Initial Memo: Paycom Software Inc (PAYC), 121% 5-Year Potential Upside (Javier CHAN, VIP)

Javier presents a "BUY" recommendation as its likely near an inflection point where we will see Paycom return to its structural growth story.

LinkedIn | Javier CHAN

1. Executive Summary

I am initiating coverage on Paycom with a BUY recommendation and a 1Y target price of $258 (209% IRR). The setup for Paycom is interesting – the stock is down ~30% YTD, with negative overhang stemming from 2 main issues, (1) revenue cannibalization headwinds, as well as (2) weak client net adds. These issues have introduced uncertainty around Paycom’s future growth, and the street is treating these as structural problems with the business. However, I believe that these are merely temporary headwinds that will soon abate, and we are likely near an inflection point where we will see Paycom return to its structural growth story.

2. Company Overview

Paycom Software, Inc. (“Paycom”) is a leading provider of comprehensive, cloud-based human capital management (HCM) software solutions. Founded in 1998 and headquartered in Oklahoma City, Oklahoma, Paycom has emerged as a prominent player in the HCM industry, serving businesses of all sizes across the United States. The company's innovative software platform offers a unified suite of applications that streamlines and automates various HR processes, including payroll, talent acquisition, time and labor management, and employee engagement, among others. They are focused on the mid to upper-market with an estimated ~7% share of TAM.

Paycom's user-friendly, intuitive software is designed to empower organizations with real-time data and analytics, enabling them to make informed decisions and drive operational efficiencies. The company's commitment to continuous innovation and customer satisfaction has been a driving force behind its success, as evidenced by its consistent recognition as a leader in the HCM space by industry analysts and organizations. With a strong focus on employee experience and a dedication to delivering cutting-edge technology solutions, Paycom has established itself as a trusted partner for businesses seeking to optimize their HR operations and enhance their overall workforce management capabilities.

PAYC Core Platform Offerings

Paycom’s key strength is in providing a single system with deep capabilities across all the above areas. In any company, they may have ADP for payroll, Workday for requesting time off, Concur for expense management, Cornerstone for learning management, etc., but Paycom provides the all-in-one solution. Once employees get accustomed to this workflow, going back to separate providers for different services will feel like a hassle and a downgrade. This creates a sticky, end-to-end ecosystem that becomes deeply entwined into clients’ business operations. Majority of revenues are generated from payroll applications, and payroll usually serves as the first touchpoint with clients before they subsequently cross-sell other modules and features.

Revenue Segments & Recognition

Paycom has 2 reported segments: (1) Recurring Revenues and (2) Implementation and Other Revenues.

Recurring Revenues comprise 98% of sales. Their recurring revenue model is primarily driven by fees charged for its suite of talent acquisition, time and labor management, payroll, talent management, and HR management applications. These fees have two main billing components: (a) fixed amounts charged per billing period and (b) variable per-employee or per-transaction fees. They do not require long-term contracts, and billing periods vary based on client payroll cycles. While undisclosed, assuming the fixed component charged per client is in line with peers at ~$40 per client, this implies that the variable component comprises ~98% of recurring revenue.

Additionally, it also includes (c) interest earned on funds held for clients. They collect funds from clients in advance of either the applicable due date for payroll tax submissions or the applicable disbursement date for employee payment services. These collections from clients are typically disbursed from one to 30 days after receipt, with some funds being held for up to 120 days. Paycom invests these funds in money markets, demand deposit accounts, certificates of deposit and commercial paper until they are paid to the applicable tax or regulatory agencies or to client employees.

Implementation and Other Revenues comprises 2% of sales. This comes from two main sources: (a) one-off set-up fees charged to new clients and existing clients adding incremental applications, and (b) sales of time clocks for their time and attendance services. The implementation fees typically range from 10-30% of the annualized contract value. These fees are recognized as deferred revenue and then amortized over an estimated 10-year client life. Revenues from time clock sales are recognized upon delivery to the client.

