Initial Memo: Proya Cosmetics (SHSE: 603605), 18% 5-Year Potential Upside (Finian SAW, EIP)

Finian presents a "HOLD" recommendation based on uncertain economic outlook and downward trends in private consumption that could impact future growth potential.

LinkedIn | Finian SAW

1. Company Overview

Proya Cosmetics, formerly known as Proya (Huzhou) Cosmetics is a Chinese beauty and personal care company which was incorporated in 2006. It researches, develops, produces, and sells cosmetics products under the Proya, TIMAGE, Off&Relax, Hapsode, CORRECTORS, INSBAHA, UZERO, and Anya brands.

Proya offers skincare, make-up, and body and hair products at high quality and affordable prices to target both the premium and mass market. It markets its products through offline channels such as pop-up booths, specialty stores and department stores which are predominantly based in China, as well as online channels through e-commerce platforms such as Tmall, Douyin and JD.com.

1.1 Key Product Offerings and Brand Breakdown

Skincare remains as Proya’s largest product segment with a 38% YoY growth from 2022.

Makeup continues to grow, seeing a 48% YoY growth from 2022 and an increase in its product share by 0.7%.

Body & Hair is the latest of Proya’s product segment having achieved considerable success since its launch in 2021 and saw the highest YoY growth of 71% from 2022.

Proya: Chinese skincare brand based off science and technology

TIMAGE: Makeup based on Chinese aesthetics, established in 2014

Off&Relax: Japanese body and hair care product, established in 2020

Hapsode: Specialised skincare product created in Korea, focused on targeting oily skin

2. China Macro and Industry Overview

2.1.1 Sector Trends

China GDP Growth is expected to remain relatively flat in the medium term due to population decline, softer public investments and a weak housing sector. China is attempting to restructure its investment-driven growth model towards one anchored more on private consumption which will be an important growth driver.

China Private Consumption Growth is expected to trend downwards due to weaker economic outlook. China is the world’s second largest consumer market with private consumption being the fastest growing segment of the economy since Covid-19. Rising adoption of “Guo Chao” (国潮)amongst the younger generation highlights a growing preference for domestic Chinese brands which have products rooted in Chinese culture.

Growing Market: China’s Beauty & Personal Care Market is expected to experience a 4.84% CAGR from 2024 to 2028. Personal care, skin care and cosmetics are anticipated to be the key drivers. With this unprecedented boom, China is poised to further solidify itself as the second-largest beauty market in the world, trailing only the United States. Additionally, China is expected to drive nearly 70% of growth within the APAC region.

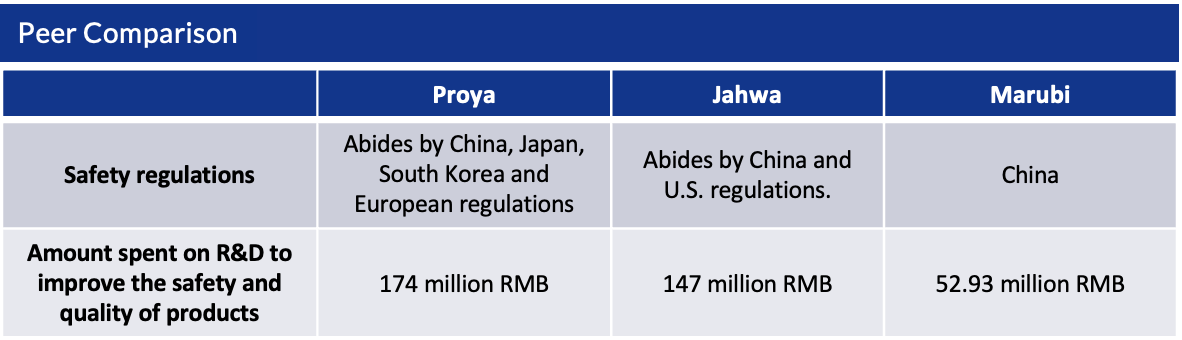

Tightening Regulations: In 2021, the China State Administration for Market Regulation issued an updated set of regulations aimed to increase the international exposure and acceptance of local Chinese brands. The new set of regulations placed increased emphasis on quality control and safety supervision, which helps Chinese brands to align with international standards. Under the new regulations, Beauty & Personal Care companies must hold a cosmetics manufacturing license and appoint a responsible person to oversee safety and quality of cosmetics.

2.2 Competitive Landscape

Strong Revenue Performance: Proya performed well in 2023 and achieved the highest revenue amongst its competitors. Additionally, Proya still has strong growth potential as their YoY revenue growth of 39.5% was also the highest amongst their competitors which averaged a 6.7% YoY revenue growth.

