Initial Memo: Intuit (INTU), HOLD (Ryan Ang, EIP)

Ryan feels that at the current valuation, Intuit lacks the margin of safety that he typically seeks hence recommending a "HOLD" position.

Linkedin | Ryan Ang

Valuation and Recommendation

On a company basis, I expect a sustainable 15% - 20% earnings growth for the company. This is primarily driven by the Small Business & Self Employed (SBSE) segment with its continued new user growth (penetration), and additional value capture from new horizontal business segments.

The company currently trades at ~FY2024 60x P/E, which is above the average of ~50x. At a 15 – 20% earnings growth, even after considering the quality aspect and high certainty of sustainable growth, a P/E multiple of 60x is too uncomfortable.

I would weigh this current high valuation and take into account of potential derating to a multiple of ~40x, which would put the IRR around 8-13%. Compounding this IRR by the years, this arrives at a price of $782 (3Y target) and $912 (5Y target). Personally, I would prefer a level of margin of safety in my initiation and, therefore, would recommend an entry price of $420 (FY2024 P/E 40x). Therefore, as this recommended price is unlikely, I will aim to build conviction and understanding of the underlying business first while I await a pullback in valuation (if and when it occurs).

Paper Overview

The SME accounting software space falls under the Enterprise Resource Planning (ERP) umbrella term, encompassing core finance and accounting systems along with broader activities like supply chain management, HR, and more. This paper focuses on the accounting software sector in the SME segment and the competitive dynamics within it.

Within the SME accounting space, particular attention is given to Intuit. Intuit remains the best-in-class player in this space, primarily due to it being the “accounting language” in the USA and equivalent geographies from having the largest scale in the number of partnering accountants and vendors which creates a natural organic momentum in its growth. Its user-friendly interface facilitates quick adoption, while extensive third-party integrations minimize user friction and frustration. Moreover, Intuit's expansion into payments, capital, and payroll services not only improves customer retention but also enables it to capture more of its business activities as its enterprises expand. Regarding industry penetration, it's noteworthy that many SMEs still underutilize accounting software despite its potential for time-saving and automation benefits. Future papers will delve into the strengths of competitors Sage, Xero, and SAP, particularly examining the resilience of their competitive advantages.

Accounting software is sticky due to its mission-critical nature, and the business model of Intuit is one that will over time further improve margin as additional platform sales can be sold at 100% gross margins. Scale advantages on marketing and R&D that are currently held by Intuit provide competitors no chance to gain a foothold into this space, and its current networks with accountants meant that Intuit’s software has become the de facto language in the SME space. This is what makes Intuit a good business.

However, one concern with Intuit is its recent M&A activity has led multiple value funds, including Terry Smith's Fundsmith, to exit their positions due to concerns over poor capital allocation by management. This leads me to analyze the 2 major acquisitions, Mailchimp and Credit Karma, to understand and find out what is the underlying story for management to make such a decision. The price paid for the acquisition is a concern, but what is more concerning is investing and expanding operations into segments where there is no competitive advantage. I seek to understand if this is the case.

Industry – But firstly, why SME Accounting?

