Initial Memo: Johnson & Johnson (JNJ) 38.72% 5-Year Potential Upside (Xin Ying CHAN, EIP)

Xin Ying presents a "BUY" recommendation with Johnson & Johnson's robust fundamentals and growth potential.

Linkedin | Xin Ying CHAN

Executive Summary

Founded in 1886 and headquartered in the U.S., Johnson & Johnson (JNJ) is a multinational corporation operating in healthcare, pharmaceuticals, and consumer goods. The company is known for its diverse product range, including prescription drugs, medical devices, and consumer healthcare products. JNJ has recently separated its consumer health segment into a new entity called Kenvue, leaving two main segments: Pharmaceuticals and MedTech, while maintaining a global reputation for innovation, research, and corporate social responsibility with a focus on sustainability initiatives.

Company Overview

2.1 Business segments

JNJ was originally organised into three business segments: Consumer Health, Pharmaceutical and MedTech. The Consumer Health segment includes a broad range of products used in the Baby Care, Oral Care, Skin Health/Beauty, Over-the-Counter pharmaceutical, Women’s Health and Wound Care markets. These products are sold online and to retail outlets and distributors throughout the world.

The Pharmaceutical segment is focused on areas such as Immunology, Infectious diseases, Neuroscience, Oncology, and Metabolic diseases. Products in this segment are distributed directly to retailers, wholesalers, distributors, hospitals and healthcare professionals for prescription use.

The MedTech segment includes a broad portfolio of products used in the Orthopaedic, Surgery, Interventional Solutions and Vision fields. These products are distributed to wholesalers, hospitals and retailers, and used principally in the professional fields by physicians, nurses, hospitals, eye care professionals and clinics.

