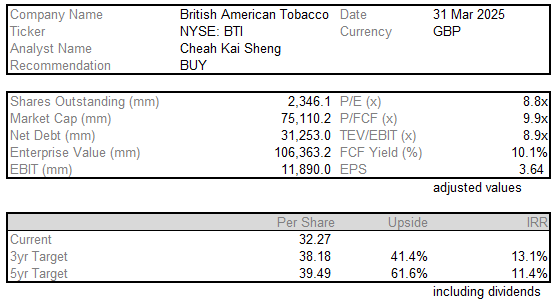

Initial Report: British American Tobacco p.l.c. (NYSE: BTI), 61.6% 5-yr Potential Upside (Kai Sheng CHEAH, EIP)

Kai Sheng CHEAH presents a "BUY" recommendation for British American Tobacco p.l.c. based on its stable cash flows, disciplined capital allocation, and clear strategic roadmap.

Executive Summary

British American Tobacco (NYSE: BTI) is one of the world’s leading tobacco companies, with a market capitalisation of approximately £56 billion and annual revenues of £25.9 billion in FY24, supported by strong pricing power and substantial market share in its core combustibles segment. The company is strategically transitioning its business toward innovative, reduced-risk nicotine products, including e-cigarettes, Heated Tobacco products, and nicotine pouches. As of FY24, smokeless products accounted for 17.5% of BAT’s revenue, indicating steady progress toward its target of 50% smokeless revenue by 2035. In spite of regulatory challenges and changing consumer and public health trends, cash flows from BAT's legacy cigarettes portfolio remain strong, with consistent dividend yields above 7% reflecting solid financial health and effective capital management. Despite regulatory pressures, BAT demonstrates robust cash generation and a promising strategic pivot, making it an attractive BUY opportunity with a three-year upside of 41.4% (including dividend yields) from its current price of £32.27 for a target price of £38.18.

Company Overview

Headquartered in London, British American Tobacco (BAT) operates in the tobacco and nicotine industries across over 180 markets worldwide with a multi-category consumer goods business model focused on both traditional combustible products and an expanding portfolio of (ostensibly) reduced-risk alternatives. The company leverages its extensive global footprint and deeply established supply chain to manage all stages of its value chain – from leaf sourcing and product manufacturing to sophisticated route-to-market capabilities. By directly contracting with tens of thousands of tobacco farmers, BAT maintains quality control over raw materials while promoting more sustainable agricultural practices.

Business Model

Raw Materials & Manufacturing

BAT does not own tobacco farms or directly employ farmers, but sources tobacco leaves directly with around 91,000 farmers and third-party suppliers. Production of BAT’s core Combustibles product line, comprising their cigarette products, takes place in 37 fully owned and fully integrated manufacturing facilities across 35 countries, ensuring proximity to key markets and cost efficiency. Although BAT operates 6 manufacturing facilities for New Category products, namely Snus, Modern Oral, and Liquids, BAT outsources the production and assembly of New Category device components to third-party manufacturers.

Distribution & Sales

BAT uses a mix of direct distribution (where it manages logistics and supply internally) and third-party distributors, depending on market size, regulatory environments, and local infrastructure. In many countries, BAT owns or partially controls the downstream supply chain, further reinforcing its vertically integrated model.

BAT abides by Responsible Marketing Principles, focusing its marketing solely on adult consumers. The Company’s marketing channels include traditional retail, digital platforms, and e-commerce sites. Direct-to-consumer online sales have expanded BAT’s consumer reach and provide valuable data on buying trends.

Business Segments

BAT’s product portfolio is divided into two main areas – Combustibles and Smokeless.

Combustibles

The Combustibles product category chiefly consists of BAT’s legacy core cigarette brands, namely its Global Drive Brands (Dunhill, Kent, Lucky Strike, Pall Mall, and Rothmans) as well as regional brands (notably Newport, Natural American Spirit, and Camel in the US market), comprising 97% of the Combustibles portfolio by revenue and volume in FY24.

Other Tobacco Products (OTP), comprising roll-your-own, make-your-own, pipe tobacco, and cigars in select regions, constitute the remaining 3%.

The Company’s combustibles portfolio remained the largest revenue contributor at £20,685 million (80% of the total).

Smokeless (New Categories + Traditional Oral)

Products in the Smokeless category are generally marketed as Reduced-Risk Products (RRPs) compared to Combustibles, although there is no universal scientific consensus confirming a definitive lower risk relative to traditional cigarettes.

The Vapour category includes devices that heat an e-liquid to produce an inhalable aerosol. BAT’s Vuse brand leads the global vapour market, holding a 40.0% market share by revenue in legal, tracked channels in FY24. Despite facing a 1.2% market share decline YoY, Vuse remains the dominant legal brand in spite of regulatory challenges, including flavour bans and competition from illicit single-use products. In FY24, Vuse generated £1.72 billion in revenue, chiefly from the US and AME regions, and was the largest revenue category after Combustibles. APMEA presents a significant growth opportunity for BAT as it currently contributes only 4.3% of the company's global Vapour revenue while maintaining a strong year-on-year growth rate of 19.1%. The current proliferation of illegal flavoured and single-use products in the emerging markets of APMEA also presents potential growth opportunities for BAT’s Vapour segment as there may be regulatory crackdown on traditional cigarettes and illicit Vapour products in the short-to-medium term as health awareness around tobacco use improves in emerging markets, opening demand for established, legal Vapour brands like BAT’s Vuse.

The Heated Products or Heated Tobacco category consists of tobacco heating devices which heat tobacco sticks or herbal-based consumables instead of burning them, thus reducing certain toxicants. BAT’s glo brand remains a smaller player compared to competitors in this space, with -7.6% overall revenue growth and -0.4% market share growth in Top markets (i.e. the largest markets for this category) to reach 16.7% in FY24, in part due to the sale of BAT’s operations in Russia and Belarus. However, glo managed to grow its revenue and market share in Japan, highlighting BAT’s ability to enhance its device offerings to capture growth in key markets in spite of stiff competition from the other nicotine majors.

The Modern Oral category features non-tobacco oral pouches sold under BAT’s Velo and Grizzly Modern Oral brands, which saw 55.0% global volume growth, chiefly in the US and AME regions, with volume share in Top markets rising 1.3% to 28.4%. Given its leading market position, BAT is poised to benefit greatly as Modern Oral products become more established in all three regions as discreet, smoke-free alternatives. Notably, volume in APMEA increased by 16.8% and revenue grew by 5.7%, despite the region contributing only 4.3% of BAT’s global Modern Oral revenue. This underscores BAT’s significant opportunity to expand and capture growth in emerging markets for Modern Oral products.

Lastly, the Traditional Oral category includes American moist snuff brands like Grizzly and Kodiak alongside Swedish-style snus under the Camel Snus brand. The US market, which accounts for 96.9% of BAT’s Traditional Oral revenue, remains a major Group revenue driver, contributing £1,058 million in FY24. However, the Traditional Oral segment faced -6.0% revenue and -8.2% volume growth in FY24, reflecting the ongoing consumer shift towards Modern Oral products. These unfavourable long-term trends have led BAT to recognise an impairment charge of £646 million to the carrying value of Camel Snus, while Camel Snus will be assigned a 20-year useful economic life (formerly indefinite) from FY25 onwards, incurring a £23 million annual amortisation cost.

BAT manages its business through three key geographic regions:

United States (US): BAT’s largest market overall, contributing the most revenue among BAT’s three regions for Combustibles, Vapour, and Traditional Oral.

Americas and Europe (AME): A broad region spanning both high-margin, more developed markets (Western Europe) and fast-growing emerging markets (Eastern Europe, South and Central America). AME contributes the most revenue for BAT’s high-demand-growth Modern Oral category, with share growth opportunities for Vapour.