High Profitability: Proya achieved strong profitability in 2023 and was the best performer with the highest EBITDA. Proya also had the highest EBITDA margin at 16.8%, compared to its competitors' average EBITDA margin of 9.8%.

Market Leadership: Proya sits firmly atop the Chinese Beauty and Personal Care Industry with the largest market capitalisation. This comes after Proya recently knocked off Shanghai Jahwa in April 2024 after their 23-year reign as the top dog.

3. Investment Thesis

3.1 Thesis 1: Proya’s products has grown to be a staple to Chinese consumers rather than a discretionary good

With China’s rising level of disposable income, the “appearance economy” has become more integrated into people’s daily lives. From May 2022 to April 2023, the sales of body care products on Tmall and Taobao exceeded 7.2 billion (52 billion RMB), outperforming the beauty and skincare category. On lifestyle platform Xiaohongshu, searches for “body care” (身体护理) increased by 750% year on year in March this year. Searches for “facial skincare” (面部护理) increased only by 56% YoY.

With the rise in the Guo Chao trend, more Chinese consumers are wearing and purchasing homegrown China brands as a form of “cultural self-confidence”. A 2019 study found that more than 72% of China beauty brands make use of “made-in-China” related keywords compared to less than 40% in 2017.

Proya has been and is expected to continue to be well positioned to ride the Guo Chao wave via its various product offerings. The catchphrase 早C晚A, meaning “C for morning and A for night,” refers to the recommended practice of using skincare products containing vitamin C in the morning and those containing vitamin A at night before sleep. Upon hearing this catchphrase, Proya is one of the few brands that Chinese consumers will be reminded of, showing Proya’s position as the leader and pioneer of the ubiquitous trend. Frost & Sullivan ("Sullivan"), a world-renowned growth consulting company, awarded PROYA Morning C and Evening A (PROYA Double Anti-Aging Essence and PROYA Ruby Essence Set) the "No. 1 in China's Morning C and Evening A Skin Care Product Sales for 3 Consecutive Years (2021-2023)" and "China's Morning C and Evening A Skin Care Product Leader (by Sales) for 3 Consecutive Years (2021-2023)".

Additionally, Chinese consumers are becoming increasingly savvy and discerning in their choices with 58% of surveyed Chinese consumers valuing efficacy and ingredients. In 2023, Proya’s Longwu R&D Center and Shanghai R&D Center were put into operation to focus on the independent research and innovation of new, green, safe, and efficient cosmetic ingredients. With Proya leading the first domestic and overseas human body testing standard for anti-oxidation and anti-sugar, it demonstrates Proya's industry leadership by making strides in product safety and R&D.

3.2 Thesis 2: Topline growth driven by sustainable iteration

Flagship product iteration cycle has consistently outpaced competitors: Flagship products which propelled Proya to fame due to their cost effectiveness, are iterated annually unlike competitors. Each iteration comes with upgraded formulations and more effective active ingredients, thus justifying price increases and serves as a lever for revenue growth as seen in how the average selling price for Proya core brand has seen steady growth in the past 4 years. Marketing of these iterations drives renewed, cumulative interest in flagships and stimulates a new round of purchases by consumers.

Expansion from singular flagship product into an ecosystem: Expansion from flagship product into an ecosystem of products within the same series encourages co-purchases, due to synergistic aesthetic benefits. This enables successful strategy of iterating products within a series and gives rise to resilient growth of the brand.

Advanced product innovation capabilities creates a diverse portfolio allowing cross-sell between brands: Proya has a strong R&D team, ongoing global partnerships and optimised operations which provides them with the capacity to consistently update their product lines with iterations and build on their diverse portfolio. These distinct product lines have their own unique positioning, allowing for cross-sell and prevents encroaching of existing customers.

Effective sales channels with sticky touchpoints to help their brands penetrate Southeast Asia: Proya has rapidly grown through their focus on online sales channels and are expected to continue converting customers and increase the stickiness of their brand.

Building on their sales channels, Proya can replicate the successful strategies of their core brand and make use of the popular Chinese, Korean and Japanese concepts to attract Southeast Asia customers via Timage, Hapsode, and Off & Relax.

3.3 Thesis 3: Strong ESG management of supply chain protects margins

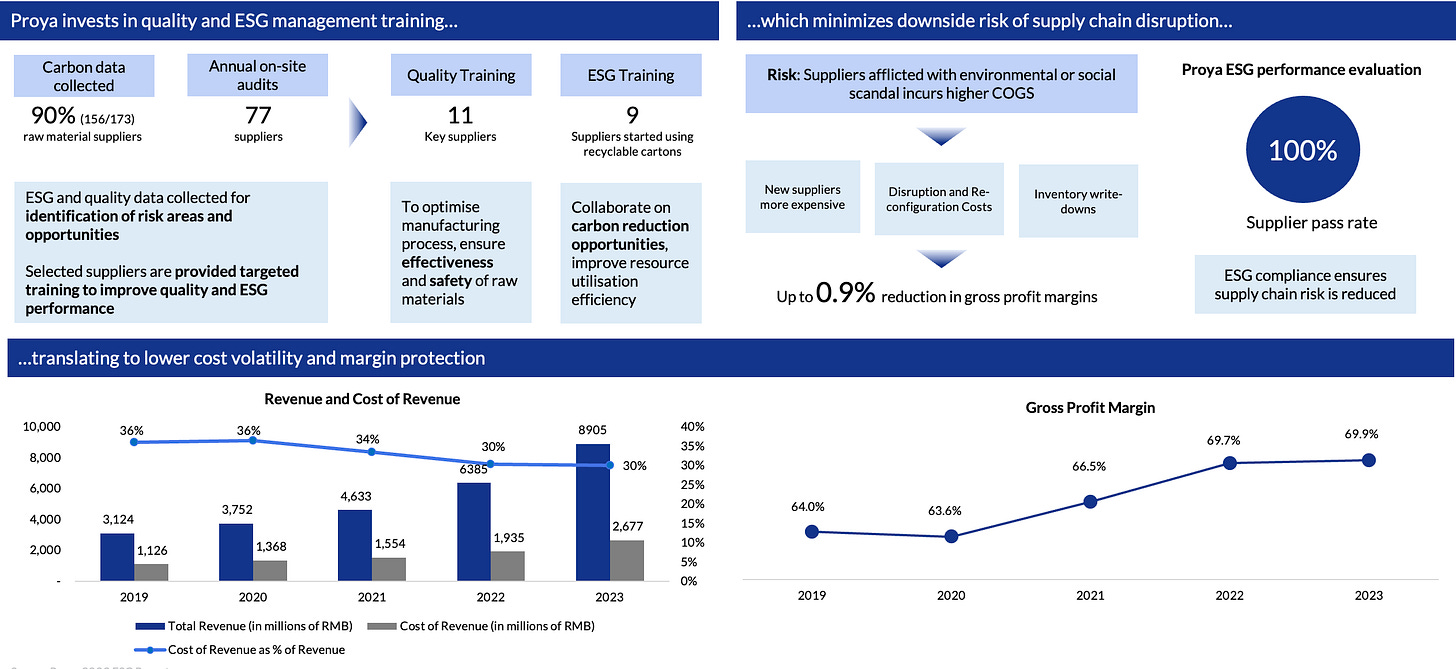

Robust ESG management process for suppliers to ensure baseline ESG compliance: Proya assesses suppliers’ ESG management from supplier admission, evaluation to disqualification. It also has industry leading measures for procurement, such as preferential purchasing of certified and eco-friendly raw materials, and supplier requirements to establish an environmental management system.

Investment in quality and ESG management training for suppliers improves supply chain ESG: Proya conducts audit and carbon accounting exercises on its suppliers to identify risk areas and opportunities across the value chain. Selected suppliers are then provided targeted training to improve quality and ESG performance, such as the effectiveness and safety of raw materials and carbon reduction.

Minimising of downside risk of supply chain disruption translating to lower cost volatility and margin protection: Proya’s commitment to supply chain ESG management over the years has decreased the cost of revenue as % of revenue, and will contribute to the maintenance of gross profit margins at 70%

4. Valuation

4.1 Revenue and Cost Forecasts

Revenue was split by brands and each was forecasted individually based on a series of analyst reports and how this memo's view differs from the street view based on the above investment theses.

4.2 Discounted Cash Flow (Intrinsic)

The discounted cash flow (DCF) method has been used to discount the next five years unlevered free cash flow, as the company cash flow is stable, to attain the free cash flow for the firm and the present value of terminal value. Using these two values, the Gordon Growth Method and EV/EBITDA Exit Multiple valuation methods were used to calculate a valuation of RMB 122.88 and RMB 127.56 respectively.

4.3 Relative Valuation (Comparables)

The EV/EBITDA Exit Multiple was used as the primary valuation method and the forecasted five-year unlevered cash flow was discounted to reach an intrinsic value. The cost of equity was found using the CAPM model blended with the cost of debt to arrive at a WACC. To supplement the primary valuation method, Gordon Growth Model was used to arrive at an intrinsic value of CNY 122.88.

4.4 Football Field Analysis

By combining these valuation methods within the 52 weeks trading range, the target price lies above all of the DCF valuation methods and in between the comparable metrics, which shows that the firm is undervalued based on its current share price. Furthermore, both DCF and the comparable methodology were taken into consideration to arrive at the target price of CNY 127.56. As utilising just an intrinsic value does not consider the market landscape, hence relative valuation methodology was utilised to include the perspectives of the market. In conclusion, the firm is undervalued at its current share price and the upside of 18% is justified.

Target Price: CNY 127.56 (18% upside)

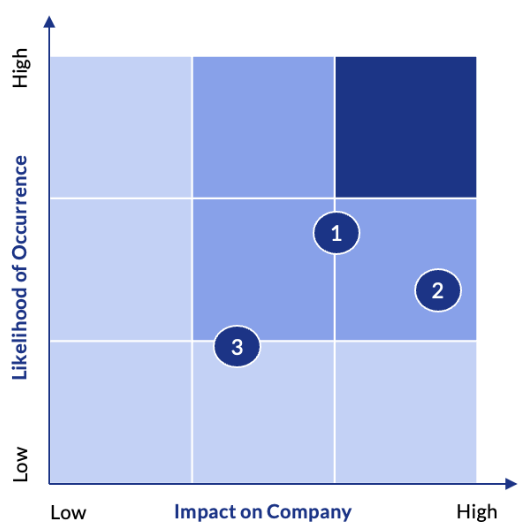

5. Risk and Mitigants

6. ESG Analysis

6.1 Identification of Proya's Material Issues

With reference to Proya’s ESG Report and SASB, 5 key material issues have been identified for analysis of Proya’s ESG performance:

GHG Emissions Management

Sustainable Packaging

Product Quality and Safety

Corporate Governance

Supply Chain Management

6.2 GHG Emissions Management and Sustainable Packaging

In relation to the issue of GHG Emissions Management, China's increasing regulation on energy utilisation and emissions emerges as a risk to Proya. China's 2024-2025 Energy Conservation and CO2 Reduction Action Plan was the first time China has provided specific energy-saving and emissions-reduction goals for industries. Although specific goals, targets and mandates has not been set for the cosmetics industry, the Chinese government’s release of this industry specific plan signals their increased prioritization of satisfying their Nationally Determined Contribution (NDC) of striving to reach carbon dioxide peaking before 2030 and achieving carbon neutrality before 2060.

In relation to the issue of sustainable packaging, there has been a rise in environmental awareness amongst Chinese consumers, placing greater pressure on companies to ensure that their practices and products are sustainable in nature. According to the 2022 Green Guilt report, 76% of Chinese consumers are willing to pay a premium of 5%-20% for environmentally friendly beauty products. The inability to manage one’s GHG emissions and to satisfy consumers shifting preference towards sustainable products can lead to an increase in financial and reputational risks. This can ultimately affect Proya’s market share, revenue and reputation.

In terms of GHG management and sustainable packaging, Proya is a leader in minimizing the environmental impacts of their operations. In the e-commerce channel, Proya is the first in the Chinese beauty industry to use recyclable cartons as a replacement for disposable cartons, thereby significantly cutting the use of cardboard and adhesive tapes and reducing carbon emissions.

2023: The proportion of sustainable materials used in packaging had reached 25.47%, representing an increase of 25.31% compared to that of 2021.

By 2025: The proportion of sustainable materials used in packaging will increase by 20% and packaging intensity will decrease by 15% over that in 2021

With Proya aligning themselves with the higher target of carbon neutrality by 2045 (as compared to China’s own NDC) and their championing of sustainable packaging, they are well-positioned to leverage on these opportunities and risks.

6.3 Product Quality and Safety

For a beauty products company, product quality and safety is a material issue as the inability to ensure the quality and safety of one’s product can lead to sigificant financial and reputational risks, such as having to pay hefty financial penalties, erosion of brand value and customer trust leading to loss of market share. These risks are exacerbated by the implementation of 10 new cosmetics standards in China after a slew of non-compliant cosmetics came to light in 2024. China also set up a Technical Committee for cosmetics standardization, launched new testing methods for specific chemicals and are in the midst of further clarifying the scope of their regulations.

Additionally, the National Medical Product Administration (NMPA) significantly strengthened its punitive measures for non-compliant products. Products found to contain the prohibited ingredient progesterone were subject to fines of up to 2.49 million yuan. New inspection measures by NMPA released on April 1, 2024 include enabling case-based inspections to be triggered when public opinion or complaints indicate that the product has quality and safety risks. These inspection measures will come into effect on November 1, 2024.

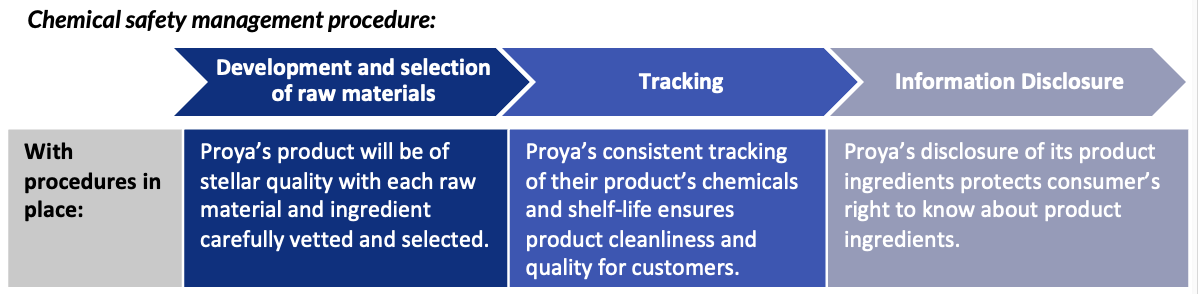

Currently, Proya has a comprehensive chemical safety management procedure to ensure that its products not only meet both local and international cosmetics standards, but are also of superior quality for its customers.

Proya also has product recall management and control procedures to immediately stop selling and recall sub-standard products already sold or in transit. This is to protect the rights and interests of consumers. These initiatives not only exhibits Proya’s exhibits their significant efforts in ensuring the safety of their products, but also shows their dedication to ensuring that their goods are of stellar quality for their customers. This well positions them to leverage on these risks to grow in their revenue and reputation.

6.4 Corporate Governance

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

7. References

BeautyTech.jp. (2022, May 17). Emerging clean beauty brands in China, from emphasis on safety to environmental considerations. Medium. https://medium.com/beautytech-jp/emerging-clean-beauty-brands-in-china-from-emphasis-on-safety-to-environmental-considerations-23b924c040a1

Chen, N. (2023, June 2). Goliath vs. David: How homegrown Proya disrupts L’OREAL’s dominance in chinese beauty industry. baiguan.news. https://www.baiguan.news/p/goliath-vs-david-how-homegrown-proya

Cheng, D. (2022, October 13). Green guilt report: Sustainable consumption in China. Daxue Consulting - Market Research and Consulting China. https://daxueconsulting.com/green-guilt-report-sustainable-consumption-in-china/

China’s cosmetics and Personal Care Market: Trends and Outlook. China Briefing News. (2023, July 20). https://www.china-briefing.com/news/chinas-cosmetics-and-personal-care-market-key-trends-and-business-outlook/

Daxue Consulting. (2024, June 7). Shifting tides in China’s clean beauty market. Daxue Consulting - Market Research and Consulting China. https://daxueconsulting.com/clean-beauty-market-china/

Duveau, J. (2023, December 4). China’s new beauty trend: Body care “skinification.” Jing Daily. https://jingdaily.com/posts/skinification-bodycare-china-beauty

GOV.CN. (2024, May). China to take action for energy conservation, carbon reduction. https://english.www.gov.cn/policies/latestreleases/202405/29/content_WS66570ed0c6d0868f4e8e79d0.html

Han, Y. (2020, February). China’s Homegrown Beauty Brands Ride the guo chao wave. Eastspring Investments. https://www.eastspring.com/docs/librariesprovider6/our-perspectives/market-insights/china-beauty-industry-new.pdf

Jahwa. (2024). Periodic reports. https://www.jahwa.com.cn/en/csr/report

Keller and Heckman. (2023, October). The changing face of cosmetics in China: Challenges and opportunities for China’s Reformed Regulatory Framework. https://www.khlaw.com/insights/changing-face-cosmetics-china-challenges-and-opportunities-chinas-reformed-regulatory

Proya. (2023). Proya Reports. 珀莱雅-致力于成为世界一流的美妆企业[公司官网]. https://www.proya-group.com/en/report

SASB. (2023, June 13). SASB Industry Topics. https://sasb.ifrs.org/standards/materiality-finder/find/?company%5B0%5D=CNE100002TP9

丸美股份:2023年度环境、社会与公司治理(ESG)报告(英文版). Sina. (2024, May). https://vip.stock.finance.sina.com.cn/corp/view/vCB_AllBulletinDetail.php?stockid=603983&id=10220607

自然力量碰撞先锋技术,珀莱雅推出全新洗护品牌「惊时」_头皮_护理_上海. Sohu. (2024, May 17). https://www.sohu.com/a/779428232_120724283