2.2 Revenue drivers

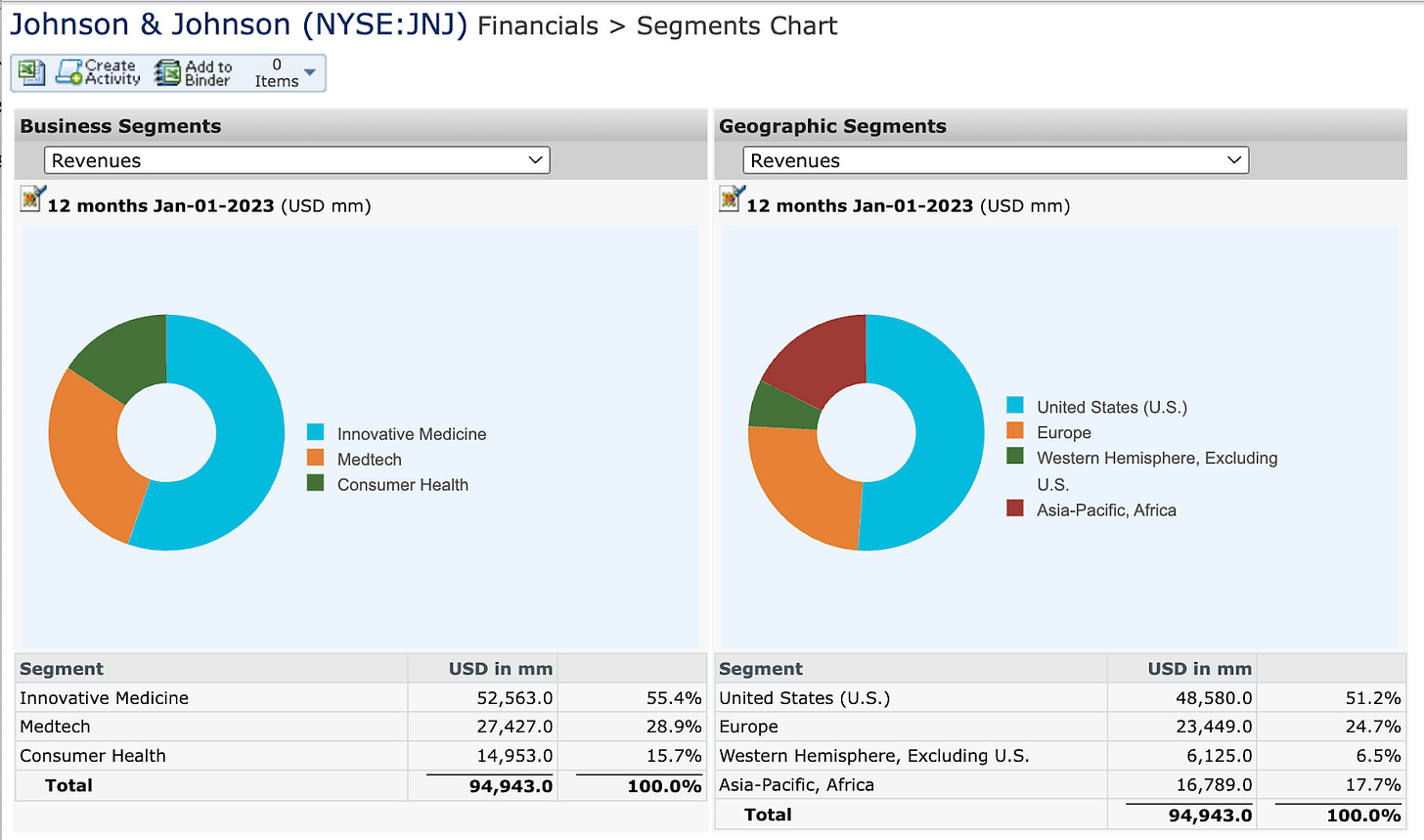

The following chart shows JNJ 2022 revenue by business segments and geographic segments, where the company had about half of its revenue from the United States. As for the revenue breakdown by business segments, slightly more than half was from the Pharmaceutical (Innovative Medicine) business segment, while the Consumer Health segment accounted for only about 15% of total sales.

2.3 Cost drivers

The cost of products sold increased as a percent of sales from 2021 to 2022 was driven by a one-time COVID-19 vaccine manufacturing exit related costs and also currency impacts in the pharmaceutical segment since the company had a global presence.

The exit-related costs from manufacturing the COVID-19 vaccine, include remaining commitments and obligations, including external manufacturing network exit costs and required clinical trial expenses. On the other hand, due to the strength of the US dollar in the past 2 years, various aspects of the pharma industry, including revenues, international expansion, and research and development costs were impacted negatively. For example, in early 2021, the US dollar strengthened against a range of currencies, which impacted the revenues of pharma companies that generate a significant portion of their revenue in other currencies.

Selling, Marketing and Administrative Expenses decreased as a percent to sales due to a reduction of brand marketing expenses in the Pharmaceutical and Consumer Health businesses.

Research and development expenses by segment of business were as follows:

The company also dedicates a significant portion of its business to its research and development activities. These expenditures relate to the processes of discovering, testing and developing new products, upfront payments and developmental milestones, improving existing products, as well as ensuring product efficacy and regulatory compliance before launch. From 2021 to 2022, research and development decreased as a percent to sales primarily driven by lower milestone payments in the pharmaceutical segment.

2.4 ESG considerations

JNJ's materiality table highlights consumer health and patient safety, product quality, and access as the three most important topics for the company.

Based on MSCI's industry-specific material topics, product safety and quality, along with governance, emerge as the two most material topics for the pharmaceutical industry. Additionally, according to MSCI ESG ratings, JNJ is also in the high average 79 companies in the pharmaceutical industry.

2.4.1 Environmental

JNJ significantly expanded procurement of renewable energy globally, propelling JNJ towards a 100% renewable electricity goal at the global level by 2025. New initiatives in 2022 included Power Purchase Agreements (PPAs) and Utility Green Tariffs, as well as expansion of on-site solar generation in several countries. JNJ maintains more than 50 on-site renewable energy systems in 20 countries and has executed more than 15 contracts for off-site renewable electricity procurement.

In addition, JNJ Vision removed the plastic pouches on the outside of delivery boxes for all ACUVUE contact lenses in Europe, saving tons of plastic across Europe every year, while in the UK, JNJ Vision’s ACUVUE Contact Lens Recycle Scheme launched in 2019, has collected over 8.7 million lenses and recently expanded to increase the capacity of lenses, blister packs and foils to be recycled each year.

2.4.2 Social

The company has improved its performance in terms of providing access to healthcare. It has also demonstrated leadership in access to medicines, moving up to second place in the 2022 Access to Medicine Index (ATMI) which provides insights into how the world's leading pharmaceutical companies perform on ensuring people living in low- and middle-income countries have access to the medicines, vaccines and diagnostics it needs.

JNJ also made a $800 million investment in the Healthy Lives Mission through a range of initiatives promoting skin cancer awareness, supporting smoking cessation, advocating for menstrual dignity, expanding product transparency and improving packaging sustainability across a wide range of Consumer Health brands in line with commitments as a signatory to the Ellen MacArthur Foundation’s New Plastics Economy Global Commitment.

Furthermore, the company commenced a yearlong global refresher program of its Six Safety Habits framework for all employees in our R&D spaces and supply chain facilities to reacquaint them with workplace habits that ensure safety continues to be an essential part of its culture.

2.4.3 Governance

JNJ’s Board of Directors constitutes six standing committees: the Audit Committee, the Compensation & Benefits Committee, the Nominating & Corporate Governance Committee, the Finance Committee, the Regulatory Compliance & Sustainability Committee, and the Science & Technology Committee. The committee members are made up of 13 board of director members with diverse backgrounds ranging from healthcare to education.

The Science & Technology Committee is led by independent directors, focusing on shaping and monitoring policies for environment, health, safety, and sustainability. Simultaneously, the Regulatory Compliance & Sustainability Committee, also comprising independent directors, oversees the effective implementation of the company's healthcare compliance, ethics, and quality programs. Both committees play vital roles in upholding the company's commitment to environmental responsibility and ethical healthcare practices.

With regards to medical safety, JNJ made advancements in multiple initiatives to improve medical safety, including innovative real-world data (RWD) methods to generate reliable real-world evidence about patient health outcomes across numerous initiatives spanning pharmaceutical products, vaccines, medical devices and Consumer Health products. One of the initiatives in 2022 was improving access to critical medical devices using RWD by generating extensive evidence of the comparative safety of critical devices.

Competitor Analysis

Pfizer Inc. is a global biopharmaceutical company involved in the comprehensive process of discovering, developing, manufacturing, and distributing medicines and vaccines across various therapeutic areas. Its diverse product portfolio includes treatments for cardiovascular, metabolic, migraine, women's health, infectious diseases, and COVID-19 prevention and treatment. Pfizer is also engaged in biosimilars, addressing chronic immune and inflammatory diseases, as well as conditions like amyloidosis, haemophilia, endocrine diseases, and sickle cell disease. The company, founded in 1849, is headquartered in New York, New York.

Eli Lilly and Company, founded in 1876 and based in Indianapolis, Indiana, is a global pharmaceutical company with a focus on discovering, developing, and marketing human pharmaceuticals. Its product range covers diabetes medications like Basaglar, Humalog, and Humulin, as well as offerings for cancer treatment such as Alimta, Cyramza, and Retevmo. Eli Lilly has also contributed to COVID-19 treatments, including Bamlanivimab and etesevimab.

Novartis AG is a Swiss-based healthcare company established in 1996 and headquartered in Basel. It engages in the research, development, manufacturing, and marketing of prescription medicines globally. The company's therapeutic focus includes cardiovascular, renal and metabolic conditions, immunology, neuroscience, oncology, ophthalmology, and haematology. Notably, Novartis has a licence and collaboration agreement with Alnylam Pharmaceuticals for the development, manufacturing, and commercialization of inclisiran, a therapy designed to reduce LDL cholesterol. The company emphasises providing healthcare solutions and collaborates with physicians.

3.1 Economic moat

Global Presence and Strong Brand Loyalty

JNJ has a strong global presence, operating in over 60 countries. The company's renowned brands, including Tylenol, Band-Aid, and Johnson's, are widely recognized and trusted by consumers. This expansive global reach and the strength of its brand give JNJ a competitive edge, establishing a positive reputation and fostering customer loyalty.

Innovative Research and Development (R&D) Focus

JNJ places significant emphasis on advancing research and development, making substantial investments in pioneering healthcare solutions. This steadfast commitment to R&D empowers the company to introduce cutting-edge products to the market, which gives the company an advantage in the fast-evolving healthcare industry.

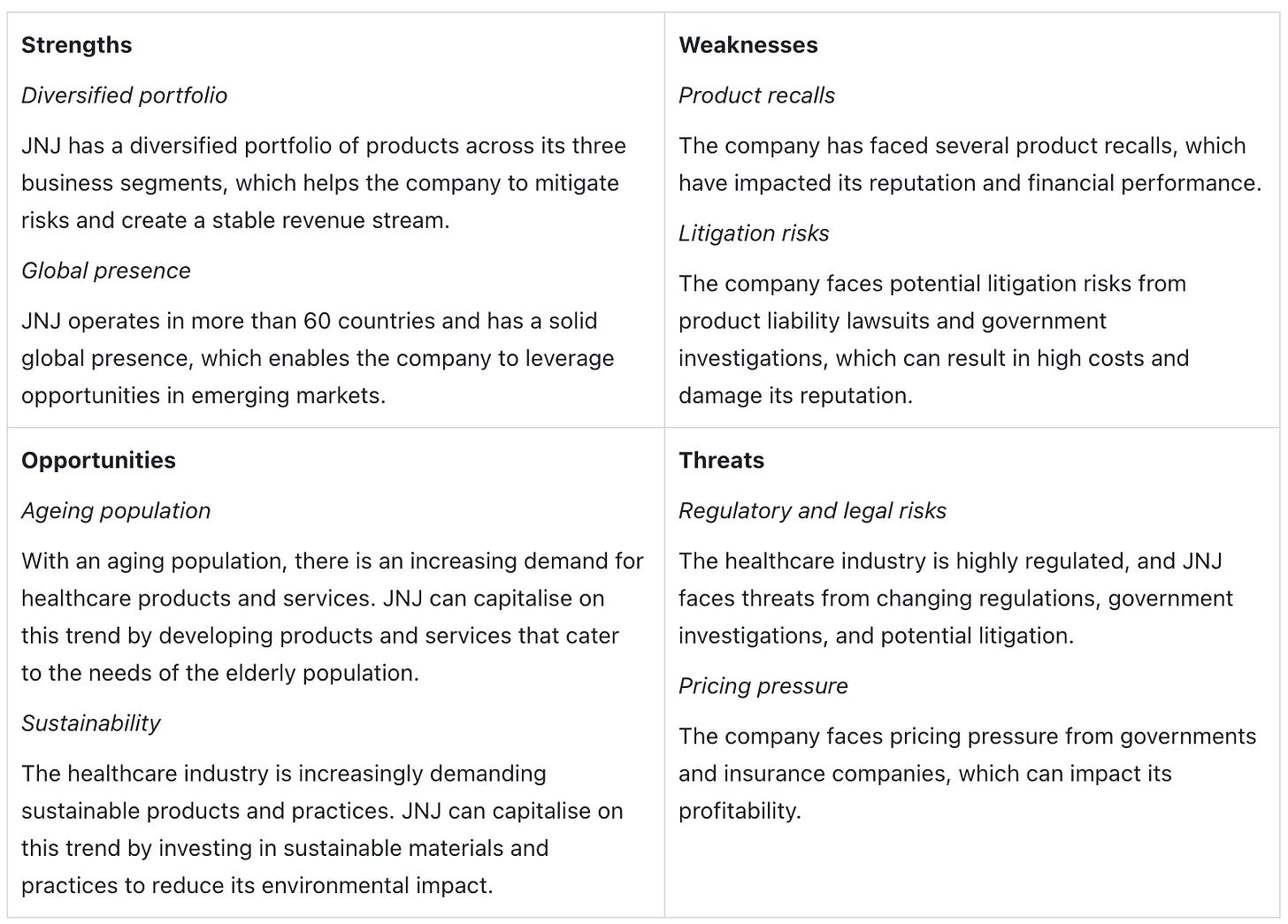

3.2 SWOT analysis

Investment Thesis

Investment Thesis 1: JNJ spin-off of Kenvue

After the separation of JNJ’s consumer health segment, the company will only be left with 2 segments, namely its Pharmaceutical, and MedTech segments. The spinoff holds several advantages. Firstly, by removing the consumer health segment, which is the slowest growing sector among the 3 segments, JNJ can focus its growth on other faster-growing sectors. In 2022, the Pharmaceutical and MedTech businesses each grew sales on an adjusted operational basis by more than 6%, while consumer health sales rose less than 4%. Consumer health also had a much smaller share of sales. In 2022, it brought in about $14 billion, while Pharmaceuticals and MedTech generated $52 billion and $27 billion respectively. Hence, without the consumer health segment, JNJ can allow for more investments in the other 2 higher growing sectors.

Additionally, the spinoff also generated over $13 billion for JNJ which can provide resources for internal pipeline enhancement or growth through collaborations and acquisitions. Even though the spinoff led to a decline in JNJ's sales and earnings forecasts for the year, the company's shares have fallen about 9%, making it an attractive investment at around 16 times forward P/E estimates.

Investment Thesis 2: Promising outlook in the pharmaceutical segment with new Medicines

Johnson & Johnson is planning to introduce 20 novel therapies for cancer, immune, and neurological diseases by 2030. This will form the foundation of the company’s ambitious outlook on its forecasted sales growth, targeting a substantial 5% to 7% increase throughout the decade. In a recent business review, JNJ revealed that seven of these anticipated drugs hold the potential for peak annual sales exceeding $5 billion each.

The separation of the consumer segment has streamlined JNJ and allows it to focus on its more lucrative Pharmaceuticals and MedTech businesses. JNJ has a slightly lower expected growth rate of 5% to 7% for its pharmaceuticals segment, compared to the impressive 8% compound annual growth reported from 2017 to 2022, which was due to substantial sales spikes for key drugs such as Stelara and the multiple myeloma medicine Darzalex. Looking ahead, JNJ remains optimistic about its Pharmaceutical segment, citing strong prospects for existing key drugs like Stelara, Imbruvica, and Darzalex.

Investment Thesis 3: JNJ's Stable Dividend Yield and Diverse Portfolio

JNJ is positioned as a stable and low-risk investment among the "Big 8" US pharmaceutical companies. With the largest market cap and revenue in the industry, JNJ's stock is characterised by its resilience, evident in a relatively small spread between its high and low share prices over the past 12 months (20%). JNJ will be an attractive choice for investors looking for a dependable, dividend-paying stock, given its history of consistent dividend payments, a dividend yield of 2.62%, and a share price that tends to weather market fluctuations.

Moreover, JNJ maintains a diverse portfolio and continues to pursue growth opportunities. The company's revenue growth of 13.5% in 2021 and a forecasted 5% growth in the current year demonstrates its ability to adapt and evolve. JNJ's focus on adjusted earnings per share (EPS) growth, with a forecasted increase of nearly 10%, suggests a commitment to financial performance. While its size may limit the excitement of overnight gains, JNJ remains a solid investment option, offering incremental growth, a resilient share price, and a reasonable dividend.

Valuation

5.1 Comparables

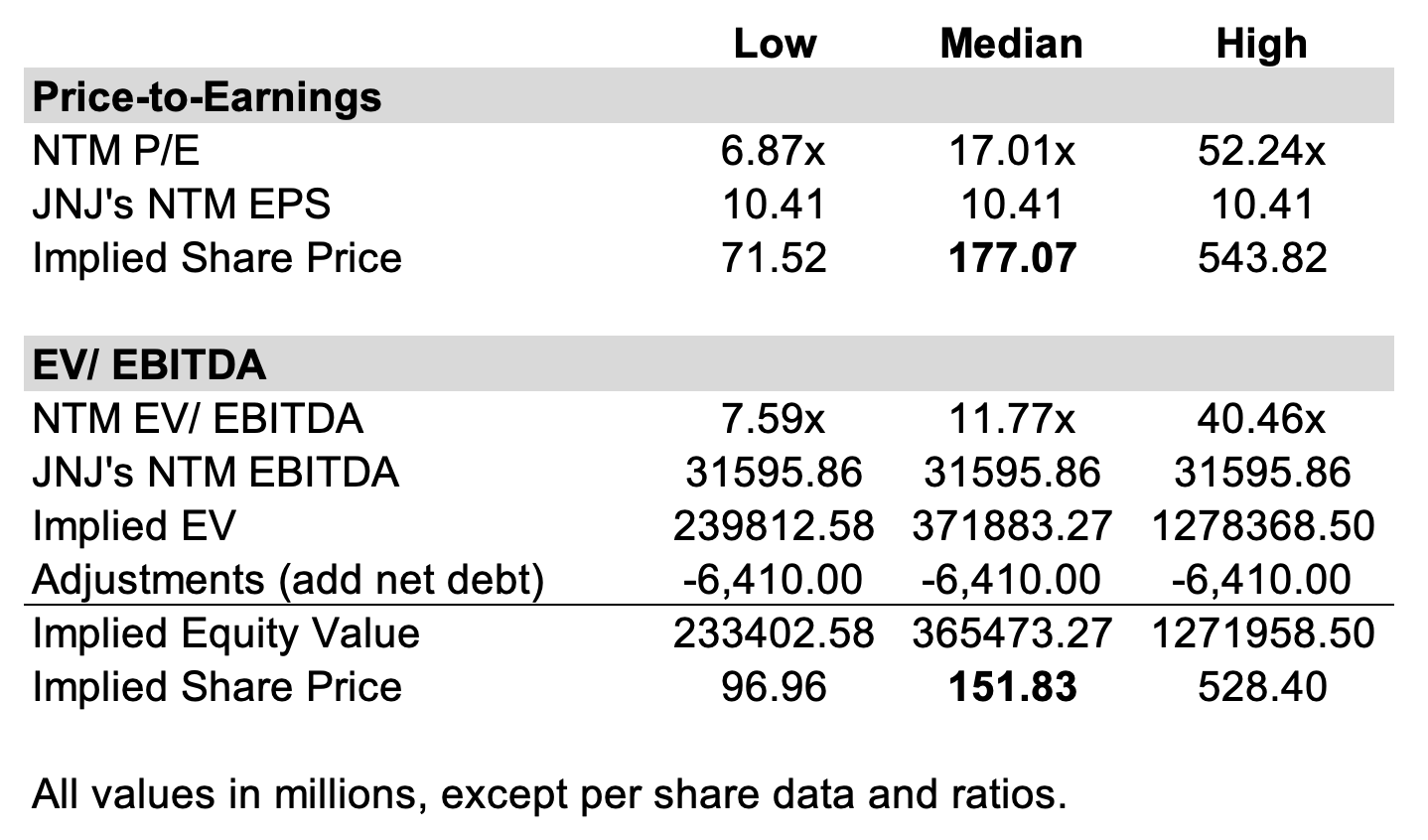

Using financial indicators such as the Price to Earnings (P/E) ratio, Price to Sales (P/S) ratio, and EV/EBITDA multiples shows that JNJ is positioned above its industry peers in terms of trading metrics.

5.2 Relative Valuation

I recommend a BUY for Johnson & Johnson, setting a 3-year price target of $191.97, and a 5-year price target of $212.61. These targets indicate potential upsides of 25.25%, and 38.72%, respectively, from its closing price of $153.27 on December 20, 2023. These projections are based on forward multiples of JNJ. The significant potential for the five-year target is driven by anticipated higher revenue resulting from the Spin-off of Kenvue Inc. and promising prospects in the pharmaceutical sector with new upcoming drugs.

Risks and Mitigation

Risk: Tens of thousands of plaintiffs have sued JNJ, alleging that the company’s baby powder and other talc products sometimes contained asbestos and caused ovarian cancer and mesothelioma. The company's attempt to use its subsidiary's bankruptcy to halt these lawsuits was rejected by the court. It was ruled that neither the subsidiary nor JNJ were in financial distress.

Mitigation: In April, JNJ's subsidiary, LTL Management, filed for bankruptcy in Trenton, New Jersey. The filing includes a proposed settlement of $8.9 billion to address over 38,000 lawsuits and prevent the initiation of new cases. This marks the company's second endeavour to address talc-related claims through bankruptcy, following the rejection of an earlier attempt by a federal appeals court.In early Dec 2023, JNJ’s VP, Erik Haas, said the company had resolved all but one of the cases scheduled for trial in 2023, "significantly curtailed" trials in 2024 and did not require the company to record any new charges against earnings. It was also reported that JNJ had reached settlements covering about 100 people.

Conclusion

In conclusion, Johnson & Johnson (JNJ), a leading global healthcare and pharmaceutical company, strategically streamlined its focus by separating its consumer health segment into Kenvue. This shift, fuelled by a commitment to innovation and corporate responsibility, allows JNJ to focus on its pharmaceuticals and MedTech segments, particularly the promising pharmaceutical division with strong growth projections and a reliable dividend yield. JNJ also invests heavily in R&D which will allow it to anticipate and keep up with the rapidly growing industry, while at the same time maintaining product safety for consumers.

Additionally, despite facing legal challenges related to talc products, JNJ's solid market capitalization of $373B, a 2.62% dividend yield, and recent revenue growth of 13.5% position it as a stable and potentially lucrative investment. Investors should carefully consider the litigation risks alongside JNJ's robust fundamentals and growth potential.

References

https://www.investor.jnj.com/files/doc_financials/2022/ar/2022-annual-report.pdf

https://www.investor.jnj.com/files/doc_financials/2022/ar/2023-proxy-statement.pdf

https://healthforhumanityreport.jnj.com/2022/_assets/downloads/esg-summary.pdf

https://www.fiercepharma.com/pharma/johnson-johnsons-spinoff-kenvue-provides-132b-ma-firepower

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk