Initial Report: BYD (SEHK:1211), 13.86% 5-Year Potential Upside, (Khadijah PINARDI, EIP)

Khadijah presents a "BUY" recommendation as the company's ability to maintain its position as a market leader and anticipate further upside potential.

Linkedin | Khadijah PINARDI

● BYD is the world’s largest plug-in electric vehicle (PHEV) manufacturer and is poised to surpass Tesla Inc as the leading battery electric vehicle (BEV) manufacturer, having overtaken Tesla in BEV sales in Q4. In 2023, BYD sold a total of 3.02 million new energy vehicles (NEVs), including BEVs, plug-in hybrid electric vehicles, and commercial electric vehicles, marking a year-over-year increase of more than 62% in both production and sales for NEVs.

● BYD ceased production of fossil-fuel vehicles in 2022, making it the world’s first automaker to phase out such vehicles. The company is now fully focused on enhancing its NEV production and sales.

● BYD presents a compelling investment opportunity in 2024, with strong growth potential supported by the rising trend of EVs, strong financials, and promising global expansion plan.

1. Company Overview

BYD, short for “Build Your Dream,” is a Chinese conglomerate manufacturing company that began as a producer of rechargeable nickel-cadmium (NiCd) batteries in 1995. Since then, it has grown rapidly into a major manufacturer of electronics, automobiles, new energy products, and rail transit. Founded by Wang Chuanfu, the company is headquartered in Shenzhen, Guangdong, China. Over the years, BYD has expanded its global presence from selling products domestically to having more than 30 industrial parks spread across 6 continents, with a focus on zero-emission energy acquisition, storage, application, and new energy solutions.

Company History

Established in 1995, BYD entered the battery market under the leadership of Wang Chuanfu by producing cheaper NiCd batteries through increased manual labor. This strategy resulted in significantly lower production costs compared to its Japanese competitors. By 2002, BYD had captured 65% of the global NiCd battery market and later expanded into NiMH and Li-ion batteries by 2009.

BYD ventured into the automobile industry through the acquisition of Qinchuan Auto company, led by Wang Chuanfu, to enter the Chinese automobile market and secure a license for car manufacturing. Within two years, BYD launched its first car, the BYD F3. The company's development in the automobile industry accelerated, producing its first plug-in hybrid car in 2008 and BEV car in 2009, becoming the majority revenue source for BYD. In the first half of 2023, BYD captured close to 40% of the NEV market in China, becoming the champion NEV producer in the country and expanding rapidly globally, entering major markets such as Southeast Asia and Europe and building factories across countries and continents.

In December 2023, BYD achieved sales of more than 300,000 passenger cars globally, contributing to a significant 61.9% increase in sales compared to 2022. Additionally, BYD was listed among the global top 10 car sales for the first time in 2023, with a 334.2% increase in car exports, reaching more than 70 countries across six continents in addition to dominating the domestic market.

2. Business Segments

BYD currently focuses on three main areas of business: Automobiles & Related Products, Mobile Handset Components & Assembly Services, and Rechargeable Batteries & Photovoltaics.

a. Automobiles & Related Products

BYD's automobile division encompasses the production and sale of passenger cars, electric buses, and rail transport, along with associated products and services. They offer competitively priced cars with features comparable to those of their main competitor, Tesla. BYD ceased sales of combustion engine passenger cars in 2022 and transitioned entirely to promoting NEVs globally. In 2022, they offered 18 car models, including those in the Dynasty Series, Ocean Series, Ocean Warship Series, E Series, and the D1.

b. Mobile Handset Components & Assembly Services

BYD manufactures mobile handset components and provides assembly services to various global corporations such as Apple, Huawei, and Samsung. In 2020, BYD also built the world’s largest mask plant, enabling the production of millions of masks and approximately 300,000 bottles of disinfectants daily. This allowed BYD to meet the increased demand for face masks during the COVID-19 outbreak in China and globally, resulting in a 162% increase in profit in 2020.

c. Rechargeable Batteries & Photovoltaics

BYD continues to produce and sell NiMH, lithium-ion, and NCM rechargeable batteries for consumer electronics, NEVs, and energy storage. It supplies batteries for BYD automobiles and notable clients such as Toyota, Kia, and Samsung.

