Initial Report: Airbnb Inc (ABNB), 52% 5-yr Potential Upside (EIP, Grace ANG)

Grace is positive on Airbnb, but recommends we approach with caution given the various risks it faces. What is your take on this business?

LinkedIn | Grace ANG

Executive Summary

I propose a strong buy on Airbnb for the following reasons: (1) strong brand, (2) excellent business model and its (3) post COVID-19 pandemic recovery potential. As a highly recognized brand in the global vacation rental market, Airbnb is a popular choice among travellers seeking unique, personalised travel experiences. Furthermore, Airbnb's business model allows it to scale globally without the need to own physical properties, reducing its capital expenditure. Additionally, after the COVID-19 pandemic, there's been a trend towards working remotely and seeking longer-term rentals. Airbnb has the potential to take advantage of these shifts in consumer behaviour especially when travel restrictions are lifted

Company Overview

Airbnb is a platform that allows for individuals to place their homes or any other properties they might possess for rental to travellers. Founded in 2007, the company has since become one of the most dominant players in the travel industry. Airbnb utilises a business model whereby individuals can list their properties within the platform, after which, travellers who are interested in renting these houses will be able to do so via the website. These are usually for short-term stays. Airbnb earns their revenue from two main parties - the hosts and the guests. Revenue is earned through the charging of a service fee to both the property owners and travellers for every booking made on the platform. The firm usually charges guests a service fee between 6%-12% of the booking subtotal. Exact fees would vary based on the reservation subtotal. Host service fees are set at a flat 3% fee for each reservation to cover the costs used to process payments. Additionally, Airbnb has delved into other areas like hotel bookings as well as creating experiences. In its attempt to raise the quality of listings, the firm had rolled out initiatives like Superhost status.

Revenue Drivers

There are a few key revenue drivers for Airbnb.

Cost Drivers

ESG Considerations

ESG Efforts by Airbnb

Competitor Analysis

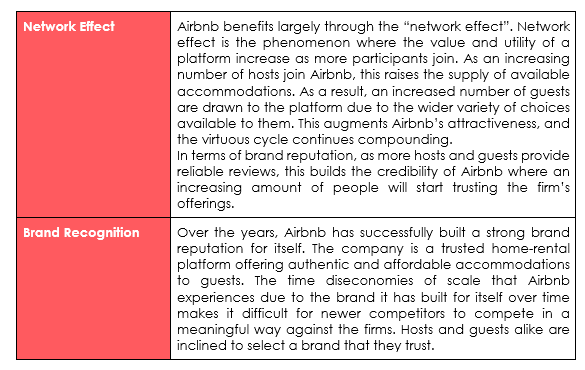

Economic Moat

Investment Thesis

1. Strong Brand

Established in 2007, Airbnb is a pioneer in the vacation rental market and has created a niche for itself as a trusted platform for unique and personalised travel experiences. Airbnb is one of the first companies that comes to mind when people think about vacation rentals or alternative accommodations to hotels. The company's name has become synonymous with the sharing economy and has even turned into a verb in some circles, with people saying they are "Airbnb-ing" their homes. This level of brand recognition can give Airbnb a competitive advantage in attracting new users and retaining existing ones. It has disrupted the traditional hospitality industry by allowing people to list, discover, and book accommodations worldwide, offering a wide range of options from single rooms to entire homes and even castles. Its customer-centric model and successful marketing efforts have solidified its brand image and reputation, which are critical factors for success in the online marketplace. This powerful brand presence gives Airbnb a competitive edge and fosters customer loyalty, which can be a strong driver of future growth.

Over the years, Airbnb has built a reputation of trust among both hosts and guests. This is partly due to its review system, which allows both parties to rate each other after each stay, providing transparency and fostering a sense of community. Trust is an essential element in a peer-to-peer marketplace, and Airbnb's ability to maintain this trust is a testament to its strong brand. Being able to innovate on user experience by equipping features like personalised recommendations, flexible search options, and secure payment processes help further differentiate its brand from others.

In addition, Airbnb operates in more than 220 countries and regions around the world, making it a truly global brand. This global presence increases its brand visibility and allows it to serve a wide range of consumers with diverse travel needs and preferences.

2. Business Model

Airbnb's asset-light business model has allowed it to rapidly scale its operations across the globe. Unlike traditional hospitality companies, Airbnb doesn't own or manage any of the properties listed on its platform, significantly reducing its capital expenditure and operational risks. Instead, it operates as a two-sided marketplace connecting hosts who have available space to rent with guests looking for accommodations, earning money from service fees charged on bookings. This model offers a high degree of scalability and flexibility, which are key for the company's continued expansion and profitability.

Essentially, Airbnb operates as a two-sided marketplace, connecting hosts who have available space to rent with guests seeking accommodations. The platform facilitates transactions, enabling hosts to list their properties and guests to search, book, and pay for their stays. By bridging supply and demand, Airbnb creates value for hosts and guests alike.

This helps it to generate revenue through service fees charged on bookings. When a guest books an accommodation through the platform, Airbnb takes a percentage of the booking value as its service fee. This revenue model allows Airbnb to scale globally without the burden of owning and maintaining physical properties.

3. Recovery Potential

The COVID-19 pandemic has fundamentally changed the way we live and work, accelerating trends towards remote work and long-term rentals. As more people embrace flexible work arrangements and choose to work from anywhere, there's increasing demand for longer-term rentals - a market Airbnb is well-positioned to tap into. Moreover, travellers are increasingly seeking out rentals in less densely populated areas, looking for unique and authentic experiences over traditional hotel stays. These shifts in consumer behaviour present significant opportunities for Airbnb to diversify its offerings and capture new market segments. Recovery Potential: The global tourism industry was severely impacted by the COVID-19 pandemic with Airbnb bearing no exception. However, as vaccination rates increase and travel restrictions are gradually lifted, the global economy is poised for recovery. People's desire to travel remains strong, and there's significant pent-up demand. Airbnb's wide range of listings, which caters to varying traveller preferences and budgets, positions it well to benefit from this rebound. Furthermore, Airbnb's ability to provide more private, distanced accommodations may make it an attractive option for travellers in a post-pandemic world.

Key Financials

Valuation

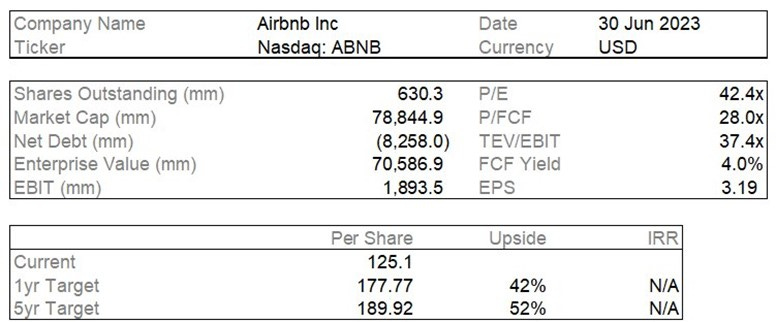

I issue a BUY recommendation on Airbnb with a one-year target price of $177.77, representing a 42.1% upside from its closing price of $125.10 on June 29, 2023. This value was obtained through the Discounted Cash Flow model.

Using the DCF Analysis with projected unlevered free cash flow to firm, and a WACC (discount rate) of 8.24% calculated using a weighted average cost of debt and equity, with the latter using the Capital Asset Pricing Model (CAPM); and a terminal FCF growth rate of 3% (long run inflation), this gives me an implied share price of $177.77.

Using a multiples valuation method, I sense-checked the value of Airbnb. Using ratios like the Price to Earnings (P/E) ratio, Price to Sales (P/S) ratio, and EV/EBITDA multiples, Airbnb is seen to be trading above its peers, and this is not surprising given its competitive advantage in this industry. Thus, the trading comps approach is not to be used for valuing Airbnb, but rather an overall checking mechanism.

Risks and Mitigation

With any investment comes with risks, and those include legal risk, operational risk, political risk, and regulatory risk.

One such risk is legal risk which may impact Airbnb’s revenue, growth rate, and WACC. In the travel and hospitality industry which is highly regulated, there are contractual obligations between its hosts and guests, which may further complicate under tighter scrutiny. These risks could lead to extensive fines, penalties, and legal liabilities if not managed effectively.

In addition, Airbnb faces operational risk which may affect its sales, growth rate, and cost of goods sold. The company’s reliability and security of its platform, as well as potential disruptions to its system could impact the company's ability to provide a seamless experience for its hosts and guests and result in reputational damage and huge financial losses.

Next, Airbnb is susceptible to political risk which can potentially impact sales and growth rate. This is especially relevant in developing countries, where Airbnb is focusing on as a growth lever. This represents a huge barrier to enter new developing markets. Moreover, the usually complex and undeveloped local laws can increase the threat of local competition with political support.

Lastly, there is regulatory risk that can impact sales, growth rate and R&D expenses. Regulatory risk is a big concern for Airbnb, given the complex and evolving regulatory environment it operates in. The company faces legal challenges related to short-term rental regulations, tax compliance, and data privacy laws, which could result in significant legal and financial liabilities if not managed effectively.

Conclusion

Overall, I initiate a buy call on Airbnb given its competitive advantage in the hospitality industry as it has a (1) strong brand, (2) excellent business model and its (3) post COVID-19 pandemic recovery potential. Using a DCF valuation, I forecast the intrinsic share price to be $177.77, representing a 42.1% upside. I strongly believe that Airbnb's business model will allow it to scale globally with the post COVID-19 pandemic recovery acting as a massive tailwind. However, I recommend monitoring the developing trends of Airbnb given that it may be susceptible to legal risk, operational risk, political risk, regulatory risk, which can negatively affect the business.

Appendix

Income Statement

Balance Sheet

Cash Flow Statement

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.