Initial Report: Blue Bird Corporation (NASDAQ:BLBD), 132% 5-yr Potential Upside (EIP, Leon LEONG)

Leon presents a "BUY" recommendation based on the increase in North America's school bus replacements and increasing adoption of electric school buses.

Executive Summary

The main narrative for Blue Bird Corporation's (BLBD) future growth lies in North America's school districts' adoption of electric school buses (ESBs) over diesel-powered school buses, which is priced at 3-4x the ASP of diesel school buses at an estimated gross margin of ~30%, compared to gross margin on diesel buses at ~10%. In FY24, BLBD's ESB sales volume was 7.8% of its total sales mix, but contributed to 24.2% of total sales $. The incremental sales volume of BLBD's ESB should also contribute to incremental margins expansion potential for BLBD.

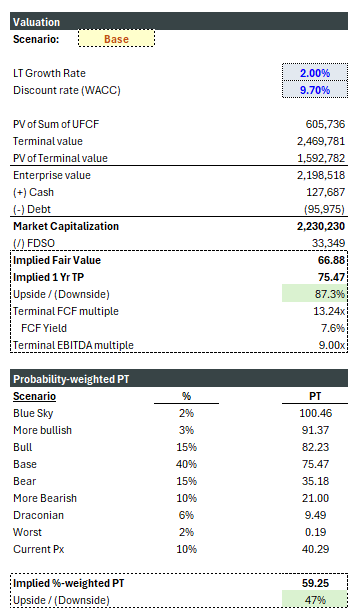

While the market has largely priced in the company's growth and margin expansion potential from 2022 - 2024, its share price has declined by ~30% from its 52w high as of 9 January 2025. Likewise, short interest has been pressing from 6.0% of oustanding shares just 6 months ago to 17.2% today. A possible cause for this is the fear of Trump's anti-ESG stance and the risk of his Administration undoing part of the Inflation Reduction Act and the Bipartisan Infrastucutre Law, risking the early exit of the US$5bn Clean School Bus Program (tranches of grants and subsidies offered to school districts to lower the large upfront cost of purchasing ESBs) and the Clean Duty Heavy Vehicle Program (~US$650m allocated to school districts for purchases of ESBs). With ESBs priced at 3-4x diesel buses, which stand at around US$350-400k per bus, the removal of the subsidy programs will jeopardize the rate of adoption of ESBs in North America, and hence, jeopardizes the growth and margins expectations of BLBD in the near term. However, I believe the unwinding of the Clean School Bus Program is unlikely to happen given the negatives of diesel buses' tailpipe emissions that continue to harm ~26 million children onboard diesel school buses daily, and potential backlash from school districts and parents should the funding and transition to ESBs stall. Moreover, ESBs differ greatly from other electric vehicles, which run only twice a day on pre-set routes, with plenty of downtime for charging, increasing the ease of EV charging and other infrastructure build-out in school districts while eliminating concerns about vehicle range issues, creating a more compelling case of supporting the switch to ESBs. The decreasing total cost of ownership ("TCO") of ESBs should also lead to TCO parity with diesel buses to spur non-subsidised purchases in the medium term as EV battery costs continue to trend downwards, bolstering BLBD's medium term growth. I lay out 8 scenarios with differing outcomes of the subsidy programs in the near term and unsubsidized adoption of ESBs in the near-medium term, alongside other key variables, including but not limited to BLBD's new bus order win rate, industry market share and raw material cost inflation that will affect its top and bottom line, to derive a probability-weighted 1-year TP of US$59.25 (~47% upside from current price of US$40.29). Long BLBD.

What is BLBD?

BLBD is the only pure-play school bus OEM in North America, manufacturing and selling Type C and D school buses across the North American market to major school bus fleet operators, state governments and authorized dealers. Its type A buses are sold through Blue Bird Micro Bird, a 50/50 joint venture between Blue Bird and Canadian based minibus manufacturer Girardin Minibus.

Blue Bird's school buses are available in three fuel categories (Electric, Diesel, and Alternative fuels including propane and gasoline). It first introduced ESBs into its product mix in 2018, which has seen sales volume increase to nearly 8% in FY2024. Alternative fuels sales volume has also steadily increased in place of diesel school bus sales volume, reaching 50% of its sales volume mix in FY2024. This makes BLBD the leader in clean technologies amongst school bus OEMs in North America, with 60% of unit sales that are non-diesel (in contrast with its two largest competitors, IC Bus and Thomas Built Buses, that have only 10~20% of their unit sales that are non-diesel). The school bus market in North America operates much like an oligopoly, dominated by BLBD (30% market share), IC Bus (35% market share), and Thomas Built Buses (32% market share). The shift to cleaner school buses presents an opportunity for BLBD to grab market share as school districts shift to non-diesel school buses in the future, given BLBD's more established position as a clean school bus OEM.

BLBD also sells school bus parts/components to its customers, which was 8% of total revenue in FY2024. While not a main revenue driver for BLBD, gross margins on aftermarket parts sales was 50% in FY2024, a highly profitable business segment. Management is also guiding LSD growth for the parts segment in the out years, similar to historical trends in the past decade, as such aftermarket sales will not be a critical driver for BLBD's narrative.

Despite ESB's relatively low contribution to BLBD's total sales volume mix in FY2024, it contributes to 24% of total bus revenue, driven by BLBD ESB's high ASP (3.5x of industry-wide diesel school bus ASP in FY24).

Given a diesel school bus's gross margin of ~10%, the estimated gross margin % of BLBD's ESB in FY2024 roughly equates to ~32%, after accounting for an additional ~US$180k cost for an electric powertrain that needs to be installed. As a result of increasing ESB sales volume in recent years, BLBD's gross margins have expanded from an average of ~11% (excl. anomaly Covid years) to 19% in FY2024.

The superior economics of ESB is set to drive incremental margins and growth for BLBD, should ESB sales volume continue to increase in the out years.

Hence, the main narrative that will continue to drive BLBD's valuation lies with the increase in North America's school bus replacements (from trough levels in Covid years), the continued adoption of ESB by school districts in North America, and BLBD's ability to win incremental ESB orders to drive incremental ESB volume sales in the out years, which will lead to a positive revision of market expectations on BLBD's growth and margin expansion potential.

Thesis 1: Incremental ESB in sales volume mix to drive growth expectations and incremental margins potential for BLBD

Emerging tailwinds in macro factors and pent-up demand for school buses are key catalysts to an upturn in the school bus replacement cycle, potentially contributing to a larger share/adoption of ESBs by school districts in the different states of North America, as school districts look to transition their aging school bus fleets to cleaner fuel types compared to diesel-powered school buses.

Sub-point #1: Top-down macro backdrop matters significantly for school bus replacement rate, which is poised to grow after trough delivery volumes in Covid-impacted years

School-bus replacement rates generally depend on three key factors: population of schooling children, home values, and property tax receipts by state and federal government. While the population of schooling children is unlikely to deviate much in the near-medium term, home values in North America will likely remain elevated given an acute shortage of owned homes (~33% below pre-pandemic levels), together with a projected increase in demand for homes in light of future rate cuts. Property tax receipts from state governments are dependent on the value of homes (higher value = higher tax receipts), where a portion will be utilised to fund the state's school districts' school bus purchases. Home prices are forecasted to rise modestly at 4% in 2025 and 2026, which should support the near term funding for school bus replacements.

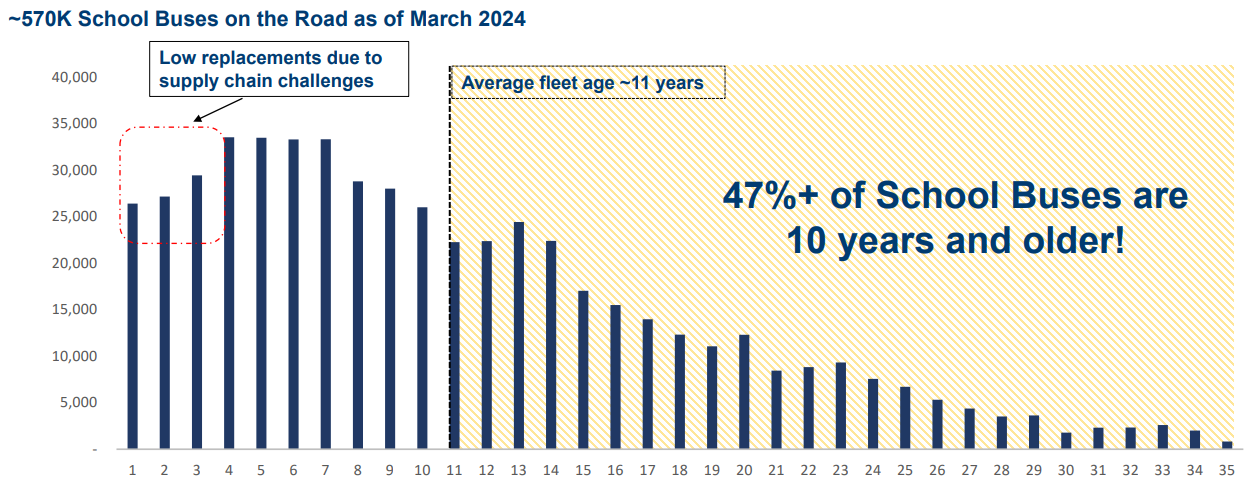

Moreover, the closure of schools during the Covid period, and supply chain constraints leading to dampened delivery volumes by school bus OEMs have led to trough delivery volumes from 2020 to 2022. We see a similar set-up during the Global Financial Crisis where a collapse in housing prices have led to trough delivery volumes, before seeing an upturn in the cycle as the industry recovers.

Additionally, >47% of school buses in North America today are >10 years old, while ~28% are >15 years old. States in North America generally prohibit the use of school buses beyond 15 years, with exception of some States like Florida that have a max allowable school bus age of 20 years. Regardless, the number of school buses that are up for replacements by regulation will increase to >50% within the next six years, which should give way to increasing replacement orders. This coupled with increasing home values, State property tax receipts, and pent-up demand for school bus replacements after the Covid-years should set the stage for a strong upturn in school bus delivery volumes.

Sub-point #2: ESBs set to take increasing volume share of total North America school-bus replacements, driven by demand side factors and grant/rebate programs

In recent years, there has been a push for electrification of school bus fleets despite the high unfront costs of ESBs, due to numerous concerns such as tailpipe emissions from diesel buses that continues to put ~26 million children at risk of developing serious medical conditions such as cancer and asthma, and has been linked to potential impairment of children's cognitive development. ESBs on the other hand, emit zero tailpipe emissions, making them the cleanest school bus option for school districts and are concurrently the lowest GHG emitter of any school bus type. Against the backdrop of a projected increase in school bus replacements in North America, I believe ESB orders will increase in absolute numbers given the call to action for school districts to replace diesel buses for ESBs, coupled with several grants and rebates that have been established to lower the upfront capital costs of ESBs.

As such, demand by school districts to purchase ESBs has been further bolstered by numerous incentives and grants from local, state and federal governments to offset the high upfront expenditure in recent years. Without any incentives or grants, the TCO of a Type C ESB is roughly US$570k, compared to the TCO of a diesel school bus at US$414k. However, despite ESB's higher upfront capital costs, its fuel costs and maintenance costs throughout its useful life is ~50% lower of what is required for diesel school buses. Under the Inflation Reduction Act (IRA), commercial clean vehicle purchasers can claim tax credits of up to US$40k for each vehicle purchased (including school buses), resulting in a net TCO of US$530k for ESBs without accounting for any Clean School Bus Program (CSBP) rebates.

The CSBP is a ~US$5bn program consisting of rebates and grants that are allocated throughout 5 tranches.

Application of the 1st - 3rd tranche of the CSBP has closed, while the 4th tranche is open till end Jan 2025, while the 5th tranche application has yet to open. With a US$322k funding/bus allocation for the 4th tranche of CSBP, a further US$322k can be used to offset the purchase of an ESB for school districts that are awarded the rebate, lowering the TCO of an ESB to ~50% of the TCO of a diesel school bus. This provides near term visibility of ESB orders and deliveries.

Additionally, the launch of the 2024 Clean Heavy Duty Vehicle (CHDV) program is set to allocate an additional US$650m for school districts to purchase 2,321 ESBs at US$280k funding per bus.

These programs cumulatively provide visibility of ~8,100 ESBs orders and deliveries by early 2027, a ~63% increase in the total number of 4,958 ESBs that are operating on the roads today. This number excludes any contributions from non-subsidized orders, which I estimate at 1,437 unsubsidized ESBs delivered in 2024. Assuming the cost curve of EV batteries continues to decline in the out years, the ASP of ESBs should decline steadily as well, bringing the unsubsidized TCO of ESBs closer to parity with TCO of diesel buses. EV battery costs are expected to decline from US$111/KWh to US$68/KWh by 2029, effectively reducing the costs of electric powertrains installed in ESBs by ~40% by 2029 (~US$70k reduction), bringing the unsubsidized TCO of ESBs to US$500k, and US$460k assuming the 45W grant remains intact.

