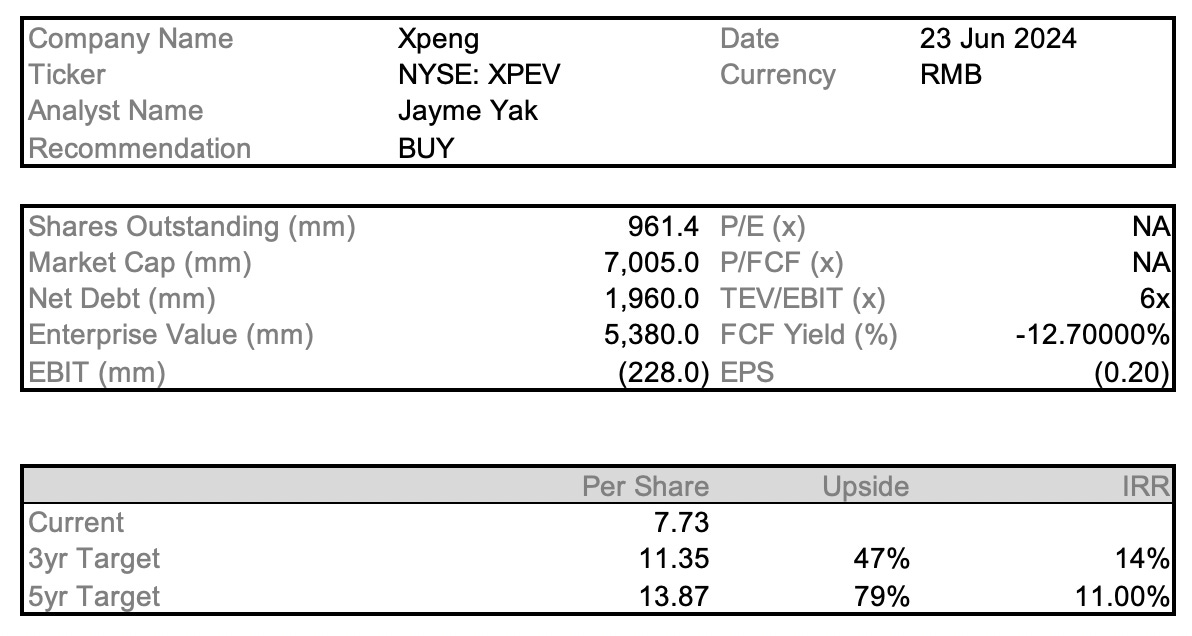

Initial Memo: Xpeng Inc. (NYSE:XPEV), 79% 5-Year Potential Upside (Jayme YAK, EIP)

Jayme presents a "BUY" recommendation based on shifting consumer demand for low-carbon products, experienced management, and well initiated risk mitigation strategies.

1. Overview

LinkedIn | Jayme Yak

2. Company Overview

Xpeng (NYSE: XPEV) is a Chinese smart electric vehicle (EV) company whose operations began in 2015. It designs, develops, manufactures and sells smart EVs that appeal to large and growing technology-savvy middle-class consumers. It also provides services including charging solutions, after-sales services and value-added services. Headquartered in Guangzhou, China, it also has main offices in Silicon Valley, San Diego and Amsterdam while the manufacturing plants are in Zhaoqing and Guangzhou, China.

Xepeng X9 launched Jan 2024; Photo credits to Xpeng website

On 1 January 2024, Xpeng launched XPENG X9 ultra smart large seven-seater MPV and commenced deliveries in the same month. Between January and February 2024, there were 12,795 vehicle deliveries.

A. Business Segments

Xpeng directly sells vehicles, and other services include charging solutions, after-sales services and value-added services. For reporting, as mentioned in the Annual Report, the Group only has one reportable segment; the Group does not distinguish between markets or segments for internal reporting.

B. Revenue Drivers

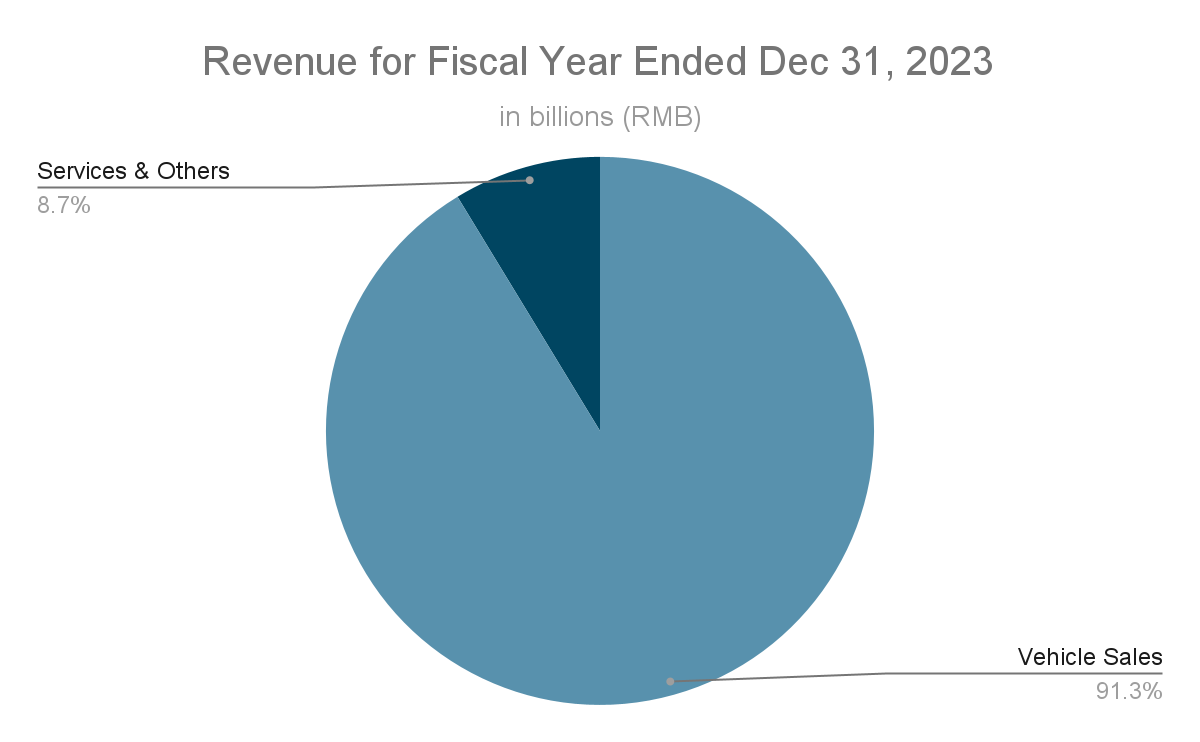

Total revenue for the Fiscal Year ended December 31, 2023 is RMB30.68 billion (USD4.32 billion), an increase of 14.2% from RMB26.86 billion the previous year.

Main source of revenue (91.3%) was from sales of their Smart EV vehicles, with revenue of RMB28.01 billion for the Fiscal Year. This is an increase of 12.8% from the previous year, primarily attributed to the increased sales growth of the G6 and G9.

The Services & Others segment made up the remaining 8.7% of revenue for the year, RMB2.67 billion (USD0.38 billion). This is an increase of 32.2% from the previous year, primarily attributed to the increase in second-hand vehicle sales, maintenance and supercharging services sales.

C. Cost Drivers

The aforementioned increase in vehicle sales also led to an increase in costs from RMB23.77 billion in 2022 to RMB30.22 billion in fiscal year 2023.

Research and development expenses were RMB5.28 billion for fiscal year 2023, a 1.2% increase from the previous year. This increase can be attributed to new vehicle programs.

Selling, general and administrative expenses were RMB6.56 billion for fiscal year 2023, a 1.9% decrease from previous year due to reduced marketing, promotional and advertising.

D. ESG Considerations

Environmental

Xpeng is aligned to China’s national ‘Dual Carbon’ commitment - to reach carbon peak by 2030 and carbon neutrality by 2060

Plans to develop short-, medium- and long-term carbon reduction targets, formulate reduction plans for Scopes 1,2,3 emissions

EVs delivered by Xpeng in 2023 will reduce carbon emissions by ~1.50 million tonnes over their entire lifecycle. Recently launched in Europe, Xpeng’s G9 electric SUV attained a top sustainability rating of five stars from Green NCAP.

Committed to boost the circular economy through establishment of an end-to-end recycling management process of waste power batteries to promote waste resource utilization

Support the green transformation of logistics and compiled the “Logistics Planning White Paper”

Social

100% client complaints responded and resolved

Satisfaction rate of complaint handling reached 80.06%

Customer satisfaction rate reached 96%

Net Promoter Score survey conducted monthly; average score in 2023 increased by 8% vs 2022

Employee empowerment: 98.6% of total employees participated in organized training sessions

Governance

The Board assumes ultimate responsibilities for Xpeng’s ESG strategies, policies and other initiatives. It also authorizes the ESG Steering Committee, headed by the President of the Company.

Committee Compensation

No informations security breaches or other cybersecurity incidents in the year 2023

Responsible supply chain: 100% of suppliers signed the Suppliers’ Integrity Commitment Letter

3. Competitor Analysis

What sets Xpeng apart from its competitors would be its focused adoption of smart technology in its vehicles. Xpeng’s mission is to drive Smart EV transformation with technology, shaping the mobility experience of the future. Xpeng develops in-house its full-stack advanced driver-assistance system technology and in-car intelligent operating system, and core vehicle systems including powertrain and the electrical/ electronic architecture.

Founded in 2014, NIO designs, develops, manufactures and sells premium smart EVs, driving innovations in next-generation technologies in assisted and intelligent driving, digital technologies, electric powertrains and batteries.

Headquartered in Beijing, China, Li Auto designs, develops, manufactures and sells premium smart EVs. Its product line comprises MPVs and sport utility vehicles. It offers sales and after sales management, technology department and corporate management services.

Tesla, Inc., founded in 2003, is an American manufacturer of electric automobiles, solar panels and batteries for cars and home power storage.

4. Investment Thesis

Increasing expectations for adoption of EVs globally aligned to Xpeng’s ambitious plans

According to the International Energy Agency, electric car sales surged in 2023 and reached almost 14 million worldwide. 95% of the sales were concentrated in China, Europe and the US, and among this, more than 30% was in China.

Xpeng has announced in March 2024 that it plans to launch more than 10 brand new models over the next three years. The EVs will continue to be designed with intelligent features such as autonomous driving systems and smart cockpits.

Shifting consumer demand and focus to low-carbon products

Xpeng has appropriately identified environmental risks brought by climate change to be one of the key risks in the upcoming years. Xpeng also identified the increasing market demand for low-carbon products. In response, Xpeng has proposed countermeasures to address these risks in this complex and fast-changing environment, including:

Identify physical and transition risks

Source and use low-carbon and lightweight components

Establish carbon emission reduction programs

Promote carbon emission reduction throughout the lifecycle of EVs in the industry chain

Significant investments in R&D

Earlier this year in February 2024, Xpeng announced its expansion plans, including plans to hire 4,000 new workers in 2024, that is a 25% expansion of its 2022 workforce.

Xpeng also plans to invest RMB 3.5 billion (USD486.36 million) in AI research and development for intelligent driving, and plans to release about 30 new products pr revised models in the next three years.

Volkswagen has also announced in July 2023 that it would invest about $700 million in Xpeng and purchase a 4.99% stake in the company.

These reflect Xpeng’s ambitious and bold moves amidst a pessimistic macroeconomic situation. Nio announced in November 2023 that it would trim its workforce by 10% to improve efficiency and growing competition. In contrast, Xpeng has decided to increase investment and expand to accelerate performance.

5. Valuation

6. Risks & Mitigation

7. ESG Assessment

Xpeng’s Materiality Matrix - Key Material Issues after engagement and communication with various stakeholders.

According to SASB, the material issues for Xpeng (Automobiles industry) are:

Product quality & safety

Labour practices

Product design & lifecycle management

Materials sourcing & efficiency

Mapping to Xpeng’s own materiality matrix, all four topics have been identified and covered in their materiality matrix

Achieved MSCI ESG Rating of AAA

Achieved Sustainalytics ratings of 25.5 (Medium risk)

Tesla: 24.7

Li Auto: 19.5

8. Conclusion

While Xpeng has been making steady progress in the Chinese EV market with growing presence, Xpeng has also appropriately highlighted that they are still a relatively new player in the field compared to its peers. As a new entrant, this implies some additional risks and disadvantages that they may face, including relatively small size of customer base, inability to reap economies of scale and generally navigation in a complex and evolving regulatory environment. Despite this, Xpeng has been proactively identifying these risks and proposing and initiating countermeasures to ensure successful and continued growth.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

9. Sources

https://finance.yahoo.com/news/where-does-xpeng-inc-nyse-180903727.html

https://ir.xiaopeng.com/static-files/be01bd9d-41dd-4293-9c31-33ce6e4e4695

https://ir.xiaopeng.com/static-files/266794e1-f86b-4d6a-8814-75851d914ada

https://sasb.ifrs.org/standards/materiality-finder/find/?company[0]=US98422D1054

https://www.asiafinancial.com/chinas-ev-maker-xpeng-unveils-big-hiring-ai-investment-plan