Initial Report: Albemarle Corporation (ALB), 15% 3-yr Potential Upside (VIP SEA, Olivia ZHANG)

There's some good potential in the chemicals industry. Let's look at Olivia's take on it.

1 Business Description

Albemarle Corporation is a global chemical company that develops, manufactures, and markets specialty chemicals. It operates in three segments: Lithium, Bromine, and Catalysts. The Lithium segment focuses on lithium compounds used in batteries, greases, tires, catalysts, and other applications. The Bromine segment offers bromine-based products used in fire safety, chemical synthesis, oil and gas drilling, water purification, and other industrial applications. The Catalysts segment provides catalysts and additives used in petroleum refining, chemical processing, and other industries. Albemarle serves various markets, including energy storage, petroleum refining, consumer electronics, construction, automotive, pharmaceuticals, and crop protection. The company was founded in 1887 and is headquartered in Charlotte, North Carolina, USA.

2 Company Overview

In 2015, Albemarle Corporation entered the lithium industry through the acquisition of Rockwood Holdings. Since then, the company has solidified and strengthened its integrated "lithium resources + lithium processing" framework, characterized by high quality, large scale, comprehensive product offerings, and global diversification. This has been achieved through a combination of external expansion and internal development.

1. In the upstream lithium resources segment, the company has established a foundation centered around the Atacama salt flat in Chile and the Greenbushes lithium mine in Western Australia, supplemented by the Silver Peak salt flat in the United States. Additionally, the company has identified the Wodgina lithium mine in Western Australia, the Antofalla salt flat in Argentina, and the Kings Mountain historical mine in the United States as future reserves.

2. In the midstream and downstream lithium chemical processing segment, the company possesses mature production facilities in North America, South America, Asia-Pacific, and Europe. Furthermore, Albemarle is currently constructing a lithium hydroxide production capacity in Western Australia.

3 Highlights

A global leader, Albemarle Corporation possesses world-class assets and a diversified product portfolio, ensuring long-term supply with dependable and consistent quality.

The company is strategically positioned to leverage significant growth prospects in the electric vehicle industry and beyond, encompassing various sectors such as mobility, energy, connectivity, and health.

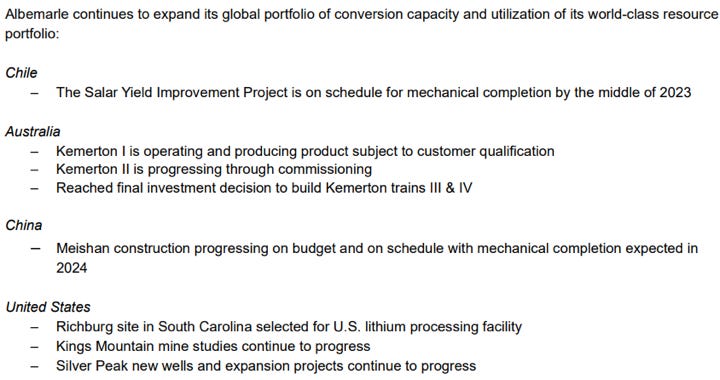

Investment layout

(Source: quarterly report)

Albemarle's acquisition strategy for processing capabilities primarily focuses on expanding in North America from China. This strategic investment aims to leverage the resource foundations present in both China and North America, ensuring the most economical and sustainable approach. In China, Albemarle invested in processing capacity in Qinzhou and Meishan, utilizing local raw materials for their projects.

In December 2022, Albemarle acquired land in Charlotte, North Carolina, USA, with plans to invest at least $180 million in establishing the Albemarle Technology Park. This world-class facility will be dedicated to research on new materials, advanced process development, and expediting the introduction of next-generation lithium products.

Furthermore, in October 2022, Albemarle successfully completed the acquisition of a lithium salt processing plant in Qinzhou, China.

4 Business Segments

The three major business segments(Lithium, Bromine, Catalysts) are differentiated based on the following:

Energy Storage: Energy storage focuses on the evolution of lithium-ion batteries and the energy sector's transformation.

Specialties: By combining the existing bromine business with the lithium business, the company aims to capitalize on diverse growth opportunities in sectors such as consumer and industrial electronics, healthcare, automotive, as well as construction and engineering.

Ketjen: Following a strategic review of the catalyst business, Albemarle has determined that the best approach is to establish it as a separate entity with its own brand identity. This structural change is intended to enable the catalyst business, now named Ketjen, to better respond to unique customer needs and global market dynamics while achieving its growth objectives. This decision leverages Albemarle's entrepreneurial tradition in the catalyst industry.

Revenue in segments :

(Data: annual report)

In 2022, the lithium business experienced significant growth, primarily driven by higher lithium prices and increased production. The higher lithium pricing also resulted in an increase in accounts receivable and inventory.

The bromine business showed slight growth, while the catalyst business experienced a decline during this quarter. The decrease in the catalyst business can be attributed to the factory shutdown caused by the December winter freeze in Texas, which offset the higher sales volume and favorable prices.

Regarding the catalyst business, it is noteworthy that the market is currently facing significant cost pressures related to European natural gas, certain raw materials, and freight, primarily influenced by the ongoing Ukraine conflict. However, these cost pressures have been partially offset by sales volume and pricing improvements.

Based on the data from the past five years, lithium has been Albemarle's largest source of revenue. Although the growth prospects for bromine and catalyst are limited, Albemarle has maintained its leading position in the industry, with bromine and catalyst serving as stable revenue sources or "cash cows," providing sufficient funds for Albemarle's expansion and strategic initiatives.

(Data: Capital IQ)

Albemarle relies on overseas markets, which, while diversifying its sources of income, also exposes the company to additional geopolitical risks. This is particularly evident in the impact of the relationship between China and the United States.

5 Industry Overview

The "US Incentives for Reducing Inflation Act" (IRA) aims to encourage domestic investments in the electric vehicle supply chain and other targets. This legislation includes tax incentives for manufacturers and consumers in the United States and in free trade agreement partner countries like Chile and Australia for purchasing key minerals such as lithium.

The decline in lithium prices can be attributed to the lag between upstream extraction and processing, resulting in a longer cycle that impacts supply and demand. In 2022, the demand for lithium far exceeded supply, leading to a significant increase in lithium prices. However, in 2023, due to electric vehicle sales not meeting expectations, there was an accumulation of inventory, resulting in an oversupply and subsequently causing a decline in lithium prices.

Although China discontinued its subsidies for electric vehicles in 2023, the impact was limited. Historical data shows that subsidy policies have been periodically canceled in the past (as shown in the chart on the right), but sales only experienced a temporary decline. Continued government incentives and consumer preferences have supported the strong demand prospects for electric vehicles.

(Source: Quarterly report)

6 Thesis

a. The main factor impacting Albemarle's profit margins is the long cycle duration in the last year. The downstream is affected by the cycle, but lithium prices fluctuate with changes in demand and supply. The extended lithium inventory cycle leads to rapid price increases, resulting from the lag in processing lithium ore into lithium salts delivered to customers, which takes approximately six months. Therefore, lithium prices rise quickly due to an excessively long supply cycle and rapid demand growth. The supply chain for one ton of lithium ore from the mine to the customer takes up to six months, with growth expected to concentrate in the second half of the year.

b. An important advantage is the stable cash flow. While midstream and downstream players are also starting to establish upstream resource layouts in the supply chain, they lack technological expertise, world-class resources, and strong cash support. Albemarle, on the other hand, benefits from significant technological support, expanding and filling the business model through continuous acquisitions, and is backed by two stable cash-generating businesses, bromine, and catalysts, enabling large-scale investments.

c. Geopolitical risk: Investments are being made in China for market positioning and rely on the Chinese market.

d. Chile's decision to privatize lithium mines, which will cause an influence in the future.

e. The downstream actively seeks to establish a presence and is a driving force upstream: Major traditional automotive manufacturers such as Volkswagen, BMW, Mercedes-Benz, and Audi are accelerating their electric vehicle strategies, which in turn benefits upstream lithium demand.

f. Three main business segments (lithium, bromine, catalysts): In these three segments, bromine and lithium salt demand are likely to be most influenced by global economic trends, including consumer and industrial spending, automotive, construction, and engineering. Additionally, they benefit from diversified end markets, allowing production allocation to higher growth or higher-profit end markets as needed. Bromine and lithium salt products also tend to experience rapid rebounds following economic downturns. Lastly, catalyst demand is closely linked to transportation fuel demand. During typical economic recessions, catalysts demonstrate relative elasticity. As oil prices usually decline during economic downturns, fuel demand increases, leading to an increased demand for processed catalysts. In an economic recession environment, the catalyst business benefits from lower raw material costs.

g. Reducing Supply Chain Risks: The investment layout in multiple countries is primarily driven by the high cost and carbon emissions associated with transporting materials over long distances. Automotive manufacturers face significant challenges due to the risks posed by lengthy supply chains. However, if they could assemble over 1,000 components in one location, the situation would be completely different.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.