Initial Report: Brookfield Corp (NYSE: BN), 236% 5-yr Potential Upside (Tong How Cheng, VIP)

Tong How Cheng presents a "BUY" recommendation based on management's proven track record and strong expected future growth in Distributable Earnings.

“We buy, build and own the backbone of the global economy.”

- Bruce Flatt, CEO of Brookfield Corp

Executive Summary

Brookfield is a leading global alternative investment firm that is led by proven capital allocators with sound investment principles. Brookfield has strong runways for future growth in its Asset Management and Wealth Solutions business. Furthermore, as of March 2025, the market value of Brookfield stock is significantly below the intrinsic value of its investments. This makes Brookfield a compelling investment for the long-term.

Company Overview

Brookfield is a leading global alternative investment firm focused on building long-term wealth for institutions and individuals around the world. Brookfield has one of the largest pools of discretionary capital globally, with around $155 Billion of their own perpetual capital, around $110 Billion of insurance float and around $1 Trillion of Assets Under Management (AUM) as of September 2024. This capital is deployed across Brookfield’s three core businesses— Asset Management, Wealth Solutions, and Operating Businesses. Through their core businesses, they aim to buy, build and own assets and businesses that form the backbone of the global economy. Over the long term, they are focused on delivering 15%+ annualized returns to shareholders.

Asset Management ($1.9B of Distributable Earnings (DE) as of FY2024)

Brookfield’s Asset Management (BAM) business is one of the leading global alternative asset managers, with around $1 Trillion in AUM as of September 2024. The business invests capital across alternative assets like infrastructure, renewable power and transition, real estate, private equity and credit. The business invests client capital for the long term with a focus on real assets (e.g. real estate, infrastructure) and essential service businesses that form the backbone of the global economy. BAM clients include some of the world’s largest institutional investors, such as sovereign wealth funds, pension plans, endowments etc.

Brookfield earns management fees on the capital they manage for their clients and carried interest based on fund performance. Furthermore, more often than not, Brookfield also invests their own perpetual capital into their own funds, alongside their clients, to reap the returns of their funds.

Wealth Solutions ($1.4B of Distributable Earnings (DE) as of FY2024)

Brookfield Wealth Solutions is focused on securing the financial futures of individuals and institutions through a range of retirement services, wealth protection products and tailored capital solutions. Through their operating subsidiaries, they offer a broad range of retirement products and services, such as annuities and pension risk transfer. The business seeks to generate attractive risk-adjusted returns on equity of 15%+ over the long term by investing predominantly in credit products to earn an investment return that exceeds its cost of liabilities.

Operating Businesses ($1.6B of Distributable Earnings (DE) as of FY2024)

Renewable Power and Transition, Infrastructure, and Private Equity

Brookfield’s investments in Renewable Power and Transition, Infrastructure, and Private Equity serve as publicly listed permanent capital vehicles that also act as their primary vehicles for making commitments to the private funds of Brookfield’s asset management business. Each of these businesses share key characteristics—highly diversified by sector and geography, generating stable and often inflation-linked revenue streams, high cash margins, market leading positions, high barriers to entry and opportunities to invest additional capital to enhance returns—all of which enable Brookfield to generate very attractive risk-adjusted returns on capital.

The Renewable Power and Transition business owns diverse and high-quality assets across multiple continents and technologies including hydroelectric, wind, utility-scale solar, and distributed energy and sustainable solutions investments. Brookfield’s capital in this business is primarily via their 45% ownership interest in Brookfield Renewable Partners (NYSE: BEP) for which Brookfield receives quarterly distributions.

The Infrastructure business is one of the world’s largest infrastructure investors and owns and operates assets across the utilities, transport, midstream and data sectors. Brookfield’s capital in this business is via their 26% ownership interest in Brookfield Infrastructure Partners (NYSE: BIP) for which Brookfield receives quarterly distributions.

The Private Equity business focuses on owning and operating high-quality businesses that provide essential products and services, and are resilient through market cycles. Brookfield’s capital in this business is via their 66% ownership interest in Brookfield Business Partners (NYSE: BBU) for which Brookfield receives quarterly distributions.

Real Estate

Brookfield’s Real Estate business is a diversified global real estate portfolio that owns and operates premier office, dominant retail, luxury urban retail and hotels, and multi and single-family residential properties in some of the best locations around the world. It has a history of strong performance over long periods of time and through economic cycles.

Brookfield’s capital in this business is via 100% ownership stake in Brookfield Property Group (BPG). BPG consists of an irreplaceable portfolio of premier properties in global gateway cities (“core”), and a portfolio designed to maximize returns through a development or buy-fix-sell strategy (“transitional and development”), including Brookfield’s capital invested in their North American residential business.

Investment Thesis

Brookfield is led by proven capital allocators with sound investment principles.

Bruce Flatt, the current CEO of Brookfield, started working at Brookfield (then named Brascan) in their investment division in 1990 when it was still primarily an industrial conglomerate involved in sectors like real estate, timber and mining. He then became the CEO of Brookfield Properties in 2000, and then CEO of the entire Brookfield Corporation in 2002. Under his leadership, Brookfield transformed from being an industrial conglomerate to become a leading global alternative investment manager. He has often been referred to as "Canada's Warren Buffett" due to his "value" investment style focused on cash flows and profitability, extended tenure as Brookfield CEO, and his large investment in Brookfield (majority of his wealth is in Brookfield stock).

Under Bruce, a key set of core investment principles were established and these core principles underpins all of Brookfield’s investment decisions. These core principles are:

Acquire high-quality assets and businesses

Invest on a value basis, with the goal of growing cash flows and compounding capital

Enhance the value of investments through Brookfield’s operating expertise

Build sustainable cash flows to provide certainty, reduce risk and lower their cost of capital

Allocate the free cash flows received to enhance value for shareholders

By using these core investment principles to allocate their capital, Brookfield shares have compounded at an impressive CAGR of 18% over the last 30 years.

Furthermore, in 2019, Brookfield acquired a controlling stake in Oaktree Capital Management, an asset management firm specialising in private credit investing led by legendary investor Howard Marks. Marks is now one of Brookfield’s board of directors. Marks has a spectacular track record, generating average annual returns of around 19% in his funds since 1995. This spectacular track record is backed by sound investment principles honed through many years of investing. This acquisition of Oaktree greatly improves Brookfield’s investment capabilities as it allows for Brookfield to tap on the expertise and experience of Oaktree and Marks.

Expected strong future growth in Distributable Earnings (DE) driven by growing AUM for BAM and growth in Wealth Solutions Business.

Among institutional investors, there is this growing shift towards alternative investments over the last 2 decades. According to a UBS survey, state and local government pension funds have significantly increased allocations to alternative investments - from 9% in 2001 to 34% in 2022 - while reducing exposure to more traditional asset classes like public equities and fixed-income. This is because alternative investments, particularly private assets and real assets, offer high and reliable returns without the volatility of the public markets. Brookfield Asset Management (BAM) can capitalise on this institutional shift towards alternatives to grow its AUM in the coming years. In fact, BAM expects to grow their AUM to $2 Trillion over the next 5 years. This growth in AUM is expected to lead to growing management fees and carried interest for BAM, contributing to strong growth in Brookfield’s DE in the coming years.

Furthermore, Brookfield also expects to grow the insurance float from its Wealth Solutions Business from around $110 Billion in 2024 to around $300 Billion in 2029. Brookfield aims to do this through acquisitions of companies and entering the annuities and pension risk transfer markets of countries with an ageing population (E.g. Japan, Europe etc.). This increase in insurance float will allow Brookfield to generate larger amounts of DE from its Wealth Solutions Business, contributing to strong growth in Brookfield’s DE in the coming years.

If all goes according to plan, Brookfield expects to grow DE by a CAGR of around 25% from 2024 to 2029.

Valuation

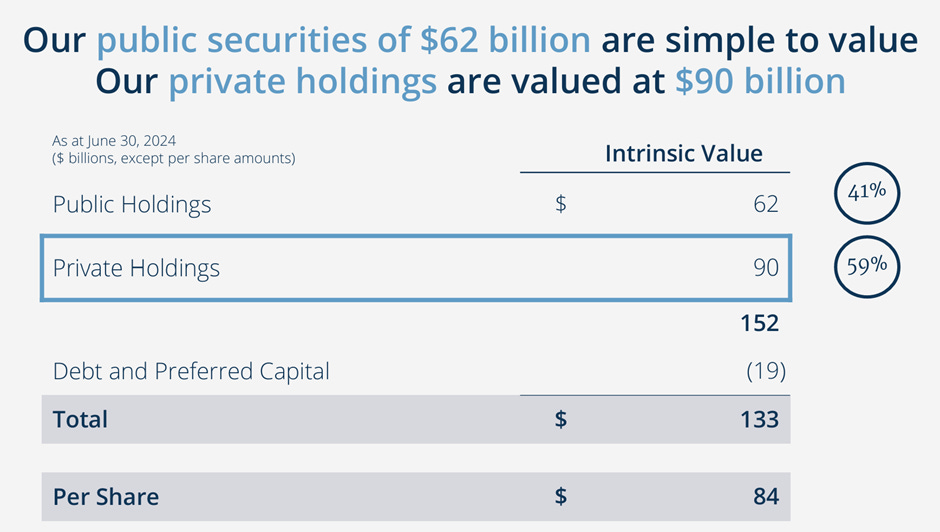

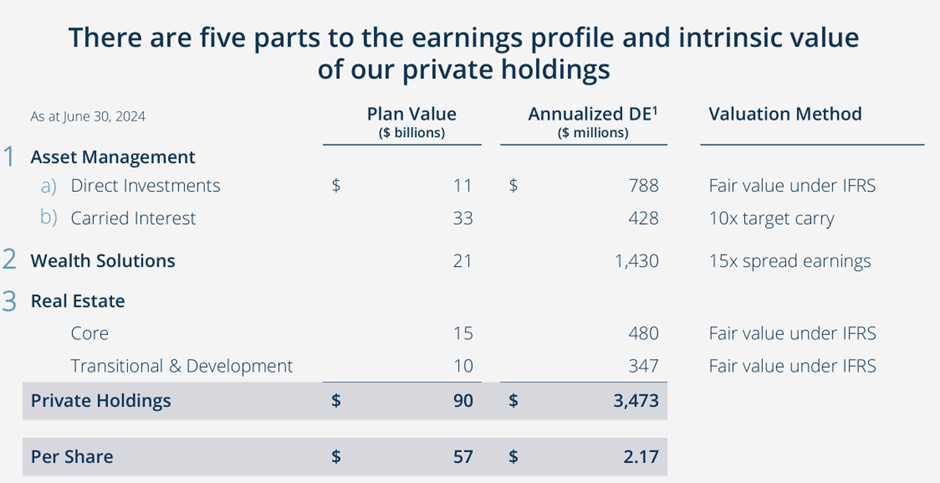

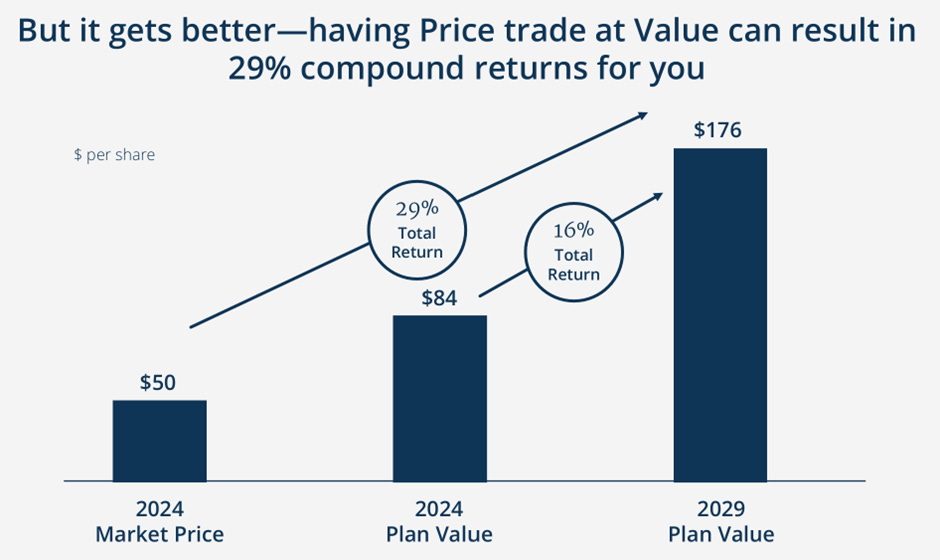

According to Brookfield’s 2024 Investor Day presentation, management has internally calculated an intrinsic value of $84/share as of September 2024 based on the sum of their valuations of their public and private holdings.

They also expect around 16% return on invested capital (ROIC) on their investments from 2024 to 2029. Assuming that the stock price trades at its 2029 intrinsic value over the next 5 years, the stock price should be around $176/share as of 2029. This represents a CAGR of around 29% from the current market price today.

Investment Risks

Reliance on management team’s expertise and capabilities.

By investing in Brookfield, you are essentially betting on Brookfield management’s ability to generate exceptional returns for the future through their capital allocation abilities. Therefore, if something were to happen to the top brass of Brookfield management, especially the CEO, this may negatively affect Brookfield’s ability to generate such exceptional returns.

High interest-rate environment

A high interest-rate environment may hinder Brookfield’s ability to exit some of its investments (e.g. private equity; real estate). This may negatively affect Brookfield’s ability to return capital to investors and generate carried interest.