Initial Report: CATL 宁德时代 (300750.SZ), 217% 3-Year Potential Upside (Mian XIA, EIP)

XIA Mian presents a "BUY" recommendation due to the company's investment theses of being an industry leader, technology moat and LFP movement.

Linkedin | XIA Mian

Executive Summary

Contemporary Amperex Technology Co., Ltd. (CATL) 宁德时代 (300750.SZ) is the world leading company in the field of R&D, production and sale of power batteries, energy storage batteries and battery recycling products, as well as battery management systems.

It has a dominating position in terms of market share in China as well as on a global level. It has strong technological capabilities as well as an excellent ESG track record. Operating in a fast expanding sector, it is set out in this report that this stock would be a great opportunity for a BUY at this point in time, with an estimated 138% upside within a year.

Company Overview

CATL is mainly engaged in research and development, production and sales of power batteries, energy storage batteries and battery recycling products, as well as battery management systems. According to the National Economy Industry Classification and Code (GB/T 4754-2017) issued by the National Bureau of Statistics, the Company belongs to the subcategory of "C3841 Lithium-ion Battery Manufacturing" under "C38 Electrical Machinery and Equipment" within the C category of Manufacturing.

In 2022, CATL's global market share stood at 37%. Its headquarters are in the city of Ningde (宁德) in Fujian Province, China, hence the Chinese name of 宁德时代. Presently, CATL has established 13 battery manufacturing bases worldwide, mostly in China but also in Erfurt, Germany and Debrecen, Hungary. It has 5 R&D centres, including one in Munich, Germany and is opening another in Hong Kong.

Business segments

Battery systems

Power battery systems

The company's power battery products include cells, modules/cells and battery packs. The company's power battery can meet fast charging, long life, long range, environmental adaptability and other functional requirements. Its products possess qualities of high power density, high cycle times, safety and reliability. According to application fields and customer requirements, the company designs personalized product solutions through customization or joint research and development to meet customers' different needs for product performance.

In the passenger car application field, the company has formed a series of products including high energy density ternary high-nickel batteries, ternary high-voltage medium-nickel batteries and cost-effective lithium iron phosphate batteries, covering different market segments such as BEVs, PHEVs and HEVs. The company has formed a series of products including high-energy density ternary high-nickel batteries, ternary high-voltage medium-nickel batteries, and cost-effective lithium iron phosphate batteries, covering different market segments such as BEVs, PHEVs, and HEVs, and matching business modes such as power switching and battery rental. They are widely used in private cars and operational vehicles.

The company provides customers with diversified products and solutions in the fields of passenger transportation, urban distribution, heavy-duty transportation, road cleaning and other buses and commercial vehicles. The company's products can be applied to two-wheeled vehicles such as electric bicycles and electric motorcycles, logistics vehicles such as electric heavy trucks and electric light trucks, covering commercial modes such as sharing and switching, as well as forklifts. Our products can be applied to two-wheeled vehicles such as electric bicycles and electric motorcycles, logistics vehicles such as electric heavy-duty trucks and light-duty trucks, and cover business modes such as sharing and switching, as well as construction machinery such as forklifts, loaders and excavators, and electric ships.

Battery storage systems

The company's energy storage battery products can be used in the electric power field to provide energy storage support for solar or wind power generation and increase the proportion of renewable energy generation; Meanwhile, they can also be used in power transmission and distribution and power consumption, including industrial energy storage, commercial buildings and data center energy storage, charging station energy storage, communication The company's energy storage application scenarios include industrial enterprises, commercial buildings and data center energy storage, charging station energy storage, communication base station backup battery and household energy storage. Based on the application scenarios of energy storage, the company has developed special batteries for energy storage with unique technologies and combined them with intelligent liquid-liquid batteries. Based on the application scenarios of energy storage, the company has developed special batteries for energy storage with unique technology, and combined with intelligent liquid cooling temperature control technology, high CTP technology, and non-heat diffusion technology, the company has launched batteries with high charging and discharging efficiency, long life, high integration, and high safety features. EnerOne, an outdoor system with high charging and discharging efficiency, long life, high integration and high safety features, and EnerC for all-climate scenarios, have been launched, providing a full range of products from cell components to complete energy storage battery systems. The company offers a full range of products, from cell components to complete energy storage battery systems.

Raw material for batteries

The company's products include some of the main raw materials required for the production of power batteries and energy storage batteries. The company also recycles The company also recycles nickel, cobalt, manganese, lithium and other metal materials and other materials in waste batteries through processing, purification, synthesis and other processes to produce lithium batteries. Through processing, purification, synthesis and other processes, the company produces ternary precursors, lithium carbonate and other materials required for the production of lithium batteries, and recycles copper, aluminum and other metal materials after collection, thus realizing effective recycling of key metal resources required for the production of batteries. The collection of copper, aluminum and other metal materials will be recycled, so that the key metal resources required for battery production can be effectively recycled.

In addition, in order to further ensure the supply of key upstream resources and materials for battery production, the company has participated in the investment, construction and operation of lithium, nickel, cobalt, phosphorus and other battery mineral resources and related products through self-built, equity participation, joint venture and acquisition. In addition, in order to further ensure the supply of key upstream resources and materials for battery production, the Company participates in the investment, construction and operation of lithium, nickel, cobalt, phosphorus and other battery mineral resources and related products through self-built, equity participation, joint venture and acquisition.

Revenue drivers

Broad customer base

CATL benefits from a broad customer base, spreading over different product lines and covering both Chinese and international major players in the field.

In terms of power batteries, the company has the widest coverage of customer groups, helping customers to build global leading competitiveness. Internationally, the company has deepened global cooperation with Tesla, BMW, Daimler, Stellantis, VW, Ford, Hyundai, Honda and other automobile enterprises. Domestically, the company has strengthened cooperative relationships with SAIC, Geely, NIO, Li Auto, Yutong and other automobile enterprises.

In terms of energy storage batteries, the company has increased the coverage of customers in all segments. Overseas, the company has deepened multi-regional and multi-area business cooperation with Tesla, Fluence, Wärtsilä, Flexgen, Sungrow, Hyosung and other leading customers in the global new energy industry.

Domestically, it has established business cooperation with the National Energy Group, State Power Investment Group, China Huaneng, China Huadian, China Yangtze River Gorges, China General Nuclear Power Group, and the China National Power Investment Group.

In terms of medium-sized batteries, the company established a joint venture with ATL to promote the development of home storage, industrial and commercial energy storage, electric two-wheelers, drones, power tools and other market segments.

In addition, the company promotes integrated innovation in a number of market application scenarios, covering smart mines, power exchange services, optical storage, charging and inspection, smart ports, electric ships and other fields.

Cost drivers

Battery Raw Material Prices

Mid-stream material prices mostly trended down in 3Q23: Anode prices are flattish in 3Q vs. 2Q; wet separator prices down 4%q/q in 3Q23; electrolyte prices dropped another 24% in 3Q23. Raw material prices also saw sharp decline in 3Q except cobalt-lithium prices fell more than 45%. Overall, it is estimated that total battery material costs had declined ~6-7% on average in 3Q vs. 2Q in 2023.

Investment Theses

#1 - Industry leader in lithium battery space with strong demand and ample space for growth

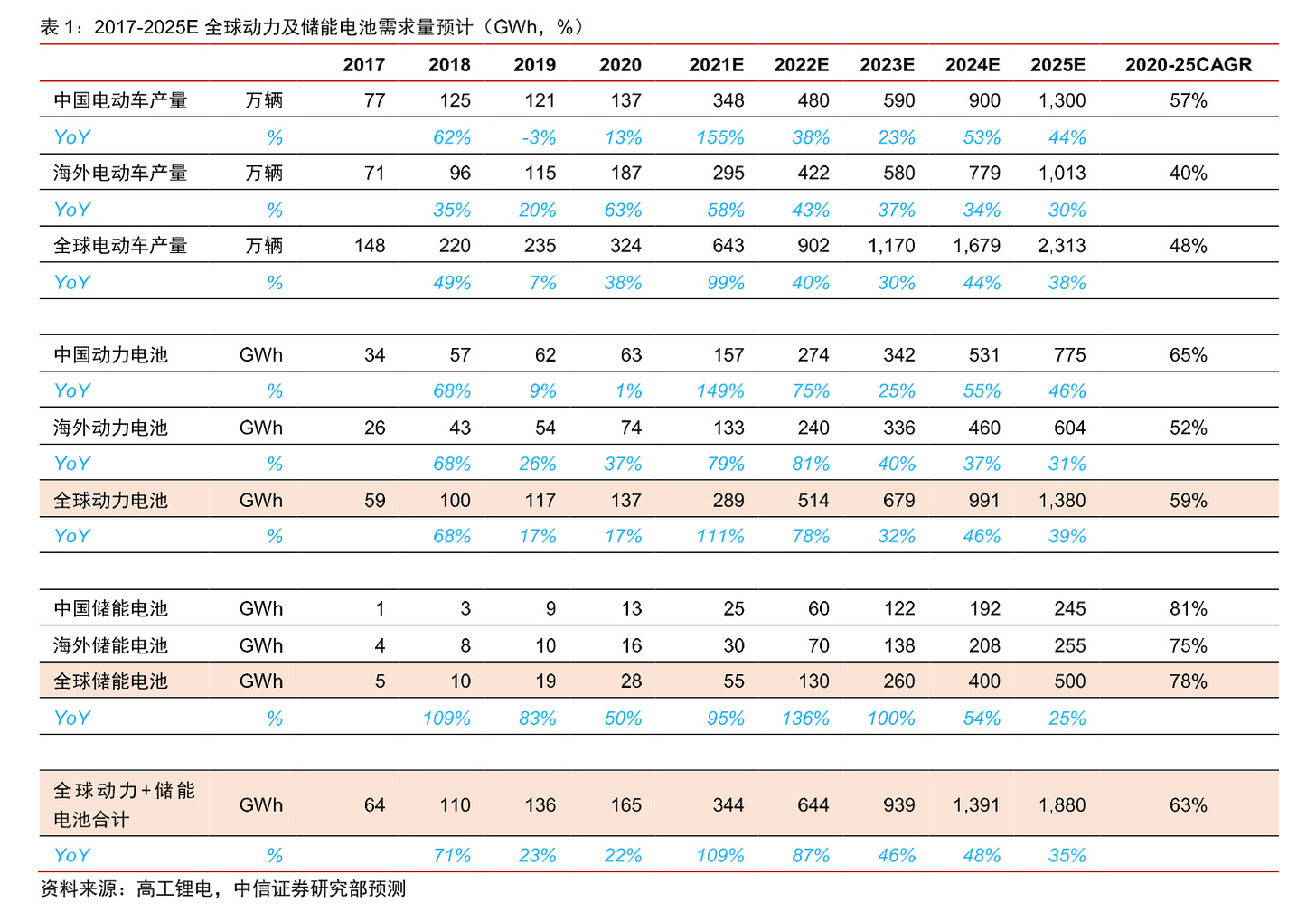

At present, the main application areas of lithium batteries are power batteries and battery storage systems. In the field of power batteries, the global demand for power batteries for new energy vehicles in 2021 is about 289GWh, and it is expected that by 2025, the global demand for power batteries for new energy vehicles will reach 1,380GWh, and the industry has entered the TWh era, with a high certainty of medium- and long-term growth, a large space, and a fast growth rate. In terms of energy storage systems, global energy storage battery demand in 2021 is about 55GWh. It is expected that global energy storage battery demand in 2025 is about 500GWh. The industry is about to enter the explosive growth period.

Trajectory shows that by 2025, the global power and storage lithium battery demand is close to 1.9TWh, 2020-25 CAGR of 63%. In recent years, the pattern of the global power battery industry is clear, and the market concentration has further increased. According to SNE Research data, the industry CR3 /CR5 in January-November 2021 was 65%/80%, compared with 2018, respectively, to improve 8/12pcts. Among them, the leading position of CATL continued to consolidate, and for four consecutive years to maintain the industry's first, the company's global market share in January-November 2021 was about 32%, and the South Korean battery company LGES market share was 20.5%, second only to CATL, being the largest battery manufacturer in the world. Their combined market share (CR2) is 52%, occupying half of the global power battery market.

#2 - Technology moat in terms of quick recharge

In the domestic market, investors are concerned about possible oversupply of batteries, driven by demand slowdown, competition and commoditisation. Indeed the latest September 2023 trend shows the second-tier suppliers’ market share rising to 34% compared to 9-month accumulated market share of 28%, of which CATL’s market share has declined to 39%.

However, OEM’s supplier diversification has been normal in most of the manufacturing processes and the EV sector is no different. Indeed, CATL’s domestic market share has been on a gradual declining trend from its peak in August 2019 at 68% down to 40% as of September 2023.

Indeed, looking at the battery cycle from 2000-2010 driven by mobile devices, major battery cell makers consolidated their position, with the Korean and Chinese players having emerged as winners, while the Japanese lost out.

This has been driven by a technology moat, cost competitiveness and solid client relationships, captive and non-captive. Given such dynamics, CATL is expected to be able to maintain their premium status. Further, CATL, combined with BYD, is expected to command 70% of market share in domestic battery installation, with CATL having the best balance of technology, economic efficiencies and scale.

#3 - LFP momentum to further solidify CATL's competitive positioning

It is widely observed that global EV demand (especially outside of China) has become more price sensitive due to the ongoing economic burden and a reduction in subsidies around the world. Adding supply chain on- shoring and a little less marketing charm for EVs as environmentally friendly products, the EV sales penetration curve is likely to become more gradual.

This provides a tailwind for LFP (lithium ion phsophate battery) cathode-based battery powered EVs to gain momentum going forward in which CATL is the major player. Indeed, according to BNEF, LFP-related cathode mix is forecast to increase market share from 41% in 2022 to 45% by 2024. Most of these gains will come at the cost of NMCs as it forecasts a 5ppt decline in the NMC cathode mix to 40% by 2024. In the longer run, BNEF expects LFPs to account for 43% of the share in 2030 and NMCs at 37%. Besides, there has been a substantial amount of discussion on the LFMP cathode mix lately, which addresses LFP’s setback in low density - it is argued that this could spark further adoption of an LFP-related cathode mix.

A cross-checking conducted by CLSA with the automakers’ plans for new EV models confirms this increase in LFP usage. Among the major automakers, Tesla is committed to LFP; major auto brands such as Hyundai are rolling out their latest models using LFP and other OEMs plan to roll out LFP-based EVs in late-2024 and early-2025.

It is also worth noting that LFP is already tried and proven in the Chinese domestic market and that LFP adoption in the overseas market will provide additional tailwinds for CATL to solidify its market position. In this aspect, Korea is significantly lagging behind, with mass production of LFP technologies still 3-4 years away. With more demand for LFPs from outside Europe, it is expected that CATL will continue to increase its market share.

