Initial Report: ArcelorMittal (MT), 75% 5-yr Potential Upside (EIP, Clive TAN Yitjin)

Clive reccommends to BUY ArcelorMittal, and monitor it closely for developments in its decarbonization roadmap, and ability to maintain its position as one of the steel leaders globally.

Company Overview

ArcelorMittal S.A. is a holding company engaging in steelmaking and mining, based in Luxembourg. It is the second largest crude steel producer globally, producing 59 million tonnes in 2022, after China Baowu Group at 131.8 million tonnes[1]. It operates through 5 business segments: Europe, NAFTA, Brazil, ACIS, and Mining. In FY2022, its revenues (%) by segment: Europe (59%), NAFTA (17%), Brazil (15%), ACIS (7%) and Mining (2%). By product: Flat products (56%), Long products (22%), Others (17%), Tubular (3%), Mining (2%).

Europe produces flat, long and tubular products. Flat products include hot rolled coil, cold rolled coil, coated products, tinplate, plate and slab. These products are sold primarily to customers in the automotive, general industry and packaging sectors. Long products include sections, wire rod, rebar, billets, blooms and wire drawing. In addition, Europe includes downstream solutions, providing primarily distribution of long and flat products as well as value-added and customized steel solutions through further processing to meet specific customer requirements. The raw material supply of Europe operations includes sourcing from iron ore captive mines in Bosnia & Herzegovina.

NAFTA produces flat, long and tubular products. Flat products are sold primarily to customers in the following sectors: automotive, energy, construction packaging and appliances and via distributors and processors. The raw material supply of the NAFTA operations includes sourcing from iron ore captive mines in Mexico to supply the steel facilities.

Brazil produces flat, long and tubular products. The raw material supply of the Brazil operations includes sourcing from iron ore captive mines in Brazil.

ACIS produces a combination of flat, long and tubular products. The raw material supply of the ACIS operations includes sourcing from iron ore captive mines in Kazakhstan and Ukraine and coal captive mines in Kazakhstan.

Mining provides the Company's steel operations with high quality and low-cost iron ore reserves and also sells mineral products to third parties. Mining segment iron ore mines are located in North America and Africa. In 2022, iron ore production in the Mining segment totalled approximately 28.6 million tonnes.

Industry overview

Steel demand in the developed economies suffered a contraction of 6.2% in 2022 due to monetary tightening and high energy costs. In 2024, a recovery of 3.2% is expected[2]. Furthermore, the recent cutting of interest rates is expected to provide tailwinds for steel demand.

Investment Theses

Investment Thesis 1: Upstream and downstream integration gives ArcelorMittal a competitive advantage.

ArcelorMittal has substantial sources of iron ore from its own mines, with a self- sufficiency rate of 61% for iron ore in 2022.

ArcelorMittal has an integrated business model that includes both upstream and downstream operations. In terms of upstream integration, controlling its own raw material production provides a competitive advantage over time in terms of lowered costs, less volatility and ability to meet customer needs effectively. Additionally, ArcelorMittal optimizes the efficient use of raw materials across its steel-making facilities and leverages a global procurement strategy (less risks of supply chokes).

In terms of downstream integration, ArcelorMittal offers distribution solutions through its Europe segment, enabling the company to provide customized steel solutions to its customers more effectively. The company's downstream assets include cut-to-length, slitting, and other processing facilities, which provide value-added service for customers and maximize efficiencies.

As of December 31, 2022, ArcelorMittal’s iron ore reserves were estimated at 4,154 million tonnes run of mine and its total coal reserves were estimated at 207 million tonnes run of mine (Run of mine refer to the material that can be extracted from a mine during a single pass or operation). This includes the ore that can be accessed and processed without the need for additional excavation or development work, indicating that their reserves and resources provide security of supply and a hedge against raw material volatility and global supply constraints. Although the actual reserve number is lower as this includes reserves at mines where ArcelorMittal owns less than 100%, based on ArcelorMittal's ownership percentage even if ArcelorMittal is entitled to mine all the reserves, and including reserves for which use is restricted.

All in all, this provides the company with some measure of stability against commodity prices and allows it to capture a bigger market. Although the extent to which steel producers mine their own iron ore (and thus have their own supply) varies depending on the production method of steel used, and thus more research has to be done to further investigate the extent of advantage that this provides to ArcelorMittal.

Investment Thesis 2: ArcelorMittal's efforts in sustainability gives it a competitive advantage in terms of protecting itself against sustainability-related risks and capitalising on sustainability-related opportunities

ArcelorMittal was recognised as a 2022 Steel Sustainability Champion, amongst 9 other companies, by the World Steel Association[3]. The World Steel Association has members in every major steel-producing country, representing steel producers, national and regional steel industry associations, and steel research institutes. Members represent around 85% of global steel production. This means that the company provided Life Cycle Inventory (LCI) data to the association's data collection programme, which covers more than 60% of the company’s crude steel production. This threshold has increased from 50% of a company’s crude steel production in previous years, indicating that the requirements for traceability has been increasing and ArcelorMittal is able to keep up.

Decarbonization is a key aspect of the Company’s climate action strategy, aiming to have a leadership position within the steel industry in terms of target-setting, performance and disclosure. In 2021, ArcelorMittal set out a clear roadmap for achieving medium-term 2030 CO2e targets with an anticipated gross investment of approximately $10 billion, and its commitment to achieve net-zero steelmaking globally by 2050. The Company’s target is to reduce carbon emissions intensity by 25% globally and by 35% in Europe by 2030. Both targets cover Scopes 1 and 2 for steel and mining per tonne of crude steel.

In addition, ArcelorMittal is involved in active engagement with initiatives such as Climate Action 100+, Net Zero Benchmark, the Sustainable Steel Principles (SSP), Climate Bonds Initiative (CBI), annual CDP climate survey and the Science Based Targets initiative (SBTi) to ensure that the challenges and opportunities associated with transitioning multiple steelmaking routes across multiple regions are clearly understood and that the approaches adopted are realistic and pragmatic. This is promising as it means the company will have less risks of being locked out of opportunities due to sustainability risks. Although ArcelorMittal does not have a science-based target yet as the steel sector guidance was recently released in July 2023[4], I expect to see ArcelorMittal set science-based targets for decarbonization in the future, in line with SBTi guidance, to reinforce its sustainability-related competitive advantage.

Investment Thesis 3: Steel is needed for future development

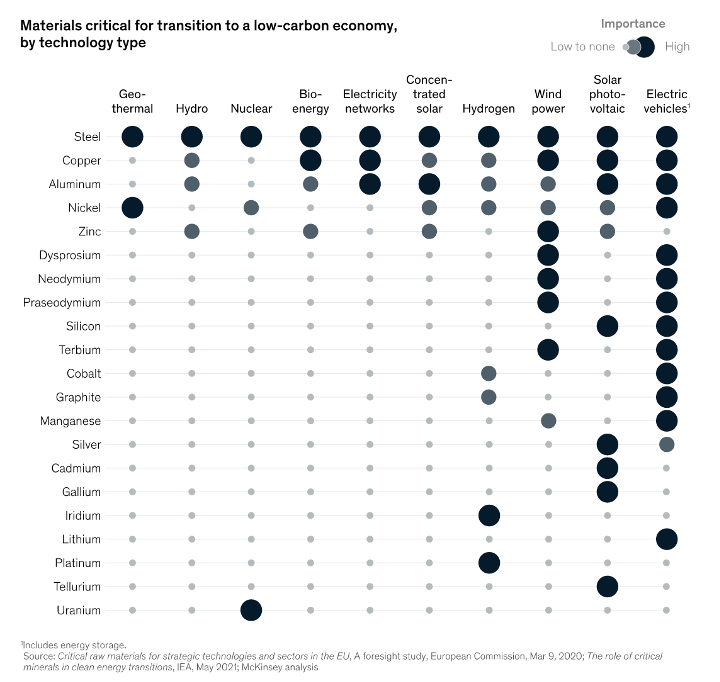

As the world moves toward net zero, the metals and mining sector will have to provide raw materials for new infrastructure as we transition from fossil fuels to wind, solar and alternative power generation, EVs and hydrogen production (Figure x). As a result, the metals & mining sector is set to grow faster[5].

Figure 1. Materials critical for transition to a low-carbon economy, by technology type.

Risks

A key risk for the company is prolonged suppressed demand and price of steel. In recent years, ArcelorMittal's steel production has been decreasing due to overcapacity and lack of demand, from 93.1 million tonnes in 2017 to 59 million tonnes in 2022[6]. However, with its integrated value chain and large scale, this provides some reassurance as the company is able to cope with periods of low prices and demand.

Another risk is the risk of Asian steel producers overtaking ArcelorMittal's leading position in steel production. As the majority of the company's capacity is located in Europe, the war in Ukraine has had a significant impact on the company’s production volumes. Macroeconomic problems, rising production costs along with low demand for finished products and other factors have been negatively affecting the results of the European division for two years in a row. In addition, the company’s Ukrainian unit has significantly reduced its capacity utilization during the war. This leads to producers with capacity outside of Europe, like those in China and India, having an advantage over ArcelorMittal in this aspect. Macroeconomic conditions and the ability of ArcelorMittal to cope should be closely observed to see how the company manages in the future.

Valuation and Conclusion

By conducting a simple comparables analysis, we can see ArcelorMittal is currently undervalued based on EV/EBITDA. This comparables analysis implies a fair value of USD 50.58/share, with an upside of 75.26% from the current share price of USD 28.86.

Therefore, the current recommendation for ArcelorMittal is BUY. We should monitor ArcelorMittal closely for developments in its decarbonization roadmap, and ability to maintain its position as one of the steel leaders globally.

[1] https://gmk.center/en/infographic/how-arcelormittal-is-losing-its-leading-position-in-the-global-steel-market/

[2] https://worldsteel.org/media-centre/press-releases/2023/worldsteel-short-range-outlook-april-2023/

[3] https://worldsteel.org/media-centre/press-releases/2022/worldsteel-announces-the-2022-steel-sustainability-champions/

[4] https://sciencebasedtargets.org/resources/files/SBTi-Steel-Guidance.pdf

[5] https://www.mckinsey.com/industries/metals-and-mining/our-insights/the-raw-materials-challenge-how-the-metals-and-mining-sector-will-be-at-the-core-of-enabling-the-energy-transition

[6] https://gmk.center/en/infographic/how-arcelormittal-is-losing-its-leading-position-in-the-global-steel-market/

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.