Initial Report: Casey's General Stores (NASDAQ: CASY), 61% 5-yr Potential Upside (Trinsy NEOH, EIP)

Trinsy NEOH presents a "BUY" recommendation for Casey's General Stores based on the company's unique competitive positioning, top-class capital efficiency and more.

Casey’s General Stores

Beyond the pump: How Casey’s is Redefining Convenience in Small-Town America

Ticker: NASDAQ:CASY

Mkt cap: US$15.9Bn

P/E ’25/’26: 30.1x/28.9x

YTD: 9.13%

Investment Summary

Long 1YTP: USD$497 (+16% share price upside)

Casey’s is the third-largest convenience store chain in the U.S., strategically positioned in underserved rural markets. Its vertically integrated model, owning both its distribution centers and real estate, drives operational efficiency and margin strength.

With 75% of store traffic unrelated to fuel and industry-leading 41% inside-store margins, Casey’s differentiates itself from traditional convenience store gas stations.

Amid rising demand for food service and accelerating industry consolidation, Casey’s southern U.S. expansion and white space penetration—supported by investments in private label and technology—are set to drive continued margin expansion and long-term growth.

Company Background

Most people still think of convenience stores as a pit stop for gas, a quick snack, and a bathroom break. Not so at Casey’s General Store. The company’s approach was simple: to capitalise on the fact that there are limited options in rural areas of the U.S. They started their first outlet in Boone, Iowa, and expanded across the Midwest and Southern regions, where populations were fewer than 20,000 and traditional grocery stores were scarce. Casey’s became more than just a fuel station—it was a place for quality food, community engagement, and even a car wash, all in one.

As of 2024, there were a total of 2,658 stores in operation. They are currently the 3rd largest convenience store chain in the U.S. and the 5th largest pizza chain in the U.S.A convenience store being known for its pizzas? Yes. Handmade pizza has been Casey’s flagship product since 1984. Unlike urban areas where Domino’s and Pizza Hut were available, Casey’s locations made it a natural decision to upsell and add food into their offerings. This became one of the best decisions ever made, giving Casey’s a unique value proposition—providing a variety of options and strong margins for a gas station convenience store.

Selling fuel alone is a tough business—essentially a low-margin, commoditized industry. The environment is highly competitive, with multiple gas stations often clustered in one area, making margins razor thin. That is why many gas stations maximize profits through in-store sales. 99% of Casey’s locations offer self-service fuel, which the company sources unbranded from the open market and distributes through its own delivery fleet, helping improve fuel margins.

Thin margins from selling a gallon of gas, business generate revenue from inside stores

Other than selling gas, the business separates its revenue by four categories: (1) Prepare food and dispensed beverage, (2) grocery and general merchandise, (3) fuel and (4) Other (this includes activity related to the wholesale fuel revenue from dealer network and car wash revenue).

In the last financial year, retail fuel sales accounted for approximately 63% of Casey’s total revenue. However, from a gross margin perspective in Q1 2025, prepared food and dispensed beverages contributed 58%, followed by grocery and general merchandise at 35%. Inside sales have been growing steadily over the past three years, in line with the company’s strategy to promote higher-margin products. Notably, 75% of store traffic is driven by non-fuel-related purchases.

There are three different store formats that caters to different areas. Each store carries ~3,000 packaged food, beverage and non-food items. Products span across private label products (which includes over 350items as of April 30, 2024), as well as favored national and regional brands. These products include non-alcoholic beverages, alcoholic beverages, packaged foods, tobacco and nicotine products, frozen foods,non-foods and your services such as ATM, lotto/lottery and prepaid cards. Each store will have 4-6 islands of fuel dispensers and storage tanks with capacity for 44,000 to 70,000 gallons of fuel. All stores open for at least 16 hours a day, 7 days a week. Most of Casey’s existing and proposed stores are within the three distribution centers' optimum efficiency range-a radius of approximately 500 miles around each distribution center.

Management

The founding of Casey’s dates back to 1959, when Donald Lamberti leased a service station from his father and began remodeling it into a convenience store. During this time, an oil businessman named Kurvin C.Fish visited the location and recognized a significant gap in underserved markets, areas that larger retailers typically avoided. Inspired by this opportunity, Casey’s was born, targeting small towns across the Midwest.

After several leadership transitions including Ron Lamb, Bob Myers, and Terry Handley, Casey’s appointed Darren Rebelez as CEO in 2019 following Terry’s retirement. Rebelez became the company’s first external CEO. Prior to joining Casey’s, he served as President of IHOP (2015–2019), and spent eight years with 7-Eleven, along with earlier roles at ExxonMobil, Thornton Oil, Fuddruckers, and PepsiCo.

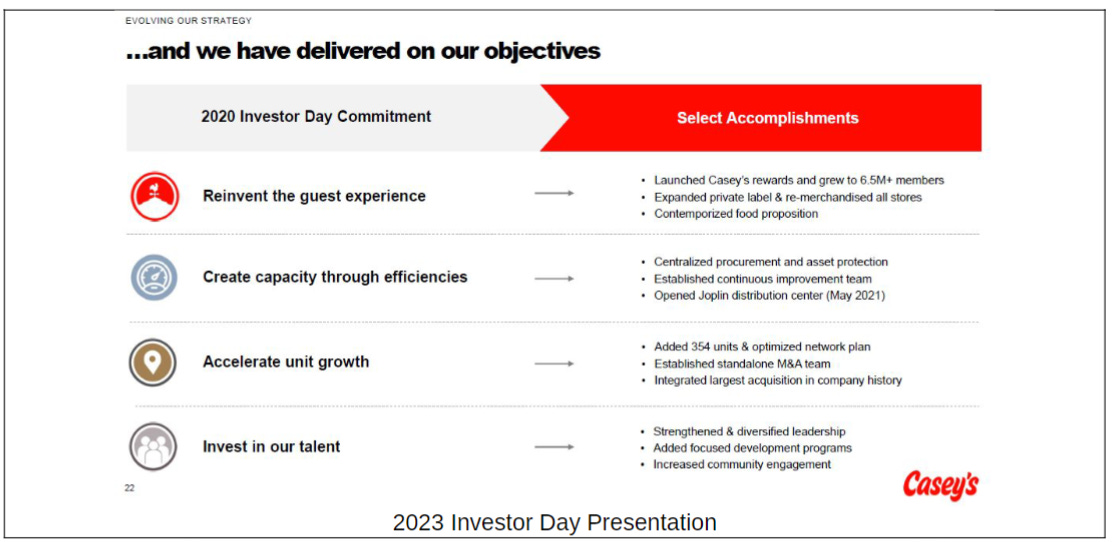

Rebelez was seen as the right leader to bring Casey’s into its next phase of growth, especially in modernizing the business through technology and data. Since his appointment, Casey’s launched a 3 year strategic plan that included the rollout of a digital loyalty programme and accelerated its M&A activities.

Business Moat

Two things that drew me to Casey’s business. First, the business owns distribution centers. Second, they directly own the real estate of all its store locations.

When Casey’s launched its business, it chose a self-distribution model. In 2004, the company established its first distribution center in Ankeny, Iowa, to supply grocery and general merchandise to its stores.Management deliberately avoided long-term supplier contracts, believing that this flexibility would allow Casey’s to adapt quickly to changing market conditions. By making that early investment, the company is now reaping the benefits of stronger margins and faster integration in mergers and acquisitions.

Today, Casey’s operates three distribution centers and a fleet of 400 tractors for grocery and fuel distribution. In addition to the original facility in Iowa, the other two centers are located in Terre Haute,Indiana (opened in February 2016), and Joplin, Missouri (April 2021). Each distribution center supports approximately 1,100 stores, giving the company significant operating leverage. Casey’s expansion strategy focuses on opening stores within a 500-mile truck radius of its distribution centers, enabling lower transport costs, fresher inventory, and more efficient working capital management. In contrast,competitors like 7-Eleven and Circle K rely largely on third-party distributors.

On the second point, the company has been actively purchasing real estate to build stores in lower-density areas. ~75% of all Casey’s locations are situated in towns with fewer than 20,000 residents markets typically overlooked by larger chains. Similar to Walmart’s rural expansion strategy, Casey’s targeted areas with less competition, resulting in lower pricing pressure.

Owning its store real estate gives Casey’s greater flexibility to adapt store formats and enhance offerings based on local needs. For example, the company launched a monthly subscription car wash service in January 2022. This ownership model allows Casey’s to remodel stores to include kitchens, car washes, and EV charging stations as needed. In times of industry change, Casey’s can respond more quickly than competitors reliant on leased properties, and it avoids rising rental costs, gaining a long-term cost advantage.

As the business scaled and built a strong brand across the Midwest and South, larger players such as Alimentation Couche-Tard showed interest in acquiring the company. However, the deal did not materialize, as Casey’s management recognized the company’s unique value proposition and strategic positioning in the market.

Industry Analysis

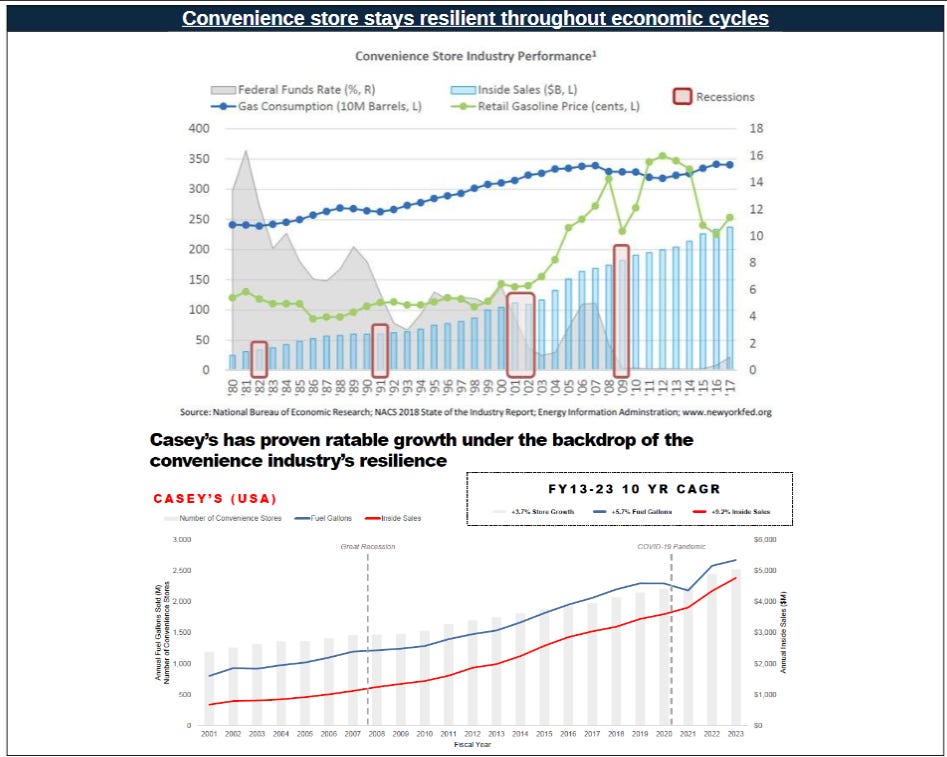

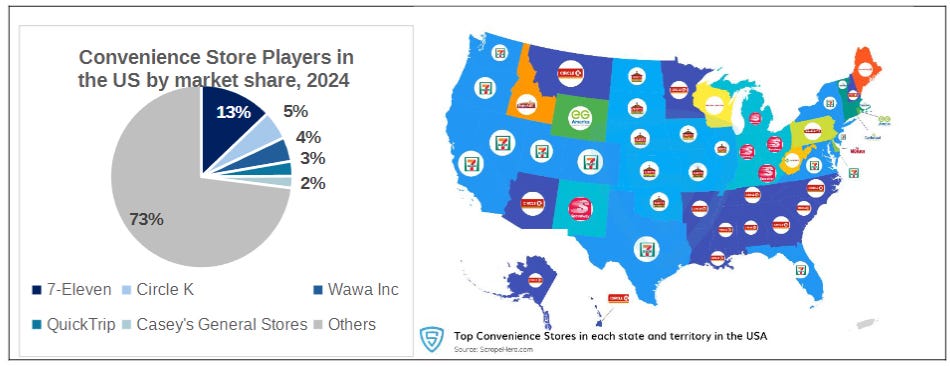

The convenience store industry in the US is heavily fragmented with the top 5 biggest players only accounting for ~27% of the total market. Industry wide, there is around 148,026 convenience stores in the US and ~60% were owned by single-store operators. There are mainly three industry trends which supports Casey’s in the long-term. Firstly, the industry has shown resiliency throughout economic cycles. Since 1980s, the industry seems independent of recessions as inside sales and gas consumption follows an increasing trend. Investing in the recession resistant industry would protect investors from negative economic impacts.

Secondly, shift in consumer trends where food offerings are driving consumers to visit convenience stores. In 2024, more convenience store players look to proprietary food offerings to give consumers a reason to seek them out. Since the 2022 inflation, US consumers have sought out less expensive options for food service than restaurants, benefitting convenience retailers. Competitors such as Seven & I Holdings discussed in its Q2 2024 earnings the company’s decision to extend its partnership with Warabeya, 7-11’sproprietary food programme in Japan. Additionally, Circle K also introduced “meal deals” which offers food and drink options for USD$5 and less. Casey’s is in a position to capitalise on this opportunity as it has been offering hot foods and meals for its consumers. Especially in the rural towns across the Midwest and Southern US where residents have limited retail options, Casey’s act as a store for essential daily needs such as meals, snacks, and groceries.

“According to the National Association of Convenience Stores (NACS), more than 8 in 10 rural Americans(86%) report having a convenience store within 10 minutes of their home, often serving as the only place in town to purchase grocery items, fuel, or other products and services.”

Lastly, the industry is consolidating. Players in the industry have been trying to acquire smaller mom and pop stores which still accounts for ~60% of the market. Recently in August 2024, Alimentation Couche-Tard, global brand owner of the Circle K brand, tried to acquire Seven & i Holdings. Seven & i Holdings owns the 7-Eleven franchise, a major brand in convenience stores and forecourt retailers in the US. If the deal had gone through, it would have effectively doubled Alimentation Couche-Tard’s market share in the US. From 2020 to 2023, the smaller players (1-50 stores) were getting acquired by bigger player. The number of stores in the 1-10 segment reduced by ~800 outlets. Casey’s have also made strides in acquiring Fikes Wholesale, adding 148 additional stores in Texas, as well as stores in Alabama, Florida,and Mississippi, and strengthening Casey’s foothold in the central US.

Peer competitors

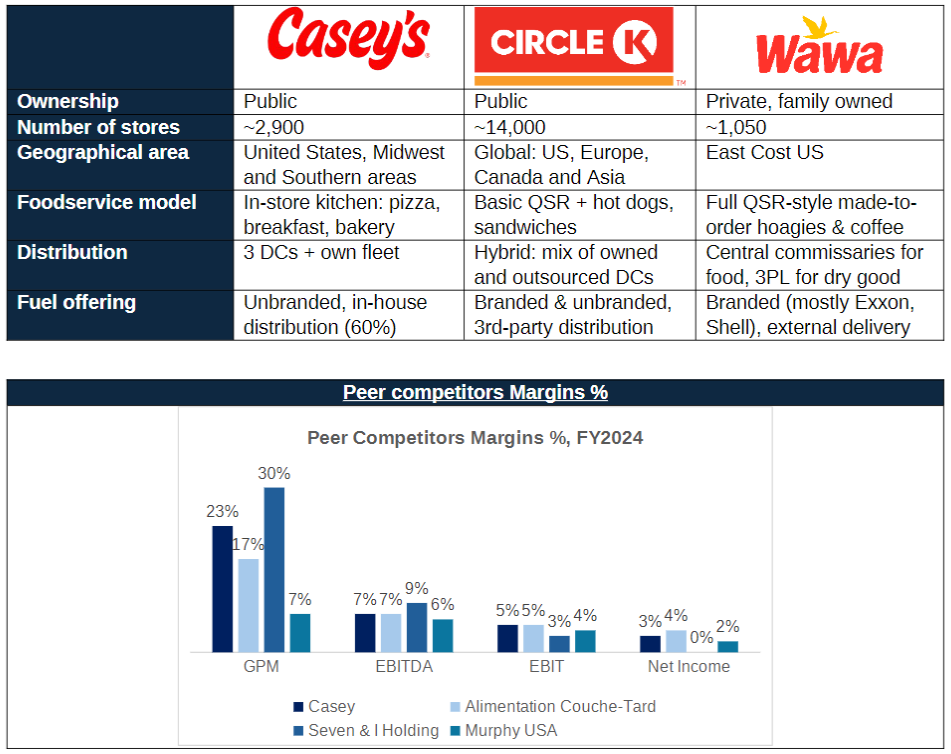

The convenience store market is highly fragmented, with a long tail of smaller players. Casey’s has risen through the ranks over the years, driven by a disciplined expansion strategy. Its closest competitors are Circle K, owned by Alimentation Couche-Tard, and Wawa. These players follow a similar approach,focusing on rural and suburban markets with a quick-service restaurant (QSR) style model. While Wawa adopts a comparable strategy, its presence is largely concentrated on the East Coast, particularly in Pennsylvania, Florida, New Jersey, and Virginia.

Over the past decade, Casey’s has consistently remained among the top five convenience store chains in the industry. It recently advanced to third place, despite having no international presence. Unlike its global peers, Casey’s dominates primarily in the Midwest and Southern regions of the United States.

Why Casey’s over Alimentation Couche-Tard (ATD)?

Based on its business margins and strategy, ATD maintains a large footprint in the global convenience store industry. Unlike Casey’s, ATD operates a mixed model that includes both company-owned and franchised locations. In the US, many of its stores are located in urban areas, where consumers have a wider range of alternatives. ATD’s growth may be slowing, particularly as its European markets become more saturated. Additionally, its gross profit is heavily dependent on fuel, which accounts for approximately50% of total gross profit highlighting a greater reliance on a volatile, lower-margin segment compared to peers like Casey’s.

Investment thesis

1. Casey’s Set to Lead Industry Consolidation Through Southern Market Expansion.

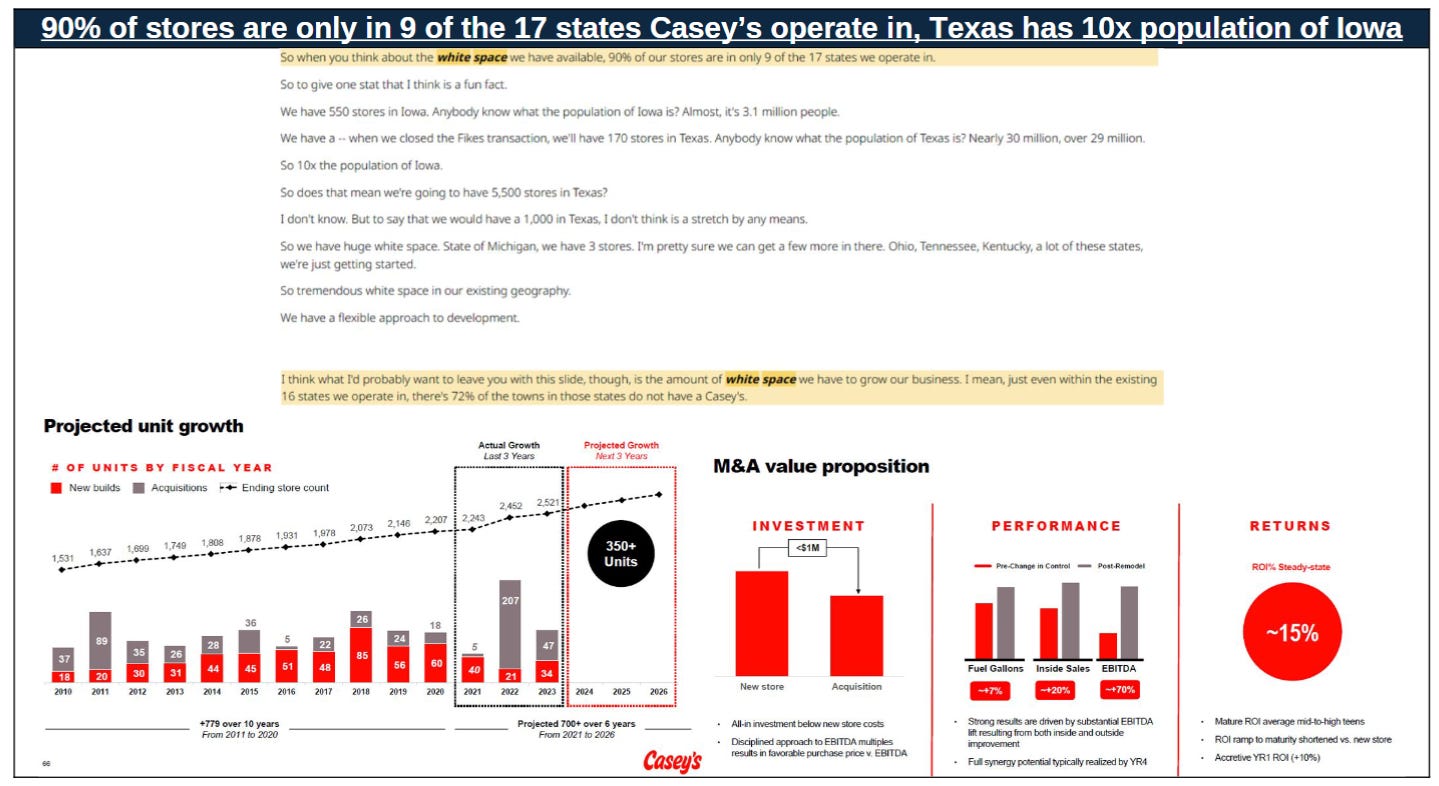

Casey’s expanded its store count from the Midwest area (Iowa, Missouri, Illinois) to the Southern US in early 2020. Over the span of three years, the business acquired ~300+ stores. They started with Bucky’s Acquisition (2021) where 94 stores were added in Arkansas, Texas and Oklahoma. In 2023, the business acquired Lone Star Food Stores which added 22 stores in Texas. More recently in 2024, the business acquired Fikes Wholesale across Texas, Alabama, Mississippi, Louisiana, and Florida.

There is still significant room for market penetration in Casey’s existing footprint, as well as in new regions such as Texas, where the company is actively expanding. Casey’s growth strategy focuses on opening stores within a 500-mile radius of its distribution centers to maximize operational and cost efficiencies. The newest distribution center, located in Joplin, Missouri, supports expansion into the southern U.S.

According to the NACS/NielsenIQ Convenience Industry Store Count, Texas has the highest number of convenience stores in the country, with approximately 16,416 locations, representing 12% of the U.S. total.Despite this, Casey’s penetration in Texas remains low at around 1.04%, presenting a substantial growth opportunity. Additionally, about 60% of Texas stores are independently owned and operated, making the market ripe for consolidation.

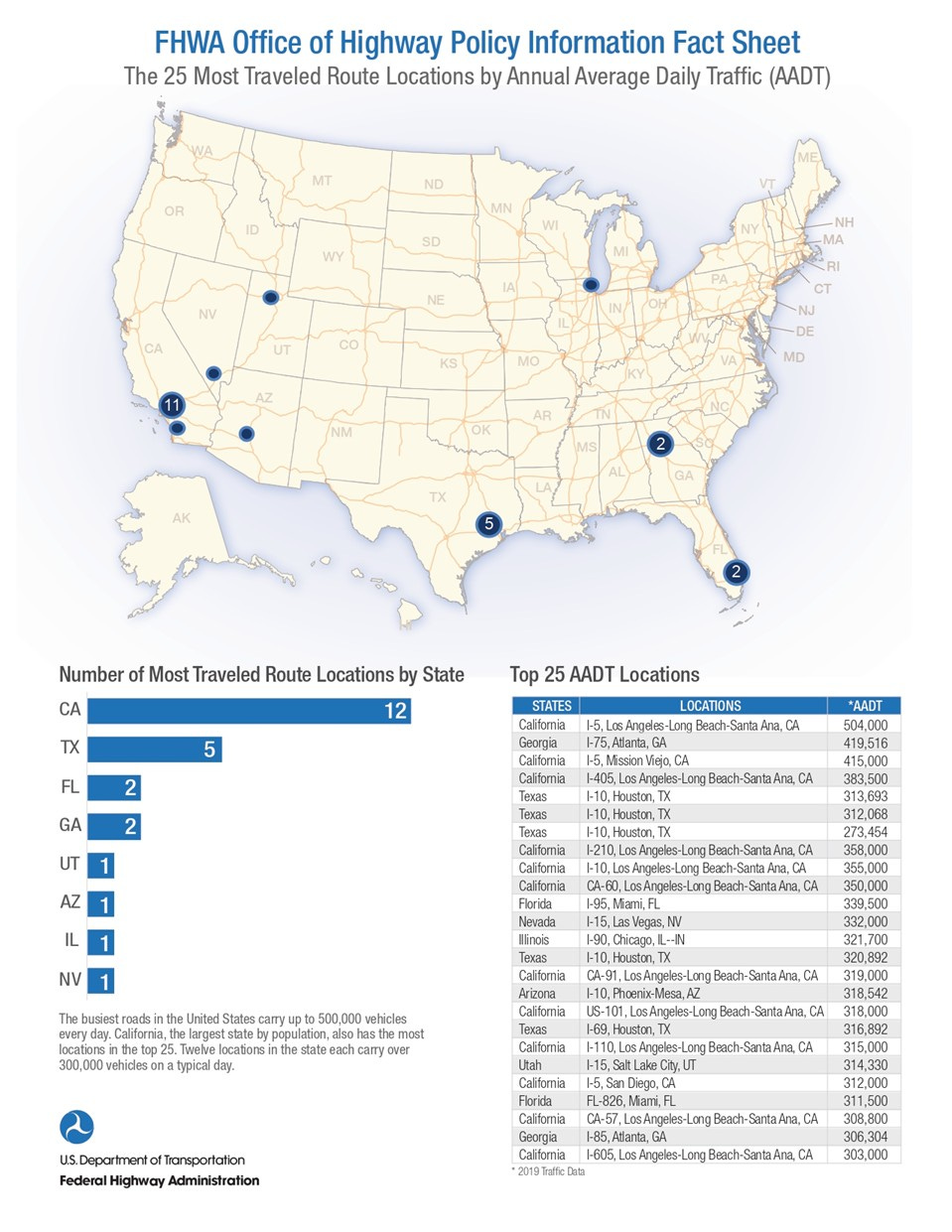

Texas also offers favorable operating conditions for Casey’s. According to the FHWA Office of Highway Policy, Texas ranks second in the number of most-traveled route locations by state (Appendix A). This high volume of roadway traffic increases the potential for footfall at Casey’s locations, driving both fuel and in-store sales.

As the industry continues to consolidate, Casey’s has a long runway for expansion through both new store openings and acquisitions. In its latest earnings call, management highlighted the significant white space opportunity available. Across the 16 states where Casey’s operates, 72% of towns still do not have a Casey’s location.

To capitalize on this, the company established a dedicated M&A team, which added 354 stores between2021 and 2023. Casey’s is well positioned to consolidate smaller operators, particularly in regions where consumer behavior aligns with its core markets. These areas also fall within the reach of its distribution centers, enabling operational efficiencies while maintaining a consistent and recognizable value proposition for local customers.

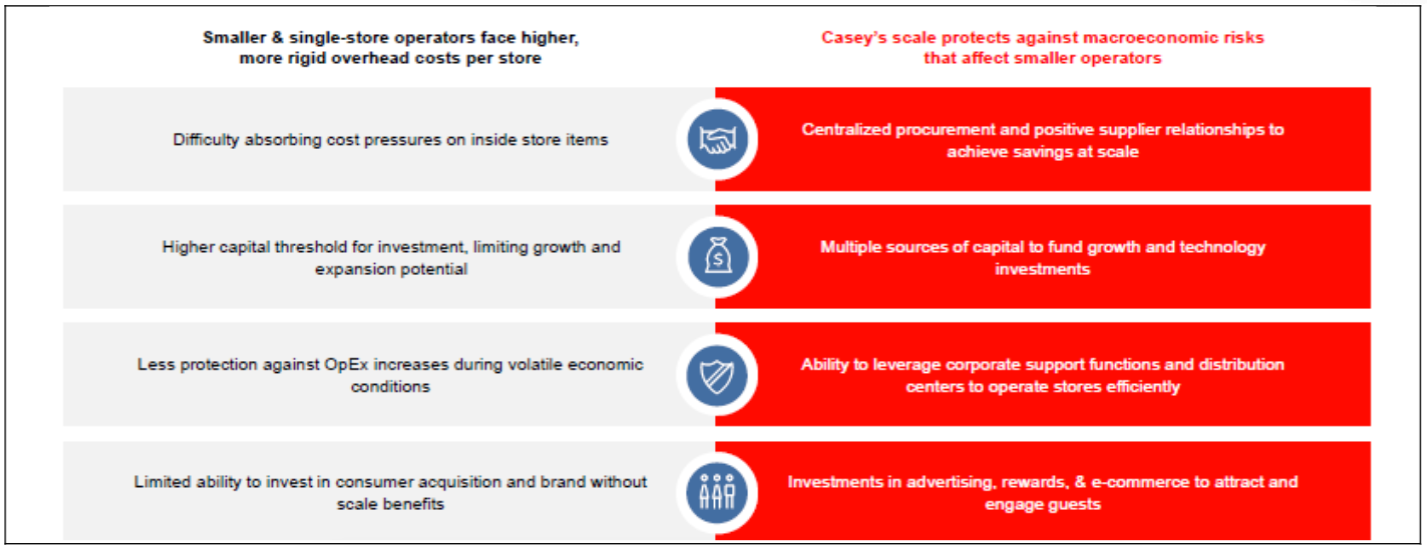

As larger players expand into regions with a high concentration of independently owned mom-and-pop stores, smaller operators increasingly struggle to compete both in terms of margins and product variety.Companies like Casey’s benefit from economies of scale, enabling bulk purchasing and more efficient operations through their owned distribution network. This translates into higher profit margins.

In contrast, smaller players lack these structural advantages and often find it difficult to maintain competitive pricing, particularly during periods of cost pressure. Larger chains also offer a broader assortment of nationally recognized brands, which attracts more customers and further reinforces their market presence. As a result, many independent operators have opted to sell their businesses to larger chains amid growing competitive pressures.

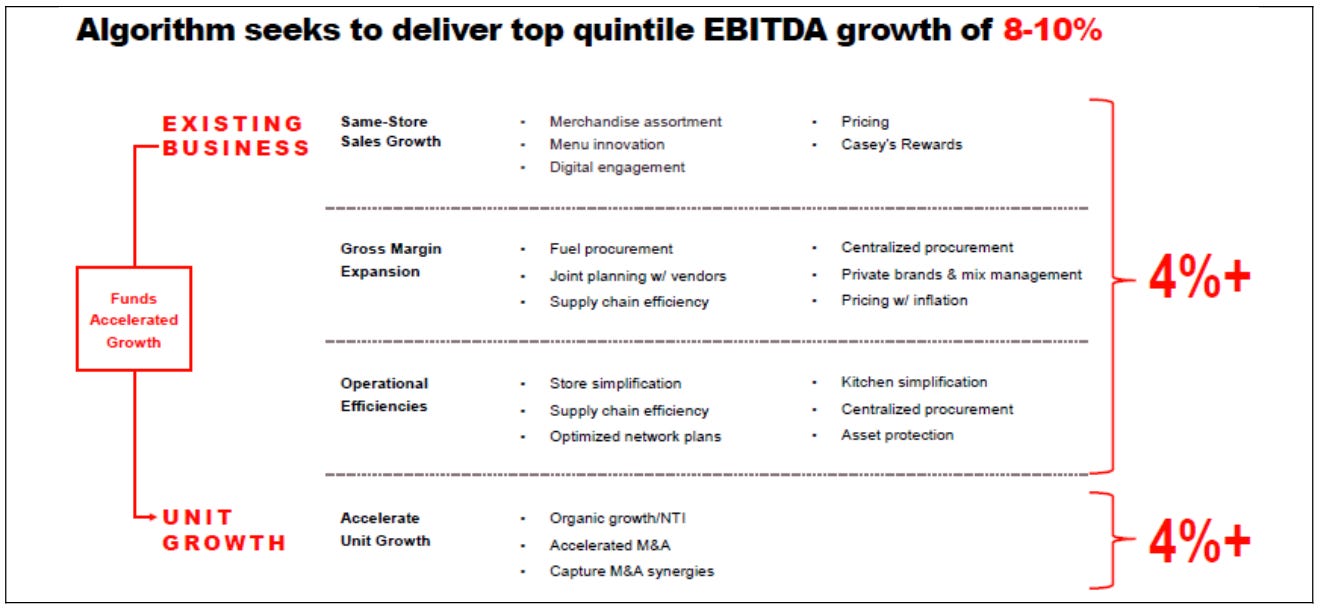

2. Private Labels, technology and distribution centers to drive Margin Expansion.

Casey’s investments into private labels, technology and distribution centers would drive margin expansion for the business. In Q2 2024, the company continued to see margin improvement in its inside-store sales.Same-store grocery and general merchandise sales increased by 1.7%, or 8.7% on a two-year stacked basis, with an average margin of 34%. Prepared food and dispensed beverage sales rose by 6.1%, or17.2% on a two-year stacked basis, with an average margin of 59%—an improvement of approximately230 basis points year over year. Casey’s private label products have proven to deliver higher margins than branded alternatives. Consumer preferences support this shift, with 69% of Midwest shoppers reporting they purchase private label products always or often. Since launching its private label program in 2021,Casey’s has achieved approximately 10% penetration in unit sales and gross profit dollars within the grocery and general merchandise category. By leveraging its own distribution centers, Casey’s is able to offer private label items at higher margins compared to national brands.

Secondly, Casey’s have been integrating technology into their business. In Q2 2020, Casey’s introduced their loyalty programme where guests can earn points from online, in-store or at pump purchases via the mobile app. Points earned can be redeemed for donations to a local school of the guest's choice, fuel discounts, or Casey's Cash, which can be used on many products sold in their stores. Today, there are ~9million active rewards members and 1/3 of Casey’s transactions come from loyalty members. The increased personalization through data analytics help to improve promotion efficiency and 12-15% increased spend per transaction.

In addition, Casey’s uses data-driven software tools to set fuel prices at individual store level. This fuel pricing tool has helped Casey’s gain up to 1.8% share in the gallons sold. Historically, the firm adopted afield level approach whereby store managers will price fuel based on how competitors were pricing along the street. Now, the company has transitioned to using a centralised pricing model from the HQ where a dedicated team will use real time data and software. Fuel prices are adjusted multiple times a day and store by store if needed. Pricing tools work hand-in-hand with procurement systems to protect margin,even as wholesale costs fluctuate. Moreover, with Casey’s owned tanker fleet, the company is able to leverage and reduce costs. Investing technology in Casey’s business has enhanced operational efficiency.In 2023, the business reported 2.3% reduced same-store labour hours. This number is expected to grow as operations scale driving cost savings. By FY2026, the management is guiding an 8-10% EBITDA% growth.

Key risks

As Casey’s continues to expand across the South and invests heavily in distribution and technology, these moves appear value-accretive in the near to medium term. However, a key structural risk lies in the declining relevance of fuel sales over time, as Electric Vehicle (EV) adoption accelerates. This could be a concern for Casey’s as there may be lower foot traffic where there is a potential loss of fuel margin and in-store purchases. In my opinion, this does not pose a huge risk to the business as I do not expect EV adoption to happen overnight. Moreover, since the business operates in the rural areas of US, I would expect the transition to be slower. Casey’s has also been adapting to the EV trend. In FY2024 Casey’s reported 170 EV charging stations across 37 stores locations across 12 states.

What sets Casey’s apart from other convenience store chains is its strong positioning as a destination for food and groceries not just fuel. As mentioned in the beginning of the paper, 75% of store traffic is non-fuel related. This positions Casey’s well for the shift toward EVs, especially since the company owns the vast majority of its store real estate, making it easier to install EV chargers. Moreover, EV charging dwell time presents an opportunity: while customers wait 15–20 minutes to charge their vehicles, they are more likely to enter the store and purchase food or other items leading to a higher average ticket size. Interestingly, most households cannot install superchargers at home, whereas Casey’s locations can accommodate them easily, giving it a strategic advantage as EV adoption grows.

Moreover, the decline in tobacco sales driven by increasing health awareness and shifting consumer preferences may impact Casey’s Grocery & General Merchandise category over time. However, the company has already taken steps to reduce its reliance on tobacco, as reflected in its recent earnings call.By shifting its sales mix away from tobacco toward higher-margin categories, Casey’s has achieved an inside gross margin that exceeds the industry average, while many competitors remain more dependent on tobacco-related revenue.

Valuation

Casey’s is currently trading at a 30.1x trailing P/E and 28.9x forward P/E, with top-line growth projected between 8–10% and EBITDA margins expanding toward 8–10% in the base case. Based on my DCF analysis using a 15% WACC and a 2% terminal growth rate, the intrinsic value of Casey’s is estimated at$462.58. With the stock currently trading at $432, the market appears to be undervaluing the company by~7%. While the stock trades at a premium relative to peers, this valuation is supported by Casey’s ability to consistently deliver EBITDA growth and maintain gross margins that are ~500bps higher than the industry average. The company’s operational efficiency, vertical integration, and margin-accretive strategy justify the premium multiple.

Financial Statements

Trading Comps

Quite an extensive write up! We have added it to our weekly pitches