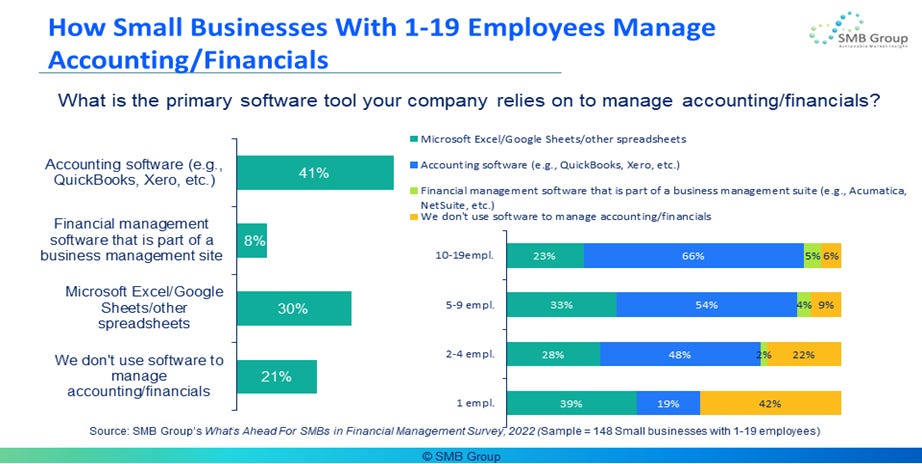

The SME Accounting benefits from a largely underpenetrated utilization of accounting software in the SME space – about 60% of SMEs do not utilize accounting software, with 30% of them using Excel and the remaining 20% on hardcopy paper and pen

Accounting and financial software enjoy significant benefits from high switching costs compared to other SME software offerings like marketing, data analytics, and HR Management (HRM), although certain segments of HRM, such as Payroll processing, are arguably equally sticky and underpenetrated. This added stickiness stems from the fact that these are simple yet critical activities that every business requires to operate. Furthermore, the switching costs tend to increase as customers become accustomed to the interface and system.

To quantify these switching costs, consider a small business owner with fewer than 5 employees who has the option of outsourcing accounting to an accountant, incurring typical annual expenses of $1000 - $5000, or managing the books themselves. The average annual subscription cost for managing one's books using software ranges between $200 USD - $300 USD, representing a substantial 80% - 95% reduction in costs. Although one must consider the time and effort required to initially learn the platform, as well as the additional daily minutes spent managing their own books, I believe that for a typical SME with fewer than 5 employees, there is a compelling appeal to utilize accounting software.

Industry – If Accounting Software is so favourable, why is adoption and penetration still low?

Firstly, adoption and penetration levels vary across geographical segments. In the US, UK, Australia, and Canada, Intuit estimates a potential customer base of about 75 million, with 8 million customers on the QuickBooks platform, representing approximately 10% penetration. Customer growth has surged from 2.3 million in FY13 to 4.5 million in FY18, averaging 400,000 customers per year during the FY13-FY18 period, and reaching 8.8 million in FY23, reflecting a doubling in customer acquisition to 800,000 customers per year for the FY19 – FY23 period. In Europe, using Sage as a proxy, current penetration is estimated at about 3% (1 billion revenue in FY2023, 30 billion TAM in FY2023). It's important to note that Sage's TAM estimation includes employees up to 1,000 employees –The SME penetration is much higher than 3%.

One reason for the low penetration and adoption of accounting software is that many SMBs underestimate the value it can bring to their backend operations. According to a survey by SMB Group, 50% of small businesses don’t use accounting software because they believe that manual methods or spreadsheets have been effective for them. This reason outweighs others such as cost and time. Additionally, about 70-80% of SMBs still outsource their financial and accounting tasks to certified accountants. However, we are observing a gradual shift among SMEs from outsourcing to managing their books, rising from 21% in 2020 to 23% in 2023. We anticipate this trend to persist, driven by rising labour costs and greater potential for cost savings.

Nevertheless, the growth of accounting software adoption depends more on the transition from Excel to accounting software rather than from outsourcing accounting to in-house management. Third-party accountants often serve as a catalyst for SME operators to adopt accounting software for more accurate and efficient bookkeeping, rather than relying solely on Excel. According to a survey by UBS, recommendations from accountants significantly influence SME operators' purchase decisions regarding which solution provider to enroll with. Therefore, having a robust network of accountant partnerships trained on the platform serves as a moat that leads to regionalization and standardization of the product platform. This is why players such as Xero have encountered difficulties in penetrating and gaining market share in the US SME market, and likewise, Intuit may face challenges entering the New Zealand market that Xero controls.

Industry – Competitive Landscape

The above image notes the key players, segmented by employee size. The base of the triangle indicates where the company first began (0-30 employees etc), and the tip of the triangle represents where it is heading. For players such as Intuit and Xero, it began its key operations in the SME space but is expanding into the middle business space of 30 employees and more. For Sage, its offerings are unique in the sense that it has solutions that could cater to from 1 - >1,500, but the penetration is still as a whole is small (as noted in the smaller body size). Conversely, Oracle and SAP hold most of the market share in the enterprise segments but are seen to expand downwards into the >300 employees segment and increasingly, the middle business segment of >30 employees.

