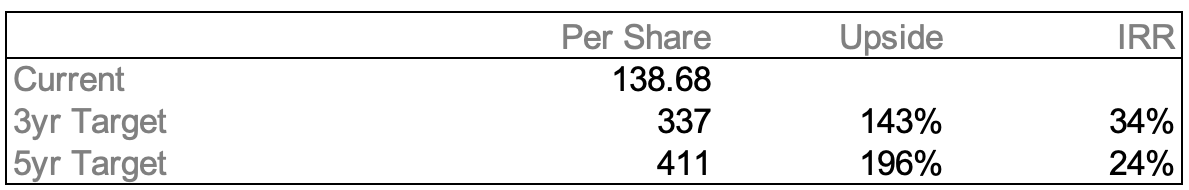

Initial Memo: Spotify Technologies (SPOT) 196% 5-Year Potential Upside (Javier CHAN, VIP SEA)

Javier presents a "BUY" recommendation as music as an industry is extremely resilient and should do well regardless of the macro environment.

Linkedin | Javier Chan

Spotify: A Compelling Case for Profitability

Spotify is the largest pure-play audio streaming service and is both driving and benefiting from the ongoing secular shift from transaction-based to access-based streaming models. The company is growing its total MAUs at ~27% and is generating positive FCF on an annual basis. Despite suffering a net loss of €430m in 2022, I believe that Spotify has a promising outlook and has a very high probability of achieving profitability within the next 3 years. My positive view on Spotify is driven by: 1) back-loaded improvements in unit economics; 2) sustainable improvements in operating efficiencies; and 3) the ability to stave off competition.

1.0 Unit Economics

Spotify’s business model has consistently been under scrutiny, with the market questioning whether the unit economics of each user is robust enough to generate positive profits. Deeper scrutiny of the key levers of the business would reveal that Spotify has plenty of opportunities to better monetise and increase the value of each user. Their blitz scaling strategy since their listing in 2018 has made this less apparent, but my view is that for Spotify, the years of unprofitable growth were the only way to amass such scale that will play a part in their achieving profitability, as the improvements in unit economics of the business are mostly backloaded and can only materialise with sufficient scale. The key levers for Spotify to improve its unit economics are 1) average revenue per MAU (ARPU) and 2) direct costs.

1.1 Price Hikes

I believe that Spotify has a significant ability to better monetise its premium subscribers with price increases. Over the years, Spotify has shown that its subscriber base has been able to readily absorb price hikes, with minimal impact on MAU growth. In the past few years, Spotify has conducted over 50 price increases1, yet as of Q2 2023, MAUs have increased by 70% since the onset of the pandemic. In July 2023, the company announced the following price hikes across more than 50 markets:

Prior to the price hike, Spotify’s ARPU was only at $56.28 per year. With average disposable income per capita in the US being ~$60k4, this would mean that a Spotify subscription only took up ~0.09% of wallet share. To examine how Spotify’s user base reacts to subscriptions being anticipated to take up a larger proportion of wallet share, we can look back to Q1 2020. US unemployment rate spiked from 3.5% to 14.7% during that quarter5, yet they saw the fastest y/y growth in MAU in 3 years (32%)6. The slowdown in premium subscriber growth was also not observed, with premium subscribers jumping 30% that quarter. This implies that user growth is not so much a function of employment/income growth, but rather a matter of consumer preferences and where they decide to spend their monies. With the recent price hikes expected to only increase Spotify’s average wallet share from 0.09% to barely above 0.1%, I reckon that this change will be relatively immaterial to their loyal user base, and the value that Spotify provides from their product offerings will be able to justify the price increase.

1.2 Scale-led Cost Advantages

I believe that Spotify will be able to continue lowering direct costs by leveraging the massive scale that they have achieved. Spotify’s direct costs comprise mainly revenue sharing with labels and publishers for both premium and advertising revenues (84% of revenues). Spotify’s pay-per-stream on average has been trending downwards. In the past decade, Spotify’s pay-per-stream has halved from $0.006 to $0.0037. This is attributed to the sheer number of ears that Spotify has managed to attract to their platform, such that they have the bargaining power to reduce revenue share. The street has expressed concern as to whether artists might leave the platform and cause a mass exodus. My view is that this is highly unlikely as there is zero incremental cost for artists to upload their works to Spotify8, and leaving the platform will only result in a loss of exposure for them. Whether they like it or not, most of them will be locked into the Spotify ecosystem. To ensure the protection of artist welfare, Spotify has made efforts to allow artists to make money from methods beyond music streaming on the app. For instance, Spotify allows integration with Shopify to allow creators to sell merchandise through the app. Creators typically earn around $0.003 to $0.005 per stream. To make $100, you need 25,000 people to listen to your song or podcast. But, if you're selling merchandise, you only need five fans to buy a $20 t-shirt on your Shopify store to make the same amount10. Ticketing promotion and fan support are also other initiatives introduced to improve artists’ experiences with low incremental costs on Spotify’s end. Being a first mover in these efforts serves as Spotify’s moat; competitors today have not introduced similar features. With these measures in place, I believe that Spotify can continue to cut its largest variable cost in revenue sharing, to improve gross margins. To examine whether there is a floor for revenue sharing, we can take Deezer, a competing app, as a case study. Deezer only has a pay-per-stream of $0.00111, about a third of Spotify, yet the share of digital music buyers using Deezer still grew by 7% from Q1 2021 to Q1 202312. Hence, I believe that there is significant headroom for further reduction in direct costs, without any worry of artist/user churn.

I estimate that the combined effects of price hikes and direct cost efficiencies will result in an improvement in Contribution per MAU from €4.83 in 2022 to €6.03 in 2025 (8% CAGR).

1.3 Improving Operational Efficiencies

In the last 2 recent quarters’ earnings calls, management highlighted ongoing efforts to streamline operations and reduce costs. Year to date, Spotify announced that they were laying off 8% of their global workforce, including 200 employees in the Podcast Strategy Shift13 14. Assuming 2% wage growth for 2023, this will result in savings of ~€100m – about a quarter of 2022 net losses.

Management also seems cognizant of their overinvestment in content deals and said that the hurdle for new investments going forward will be significantly higher1. Weak margins in 2022 were attributed to investments in the Podcast business, but these were mostly investments in marketing expenses and exclusive content deals1, which by nature will be frontloaded and moderate subsequently, as seen in their core music streaming business. Furthermore, during the 2022 Investor Day, management guided that Podcasts are expected to be a 40-50% gross margin business within the next 5 years but are still in investment mode15. As of the Q2 2023 earnings call, management says that Podcasts are on track to break even and achieve the level of margins as previously guided1.

Overall, management has offered reassurance by stating that operating expenses as a percentage of revenue should come down because they are not going to increase it to the same extent that they have had in past years1. I reckon that these are cost levers that are well within their control, and the company has made visible efforts to achieve this target. I estimate that the combined effects of organizational streamlining and further operational efficiencies will reduce total operating expenses from 30.6% of revenue in 2022 to 24.3% in 2025 (7% CAGR).

1.4 Dispelling Fears of Competition

Bears are concerned about Spotify’s ability to capture market share in music streaming, with the biggest competitor being Apple Music.

From online reviews, audiophiles say that Apple Music has slightly higher music quality than Spotify, and that is what has resulted in some jumping ship. For the average retail consumer, their ears are not going to be attuned to identify such minutiae differences in quality, especially for Podcasts where there will be no material difference in levels of enjoyment. While further investments in audio tech and introducing Lossless audio might help Spotify to reduce the biggest reason for churn, I doubt that this impact will be material and for now, Spotify is better off investing in expanding its product offerings, especially in the podcast space where other platforms seem to be neglecting.

According to Podtrac, Spotify was the most preferred podcast application with a third of US podcast listeners, which is a 21% increase in audience share for the platform since September 2021. Apple Podcasts followed closely behind as the second most preferred platform with a quarter of all US podcast listeners. There were no other major competitors to Apple and Spotify, with the next nearest application on the list, iHeartRadio, only amassing 6.2% of the audience share.

Another reason why I think we can be reassured of Spotify’s position in the market is because their biggest competitor, Apple Music, caters mostly to Apple users.

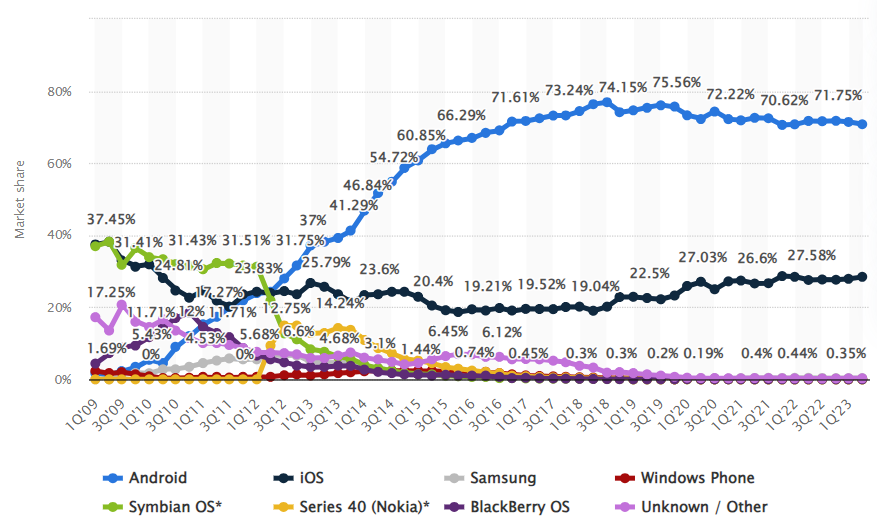

Globally, Apple OS only takes up 28% share, while Android dominates with >70%. Looking at Google Play Store downloads, Spotify has seen >1 billion downloads while Apple Music has only 100m. This would mean that Spotify has 10x the popularity of Apple Music on non-Apple devices.

It would seem like non-Apple users generally tend to not participate in the entire ecosystem, and their walled garden could be a double-edged sword that might drag them in terms of capturing share in their non-iPhone products and services. With that, Spotify would undoubtedly be the most well-positioned player to capture the rest of the market.

1.5 Breakeven Analysis

From 2022 to 2025, I assumed premium users comprised ~38% of MAUs, ~4% higher premium ARPUs, gross margin expansion by 320bps, and 7% CAGR in operating expenses. Dividing 2025 fixed costs by contribution per MAU, I derived a breakeven MAU of ~622m. This would imply a 3Y CAGR of 8% from 489m in 2022, much lower than the 3Y historical CAGR of 22%, and last quarter’s growth of 27%. There is a high likelihood that Spotify will comfortably achieve this and turn profitable at the operating level.

2.0 Valuation

Spotify currently trades at 1.5x NTM sales and is looking extremely cheap. Music as an industry is extremely resilient and should do well regardless of the macro environment; relative to other tech sectors the sentiment here should not deteriorate as much and would allow for a higher potential to outperform. I believe the max downswing from here would be at most ~30%, this is likely to be driven by temporary depression in sentiment due to recession fears, MAU growth slowdowns etc, but I would recommend accumulating even more at those levels.

This is a long-term bet that I see very little likelihood of not materializing, but would still require ongoing monitoring, especially in margins and MAU growth. I value Spotify at 3x target EV/Sales, in line with the historical average. This would imply a 3Y target upside of 120%, and a 5Y target of 168%.

Sources:

1 Spotify Q2 2023 Earnings Call & Presentation

2 Spotify 2022 Annual Report

3 https://newsroom.spotify.com/2023-07-24/adjusting-our-spotify-premium-prices/

4 https://fred.stlouisfed.org/series/A229RC0A052NBEA

5 https://fred.stlouisfed.org/series/UNRATE

6 Spotify Q1 2020 Earnings Call & Presentation

7 https://www.whippedcreamsounds.com/how-much-does-spotify-pay-per-stream/

8 https://artists.spotify.com/en/blog/now-in-beta-upload-your-music-in-spotify-for-artists

11 https://producerhive.com/music-marketing-tips/streaming-royalties-breakdown/

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk