Initial Memo: Celcius Holdings. Inc. (CELH) SELL, (Jon Lon Yiong, EIP)

Jon Lon recommends a strong “SELL” position on CELH as the company is likely to plateau in its growth having transitioned into a heavy reliance on Pepsi Co.’s distribution network.

Linkedin | Jon Lon Yiong

Executive summary

1) Limited upside potential given the saturation within the United States market

2) Lack of purpose beyond functionality

3) International expansion poised with headwinds

Company Overview

Celsius Holdings (NASDAQ: CELH) is a functional energy drink and liquid supplement company that engages in the development, processing, marketing, sale and distribution of its product line. CELH does not manufacture their products but instead develops the formula (“recipes”) for their product line and engages 13 different co-packers to manufacture their product lines. CELH currently have 5 product lines and differentiates itself by branding as a healthy energy drink brand with health benefits such as weight loss and muscle recovery. CELH’s customers include distributors, retailers and convenience stores. [Source: 2022 10K] CELH is currently the fastest growing energy drink company with a market share of 5.9%% behind Redbull (33.8%) and Monster Energy (37.5%).

Business segments

CELH has a single business segment, that being the sale of energy drinks, with the bulk of revenue generated from distribution in North America (94.47%), followed by Europe (4.75%), Asia (0.56%) and others (0.22%).

a) Geographical Distribution

Under the distribution channel in the United States, CELH runs 4 types of distribution channels namely, i) distribution via Pepsi Co., ii) direct store deliveries, iii) direct to retailers and iv) e-commerce platforms; Amazon, Walmart and Instacart.

Pepsi Co. accounts for 95% of distribution, following a partnership agreement in 1 August 2022, where Pepsi Co. would become the preferred distribution partner globally for CELH, in exchange, Pepsi Co. will make a net cash investment of USD 550 mn to CELH in exchange for convertible preferred stock. Following the agreement, CELH has terminated over 250 independent distributors which it had previously worked with. The partnership opens up Pepsi’s network and access to food service outlets, independent convenience stores, vending machines, and college campuses. Most notably, Pepsi caters to 60% of the college and university population in the United States and the military. The remaining distribution channels are agreements with other retailers; Publix and Costco, and stores, including gyms and convenience chains, as well as online channels. As of FY 2022, CELH had 210,000 distribution points and estimates an additional 150,000 distribution points with Pepsi Co. partnership.

In Europe, distribution is done under Func Foods, a subsidiary which it acquired in 2019 consisting of a portfolio covering energy drinks, workout snacks and supplements. In Asia, distribution is done through local distributors in Hong Kong and in China, QiFeng Food Technology (Beijing) Co. handles local production and distribution. QiFeng holds the exclusive license to manufacture, market and commercialize Celsius brand products in China, and in return pays a volume-based royalty fee.

Notably, CELH does not handle the production or manufacturing of their own drinks but instead engages several co-packers to produce their product in batches for a given period. The goods are then sold to the distribution channels mentioned above. Products are then sold to the end consumer through the various distribution location points. While CELH has a relationship with 13 co-packers, it currently engages 6-7 of them annually.

Under this arrangement, raw materials are purchased either by CELH directly or by the co-packers, with all production costs directly incurred by the co-packers before charging a final price to CELH. This arrangement reduces direct production overheads and allows CELH to produce at multiple locations across geography optimising their supply chain.

b) Revenue by Distribution Channel

While not disclosed in full, as of Q3 2023, CELH announced that 58% of sales revenue is from convenience stores, which it aims to increase further to 70% to be compatible with the likes of Monster Energy and Redbull.

In 2023, CELH focused on increasing its footprint within the United States through two prongs, namely increasing its expansion of CELH into food service stores and increasing the number of products and distribution points in retail stores. Under the former, CELH is leveraging the partnership agreement with Pepsi Co. to enter into 2,000 Jersey Mike and 3,000 Dunkin Donut locations. For the latter, the company is replicating their existing success strategy within the United States aiming to increase its market share in South Florida to 24% up from the current 17.4% through the following initiatives increasing the number of dedicated CELH shelves, increasing the number of products held, and having sales representatives on the ground. In addition, CELH has entered into partnership agreements with stores like 7-Eleven to launch exclusive flavours, like Green Apple Cherry, that are available all year round only at partnered outlets.

c) Revenue by Customers

As of Q3 2023, the company’s revenue mix was as follows; Pepsi (60.8%), Costco (11.4%) and others (27.8%), with management forecasting a further increase in concentration with Pepsi moving forward.

Key Drivers

1. Revenue drivers

Revenue from CELH can be categorised by geographical footprint, with the key driver being the number of distribution outlets it has as well as the number of stock-keeping units per outlet.

2. Cost drivers

Cost of goods

Includes costs such as liquid, sugar and packaging content like aluminium and cardboard. CELH does not always directly purchase these materials and pays a total fee to the co-packer who handles the purchase of raw materials.

Sales & Marketing Expense

This cost fell as a % of revenue following the consolidation of distribution channels as part of sales expenses was generated from the cost of onboarding new distributors.

ESG Considerations

President & CEO

Mr John Fieldly was originally the Chief Financial Officer of CELH in 2012 when CELH had to be delisted but managed to turn around the company by late 2015 when it was re-listed. He then took over the role of CEO in 2018. Before joining the company, he had over 20 years of experience in financial and operations management, having managed 5 business units at a B2B leading media and marketing company servicing the retail industry, food services, healthcare and targeted consumer markets.

Other Members of Management

The management team has an average tenure of 2.7 years, with most of the management having 1 year of experience. Despite being new to CELH, all members have had extensive experience in similar roles at other beverage companies, most notably Hiball Energy and Rockstar. Specifically, the Marketing and Sales were onboarded to aid the CEO in his expansion plans.

Board of Directors

The Board of Directors has an average tenure of 2.8 years, with the lead independent director having prior experience as the Chief Risk Officer of Coca-Cola Enterprises and previously being on the board of Rocky Mountains (an alcohol-focused beverage company). While Mr John Fieldly, the CEO, is also the President, the rest of the Board members are independent members ensuring sufficient counters to the lack of independence by the President.

While several members of the Board hold concurrent roles in other Boards, none hold more than two roles in total, ensuring sufficient time is dedicated to carrying out their duties for the shareholders of CELH. Each member of the Board also has relevant experience, having been a Director at other food and beverage companies or involved in analysis and asset management covering sectors related to the food and beverage industry before their role in CELH.

Internal Ownership

Management cumulatively holds less than 1% of the total ownership of the firm. While there were

Industry Analysis

CELH mainly operates in the United States, with only a small portion of its revenue derived from Europe.

United States Market Size & Market Dynamics

The energy drink market is an extension of sugared drinks having existed for decades. However, energy drinks were first popularised in 1965 by Pepsi Co. and subsequently Red Bull. The US market is estimated to be worth USD 107.7 billion and is expected to have a CAGR of 5.18%. Energy drinks are helmed for the improved functionality that they provide post-consumption often touting revitalisation and energised as the key reason to consume the drink. Outside of functionality, energy drinks are closely associated with the motor racing industry, extreme sports and gaming events primarily driven by marketing associated with the two biggest players, Redbull and Monster Energy. It was also estimated that 3.4 billion litres were sold in 2023, with 55% coming from the sale of ordinary sugared energy drinks and the remainder from reduced sugar energy drinks indicating a trend towards healthier alternatives. The former has grown at an annual rate of 0.7%, while lower sugared drinks grew at an annual CAGR of 4.6%.

It should also be noted that it is not uncommon for smaller players in the industry to be acquired or merged with larger players. In July 2023, Bang Energy, a player who held roughly 8% of the market was acquired by Monster Energy following the parent group’s insolvency. Smaller players may also opt to work with larger players, with one player being Rockstar Energy, which since 2012, entered into an exclusive distribution network agreement to be the only energy drink distributed from the Pepsi Network. It follows that the industry favours those with the largest scale in operations and distributions which creates a level of barrier to entry for new players even though the formulation mix can be easily copied.

Competitor Analysis

The United States energy drink market is dominated by several large players with a few smaller players. The market is in a relatively mature state with an estimated yearly growth in the low single-digit range. There are several listed and private players, most notably, Red Bull, Monster Energy, Bang, Rockstar Energy, and Alani Nu. The chart below illustrates the key players in the industry;

Red Bull: Headquartered in Austria and founded in 1987, Red Bud Bull expanded into the United States in 1996. While privately listed, Red Bull reported the sale of 11,582 billion cans in 2022, Red Bull is estimated to hold roughly 39% of the market, making it the largest player in the energy drink market. Red Bull is known for their unique marketing strategy and association with events full of high adrenaline and high risk such as Formula 1, cliff diving and sports events including football, auto racing, and ice hockey amongst others. Their key message of “Red Bull gives you wings” also represents a strong tie with the functionality of energy drinks as a booster.

Monster Energy: Operating under the current company name since 2012 and headquartered in California, Monster Energy currently holds the second-largest market share, just trailing behind Red Bull. Monster Energy is traded under the NASDAQ with the ticker MNST and reported USD 6.3 billion in sales for FY2022. Monster Energy focuses on having a diverse range of SKUs, ranging from different flavours to low-sugar options, and has branded itself closely with extreme sports. It similarly focuses on events that are associated with the key themes of energy, intensity, and excitement namely extreme sports and competitive gaming.

Bang: Founded in 1993 and formerly operated under the Vital Pharmaceuticals parent company, Bang Energy was acquired by Monster Energy in September 2023 following the parent company file for bankruptcy. Bang Energy has 12 SKUS and two multipack SKUs which were manufactured by Coca-Cola bottlers. Bang Energy focused on branding itself through influencers and creating long-lasting relationships with the influencers and their followers by extension. Bang Energy employed a selective approach to scouting for brand ambassadors, namely being young, athletic and having a lively and dynamic way of living. Notably, Bang Energy previously signed an exclusive distribution deal with Pepsi in March 2020 but later terminated the contract following alleged claims that Pepsi Co has used intimidation tactics against independent distributors and major retailers to threaten anyone who failed to purchase Bang Energy exclusively from Pepsi. Before filing for bankruptcy, the deal has been reignited in June 2023.

Rockstar Energy: Rockstar Energy was formerly founded in 1998 and was produced by Coca-Cola until February 2009, when Pepsi Co. took over.

While each competitor employs different marketing strategies, their target audience remains those between the ages of 18-35, namely those in the Gen Z age group and who have some degree of participation in active sports.

Investment Thesis

The street estimates that CELH will achieve 40% revenue growth for the financial year 2023 and an estimated 20% for the following year. The main premise for the debate centres around the distribution partnership agreement with Pepsi, which will provide it with an additional 150,000 distribution points located across the United States, providing it with a total of 360,000 distribution points across convenience stores, food outlets and retail stores. Moreover, the street remains optimistic that Celsius’s shift in branding to act as both a health drink and substitute for coffee, as well as its expansion overseas, will help it achieve these targets. Despite the expansion, Celsius’s management cites that it aims to maintain the current sales, and general and administrative spending relative to revenue. However, I remain pessimistic for the following reasons;

Thesis 1: Underperformance within the United States Market as competition intensifies

A large driver for CELH’s street estimates is contingent on the success of capturing a greater market share of>10% within the United States markets. However, the energy drink market is mature and is expected to have a moderate compounded annual growth rate of 4.45% from 2023-2027.

The trend is unlikely to buck as most consumers are concentrated within those aged 49 and below, with an average consumption of 2 cans per day with these numbers decreasing in older age groups.

Even with the Pepsi partnership and their access to roughly 60% of the college and university population in the United States, of which the total population accounts for 20.3 million, the students will not drive sufficient growth as consumption remains fixed to account for the 40% expected revenue growth. Assuming a market share of 18% in line with the total expected market growth rate for the year 2023, the total revenue derived is expected to only hit $35.78 million or 5% of revenue derived from the Financial Year 2022. This is a vast shortfall to the expected 40% of revenue growth for FY2023, with a 35% revenue shortfall. Moreover, this is unlikely to grow past the existing 10% of revenue derived from Food Services as energy drinks lack a reason for drinking beyond functionality as they do not have any social and casual situations in which the drink can be consumed.

Moreover, the Pepsi partnership network may have waning growth opportunities. From a previous partnership with Rockstar Energy, the distribution network never allowed the competitor to exceed 5% of the total market share. It should be noted that under the distribution network up till 2019, Rockstar prevented Pepsi from distributing any other energy drink before the acquisition. Nevertheless, while the terms for Celsius are favourable, the maximisation of distribution points within Amercia will be complete as of 2023. Additionally, while the distribution network serves as a boon for Celsius, the partnership merely acts as a form of diversification for Pepsi to have some exposure to the energy drink market. A similar scenario could emerge where Celsius is unable to exceed the current 10% of the market share it holds once the distribution network from Pepsi has been exhausted.

With waning, organic growth from new customers, growth will have to come from challenging existing players within the market instead. However, the market structure is one which heavily favours bulk purchases, leading to a “winner-takes-all” situation, where most consumers will opt to shop with only one single brand.

For example, products are typically sold in packets of 4, 6, 9 and even 12, and are usually accompanied by discounts. Celsius’s management has also cited that their strategy is the follow price hikes and decreases of Red Bull and Monster Energy, with similar discounts offered. Often, bulk purchases are accompanied by such discounts, running an average of 25 weeks out of 52 weeks in a year. This has been accompanied by the increased preference for purchasing bulk within the American consumer due to convenience, with a reported increase in pure spending at wholesale clubs, grocery stores and discount stores, which are the distribution points that Celsius currently has access to.

Celsius also faces challenges in both acquiring new customers and retaining existing ones as it shifts towards a “healthy” drink image. In a move to be differentiated from the other major players, Celsius is attempting to brand itself as healthy, citing lifestyle and clean diets to accompany its existing marketing claims. However, the move may prove to have dilution as Celsius has a lower term association with energy drinks based on search results. Moreover, the healthy drink space is one with additional challenges. With 63% of American consumers exceeding the limit for sugar consumption and 77% exceeding the limit for saturated fats, the Food Department of America is seeking to enforce new regulations where products must provide at least 10% of the required intake for 1 or more of the following nutrients of vitamin A, C, calcium, iron, protein or fiver. This could pose challenges to existing formulations such as Celsius. Moreover, in a recent consumer survey in America, 49% of participants associated the term “healthy” with low or sugar-free, all-natural, and plant-based. Notably, these claims are not ones which Celsius can meet with ease due to the high sugar content (be it natural or artificial), artificial colouring and flavours added.

Based on the existing growth in revenue, 24% was attributed to come from new consumers to the energy category and 47% came from existing consumers buying more. However, as addressed above, new consumer growth will be limited and will likely be driven by short-term interest from the new distribution point, while existing consumption spending increase will be limited due to a contrasting brand image. While the structure of product sales, namely in bulk, could further drive existing consumer spending, it assumes that Celsius is the overall winner of the market. However, this remains unlikely against bigger competitors with their unique proposition coming from health claims.

For the following reasons, Celsius is likely to underperform revenue growth targets, as existing consumption plateaus from the exhaustion of the new distribution and the inability to further increase existing consumer spend.

Gross margins are likely to continue hovering around the 46%-50% range, as Celsius remains a price-taker relative to the other competitors and will not be able to substantially increase margins as it relies on external co-packers.

Thesis 2: Lack of purpose beyond functionality

Notably, the second key portion of growth is within the revenue contribution from the Food Service segment. Part of this strategy includes using Celsius to replace caffeine at the different food outlets. However, this seems unlikely due to a lack of functionality. For example, Monster Energy has had an exclusive partnership with McDonald’s to include the beverage as one of the options at all their American outlets. However, despite launching this in 2015, the food service continues to account for <2% of total revenue as of 2022.

While the caffeine content is sufficient, energy drinks lack the social nuance associated with energy drinks. Usually, energy drinks are consumed purely for their function, namely to act as a boost of energy and to revitalise the consumer as a way to stave off tiredness. Coffee indeed has a similar function, however, a stark difference lies in the other situations in which coffee can be consumed, such as using it as a means to socialise and even the process of brewing coffee can act as a stress reliever. Moreover, coffee also contains other factors which drive their consumption, such as aroma, quality and habit, which are variations that exceed the current consumption methods of energy drinks.

To put it simply, we often might say “Let’s catch up over a cup of coffee”, however, could we imagine saying “Let’s catch up over a cup of energy drinks” instead?

As a result, in the longer term, revenue growth is likely to align with the energy drink growth average due to the inability to capture new market segments.

Thesis 3: International expansion poised with headwinds

Lastly, management seeks to expand overseas as part of its strategy to attain the stated revenue growth targets. In the interim, Celsius plans to enter the Canadian market for the financial year of 2024, namely citing the similarities with the United States. What stood up was that management largely came from Bang or past experiences in beverage companies that had the majority of its operations in the United States only. Nevertheless, even if management was successful in capturing the Canadian market, the energy drink market is valued at roughly USD 2.7 billion only relative to that of the United States which is more than 40X greater at USD 107 billion. Assuming optimistically that Celsius can capture 5% of the market in the immediate year, that only amounts to USD 135 million or roughly, 7% of FY 2022’s revenue. Moreover, Celsius will have to establish a culture of consuming energy drinks and the brand image of being a healthy drink.

Moreover, as previously mentioned management has largely failed to prove itself. For instance, Celsius acquired Func Foods in 2019, a company which deals in products such as energy drinks, pre-and-post workout snacks and other health foods which complement Celsius’s branding. While the acquisition was done to enter the European market, post-acquisition, Celsius has failed to substantially grow the revenue derived from Europe in absolute dollars and in fact has led to an overall lower percentage share contribution.

Additionally, the management lacks an understanding of Asia, where in the current operations, Celsius derives revenue of less than 1% (0.035% of FY 22 revenue) from across Asia. Celsius does not oversee local production, distribution, or marketing and instead relies on an exclusive partnership with Shandong Qufeng Food Tech Co. Ltd to handle all of these. In exchange, Celsius simply receives a fixed royalty-based fee from the exclusive partner.

This signals that management lacks confidence and understanding of the Asian market, instead opting to minimise the rewards and risks of entering into this geographic market.

Another area to note, before the partnership agreement with Pepsi, Celsius had to spend an average of 15% of revenue to distribute the product. As mentioned by management, the objective of trimming back Selling, General and Administrative expenses and holding them at current levels as a % of revenue, Celsius will end up having to fully rely on Pepsi’s distribution network and marketing to drive further expansion overseas. Moreover, the lack of a proven track record in expanding to major geographic regions and trimming back on selling and marketing expenses will pose hurdles in acquiring future revenue growth overseas.

Resultingly, while Celsius will be able to maintain current levels of Selling, General and Administrative spending, longer-term revenue growth will be maintained at the levels of the broader energy drink market in the United States due to difficulty in penetrating new markets.

Valuation

Discounted Cash Flow Model - Gordon Growth Model

Several valuation methods were used, with with the DCF - Gordon’s Growth model deriving an estimated price of USD 23.2 in one year.

WACC: The following computations were used to derive the weighted average cost of capital. The beta utilised was 1.5 for the DCF, which was derived from a 5-year daily regression of beta. The cost of debt was 6.16%, which utilised the credit rating to derive the implied credit rating and risk-free rate. The cost of equity of 11.42% was derived using the Capital Asset Pricing Model, with a risk-free rate of 3.91%, taken from the average yield of a 10-year United States government bond. The equity risk premium was taken from the New York University publication of the country equity risk premium.

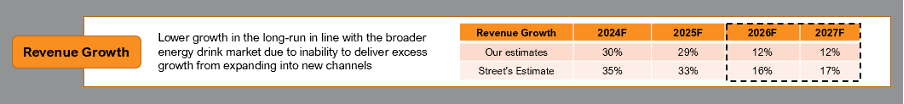

Operation Build-Up: The revenue growth assumes an initial 100% growth in FY2023, before a gradual taper down to 30% and 29% for FY2024 and FY2025 respectively. The sentiments have been reflected in the thesis above, namely a limitation to getting new customers through new distribution points and difficulty in getting existing consumers to purchase more. Moreover, longer-term growth is likely to be capped at the industry growth of the United States market due to the inability to capture new segments and geographic markets.

As mentioned previously, since Celsius is a price-taker, they follow similar pricing strategies to their largest competitors, leading to an inability to significantly raise prices to increase margins. Moreover, since they rely on external co-packers, Celsius is unable to drive down their cost significantly. The rationale for the Gross Profit Margin not exceeding 50% was because of the historical inability of the company to reach the same margins that Monster Energy had when it was of a similar revenue scale.

Selling, general and administrative expenses were kept at 28% of total revenue to reflect management’s outlook towards trimming back selling fees (as they no longer require new distributors) and marketing expenses (opting to rely on Pepsi instead)

Terminal Growth Rate: The terminal/ perpetuity growth rate assumed was 2.5% as an average from the range between 2%-3%.

Sensitivity Analysis: The following sensitivity analysis on the WACC and terminal growth was conducted to assess the possible price targets.

Discounted Cash Flow Model - Exit Multiple (EV/ EBITDA)

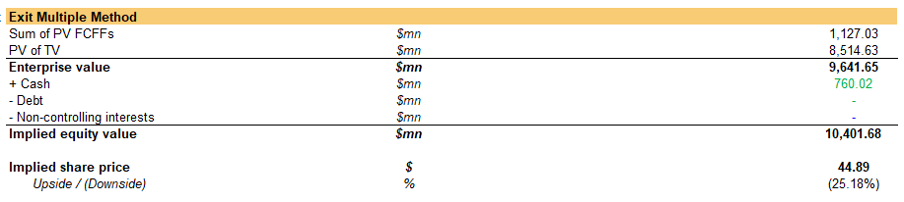

The exit multiple method was also applied, leading to a target price of USD 44.89.

Relative Valuation - EV/ EBITDA

Based on the relative valuation method, we derived a price target of USD 45.75, assuming a base case of 32.5x enterprise value/ EBITDA, which was taken as the average against their closest competitors. EV/EBITDA was selected as the most common relative method used by the street and the company’s suitability as a profitable one and factoring in our perspective as a public equity shareholder.

Blended Approach

Applying a blended approach with a 50% weight to Relative Valuation, 30% to the DCF- Exit Multiple Approach and 20% to the DCF - Gordon Growth Approach, leading to the target share price of USD 32.6.

Risks and mitigation

Delivery Risks: A key risk to the thesis is the ability of management to successfully continue capturing market share within the United States through the successful brand push as a healthy drink that will allow CELH to earn a place in the food service sector and penetrate new customer segments outside of convenience stores. In this event, CELH would be able to meet the street’s expectations that CELH can expand the market share above 10% and consistent growth of 30-40% over the next 4 years.

Mitigation: However, based on the management’s previous experiences, lack of factors beyond functionality associated with the consumption of energy drinks, and lack of differentiation compared to competitor products, there remains a high possibility that management will fail to meet targets per the street’s estimates.

International Expansion Risks: Management could potentially find success in capturing market share in the overseas market having outlined Canada as their next expansion target for FY 2024, with further exploration of markets like the UK, Germany, and Japan. In moving to overseas markets, they still maintain access to Pepsi Co.’s network as their primary distributor reducing the selling expenses as they do not require as many new distributors onboarded. Additionally, the new markets present new opportunities both in the energy drink space and as a beverage away from the saturated United States energy drink market.

Mitigation: Nevertheless, expansion into overseas markets poses a high chance of failure as management has not had experience operating outside of the Americas and North American market, with a previous track record being unimpressive post-acquisition of Func Foods. The reliance on local distributors in Hong Kong and Asia who have the right to market and distribute the product also indicates that management lacks expertise in managing expansion into these markets. The expansion overseas would also require a higher marketing expense to support brand awareness as energy drink consumption is low overseas and competition in the health drink segments is tight due to saturation.

Distribution Network Risks: Management seeks to reduce the amount of billback allowances and trim down marketing and sales expenditures despite focusing on growth. Driven by the access to Pepsi’s distribution network and dedicated shelves in convenience stores, management aims to close out their net loss from FY2022 whilst still maintaining growth through the reduction of discounts and incentives given to stores to hold their products as well as trim back on marketing.

Mitigation: While management remains optimistic that trimming the number of discounts and incentives will be feasible in the United States due to the distribution network they have, the plan to move towards a healthy drink brand added to increasing their SKU portfolio implies that the billback allowance and marketing amount will increase relative to revenue levels if they wish to maintain high growth rates given the nature of the energy drink market dynamics.

ESG assessment

CELH had previously published its first and only sustainability report in August 2021. The company follows the MSCI ESG Rating benchmark and UN SDGs to facilitate the disclosures applied.

Environmental Coverage and Mitigation Strategies

CELH manages its environmental footprint through the packaging utilised, with 90% of products sold in 12oz aluminium cans which are 100% recyclable. The company has also aimed to reduce the transportation miles between co-packers and distribution points in a bid to reduce carbon footprint.

It should be noted that the company did not disclose the targets and current carbon footprint emitted nor the amount of packaging waste produced in its operations. The company has also not mentioned any efforts to reduce the external packaging required, which is often made from non-recyclable materials like cardboard and plastic. CELH also has limited direct control over the manufacturing of its products due to the reliance on third-party co-packers who source part of the materials used.

Social Coverage and Mitigation Strategies

CELH beverages advertise themselves as nutritional as has conducted several studies to showcase the benefits of consuming CELH. Since 2005, the company has worked with universities to publish 6 different studies covering the benefits of consuming CELH. The studies have supported several claims that it aims to utilise as part of its health branding, including thermogenic properties which have proven properties to increase metabolism and make the nervous system more active. In addition, studies have shown that Celsius products can help reduce body fat, increase endurance and provide greater resistance to fatigue.

CELH has not disclosed any conditions in relation to the labour, nor health and safety protocols utilised. While a portion of labour is outsourced to co-packers, CELH should consider disclosing existing data regarding the employee’s training and the number of incidents given that it is still in the manufacturing industry which involves risk.

Governance Coverage and Mitigation Strategies

CELH has a fully independent board except for John Fieldly who is the Chair of the Board and CEO. The Board and Management also have a total stake of <1% of total ownership. The Board also has an Audit Committee, Compensation Committee and Governance Committee, which are all headed and constituted by independent directors ensuring sufficient independence and lack of influence for the President. CELH board also has a gender mix of 37.5%, with the same amount of members from different ethnicities. Management only has 10% of its members from a different gender, indicating a lack of diversity within management.

CELH has employed standard practices in ensuring sufficient independence between the Board and management, along with the relevant committees to ensure that the Board acts in the interest of shareholders. However, it should be noted that the average age of the Board is 57.5 years old and consists of largely inexperienced members.

ESG Remarks

Overall, CELH performs adequately with governance practices but lacks diversity in its management and has a relatively old Board, relative to the target audience of CELH, being those between 18-35. The lack of diversity may pose a challenge in understanding consumer trends and needs given the nature of CELH’s beverage and segway into consumption as a healthy beverage beyond functionality. The company also could improve on the level of disclosures and metrics used to assess its environmental and social performance, along with the requisite targets it aims to achieve. The frequency of sustainability reporting is also needed for greater assessment of performance in these two matters.

Conclusion

This coverage recommends a strong “SELL” position on CELH. While CELH has demonstrated high growth in the energy drink market previously, the company is likely to plateau in its growth having transitioned into a heavy reliance on Pepsi Co.’s distribution network which had previously failed to push Rockstar’s market share beyond 5%. Moreover, CELH’s attempt to brand itself as a healthy drink poses additional challenges as it would have to overcome the stigma associated with energy drinks and develop new lifestyle trends that integrate energy drinks into everyday consumption. Additionally, the expansion into overseas markets may prove futile without significant marketing spending and a lack of expertise within the current management team.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk

References

References

1) Celsius Holdings, Inc. to Present at Upcoming Investor Conferences - Celsius Holdings Inc. %

2) Annual Reports - Celsius Holdings Inc.

4) Energy Drink Trends | Glanbia Nutritionals

5) Energy drink consumers discuss performance and variety – Echoes (alechoes.com)

6) Red Bull Or Monster? Health Digest Survey Reveals The Most Preferred Energy Drink

7) Survey of energy drink consumption and adverse health effects in Lebanon - PMC (nih.gov)

8) US consumer spending: 2022 survey results | McKinsey

9) Price discounting as a hidden risk factor of energy drink consumption - PMC (nih.gov)

10) Buy Monster Energy Drink, Green, Original, 16 Fl Oz (Pack of 24) Online at desertcart SINGAPORE

13) Monster Beverage Completes Acquisition of Bang Energy | Monster Energy Company (monsterbevcorp.com)

14) U.S. energy drink market share 2023 | Statista (ntu.edu.sg)

15) Undergraduate enrollment in U.S. universities 2023 | Statista

16) A survey of energy drink consumption patterns among college students - PMC (nih.gov)

17) Consumers of energy drinks in 2023, by age | Statista (ntu.edu.sg)

18) Global: energy & sports drinks revenue 2014-2027 | Statista (ntu.edu.sg)

19) https://www.statista.com/outlook/cmo/non-alcoholic-drinks/soft-drinks/energy-sports-drinks/canada

20) Energy & Sports Drinks - US | Statista Market Forecast

21) https://www.wsj.com/articles/mcdonalds-testing-sales-of-monsters-energy-drinks-1445369289?alg=y

22) Consumer Choices and Habits Related to Coffee Consumption by Poles

23) Coffee Statistics: Consumption, Preferences, & Spending

24) New study claims coffee is more popular than water in the US – but what about specialty coffee?

Thank you for the analysis.

May I know what makes Monster successful? And is Celsius doing the same / different things?