Key Operating Metrics

Paycom’s revenue has grown at 23% CAGR from FY19-23, mainly driven by client growth (9% CAGR) and APRU improvements (13% CAGR). Majority of client growth comes from capturing legacy players’ market share, with a smaller portion from greenfield business. ARPU growth mainly comes from the cross-selling of more modules to each client (i.e. onboarding, tax filing, applicant tracking system, and 30+ others), as well as targeting employees with more clients.

Paycom reports an “Annual Revenue Retention Rate” metric that is consistently at or above 90%. On a gross basis, this is considered high, however, Paycom uses a unique methodology to calculate retention, which makes it not directly comparable to other SaaS companies that usually report on a Net Revenue Retention Rate (NRR) basis. Adjusting Paycom’s metric to make it like-for-like, we can see that Paycom’s NRR was 111% in 2023, placing it well above the median of 103% for SaaS companies with high annual contract values (>$25k). Paycom’s competitors are laggards in product stickiness – Paycor had 94% NRR and Paylocity had 92% NRR as of last reported quarter.

The stickiness of Paycom’s products can be attributed to them having a differentiated offering by means of Beti (explained later), and the deep integration of their products into clients’ operations which creates high switching costs. This has allowed them to increase ARPU over time, and has helped them to expand margins through the benefits of operating leverage. Gross margins are stable at about 85% and EBITDA margins have been expanding, now standing north of 42%.

Paycom has an excellent track record with capital allocation. They have been able to invest in growth while achieving a high average ROIC of ~27% and ROE of ~29% over the past 5 years.

3. Industry Overview

TAM

I estimate Paycom’s TAM to be ~$23bn. This is based on the 320,000 establishments and ~94mn employees within Paycom’s target client size (50-1000+ emp.), and a $40 per client and average $20 per employee charge per month. This implies ~7% TAM penetration based on 2023 revenues (mgmt. commentary is ~5%). Experts believe that getting to 15% market share is highly possible. It is worth noting that each competitor defines their TAM slightly different, depending on their positioning and type of client targeted. The global HCM software market is expected to grow between 4-5% CAGR from 2023-2028.

The key drivers of growth of the overall HCM market are:

Increasing demand for integrated solutions that combine core HR functions like payroll, talent management, and workforce management into a single platform.

The need for data-driven decision-making, with data analytics and automation playing a key role in core HR functions.

Adoption of advanced technologies like AI and machine learning to streamline HR processes and enable data-driven decision-making.

The major growth areas are expected to be core HR functions like payroll, talent management, and workforce management, with automation and data-driven decision-making playing a key role.

For Paycom, another major driver of TAM expansion is their move upmarket to target firms with >10,000 employees. This increases average employees per client, which is a tailwind for the variable billing component.

Peer Positioning

Source: Paylocity Q3 FY24 Investor Presentation

Each HCM player targets a slightly different market. Paycom overlaps with Paylocity and Paycor in the bottom markets, but they have recently been trying to punch upmarket to take share from players the like of Dayforce and Workday.

An important industry dynamic to note is that 75-90% of the billings for modern HCM software players come from the displacement of legacy players like ADP and Paychex. ADP and Paychex have an inferior product where the tech is older, and customer service is poor because these companies are too large and inefficient. They barely had any competition for the past 30-40 years, but are now facing disruption from the modern players. The sales pitch for Paycom is much easier when going to ADP/Paychex clients, compared to going to greenfield clients who have no experience with using HCM SaaS/outsourcing, as the objective is just to demonstrate that Paycom’s product is better. Modern HCM companies capturing share from legacy players is a trend that is expected to continue for the next several years.

The HCM space is highly competitive, and historically there has been little product differentiation. Incumbents traditionally competed on sales and marketing/go-to-market strategies and in areas like customer service. Even any differences in the tech were marginal. However, recent developments at Paycom indicate that this dynamic may be about to shift. More on Paycom’s differentiation will be covered below.

4. PAYC Set-up (-30% YTD)

PAYC stock is down -55% in the past twelve months. In 3Q23, the company missed guidance for the first time in history and provided weak guidance for 2024 sales and EBITDA. In 4Q23, they beat earnings and topline guidance was in line with the street, but margin guidance came up short of consensus, sparking another sell-off. Latest 2024 guidance implies 10-12% y/y revenue growth and a -370bps contraction in EBITDA margin.

Weakness in sales growth stems from two issues: (1) revenue cannibalization from Beti adoption, and (2) weak client net-adds. While these issues have presented about a 10-15% headwind to prior sales expectations, these effects are likely temporary, and we should soon see an inflection point where PAYC returns to higher growth.

5. Investment Thesis

The adoption of Beti has created some headwinds with regards to cannibalization and weak client net adds. The market is treating these as structural problems with the business, but deeper scrutiny would reveal that these headwinds are most likely temporary (and necessary); improvements in business economics will be backloaded.

What is Beti?

Beti is Paycom’s industry-first automated payroll solution that empowers employees to process their own payroll directly within Paycom's unified HCM software platform. It fundamentally changes the traditional payroll approach by putting the responsibility and verification process into the hands of employees themselves.

At the start of each pay period, Beti automatically pulls in live data on employee hours worked, approved expenses, compensation changes, and other payroll-related information from across Paycom's integrated modules like time and attendance, benefits administration, and more. Employees can then review, troubleshoot, and approve their own payroll details before final submission, ensuring greater accuracy and engagement. Beti guides employees through this self-service process, identifying potential errors or missing information that needs to be addressed upfront. This streamlined, employee-driven payroll experience increases efficiencies, reduces processing time, and minimizes costly payroll mistakes for the employer.

Before Beti, employers would have to import files from each of the different systems like compensation adjustments, bonuses, spot bonuses, time and attendance. They would create each import file and manually import it into payroll. For enterprise customers, they might have to do this 100,000 times. The architecture wasn't there so they had to go into each business individually in their dropdown and repeat the process.

Beti automates creating and pulling in all of those different pieces of information into payroll. With that, everyone benefits. Companies with multiple businesses benefit way more than if you only have one business where instead of it taking 30 seconds, it takes zero seconds because it's scheduled.

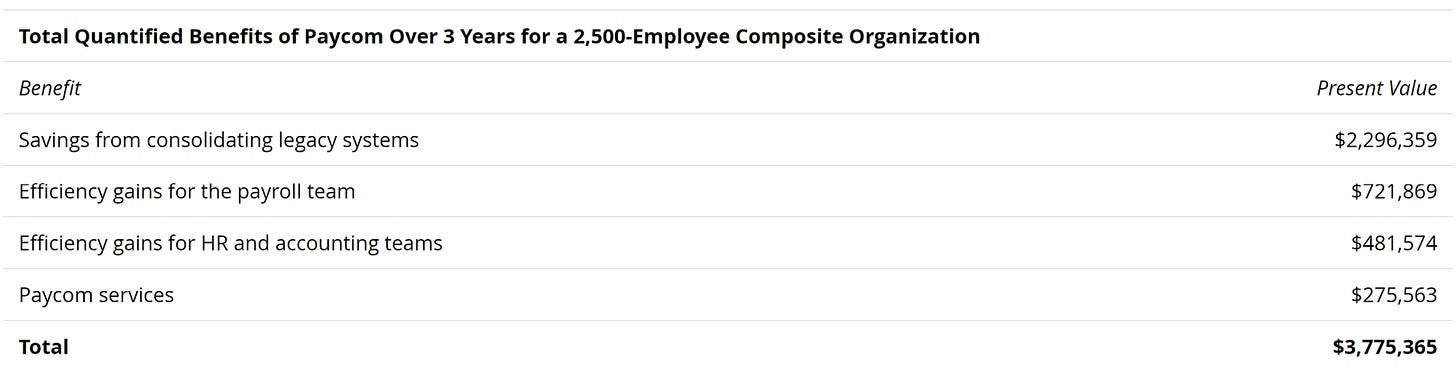

Quantifying Beti’s Economic Value

A study conducted by Forrester Consulting revealed that Beti reduced time spent correcting payroll errors by 85%, lowered labor for payroll processing by 90%, saved HR and accounting teams over 2,600 hours per year, and saved employers $3,775,365 over three years.

At the same time, Beti empowers HR to break out of the weekly payroll cycle to focus on more important tasks like performing investigations, entering new markets, fostering diversity, equity and inclusion, researching compliance trends, and building out additional benefits for employees. Nucleus Research found that on average, payroll administrators using unautomated systems spent eight hours per 100 employees reconciling errors each pay period.

Beti is also used as an employee engagement and retention tool; employee retention is a big challenge for many companies. “The longevity of my employees at the sites that have the full Paycom experience has increased from nine months to 16 months on average,” said a payroll manager in the manufacturing industry. “Those employees are staying 75% longer.”

Reviews

Beti’s reception so far has been largely positive – their app has a 4.8/5.0 rating on the iOS App Store and 4.6/5.0 on the Google Play Store. For reference, Netflix has 3.6/5.0 on both iOS and Android. Beti has also proven to be a stickier product, with management calling out a 99% retention rate, compared to overall Paycom revenue retention at 90%. The adoption of Beti should be a structural tailwind for overall retention at Paycom.

Cannibalization Issue

While Beti has seen successful adoption, the same success has been a double-edged sword for Paycom. Due to Beti’s ability to bring error rates down to near zero, Paycom had to forgo some transaction-based revenues that were attributed to the correction of certain errors. (E.g. unscheduled payroll, missed expense reimbursements, not having the correct overtime hours recorded etc.) This cannibalization was estimated to bring about 10-15% headwinds to revenues. Essentially, Paycom (and the rest of the industry) previously made good money selling the “cure”, but now Paycom is focused on selling the “prevention”, which is an attractive long-term value proposition.

Another source of revenue headwinds was from Client Relation Representatives (CRRs), the sales team in charge of cross-selling, being overly focused on converting the existing client base to Beti instead of doing their previous job of cross-selling additional modules. Since Beti’s release, the internal mandate was to focus on converting clients to Beti; modules were not allowed to be cross-sold to clients who were not on Beti, rationale being Beti was the key to increasing client stickiness, so that was the product they had to push first. To incentivize CRRs to sell Beti, management set the commissions for Beti at 3x the usual rate as it was a lower revenue product. 75-80% of what CRRs made were from commissions, so selling Beti became more lucrative for them. This also explains the weak 0.7% net client growth in 2023, as CRRs were busy converting the existing client base instead of focusing on base expansion, which was not necessarily revenue generative. Management estimates that these CRR headwinds caused them to leave ~$15-20 million on the table in 2023.

The Silver Lining for Paycom

With the transition from the legacy platform to Beti stirring up so many headwinds, investors have become skeptical about Paycom’s aggressive push for Beti conversions. My view is that this is going to be a long-term story – Beti has proved to be a sticky product with a strong value proposition, and what Beti is for Paycom is that it is a differentiated product in a industry that provides a highly commoditized service. For competitors, most are offering similar services that have little point of differentiation. This was the case for Paycom as well before the launch of Beti in 2021.

With a stronger and stickier base, it is likely that Paycom will eventually be able to make up for the loss in “error” revenues by resuming the cross-selling of modules. Clients that were paying for the legacy product had already exhibited the willingness to spend a higher amount on the legacy platform (including error fees), so cross-selling to these clients will be low-hanging fruit as it is essentially just redirecting their spends towards a more value-added service, rather than just spending it on correcting errors.

With 70%+ of Paycom’s client base already on Beti, it is likely that they will soon divert their efforts back towards cross-selling. In their 1Q24 earnings call, management’s tone was that they were deemphasizing Beti conversions for CRRs moving forward. Furthermore, the remaining “error” revenues make up only 5% of total revenues, so any further headwinds should be marginal.

Beti is also helping Paycom to generate leads. They are getting leads from employees that use Beti at their company and are getting accustomed to managing all HR related tasks from one system. Once an employee gets used to doing everything themselves, they don’t do well going backwards in technology. When they go to another company that has multiple products, multiple logins in which often times it's duplicative effort on their part, they are more likely to desire the simplicity and convenience of Paycom, thus they become long-term advocates for the business. 5 years ago. Paycom had 0 employee referrals, now they get thousands of leads.

Paycom currently only has a TAM penetration of ~5%, and the industry is still dominated by legacy players, so there is no worry about saturation. Despite a messy transition, Beti will eventually help Paycom to increase the lifetime value (LTV) of clients, as clients will stay for longer and develop higher dependence on their platform which will grant Paycom greater pricing power. Paycom will emerge with a stickier product with structural growth tailwinds. As the dust settles, Paycom should be able to bring higher client net adds, and continue to exploit the existing client base with improved monetization and further cross-selling. Their move upmarket should also contribute materially to ARPU growth as they target larger companies with more employees.

Paycom’s Counter-positioning Moat

Beti effectively crafted a moat for Paycom as the business model of offering a “prevention” is starkly different from their competitors’ models of offering the “cure”. While the transition has created temporary headwinds for growth, Paycom biting the bullet early on will make the longer-term story more compelling as this becomes a counter-positioning play, rather than the pure sales and marketing game that the other competitors are partaking in.

Competitors will likely not be able to effectively replicate something like Beti. This is because Paycom's applications like payroll, time and attendance, talent management, and HR management all run on and pull data from the same single database. With a single centralized database, any changes an employee makes in Beti instantly sync across all of Paycom's integrated applications. This ensures payroll is calculated accurately using the most up-to-date employee information from one source of truth. This is in contrast to competitors who may have separate databases or systems for different HR functions that need to be integrated. Payroll providers using disparate databases or third-party integrations would face challenges keeping employee data fully synchronized in real-time across all systems. This could lead to payroll errors if employee updates in one system don't reflect in the payroll processing system. Currently, Paycom’s competitors run on open software architecture and focus on integrating with others.

According to an expert familiar with HCM software, the only way that Beti works is if you have the innate structure, i.e., your benefits administration, your expense management, your PTO, your time and attendance, is all a single database platform. If it's not a single database, once they run Beti, they will run into all kinds of errors, "bugs” and integration issues. Therefore, Paycom’s single database architecture grants them another source of moat, as it makes it difficult for peers to recreate a similar product like Beti with the same level of sophistication as Paycom. Any attempts to do so would require large amounts of time, resources and R&D.

Paycom’s proprietary technology has granted them a competitive advantage and a hard-to-replicate value proposition. Based on the above analysis, I am confident that the long-term story for Paycom is intact, and possibly stronger now, despite the stock being beaten-up and punished.

6. Key Assumptions and Model Outputs

I am underwriting 17% revenue growth and 40% EBITDA margin in 2025, mainly driven by ARPU improvements and a resumption in client additions.

ARPU growth is driven by higher recurring spends per employee as CRRs redirect their efforts towards cross-selling more revenue generative modules post-Beti conversion, and an increased number of average employees per client as Paycom moves up-market.

Client growth should rebound meaningfully, though I remain conservative, being mindful of sales teams’ capacity. I estimate that each sales representative is currently managing between 80-85 client accounts (55 sales teams, average 8 reps per team). Paycom should expand the number of sales teams/reps per team in order for there to be more bandwidth for future growth. Latest quarter commentary hinted that opening new sales teams were not on the roadmap for 2024, as the year seems to be more about optimization than growth. Assuming that they do not open new teams by the end of 2025, the implied number of accounts per rep, based on the 39.8k total clients that I am underwriting, will be about 90. This should be fine, given that the max bandwidth per sales rep is usually 100-150 accounts.

Margin expansion is attributed to a ~500bps increase in gross margin, as Beti, the higher commission thus lower margin product, makes up less of future sales. The rest comes from benefits in operating leverage in mainly the D&A and admin cost lines.

7. Valuation

PAYC stock currently trades at 10x EBITDA and 17x P/E, more than 1 standard deviation below its 10-year median multiple. It is also trading at the lower range of its peers, which does not seem warranted given the stronger growth prospects and best-in-class margins. I am valuing PAYC at 17.1x 2025 EBITDA and 25.2x 2025 EPS, in line with the comp group median, to derive a weighted target price of $258. As PAYC gets back on track with its structural growth story post-Beti transition, the stock should rerate meaningfully as the market gets more visibility on growth levers. The entire industry seems to be going through a derating in the face of U.S. macro challenges, hence I remain conservative in my choice of exit multiple. Target multiples remain >1SD below PAYC’s historical trading range.

8. Catalysts

Key catalysts to watch would be Q3 and Q4 2024 earnings, to spot a potential inflection point in client adds and ARPU growth. Initial 2025 guidance will likely be provided during Q3 which will help to center expectations.

9. Key Risks

Product Risk: There are some product risks associated with Beti and the rest of their suite of solutions. With Beti only being out for 2 full years, it has not exactly been time-tested. While the feedback has been mostly positive, the company has also seen some negative reviews with regards to Beti not being able to process irregular payroll arrangements well, causing numerous bugs and issues. This will be an issue that Paycom must address and fix, as a meaningful part of their client base likely has such payroll arrangements (e.g. part-time/contracted employees). There is also some execution risk as Paycom moves upmarket to take on established players like Workday, ADP etc. Their brand is less well-known in these markets and competition is fierce, so their go-to market strategy may take some time to achieve maturity.

Sales Capacity: Paycom’s sales reps are currently managing about 80-85 accounts on average. Each rep should be able to handle between 100-150 accounts, but this capacity may vary from person to person. If actual capacity is lower than expected, teams may get spread too thin and their ability to sell may be impeded.

Key Man Risk: Some former employees have said that Paycom is basically run by founder and CEO Chad Richison, and some even say that the rest of the management team does not matter. Chad is known for being very headstrong, stubborn and demanding, but he is also the reason that Paycom has reached the heights that it has. It seems to be consensus that he is an extremely good business man, some comparing him to the likes of Steve Jobs, Elon Musk, and Jeff Bezos. However, it is also known that he has a big ego. Chad has served shareholders well for the most part, but it remains a risk having such a domineering character at the helm.

Toxic Company Culture: Some former employees have described the environment to be toxic and highly bureaucratic, with everything coming top down (mostly from Chad). Some also described a “cult-like” mentality within the company, and its usually Paycom’s way or the highway. An unfavorable company culture can lead to multiple problems. Employee churn is one potential issue. Employee retention is important, especially in sales roles where client relationships matter. Overly frequent employee churn can impact the quality of service, as new employees will have to keep getting retrained on products and have to rebuild client relationships. Another potential issue is that some problems at the bottom don’t get reported upwards out of fear. This ties back to the very top-heavy structure of the company. In the long run, there may be a lack of checks and balances on Chad, and this may cause an echo chamber which is not necessarily the best for business, no matter how great of a businessman Chad might be.

Macro Risk: A majority of Paycom’s revenues (~95%) is a variable component tied to the number of employees they serve. Poor U.S. macro may cause downsizing of some clients or may cause some of their clients to close down. This is somewhat already being observed in their small clients segment, though small clients only make up 3.5% of revenues. According to Paycom and some of their former employees, their client base is representative of the U.S. labor force. During the GFC, U.S. payroll declined by about -3% per year on average in 2008 and 2009, so if we were to enter a deep recession, this should be the kind of headwind we can expect. These headwinds should be partially offset by their push up-market, though their success greatly depends on execution. Sensitivity analysis indicates that every 1% change in 2025 revenues moves EBITDA by 2.5% and EPS by 4%. While this is a material risk, the margin of safety is wide when it comes to valuations.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

Appendix

Net Retention Rate

Calculation of Paycom’s Net Revenue Retention Rate is as follows:

Paycom Retention Rate * End RR ÷ Beg RR = SaaS Net Revenue Retention

The fact that this post has no likes should be a crime. What a well written post.