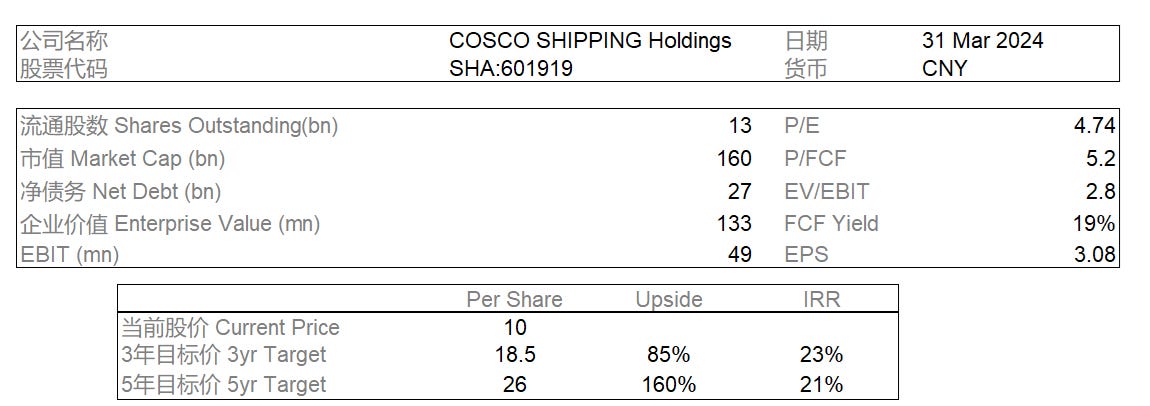

Initial Report: COSCO shipping holding Co., Ltd., (SHA: 601919), 160% 5-yr Upside(Jixiang Zhu, CC VIP)

Jixiang Zhu presents a "buy" recommendation for COSCO Shipping is expected to usher in performance growth with the the Belt and Road initiative and the rebound of shipping demand.

1.Executive Summary

Name: COSCO SHIPPING Holdings Co., Ltd. (中远海控)

Tickers: SHA:601919 / HKG:01919

Sector: Transportation – Shipping & Ports

Core Business: Container shipping (96.6% of revenue) and global port operations.

Market Position: **#3 global container shipping company** with the largest fleet size and coverage across 39 ports worldwide.

2.Company Overview

Business segments

· Container Shipping (96.6% of revenue): Operates a fleet of 500+ vessels, covering major global trade routes (Asia-Europe, Trans-Pacific).

· Port Operations: Manages 39 ports globally, focusing on strategic hubs (e.g., Piraeus, Rotterdam).

Revenue drivers

· Global Trade Volume: Exposure to recovering global trade post-pandemic.

· Freight Rates: Beneficiary of supply chain normalization and long-term contracts.

· Port Throughput: Synergy with shipping business enhances profitability.

Cost drivers

· Fuel Costs: Hedged via LNG-powered vessels and efficiency improvements.

· Charter Expenses: Long-term vessel leases reduce volatility.

· Maintenance & Labor: Scale advantages lower unit costs.

3.Competitor Analysis

a. Economic Moat

Scale Advantage: Largest fleet globally ensures cost leadership.

Integrated Network: Synergy between shipping and ports optimizes logistics.

SOE Backing: Access to government support and financing.

Key Competitors:

Maersk (Denmark), MSC (Switzerland), CMA CGM (France).

4.Investment Thesis

· Cyclical Recovery: Post-pandemic trade rebound and inventory restocking.

· Attractive Valuation: Undervalued vs. peers (P/E <5x, FCF Yield >19%).

· Dividend Potential: Strong cash flow supports rising shareholder returns.

· Strategic Positioning: Belt and Road Initiative (BRI) enhances growth in emerging markets.

5.Risks and Mitigation

Key Risks:

Global Trade Slowdown: Diversify into intra-Asia and Africa routes.

Freight Rate Volatility: Lock in long-term contracts (70% of volumes).

Regulatory Risks: Proactive compliance with ESG and antitrust policies.

Mitigation Strategies:

Maintain net cash position for cyclical downturns.

Expand digital logistics platforms (e.g., blockchain for supply chain).

6.Conclusion

Key Risks:

Global Trade Slowdown: Diversify into intra-Asia and Africa routes.

Freight Rate Volatility: Lock in long-term contracts (70% of volumes).

Regulatory Risks: Proactive compliance with ESG and antitrust policies.

Mitigation Strategies:

Maintain net cash position for cyclical downturns.

Expand digital logistics platforms (e.g., blockchain for supply chain).