Initial Memo: Daiichi Sankyo (4568.T), 67% 5-Year Potential Upside (Leslie TAN, VIP GC)

Leslie presents a 'BUY' recommendation due to Daiichi's strong resilience to withstand cycles and long commitment and aligned interest from its management team.

Linkedin | Leslie Tan

Executive Summary

ADC, or Antibody-Drug Conjugate, has emerged as a groundbreaking modality for cancer treatment, revolutionizing conventional approaches across various indications. Daiichi Sankyo has established itself as the global leader in this field, boasting an industry-leading technology platform and a robust pipeline. This places the company in a unique position as a pioneering force in the disruptive biotechnology sector on a global scale.

In terms of financial performance, Daiichi Sankyo is poised for remarkable growth, primarily driven by its Her-2 ADC and Trop-2 ADC products. Revenue is projected to double, while net profit is expected to triple over the next three years. Additionally, the company's extensive ADC pipeline ensures sustainable growth for the foreseeable future.

Regarding stock performance, the forward PE ratio for the next three months stands at 34.6x. Given its status as one of the few exceptional growth stocks in the Japanese healthcare market, Daiichi Sankyo is Ill-positioned to benefit from the anticipated strength of the Japanese capital market in the coming years. The three-year target price of 5334 JPY implies a PE ratio of 40x, offering a 39% upside compared to the current stock price and realizing an 11.5% IRR. Furthermore, the five-year target price of 5334 JPY implies a PE ratio of 30x, also providing a 39% upside compared to the current stock price and realizing a 10.9% IRR.

Company Overview

Founded in 1899 in Tokyo, Japan, Daiichi Sankyo has established itself as a prominent player in the pharmaceutical industry. As a leading healthcare company, it has made significant contributions in medical innovation and therapeutic advancements. Notably, Daiichi Sankyo has been involved in groundbreaking research and development, resulting in the introduction of several successful drugs and treatments. In 2006, the company acquired the Indian generic drug manufacturer Ranbaxy Laboratories, expanding its global presence and enhancing its product portfolio. With a diverse range of pharmaceutical products, Daiichi Sankyo operates in over 20 countries and is recognized for its commitment to improving global health.

In the latest financial year, Daiichi Sankyo reported a revenue of 1,278,478 mn JPY and demonstrated a growth rate of 22%. Key stakeholders in Daiichi Sankyo include prominent institutional investors, with Capital Research and Management Company at 7.89%, BlackRock at 6.4%, Nomura Asset Management at 5.27%, and Nissay Asset Management at 4.48%.

Business segments and revenue drivers

Daiichi Sankyo’s revenue consists of three segments: ADC products, Milestones/ Royalties and other drugs. As of 2023, ADC products account for 26.4%, Milestones/ Royalties account for 4.9% and other products account for 68.7%. ADC products include ADC Products, Enhertu (DS-8201), Dato-DXd (DS-1062), Her3 DXd (U3-1402) and B7-H3 (DS-7300), which are the main drivers in the coming years.

ADC Products

Daiichi Sankyo has a robust pipeline of ADC candidates that are being evaluated in clinical trials across multiple indications. These include HER2-targeting ADCs for breast cancer, TROP2-targeting ADCs for various solid tumours, and B7-H3-targeting ADCs for lung and other cancers. The company's commitment to advancing ADC technology is demonstrated by its investment in research and collaborations to explore new targets and improve clinical outcomes.

DS’s ADCs are designed to selectively deliver potent cytotoxic agents directly to cancer cells, minimizing damage to healthy tissues and reducing side effects. This targeted approach enhances the therapeutic efficacy of the treatment while potentially improving patient outcomes. The company utilizes its deep understanding of antibody engineering, linker technology, and potent cytotoxic payloads to create novel ADCs with enhanced properties, which are leading the treatment of the unmet medical needs for breast cancers globally and becoming the main growth driver for the next five years.

Daiichi Sankyo’s ADC revenue is expected to grow at a CAGR of 25.5% in the next five years. Its total revenue is expected to grow by five times to 1.5tn at the end of 2028.

Milestone and Royalties

Daiichi Sankyo and AstraZeneca have formed a strategic partnership in the field of ADCs to accelerate the development of innovative cancer therapies. This collaboration combines Daiichi Sankyo's expertise in ADC research and development with AstraZeneca's global commercialization capabilities. The partnership includes exclusive global rights for AstraZeneca to Daiichi Sankyo's lead ADC candidate, DS-8201, which targets HER2 (human epidermal growth factor receptor 2) - a protein overexpressed in certain cancers, particularly HER2-positive breast cancer. Additionally, the collaboration extends to the development of Trop2-targeting ADCs, as Trop2 is highly expressed in various solid tumours.

DS-8201, the flagship ADC candidate, has shown promising results in clinical trials by specifically targeting HER2 on cancer cells, delivering a potent cytotoxic payload to inhibit tumour growth. AstraZeneca provides significant financial support to Daiichi Sankyo as part of the partnership agreement, including upfront payments, royalties, and milestone fees. Daiichi Sankyo stands to receive royalty payments based on net sales of DS-8201 and potential future ADC products resulting from the partnership. Moreover, the collaboration encompasses the development of Trop2-targeting ADCs, leveraging the high expression of Trop2 in solid tumours such as lung, breast, and bladder cancers.

Daiichi Sankyo’s royalties and milestone fee revenue is expected to grow at a CAGR of 7.3% in the next five years. The business will contribute more than 100bn JPY cash to the company every year.

Others

For others, Daiichi Sankyo's history of M&A has led to a diverse range of businesses and products within the company. Through strategic acquisitions, Daiichi Sankyo has expanded its portfolio, entered new markets, and enhanced its capabilities in various therapeutic areas. These M&A activities showcase the company's commitment to growth and innovation.

As a result, Daiichi Sankyo's portfolio spans multiple therapeutic areas, including cardiovascular, oncology, and infectious diseases, enabling the company to address diverse patient populations and contribute to the advancement of healthcare. Daiichi Sankyo's diverse portfolio encompasses various notable products, including American Regent, Sankyo Espha, Lixiana (Edoxaban), and Tarlige (eptinezumab). These products showcase the company's commitment to delivering innovative solutions across different therapeutic areas.

American Regent, a subsidiary of Daiichi Sankyo, specializes in pharmaceutical ingredients. With a focus on quality and safety, American Regent plays a crucial role in the production of essential pharmaceutical components.

Sankyo Espha represents an important offering within Daiichi Sankyo's pharmaceutical lineup. This product contributes to the company's commitment to providing effective treatments for a range of medical conditions.

Lixiana (Edoxaban) is another significant product within Daiichi Sankyo's portfolio. As an oral anticoagulant, Lixiana offers a valuable therapeutic option for patients with atrial fibrillation and venous thromboembolism.

Tarlige (eptinezumab) is a noteworthy addition to Daiichi Sankyo's product range. Developed as a monoclonal antibody therapy, Tarlige addresses the needs of patients suffering from migraine attacks.

Cost drivers

Gross margin of Daiichi Sankyo was 71.6% in 2023 and is expected to expand to 78.0% in 2028 driven by the change in product mix. ADC products will contribute a higher gross margin thanks to the higher pricing of innovative drugs. NOPAT margin is stable at around 7%. I believe the NOPAT margin will grow a bit to 8.0% in 2028.

For expenses, R&D and SG&A are growing as the revenue expands, especially for R&D, which is the main cost driver for a pharmaceutical company. I believe with sufficient cash flow and a proven modality of leading products, Daiichi Sankyo will continue to invest in the future pipeline by 2.5x folds.

Competitor Analysis

Companies like Seagen, ImmunoGen, and Spirogen have emerged as key players, with Seagen being involved in over 30% of the currently marketed ADC products. These companies have had a profound impact on the development of ADC technologies and patents. Choosing the right cytotoxic drug is a crucial aspect of ADC development.

Currently, most ADCs carry DNA-targeting or microtubule inhibitors. Substances like auristatin derivatives 奥瑞斯他汀衍生物 (MMAE) and maytansinoids美登木素生物碱衍生物 (Dx) are widely used, with Seagen and ImmunoGen being the owners of their respective technologies. PBD (pyrrolobenzodiazepine) compounds, derived from Streptomyces, have also gained attention, with Spirogen being an early innovator in this area.

We can tell the patent domination of linkers and payloads in the chart below:

The ADC market is becoming crowded with more MNCs exploring the candidates. Different MNCs adopt different strategies:

AstraZeneca: AstraZeneca strategically acquired Spirogen, a pioneer in PBD-based ADC technology, allowing them to enter the ADC field. They also invested in ADC Therapeutics and collaborated with Daiichi Sankyo, further expanding their presence in the ADC market.

AbbVie and Gilead: These companies secured their positions in the ADC field through significant acquisitions. By acquiring companies with established ADC technologies, products, or pipelines, AbbVie and Gilead gained a foothold in the ADC market.

Roche: Roche represents a risk-averse strategy by focusing on collaborations rather than developing their own ADC platform. They partnered with ImmunoGen to obtain the successful ADC product Kadcyla and collaborated with Seagen to launch Polivy, both of which have shown positive sales performance.

Novartis: Novartis followed a similar strategy as a latecomer to the ADC field. They established collaborations, including a collaboration with Daiichi Sankyo, to access promising ADC technologies or products and enter the market.

Merck: Like Novartis, Merck adopted a strategy of collaboration to enter the ADC field. They collaborated with Seagen to develop and commercialize ADCs.

Pfizer: Pfizer initially entered the ADC field through the acquisition of Wyeth, which included the world's first ADC, Mylotarg. However, they shifted their focus away from ADCs for a period. Recently, with the success of ADC Therapeutics' products, Pfizer regained interest in the ADC field and is reportedly in preliminary negotiations to acquire Seagen, which could significantly boost its presence in the ADC market.

Daiichi Sankyo: Daiichi Sankyo has strategically collaborated with multiple pharmaceutical companies, including AstraZeneca, Novartis, and Pfizer, to develop and commercialize ADCs. These collaborations have allowed Daiichi Sankyo to leverage its expertise in ADC technology and expand its presence in the ADC market.

Investment Thesis

ADC technology spreadheads to shape the treatment of cancer

ADC technology is shaping the treatment of cancer by increasing the efficacy of anticancer medications, minimizing systemic drug distribution, and providing novel therapeutic alternatives for diseases with poor prognoses and few treatment options

Increased Efficacy

ADCs have shown promising results in clinical trials. For example, in a phase 3 trial, Enhertu, an ADC developed by AstraZeneca and Daiichi Sankyo, demonstrated a statistically significant improvement in progression-free survival compared to standard-of-care chemotherapy in patients with HER2-positive metastatic breast cancer. The median progression-free survival was 28.8 months in the Enhertu group compared to 5.6 months in the chemotherapy group. These results demonstrate the potential of ADCs to improve treatment outcomes in cancer patients. These results are significantly better than those achieved with traditional chemotherapy or HER2-targeted therapies alone.

The use of ADCs can increase efficacy in cancer therapy because they can selectively target cancer cells while sparing healthy cells. This is because the monoclonal antibodies in ADCs are designed to recognize and bind to specific antigens that are overexpressed on the surface of cancer cells. Once the ADC binds to the cancer cell, the chemotherapy drug is released and kills the cancer cell. This targeted approach can reduce the side effects associated with traditional chemotherapy, which can damage healthy cells as well as cancer cells.

The use of ADCs can increase efficacy in cancer therapy because they can selectively target cancer cells while sparing healthy cells. This is because the monoclonal antibodies in ADCs are designed to recognize and bind to specific antigens that are overexpressed on the surface of cancer cells. Once the ADC binds to the cancer cell, the chemotherapy drug is released and kills the cancer cell. This targeted approach can reduce the side effects associated with traditional chemotherapy, which can damage healthy cells as well as cancer cells.

Minimizing systematic drug distribution

ADC technology can minimize systemic drug distribution in cancer treatment by selectively delivering cytotoxic drugs to tumour cells while sparing healthy cells. The large size of ADCs minimizes their distribution into metabolizing and healthy tissues, and ADCs provide a selective targeting mechanism for cytotoxic drugs, improving the therapeutic index in clinical practice. The primary purpose of ADCs is to increase the efficacy of anticancer medications by minimizing systemic drug distribution and targeting specific cells, and ADCs successfully minimize the systemic toxicity of chemotherapy and provide novel therapeutic alternatives for diseases with poor prognoses and few treatment options.

Advanced drug delivery systems provide a targeted approach for delivering cytotoxic chemotherapy to tumours while limiting effects on healthy cells. For example, ado-trastuzumab emtansine (Kadcyla) is an ADC used to treat HER2-positive breast cancer. It consists of the monoclonal antibody trastuzumab linked to the chemotherapy drug DM1 via a stable linker. The trastuzumab selectively binds to HER2 receptors on breast cancer cells.

Once bound, the entire ADC complex is internalized into the cell. Inside the cancer cell, enzymes cleave the linker, releasing DM1 to cause cell death. This targeted release mechanism allows Kadcyla to achieve powerful antitumor activity while bypassing healthy cells that do not overexpress HER2. As a result, it can treat breast cancer more effectively at a lower systemic dose of DM1, reducing side effects compared to traditional chemotherapy. Kadcyla's antibody component also serves to repeatedly transport DM1 back inside tumour cells, ensuring a lasting response with fewer treatment cycles than standard therapy alone.

Alternative therapy for previously unmet medical needs

For many years, certain types and subtypes of breast cancer presented formidable challenges due to resistance to existing therapies or lack of treatment options. However, recently approved ADCs have begun to fulfil significant unmet medical needs in these hard-to-treat settings.

One area where ADCs have been transformative is in treating HER2-positive breast cancer. This aggressive cancer subtype accounts for around 20% of cases but was difficult to manage for many years. Traditional chemotherapy could control the disease for a time but did not provide a lasting benefit and toxicity was a major concern. The approval of ado-trastuzumab emtansine (Kadcyla) in 2013 changed this. As an ADC, Kadcyla delivers the potent chemotherapy agent DM1 directly to HER2-expressing breast cancer cells via the targeting antibody trastuzumab. In clinical trials, Kadcyla demonstrated a 33% reduced risk of disease progression or death compared to lapatinib plus capecitabine in patients who recurred after prior treatment. Its targeted mechanism allows effective control of HER2-positive breast cancer at lower system doses than standard chemotherapy alone, fulfilling an important unmet need.

For patients with triple-negative breast cancer, which lacks hormone receptors and HER2 expression, limited effective therapies also existed. This cancer is often resistant to traditional chemotherapy. However, new ADCs have shown promise in trials. Sacituzumab govitecan (Gilead) for instance, delivers the topoisomerase inhibitor SN-38 to cancer cells expressing the target Trop-2. In a phase 3 trial, sacituzumab govitecan reduced the risk of death for patients with metastatic triple-negative breast cancer by 21% compared to single-agent chemotherapy. Its targeted profile may overcome resistance and fulfil an unmet need for this difficult-to-treat patient subgroup.

While ADCs have made great strides in treating cancers like HER2-positive breast cancer, their potential is not limited to just a few tumour types. Researchers are actively exploring the use of ADCs across multiple other solid and haematological malignancies where this approach could provide major benefits. Lung cancers, the leading cause of cancer death worldwide, express antigens ripe for ADC targeting like HER2; early results with DS-8201 have been promising. Prostate cancer driven by HER2/3 signalling may respond to novel bispecific ADCs as well. Melanoma, bladder cancer, and other solid tumours overexpressing proteins such as Nectin-4 and FGFR3 are also candidates. In hematologic cancers, BCMA and CD33 ADCs have demonstrated activity in diseases as prevalent as multiple myeloma and acute myeloid leukaemia. Even rarer cancers, where survival rates are notoriously low due to lack of options, could see improved outcomes from precisely targeted ADCs. Neoadjuvant and adjuvant settings pre- and post-surgery are also under exploration, with the goal of reducing the risk of future recurrence or metastasis across cancer types. Continued advancements in ADC technology spearhead investigations into these diverse indications that may transform treatment.

Daiichi Sankyo breaks through in ADC areas with blockbusters through continuous innovation

Daiichi Sankyo positioned itself as a global pharma innovator several years ago and focused on innovation in oncology. It keeps sustainable innovation and maintains leading positions in the pharmaceutical area. It has outstanding products to provide sufficient cash flow and keeps investing them in research, development and licensing of the best novel medicines. For oncology, the company has brought forth groundbreaking treatments that have revolutionized cancer care such as Enhertu and other products such as acute myeloid leukaemia (AML) treatment with its novel FLT3 inhibitor called quizartinib. Daiichi Sankyo invested the highest proportion of R&D/Rev among the eight biggest Japanese companies.

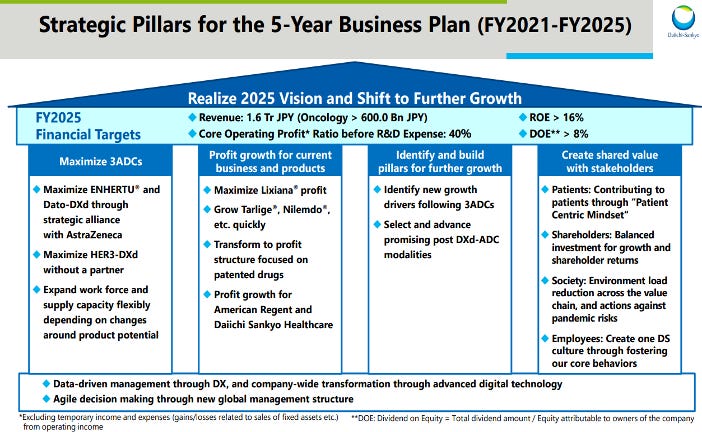

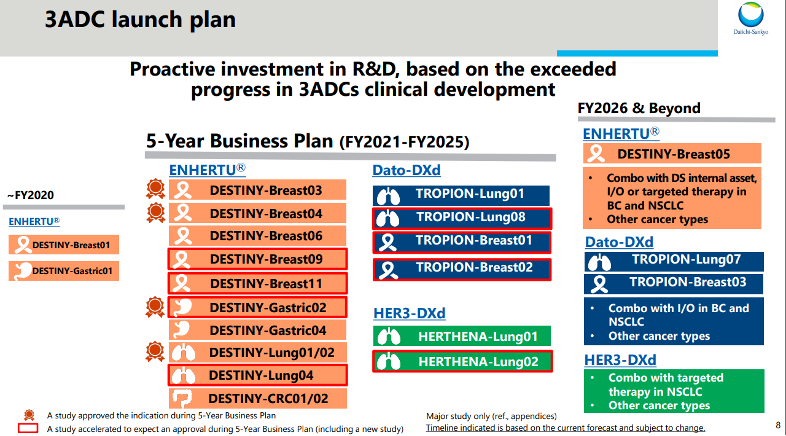

Daiichi Sankyo has ambitious 5-year business goals with targets for significant growth, aiming for a 40% increase in both revenue and core operating profit. A key focus is maximizing the value of its 3 leading ADCs, especially Enhertu and Dato-Dxd. The company also aims to drive growth across its existing businesses and products such as Tarlige, Nilemdo, and Lixiana. To achieve these targets, Daiichi Sankyo will leverage its strengths in oncology and its pipeline of novel targeted therapies while continuing to expand globally and capitalize on other core product franchises. This well-balanced strategy combines revenue generation from current brands with forging new standards of care through the next wave of innovative ADC medicines.

Daiichi Sankyo's revenue from 2019 to 2028 showcases a steady growth trajectory. Total revenue increased from 929,717 in 2019 to 2,517,078 in 2028, with consistent year-over-year growth rates ranging from -2% to 26%. The company's ADC products, such as Enhertu (DS-8201) and Dato-DXd (DS-1062), demonstrated remarkable growth, accounting for a rising percentage of total revenue over the years. Enhertu specifically showed significant growth, increasing from 1.4% of total revenue in 2020 to 48.6% in 2028. Other revenue sources, including Sankyo Espha, Lixiana (Edoxaban), Tarlige (eptinezumab), and American Regent, maintained a significant portion of total revenue, though their percentages decreased as the LOE issue.

3 ADCs

Daiichi Sankyo's three flagship ADC programs that are key parts of their strategy include:

Enhertu (trastuzumab deruxtecan) - An HER2-directed ADC approved for metastatic breast and gastric cancers. It is their lead product and has demonstrated significant tumour shrinkage and overall survival benefits in clinical trials.

Dato-Dxd (datopotamab deruxtecan) - A TROP2-targeted ADC in late-stage development for multiple cancer types including non-small cell lung and breast cancer. Early data shows promise as a potential new standard of care.

DS-1062 (milciclib-cetuximab conjugate) - A c-Met/EGFR bispecific ADC currently in Phase 1 trials for various solid tumours. It combines targeted delivery of two different chemotherapies via a single agent.

Daiichi Sankyo's ADC (antibody-drug conjugate) technology stands out for its unique features and capabilities, which contribute to its potential to outperform other ADC technologies in the field. Here are some key aspects that distinguish Daiichi Sankyo's ADC technology:

Payload Innovation: One crucial element of ADC technology is the cytotoxic payload, the drug component DXd that is attached to the antibody. Daiichi Sankyo has developed a portfolio of potent cytotoxic payloads that exhibit high efficacy in targeting and killing cancer cells. These payloads are designed to be stable during circulation in the bloodstream and selectively released upon reaching the tumour microenvironment, maximizing their therapeutic impact while minimizing side effects.

Site-Specific Conjugation: Daiichi Sankyo employs a site-specific conjugation approach, which allows for precise attachment of the cytotoxic payload to the antibody. This method ensures consistent drug-to-antibody ratios, resulting in a more homogeneous and predictable ADC product. By maintaining a defined drug-to-antibody ratio, the efficacy and safety of the ADC can be optimized, leading to improved therapeutic outcomes.

Enhanced Antibody Design: The selection and engineering of the antibody component are critical in ADC technology. Daiichi Sankyo focuses on developing high-affinity antibodies that specifically target tumor-associated antigens. By selecting the right antibody and optimizing its properties, such as binding affinity and internalization rate, Daiichi Sankyo's ADC technology can effectively deliver the cytotoxic payload into cancer cells, enhancing the precision and potency of the therapy.

Robust Linker Technology: The linker serves as the bridge connecting the antibody and the cytotoxic payload in an ADC. Daiichi Sankyo has developed proprietary linker technologies that provide stability during circulation and controlled release of the cytotoxic payload within the targeted cancer cells. This ensures that the payload is released at the right time and location, maximizing its therapeutic effect while minimizing off-target toxicity.

Alpha

Daiichi Sankyo's commitment to innovation extends beyond its focus on antibody-drug conjugates (ADCs) in oncology. The company has also implemented an Alpha strategy R&D pipeline to explore additional opportunities in the fields of oncology, specialty medicine, and vaccines. This strategic approach demonstrates Daiichi Sankyo's dedication to expanding its portfolio and addressing unmet medical needs across various therapeutic areas.

Within the Alpha strategy R&D pipeline, Daiichi Sankyo aims to identify and develop novel therapies that have the potential to make a significant impact on patient care. By exploring opportunities in oncology, the company continues to seek out innovative targets, pathways, and treatment modalities that can enhance the understanding and management of cancer. Additionally, Daiichi Sankyo's focus on specialty medicine highlights its efforts to develop therapies for specific diseases or patient populations where there may be limited treatment options available.

Rising ROIC with increasing margin and stable capital efficiency

Operating expenses have been stable at 60% of total revenue, higher than its peers due to it expanding globally. The company guides an improving margin profile to 10% in 2025 There is further room for the decrease in S&M cost and we believe the SG&M/Rev ratio will decrease from 37% in 2023 to 33% in 2026. R&D costs will remain high but decrease from 27% to 24% of the total expenses to keep its leading position.

The capital efficiency of Daiichi Sankyo will remain high at around 2.5 as its incremental capital expenditure won’t fluctuate much and the solid position in the value chain ensures its working capital efficiency.

Strong resilience to withstand cycles

A resilient balance sheet with a low debt profile and improving working capital metrics. Its net cash remains high at around 0.7tn JPY while its cash conversion cycle has become negative due to its improving bargaining power with suppliers, thanks to the popularity of Enhertu.

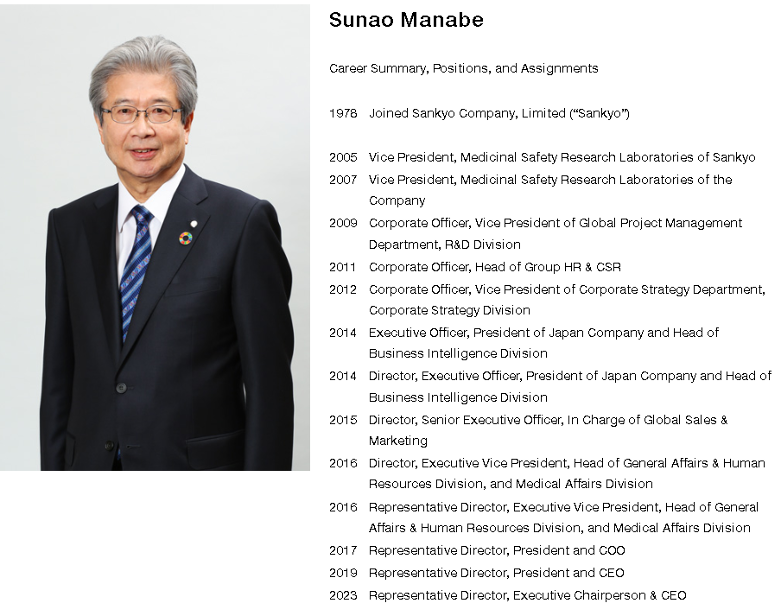

Long commitment of the management team with aligned interest

Valuation

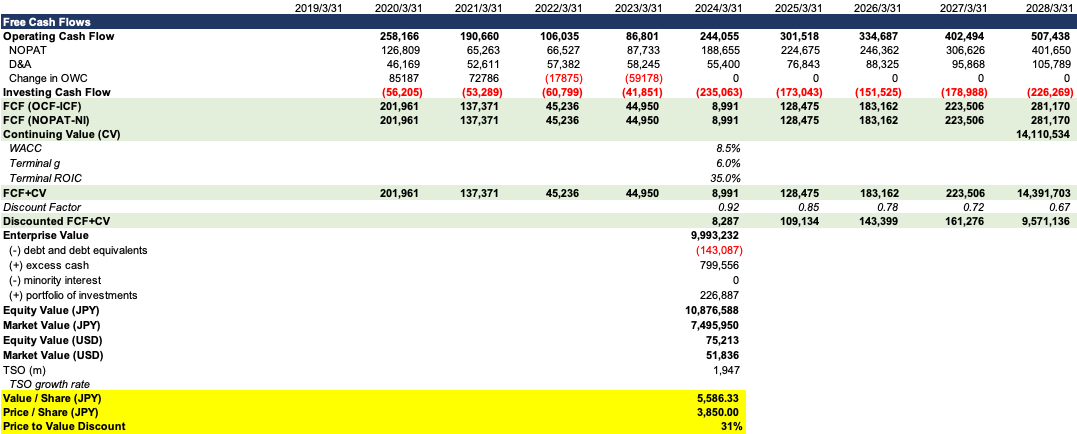

Both CCA and DCF valuation methods are applicable to Daiichi Sankyo.

For CCA, we give a PE of 40x in three years. With the estimated net profit growth of 30% in 2027, we will have a forward PE of 31x. In the model, the EAT in 2027 is 321.3bn JPY. So the implied valuation is 9871bn JPY, which is an upside of 39%.

For DCF, the free cash flow projection and valuation are as follows. We give the WACC of 8.5% and 6% terminal growth after 2028. We will get a market value of 7496bn JPY, with an implied 31% price-to-value discount.

Risks and Mitigation

Late-stage R&D failures or disappointments

Daiichi Sankyo’s long-term value is underpinned by its deep pipeline. If there are R&D failures on the key products, the NPV will be discounted.

Mitigants:

Diversify its pipeline to reduce reliance on a single product

Active partnerships to reduce risks and decrease development costs

Manufacturing accidents in biologics

Manufacturing biologics is hard and accidental, especially for ADC. Problems with manufacturing may do harm to patients’ health and affect the company’s reputation

Mitigants:

High standard of quality control

Balance in-house manufacturing and CDMO to mitigant risks

Disruptive biology technologies that replace existing products

Cancer screening, mRNA, and cancer vaccine may replace the ADC methods in the long run

Mitigants:

Partner with frontier players

Acquire disruptive technologies

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk