Initial Report: Canadian Pacific Kansas City Ltd (TSE: CP), 42% 5-yr Potential Upside (EIP SG, Nicholas TAN)

With the only single-line transnational haul and a well-diversified business mix driving top-line performance, CPKC is well-positioned to grow and capture a larger market share.

LinkedIn | Nicholas TAN

Executive Summary

1. Strategic Merger With Kansas City Southern Gearing Up To Drive Growth

2. Well Diversified & Resilient Portfolio Of Transported Goods With Solid Long-Term Prospects

3. Strong Focus On Operational Efficiency A Ticket To Improved Profitability

Company Overview

Canadian Pacific Kansas City Limited (CPKC) is a North American Class I freight operator headquartered in Calgary, Canada. The Company was formed in April 2023 through a merger of two historical railways - Canadian Pacific (CP) and Kansas City Southern (KCS), which were previously the sixth and seventh largest North American Class I railroads by revenue respectively. CPKC is the first and currently the only single-line transnational railway connecting Canada, Mexico, and the United States. It operates approximately 32,000 kilometres (20,000 miles) of rail across the three countries.

Business Segments

CPKC’s business segments could be broadly categorised into two main groups: (a) Freight Transportation and (b) Non-Freight Services.

Freight

The Company primarily derives its revenue from transporting freight (97.87% of total revenue). CPKC operates 3 business lines for its freight business, which encompass bulk commodities, merchandise and intermodal traffic.

● Bulk commodities: This business line encompasses the transportation of large quantities of commodities, including Grain, Coal, Potash as well as Fertiliser & Sulphurs, across long distances.

● Merchandise: This business line maintains a spectrum of industrial and consumer products, including Forest products, Energy, Chemicals & Plastics, Metals, Minerals & Consumer Products as well as Automotives.

● Intermodal Traffic: This business line covers retail goods in overseas containers that can be transported by train, ship and truck as well as in domestic containers that can be moved by train and truck.

In Fiscal Year 2022, CPKC generated a total Freight revenue of $8,627 million. Amongst its Freight revenue, 38% of the total Freight revenue was derived from Bulk, followed by Merchandise with 36% and Intermodal with 26%. A detailed breakdown of CPKC’s total revenue in FY2022 is shown on the right:

Non-Freight

In addition to its freight business, CPKC also generates a relatively small portion of its revenue (2.13%) from non-freight activities. This encompasses leasing assets to passenger service operators, switching fees and revenue from logistics solutions.

Revenue Drivers

CPKC relies on two main revenue drivers for its top-line performance:

· Intermodal Transportation Services: This involves the transfer of cargo containers or trailers between different modes of transportation, such as trains, trucks, ships

· Rail Transportation Services: This encompasses the transportation of large volume of cargo over CPKC’s network

Revenue Variance Analysis

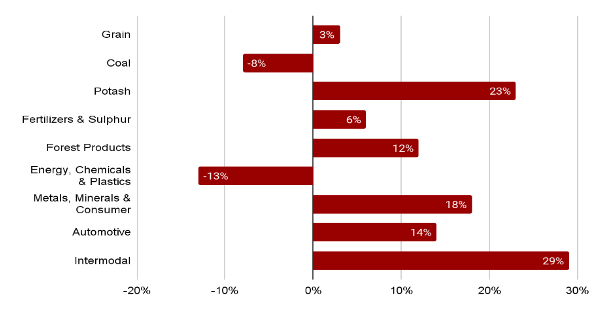

The freight revenue variance for each business line is shown in the chart below. Based on the information given, the overall freight revenue variance is 8%.

Cost Driver

Labour compensation and benefits

Compensation and benefits constitute the largest cost component for CPKC, amounting to an estimated CAD1,570 million in 2022. With powerful trade unions in the North American region, labour is expected to be one of the leading cost factors for CPKC as employees demand higher wages and improved working conditions. In August 2022, CPKC signed a collective agreement with a trade union, Teamsters Canada Rail Conference (TCRC) – Train and Engine, which includes a 3.5 % wage increase in 2022 and 2023 and increased benefits[1]. Other than bottom-line performance, labour strikes also resulted in lost revenue by halting or disrupting routine operations. In July 2023, a two-week strike at British Columbia, the largest port in Canada, halted CPKC's operations at most ports along the West Coast[2]. Thus, labour remains the key cost driver that could adversely impact CPKC's profit margin.

Fuel

Fuel expense represents the second-largest operating cost for CPKC, which stands at approximately CAD 1,400 million. Fluctuations in fuel prices wield substantial influence over CPKC's profit margin. In recent years, fuel prices have been fluctuating in recent years due to global oil supply disruptions from the Russian-Ukraine and Israel-Hamas wars as well as inflationary pressures. For instance, oil price has spiked to a 10-month high to $92.40 per barrel in September as OPEC predicts tight supplies[3]. The volatility in these factors underscores the importance of managing fuel-related costs to mitigate their potential impact on CPKC's financial performance.

ESG Consideration

The Company's sustainability practices earned it a place on the Dow Jones Sustainability Index for North America for 3 consecutive years. In 2022, CPKC was also included in the Dow Jones Sustainability World Index for the first time. It was awarded a spot on CDP's "A List" for the second time, a testament to its dedication to combating climate change. CP was also conferred the 2022 World Finance Sustainability Award for Most Sustainable Company in Transportation, solidifying its place as one of the foremost sustainability performers in the transportation industry.

Management

President & CEO

Mr Keith Creel became the President and CEO of CP (former name of CPKC) on 31 January 2017. He was the president and chief operating officer from 5 February 2013 to 30 January 2017.

Prior to joining the Company, Creel was the Executive Vice-President and COO at CN from January 2010 to February 2013. While at CN, Creel assumed various positions including Executive Vice President, Operations, Senior Vice President Eastern Region, Senior Vice President Western Region, and Vice President of the Prairie Division.

Creel began his railroad career at Burlington Northern Railway in 1992 as an intermodal ramp manager in Birmingham, Alabama. He also spent part of his career at Grand Trunk Western Railroad as a superintendent and general manager and at Illinois Central Railroad as a train master and director of corridor operations before its merger with CN in 1999. Creel has more than 20 years of experience in the railroad industry and gained solid operational expertise from the various roles he held previously.

Other Key Executives

The average tenure of the management team and the board of directors is 7.1 years and 6.9 years respectively. The members of CPKC’s management team are shown below:

Inside Ownership

Presently, insiders hold a modest 0.02% of outstanding shares, representing approximately CAD $19 million. While this figure may seem insignificant to the overall ownership structure, it still provides some alignment between the company's management and its smaller shareholders. It is also worth mentioning that the relatively limited insider ownership could be attributed to the CP-KCS merger, which led to the issuance of additional CPKC stocks for existing KCS shareholders.

In the last three months, CEO Creel has demonstrated his confidence in CPKC's future by exercising stock-based options to acquire an additional 117,954 shares[4]. This strategic move by the CEO signals the company's potential for growth and that CPKC stocks may be currently undervalued. Adding weight to this sentiment, Director Matthew Paul has also shown confidence in CPKC's prospects by acquiring an additional 3,500 shares[5]. These insider transactions collectively signal an optimistic outlook, as insiders foresee favourable developments or an upward trajectory in CPKC's stock price in the foreseeable future.

Executive Compensation

CPKC’s executive compensation program encompasses 4 elements: (a) Salary, (b) Short-term incentives - cash, (c) Long-term incentives - Performance Share Units and (d) Long-term incentives - stock options[6].

In 2020, the compensations are determined based on a compensation comparator comprising 6 Class 1 Railroad peers and 11 capital-intensive Canadian companies competing with CPKC for talent.

CPKC's total direct compensation focuses on driving financial, safety, operational, and customer satisfaction results while creating shareholder value. Executives also receive pension benefits and perquisites as part of their overall compensation. The annual incentive bonus was structured such that 70% was linked to corporate financial performance, 20% to safety performance, and 10% to operating performance.

Industry Analysis

Currently, CPKC is operating in two main markets: (a) Canada and (b) United States of America (U.S). Furthermore, CPKC will be serving the Mexican Market after the full integration of CP and KCS.

Canada Market Size & Structure

The freight rail sector forms the backbone of Canada's economy, moving more than 320 billion dollars worth of goods annually across a coast-to-coast network[7]. Almost all sectors of the Canadian economy depend on the freight sector, including manufacturing, agriculture, natural resources, wholesale, and retail. The Canadian rail freight transport market generates approximately $10 billion annually and is expected to grow at a CAGR of 3.5% from 2023 to 2028[8].

The Canadian Rail Network, with a total track length of 45,199 kilometres, is mainly used to transport freight and is owned as follows:

● CN owns 49.1% (22,186 km)

● CPKC owns 25.6% (11,574 km) and

● Other railways own approximately 25.3% (11,439 km)

Canadian National Railway (CN) and CPKC are Canada's two dominant freight rail operators. They are Class I railways, meaning their revenues exceeded $250 million in the past two years. Of the total Canadian rail transport industry revenues, CN accounts for over 50% and CPKC for approximately 35%. CN and CP also represent more than 95% of Canada's annual rail tonne-kilometres, more than 75% of the industry's tracks, and three-quarters of overall tonnage carried by the rail sector. Within Canada, these two firms serve as important supply chain links for Canada's key trade corridors and gateways.

U.S Market Size & Structure

In the U.S freight rail market, the total market is shared among 6 major freight railroads[9]. The size of the U.S. rail freight market is currently valued at USD 69.1 billion and is anticipated to grow at a CAGR of over 9% during the forecast period[10]. The current U.S market could be described as 3 duopolies: Union Pacific and BNSF dominate the west. CSX and Norfolk Southern primarily operate on the east coast, while CPKC and CN run routes north and south.

Mexico Market Size & Structure

In Mexico, the freight railway system is owned by the federal government and operated by CPKC and Ferromex under concessions from authorities. The Mexico Freight and Logistics Market size is valued at 128.10 billion USD in 2023 and is expected to reach 171.40 billion USD by 2029, growing at a CAGR of 4.97% from 2023 to 2029[11].

Competitor Analysis

The North American market is shared by 7 major Class I railways - Burlington Northern and Santa Fe Railway, Canadian National Railway, CSX Corporation, Ferrocarril Mexicano, Norfolk Southern, Union Pacific. The map below illustrates the various railway networks owned by the 7 railroad operators.

North American Freight Rail Competitors

● Burlington Northern and Santa Fe Railway (BNSF): Headquartered in Fort Worth, Texas, BNSF Railway operates the largest freight railroad networks in the United States, with 32,500 miles of rail across the western two-thirds of the United States. The railway company generated a total revenue of USD24,281 million over the past 12 months.

● Canadian National Railway (CN): Based in Montreal, Canada, Canadian National Railway Company is Canada's largest railway in terms of both revenue and the physical size of its rail network. With approximately 20,400 route miles of track, CN’s rail network spans Canada from the Atlantic coast in Nova Scotia to the Pacific coast in British Columbia. The Company maintains a market capitalization of 103,895.9 million and generated CAD16,899.0 million in revenue over the past 12 months.

● CSX Corporation (CSX): CSX is one of two primary U.S. railroads serving the East Coast, the company connects 23 states and two Canadian provinces. Headquartered in Jacksonville, Florida, the Company encompasses about 20,000 route miles of track. With a market capitalization of 89,109 million, CSX generated a total of USD14,707.0 million revenues over the past 12 months.

● Ferrocarril Mexicano (FXE): Ferromex is a Mexican Class I railroad operator that maintains more than 6,835 miles of track network that connects to Mexican ports and with the major markets in Mexico, the US and Canada. The Company generated MXN40,299.2 in revenue over the past 12 months.

● Norfolk Southern (NS): Norfolk Southern is the other East Coast U.S. railroad that has historically been a major transporter of coal, industrial products, and automobiles. Headquartered in Atlanta, the company serves 22 states with its 19,500 miles of track. NS maintains a market capitalization of 69,141.8 million and generates USD12,320.0 million of total revenue over the past 12 months.

● Union Pacific (UP): Based in Omaha, Nebraska, Union Pacific is the second largest Class I freight railroad in the United States. With a network of 32,100 rail miles, the Company covers 23 states in the western two-thirds of the United States. As of November 2023, UP maintained a market capitalization of 190,418.8 million and generated USD24,140.0 million in revenue over the past 12 months.

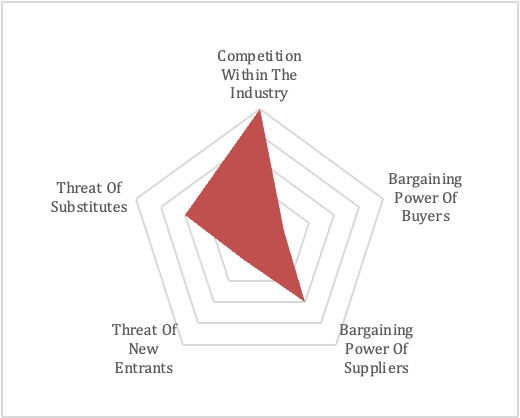

Porter's Five Forces

Competition Within The Industry - High

The competitive rivalry in the North American rail industry is high. In Canada, CPKC competes with CN in a duopoly market, with CN being the dominant player. In the U.S., CPKC competes with other Class I railroads, including Union Pacific, BNSF, and others. In Mexico, CPKC is also engaged in a duopoly with Ferromex. Competition in the rail industry is based on reliability, pricing, and service offerings. The adoption of Precision Scheduled Railroading (PSR) by multiple rail operators has further intensified competition by focusing on operational efficiency. However, CPKC's transnational network, the only single-line haul currently connecting Canada, the U.S., and Mexico, gives it a powerful advantage over its competitors. The focus on different geographical areas of the various Class I rail operators, with few overlapping rail networks among them (except for CN), has also reduced direct competition.

Bargaining Power Of Buyers - Low

The bargaining power of buyers in the rail industry is generally low. For many customers, rail transport is a crucial component of their supply chain. With few overlapping networks amongst the current Class I railroads, it is difficult for competitors to serve a location covered by a railroad operator. The cost of switching to alternative transportation modes may also be high, giving CPKC some leverage. Given these factors, buyers have limited power in setting prices. Nevertheless, in competitive markets, large customers may have some bargaining power.

Bargaining Power Of Suppliers - Moderate

The bargaining power of suppliers for CPKC is moderate. In the rail industry, suppliers may include equipment manufacturers, fuel providers, and maintenance service providers. While there are multiple suppliers for rail components, the specialised and complex nature of railroad equipment and the reliance on specific suppliers for certain services may give suppliers some negotiating power. As a result, railways often maintain long-term relationships with their suppliers. Furthermore, many railways might require foreign suppliers to procure equipment, which is susceptible to international relations, trade restrictions, and other global events.

Threat Of New Entrants - Low

The threat of new entrants into the rail industry is generally low. The capital-intensive nature of the industry, the need for an extensive rail network, and regulatory requirements create significant barriers to entry. Establishing a new railroad would require significant capital and regulatory approvals, making it difficult for new competitors to enter the market. Thus, it is unlikely that there will be any new entrants less one that could gain substantial share in the mature market.

Threat Of Substitutes - Moderate

The threat of substitutes for rail transportation is moderate. While there are alternatives to rail, such as trucking, air or ocean freight transport, rail transport presents advantages in terms of cost efficiency and reduced emissions. Air freight transport remains the most costly delivery method, while shipping is less reliable and secure and is constrained to locations near water bodies. Trucking is also a more expensive mode of moving freights than rail despite offering greater accessibility. Rails are also more fuel-efficient than road freights in transporting large volumes of goods across long distances.

Economic Moat Crossing Ahead

CPKC derived economic moats from two sources: (a) low cost and (b) efficient scale.

Cost Advantage

As seen from Porter's 5 forces analysis, railroads are relatively cheaper than other modes of transportation - trucking, air, and ocean freight. Thus, CPKC, as a rail operator, has a cost advantage over other modes of transportation. Within the North American rail industry, synergies from the KCS-CP merger would also allow CPKC to lower costs and remain more competitive.

Efficient Scale

In addition to cost advantages, CKPC's economic moat is based on efficient scale. According to Morningstar, efficient scale refers to operating in a limited market efficiently served by one or a very small number of companies, deterring potential competitors from entering the market. Due to the capital-intensive nature of the railroad industry and the significant barriers to entry, market entry is not justifiable by the limited profit potential that a new entrant might achieve. This creates a market that supports few competitors, which limits competitive pressures and reinforces CPKC's position.

Financial Statement Analysis

CPKC Ratios

Key Ratios

Over the past 5 years, CPKC has demonstrated a positive trajectory in revenue growth, surging by a substantial 44% from CAD 7,792 million in 2018 to a robust CAD 11,241 million in the trailing twelve months of 2023. Although the COVID-19 pandemic hurt shipments of several commodities and merchandise, CPKC performed fairly well, with only a marginal decrease of 1.05% due to its diversified business mix in 2020. In 2021, CPKC's revenue rebounded to CAD 7,995 million, demonstrating an improvement of 3.70%. This rebound in revenue highlighted the company's ability to adapt and recover swiftly from the pandemic-induced challenges. Building upon this momentum, CPKC experienced remarkable growth, with a substantial 40.6% surge in revenue from CAD 7,995 million in 2021 to an impressive CAD 11,241 million in 2023.

However, CPKC's Return On Assets (ROA), Return On Equity (ROE) and Return On Capital (ROC) have declined over the past five years, with decreases of 61.86%, 64.43%, and 66.42%, respectively. These drops in 2020 can be attributed to the complete acquisition of Central Maine & Quebec Railway US Inc. (CMQ US), which altered CPKC's asset and equity base. These ratios experienced a further decrease after CP acquired KCS in 2021. The integration of KCS to form the present CPKC has greatly expanded its asset base and common equity.

Compared to its North American Class I peers, CPKC appears to be underperforming in terms of its ROA and ROE in 2023. However, these results could stem from the recent strategic acquisitions undertaken by CPKC. The expansion in asset and equity base due to these acquisitions is currently influencing these financial indicators. Given this unique set of circumstances, the ratios may not accurately reflect the long-term performance of CPKC. Thus, these results might be characterised as one-off occurrences and the metrics may evolve in a more favourable direction in subsequent periods.

CPKC has maintained an upward trajectory in its net income margin over the past five years at a rate of 18.53%, in line with its revenue growth. This consistent increase underscores the company's enhanced efficiency in managing operating costs and translating revenue into net profit. Notably, CPKC’s near 40% net income margin in 2022 is industry leading. The rising net income margin signals a positive trend in CPKC's bottom-line performance, indicating effective financial management and a robust approach to profitability.

Conversely, the same period has witnessed a decrease in both EBITDA and EBIT margins for CPKC. This nuanced shift in margins suggests potential complexities associated with the integration of KCS into CPKC. The transformative nature of this integration may temporarily impact the operational profitability captured by EBITDA and EBIT, reflecting the complexities of merging two entities with distinct operational structures.

While the decrease in EBITDA and EBIT margins might be a short-term consequence of the integration process, the concurrent rise in net income margin highlights CPKC's ability to navigate these challenges and maintain a positive trajectory in terms of overall profitability.

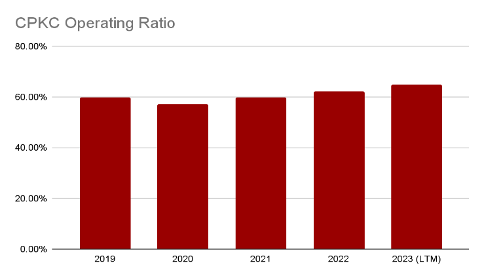

Operating Ratio

Over the same period, CPKC boasted a leading operating ratio below 60%. However, this figure experienced an increase following the acquisition of KCS. Nevertheless, the management remains optimistic and expressed confidence that the operating ratio will experience steady improvements as the two entities integrate.

Dividend & Share Buybacks

CPKC has consistently paid regular dividends for the past two decades, delivering value to its shareholders. The Company has also gradually increased its dividends per share over the years. Over the past decade, CPKC has demonstrated financial prudence by maintaining its payout ratio within a range of 15% to 20%. The low payout ratio ensures shareholders receive returns while the Company can pursue reinvestment opportunities. Furthermore, the increase in CPKC's dividends has been consistent with the upward trajectory of its net income, indicating that dividends are dependent on financial performance. This underscores the sustainability of CPKC in generating and distributing value.

Additionally, CPKC strategically deploys its free cash flows in selected years to engage in share buybacks to ensure a minimum level of shareholder value.

Investment Theses

Strategic Merger With Kansas City Southern Gearing Up To Drive Growth

The successful merger between KCS and CP has offered CPKC an invaluable opportunity to grow revenues over the long term by penetrating new markets and serving previously inaccessible populations. The comprehensive rail network enables CPKC to attract a wider customer base through unique value-added services - increased access to more markets, reduced transit times as well as a more direct and cost-efficient way of transporting goods across the North American region.

Additionally, CPKC is well-positioned to capture a more significant market share as shippers pivot from trucking to rail to avoid traffic congestion at the US-Mexico borders. According to Creel (2023), trucks could spend 2-3 days at the border as their cargos are unloaded, inspected, and reloaded for inspection. CPKC's International Railroad Bridge over the Rio Grande River at the U.S.-Mexico border at Laredo, Texas, emerged as an alternative to highway ports of entry[12].

With labour issues on the North American West Coast and the Panama Canal's recent reduction in vessel transits, the Port of Lazaro Cardenas is portrayed as an alternative for Asian shippers seeking uninterrupted access to North American markets[13]. As one of the few rail operators that could access the port through its network, CPKC is well positioned to capture any increase in trade volumes at the port. CPKC also has an opportunity to facilitate freight movement between key manufacturing hubs in North America as manufacturers are also diversifying their supply chain by moving their manufacturing capacity to Mexico after facing COVID-19 and the subsequent supply chain challenges.

Other than top-line growth, the merger also provides CPKC with opportunities to improve its bottom-line performance. CPKC estimated that the merger could generate $800 million in annual synergies in the years after the merger closed[14]. These synergy-driven cost savings not only enhance the company's profitability but also position CPKC as a financially robust and sustainable player in the rail transportation industry.

These growth prospects support CPKC to be a major player in the North American rail transportation industry and are poised for sustained success and value creation in the future.

Well Diversified & Resilient Portfolio Of Transported Goods With Solid Long-Term Prospects

CPKC has created a diversified business mix, representing a robust and balanced portfolio that spans the transportation of a wide array of commodities and merchandise across multiple origins and destinations across Canada, the U.S., and Mexico. This product and geographic diversity better position the Company to face economic fluctuations and enhance its potential for growth opportunities. The resilience of CPKC's revenue stream is underscored by a revenue variance analysis, revealing that CPKC's overall freight revenue variance is 8%, which is lower than most of its individual revenue streams.

CPKC's revenue resilience is further enhanced by its transportation of essential and non-discretionary goods, which remains indispensable even in the face of economic turmoil. A prime example of such non-discretionary products is grains, which constitute the largest revenue stream for CPKC. As a staple food source, livestock feed, and an essential ingredient for biofuel production, grains represent a vital commodity with consistent demand regardless of economic fluctuations. Revenue generated from transporting these essential goods provides a stable flow of income for CPKC and enhances its quality of earnings.

Beyond its diverse portfolio, CPKC also assumes a pivotal role in the Canadian economy as the backbone of Canada's economy. Serving as one of the two key supply chain links for Canada's key trade corridors and gateways alongside CN, CPKC is an integral infrastructure to the nation's economic vitality[15]. This position further enhances CPKC's quality of earnings and growth prospects.

With growing global concerns about greenhouse gas emissions, the rail sector, including CPKC, is poised for long-term growth prospects. Rail transport is 4 times more fuel-efficient than trucking[16]. A train can also keep more than 300 trucks off public roads and generate 75% less GHG emissions. As regulatory and consumer pressures drive a shift towards more sustainable transportation practices, CPKC is well-positioned to capitalise on this trend and reinforce its dominant position in the market.

As a result, CPKC is a resilient and robust player in the rail industry that is expected to continue to grow over the long term.

Strong Focus On Operational Efficiency A Ticket To Improved Profitability

Prior to the merger with KCS, CP was well known as one of the leading railroads for operational efficiency and profitability. Over the past few years, CP maintained a leading operating ratio consistently below 60%, a testament to its operational efficiency. While the ratio experienced a marginal rise to 64.9% in 3Q 2023 post-acquisition of KCS, the management is confident that this figure is poised to improve with the complete integration of the two entities. Despite this transitional period, CPKC boasts an industry-leading net income margin of 37.1% among North American Class I Operators over the last twelve months.

The Company's strong focus on efficiency also translated into a positive trajectory of financial and operational success for CP. Earnings from operations see a steady rise, climbing from 2,712 in 2018 to 4,521 in 3Q 2023. Despite an increase in shares outstanding, CPKC's earnings per share also show positive results, surging at a rate of 65.4%, from $2.73 to $3.78, over the same period. This financial performance underscores the tangible results of CPKC's commitment to efficiency, reinforcing its position as an industry leader in operational efficiency and profitability. Recognising that safety increases productivity and efficiency, CPKC also established a strong safety culture to drive bottom-line improvements.

CPKC's commitment to operational efficiency is also expected to continue under the leadership of CEO Keith Creel and his management team. CEO Keith Creel, a visionary leader with two decades of operational expertise in the rail industry, spearheaded the implementation of precision scheduled railroading (PSR), which enabled CP to boost volumes while concurrently reducing costs[17]. Under Creel's leadership, CP has also become an industry leader in safety performance and developed more efficient methodologies to connect customers to domestic and global markets. The successful merger of KCS and CP stands as a testament to Creel's strategic vision and operational prowess. Led by an operating-focused management team, CPKC is well-positioned for current success and poised for sustained success and industry leadership.

Valuation

Discounted Cash Flow Model

This report employs the DCF model as its primary valuation methodology. Based on the DCF model, the 3-year and 5-year target prices of CPKC are CAD$120.34 and CAD$134.34 respectively. The inputs used in the DCF model are described below:

Beta: A beta of 0.87 was used for CPKC in the DCF model. This beta is calculated by dividing the product of the covariance of the security's returns and the market's returns by the variance of the market's returns over 5 years. The market selected is the S&P/TSX Composite Index (^GSPTSE). CPKC's historical stock price data and S&P/TSX Composite Index price data were retrieved from Capital IQ.

Cost of Equity: The cost of equity of 8.0% was derived based on the Capital Asset Pricing Model. The risk-free rate of 3.70% was computed using the average of Canada’s 10-years government bond yield[18]. The equity risk premium was assumed to be S&P/TSX Composite Index’s past 10 years market return of 5.11%.

Cost of Debt: The pre-tax Cost of Debt of 5.68% was computed using the average bond yield of CPKC’s last 5 issued bonds. An after-tax Cost of Debt of 4.5% was derived after accounting for a tax shield from a tax rate of 21.42%.

Weighted Average Cost of Capital: A WACC of 7.34% was computed using the WACC formula - WACC= (E/V × Re) + (D/V × Rd × (1−Tc)).

Projected Revenue Growth: The revenue was split into the individual components of CPKC's freight business lines for growth projection. From 2023 to 2025, higher growth rates are assumed as CPKC undergoes integration to achieve annualised synergies. From 2025 to 2027, the CAGRs for Components' respective markets are considered the growth rate.

Terminal Growth Rate: A terminal/perpetuity growth rate of 3% is assumed.

Sensitivity Analysis: A sensitivity analysis on the WACC and terminal growth rate was conducted to stress-test the valuations.

Scenario Analysis: Three scenarios - Bull, Base and Bear - are created to stress test the DCF model. Based on the analysis, the 3-year target price of CPKC is CAD$96.51 to CAD$140.76 while the 5-year target price ranges from CAD$107.44 to CAD$158.53.

Relative Valuation Method

A company-comparable analysis is also performed when evaluating CPKC. This encompasses the Total Enterprise Value Multiples and Pricing Multiples. The Total Enterprise Value multiples computed are TEV/Revenue, TEV/EBITDA, and TEV/EBIT, while Pricing Multiples consist of the P/E ratio. The results of the analysis are shown below:

Based on the results, the 3-year and 5-year target prices are $118.00 and $175.59 respectively.

Football Field Analysis

The Football Field Analysis shows the 3-year target prices of CPKC using different valuation methods and multiples.

Investment Risks & Mitigation

Integration Risks: As with any M&A transactions, there are integration risks associated with it. Integration challenges, such as cultural differences, technology and system integration, and regulatory requirements, could impact the timeline and success of the merger. One crucial yet complex task was designing an integrated operating plan that incorporated precision scheduled railroading (PSR), which CP leaders long have considered a key aspect to optimal service performance.

Mitigating Factor: CPKC has formulated a comprehensive integration plan backed by stress tests to ensure the seamless convergence of all essential elements[19]. Over the past year, a dedicated integration management office, chaired by CEO Creel, has worked closely to ensure cadence for the combined entity's operational synergy. The integration efforts also encompass discussions for over 165 processes and plans for various aspects ranging from payroll and real estate management to customer relations. This multifaceted approach reflects CPKC's commitment to addressing every part of the integration process to ensure operational cohesion and efficiency. On May 8, 2023, teams from CP and KCS also conducted an alignment meeting to discuss new standards and exceptions.

Regulatory and Political Risks: The railroad industry is subjected to extensive regulations and oversight. Political uncertainties and shifts in regulatory policies may significantly impact the company's operational and financial performance. Notably, there is a specific concern for CPKC's operations in Mexico after President Andres Manuel Lopez Obrador drafted a decree to permit freight railways to allow passenger service on their tracks[20]. Such regulatory development introduces a noteworthy element of uncertainty and underscores the importance of closely monitoring political dynamics that could directly affect CPKC's operational flexibility and overall business strategy.

Mitigation: CPKC has successfully entered into an agreement with the Mexican government to conduct a comprehensive study focusing on passenger trains along a strategic 200-kilometre corridor extending northwest from Mexico City[21]. CPKC also expresses confidence that the decree, set to be effective on 20 November 2023, will not exert any adverse effects on its extensive network. The Company has also maintained healthy relationships with regulatory bodies, staying abreast of policy changes, and actively participating in industry advocacy can help navigate regulatory challenges.

Powerful Trade Unions: North American Class I railway operators, including CPKC, are subjected to collective bargaining agreements by employees through trade unions. Employees' demands for higher wages and improved working hours could adversely affect the bottom line of businesses such as CPKC. As trade unions become more influential in the transportation industry, they pose a significant risk to CP's upside as an investment.

Mitigation: CPKC plans to reduce dependency on a single port by developing capabilities in alternative ports. For instance, the Company is portraying the Port of Lazaro Cardenas in Mexico as an alternative gateway to North America for Asian shippers amid labour issues on the West Coast[22]. Such diversification could ameliorate some pain for CPKC should there be a significant disruption to any ports.

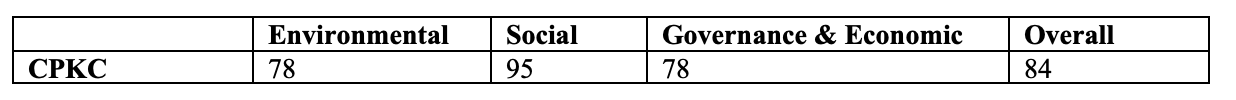

ESG Assessments

ESG Ratings Across Rating Agencies

Sustainalytics Risk Rating

Sustainalytics is a leading ESG rating agency that supports investors in making responsible investment decisions. The ratings are comparable among industry peers and across industries. The new rating distinguishes five levels of risk - negligible (1%), low (26%), medium (40%), high (23%) and severe (10%). According to Sustainalytics’ ESG risk rating, CPKC scored 17.3, which is within the low-risk range[23]. In terms of rankings, CPKC ranks 64 out of 396 companies in the transportation industry and 3052 out of 15721 globally[24].

S&P Global – Global ESG Score

The S&P Global ESG Score is a relative score measuring a company's performance on and managing material ESG risks, opportunities, and impacts compared to their peers within the same industry classification – TRA Transportation and Transportation Infrastructure. Based on the results, CPKC performs relatively better than its competitors in all 3 aspects of ESG, with an overall score of 67 [25].

Refinitiv

Refinitiv ESG Ratings measure a company's performance concerning ESG factors. The rating agency uses more than 630 different ESG metrics when computing an ESG score for companies. The scores given by Refinitiv are categorized into 4 quartiles, with the 1st quartile being the worst ESG performer and 4th being the best relative ESG performance and transparency in ESG disclosures. CPKC lies in the 4th quartile range, indicating that it is performing well in ESG relative to other industry peers[26].

MSCI ESG Rating

MSCI’s ESG ratings assess how well companies manage ESG-related risks compared to their industry peers. The ESG ratings range from leader (AAA, AA), average (A, BBB, BB) to laggard (B, CCC). MSCI provided CPKC with an “A” rating among 99 companies in the road & rail transport industry[27].

Integrated Return On Investment

Integrated Return on Investment (IROI) is a framework and methodology used to measure and communicate the social, environmental, and economic value created by an organisation or a specific project. IROI is a form of impact assessment that goes beyond financial measures to evaluate an initiative or organisation's broader social and environmental outcomes. It aims to quantify the non-monetary value generated by the resources invested.

IROI = (Economic Value + Social Value + Environmental Value) / Investment

This report employs the IROI to evaluate the social, environmental, and economic value created by CPKC.

An IROI of 1.67 was derived from our computation. This means that for a dollar invested in CPKC, there is $1.67 worth of economic or environmental value created. It is also worth mentioning that the social value component was excluded from the computation due to a lack of required information.

Conclusion

Overall, this report recommends a strong “buy” on Canadian Pacific Kansas City Limited (TSX: CP). With the only single-line transnational haul and a well-diversified business mix driving top-line performance, coupled with a competent management team that emphasises operational efficiencies (bottom-line performance), CPKC is well-positioned to grow and capture a larger market share. The 3Y and 5Y target prices based on a DCF analysis are CAD$120.34 and CAD$134.34. In terms of ESG, CPKC is also performing better than its peers, as shown by its better ESG ratings from various rating agencies. Investment in CPKC also creates positive social and environmental impacts, as demonstrated by the derived IROI (>1).

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

[1] https://investor.cpr.ca/news/press-release-details/2022/Canadian-Pacific-and-TCRC-TE-arbitration-ends-with-new-two-year-collective-agreement/default.aspx

[2] https://www.bnnbloomberg.ca/cpkc-lowers-earnings-expectations-due-to-economic-headwinds-port-workers-strike-1.1989489

[3] https://www.reuters.com/markets/commodities/oil-prices-stable-market-awaits-data-inventories-economy-2023-09-12/

[4] https://www.theglobeandmail.com/investing/markets/stocks/CP-N/insiders/

[5] Ibid

[6] https://www.sec.gov/Archives/edgar/data/16875/000119312521082825/d142846dex991.htm#toc59966_12

[7] https://railwaysuppliers.ca/english/industry/industry-information.html/industry-statistics

[8] https://www.mordorintelligence.com/industry-reports/canada-rail-freight-transport-market

[9] https://www.cnbc.com/2022/02/03/why-freight-railroads-are-so-successful-in-the-us.html

[10] https://www.mordorintelligence.com/industry-reports/united-states-rail-freight-transport-market#:~:text=US%20Rail%20Freight%20Transport%20Market%20Trends&text=The%20market%20for%20freight%20rail,railway%20network%20in%20the%20world

[11] https://www.mordorintelligence.com/industry-reports/mexico-freight-logistics-market

[12] https://www.ajot.com/premium/ajot-railways-gearing-up-for-stiff-mexico-intermodal-competition

[13] https://www.asiacargonews.com/en/news/detail?id=8825

[14] https://seekingalpha.com/article/4588580-canadian-pacific-kansas-city-southern-merger-synergies-reshoring-benefits

[15] https://railwaysuppliers.ca/english/industry/industry-information.html/industry-statistics

[16] https://www.cpkcr.com/fr/medias/canadian-pacific-and-kansas-city-southern-execute-agreement-to-c

[17] https://www.fool.ca/2023/07/21/canadian-pacific-railway-stock-is-a-strong-contender-for-a-long-term-portfolio-2/

[18] https://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/

[19] https://www.progressiverailroading.com/canadian_pacific_kansas_city/article/The-next-step-for-CPKC-Fully-fusing-and-fostering-growth-as-the-newest-Class-I--69401

[20] https://globalnews.ca/news/10100144/cpkc-mexico-decree-passenger-rail-service/

[21] https://globalnews.ca/news/10100144/cpkc-mexico-decree-passenger-rail-service/

[22] https://www.asiacargonews.com/en/news/detail?id=8825

[23] https://www.sustainalytics.com/esg-rating/canadian-pacific-railway-ltd/1008762639

[24] https://www.sustainalytics.com/esg-rating/canadian-pacific-railway-ltd/1008762639

[25] https://www.spglobal.com/esg/scores/results?cid=4995550

[26] https://www.knowesg.com/esg-ratings/canadian-pacific-railway-limited

[27] https://www.msci.com/zh/esg-ratings/issuer/canadian-pacific-kansas-city-ltd/IID000000002132019