The TCO of ESBs can be further reduced if Vehicle-to-Grid (V2G) batteries are installed within the electric powertrain in the ESBs, which allow ESBs to deliver energy back to the electrical grids when they are not in use, effectively allowing the school districts to sell excess energy stored in the ESBs to utility companies that require greater energy supply during peak consumption periods. School buses are perfect assets for V2G as they typically operate only 4-5 hours per day and are idle for 80% of weekdays and nearly 50% of the time in a year, presenting ample downtime opportunities to deliver excess energy back to the electrical grids. Assuming an annual average of US$3,000 V2G revenue, an ESB can generate US$45,000 throughout its useful life (15 years). This potentially lowers unsubsidized TCO of ESBs to US$455k, and US$415k assuming the 45W grant remains intact by 2029, further bridging the true TCO gap between diesel school buses and ESBs, which presents significant upside to end market demand of ESBs / future unsubsidized adoption of ESBs.

On the back of this, I project a 5-year CAGR of 33% for unsubsidized ESB orders in North America through 2029. A 40% burn rate assumption on each prior year's industry-wide ESB backlog derives the following estimated incremental industry-wide ESB delivery.

It is worthwhile to note that ESBs on the road today constitute only ~1% of total operating school buses. At my industry-wide projected numbers, total ESBs on the road will only account for ~5% of total operating school buses by 2029, which I believe is a conservative take on the future electrification of school bus fleets. Hence, future electrification opportunities for school bus fleets remain large, provided grants and rebates can continue to stay afloat while unsubsidized TCO of ESBs decline from a reduction in battery costs.

Sub-point #3: BLBD stands out in ESB orders and deliveries even amongst incumbent school bus OEMs, while new upstarts specializing in electric buses and trucks will not be able to compete in the near-medium term

North America's school bus market operates in an oligopoly fashion, dominated by three large incumbents (Blue Bird Corp, Thomas Built Buses, and IC Bus), cumulatively accounting for 97% of the market. There have been new upstarts, including GreenPower Motor and Lion Electric that specialize solely on electric buses and trucks, with a portion of their products being electric school buses.

BLBD leads in total ESB commitments (CSBP tranche 1 + 2 + unsubsidized ESB orders) from school districts at 28% of total commitments (orders + operating buses). Thomas Built Buses falls short by 4% of total share while IC Bus lags behind by >10%. As of FY2024, BLBD has also delivered its 2,000th ESB while latest information for Thomas Built Buses indicate that it has delivered ~1,000 ESB. It would be reasonable to assume IC Bus has lower than <1,000 delivered given its substantially lower ESB commitments. Amongst the incumbents, BLBD appears to be leading in orders and deliveries of ESBs. Both IC Bus and Thomas Built Buses manufacture commercial buses on top of school buses, while BLBD has close to a century of specializing solely in school buses. Given the school bus market's heavily regulated product specifications, it wouldn't be surprising that ESB orders, with newly integrated technologies, will be in the favor of BLBD given the company's long-standing reputation as a "school bus only manufacturer"

While Lion Electric has a 23% share of total ESB commitments despite being a young upstart in the industry, it very recently defaulted on its debt obligations and has sought bankruptcy protection to restructure itself. This highlights the difficulties of new upstarts in competing against industry incumbents, especially when new upstarts' initial lower total sales volume is insufficient to spread out the significant fixed overhead costs to reach profitability. Lion Electric has also cut its workforce by close to 50%, which strains near-term production capacity, posing the question of whether it can service the remaining backlog that it has. Nevertheless, it appears future ESB orders from school districts will likely go to the three industry incumbents instead of Lion Electric, given its slowdown in production capacity and possible working capital issues. GreenPower Motor (GPM) on the other hand, has the lowest ESB commitment amongst all major players in the school bus market, and faces a similar plight as Lion Electric, incurring losses year after year with its cash level as of 30 Sep 2024 at <1/10 of what it had 6 months prior. It should also be noted that GPM has >19 bus models (with 15 in commercial trucks and buses), hence I doubt its ability to scale its ESB business given its large cash burn from steep losses and diverted focus on its commercial truck and bus segment.

BLBD's management has further guided a 30% order win rate for ESBs for the CSBP tranche 4 & 5 + the CHDV program, equating to visibility of ~2,428 incremental electric school buses allocated to BLBD from these programs alone by 2026, more than what it has cumulatively delivered in the past 7 years. Furthermore, since the guidance was given before Lion Electric declared bankruptcy, there are some upside opportunities if new orders from these programs are allocated away from Lion Electric towards other school bus OEMs. I remain optimistic that BLBD will retain its market-leading position in ESBs as adoption of ESBs ramps up in the future.

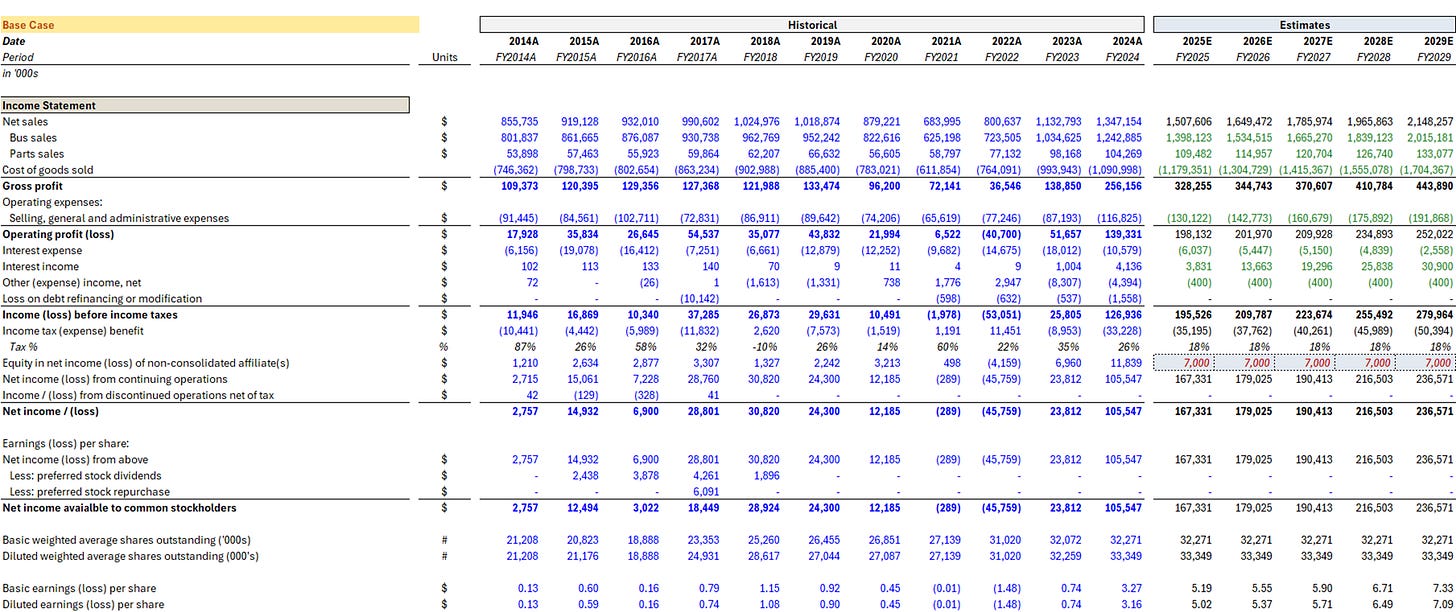

Price growth in recent years has been contributing significantly to incremental y/y revenue for BLBD as % of ESBs in BLBD's sales mix have begun to scale. Moving forward, I expect incremental revenue contribution from volume growth to increase as we enter an upturn cycle of school bus replacements in the years ahead, while price growth declines but remains significant from increasing ASP (volume of ESBs increase in out years increasing overall bus ASP + ASP increasing in-line with inflation for all fuel-type buses as part of BLBD's dynamic pricing mechanism).

Thesis 2: Near-term subsidy programs for electric school buses will likely remain, re-aligning market expectations in near-term industry-wide ESB order rate and BLBD's ESB volume sales

Every U.S. State with the exception of Wyoming (48 out of 49) have committed to ESB orders according to latest data from World Resources Institute. Furthermore, 7 States have established zero-emission school bus transition legislations, with Washington mandating 100% of new school bus purchases as ESBs once ESBs reach TCO parity with diesel buses. In Colorado, Michigan and Washington D.C, 100% of school bus sales are required to be ESBs by 2030. Given increasing widespread adoption and increasing awareness of the benefits ESBs provide over diesel school buses, any actions by Trump's administration to remove the remaining tranches of the CSBP (~US$2bn funding) and CHDV program (US$650m funding) for school districts across the U.S. to offset costs of purchasing ESBs will face major backlash.

Furthermore, clean tech investments from the Inflation Reduction Act have primarily flowed into Republican States, which have benefitted from a pipeline of 35 gigafactories and ~US$101bn investments into EV and battery supply chains. Trump may face the risk of retaliation from his own party for repealing the IRA.

Applications for Tranche 4 of the CSBP and the 2024 CHDV program are also scheduled to close by Feb 2025, and once school districts are selected and order commitments are made, it would be difficult for any rescindment should the CSBP and CHDV program be cancelled, which makes it unlikely that they would be repealed. Thus, uncertainty ultimately boils down to the continuity of the 5th tranche of the CSBP (which may only be open for applications from late 2025). I remain optimistic about the continuity of the 4th Tranche of the CSBP and the CHDV.

Thesis 3: Alternative fuel buses remain an opportunity for BLBD from a lack of competition and potential demand surge

BLBD is the only major school bus OEM that manufactures alternative fuel buses (propane and gas), after IC Bus and Thomas Built Buses exited the manufacturing of these fuel-type buses. This means the majority of propane school bus orders from school districts that are looking to transit away from diesel school buses will go to BLBD. In 2024, propane and gas school buses in operation amounted to ~52,000 units (9.1% of total school buses in operation).

However, one caveat is that propane buses can actually emit more carbon dioxide and carbon monoxide than diesel buses, which makes them another type of school bus that pollutes. The only health advantage propane school buses have over diesel is its lower nitrogen oxide emission (~96% lesser), which reduces the risk of harmful impacts on children onboard the school buses.

While ESBs ultimately remain the cleanest and most ideal fuel-type school bus for school districts to switch to, propane and gas school buses do present some benefits for school districts, such as having the lowest TCO amongst all fuel-type buses, with a 50% lower fuel and maintenance costs while having a price tag of ~US$20k more expensive than a typical diesel school bus, while mitigating to a certain extent the harmful impacts of emissions on children.

The lack of competition from the other two incumbents' exit in this space presents opportunities for BLBD to capture a larger share of the market, and increase its delivery volumes from replacements of existing propane school buses or new purchases from school districts switching from diesel bus fleets to propane/gas school buses. The economics of propane and gas school buses is also slightly better than that of diesel school buses from their slightly higher ASP, which will benefit BLBD if its % of sales mix increases in the out years.

Valuation

Using DCF, my probability weighted PT factoring in 8 different scenarios with changing variables and the current price yields a 1 Year PT of US$59.25, implying an upside of 47% over the current price of US$40.29.

I also conducted a regression of the three incumbent school bus OEMs' FY25E EV/EBIT multiple against their FY25E EBIT Margin.

Using my estimate of BLBD's FY25 EBIT margin to the regression equation derives an EV/EBIT multiple of 6.8x for BLBD. However, given BLBD's higher growth potential compared to Traton (owns IC Bus) and Daimler (owns Thomas Built Buses), I adjusted the multiple upwards by 2.0x to derive an adjusted EV/EBIT multiple of 8.8x. Applying this multiple to my FY25 estimate of BLBD's EBIT yields an implied share price of US$53.47, an upside of 33% to the current share price and is close to my DCF valuation.

Scenarios (Key Sensitivites Only):

Blue Sky: Tranche 4+5 of CSBP continues, CDHV program continues, BLBD industry-wide market share increases (100bps for each year), Order wins from CSBP and CDHV at 35%, Industry-wide North America school bus sales volume increases at ~6.5% CAGR through 2029, incremental unsubsidized ESB orders increases by 30%

More bullish: Tranche 4+5 of CSBP continues, CDHV program continues, BLBD industry-wide market share increases (100bps for each year), Order wins from CSBP and CDHV at 34%, Industry-wide North America school bus sales volume increases at ~6% CAGR through 2029, incremental unsubsidized ESB orders increases by 20%

Bull: Tranche 4+5 of CSBP continues, CDHV program continues, BLBD industry-wide market share at 30%, Order wins from CSBP and CDHV at 32%, Industry-wide North America school bus sales volume increases at ~5% CAGR through 2029, incremental unsubsidized ESB orders increases by 10%

Base: Tranche 4+5 of CSBP continues, CDHV program continues, BLBD industry-wide market share at 30%, Order wins from CSBP and CDHV at 30%, Industry-wide North America school bus sales volume increases at ~5% CAGR through 2029

Bear: Tranche 4+5 of CSBP continues, CDHV canceled, BLBD industry-wide market share at 30%, Order wins from CSBP at 28%, Industry-wide North America school bus sales volume increases at ~4% CAGR through 2029, incremental unsubsidized ESB orders decreases by 10%

More bearish: Tranche 4 of CSBP continues, Tranche 5 of CSBP and CDHV canceled, BLBD industry-wide market share at 30%, Order wins from CSBP at 27%, Industry-wide North America school bus sales volume increases at 3% CAGR through 2029, incremental unsubsidized ESB orders decreases by 20%

Draconian: CSBP and CDHV programs are completely repealed, BLBD industry-wide market share at 30%, Industry-wide North America school bus sales volume increases at 2% CAGR through 2029, incremental unsubsidized ESB orders decreases by 30%

Worst: CSBP and CDHV programs are completely repealed, BLBD industry-wide market share at 30%, Order wins from CSBP and CDHV at 26%, Industry-wide North America school bus sales volume increases at 1% CAGR through 2029, incremental unsubsidized ESB orders decreases by 40%

Catalysts

Fulfilment of ESB orders from awardees from Tranche 4 of the Clean School Bus Program - Mid to Late 2025

Fulfilment of ESB orders from awardees from the 2024 Clean Heavy Duty Vehicles Program - Mid to Late 2025

Fulfilment of ESB orders from awardees from Tranche 5 of the Clean School Bus Program - Mid 2026

Higher than guided ESB order wins (>30%) from CSBP and CHDV program - Mid to Late 2025

Earnings Print (Potential consensus beat and FY25 guidance raise in Q2/Q3'25) - May/Aug 2025

Risks

Repeal of CSBP and CHDV programs impacting near-term orders of ESBs from school districts (But Tranche 4 of CSBP and CDHV programs will likely not be repealed)

Loss of market share to incumbent school bus OEMs (But historically it has been relatively constant at 1/3 each)

Weaker than expected unsubsidized purchases of ESBs by school districts (But difference in TCO of ESBs and diesel powered buses are reaching cost parity, presents some risk in the near term, but medium term adoption will likely accelerate)

ESG

Leading amongst school bus manufacturers in manufacturing ESBs, which produce <50% of GHG emissions compared to diesel and propane-powered school buses. Transition from manufacturing and selling of diesel to electric school buses also greatly benefits the health of children onboard school buses. (Positive)

Manufacturing of propane and gas school buses may marginally benefit the health of school children but can actually emit more GHG emissions than diesel school buses, negative for the environment. BLBD's propane and gas bus volume sales are likely to increase in the future. (Negative)

Absolute tonnes of CO2 emissions from BLBD have also been declining from 2017 to 2023, which is a positive sign of lowering emissions from their manufacturing processes. While its Overall ESG score has increased recently, it is currently underperforming against a benchmark (Machinery, Tools, Heavy Vehicles, Trains & Ship Industry).

Appendix

Income Statement

Balance Sheet:

Cash Flow Statement:

Revenue Build:

Cost Build:

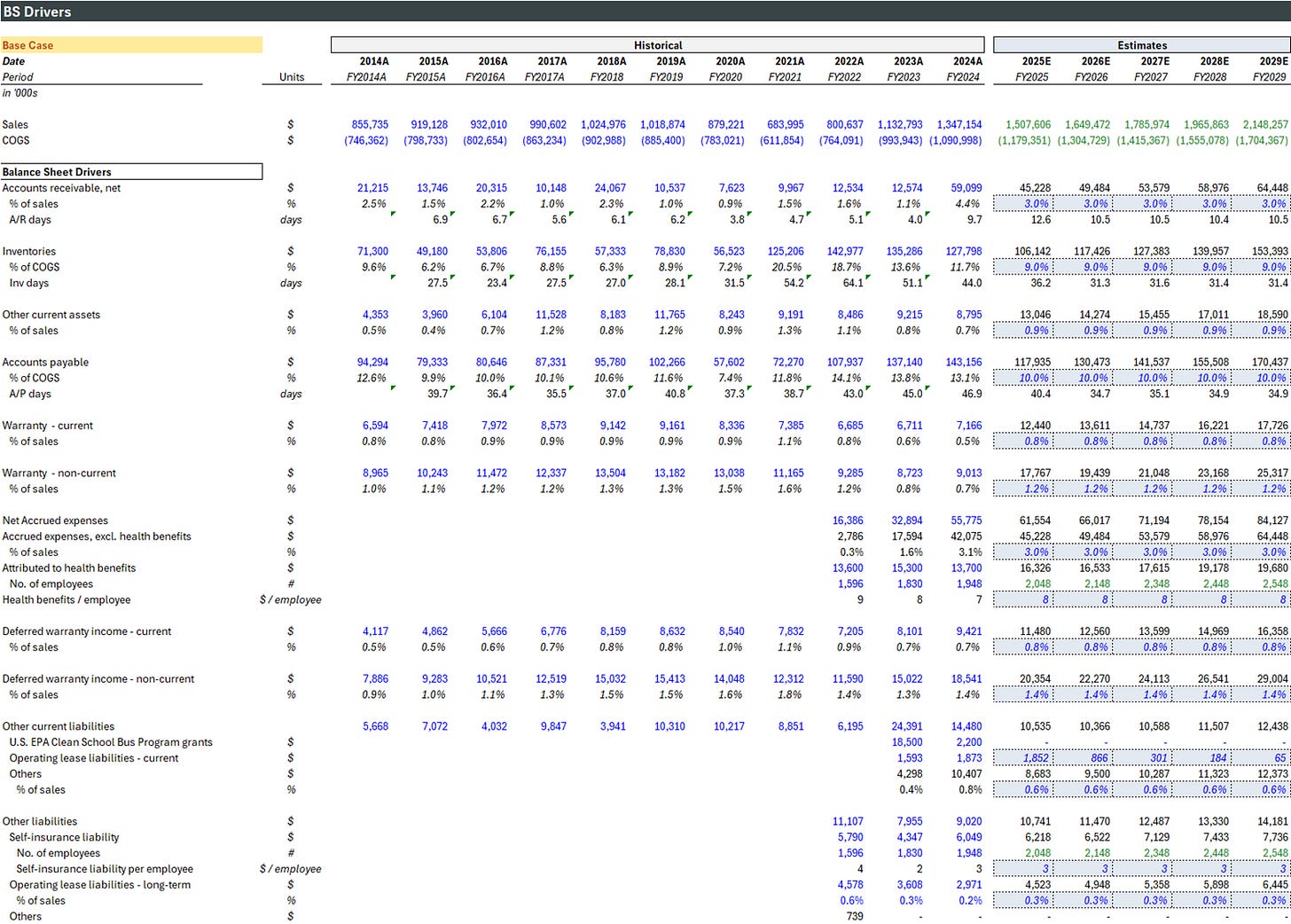

B/S Drivers:

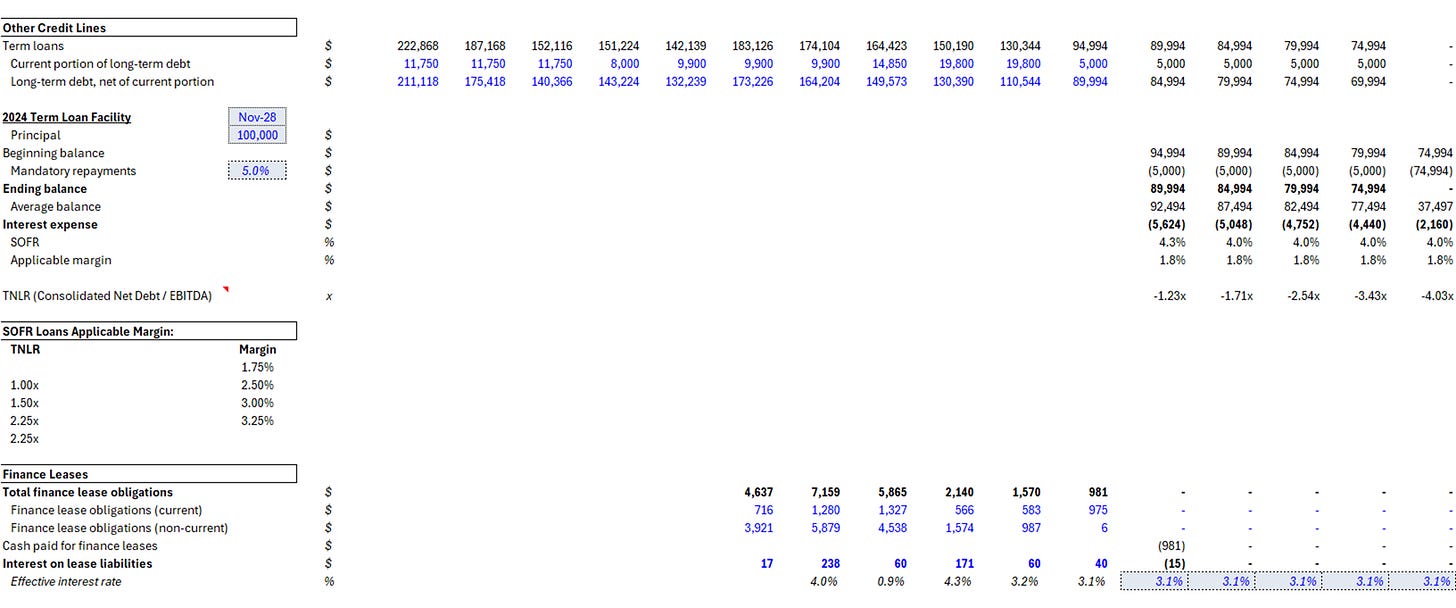

Debt Schedule:

CAPEX Schedule:

Macro Metrics:

CSBP Assumptions

CDHV Program Assumptions

Are you still bullish on BLBD, after the recent updates on EV pause due to tariffs, and uncertainty around round 4+5 funding along with a declining school population???