3. Revenue Drivers

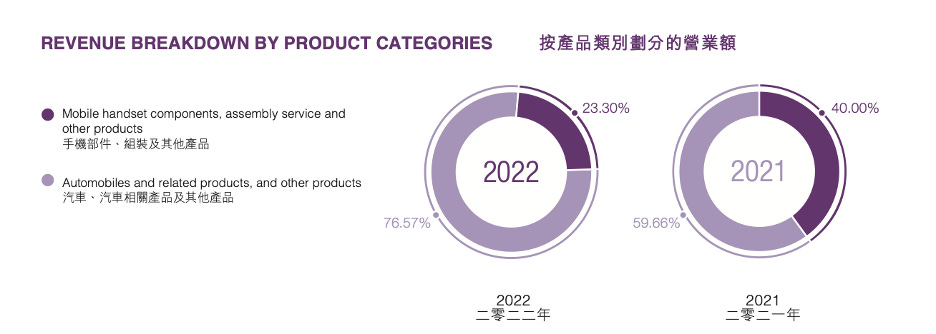

BYD experienced significant revenue growth in 2022, nearly doubling its revenue from approximately 216 billion RMB in 2021 to over 424 billion RMB. During the same period, its gross profit increased by approximately 156.59%, rising from 28 billion to 72 billion RMB. The automobile and related products segment accounted for approximately 76% of BYD’s revenue, totaling 324.7 billion RMB, while the mobile handset component segment reported revenue of over 98 billion RMB in 2022.

4. Competitor Analysis

The EV landscape is growing very fast and is unforgiving in terms of the pressure to keep coming up with innovations to be the best among all. In order to stay competitive in the industry, BYD needs to maintain its pace and continue to improve on what they offer. Here are some of BYD's top competitors. However, the list is not exhaustive.

a. TESLA

Headquartered in California, United States, Tesla has been BYD’s primary competitor, dominating the EV market for some time. However, BYD has experienced rapid growth for the past few years and is now gaining ground on Tesla.

b. SAIC-GM-Wuling (SGMW) Automobile

Headquartered in Liuzhou, China, SGMW is a joint venture between SAIC Motor, General Motors, and Liuzhou Wuling Motors. Specializing in manufacturing micro-electric vehicles, SGMW has a strong presence in the domestic Chinese market, similar to BYD.

c. Volkswagen AG (OTC: VWAGY)

Headquartered in Wolfsburg, Germany, Volkswagen is one of the world’s largest automotive manufacturers and a leading competitor in the EV sector. With extensive global reach and market penetration, Volkswagen presents a formidable challenge to BYD.

d. Zhejiang Geely Holding Group Co.

Headquartered in Hangzhou, China, Geely is an automotive group company that owns several car brands, including Volvo and Geely Auto. With a diverse portfolio and significant investments in new technologies, Geely has emerged as one of BYD's top competitors.

e. Dongfeng Motor Group Company

Headquartered in Wuhan, China, Dongfeng Motor is one of the largest automotive manufacturers in China. With partnerships with top automakers such as Honda and Nissan, and a focus on innovation, Dongfeng Motor poses a strong competitive threat to BYD.

5. Economic Moat

I believe that BYD’s economic moat lies in its Vertical Integration and Strong Government Support.

a. Vertical Integration

A study has demonstrated that two key elements influencing a company's growth in the EV industry are batteries and chips. The majority of BYD's key vehicle parts, including chips and batteries, are internally produced thus I believe that BYD will be able to continue maintaining cost parity with its rival through cutting additional expenses and increasing production speed.

b. Strong Government Support

As BYD was growing its automobile sector, Beijing began promoting electrification to reduce pollution, dependence on foreign oil, and to generate jobs in the economy. The government has poured more than 200 billion yuan in subsidies for EVs and PHEVs producers and consumers since 2009. Between 2015 and 2019, China introduced a policy called the “power battery whitelist,” providing subsidies to EVs that used batteries made only by Chinese businesses. This calculated action helped expand the global battery sector and secure China's dominance over the EV and battery markets. As a result of the significant size of China's EV industry and ensuing cost advantages, Chinese companies continue to lead the global battery market even after subsidies were discontinued in 2019.

This resulted in China’s EV industry growing rapidly, selling more than 6 million EVs (half of all EV sales globally) in 2022, and EV ownership reaching 13.1 million units in Q4 2022.

Although subsidies are declining as the market matures, the government still offers purchase tax exemptions and various infrastructure support such as exclusive parking spots, waived or reduced parking and charging service fees, entry to ultra-low- or zero-emission zones, and priority lanes in roads. Moreover, regional offices provide localized subsidies to producers and consumers. For example, the Chengdu government offers an award of up to 50 million yuan to any car manufacturer introducing a new EV model and 8,000 yuan to consumers for purchasing EVs. This is done to achieve its goal of having 800,000 EVs on the road by 2025.

6. Investment Thesis

I believe that it is a good time to invest in BYD due to the current rising trend in switching from combustion engine vehicles to NEVs, BYD’s strong financials, rapid increase in sales, and promising global expansion plan.

a. EV is the Trend

EV sales have been growing over the years and are projected to continue despite slower growth in 2024 due to the global economy's slowdown. In Q3 2023, BEV and PHEV sales experienced the strongest YoY growth since Q4 2021. Additionally, with prices declining due to technological improvements and companies’ strategies to win customers, EVs will become more accessible, leading to continued sales growth. Cox Automotive has forecasted that NEVs would account for more than 20% of total vehicle sales in 2024.

b. Strong Financials & Surge in Sales

In Q4 2023, BYD delivered 526,406 vehicles, surpassing Tesla’s 484,507 and becoming the top EV manufacturer by sales. This contributed to a 61.9% increase in BYD's overall sales in 2023. BYD expects its net profit in 2023 to increase by about 86.5% compared to the previous year due to surging sales and a more efficient supply chain, resulting in cost reductions. Despite heavy competition in the NEV industry, BYD managed to significantly enhance its profitability, demonstrating resilience against key competitors.

c. Strong Global Expansion Plan

In 2023, BYD’s global presence grew by 334.2%, delivering a total of 242,765 units of its passenger cars to more than 70 countries across six continents. BYD has invested in manufacturing factories in Hungary and Thailand, and plans to continue expanding its presence through factories in Indonesia and Mexico as launching points for the Indonesian and U.S. markets.

7. Risks & Mitigation

While investing in BYD seems very compelling, there are risks associated with investing in the company. However, there are ways to mitigate these risks as well.

a. Regulatory and Compliance Risks:

As BYD’s main market is China, it is heavily dependent on China's government regulations for selling its products. Changes in government regulations can have a significant impact on BYD’s overall operations and sales dynamics. The mitigation for this would be for BYD to continuously monitor regulatory developments and maintain compliance throughout all of its processes. Additionally, BYD is also exposed to the risks of employing forced labor in its supply chain processes. For example, as one fifth of China’s aluminum is produced by smelters in Xinjiang, there is a risk of BYD having its aluminum supplies exposed to alleged forced labor in Xinjiang, China. The mitigation would be for BYD to thoroughly map its supply chain, identifying and addressing potential links to exposure to forced labor.

b. Market Competition:

While BYD might have surpassed Tesla in Q4 BEV sales, market competition is increasing thus BYD should focus on continuing its innovations, providing product differentiation, and building a strong brand image globally. What BYD can do is to continue to innovate and diversify its product portfolio while also building partnerships with other companies to gain a competitive advantage in the new markets BYD is entering.

c. Supply Chain Disruptions:

As the market demand for NEVs keeps increasing, BYD is at risk of supply chain disruptions, where it is found that there are exposures to long delivery times for new orders (the delivery of new orders requires about more than 3 months, while Tesla sends out their cars on average in 1-5 weeks, causing customers to switch to other brands). Another supply chain risk BYD is exposed to would be data management and collaboration issues. While BYD has an intelligent procurement system, their system operates independently, requiring managers to manually collect data from various systems and analyze them on Excel, exposing the company to the risk of data mismatching which may lead to further supply chain disruptions. Lastly, BYD’s vertical integration system leads to low collaborations with suppliers, as BYD is less dependent on suppliers, resulting in an unstable supplier procurement system. The mitigation would be for BYD to strengthen relationships with suppliers and build strategic partnerships, as it is very important for BYD to have strong and stable supply chain systems given its vertical integration. BYD has also been building factories all over the world to mitigate the disruption effects in the supply chain, as these factories help them to be closer to their consumers.

8. ESG Components

I believe that BYD has made significant efforts to minimize its carbon footprint and prioritize its employees' well-being, as well as compliance in governance. However, I also believe that there is room for further improvement.

a. ESG Risk

BYD has previously faced several allegations, such as IP-related allegations and lawsuits regarding IP infringement, whereby BYD is accused of copying designs and technologies from other companies, labor practices and human rights issues within its supply chain, quality and safety incidents, and negative environmental impacts of its operations. To mitigate these risks, I believe that BYD could further improve safety for its employees and the environment, maintain an ethical supply chain, and manage its environmental impact.

b. ESG

BYD has been publishing annual CSR reports since 2010 and is committed to reducing global footprints by promoting the low-carbon transition from fossil fuel vehicles to NEVs, building green energy systems, and minimizing emissions in its daily production and operations. It follows Hong Kong’s Exchange’s ESG reporting guide, Global Reporting Initiative’s (GRI), and China’s CASS-CSR guidelines. I believe that, in general, BYD has done a good job; however, further transparency is needed as it is important.

a. External Ratings

9. Conclusion

I decided to write about BYD as my curiosity and interest in the company grew, especially after my friend’s family purchased one of their vehicles. Despite its share prices declining since Q4 2023, I remain confident in the company's ability to maintain its position as a market leader and anticipate further upside potential. Therefore, I issue a BUY recommendation for the company over a long period of time, while also acknowledging and accounting for the investment risks it poses.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

Cock leh. 13.86% for 5Y means 2.68% per year. I in-out mkt already 4% in few hours. SGD TD already 3% for 6mths. What sort of stupid research is this?? 滚!