Asia-Pacific, Middle East & Africa (APMEA): A broad region containing developed markets like Japan and South Korea, as well as large and high-growth emerging markets such as Pakistan, Bangladesh, Indonesia, and Vietnam. APMEA contributes the most revenue for BAT’s Heated Products category, with huge market and share growth opportunities for Vapour and Modern Oral.

In FY24, total Group revenue was down 5.2% YoY (or 0.5% on a constant currency basis) to reach £25,867 million. The US contributed 43.6% of Group revenue, while AME contributed 35.7% and APMEA contributed 20.7%. FY24 performance was dragged down by the sale of operations in Russia and Belarus, which caused a drag on revenue by £479 million.

Revenue Drivers

Resilient Combustibles price/mix

Combustibles volume was down 9.0% overall in FY24, dragged down by a 10.1% drop in the US, the largest market. However, Combustibles revenue was down only 1.6% at constant currencies due to a favourable price/mix of +5.3% (at constant currencies, revenue rose by 0.1% while volume fell by 5.2% excluding the impact of the sales of operations in Russia and Belarus).

Despite the volume decline, BAT recorded a 50-basis-point increase in its U.S. premium volume share, propelled primarily by strong performance from Newport soft-pack and Natural American Spirit. BAT’s strategic price increases on higher-tier cigarette brands thus helps to offset industry-wide volume declines. The resilient price/mix shown by BAT’s Combustibles segment is reassuring given that Combustibles delivers ~80% of BAT’s revenue.

Transition away from Combustibles to Smokeless products

New Categories revenue grew by 6.1% at constant currencies, with growth across all three regions. Notably, APMEA has seen significant volume growth in New Categories products,

BAT's total revenue from New Categories was £3,432 million, or 13.3% of overall Group revenue.

Continued strong global volume growth (up 55.0%) in the Modern Oral product category, with BAT’s category volume share in Top markets for Modern Oral up 1.3 ppts to 28.4%. Volume share leadership in Modern Oral in AME remained dominant at 64.7%, with continued market leadership (through Velo) in 21 European markets

To diversify the company away from the controversial and risky Combustibles segment, BAT targets to achieve 50% of revenue from Smokeless products by 2035. Smokeless products contributed 17.5% of revenue in FY24 and 16.5% in FY23, while Smokeless product consumers grew by 14.4% in FY24 and 14.3% in FY23.

The New Categories segment as a whole became profitable on a contribution basis in FY23, two years ahead of schedule.

Cost Drivers

Raw Materials and Consumables

BAT’s primary cost driver, raw material and consumable costs, increased by 0.4% to £4,565 million in FY24, compared to £4,545 million in FY23.

BAT is exposed to agricultural volatility, an industry risk, which may drive up tobacco prices if adverse weather events occur in the future. However, this has not materially affected BAT in FY24.

Inflationary Pressures

BAT faced a 6.5% cost inflation valued at £387 million in inflation-related cost increases in FY24, primarily due to rising tobacco leaf costs as well as labour and energy costs.

Foreign Exchange

BAT experienced a negative FX impact on costs due to currency volatility. The transactional foreign exchange loss amounted to £136 million in FY24 and £293 million in FY23.

Employee Benefit Costs

Employee costs increased by 6.3% to £2,831 million in FY24, up from £2,664 million in FY23. This was primarily due to salary growth, especially in the US, where BAT expanded its workforce to support growth in New Categories. Despite the cost increase, BAT actually reduced its Group headcount from 49,839 employees in FY23 to 48,209 in FY24.

Depreciation, Amortisation, and Impairments

Depreciation and amortisation expenses were £3,101 million in FY24, a sharp decline from £28,614 million in FY23. FY23's anomalous figure was heavily impacted by a significant impairment charge on BAT's US Combustibles brands as unfavourable consumer trends caused management to recognise the diminished long-term value of their US portfolio.

In FY24, BAT incurred additional impairment costs of £646 million related to Camel Snus as consumer preferences shifted toward Modern Oral alternatives.

Regulatory and Litigation Costs

In FY24, BAT faced several large, one-off charges, including £6.2 billion for ongoing litigation in Canada, £449 million from an excise tax assessment in Romania, and £149 million in fixed asset impairments related to the Group’s exit from Cuba and other restructuring costs. Such regulatory and legal challenges remain a significant cost consideration for BAT, especially given its reliance on its core Combustibles portfolio, which faces greater regulatory pressure on a public health basis as compared to its Smokeless products portfolio, which currently comprises only 17.5% of revenue.

ESG Considerations

ESG scores for BAT span a wide range across the different ESG ratings agencies. Sustainalytics assigned BAT an ESG Risk Rating of 30.3 (High risk), though it ranks above average within its industry group at 202 out of 563. MSCI maintained its rating of BAT at A on a scale from AAA to CCC, an upper average score. S&P Global rated BAT’s ESG performance most favourably, assigning an ESG Score of 68/100, highlighting BAT’s 'very high' data availability and significant peer outperformance in Environmental and Social aspects.

To reduce the health impact of its products, BAT has adopted a long-term strategy of accelerating its transition towards RRPs by expanding their New Categories portfolio and gradually reducing reliance on their core Combustibles portfolio. In FY24, BAT invested £380 million in R&D to enhance these offerings. By 2035, it aims to generate 50% of Group revenue from Smokeless products and reach 50 million consumers by 2030. Scientific validation remains a priority, with BAT conducting extensive in-house research and engaging external scientists to substantiate the harm reduction potential of its products. Platforms like Omni provide transparency to consumers regarding the scientific data supporting these claims.

On the environmental front, BAT has set ambitious targets to reduce its carbon footprint. The Company is committed to achieving a 50% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, with further reductions in Scope 3 emissions under validation by the Science Based Targets initiative. Notably, its German manufacturing site reduced emissions by 41% in FY24 through biomass boilers and solar PV installations. BAT is also advancing its circular economy commitments, with 97% of its packaging materials now recyclable, reusable, or compostable. Initiatives such as Vapour pod recycling schemes further demonstrate its dedication to reducing plastic waste. Additionally, BAT is pursuing Deforestation and Conversion Free status across all contracted tobacco leaf suppliers by 2025 and has implemented water management standards in water-stressed regions to minimize consumption.

Social responsibility remains a core priority for BAT, reflected in its extensive efforts to support agricultural communities, foster economic resilience, and uphold human rights. The Company directly contracts with approximately 91,000 farmers globally through its Thrive Supply Chain programme. This initiative offers comprehensive support by providing technical guidance, promoting sustainable agricultural practices, and encouraging crop diversification to ensure farmers achieve resilient incomes. In FY24, 94% of contracted farmers successfully diversified their income sources, enhancing their financial stability. BAT’s commitment to social development extends to addressing water scarcity and improving access to clean drinking water. Through its Probaho initiative in Bangladesh, BAT has installed 126 filtration units that supply 620,000 litres of clean water per day to over 310,000 people across 25 districts. This programme, now in its fifteenth year, has become a cornerstone of the Company’s community support efforts.

Empowering women within the agricultural sector is another key focus. In Kenya, BAT launched a women’s development programme aligned with the UN’s Women’s Empowerment Principles, providing financial literacy, entrepreneurship training, and agricultural skills to over 600 participants. In Vietnam, a similar initiative has supported more than 130 women with interest-free loans to establish small businesses and improve livelihoods.

On the governance front, BAT enforces rigorous governance standards through its Standards of Business Conduct (SoBC) and Global Supplier Code of Conduct (SCoC). In FY24, BAT conducted 417,600 human rights training sessions across its supply chain, focusing on eliminating child labour, ensuring fair wages, and promoting safe working conditions. The Group Code of Human Rights in Tobacco Farming, introduced in FY24, further strengthens these commitments by aligning with international standards such as the UN Guiding Principles on Business and Human Rights.

Grievance mechanisms are a critical component of BAT’s human rights framework. In FY24, 97.96% of farmers and farm labourers reported access to at least one grievance mechanism. The Company successfully resolved all 307 grievances raised during the growing season, demonstrating its commitment to maintaining fair and just working conditions.

To combat illicit trade, BAT employs stringent Anti-Illicit Trade Compliance Procedures. The Company’s dedicated Forensic and Compliance Team collaborates with law enforcement agencies to investigate and mitigate counterfeiting and product smuggling. Advanced monitoring tools like the Empty Pack Survey provide insights into illicit trade activities, further supporting BAT’s efforts in safeguarding its legitimate supply chain.

BAT’s governance model also includes comprehensive financial crime compliance measures. The Company has implemented a Third-Party Anti-Financial Crime Procedure and a Sanctions Compliance Framework to mitigate risks associated with bribery, corruption, and money laundering. In FY24, BAT launched enhanced compliance training for employees in regions with heightened sanctions exposure, reinforcing a robust culture of ethical conduct.

Competitor Analysis

The global tobacco and nicotine market is valued at around US$927 billion, with Combustibles (~US$763 billion) remaining the largest segment, followed by Smokeless products (~US$76 billion). BAT operates in a highly concentrated oligopolistic global market with five other major players, namely Philip Morris International (PMI), Japan Tobacco International (JTI), Altria Group, Imperial Brands, and the state-owned China National Tobacco Corporation.

Philip Morris International (PMI)

PMI is the largest global nicotine company ex-China, with leading market shares in multiple geographies, chiefly Europe, Japan, and Korea. Notably, PMI is the global market leader in reduced-risk, i.e. Smokeless products, which comprised 39% of PMI’s revenue in FY24, significantly greater than BAT’s 17.5% share. PMI’s IQOS dominates Heated Tobacco with a ~60% global market share and has accelerated the shift away from cigarettes in European markets, while PMI’s acquisition of Swedish Match in 2022 significantly expanded its presence in Modern Oral (via ZYN). Its expansion of IQOS in Europe has accelerated the shift away from cigarettes in certain markets. PMI’s early and successful pivot towards Smokeless products coupled with the continued strength of its Combustible portfolio reinforces PMI’s status as the global nicotine major best positioned to weather the expected worldwide regulatory tightening for Combustibles due to public health concerns and to capture the growing market for Smokeless products.

Japan Tobacco International (JTI)

JTI is the third-largest global tobacco company by total revenue and volume, with strong market share in Japan, parts of Europe, and Central Asia, and a growing presence in emerging markets with cost-competitive brands.

JTI has made significant investments in reduced-risk products such as Heated Tobacco and e-cigarettes to compete with existing market leaders such as PMI’s IQOS and BAT’s glo. For instance, JTI’s heated product, Ploom, has grown in Japan and selected European countries to capture ~12% share of global Heated Tobacco.

Altria Group

Altria is the fourth-largest global nicotine player, with a predominantly U.S.-centric presence. ~42% volume share in the U.S. cigarette market. Altria’s key strength is its dominance in the US cigarette market via flagship brands such as Marlboro, holding a ~42% volume share. Altria also offers Modern Oral products (such as on!), but is belatedly playing catch-up in other, larger reduced-risk product categories such as the Vapour segment, where Altria’s investment in Juul failed to deliver returns due to intense regulatory scrutiny, as well as the Heated Tobacco segment, where Altria lacks a product altogether.

Imperial Brands

Imperial is the fifth-largest global nicotine firm, with a strong footprint in Western Europe, Africa, and the Americas. However, Imperial’s Combustibles market share, its core product category, has remained stagnant even in its core geographies, while it has struggled to capture significant market share in Smokeless product categories. Imperial’s attempt to enter the Vapour category in Europe and the US (via blu) faltered from a once-leading position as it failed to retain market share against brands such as PMI’s Vuse, while its presence in the Heated Tobacco and Modern Oral product categories has failed to grow beyond small-scale rollouts and consumer trials. In recent years, Imperial has adopted a strategy of focusing on its profitable Combustibles portfolio instead of competing in the Smokeless product categories, which represent low-single-digit percentages of Imperial’s revenue.

China National Tobacco Corporation (CNTC)

Despite being the largest nicotine company by revenue and volume globally, CNTC remains focused on domestic sales in China and maintains a minimal international presence, primarily in Southeast Asia and Africa. Exports are not a priority as CNTC’s primary mandate as a state-owned monopoly is to meet domestic demand and state oversight over tobacco farming, manufacture, and sales remains strict. China’s huge domestic demand also dwarfs opportunities in smaller export markets and reduces any motivation for CNTC to expand abroad. Also, CNTC’s ability and willingness to pivot to Smokeless products has been limited by consumer preferences in China (heavily favouring Combustibles) as well as regulatory constraints. As such, in the medium term, CNTC is unlikely to pose a significant threat to the other global nicotine majors.

Investment Theses

Leadership and Accelerating Growth in New Categories Products

BAT is undergoing a strategic transformation toward a multi-category nicotine business, and is currently the second-largest player in the reduced-risk product space after PMI. In FY24, BAT’s Smokeless segment, which includes Vapour, Heated Products, and Modern Oral, generated 17.5% of total Group revenue, up from 16.5% in FY23 and 15.5% in FY22. This reflects 8.9% organic YoY revenue growth despite regulatory challenges in markets like Mexico, which banned Vapour products such as BAT’s Vuse. Looking ahead, BAT has stated its ambition for 50% of Group revenue to come from Smokeless products by 2035. The Company’s progress in New Categories, its diversified global footprint, and strong brand equity in both legacy and emerging products position it to take advantage of the long-term structural shift away from combustibles.

BAT’s New Categories growth is currently being driven particularly by Modern Oral, which recorded revenue growth of 40.3% in the AME region and an impressive 223% in the US. Global Modern Oral consumers reached 7.4 million in FY24, marking a 54.2% year-on-year increase. BAT also leads in Vapour devices, the largest New Categories segment, with a 50.2% value share in the US and 59.9% value share in AME for the rechargeable segment. Despite a 2.6% constant currency decline in Vapour revenue, driven by regulatory restrictions and illicit market activity in North America, BAT’s innovation pipeline (e.g., Vuse Go Reload and new device formats) positions it well to recapture growth once regulatory conditions stabilise, while APMEA presents a high-volume growth opportunity in the medium-to-long term.

Among its global peers, BAT ranks second only to PMI in terms of revenue contribution and market share from New Categories products. While PMI maintains a lead, particularly through the commercial success of IQOS in the Heated Tobacco segment, BAT has built a strong multi-category portfolio among Smokeless products. These brands are increasingly gaining traction in key markets. Given the structural decline in combustibles and the high-growth trajectory of reduced-risk alternatives, BAT is strategically well positioned to expand its footprint and capture substantial value from the New Categories segment, which is expected to grow at a 4.4% CAGR until 2030.

Strong Pricing Power and Combustibles Price/Mix Resilience

BAT continues to exhibit exceptional pricing power, fundamental to maintaining profitability despite global declines in cigarette volumes. BAT's Combustibles portfolio features a range of well-established and premium brands that enjoy significant brand loyalty, particularly in the U.S. Given the typically high brand stickiness among smokers, especially for premium products, BAT is well-positioned to mitigate the financial impact of the broader decline in Combustibles demand driven by public health initiatives and changing preferences among younger consumers. BAT’s proven ability to safeguard its Combustibles revenues and counteract volume decline by increasing prices, evident from its favourable price/mix metric (+5.3% in FY24), underscores BAT’s resilience to long-term global trends affecting the traditional cigarettes market. Given the short-term reliance of BAT on its Combustibles portfolio, which contributes ~80% of Group revenue, BAT shows promise in being able to transition production and sales to New Categories without a significant adverse impact on its top and bottom lines.

Attractive Dividend Yield and Commitment to Shareholder Returns

BAT offers investors a highly attractive dividend yield, currently standing at 7.4%. In FY24, the dividend per share amounted to £2.40, representing a payout ratio of ~64%, comfortably supported by a strong underlying cash generation business model. In successive Annual Reports, BAT has pledged to distribute 65% of sustainable long-term earnings as dividends to shareholders, which it has largely adhered to in recent years. Even when BAT sustained huge non-cash impairments amounting to £4.3 billion in goodwill and £23.0 billion in the carrying value of its US Combustibles portfolio in FY23, its operating cash flows were not significantly affected, allowing BAT to maintain a payout ratio of over 62% and consistently growing their dividends per share by +2.0% from FY22 to FY24 despite market volatility, impairment charges, and regulatory challenges. This reflects management’s commitment to disciplined capital allocation, rewarding shareholders through sustained dividends and providing ample cash reserves for opportunistic share buybacks if the stock drops significantly.

ESG Theses

Improved Revenue Resilience via Leadership in RRPs

BAT’s accelerated shift towards next-generation, potentially less harmful products significantly enhances its ESG profile. In FY24, approximately 17.5% (£3.4 billion) of BAT’s total revenue derived from Vapour, Heated Tobacco, and Modern Oral products. This strategic shift aligns with public health objectives, demonstrating BAT’s commitment to harm reduction and improving societal impact. Given the rapid growth and consumer acceptance of these products, BAT is likely to attain its 2030 goal of achieving over £5 billion annual revenue from New Categories. This shift will also allow BAT to avoid regulatory scrutiny and reduce the incidence and severity of one-off impairment and litigation costs, which has especially plagued BAT in FY23 and FY24. As such, BAT’s proactive ESG efforts complement its efforts to increase business resilience amid changing global health and consumer trends.

Ambitious Climate and Environmental Goals

BAT’s comprehensive climate strategy addresses critical environmental concerns with concrete targets. The company aims for carbon neutrality by 2030 (Scope 1 and 2 emissions) and net-zero across its entire value chain by 2050, in line with the Paris Agreement targets. Notably, BAT has achieved a 30% reduction in emissions from its direct operations since 2017, demonstrating credible progress. Its robust environmental governance includes a detailed roadmap involving renewable energy adoption, sustainable packaging, and responsible agriculture practices. These commitments position BAT favorably among sustainability-focused investors seeking exposure to companies making tangible climate commitments, potentially offsetting the stigma of operating in a sin industry, which might hamper the inclusion of BAT in consumer-facing funds and investment products.

Strong ESG Disclosure and Compliance with Evolving Standards

BAT demonstrates strong leadership in ESG transparency and compliance, as recognised by rating agencies such as S&P Global which rate BAT very highly in terms of ESG data availability as well as in peer performance. The company's disclosures align closely with globally recognized frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), Global Reporting Initiative (GRI), and the EU Corporate Sustainability Reporting Directive (CSRD). BAT’s proactive alignment ensures that it remains ahead of regulatory trends, minimising compliance risks and capitalising on emerging opportunities from sustainability-driven investment flows.

Valuation

I used a two-stage dividend discount model to represent BAT’s growth prospects in its New Categories portfolio in all three regions, especially APMEA, although there is inherent business execution risk. I assumed a cost of equity of 6.93%, long-term ROE of 16.07%, and long-term dividend payout ratio of 65.0% based on historical data.

I assumed a long-term growth rate of -1.0% based on the expected gradual decline in Combustibles to be offset by medium-to-long term growth in New Categories. I used such a conservative estimate to capture a pessimistic Western-centric outlook on the long-term prospects of sin industries such as the tobacco & nicotine industry which BAT operates in, understandable considering the greater level of scientific dissemination and public health awareness of the dangers of tobacco use. However, I believe that projecting a -1.0% long-term growth rate prices in a sizable margin of safety given the enormous untapped potential in the emerging markets of Asia, the Middle East, Africa, and South America. These markets have youthful demographics, rapidly rising disposable incomes, less robust public health awareness and political willpower, and high potential for penetration by BAT's various New Categories product lines, given the lack of established premium brand presence with the notable exception of PMI's product lines as PMI is the clear leader among the nicotine majors in terms of global market share across all nicotine product categories.

Lastly, I gave BAT a 5-year runway where they could achieve a superior ROE of 20.0% if their regional units execute expansion plans successfully, as did BAT's Japan unit. Given these inputs, I found BAT’s intrinsic value to be £36.90 or US$47.24, giving it a 12.6% upside at today’s price of US$41.30.

I believe relative valuation is not appropriate for valuing BAT as there are key differences among the nicotine majors.

Altria operates almost exclusively in the US market, lacking overseas growth exposure. JTI lacks the degree of overseas diversification enjoyed by PMI and BAT while also being exposed to significant geopolitical risk due to its operations in Russia.

In the RRP space, Imperial and JTI are both far behind the two dominant players, PMI and BAT. Even then, PMI's revenue share from Smokeless products stands at 39.0% in FY24, eclipsing BAT at 17.5%.

Altria and BAT in particular have been saddled with heavy past and ongoing litigation and impairment costs, while PMI has managed to avoid similar penalties, or at least has not reflected these concerns in their accounting. Therefore, it is not particularly useful to value BAT via peer comparison given its unique circumstances.

To build its global portfolio, BAT has pursued an aggressive acquisition strategy, most notably of Reynolds American Inc in 2017 for $49.4bn. This is a much more aggressive approach than PMI, which has built its brand portfolio value more organically. This is reflected by BAT having 79.3% of its total assets in intangible assets versus 45.1% for PMI. Therefore, BAT is more vulnerable to impairment risks and demand shocks than PMI, which dampens investor sentiment around BAT. It is thus not surprising that PMI's P/E ratio (currently 35.7) has been consistently and significantly higher than BAT's (currently 22.3).

Conclusion

British American Tobacco presents a compelling investment opportunity, underpinned by stable cash flows, disciplined capital allocation, and a clear strategic roadmap for long-term transformation. Although the company remains dependent on Combustibles in the near term, it has demonstrated consistent execution in expanding its New Categories portfolio, particularly in Modern Oral and Vapour. This positions BAT to benefit meaningfully from the structural shift toward reduced-risk products as consumer preferences evolve and regulatory scrutiny intensifies.

The company's strong pricing power, especially in premium Combustibles markets such as the United States, continues to support resilient margins and offset volume declines. At the same time, BAT’s commitment to shareholder returns is evident in its consistent and well-covered dividend, supported by healthy free cash flow generation and efficient cost management.

From an ESG perspective, BAT is actively repositioning itself through ambitious climate goals, enhanced social and environmental programmes, and consistently high transparency. These efforts, together with its pivot toward products with lower harm potential, reflect a broader shift toward sustainability and long-term business resilience against regulatory and social risks.

Considering its relatively low valuation, growing revenue contribution from New Categories, and continued progress on ESG initiatives, BAT offers investors a blend of income, defensive stability, excellent ESG performance, and long-term growth opportunities. While regulatory and execution risks persist, they appear to be largely priced into the stock, presenting a significant upside opportunity as long as BAT advances its transformation and expansion strategies.

Love the divi yield