Initial Report: Axon Enterprise (NASDAQ: AXON), -18% 3-yr Potential Downside (Finian SAW, EIP)

Finian SAW presents a "SELL" recommendation for Axon Enterprise based on its exceptionally high valuation relative to its peers, and critical ESG issues plaguing the company.

1. Company Overview

Axon Enterprise (formerly known as TASER) has 3 segments in line with the company’s mission to protect life:

The aforementioned TASER devices:

Axon's flagship offering is its range of TASER energy weapons, designed to provide law enforcement with less-lethal alternatives to firearms. These devices temporarily incapacitate individuals, facilitating restraint with a significantly reduced risk of injury. Beyond manufacturing and selling these conducted energy devices (CEDs), Axon supplies related accessories, including batteries, extended warranties, and offers digital subscription training content. Additionally, the company provides virtual reality (VR) training modules and other professional services associated with TASER and VR implementations.

Sensors

Body-worn cameras (BWCs): Recognizing the growing need for transparency and accountability, Axon has developed a range of body cameras. These devices capture high-definition video and audio, providing vital evidence during incidents and enhancing officer safety.

Other Sensors and Devices: In addition to TASERs and BWCs, Axon also offers other connected devices that capture data on various aspects of public safety—ranging from drone cameras, in-car cameras to integrated sensors. These hardware tools form the foundation of its broader digital ecosystem

Software & Services Axon offers a range of SaaS solutions designed to improve operational efficiency. These services include digital case management, data analytics, and reporting tools that help law enforcement agencies streamline investigations and enhance accountability.

Axon Evidence and Axon Cloud: A cloud-based evidence management system, Axon Evidence allows agencies to securely upload, manage, and share digital evidence from body cameras and other devices. The cloud service ensures that data is stored in a compliant, scalable, and easily accessible format.

Axon Respond and Fusus: Having acquired the company Fusus in 2024, Axon has integrated a real-time operations solution which combines media streams from body cams, CCTV camera networks, ALPR (license plate readers)drones into a unified dashboard on its Axon platform for first-responders. By enabling live video streaming, interactive mapping and critical alerts on the go, Fusus helps first-responders make faster, more informed decisions that enhances situational awareness.

AI-driven tools: Prior to the generative AI craze, Axon was already providing AI-driven tools to its software customers such as Redaction Assistant, a tool that redacts license plates, faces and Personally Identifiable Information (PII) from video evidence automatically. The latest AI-driven tool that was launched is Draft One, which uses generative AI to draft incident reports based on audio from body-worn cameras. Not only does DraftOne reduce first-responders’ administrative burden by saving 1-2 hours worth of desk work a day, its reports are also claimed to be more complete and accurate than manually drafted reports. DraftOne and other AI tools are offered separately in various user plans but also bundled into an “AI Era” premium plan which can be purchased as an add-on to existing plans.

All of Axon’s segments have high double-digit gross margins as of FY2024, with Software & Services having the largest margin at 76% due to its asset-light subscription model, followed by TASER at 63% which is very impressive for hardware and lastly Sensors & Others with 41%.

The 4-year Revenue CAGR From 2021 to 2024 for these 3 segments has also been very attractive at >20% levels. Software and Services has experienced electrifying growth at 48% CAGR, then Sensors & Other with 36% CAGR and lastly TASER at 23%.

The standout category is clearly Software & Services with the highest growth and margins. However, the other two are also nothing to scoff at and are in fact crucial feed-ins to the growth of software revenue.

2. The Moat: What makes Axon’s business model so compelling?

2.1 Stickiness of revenue from products and services

Axon’s products and services are mission critical to their customers who predominantly law enforcement from the US Federal government, US state & local public safety agencies and International governments. Switching not only carries a high risk to their operations, it is also time-consuming and expensive, think having to transfer thousands of hours of video footage from Axon’s cloud to another provider, retraining staff on new equipment, systems and more. With Axon being a proven and leading provider, once customers have bought into Axon’s products, services and plans, they are less likely to switch away.

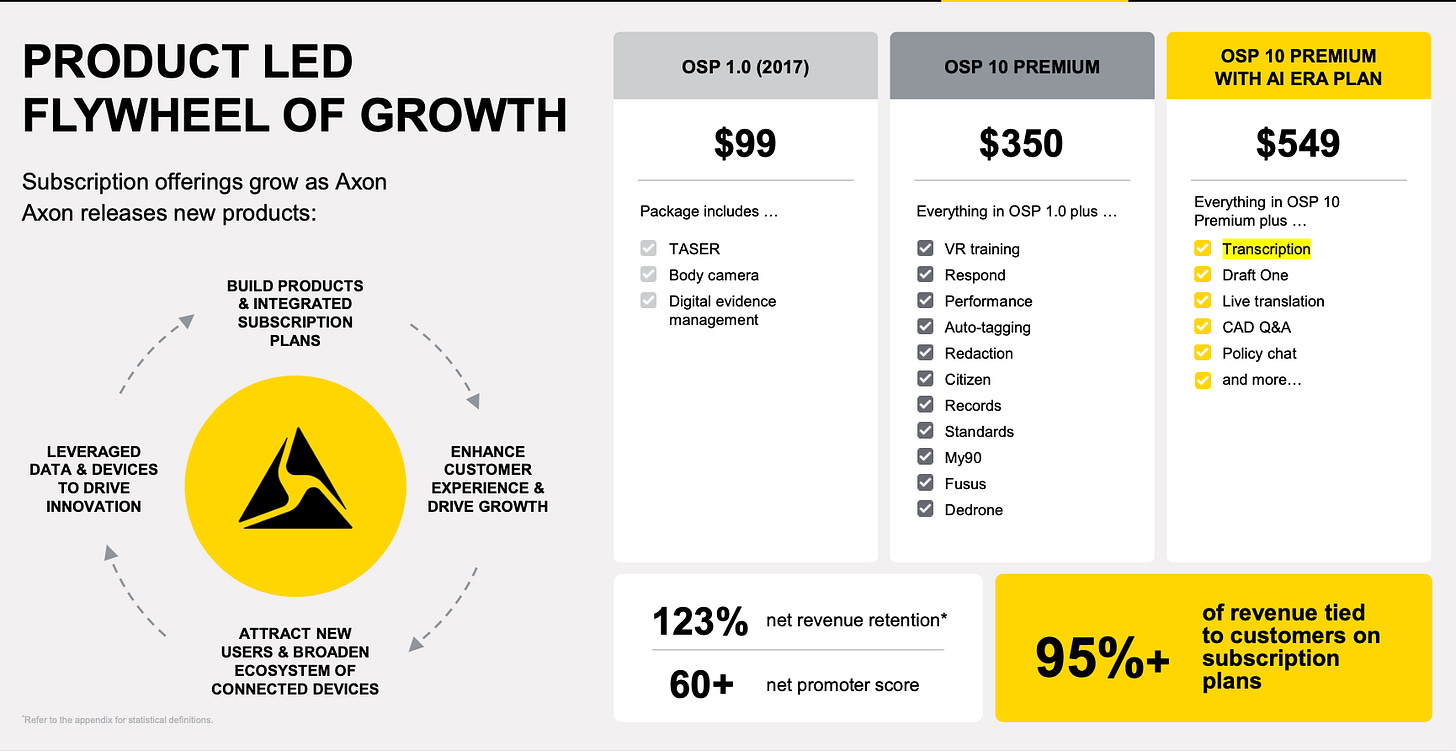

Additionally, with 1B out of its 2.1B annual revenue being recurring revenue, it indicates that a large proportion of customers purchase multi-year subscription plans which are paid annually, with new software features and upgraded hardware device replacements (subject to plan type) being provided over time, essentially locking them in for up to 5-10 years. Axon’s 123% net revenue retention reveals that not only is there no net revenue loss from churn and, existing customers also increase their spending year-over-year.

Refresh/Upgrade cycles with innovation pipeline increase top-line:

Every few years, Axon’s hardware lines will undergo an upgrade cycle, similar to Apple’s annual refresh of iPhones. For example, the latest TASER 10 introduced in 2023 brings notable upgrades — including a much larger cartridge capacity of up to 10 shots (compared to just 2 in previous models like the X2 and TASER 7), longer firing range, and improved precision. Revenue from the TASER division surged by 37% year-over-year in the fourth quarter in Q4 2024 and much of it can be attributed to strong demand for TASER 10. With each new release being offered at a higher price point (and also increasing the number of cartridges in the case of TASER 10), releases effectively increase the revenue per user.

Additionally, Axon’s software segment is primed for long-term margin accretion. The company has already achieved meaningful hardware penetration across U.S. law enforcement agencies, with broad adoption of TASER devices and body cameras. However, the underpenetrated opportunity lies within the software-heavy Officer Safety Plans (OSPs)—bundled solutions that integrate Axon's hardware with recurring software subscriptions.

Currently, less than 20% of Axon's customers are enrolled in these comprehensive OSP bundles, with many agencies still on lower-tier packages that include only basic hardware and minimal software. This creates a significant runway to upsell existing customers to higher-value OSPs that feature advanced software modules such as Records Management, Dispatch, Evidence Analytics, and AI-driven Draft One report automation.

In addition to this upsell potential, Axon has demonstrated an ability to implement annual price increases and introduce premium tiers as new capabilities are developed. For instance, the latest AI-powered Draft One report-writing tool is expected to be embedded in premium OSP offerings over the next year, providing a compelling incentive for customers to migrate upwards.

2.2 Integrated Ecosystem enables cross-selling opportunities and further lock in

Axon’s business model is uniquely advantaged by its fully integrated hardware and software ecosystem, which creates powerful cross-sell opportunities and long-term customer lock-in. Unlike competitors that offer fragmented, stand-alone products, Axon’s suite of solutions is designed to work seamlessly together—enabling agencies to streamline workflows, enhance officer safety, and improve public accountability.

The company’s hardware products—such as TASER devices and body cameras—are often the entry point for law enforcement agencies, and their adoption naturally paves the way for deeper software engagement. At the core of this ecosystem is the interoperability between Axon’s hardware such as TASERs, body camera and its cloud-based software platforms Axon Evidence, Axon Cloud etc.

For example, Axon’s TASERs and body cameras are engineered to automatically trigger recording and data upload to Axon Evidence and Axon Cloud when a weapon is drawn—ensuring that critical video evidence is captured and securely stored in real time without manual intervention. By creating a seamless integration between its devices and cloud-based software, it simplifies operations for law enforcement, reduces the friction of managing multiple, disjointed systems and makes it easier for customers to expand their use of Axon’s services over time.

Axon effectively has a hardware-to-software adoption cycle which provides Axon with the opportunity to upsell higher-value software packages as customers experience the tangible benefits of its devices. For instance, customers that initially purchase TASERs or body cameras are well-positioned to add Axon’s software offerings through subscriptions such as the Officer Safety Plans (OSPs) to their arsenal.

The result is an expanding base of software subscribers, who are locked into the Axon ecosystem as they continually benefit from ongoing software updates and additional capabilities, such as AI-driven analytics, evidence management, and real-time connectivity features.

Given that only a small percentage of current customers are utilizing Axon’s full suite of software solutions, there is substantial potential for expansion in this area, further cementing the company’s position in the market. Axon currently captures less than 1% of the average law enforcement agency’s budget and with the adoption of premium products and services, Axon could increase this share to 3%. Even at 3%, Axon’s solutions are still positioned as providing exceptional value, addressing real operational challenges and significantly increasing efficiencies at a relatively low cost.

Additionally, Axon’s innovative hardware refresh cycles—such as the release of upgraded TASER models and body cameras—serve as catalysts for software adoption. With every hardware upgrade, customers are incentivized to adopt new software capabilities that maximize the value of their updated devices. This continuous cycle of innovation and bundling helps drive long-term growth and increases customer lock-in, further reducing the likelihood of churn and increasing revenue visibility.

3. The Growth Narratives

3.1 Increasingly favourable regulatory landscape

Axon’s expansion is inextricably tied to evolving public policy and regulatory mandates that are reshaping law enforcement practices. A surge in societal calls for police accountability has prompted numerous U.S. states and major cities to require body-worn cameras. This wave of legislation—sparked by high-profile incidents—has created a significant tailwind for Axon. For example, as states like New Jersey and Illinois phase in camera mandates for all officers, law enforcement agencies are compelled to upgrade their technology, often choosing Axon due to its established reputation and market leadership. With current estimates indicating that less than 15% of U.S. state and local agencies have fully adopted body cameras, there is a vast potential market waiting to be activated.

In parallel, a broader shift in policing strategies toward de-escalation and reduced use of lethal force is aligning well with Axon’s TASER solutions. Many departments are now mandating or encouraging the use of TASERs as a first-line response before resorting to firearms. Some municipalities have even begun to require that officers exhaust non-lethal options, reinforcing the push for alternatives to lethal methods. This regulatory trend ultimately drives further adoption of its less-lethal products, bolstering Axon’s growth trajectory.

3.2 Breaking into the Enterprise Security market

One major growth narrative for Axon is how the company is leveraging its solid reputation in traditional law enforcement to break into the enterprise security market. Recognizing that enterprise security has vast untapped potential given that there are 20x more frontline workers in enterprise security compared to public security , Axon is tailoring its offerings for industries where safety and incident management are critical.

The launch of the Axon Body 4 Workforce marks a pivotal shift. This lighter, enterprise-focused body camera is optimized for sectors like retail, healthcare, and transportation, where the need for rapid incident documentation is growing. It opens the door for companies that require reliable, high-quality recording devices to safeguard their assets and personnel.

Complementing its hardware advances, Axon has upgraded its Axon Fūsus platform to meet the needs of enterprise security. Now this integrated system enables enterprises to share live inputs from the enterprises’ network of CCTV cameras and alarms to facilitate immediate coordination with local law enforcement during emergencies. By bridging the gap between corporate security systems and public safety infrastructure, Axon delivers a comprehensive solution that addresses complex security challenges.

In 2024, Axon secured its biggest contract in its company history, and it was with a major enterprise client. This achievement is a teaser into the growth that the enterprise market can bring to Axon, which has a TAM of $40B according to Axon. Given the potential to replicate law-enforcement offerings to cater to enterprise security, as seen through Axon Body 4, Axon is well positioned to capture a large slice of the market and it has already begun doing so with enterprise bookings leaping 3x year on year. As Axon continues to optimise its integrated ecosystem for enterprise, the opportunities to convert these enterprise customers into long-term, recurring revenue streams could mark the next stage of growth for Axon.

3.3 Expansion into international markets

Axon’s horizon is broadening significantly as the company pivots to tap international markets—a shift that is rapidly transforming its revenue landscape. Traditionally anchored in U.S. law enforcement, which accounts for roughly 75% of its revenue, Axon has experienced a dramatic surge overseas. In 2024, international bookings demonstrated impressive sequential gains—up 40% in Q3 and nearly 50% in Q4—hinting at triple-digit year-over-year growth that signals a robust global appetite for its solutions.

Key to this international momentum is Axon’s strategic expansion of its product lineup. Beyond the core body cameras and TASER devices, the company has introduced advanced offerings like Fūsus, Dedrone’s counter-drone technology, and a suite of AI tools. These innovations cater to evolving public safety challenges and provide compelling, integrated solutions for markets where agencies are only just beginning to modernize their security infrastructures. In many regions, from European cities to emerging markets in Asia-Pacific and Latin America, law enforcement agencies and private security providers are stepping up their investments in digital evidence management and integrated monitoring systems.

Axon’s international strategy is further enhanced by its tailored regional approach. Recognizing that one size does not fit all, the company has bolstered its international team by hiring local experts and adapting its offerings to meet regional requirements—whether that means complying with different data hosting rules, language needs, or specific regulatory environments. This localized execution has already led to transformative wins, including landmark deals in countries like Germany, where recent approvals have paved the way for wider adoption of TASER devices. These successes underscore an enormous, underpenetrated market opportunity—estimated to add over $32 billion to the international government segment—where many police forces remain in the early stages of adopting body cameras and cloud-based evidence systems.

As Axon continues to expand its global footprint, international revenue is poised to grow from about 20% of the company’s total revenue to an estimated 25–30% in the near future. This shift not only diversifies its revenue base but also reduces the reliance on U.S. government budgets, creating a more balanced and resilient business model. With strong momentum across EMEA, APAC, and Latin America, Axon is positioning itself to become a dominant player in global public safety technology—setting the stage for sustained, long-term growth.

4. Valuation

Current Trading Metrics: Axon is currently trading at $534.95 per share with a forward P/E of 111.45x. This exceptionally high multiple reflects robust market optimism regarding Axon’s growth prospects and its transformation from a hardware-centric business to one driven by recurring revenue from integrated software and cloud services.

Historical and Peer Context: Over the past five years, Axon’s average P/E has been approximately 119.92x. In contrast, its peer group trades at much lower multiples—with the highest around 55.79x and an average near 32.33x. This stark difference highlights that Axon has consistently commanded a premium relative to its industry.

The key question is whether Axon can sustain its high valuation multiples over time. If revenue growth remains strong, and the company continues to expand its ecosystem while navigating regulatory and competitive pressures, the market is likely to support its premium pricing. However, any misstep—such as slower-than-expected ARR growth, heightened competition, or regulatory headwinds—could lead to a re-rating, driving a potential valuation contraction. This was evidenced during the Flock Safety split. When Axon ended its long-standing partnership with Flock Safety, the stock experienced a dramatic decline—dropping over 18% in a single day on 18 February 2025 and an additional 10% the next day. Given that Axon is trading at very elevated forward P/E levels, even a minor negative event could prompt a re-rating, driving its valuation closer to more sustainable levels.

Using a relative valuation approach that applies forward P/E multiples that are more normalised but still applying a premium given Axon’s moats and compelling growth story, a 3Y target price of $440.52 (-17.66% downside) and 5Y target price of $531.36 (-0.67% downside) is derived using a forward P/E of 45x and 40x respectively.

5. Critical ESG Issues

5.1 Social: Controversial Diagnosis of "Excited Delirium" and Taser Safety

Axon Enterprise faces significant social challenges related to the safety and lethality of its products. A particularly contentious issue is the association between Taser use and fatalities, often linked to the controversial diagnosis of "excited delirium." "Excited delirium" has been cited in numerous cases involving sudden deaths during police encounters, characterized by extreme agitation, aggression, and distress. However, this term lacks recognition from major medical authorities, including the American Medical Association and the World Health Organization, leading to widespread criticism of its validity. Critics argue that the diagnosis has been misused to justify excessive force, disproportionately affecting marginalized communities.

Reports indicate that Axon has played a role in promoting the concept of "excited delirium" to mitigate liability associated with Taser-related deaths. In 2007, the company purchased numerous copies of a book entitled Excited Delirium Syndrome authored by Dr. Vincent Di Maio, a defense expert for Axon, and his wife Theresa. This dissemination of literature supporting the diagnosis has raised concerns about the company's influence on medical and law enforcement narratives surrounding in-custody deaths.

The use of Tasers has been linked to numerous deaths and injuries. A Reuters investigation identified more than 1,000 deaths in the United States involving Tasers, with the stun gun being ruled as a cause or contributing factor in 153 of those cases. These incidents raise concerns about the safety of Taser deployment, especially on individuals experiencing mental health crises.

Axon maintains that its Taser devices are a safer alternative to lethal force. The company asserts that "TASER energy weapons have been used to save more than 300,000 lives from death or serious bodily injury." Additionally, Axon references studies indicating that the risk of death in a conducted energy device (CED)-related use-of-force incident is less than 0.25%, suggesting that such devices do not cause or contribute to death in the majority of cases.

The controversies surrounding "excited delirium" and Taser-related fatalities present significant social and ethical challenges for Axon. The promotion of a disputed medical diagnosis and the association of its products with in-custody deaths have implications for public trust and the company's social license to operate. Addressing these issues requires Axon to engage transparently with stakeholders, support independent research into the safety of its products, and ensure that its technologies are used responsibly and ethically by law enforcement agencies.

While Axon's innovations aim to provide less-lethal options for law enforcement, the social material issues associated with Taser use highlight the need for ongoing scrutiny and responsible management to mitigate adverse outcomes and uphold public confidence.

5.2 Governance: Questionable ethics and executive compensation

In May 2022, Axon announced plans to develop drones equipped with Tasers, aiming to address mass shooting incidents. This initiative was met with strong opposition from Axon's AI Ethics Board, which had previously advised against such projects due to ethical and safety concerns. The board criticized the proposal as a "dangerous and fantastical idea," arguing that it could lead to increased surveillance and use of force, particularly in marginalized communities. As a result, nine of the twelve board members resigned, expressing a loss of confidence in Axon's commitment to ethical governance.

Shortly after the ethics board's resignation, Axon proceeded to acquire Sky-Hero, a Belgian company specializing in military-grade drones. This move intensified concerns about Axon's strategic direction and its adherence to ethical considerations in product development. Critics argued that the acquisition contradicted the company's stated commitment to responsible innovation and raised questions about its governance practices.

Axon has also faced scrutiny over its executive compensation practices. Reports indicate that the company's top executives have received remuneration packages placing them in the upper echelons compared to industry peers, despite public commitments to median-level compensation. For instance, CEO Rick Smith's substantial stock option awards have drawn attention to potential misalignments between executive pay and shareholder interests. Additionally, undisclosed expenditures, such as sponsorships linked to company executives and lavish gifts, have raised concerns about financial transparency and adherence to corporate governance norms.

These incidents collectively highlight significant governance challenges within Axon. The resignation of the ethics board underscores potential deficiencies in the company's internal oversight mechanisms and its responsiveness to ethical advisement. The pursuit of controversial technologies without adequate ethical review, coupled with questionable financial practices, suggests a need for enhanced governance structures to ensure accountability and alignment with ethical standards.

6. Conclusion

While Axon Enterprise, Inc. (AXON) has demonstrated a compelling growth trajectory, solidifying its position as a leader in law enforcement technology, the current stock price does not adequately reflect the inherent risks. Given the combination of overvaluation and unresolved ESG issues, a sell position is recommended on Axon Enterprise.

7. References

Axon. (2025, February). Axon Enterprise, Inc. (AXON) Q4 2024 Earnings Call Tuesday. https://filecache.investorroom.com/mr5ir_axon/542/Q4_2024_Earnings_Call_Transcript.pdf

Dastin, J. (2021, Winter). Taser maker axon has a moving backstory. it’s mostly a myth. Reuters. https://www.reuters.com/investigates/special-report/axon-taser-corporate-governance/

"Excited delirium” and deaths in police custody. Physicians for Human Rights. (2022, March). https://phr.org/wp-content/uploads/2022/03/PHR-Excited-Delirium-Report-Executive-Summary-March-2022.pdf

Johnson, K. (2022, June 6). Axon’s taser-drone plans prompt AI Ethics Board resignations. Wired. https://www.wired.com/story/taser-drone-axon-ai-ethics-board/

National Urban Security Technology Laboratory. (2023, March). Body Worn Cameras with Automatic Activation Assessment QuickLook. Department of Homeland Security. https://www.dhs.gov/sites/default/files/2023-03/Quick%20Look%20Summary%20Body%20Cams_Final_appoved_508.pdf

Olumhense, E. (2023, September). Axon’s ethics board resigned over Taser-armed drones. then the company bought a military drone maker – the Markup. Axon’s Ethics Board Resigned Over Taser-Armed Drones. Then the Company Bought a Military Drone Maker – The Markup. https://themarkup.org/2023/09/08/axons-ethics-board-resigned-over-taser-armed-drones-then-the-company-bought-a-military-drone-maker

Rizzi, C. (2023, August 23). Axon facing class action over alleged monopoly on Taser, body camera markets. ClassAction.org. https://www.classaction.org/news/axon-facing-class-action-over-alleged-monopoly-on-taser-body-camera-markets

Rueter, T. (2024, December 17). ACLU slams AI police reports, and axon in particular. GovTech. https://www.govtech.com/biz/aclu-slams-ai-police-reports-and-axon-in-particular