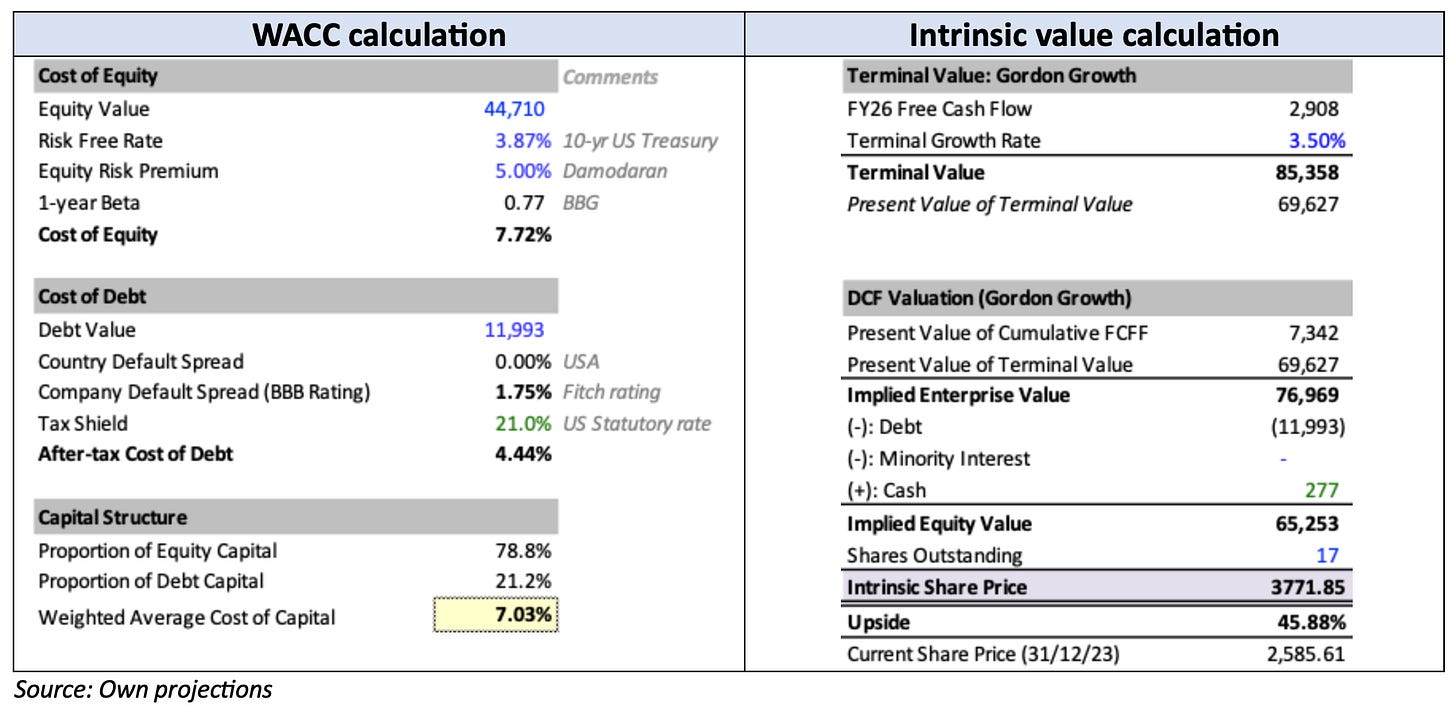

Discounted Cash Flow Valuation

In my discounted cash flow valuation of AZO, I decided to base my analysis on a 3-year projection horizon, because I believe the next 3 fiscal years would be most pertinent, given AZO's terminal growth rate depends on its execution risk in Mexico and Brazil as mentioned in its management's strategy for international expansion from 2024 to 2026.

My DCF valuation of AZO gives me an intrinsic share price of $3,771.85, an upside of 45.88%.

Risks & Mitigations

Rise of the Electric Vehicle

Investors might be concerned about the macro shift away from Internal Combustion Engine (ICE) vehicles, towards Electric Vehicles (EVs) because EVs have significantly fewer moving parts compared to an ICE vehicle (20 moving parts in EV vs 2,000 moving parts in ICE). Would this adversely affect AZO as EVs have a lesser need for repairs and maintenance? I believe not, at least for the next two decades.

According to Counterpoint Market Research, EV sales are not expected to overtake to ICE sales in the next decade. Nevertheless, even if ICE vehicles lose share to EVs, ICE vehicles will still remain in the market at a significant market share of 40%+.

Mitigations:

AZO’s international expansion strategy in emerging markets such as Mexico and Brazil hits the nail on the head – these countries have an EV share of less than 1%, which is a far cry away from the 6% share in the US.

AZO’s management should begin to look at creating a new line of EV-focused aftermarket auto parts to cater to EVs that are no longer under the original manufacturers’ warranties.

In addition, AZO could increase their line of products to offer technology products such as safety parts, and comfort parts, which are increasingly common in EVs.

ESG assessment

Environment

Low risk: While I believe this area poses a low risk, environmental issues could still impact AZO.

Carbon footprint: High reliance on transportation for product delivery and customer travel increases emissions. (Data not readily available in reports).

Waste management: Concerns about hazardous waste from batteries, oils, and automotive chemicals. (AZO reports a 76% recycling rate for used oil).

Packaging: Large amounts of packaging materials create additional waste. (AZO reports no specific data on packaging reduction efforts in reports).

Social

Medium risk: Some social risks warrant attention, particularly labour practices and diversity.

Labour practices: Concerns about employee safety in warehouses and stores, along with the potential for long hours and low wages. (AZO reports a Total Recordable Case Rate (TRCR) of 1.08, below industry average).

Diversity and inclusion: Lack of diversity in leadership positions and potential gender pay gap. (AZO reports 22% women in senior management and 74% white managers).

Product safety: Risks associated with selling car parts, the potential for recalls or accidents due to faulty products. (AZO has a product safety recall process but data on recall frequency is not readily available).

Governance

Low risk: Governance aspects seem robust, but transparency and risk management could be improved.

Executive compensation: Concerns about high CEO pay compared to average employee wages. (AZO CEO received $16.8 million in 2021, while the average store employee made $42,000).

Board diversity: Lack of diversity on the board of directors. (AZO reports that 2 out of 10 board members are women and 1 is Hispanic).

Risk management: More details are needed on specific ESG risks identified and mitigation strategies. (AZO reports on general risk management processes but lacks specific ESG risk analysis).

Updates

25th Jan 2024 - Rental Car Company Hertz sells off 1/3 of its EV fleet citing expensive repair costs, and weak consumer demand:

https://www.reuters.com/business/autos-transportation/hertzs-ev-sale-fan-cost-concerns-dampen-used-car-market-2024-01-16/

27th Feb 2024 - Q2 Earnings Call - Key Takeaways:

TOPLINE

US sales (~90% of total sales): SSS growth 0.3% vs 5.3% last year.

DIY (70% of US sales): First 4 weeks of Q 0.7%, second 4 weeks of Q -6.2%, last 4 weeks of Q 4.8% (due to harsher winter that causes more car breakdowns). Mgt expects the next Q to not have much weather impact.

Traffic down 2.2%

Ticket up 1.7%. Discretionary sales are down. Mgt expects more improvements as inflation goes down, with ageing cars.

Commercial (30% of US sales): For the first half of the Q, winter storms caused many shutdowns of commercial customers.

Mexico & Brazil sales (~10% of total sales): SSS growth 23.9% vs 30.6% last year.

Mgt reiterates that they will continue deploying capital to Mexico & Brazil and this will be the growth story.

MARGINS

Gross margin: 53.9%, up 160bps yoy

+100bps, driven mainly by core business margins

+63bps from LIFO benefit. Mgt models $2mn LIFO headwind next Q (<30bps headwind)

EBIT margin: 19.3%, up 110bps yoy

-49bps from SG&A deleverage from higher expenses in store payroll and IT

The remaining margin expansion was driven by +ve SSS and GPM improvements

BOTTOMLINE

Net income up 8.1% yoy, EPS up 17.2% yoy

Driven by higher net income, and share buybacks (share count in 2Q was 7.8% lower yoy)

My opinion:

The thesis remains intact.

Remain bullish on International stores, and steady on US DIY and fast-growing commercial segment.

US DIY SSS growth on good momentum considering that the last 4 weeks of Q were up highest (+0.7%, -6.2%, +4.8%).

Watch out for new competitors in Mexico and Brazil due to attractive margins from AZO. However, barriers to entry should remain high due to economies of scale and the high SKU count needed.

Macro - The latest US consumer sentiment (Feb 24) released yesterday was weak - this reiterates my thesis on the counter-cyclical benefit for AZO.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk