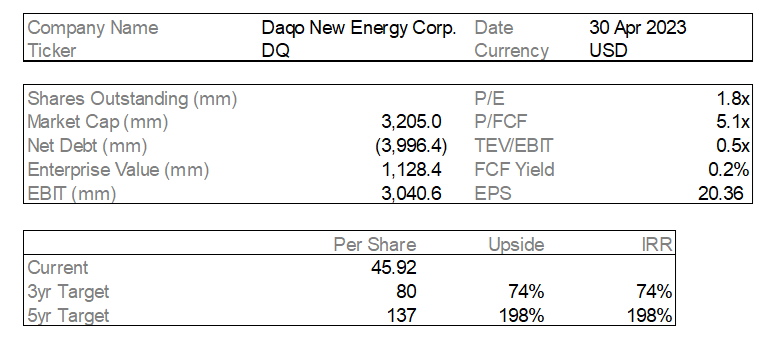

Initial Report: Daqo New Energy Corp. (NYSE: DQ), 198% 5-yr Potential Upside (EIP, Team Viridi Terrae)

Better late than never!

LinkedIn | Jaclyn GUAN

Business Overview

DAQO is a leading high-purity polysilicon manufacturer based in China. They manufacture and sell high-purity polysilicon to photovoltaic product manufacturers, who further process their polysilicon into ingots, wafers, cells and modules for solar power solutions. Currently, DAQO’s annual capacity for polysilicon is 70,000 MT in Xinjiang.

Investment Analysis

1. DAQO is a global leader in polysilicon manufacturing, a key raw material in the high-growth solar PV industry.

There is an increasing demand for renewable energy, such as solar energy, as the world moves towards a net-zero world. The estimated CAGR for global solar PV market is 25.9% from 2021 to 2028.

Polysilicon is a crucial raw material in the solar photovoltaics (PV) supply chain, hence its demand will also be positively affected. With 13% of the global market share, DAQO is one of the top manufacturers of high-purity polysilicon. As such, we foresee high growth potential for DAQO as a critical node in a high-potential industry.

2. DAQO has a strong balance sheet with increasing sales volume YOY and a healthy cash position.

Based on historical financial data, DAQO’s revenues and gross margins grew by 281.8% and 7.4 percentage points YOY respectively in 2Q’22. DAQO has little to no debt, with a 80.3% FCF margin.

Looking at the future, based on publicly disclosed deals, DAQO has secured multiple deals that suggest strong polysilicon sales in the next few years.

Estimated production in full year of 2022: 130,000 – 132,000 MT (i.e., Q4’22 production was est. 29,890-31,890 MT, higher than Q4’21)

Oct’22: DAQO announced that it would supply 150,300 metric tons (MT) of high-purity mono-grade polysilicon between November 2022 and December 2027 to a solar wafer-making subsidiary of Shuangliang Eco-Energy, a Chinese polysilicon wafer producer.

Daqo is expanding its annual production capacity to 305,000 metric tons of polysilicon by the end of 2023, a ~50% increase from current levels.

ESG Analysis: Low to medium ESG risk

From an environmental perspective, DAQO’s product contributes directly to the global effort of making renewable energy more cost-efficient and available.

Internal effort to reduce greenhouse gases: DAQO’s comprehensive energy consumption density and GHG emissions density decreased year by year. Compared to 2020, the company’s GHG emissions density in 2012 dropped by 7.1%, while the overall energy consumption density dropped by 7%.

Active involvement in ensuring supply chain assurance: DAQO has a Supplier Assessment initiative to access its suppliers’ CSR management performance in terms of employee rights and interests, environmental protection and safety management. Assessment is conducted monthly, and they have annual evaluations of suppliers to assess their supply assurance capabilities.

From a governance perspective, DAQO established a clear board structure to ensure checks and balance within the company, including an ESG Governance structure. However, their main risk is the controversy over its Xinjiang factories and workforce.

A substantial amount of polysilicon production and storage facilities are located in Xinjiang, China. Some UN experts on slavery have concluded that there is evidence of forced labor of members of minority groups in China's western Xinjiang region. DAQO’s Xinjiang subsidiary has landed itself on the U.S.’s “Entity List”. This Entity List designation is an impediment to DAQO’s ability to do business with American companies, although the designation does not in itself ban DAQO from potentially exporting its products to Western markets, even in the U.S.

The team notes that the company’s subsidiary, Xinjiang Daqo New Energy Co., Ltd. listed on the STAR Market of the Shanghai Stock Exchange in 2021. Such a listing will bring greater information disclosure requirements, and hopefully entails greater transparency and regulatory scrutiny over the labor use in Xinjiang.

Other risks

Forecasted drop in earnings this year due to weakening polysilicon prices

Weakening polysilicon prices is a result ofincreasing polysilicon supply in the Chinese market

However, from a LT growth outlook, growth of the solar energy market will persist for years to come, hence we can expect that demand for solar-grade polysilicon will continue to rise globally. Daqo is well-positioned to capitalize on this with enormous production capacity and resulting EOS.

Delist risk due to US-China disagreement on auditing requirements and information sharing

Delisting may occur if a company has been identified by the SEC for 3 consecutive years in case of the Public Company Accounting Oversight Board (PCAOB) being unable to inspect the auditor’s working paper related to such a company.

DAQO previously said that it was exploring to list on Hong Kong stock exchange.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.