Valuation

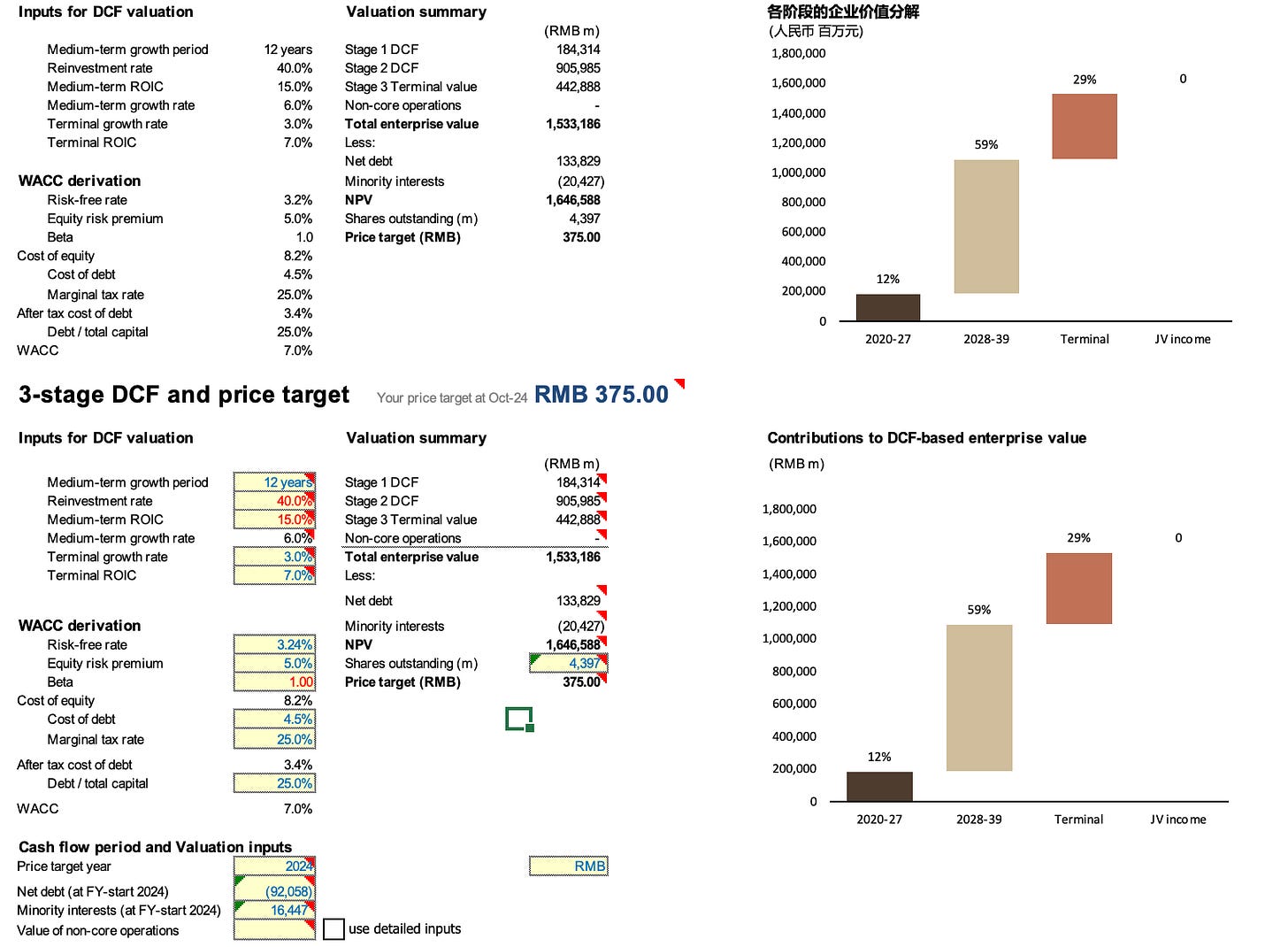

Making reference to a 3-stage DCF model built by UBS, the price target for CATL in 2024 is RMB 375, which represents a upside of 138% using the share price as of 25 December 2023 (RMB 157.54).

Risk and Mitigation

Intensified competition and reaching the market share ceiling

It is observed that several battery suppliers have been adding capacity aggressively and most tier-2 suppliers are targeting a more-than-double capacity or shipment volume next year. Overall, top Chinese players could be releasing a total ~60-70% increased capacity in 2023. While the export market and ESS demand may absorb some of the excess supply, it is believed there may be fiercer price competition in the domestic EV battery market in 2023 and 2024.

With a 35% global share (50% in China, >20% ex-China based on JPMe), it has been argued by some analysts that room for further share increases by CATL to be rather limited. CATL (and other Chinese battery supply chain players’) potential participation in the US market remains unclear until further clarifications on US IRA are provided (likely by the year-end). Before such clarification, it is reasonable to assume a limited share in the US market.

ESG Assessment

In 2022,

Received A in MSCI ESG Rating

Scoring 51 in S&P Global Corporate Sustainability Assessment

Scoring B in CDP climate change questionnaire and winning the Environmental Leap Forward Award

Scoring A- in SynTao Green Finance rating

Has a Corporate Sustainability Management Committee in place

Rated Grade A by Shenzhen Stock Exchange in the information disclosure evaluation for 3 consecutive years

Awarded "2022 Best Practices for Corporate Governance of the Board of Directors of Listed Companies" by the China Listed Companies Association

Ensured 100% coverage of staff integrity training in terms of anti-corruption efforts

During the reporting period, the R&D investment reached CNY 15,510,45 million, a year-on-year increase of 101.66%

In particular, the CTP 3.0 battery "Qilin" has set a new record for the greatest integration of battery systems in the world, and was recognized by TIME as one of the best inventions of 2022

418 energy-saving projects progressed throughout the year, equivalent to avoiding 447,230t CO2 emssions

Reached 26.6% in renewable electricity transition

CATL-SC's zero-carbon factory continues to receive the PAS 2060 certification on carbon neutrality

The 1st to obtain EPD certification in the global EV battery industry

Established a full life-cycle quality management system

Passed CTEAS1001-2017 after-sales service certification with twelve starts, the highest in China

Conclusion

Given the above analysis, a BUY recommendation is issued on CATL as of 26 Dec 2023.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.