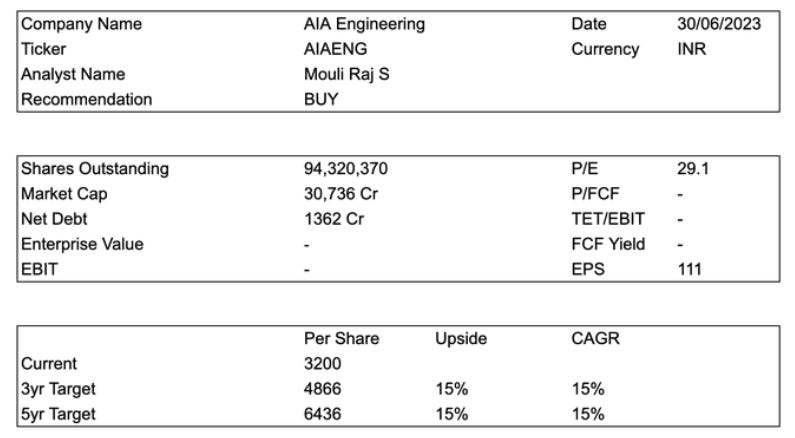

Initial Report: AIA Engineering Limited (AIAENG), 15% 5-yr Potential Upside (VIP SEA, Mouli RAJ)

Mouli believes that there is strong moat, opportunity for growth and market for AIA Engineering's products. Let's read on with his thesis.

LinkedIn | Mouli RAJ

Executive Summary

AIA ENGINEERING LIMITED was established in 1979 at Ahmedabad, India. They are into Offering Customized process optimisation and technical assessment to sectors such as Cement, Mining, Thermal, Quarry.

This company is ranked second in the world for its production of Hi-Chrome castings. The company has 11 subsidiaries in countries including India, UAE, UK, USA, etc. In Fiscal Year 2021-22, 78.88% of its total sales came from outside India while the balance 21.12% came from within India.

This report issues a BUY recommendation on AIA Engineering (AIAENG) given the following theses: (a) Use of High Chrome consumable wear parts in mining industry the level of penetration of High Chrome wear parts (mainly High Chrome Grinding Media and mill liners) is only in the region of around 20% thereby leaving a considerable growth opportunity for conversion of the mines from the use of conventional wear parts (mainly Forged Grinding Media) into the company’s High Chrome Grinding Media. (b) Annual consumption of Grinding Media for the mining segment is estimated at 2.50 million tons with less than 20% of the same converted to High Chrome, thus offering a sizable growth opportunity of conversion.

(c) By investing in a company operating within an oligopoly market, offering non-cyclical products in a cyclical industry, and specializing in fast-moving industrial goods, we can leverage the benefits of market dominance, stability, and consistent demand to achieve strong long-term profitability and mitigate the risks associated with economic volatility.

(d) With a substantial liquidity of 2300 crores ($29 million) and a strategic focus on future capital expenditure plans, combined with low debt levels which is 58 crores (Equivalent of $7 Million) and an impressive return on capital employed (ROCE) of 25%, the company is well-positioned to fuel its growth trajectory. The ample cash reserves not only provide financial flexibility but also enable the company to seize opportunities, expand operations, and deliver sustained value to shareholders. This prudent financial management, coupled with a strong ROCE, underscores the company's ability to generate profitable returns on invested capital, making it an attractive investment proposition

Company Overview

Business Segments

The company has four business divisions such as Cement, Mining, Thermal, Quarry.

Despite having four business divisions, the company's primary focus is on cement and mining, as these are their largest customers.

The above image depicts the list of ingredients that goes through the cement production process and grinding media is among one of them.

There are two kinds of grinding media available in the market and they are:

(i) Conventional Mill

(ii) High Chrome Mill

High chrome has greater advantages over traditional grinding media and in the long run saves the customer more money along with an increase in efficiency.

And AIA is providing High Chrome Mill

How does the business transaction happen between their clients?

The company can provide assurance to its customers even if it is not physically present in the country where the order is being placed. The company is based in India, where it conducts production and exports. Providing door-to-door delivery ensures customer satisfaction. They handle the entire supply chain process, including fulfillment and the last-mile sale, without involving third-party intermediaries.

To provide further convenience, the company maintains stock points in various locations, strategically positioned for quick access to customers who have already placed orders. As part of their strategy, if a customer orders a substantial volume of 10,000 or 15,000 tons (equivalent to 1,000 tons per month), the company is willing to stock 2 to 3 months' worth of inventory near the customer's location. This arrangement provides the customer with visibility and supply assurance for a period of 4 to 6 months. This approach eliminates the need for a local plant, as the inventory is already positioned accordingly. The specific stocking strategy depends on factors such as the customer's requirements and the logistics involved, including ocean lines and local conditions in the target country.

Additionally, the company proactively accepts orders in anticipation, especially when the plant is commissioned. However, the actual invoicing for these orders may occur starting from the following year onwards.

How does AIA customize its products?

The company customizes its products based on the specific conditions and requirements of end users. This customization involves designing the shape of the part or castings, as well as determining the appropriate alloy and size of the grinding media. The company's innovation primarily stems from providing tailored solutions that address the unique set of conditions presented by end users.

Revenue Drivers

The growth in the cement industry for the company will closely align with the industry's overall growth rate, which remains modestly in the higher single digits. This is because the cement industry globally has already largely transitioned to the high chrome product they supply. In India, the consumption of these wear parts in cement is comparatively lower. While the company holds a significant market share of 35% in the industry, excluding China, the consumption ratios are already low due to widespread conversion.

Their non-mining business is projected to be around 75,000 to 80,000 tons. Even with a 10% growth, amounting to 8,000 tons, it remains insignificant compared to the expected 300,000 tons overall growth this year. Therefore, the company's growth primarily relies on the mining market, resulting in tepid growth aligned with the existing industry trends.

The company is intensifying its focus and dedicating significant resources to the South American market. Recognizing its immense importance, they are doubling their efforts in this region. The company anticipates having noteworthy developments to announce in the coming quarters, indicating their commitment to expanding their presence and operations in South America.

Cost Drivers

Ferrochrome is the important raw material and it is very volatile

Passing through both the ups and downs of raw material to customers.

The company highlights a recent supply arrangement they have established with SAL Steel, a Ferro Chromium producer based in Ahmedabad. This arrangement operates as a job work agreement under a commercial supply agreement. Its primary purpose is to enhance the company's supply chain by introducing diversification. Given the significance of Ferro Chrome as a crucial raw material, this partnership is strategically valuable.

Under the terms of the contract, the company has secured the entirety of SAL Steel's production capacity for a minimum duration of 3 years. This arrangement provides the company with a reliable source of raw materials, ensuring raw material security for their operations.

Competitor Analysis

AIA manufacturers in India where labour cost/cost of production is far lower than abroad. And it exports most of its products. This makes their margins multiple times higher than peers. Maggoteux works with around 5-10% whereas AIA works with around 20-30% in spite of being aggressive with its pricing.

The business is technical in nature. This results in high switching costs for clients. (The nature of the product is that of a refractory, so it makes a small % of cost but the failure of the product will result in a big hit on production).

The company asserts that they have not experienced any notable losses to competitors. Their primary goal is to gain market share and convert mines, with a specific emphasis on transitioning customers from forged media to grinding media. They believe their solution is superior in this regard. While they acknowledge Magotteaux as a significant global competitor, the competitive landscape remains relatively unchanged.

Economic Moat

For AIA clients the cost is low compared to the total costs but the company needs it to function hence there is a customer stickiness.

In the context of grinding media or liners, AIA offers a compelling proposition. By implementing their solutions, one can achieve a remarkable reduction in consumption ranging from 10% to 20%. This translates to a direct increase of 1% to 2% in EBITDA.

AIA's value proposition extends beyond mere cost savings. They emphasize additional advantages such as reduced power costs, decreased expenditure on other reagents during the DP stage, and marginal improvements in throughputs. As a result, the overall cost of ownership for the mine experiences a significant decrease. This comprehensive approach sets A apart from competitors.

AIA has evolved into a more potent solution provider over time. Their offerings now deliver substantial benefits without incurring any extra costs. The miner pays solely for the supplied product, without additional charges for services, consulting, or any other value-added features brought to the table

The company emphasizes that their value proposition extends beyond being a replaceable vendor. They actively engage with customers and continuously seek opportunities to add value. Sales representatives from the company are present at the customer site, fostering discussions on potential enhancements and novel prospects. They believe that pricing discussions should be the final conversation, highlighting the significance they place on building strong relationships and delivering value-added solutions.

Investment Thesis

From a Global Industry perspective, while the Cement Industry has practically worldwide converted into the use of High Chrome consumable wear parts in mining industry the level of penetration of High Chrome wear parts (mainly High Chrome Grinding Media and mill liners) is only in the region of around 20% thereby leaving a considerable growth opportunity for conversion of the mines from the use of conventional wear parts (mainly Forged Grinding Media) into the company High Chrome Grinding Media.

The company's current primary industry focus lies in the global mining sector, with particular emphasis on copper, gold, and iron ore mines worldwide. They strategically target these specific types of mines across various geographical regions where the extraction of these ores is actively taking place. By directing their efforts towards serving the needs of the mining industry in these key sectors, the company aims to establish a strong presence and deliver tailored solutions to support mining operations globally.

And also the company is actively addressing the mining sector's conversion opportunities by providing a comprehensive range of solutions tailored to meet the specific requirements of mining customers. These solutions encompass various benefits, including cost savings achieved through lower wear rates and reduced consumption due to the advantages of High Chrome technology. Additionally, AIA offers downstream process-related advantages, such as cost reduction in the usage of expensive reagents and improved ore recoveries through the use of High Chrome Grinding Media. The company also specializes in unique Mill Lining solutions that enhance throughput and decrease power costs, further adding value to their customers. AIA is expanding its portfolio by offering exclusive Mill Liners to the mining market, enabling them to capture a larger share of the estimated 300,000-ton global market and unlocking additional growth opportunities. In order to support their expansion in this segment and facilitate higher cross-selling opportunities for Grinding Media, AIA plans to commission a dedicated greenfield Mining Liner plant in the second quarter of the 2022-23 financial year.

With the continuous improvement of their product mix and an expanding customer base that includes larger mines such as copper and gold mines, the company foresees the potential for enhanced margins. As they penetrate deeper into these lucrative markets, they anticipate increased sales of liners and other products, leading to a positive impact on their profitability. The company's strategic focus on targeting high-value segments and optimizing their product offerings positions them to capitalize on improved margins in the foreseeable future.

Valuation

The normalization of travel conditions is anticipated to facilitate the acquisition of new mining customers for AIA. Despite the potential impact on base volume due to anti-dumping measures in Canada and South Africa, the company foresees.

The projected compound annual growth rate (CAGR) for revenue is approximately 12.3%, while for EBITDA it is around 5.9% for the fiscal years 2022 to 2025. This growth is expected to be supported by consistent margins ranging from 22% to 23%. The sustained margins indicate the company's ability to maintain profitability over the specified period.

Based on the above factors I value AIA’s business at | 3700 (i..,32x P/E on FY25E EPS).

Risk and Mitigation

Magotteaux has initiated arbitral proceedings against Mr. Bhadresh K. Shah and the Holding Company before the International Chamber of Commerce, London (ICC) claiming damages of its patent and breach of the settlement deed.

On 02 August 2019, the three member Arbitration Tribunal passed a unanimous Award declining jurisdiction to hear the dispute and dismissing claims of Magotteaux.

Magotteaux has preferred an appeal before the Commercial Court of England (QBD) for a partial award passed by the Arbitration Tribunal. The company has made no provision for the same in its books

Anti Dumping Duty with their foreign clients:

The fact remains that in F.Y. 2021-22 AIA lost a

major portion of the sales to Canada owing to the Anti- Dumping Duty imposed by the Canadian Authorities

and there was also a significant loss of sales to South

Africa owing again to trade restrictions imposed by

South African Authorities, the combined volume loss

being approximately in the region of around 32,075 MT.

If their clients products gets redundant by any creative destruction then AIA’s business may have an adverse impact

Since it’s a B2B business there is a lack of transparent information available on the internet unlike B2C where everyone has access and understand it

Operating under a changing industry where a new innovation can be a black swan event for their business: The company operates in an industry characterized by rapid technological advancements and disruptive innovations. While this presents growth opportunities, it also exposes the business to the risk of a black swan event—an unforeseen innovation that could significantly impact their operations and competitive position. It is crucial to closely monitor industry trends and maintain agility to adapt to potential market disruptions.

Environmental Impact: The company faces the risk of environmental impact due to its operations. Increasing regulatory scrutiny and public awareness regarding sustainability and environmental responsibility pose potential challenges. Failure to adequately address environmental concerns may result in reputational damage, legal liabilities, and increased compliance costs. Proactive measures such as adopting sustainable practices and complying with environmental regulations are essential to mitigate this risk.

Losses caused due to Fire & Accident: The company is exposed to the risk of losses resulting from fire accidents and other unforeseen disasters. These incidents can lead to property damage, disruption of operations, and potential loss of life. Implementing robust safety protocols, regularly conducting risk assessments, and investing in comprehensive insurance coverage can help mitigate the financial and operational impact of such events.

Losing business in events like war between countries: The company operates in an environment where geopolitical tensions and conflicts can impact international trade and business relationships. Events such as wars or trade disputes between countries may lead to a loss of business opportunities, disruption of supply chains, and market instability. Diversifying the customer base and maintaining a strong network of international partnerships can help mitigate the risk of losing business in such events.

Unavailability of raw material like Ferrochrome: The company relies on the availability of key raw materials like Ferrochrome for its operations. Any disruption in the supply chain, such as shortages or price fluctuations, can have a significant impact on production and profitability. Establishing alternative sourcing options, maintaining strategic inventory levels, and monitoring market dynamics are vital to mitigate the risk of raw material unavailability and ensure continuity of operations.

ESG Assessment

The company demonstrates a strong commitment to environmental, social, and governance (ESG) considerations, with regular discussions and focus on these matters at the board level. Their journey towards renewable power began at the end of March 2022 when approximately 20%-22% of their power was sourced from renewable sources. The company aims to increase this share to 30%-35%, taking advantage of the current policy allowances.

While there are limitations on setting up captive renewable offsite facilities, the company plans to maximize their use of renewable energy within the existing regulations. They have also made efforts to shift to cleaner fuel sources, such as using PNG (piped natural gas) instead of coal-fired electricity for heat treatments.

In addition to addressing fuel-related concerns, the company actively promotes sustainability through initiatives like green plantations. They strive to bring value to their customers by helping them reduce power costs and minimize energy consumption within their systems. Notably, their chrome grinding media has the potential to decrease the use of toxic reagents and enhance the recovery of gold and copper, further contributing to a more sustainable approach.

Overall, the company's focus on ESG considerations extends beyond compliance and encompasses proactive measures both at the operational level and in collaboration with customers to create a positive environmental impact.

Governance

Composition of the Board: The company’s board of directors is composed of 9 members, including 4 independent directors, 2 non-executive directors, 1 whole time director, 1 managing director & 1 Chairman.

Bayesian

As mentioned above my investment thesis in AIA business are due to the following factors:

There is a long runway for converting conventional mills into high chrome mills, and AIA is a pioneer.

With 2300 crores ($29 million) in cash and a strategic focus on capital expenditure plans, the company is in good financial health with low debt levels of 58 crores (equivalent to $7 million) and an impressive return on capital employed of 25%.

With Bhadresh Shah as managing director and promoter and Sanjay Majmudar as independent director, the management team has a proven track record for shaping up businesses.

If any of the above scenarios change and have a negative impact on the business in the future, then I might change my mind and vice versa.

Bayesian Formula for Investing:

Initial Beliefs + Recent Objective Data = A New and Improved Belief.

Initial Beliefs (Above 3 Points) + Recent Objective Data (Which I’ll be making in the future upon reading AIA’s concalls, Annual Reports) = A New and Improved Belief (I will take BUY or SELL decision as per the scenario).

Conclusion

Over the past few years, the company faced challenges that hindered its growth. However, the underlying thesis has always been that there is a substantial market opportunity for their products. The market for forged material alone exceeds 2 million to 3 million tons, with chrome accounting for only 0.5 million tons. This indicates a significant growth potential for the company.

Despite the previous setbacks, the company has managed to recover and resume its growth trajectory. Their belief is that chrome provides superior solutions compared to forged materials, particularly in terms of working conditions and the number of mines involved. The company envisions a promising growth runway in line with their understanding of the market

Expanding into 120 countries and directly engaging with consumers sets the company apart, as they offer a solution-driven product rather than a commodity. However, the decision-making cycle and engagement process with customers can cause variations in growth projections from year to year. Nevertheless, the company has witnessed growth from both existing and new customers, particularly those who have transitioned from forged materials to chrome. This success reinforces the company's overall thesis and validates the volume addition achieved.

Talk about strong MOAT, Opportunity for growth as there is a changing landscape going on to convert the traditional grinding media into ferro chrome, High rate of ROCE which is really good as the capital reinvestment of incremental capital generation.

“You’re not what you say you’re what you do”

~ Carl Jung

By meeting their expectations over the years, the company has also walked the talk.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.