From my research, I note that companies in the SME space do not employ a dedicated salesforce to gain the unpenetrated segments and rely heavily on referrals and organic growth. Advertising strategies are often high-reach, low-touchpoint campaigns rather than dedicated and personalized campaigns. This is because the characteristics of the SME segment is that the majority of untapped TAMs consist of businesses with less than 5 employees. Hence, even the cost of a small, dedicated salesforce would not make any economic sense [See Appendix – TAM Breakdown].

Therefore, as growth is largely organic, companies do not compete by having larger salesforces, but on the scale of partnerships and networks. As mentioned above, accountant referrals are big channels for the adoption of preferred software platforms. For Intuit, it boasts the largest number of accountant partnerships, with 600,000 accountants trained and partnered on the QuickBooks platform. This is compared against Xero’s 200,000, and Sage’s 80,000. However the network of accountants is largely regionalized, meaning that as Intuit’s focus is largely in North America, its large partnership of accountants in North America does not translate into any network effect in Australia, New Zealand or the United Kingdom.

Framework to Analyse SME Accounting Businesses

The following will list the key considerations on which will I be evaluating the business – 1. Product Quality (Ease of Use/ Infrastructure (Open/Close), 2. Core market structure and 3. Portfolio Breadth.

Product Quality and Pricing

In this category, the key consideration would be how easy it is for users to adopt as well as the pricing relative to other offerings. To further evaluate this, we would be looking at the time needed to learn and use the platform, the number of features as well as number of integrations that are built upon the product and weigh it against the customer needs of the region.

Core market structure.

In this category, the point of analysis is on whether the company has hit a “point of inevitably” or critical mass where the company’s product becomes the standard as a result of same-sided network effects.([1]) For the case of SME accounting software, this same-sided network effect comes in the form where software solutions such as QuickBooks become the default operating language for the region such that any businesses that are not yet on the system would be encouraged to adopt this system either by their in-house/outsourced accountants, suppliers, or potentially government in the form of taxes preparation. We evaluate their strength by comparing their partnership and vendor scale.

Portfolio Breadth

One of the biggest pushbacks against investing in the SME space is that the average lifespan of an SME is less than 5 years, meaning that turnover is around 15% per year. This means that companies may need to continuously spend to acquire new customers and restricted pricing (purchasing power of SMEs is low) would mean that lifetime value (LTV) is considerably lower when compared to the middle markets and enterprise segment. Therefore, a mitigating factor is whether the portfolio offerings of the company are robust and wide enough to allow it to “follow” its clients as they progress, which in return helps to reduce the overall churn levels. I do admit that there will be a point where offerings such as NetSuite or SAP would be more suitable, but case examples of Uber building a multi-billion-dollar business before switching away from QuickBooks tell me that the incentive to switch comes much later in employee size progression.

The following table does a quick comparison across the space and very quickly, one can understand why Intuit stands out with their massive partnership scale, customer scale and the intuitiveness of their platform.

Quick Snapshot of Coverage Operating Metrics Based on Framework

* - Might be in local currency for Xero

Company Coverage – Intuit (Nasdaq: INTU)

Intuit was started in 1983 by Scott Cook and Tom Proulx in Palo Alto, California. The story of how Intuit began was quite interesting – Scott Cook first started his career in Procter & Gamble where he learned about product development, and market research before becoming a strategic consultant at Bain & Company. The idea of personal finance software came to him when his wife first complained to him about how time-exhaustive and difficult it was to pay basic bills. This is when Scott realizes that there may be a market opportunity for a personalized financial tool. Scott teamed up with then-co-founder, Tom Proulx, to create the first personalized finance software called Quicken. However, in 1991, Microsoft launched its own personal financial tool, Microsoft Money, where it aimed to be the direct competitor against Intuit. In response, Intuit had to provide a USD15 rebate to retailers to retain their loyalty. This event is crucial in helping us understand Intuit’s eventual spinoff of Quicken and why it was a good decision, despite it being a major revenue contributor at the point of time. Quicken, or the personal finance space, has no moat. Retailers are incentivized by rebates, software providers have no pricing power, and users have no incentives to stay. However, the unexpected invention of Quicken was the realization that about 50% of users were using Quicken for small businesses, despite it being designed as a 100% personal product. This led to the decision for further research and user testing which validated the finding that the real profit pool is not in the consumer market, but the business market. In 1992, Intuit launched QuickBooks with less than half of the features of accounting software but was priced at twice the level of the top offerings. Experts at that point in time disapproved of QuickBooks for the lack of features but the product became the best-selling accounting software due to one key reason – it met customer needs of doing accounting, without needing to understand accounting. This arguably set the culture at Intuit – a customer-centric focus rather than feature stuffing, similar to Steve Jobs’s philosophy of “Working back from the customer”. Then, in 1993, Intuit went public. The proceeds from the IPO were used to acquire a tax-preparation software company called Chipsoft whom Scott and Tom met during a conference which shared the same vision and objectives as Intuit. The combined businesses and the customer-centric culture became the core pillars of current-day Intuit’s dominance in the accounting and tax preparation industry.

In today’s Intuit, there are 4 key business segments – 1. Small Business and Self Employed (SBSE), 2. Consumer (CG), 3. Credit Karma (CK) and 4. ProTax. SBSE contributes the most revenues, at 57% of company revenues, followed by CG, at 30% of company revenues, then by CK at 10% of revenues and ProTax at 3% of revenues. In terms of profitability, ProTax has the highest operating margin at 70%, followed by CG at 65%, SBSE at 56% and CK at 26%. This means that with respect to materiality, only SBSE and CG are worth considering as they contribute ~90% of operating income. In terms of growth, SBSE continues with the highest predictable growth of 16-17%, followed by CG at 7-8% and ProTax at 3-4%. CK on the other hand experiences much volatile growth, with negative MDD% to negative LDD% growth, despite initial expectations of positive MDD% growth for the same FY2023.

Growth Drivers of Business Segment

Small Business and Self-Employed – QuickBooks Online

The SBSE segment is a clear example of Intuit’s moat and pricing power. The gross retention rate for Intuit’s SBSE solutions hovers around 80+%, which may pale when compared against enterprise players like Workday’s and Salesforce’s 90 – 95%. However, the context needs to be set that around half of SME businesses cease to exist beyond 5 years (15% churn), meaning Intuit’s gross retention is respectable when considering the context. Furthermore, gross retention rates remain stable over the years despite large incremental in ASP (10 – 33%) across product segments (e.g. in 2023), displaying Intuit’s pricing power over its customers. This is understandable as solutions such as QuickBooks are mission-critical, and costs are low in terms of the overall costs of operating the business.

SBSE business segment consists of 2 key products – 1. QuickBooks Online (QBO) and Related Iterations and 2. Online Services. As briefly alluded to above, customers use QuickBooks to manage their businesses’ finances such as bookkeeping, payroll management and increasingly, payments.

Since the launch of QuickBooks online, a few renditions such as QuickBooks Self-Employed, QuickBooks Growth, QuickBooks Advanced (QBOA) and QuickBooks Live were introduced to better cater towards differentiated customer needs. The key difference between the differentiated offerings is the types of features and user support. For example, QBOA is catered towards medium-sized businesses of up to 30 employees. Intuit estimates that around 10-12% of existing QuickBooks customers reach this size each year, with about half of them leaving QuickBooks for other solutions. This prompted the introduction of QBOA which is a low-cost alternative of ~USD 2400/annual as compared to alternative providers (SAP/Sage) which may cost up to USD25,000/annual. QBOA was launched in 2018, with 180K identified customers. Since then, it has reached 118K customers, many of whom were not originally from QuickBooks, signifying market share gains from other players. What is more important is the acknowledgement of Intuit’s capability to slowly creep up the industry, expanding its core competencies from less than 10 to less than 30 employees and expanding the business TAM.

Then in 2019, Intuit launched QuickBooks Live, which is another feature to connect existing users with a trained, certified public accountant. However, one should look at QuickBooks Live as a means to reduce churn and increase the overall LTV of customers, rather than as a replacement for QuickBooks Online. We note from experts that even though QuickBooks may be intuitive in principle, the live functionality would address a previously known gap, especially in dealing with regulatory, cross-regional compliance, or unique accounting rules. The estimated market TAM given by Intuit’s management is 75M potential customers (Small and Medium Businesses). As the current customer count stands at around 8mil, this implies a slightly over 10% penetration level. However, a quick Google search will show that the implied core market size stands at around ~45M SMEs across geographical regions, about a 40% decline in TAM. Based on this new TAM number, it would mean that QuickBooks penetration is around ~20% penetrated. On average, Intuit obtains 0.8M new QuickBooks customers annually, which translates to about a 1-2% increase in penetration annually. Nonetheless, as all TAM estimations are wrong, this practice does not flag any massive concerns in terms of saturation. On a geographic basis, Intuit already displays the largest scale in terms of the number of customers, making QuickBooks the de-facto accounting software and language of the SME business.

This allows us to have strong conviction that this subsegment will continue to grow at MDD%, driven by continued volume gains from new customers and additional spending on value-added services like the “Live” features which are priced 2x-3x higher than the average base plan. [See below paragraph for the breakdown of MDD%]

An additional point of Intuit expanding horizontally across SME business activities.

As mentioned above, Intuit first started out in the accounting business, and then it progressively entered into tax x preparation, then into consumer finance, and marketing and now it is expanding into other mid-market segments (Payments, Capital, Payroll, Commerce and Banking). In the 2023 investor day presentation, Payments has overtaken and became the largest unexploited TAM by Intuit, representing $57bil in TAM, out of the $312Bil total TAM.

Intuit Investor Day 2023 Payments Vision

Historically, Intuit has opted to collaborate with Bill. Holdings (NASDAQ:BILL) as a channel partner for Bill to process B2B business payments directly. Intuit was such an important partner that at multiple occurrences as well as in the annual report of Bill.com, the company has noted that one of the key risks it could face was Intuit deciding not to collaborate with Bill. This risk came through in August 2023, when Intuit announced the big bets which included its entrance into the B2B payments space. This makes logical sense to me – Intuit already handles the accounting, finance, and tax preparation for small businesses. It would make a natural extension to go into the B2B payment space given the customer captivity it already holds. Furthermore, the automation of billing and bookkeeping would be a value-add to its core customers. The market has reflected this pessimism on Bill, reflecting a decline of ~40% in its share price since then despite Intuit referrals accounting for less than 1% of sales. This pessimism is largely driven by the tapering of Bill’s future growth expectations without Intuit as a channel for referrals, as well as the competition between Intuit and Bill which would affect profitability. Furthermore, if competition tilts towards advertising and sales capabilities, then Intuit stands out with its scale advantage.

Breakdown of MDD% SBSE Growth When adding in these additional sub-segments, the entire small business and the self-employed segment is projected to grow 15 – 20%, with 10% from new customers, and another 10% from additional revenue per customer from these value-added services. This long-term expectation of 15 – 20% growth is reasonable from my perspective, and I have no reason to doubt the long-term viability of this segment, bearing any major adverse macroeconomic tail event.

Intuit Tax Preparation Segment - TurboTax

As written above, TurboTax was first developed by Michael A. Chipman of Chipsoft in 1984 and was sold to Intuit in 1993 when Intuit IPO. This software is designed to guide users through their tax returns through a simple step-by-step process. Typically, TurboTax software is released late in the year when the latest revision to the tax code from the IRS is completed and the IRS approves of TurboTax versions. Because of TurboTax, Intuit has been the subject of major controversy, with its multi-million lobbying campaign against the IRS from creating its own online system of tax filing like those that exist in other wealthy countries. I live in Singapore, and I have yet to even file my own income taxes, but I could understand the importance of having your tax done right. To most, this is often the day you pay the most (taxes), or the day you receive the most (subsidies).

Investor Day 2023 – Tax Industry Breakdown

Now in this space, there are 3 key drivers – 1. Number of total returns, which is tagged to the number of US Citizens, 2. The channel split % between assisted tax preparation (outsourced to Tax professionals), TurboTax (Intuit’s DIY offering), and other DIY software. 3. the average price per return. To start, you should first understand why growth in this space hinges on internal market share gains for TurboTax, rather than riding the industry growth, but also taper the expectations on the market share gain pace for TurboTax as the tax industry is largely ruled by trust rather than costs motivations.

Historically, the number of total IRS filings grows at 1% annually, on average. Therefore, Intuit’s tax growth is not driven by industry growth, but by internal market share shifts. Intuit’s TurboTax accounts for 28% of the market, but 60% of the DIY software space. However, the dominant segment is still the Assisted segment, where an individual outsources this to tax professionals and traditional tax houses. This segment remains sticky, with market share only declining from 59% to 54% (5%) in 10 years. The tax preparation segment is in many ways, driven by trust, and trust is not easily broken. Many generations have come and gone using a family tax agent, and as mentioned above, this is an extremely important day financially and most would continue relying on someone they trust to prepare their taxes, rather than attempting to do it themselves. Therefore, although comparative arguments in terms of TurboTax’s cost savings in comparison to using a tax agent seems compelling, there exists an equally compelling argument against TurboTax where the upfront time needed to learn the platform is a significant dissuading factor from massive adoption in the current generation.

Intuit has introduced new solutions to help combat adoption fears. For example, it introduced both the TurboTax Live function and the Intuit Assist (AI solution), where users can get connected to a tax professional to address any concerns and doubts. This is beneficial on two fronts – Firstly, these solutions stem a retention issue where every year. 10Mil users abandon the DIY method (4M attrition for TurboTax) and go to the assisted method every year([4]). Furthermore, about 45M households visit TurboTax but do not actually log in to start taxes. 16% of new signups who start, abandon the process before entering any tax-related data too. This is driven by the lack of confidence that new users face, as well as the uncertainty of whether TurboTax could assist with their situation. With these new solutions, I believe it would help alleviate some concerns and improve retention.

There is also much talk about the higher ASP with the assisted software solutions, which is price, on average, 2x-3x than base plans. However, this is often accompanied by higher costs associated with the inclusion of professionals. Therefore, margins should remain stable, but one advantage is slow but surely market share gains from the assisted segment over time. This segment is the slowest growing, with about LDD% long-term growth expectations

Breakdown of LDD% Tax Segment Growth - (0 – 2% based industry growth, 2 – 4% market share gains, 4% - 6% higher APPR).

Mailchimp Acquisition

Disclaimer – Personally, I still do not have a good framework to decide if the trade-offs for acquisitions are justified. I welcome any suggestions and feedback for this segment and would appreciate any guidance.

There are 2 large acquisitions that are essential to highlight as they highlight the management quality of Intuit. These 2 acquisitions are 1. Mailchimp and 2. Credit Karma. Let’s start with Mailchimp.

In FY2021, Intuit acquired Mailchimp to expand its presence across the value chain of SME software needs, including marketing and CRM management. The acquisition price for Mailchimp stood at $12 billion, equivalent to 12x LTM Sales. At the time of acquisition, Mailchimp boasted 13 million users, 2.4 million Monthly Active Users (MAUs), and 800,000 paying customers. This translates to Intuit spending approximately $920 to acquire each customer, a notably high figure compared to the annual cost of QuickBooks, which ranges from $200 to $300. The primary aim of acquiring Mailchimp was to enable Intuit to integrate its marketing offerings and cross-sell Mailchimp's advertising solutions to QuickBooks' 8 million user base more seamlessly. On a positive note, the Average Revenue Per User (ARPU) for Mailchimp stands at $1000, three times the ARPU of QuickBooks. This suggests that Intuit could recoup its investment if approximately 33% of its current user base adopts Mailchimp solutions.

While the CEO of Intuit has heralded this acquisition as a "game changer" for SMEs, there remains uncertainty surrounding its true impact. Mailchimp's expertise spans email marketing, website management, and customer relationship management, but its competitive advantages relative to competitors are unclear. Additionally, it's uncertain whether the success of the acquisition hinges solely on converting SMEs not currently using any advertising solution or on persuading SMEs to switch to Mailchimp due to enhanced ease and convenience. Moreover, I am unsure about the extent to which the convenience of using Mailchimp for SMEs has improved, both before and after the acquisition. Furthermore, I question whether there is a comparative advantage to using Mailchimp within the ecosystem compared to using another advertising solution outside the ecosystem. Consequently, I can only view this acquisition as Intuit's attempt to expand across SME business activities, albeit at a steep price.

Credit Karma Acquisition

Moving forward to the acquisition of Credit Karma in FY2020. This acquisition totalled $7.1 billion, representing a multiple of 7x sales and 30x EBIT, and is another complex case to understand. As mentioned earlier, Intuit initially ventured into the personal finance space with its product, Quicken, but swiftly shifted focus to the commercial segment upon recognizing the more favourable industry dynamics there. The personal finance space poses significant challenges for startups—products are often undifferentiated; users lack incentives to remain loyal to a particular solution and most are generally unwilling to pay for what is typically viewed as a "budgeting" tool. This highlights the "biggest problem" articulated by a competitor of Credit Karma, Monarch Finance, who noted that the primary issue of the personal finance industry lies in the business model. In short, a free personal finance app is not sustainable due to the high costs associated with financial data aggregation in terms of needing to attract users to use the app. However in order to provide incentives, apps often rely on advertising support to fund such incentives. But sooner or later, the needs of advertisers often supersede those of the users, undermining the core purpose of the app—to improve users' financial lives. This is what often makes new startups in personal finance fail.

What sets Credit Karma apart? Firstly, Credit Karma is a personal financial platform that provides free credit scores and assists users with their personal finance management. Its key moat lies in its vast user base of 130 million, far surpassing its closest competitors such as Credit Sesame (15 million users) and Experian CreditWorks (user count undisclosed). Achieving such scale already means that Credit Karma has overcome the key challenge of expensive financial data aggregation that plagues players in this segment. With such an established user base, Credit Karma has been able to create a business model that enables it to take a commission on any successful sales of banking products and services. For example, whenever a user requests a credit check, Credit Karma can determine how much the user is currently paying for loans. If there's an opportunity for the user to save money by switching to other banking product providers (such as loans and mortgages), Credit Karma can identify this. Financial institutions are also inclined to offer better rates as they gain a clearer understanding of individuals through their credit scores and spending habits on Credit Karma. This ultimately reduces risk and leads to improved pricing. Interestingly, the same obstacles of expensive user and data scale that Intuit’s Quicken faced have now become barriers to entry that work in Credit Karma's favour. I suspect that Intuit's initial smaller acquisition of Mint, another personal finance app albeit on a smaller scale, reflected management's recognition of the difficulty in developing a product to rival CK. CK represents a significant portion of company sales, accounting for about 15% of sales in FY2022, but only 8% of operating income (margins are lower – 30% vs SBSE’s 55% and TurboTax's 60+%). Sales are also more expectedly more volatile, as it is tagged with the overall macro environment and sensitive to economic cycles. So although I am convinced that acquiring Credit Karma is a good execution decision, what makes this a good space to compete? In essence, why acquire CK?

The primary rationale behind the acquisition of Credit Karma lies in Intuit's strategic efforts to monetize and leverage synergies with TurboTax. For example, the 40 million users (Personal/Business) of TurboTax can seamlessly deposit their tax refund money into a Credit Karma checking account and utilize this cash for other services like billings and payroll. Furthermore, the existing user base of Credit Karma, with 50% of its 130 million users being millennials and younger, presents an untapped customer pool that can potentially become new users of TurboTax. For businesses, acquiring Credit Karma means that by combining cash flow and accounting information from QuickBooks with Credit Karma's credit and asset data, users of QuickBooks can now access better company credit card terms and loans in a quicker and simpler manner. Lastly, the acquisition helped Intuit to better integrate and achieve its overall strategy of becoming more A.I and Machine Learning in its processes by bringing in valuable data([5]) that it contains. Credit Karma is said to bring over 55,000 tax and finance attributes per customer, and over 35bn daily ML predictions on the AI platform. In short, the acquisition of Credit Karma seems to make the entire solution much more connected and integrated to each other and provide a much “rounder” solution. Based on expert analyses, all agree that this acquisition opens a lot of opportunities for Intuit to exploit, creating further optionality for Intuit to expand into. However, one concern is the lack of concrete/quantitative synergistic information that Intuit gained from this acquisition. Since FY2021, Credit Karma has only provided a cumulative $1.13 billion in operating income, reflecting a 15% payback on its acquisition price of $7.1 billion. It is unclear how much exactly Credit Karma assisted in the growth of TurboTax and SBSE segments, but I suspect that the impact is low. Additionally, the $7.1 billion price tag is partially paid by issuing shares of 13.3 million shares, representing a 4% dilution to shareholders.

Should shareholders of Intuit be concerned? Firstly, it does not appear that Intuit is relying 100% on M&A to expand its horizontal offerings. For example, in the case of payments which is the largest unexploited TAM according to management, intuit is building its offering rather than buying over current players, for example, buying over Bill holdings. Secondly, the 2 big acquisitions do make operating sense in the aspect of value creation to its users, albeit the hefty price tag paid. However, when considering the impact of acquisition on a financial basis, the return on capital has declined from above 28% in FY2020, to just 11% in FY2022, reflecting a real slowdown and impact on the overall capital efficiency. It is for this reason that Fundsmith decided to exit Intuit as it reflects management delusion and fundamental misalignment. As for me, I do like the investments that management is making to make its offerings more robust and become a one-stop shop for SMEs. But all things considered, I still lack the clarity and understanding to make a judgement on management and therefore, rely more on the underlying business profile and growth expectations, as well as a suitable valuation to drive my investment decision. Therefore, at its current valuation, it lacks the margin of safety that I typically seek, despite the strong underlying business profile and industry tailwinds.

Appendix

Breakdown of TAM

To better understand the characteristics of this remaining TAM in terms of the average size of these businesses, a sanity check using labour workforce numbers of the USA would tell us that the majority of the 35M US TAM are less than 5 employees (US labour workforce at 167mil. Assuming the median number of 3, 35*3 = 105mil). This is important in 2 aspects – 1. It tells us that Intuit’s core market is still strictly <5 employees and therefore, expectations on QBOA should be managed. 2. It also explains why the global SME accounting space is still largely underpenetrated. The annual revenue from a less than 5-employee customer base is about 250 USD annually per customer. In order to justify a dedicated salesforce chasing these accounts, a 10-man tech sales team of 100k USD would mean that in order to just break even, the salesforce would need to achieve 4,000 sales targets per year or about 1.3 closings per working hour. This does not make any economic sense to chase that growth, which explains Intuit’s approach of being very disciplined to maintain their margins, focusing on wide reach low touchpoint sales strategy, and only having a dedicated sales team for QBOA segments.

Footnotes

1- Same-sided network effects refer to an increase in value for the current users who are already on the platform. For example, Windows experiences same sided network effect due to more file compatibility

([2]))(No exact target employee segmentation, estimated from Xero central where 200* was the maximum recommended employee size for clients.)

([3])(Collaboration is on a per-client basis, where accounting firms works with their clients using) (Fortnox.)

([4]) According to Intuit and a paper written by author YoungHamilton from Analysing Good Business

([5]) Over 55,000 Tax and finance attributes per customer and over 35bn daily ML predictions for the AI platform.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk