Initial Report: Alibaba Group (BABA), 44% 5-yr Potential Upside (VIP International Chapter)

VIP IC is making a move in Alibaba. Let's read on to understand why

LinkedIn | Rebecca Yang (CIO)

1 Business Overview

Alibaba is a Chinese technology conglomerate, with business dealings in e-commerce ,logistics, cloud computing, and digital media and entertainment.

A breakdown of its revenue is as follows:

Below are its product offerings in the different segments: China TED, Youku

Innovation initiatives: DAMO academy

The majority of BABA’s revenue is generated from its e-commerce segment, followed by Cloud computing and Intl commerce. These 3 segments are also seen as the main drivers for Alibaba’s growth and will be the focus of our analysis.

2 Business Model

2.1 Business Model (Online Retail)

(1) Alibaba's revenue from e-commerce is mainly divided into the Chinese market and the international market, with the Chinese market accounting for the main source of revenue. For FY2021 to FY2022, 76% of Alibaba’s revenue came from E-commerce, which is further split into China ecommerce and Global ecommerce as shown in more detail below:

(2) Alibaba has a wide layout, involving B2B, B2C and C2C.

(3) Revenue from China E-Commerce includes Customer management, and Direct sales and other

Customer management:

Advertising Revenue (P4P, CPM, CPC)

Commissions on transactions ( Based on a percentage of transaction value generated on Tmall and certain other marketplaces. Range from 0.3% to 5.0% depending on the product category.)

Direct sales and other:

Primarily consists of revenue from product sales.

Eg. Sun Art, Tmall Supermarket and Freshippo

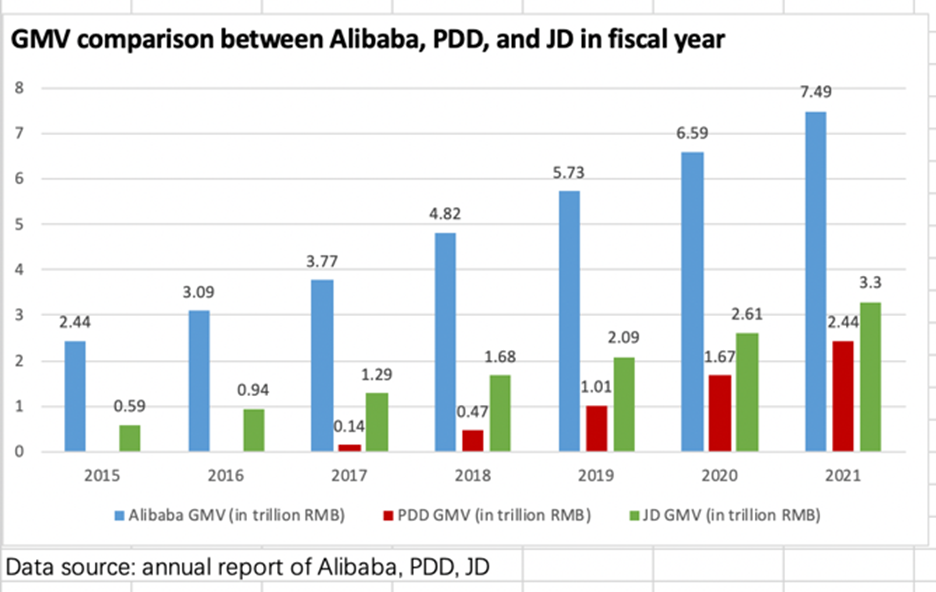

(4) GMV

While Alibaba GMV has been growing, the rate of growth is slowing, but it is still ahead. In fiscal year 2021, Alibaba GMV reached 7.494 trillion yuan, more than PDD and JD combined. 2022.3.31, total GMV transacted in the Alibaba Ecosystem was RMB8,317 billion for the fiscal year 2022, which included RMB7,976 billion of GMV generated from our China consumer-facing businesses, including those in China commerce, Local consumer services, and Digital media and entertainment segments, and US$54 billion of GMV generated from our International commerce retail business.

The main driver of Alibaba's GMV is the number of new annual active consumers each year. For the fiscal year 2022, Alibaba served approximately 1.31 billion annual active consumers through our global consumer-facing businesses in the Alibaba Ecosystem, including over 1 billion in China and 305 million consumers outside China.

The slower growth rate of GMV is related to Internet users. The number of Alibaba and Pinduoduo users reached 1.005 billion and 882 million respectively, which covered the majority of Chinese Internet users. China's network users have basically reached top penetration, and the growth rate slows down, which leads to the slow growth of new active users, therefore, indirectly leads to the slow growth of GMV.

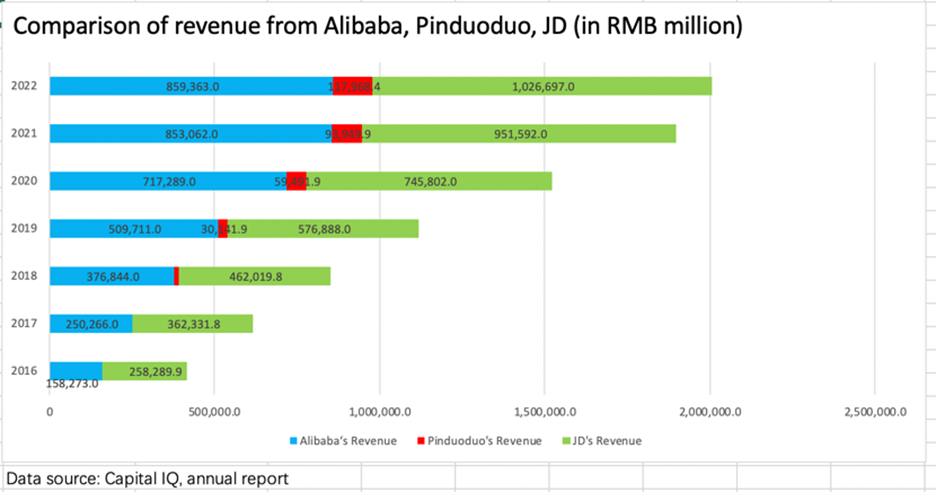

(5) Comparison of revenue, gross profit, net income between Alibaba, Pinduoduo, JD

(The data for 2022 are all LTM 12 months, ended in 2022/09/30)

Revenue Comparison:

Gross Profit:

Net Income:

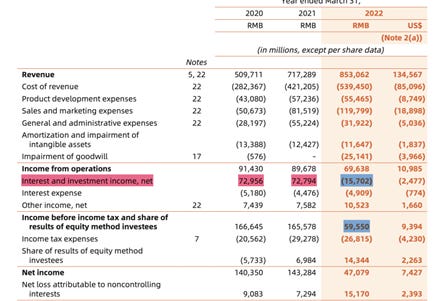

Sales and marketing expenses increased by 47% from RMB81,519 million in the fiscal year 2021 to RMB 119,799 million in the fiscal year 2022 as Alibaba continues to invest in marketing and promotion.

For investments in Taobao Deals and Taocaicai, Alibaba increased spending for user growth, as well as support to merchants.

*Net income decrease from 2021 to 2022 is a result of a sudden loss in interest and investment income compared to profit in this segment in 2021.

(6) Free cash flow (Alibaba)

Free Cash Flow:

(7) Industry trend

Live-streaming increasing percentage

Live-streaming market size

2.2 Business Model (Cloud)

Cloud computing has 3 service models:

1. SaaS (Software-as-a-service)

Companies provide applications that are hosted on cloud-computing infrastructures to users over the internet, usually for a monthly subscription fee. It is the most commonly used service within the cloud market. Mainly targeted at businesses that would require these applications. Gross Margin 50%-70%

Examples: Salesforce

2. IaaS (Infrastructure-as-a-service)

Provides cloud-based and pay-as-you-go services such as storage, networking and virtualization. Allow businesses to purchase computing resources on-demand instead of buying and managing hardware. Gross Margin around 10-15%.

Examples: Microsoft Azure, AWS EC2, Digital Ocean

3. PaaS (Platform-as-a-service)

A hybrid between IaaS and SaaS. Provides a platform for software creation, giving developers freedom to build and deliver software. Aimed more at developers or businesses who want to create unique applications without taking on all responsibility of hardware. Gross Margin around 50%-70%.

Examples: Google App Engine, Heroku

阿里云 – Focus on PaaS and IaaS, to become a SaaS accelerator

In 2019, Ali Cloud announced that they will shift their strategic focus to be “integrated” into partner companies’ products and enterprise solutions, as well as to not touch the SaaS model.

Another key announcement was the integration of DAMO academy into Ali Cloud to research and come up with AI technologies that would help them to better service their partners.

Business Model

IaaS and SaaS. Ali Cloud provides hardware and solutions to assist SaaS companies to realise their enterprise products.

Example: SaaS accelerator, drag and drop modules to quickly create applications.

Ali Cloud Robotic Process Automation (RPA) – replace manual work by automating processes like inventory calculation, financial reports, expense claims etc. Developers can utilise RPA to automate processes in their relevant products.

The SaaS market in China is fragmented and most independent software vendors have less than 2B in market share and have to resort to outsourcing product development work. This results in low gross margin and inability to scale. For these SaaS enterprises, partnering with Ali Cloud would mean that they can harness these solutions and increase their gross margin.

China Public Cloud Computing Market Overview

Both IaaS and PaaS will achieve growth in coming future

Alibaba Cloud holds 37% of the market share in 2021 and is the current market leader. This is versus 31.1% in 2020 and 28.9% in 2018. Due to the Matthew effect, market leaders will likely continue to consolidate the market.

Conclusion

Alibaba Cloud’s first mover advantage, having set up their cloud computing segment in 2009 has allowed them to research many industry-leading technology that would boost their services to 2B customers. For instance, polarDB, their cloud-native database is the only large-scale global database management system cloud provider in the Leaders Quadrant of Gartner Magic Quadrant. Dingtalk, the digital collaboration workplace and application development platform is also China’s largest business efficiency mobile app in MAU in March 2022. With better technology compared to competitors, as well as a growing market, exponential growth for Alibaba Cloud is expected in the next few years.

3 Investment Thesis

3.1 Commerce

Easing of covid restriction in China

After 2 years of sporadic lockdowns, the Chinese government has finally decided to ease restrictions. From a macroeconomic perspective, the easing of restrictions would finally bring some certainty to the Chinese and the business environment, and general economic growth would likely translate to higher spending from the population. For e-commerce platforms like Taobao, this would also mean less uncertain lockdowns that have impacted logistics services in various provinces that have affected its sales. BABA’s brick and mortar offerings like Freshhippo would also stand to gain from the easing of restrictions.

Resilient growth despite strong competition

Despite facing strong competition from Pinduoduo, JD as well as live-streaming platforms like TikTok, Alibaba has reacted strongly by introducing similar products to protect its market share. Taobao Deals, its solution to Pinduoduo, was launched in 2018 and reached over 300 million users in 2022. Even though this is still fewer than the 900m users of Pinduoduo, it shows Alibaba’s ability to leverage its manufacturer and consumer networks to quickly gain users to battle with competition in the lower-tier cities segment. As for livestream commerce, Alibaba has sought to integrate livestreaming elements into Tmall and Taobao. Overall, as a commerce giant with an existing network effect that Alibaba can leverage on against its competitors, we should see resilient growth in the next few years.

3.2 Cloud

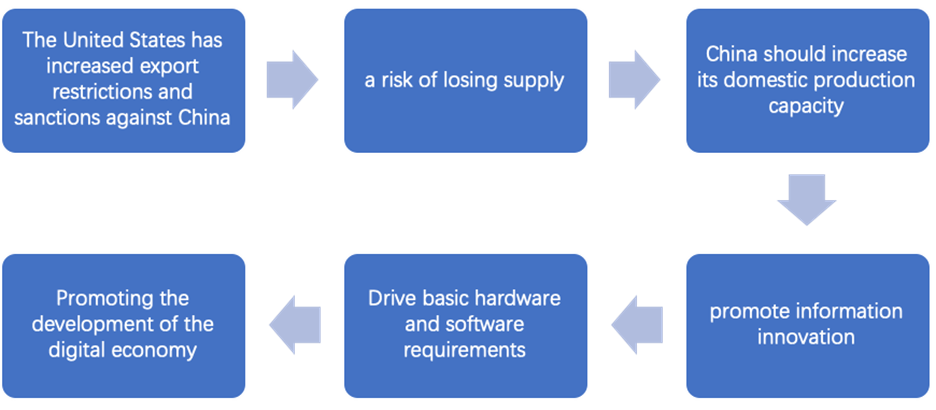

The United States has increased its export restriction and sanction of hardware and software to China, which reflects the importance of domestic production in China. The government has enacted policies to support the development of the digital economy

China in the CPU, operating system and cloud computing(Database) relied heavily on imports from foreign, with domestic production rates 0.5%, 1.2% and 47.4% respectively in 2020. The CPU industry is basically monopolised by foreign countries. The operating system is dominated by Windows, IOS and Android. The market share of Windows systems is over 90%.

As the United States gradually increases the restrictions on the export of CPU to and sanctions of the tech and computer development, there is a risk that China will lose the supplier. Therefore , it is necessary to improve the domestic production capacity and promote information technology application innovation industry.

The accelerated development of information innovation is conducive to promoting the demand for basic software and hardware, enhancing domestic production. It is also the key to developing the digital economy. With the digital economy scale as a percentage of GDP rising from 32.7% in 2017 to 39.8% in 2021, the digital economy has become a key force driving our country’s economic development. The government actively enacted policies to support and promote the digital economy.

Policy support to develop digital economy:

● 2019-today The Fourth Plenary Session of the 19th CPC Central Committee proposed "Promoting the Construction of Digital Government” which serves the modernization of national governance system and governance capacity, and promotes the all-round digital transformation of government functions.

Digital government (GovCloud, government informationalization and digital village) is a core of the digital economy.

● “The 14th Five-year plan - the development of digital economy 202201” indicates that digital infrastructure has been widely integrated into production and life. E-government services have been further improved, networked, digital and intelligent service systems for enterprises and the people have been improved.

● China National Big Data Computing Project “东数西算” is mainly to introduce the data processing needs of eastern region to the west to provide calculation.

The support of policies accelerates the digital transformation, it is also conducive to the integration of resources between industries to achieve Green development, and is conducive to the formation of a dynamic balance of horizontal supply and demand.

Cloud computing industry presents a high boom due to the strong policy conditions, macro-economic environment, huge social value

The aforementioned policies are a big driver of the industry for private companies or state-owned enterprises.

Moreover, "Proactive fiscal policy" which increases government spending on building infrastructure (for example, 5G development) and "stable monetary policy" which adjusts the interest rate to stimulate the economy significantly boost demand related to the Internet economy and boost the development of the cloud computing industry.

Cloud computing has a huge social value in the use and recycling of resources, or in the field of urban planning or medicine and even government information processing.

Cloud computing plays an important role in the digital economy. It can drive the development of cpu, storage, network, database and other infrastructure.

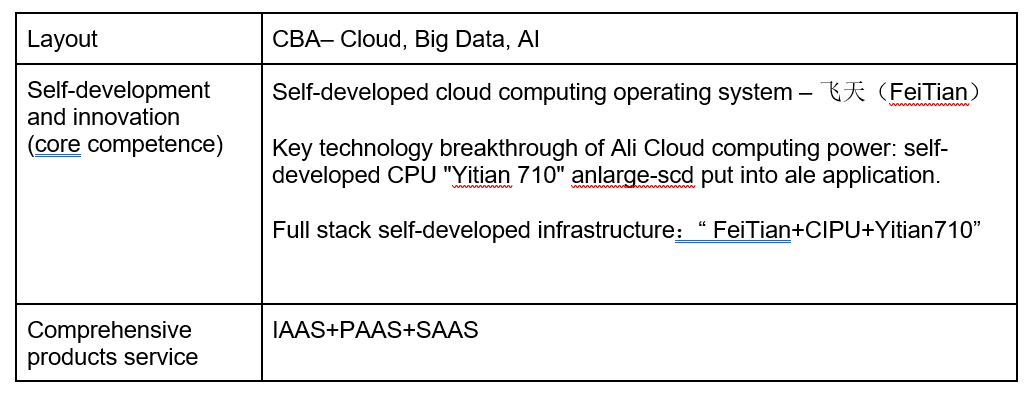

AliCloud has core competence in self development and innovation, and provides comprehensive product service. Alicloud devotes to lowering the threshold of Cloud computing

Ali Cloud's layout is very complete, including cloud computing, big data and AI. In 2009, it started to develop its own cloud computing operating system "Feitian". Ali Cloud's Feitian is the first independently developed operating system in China, and only Amazon, Microsoft and Google have mastered this technology in the world, which has established Ali Cloud position in the industry and improved its core competitiveness.

It also has a major breakthrough in computing power. The self-developed CPU "Yitian 710" has been put into large-scale application. Ali Cloud released a self-developed CPU, marking that Ali Cloud has carried out the independent innovation of full-stack cloud infrastructure. The “Yitian 710” ultra-high computing performance and low power consumption is expected to reduce the operating cost of data centres, thus lowering the threshold for enterprises to access the cloud.

Self-developed operating systems and the self-developed chips (internal customization degree is high) effectively reduce energy consumption and operating costs.

Ali Cloud provides IAAS+PAAS+SAAS services, computing, storage, big data, artificial intelligence and other service products. There are 400-500 kinds of Ali Cloud PaaS products, subdivided categories are more complete. So it can better meet customer needs and customised services

Dingtalk as the operating system with more functions and lowering the threshold for clients to develop applications

“云钉一体”

With the impact of the pandemic, more and more enterprises are embracing cloud computing and enjoying its benefits. But the end state of the cloud is not just an IT facility, but a platform that can provide a wide variety of services.

One is to Dingtalk as the toB entrance, delivery of Ali cloud services; On the other hand, it is also hoped that Dingtalk's business for enterprise services can go deeper than digital office collaboration and simple IT services. After all, the more comprehensive the enterprise service functions have, the more prominent the moat effects. Low-Code development is the ability to quickly generate applications with low code or no coding.

According to a set of data provided by Dingtalk, the number of low-code developers on Dingtalk currently exceeds 3.8 million.At the beginning of 2021, there were only 380,000 low-code apps on Dingtalk, which grew to 2.4 million in December 2021. By the end of September 2022, there were more than 5 million low code applications, an increase of more than 120% from the previous year.

This platform reduces the difficulty of developing applications and improves the efficiency of development. At the same time, it also saves the development cost and expands the scope of use.

Cloud computing revenues have been growing steadily, the business scale will continue to expand in the future

Ali Cloud is the largest cloud manufacturer in China by revenue. Revenue in fiscal year 2022 (natural year: April 2021 - March 2022) was 74.6 billion yuan. From the perspective of profit scale, the adjusted EBITA of Alibaba Cloud in the fiscal year 2022 was 1.2 billion yuan, and the EBITA profit rate was 1.5%, making it the only profitable cloud manufacturer in China.

China has removed the epidemic policy and the economy is about to recover. For enterprises, they will continue to increase digital transformation. As the force behind the intelligent transformation of the industry, its cloud service sector is expected to be further released and its revenue scale is expected to continue to expand.

Alibaba Cloud has always occupied the first leading position in PAAS and IAAS market share.

2020, IAAS market share in China 2021, IAAS market share in China

4 Risk

Regulatory Risks

In China, the regulation causes lots of uncertainty. The authorities stopped Ant's $34 billion+ IPO in 2020. The anti-monopoly policy caused damages to the E-commerce segment under the strict supervision from authorities.

But other competitors will also be subject to anti-monopoly regulation. In the short term there will be some revenue slowdown, but in the long run it will be relatively helpful for the development in the ecommerce industry.

Data security

Data security risks have always existed, such as data breaches, or data content security etc. Alicloud also pays much more attention to the data security services to protect the database and provide comprehensive security service.

The relationship between US and China

Last year, China and the United States reached an agreement on Chinese company audits under which U.S. accounting regulators would inspect Chinese audits. But it could still face audit problems leading to delisting in the future. Alibaba has already ahead of schedule in this regard, listing in Hong Kong. So it neutralises some of the risks.

Live-streaming attracts users

The rapid rise of live streaming Ecommerce did capture some customers, but I think it will only have a small impact on Alibaba in the short term. Because there are a few products available in live streaming e-commerce, consumers are usually only able to buy the products sold by KOI, so they are passive, have fewer options. Moreover, the products are diversified and concentrated in the cosmetics and clothes category. In the long run, Alibaba e-commerce moat is wider.

5 Valuation

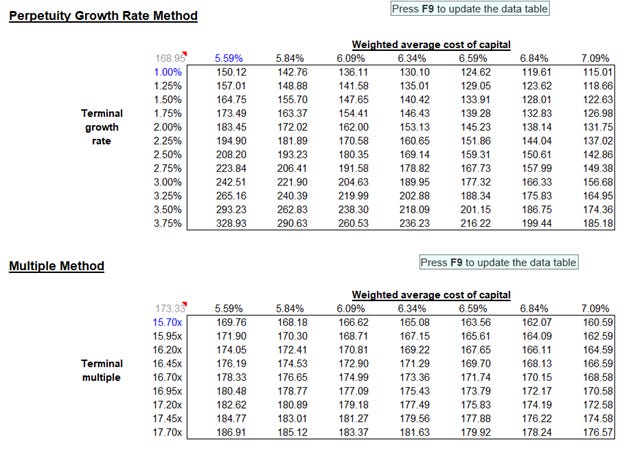

Using the perpetuity growth method we deduce a 5y target price of USD 168.95, representing a 45% upside. From the multiples method, Alibaba is currently trading below industry mean, assuming a LTM EV/EBITDA multiple of 16.7x, we arrive at a USD 173 target price.

Sensitivity analysis

6 Conclusion

Overall, Alibaba is an internet giant that is in a stage of transformation. Facing strong competition in the e-commerce segment, it has shifted its focus to go into cloud computing, a budding industry with massive potential. Given its early mover advantage and heavy investment in Ali Cloud, Alibaba is likely to emerge as a winner in the Cloud Computing industry in China. At the same time, its existing network effect and cash generation ability in the commerce segment cannot be underestimated. Alibaba is severely under-priced by the market due mainly to regulatory risks, which is slowly being wrapped up by the Chinese government. Therefore, now would be an opportune time to invest in Alibaba.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.