Initial Report: DoorDash (DASH), 31% 5-yr Potential Upside (EIP, Chee Siang CHEW)

Is DoorDash a steal? Let's see why Chee Siang thinks its worth the shot.

LinkedIn | Chee Siang CHEW

Overview

DoorDash is a leading provider of horizontal, on-demand, last-mile fulfillment services with operations in the U.S., Canada and Australia.

Business model

The company’s primary offering is the DoorDash marketplace, which serves three constituents, namely merchants, consumers and dashers.

DoorDash has expanded into other delivery verticals such as grocery, pharmacy and convenience.

DashPass

The company’s primary offering is the DoorDash marketplace, which serves three constituents, namely merchants, consumers and dashers. DoorDash has expanded into other delivery verticals such as grocery, pharmacy and convenience.

Financials overview

Since 2020, DoorDash has turned into a profitable company as they benefited from the pandemic.

Achieving a positive net income margin and gross profit margin remaining relatively constant at 42% - 51%.

Margins may face pressure in near term due to rising costs from new verticals.

The United States is DoorDash’s largest market, accounting for 95% of total revenue in 2022

DoorDash has plans to expand its sales geographically through new acquisition of Wolt. Developing their presence in the EU region.

Industry Overview

Nature of industry

Consolidation of market

The market is extremely fragmented and DoorDash is constantly vying for market share with other local food delivery logistics platforms like Uber Eats, Grubhub and Postmates, chain merchants that have their own online ordering platforms, such as pizza companies like Dominos and other local merchants, which own and operate their own delivery fleets, grocery delivery services, and also traditional grocers.

As the company is increasing its international presence, it is facing competition from local incumbents in the markets. Also, as DoorDash is expanding its vertical beyond food delivery logistics, it is expected to compete with large Internet-based companies, such as Amazon and Google.

Customer acquisition tactics

Industry participants have offered heavy discounts to customers and merchants to drive order volumes and gain market share. the current landscape has narrowed to two national players (DASH and UBER) with both companies facing the pressure of turning profitable as public companies.

Key players

DoorDash continue to take share from rivals such as Uber Eats and Grubhub, as the expansion into new verticals offsets pressure from commission caps enforced by various cities. The company has seen take rates improve to peak-pandemic levels despite these caps, and there may still be some upside to be realized with proper execution and traction in non-restaurant categories.

Though take rates have improved, the company continues to trail Uber Eats, which boasts a take rate of around 20%. DoorDash may remain focused on expanding its customer base and taking market share from competitors before prioritizing initiatives to increase take rates.

Thesis

Thesis 1: Expansion into non-restaurant categories

New verticals

DoorDash's subscription focus is timely given their brand advantage and higher trip and order frequency vs. smaller peers, and we believe it may help maintain annual revenue gains of 25-30%.

DoorDash's expansion into non-restaurant categories such as grocery, pharmacy, convenience stores and alcohol delivery could boost organic gross order value (GOV) at an industry-leading compound annual rate of 20% in 2021-24. This, coupled with pandemic tailwinds, increased the company's gross order volume by 70% in 2020-21, trailing only Uber, which increased its delivery volume by 71%.

DoorDash may generate roughly 92% of its GOV from existing customers vs. 85% last year, suggesting more repeat orders. The company continues to add DashPass subscribers, which could help predictability in its revenue post-pandemic, as food delivery growth returns to normal levels.

Key partnerships

These key partnerships across supermarkets, retail stores, hardware stores and other products are likely to increase DoorDash’s leads and sales, strengthening its leading position.

Thesis 2 – Entry into new markets via strategic acquisitions: Non-US Markets through Wolt

Significant Europe market potential

European consumption:

Delivery only comprises of a small portion of the European Consumption habit. Utilising the best-in-class capabilities by parent DoorDash, subsidiary Wolt can capitalize on opportunities present in European market. Wolt also diversifies geographical revenue streams, providing extra stability as the company matures.

Entry into European markets through Wolt

DoorDash has been investing heavily in strategic acquisitions for a while to expand its footprint. The recent acquisition of Wolt is helping DoorDash fast-track its product development, grow its international base across 27 countries and bring a greater focus to its markets outside the United States.

The acquisition of hospitality technology company Bbot will add its products and technology to Dash’s platform. This will offer merchants more solutions for their in-store and online channels, including in-store digital ordering and payments.

ESG Scorecard and Summary

Financial materiality and effects of ESG performance

Strong managerial oversight, audit systems and transparency of disclosures reduces our downside risk. This strengthens senior level of commitment and accountability mechanisms for responsible investment implementation.

With below par performances across material ESG factors, we would instead increase our cost of capital to reflect increased manageable risk such as avoiding data security breaches and Dasher safety incidents.

We will continue to engage management to improve board diversity and independence to strengthen DoorDash’s ability to identify opportunities and risk. Anticipating and capitalizing on relevant future factors such as policy shifts in regulatory and consumer shifts.

Corporate Governance: Board Composition

Material ESG Issues and Opportunities

Board diversity

Board composition doesn’t reflect the workforce population:

Board is mostly White/Chinese & Male.

Research shows diversity improves decision-making and formulation of more balanced policies etc. This leads to better corporate governance.

A board not reminiscent of its stakeholders, are less likely to make decisions that reflects the interests of its stakeholders.

What can be done?

Implementing a Board policy that mandates a diversity requirement.

Nominating committee’s performance criteria to include effectiveness of board diversity policies.

Succession planning of prospective executive directors, should emphasize development and opportunities for candidates of diverse backgrounds.

Data security

Why does it matter:

DoorDash was named in a list of top 10 data breaches of 2022.

DoorDash stores sensitive customer data such as addresses, payment and personal details. Breach of such data can lead to loss of trust, loss of data and decline in market share.

DoorDash would also be liable for litigation risk as they failed to adequately protect customer’s personal data. This can be prohibitory costly.

What is DoorDash doing:

DoorDash have since added security layers around data, improving access controls, hiring additional personnel with data security experience, and using outside expertise to identify and repel threats.

They have tried to improve such disclosure in their annual statements

What can be done:

Onboarding of experts in cybersecurity in their board and management would significantly help DoorDash manage data security risks and implement strong mitigation measures.

DoorDash can seek to further invest in their IT infrastructure through partnering with cutting edge zero-trust cybersecurity vendors such as CrowdStrike.

Workforce rights and safety

Why does it matter:

According to a Gig Workers Rising report, more than 50 app workers were killed between 2017 and 2021, and their families allegedly received little to no compensation from the ride-share companies.

Many of these drivers were reportedly murdered either by passengers, customers, or random people.

The workers also mentioned instances of sexual and physical harassment, low compensation, and unsafe conditions, as well as the psychological trauma that resulted from their harrowing experiences.

What are DoorDash doing:

SafeDash, with two new in-app features:

Safety Reassurance Call: ADT will remain on the phone and can request emergency response as needed.

Emergency Assistance Button: If a Dasher is ever in need of emergency services, they can swipe a button. ADT will contact 911 on the Dasher’s behalf, discreetly remaining in contact with the Dasher by text.

What can be done:

Sadly, gig economy workers do not enjoy the same benefits as a full-time salaried workers.

Strengthen security measures for drivers and to provide financial support to their families if they should be killed while at work.

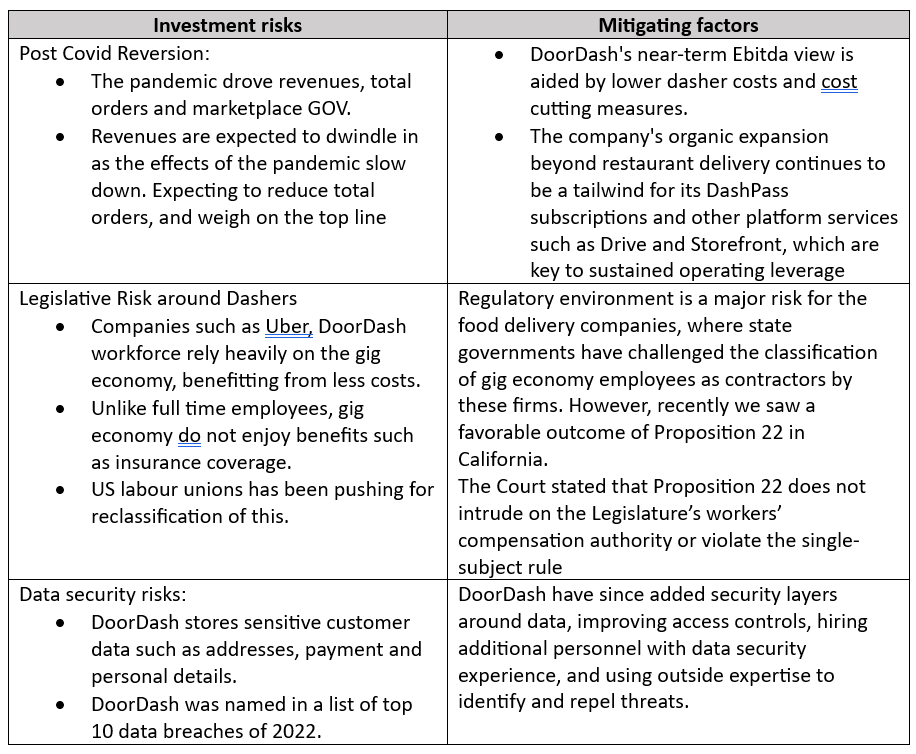

Key investment risks

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.