Initial Report: Brookfield Renewable Partners (NYSE:BEP), 242% 5-yr Potential Upside (Magnar Tan, EIP)

Magnar Tan presents a "BUY" recommendation based on its insulation from short-term power price fluctuations, ownership by Brookfield Asset Management, and rising demand for green energy.

Executive Summary

Brookfield Renewable Partners L.P. (TSX: BEP.UN; NYSE: BEP) is a leading global renewable energy company headquartered in Toronto, Ontario, Canada. The company owns and operates a diversified portfolio of renewable power assets, including hydroelectric, wind, solar, distributed energy, and sustainable solutions. In 2024, Brookfield Renewable achieved record financial results, delivering 10% growth in Funds From Operations (FFO) per unit and deploying $12.5 billion ($1.8 billion net) into growth initiatives. The company also secured landmark agreements with major corporate customers like Microsoft and continued its successful asset recycling strategy, generating significant proceeds to fund future growth.

Founded in 2011 through the merger of Brookfield Renewable Power Fund and assets owned by Brookfield Asset Management, Brookfield Renewable Partners is publicly traded on the Toronto Stock Exchange (TSX:BEP.UN) and New York Stock Exchange (NYSE:BEP). It is majority-owned by Brookfield Asset Management (approximately 60%). The company has grown significantly over the past decade through strategic acquisitions and organic development. As of early 2025, Brookfield Renewable has approximately 33,000 megawatts (MW) of operating renewable power capacity globally and a development pipeline of about 200,000 MW. Its primary business strategy involves long-term contracted renewable energy generation, asset recycling to crystallize value, and disciplined capital deployment into high-return projects.

1. Company Overview

1.1 Business segments

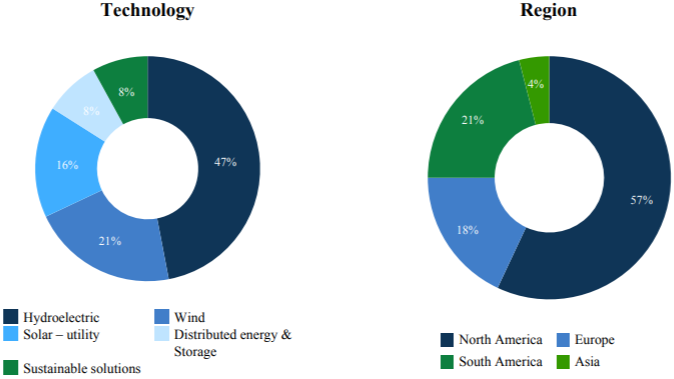

Brookfield Renewable has a complementary portfolio of hydroelectric, wing, utility-scale solar, energy storage and distributed generation and other sustainable solutions assets:

Hydroelectric Power (47%): the largest segment in BEP's portfolio and continues to be a premium and differentiated technology as one of the longest life, lowest-cost and cleanest forms of power generation. Hydroelectric plants have high cash margins and storage capacity with the ability to dispatch power at all hours of the day.

Wind & Solar Power (37%): provide exposure to some of the fastest growing renewable power sectors, with high cash margins, zero fuel input cost, and diverse and scalable applications. Wind and solar are now among the lowest cost forms of power generation available globally.

Energy Storage & Distributed Generation (8%): provide the markets in which they are located with critical services to the grid including dispatchable generation which provide independent, secure, behind the meter power solutions to customers.

Sustainable Solutions (8%): sustainable solutions assets, such as carbon capture, renewable natural gas capacity, nuclear service business, and eFuels business are helping corporates and countries enhance their operations and achieve their net-zero goals.

Brookfield Renewable's renewable power portfolio consists of hydroelectric, wind, utility-scale solar, DG and storage facilities in North America, South America, Europe and Asia-Pacific, and its total power portfolio consists of approximately 46,200 megawatts of installed capacity.

Brookfield Renewable invests in assets directly, as well as with institutional partners, joint venture partners and through other arrangements. Their globally diverse portfolio helps to mitigate resource variability, and improves consistency of cash flows.

1.2 Revenue drivers

BEP’s revenue model is primarily based on electricity generation and contracted sales agreements. The company benefits from long-term contracts that provide predictable cash flows, with additional revenue from merchant power sales and renewable energy credits (RECs). The primary revenue drivers include:

Power Generation Output (GWh): Electricity production levels are influenced by capacity additions, hydrology conditions, wind speeds, and solar irradiance. BEP’s growing asset base ensures increasing generation over time, while existing hydro assets provide a stable and high-margin revenue stream.

Power Purchase Agreements (PPAs) & Market Prices: Approximately 80-90% of BEP’s revenue comes from fixed-price long-term PPAs, reducing exposure to short-term energy price fluctuations. The remaining portion is exposed to merchant power sales, where revenue fluctuates based on market electricity prices.

Acquisitions & Organic Capacity Growth: BEP actively expands its portfolio through strategic acquisitions of renewable energy assets. This growth strategy allows the company to scale revenue through new projects while benefiting from favourable power pricing trends.

Renewable Energy Incentives & Carbon Markets: Government policies such as carbon pricing, tax credits (e.g., ITCs/PTCs), and renewable portfolio standards (RPSs) support BEP’s revenue growth. The company also generates revenue from selling renewable energy credits (RECs) and carbon offsets.

BEP’s revenue growth is expected to continue benefiting from increasing corporate demand for clean energy, grid decarbonisation mandates, and higher electricity consumption from AI-driven data centers and electrification trends.

1.3 Cost drivers

BEP's cost structure is driven by operating expenses, financing costs, and capital expenditures.

Operating costs: Routine maintenance and servicing of hydroelectric dams, wind turbines, and solar panels.

Financing & Interest Costs: BEP maintains a highly leveraged capital structure, with non-recourse project debt financing many of its renewable energy assets.

Capital Expenditure: CapEx typically represents 25-35% of BEP's annual revenue, with spending focused on wind and solar expansion. As BEP looks to increase electricity generation, investments in new projects, asset upgrades, and energy storage is needed to drive revenue.

2. Competitor Analysis

2.1 Renewable Energy Market

The Global Renewable Energy Market is experiencing rapid growth due to policy tailwinds, corporate renewable energy demand, and technological improvements.

Increasing corporate demand: Corporate emissions targets as well as pressure from stakeholders and investors are driving demand for green energy. As a result, Corporate Power Purchase Agreements (PPAs) as a form of long-term contracted renewable energy serves as a solution to provide consistent levels of energy along with predictable pricing. In 2023 alone, over 38 gigawatts of clean energy were procured by corporations globally. This demand is expected to increase at a CAGR of 12-15% in the next 5 years.

Decreasing Levelised Cost of Energy (LCOE): Utility-scale solar has seen an 80% drop in cost since 2010, along with technological advancements that make wind turbines, battery storage and green hydrogen more efficient hence more commercially viable. Coupled with the increased demand, the CAGR for these sources of green energy is estimated in the 20-40% range for the next 5 years.

International policy tailwinds: Besides tax credits and incentives, governments are beginning to tackle transmission bottlenecks and permitting challenges, simultaneously putting pressure on corporations to transition to green energy to meet global net-zero targets by 2050. The European Union continues to implement the Green Deal aimed at reducing carbon emissions and promoting renewable energy investments, while in Asia-Pacific, China and India are investing heavily in renewable energy infrastructure to meet growing energy demands sustainably.

2.2 Renewable Energy Companies

BEP’s closest competitors are those who operate with a similar portfolio of assets and geographical regions.

BEP is strategically positioned to capitalise on industry trends, and its multi-asset portfolio provides it with diverse renewable energy sources and solutions for flexibility and resilience. Coupled with the PPA business model, it stands out among its competitors.

3. Investment Thesis

3.1 Long-term Power Purchase Agreements

Power Purchase Agreements (PPAs) are contracts between BEP and a customer, where BEP supplies renewable electricity at a fixed price over a duration of 10-20 years.

PPAs shield BEP from short-term power price fluctuations. If energy prices fall, BEP's PPAs lock in pricing to ensure revenue is unaffected. If energy prices increase, BEP can turn to its spot market segments to capitalise on this short-term trend, while still maintaining stable revenue from its PPAs. As these PPAs are indexed to inflation, as inflation rises, revenues will grow accordingly without having to rely on new contracts.

More than 90% of BEP's power output is sold under long-term PPAs, essentially guaranteeing stable cash flows for the next 10-20 years. With stable cash flows, BEP can increase both borrower and investor confidence in the business, which will allow it to further its expansion plans. With bigger production capacity, it can secure bigger and more long-term PPAs, re-enforcing its moat in contractual cash flows.

3.2 BEP's ownership by Brookfield Asset Management

Brookfield Asset Management owns around 48% of BEP, and has full control of BEP's management and operations. As a result, BEP's expansion strategy is directly influenced by BAM's infrastructure and expertise in the area. BAM manages over $900 billion in assets across infrastructure, private equity and real estate.

Renewable energy projects require massive upfront capital, and a strong cost driver BEP faces is the cost of borrowing. With BAM's backing, BEP can tap on BAM's existing institutional relationships to secure funding from investors at terms far more favourable than its competitors without parent-company backing such as Orsted and Clearway Energy who are operating at a similar scale. In a rising interest rate environment, BEP is far less affected than competitors if it is able to lock in low-rate debt.

In 2023, BEP issued $500 million worth of green bonds at a 4.25% interest rate, while firms at a similar scale had to issue debt at a 6-8% interest rate. Lower interest rates allow BEP to retain cash and reinvest in its expansion strategy, on top of lower risk of defaulting. BAM's sheer capital pool also ensures BEP has a low default risk, while channelling less resources into securing funding.

Not only does BAM ease BEP's sourcing of capital, it also allows BEP to directly purchase infrastructure from them at prices below market value. In 2021, BEP acquired $1.5 billion of hydro and wind assets directly from Brookfield Infrastructure, avoiding expensive bidding processes that its competitors have to go through. This swift acquisition of assets can allows BEP to expand more rapidly and at lower cost of capital, capturing greater market share.

3.3 Rising demand for green energy

The exponential growth of data centres driven by cloud computing, AI and digital transformation puts BEP at a favourable position to capture the inflexion point of this green transition.

Data centres currently account for 2% of global electricity demand, but by 2030 could consume 5-8% of global electricity. In 2024, investment by giant technology firms grew 50% year-on-year. At the same time, the cost of carbon emissions are increasing due to regulatory measures that urge the tech industry to pledge net-zero emissions. As a result, many are turning to green energy to power their data centres.

BEP has a massive renewable energy portfolio, both asset-wise and geographically. Its global footprint aligns with expansion plans of cloud data centre owners, while its portfolio of renewable energy sources allow it to supply the best blend of green energy to huge tech firms at mutually beneficial terms.

In 2024, BEP and Microsoft entered into an agreement to deliver over 10.5 gigawatts of new renewable energy capacity between 2026 and 2030 across the US and Europe, nearly eight times larger than any previously signed corporate PPA. BEP also singed a 10-year PPA with the Tennessee Valley Authority to deliver 377 megawatts of clean energy to its power utility customers. BEP's diversified customer base, as well as its massive productive capacity strategically positions it to capitalise on the rising demand for green energy through its PPA business model.

4. Valuation

I assumed a constant EV/EBITDA multiple of 24.8x for 2027 (3 years) and 2029 (5 years), and a constant number of shares outstanding to arrive at a 3-year target price of $41.55 (74.64% upside), and a 5-year target price of $81.42 (242.24% upside).

5. ESG Assessment

BEP has an ESG Risk Rating of 15.8 (Low Risk), ranking 43(rd) out of 652 in the industry. Its MSCI rating is AA, considered as a leader among 139 companies in the utilities industry. Its approach to sustainability focuses on accelerating the transition to net zero while supporting a responsible transition to green energy. Highlighted material topics with the highest priority under each pillar are:

(Environmental) Water and waste resources: In 2023, the company developed comprehensive water management plans for all of its operations located in high-risk areas. Each plan includes site-level water usage tracking, mitigation strategies, regional targets, and scheduled environmental audits. Additionally, the company advanced its waste reduction goals by committing to diverting 100% of major components from landfill and successfully reduced landfill waste by 40% year-over-year.

(Social) Health, safety, security and environment (HSS&E): BEP recorded a high-risk incident frequency rate of 1.08 per million hours worked, below its threshold of 1.5. They delivered 173,834 hours of HSS&E training and conducted 14,960 Safe Work Observations. Key focus areas include hazard identification, job safety planning, emergency preparedness, and contractor alignment.

(Governance) Systemic risk management: BEP applies a globally integrated Risk Management Program aligned with ISO 31000, COSO, and Task Force on Climate-related Financial Disclosures (TCFD) frameworks. Risk assessments are performed annually across all operations, with each business maintaining its own live risk inventory. The program is embedded across the investment lifecycle, including due diligence, portfolio monitoring, and post-close integration. Cross functional collaboration and scenario planning further enhance their resilience to climate and operational risk.

BEP’s 2023 metrics suggest strong overall progress in hitting its targets, even exceeding in areas such as safety and training delivery. This shows their strong alignment with ESG goals, and their proactive commitment to sustainability.

6. Risks and Mitigation

6.1 Energy price decline

As technology advances and investments in green energy across the industry increase, prices of green energy are set to fall, impacting BEP’s minority revenue stream (~10%) of spot energy prices. This is mitigated by BEP’s long-term PPA business model, with an intentional limit on exposure to spot market prices, ensuring stable, predictable cash flows. It also diversifies its exposure to markets by selling in different regions, thereby reducing the risk of a single market affecting its entire spot market revenue stream.

6.2 Climate risk

The majority of BEP’s physical assets are in hydroelectric power (47%), and it being largely concentrated in Latin America exposes it to droughts and changing climate patterns which can affect energy outputs. BEP mitigates this by managing a diversified asset mix and strategically growing its investment in wind and solar energy segments to reduce reliance on hydro over time.

7. Conclusion

Brookfield Renewable Partners presents a compelling long-term investment opportunity supported by a stable, inflation-indexed cash flow profile, disciplined capital allocation, and exposure to structural growth in renewable energy demand. Its alignment with Brookfield Asset Management provides competitive advantages in financing, execution, and access to high-quality assets. While risks related to power market exposure and asset concentration exist, they are mitigated through geographic and technological diversification. Based on strong fundamentals, credible growth visibility, and an attractive valuation outlook, BEP warrants a buy recommendation.