Initial Report: Duolingo Inc (NASDAQ:DUOL), 69% 5-yr Potential Upside (LIM Zi Hui, EIP)

LIM Zi Hui presents a "BUY" recommendation based on Duolingo's increasing use of AI and expansion into adjacent educational domains.

Company Overview

Duolingo Inc. (NASDAQ: DUOL) is a leading language learning and education service provider with over 110 million monthly active users (MAUs) globally. It offers a gamified language-learning experience, providing over 100 courses teaching 43 languages, math, and music.

Duolingo operates on a freemium model with three tiers - the free tier, ad-free Super Duolingo with additional features, and Duolingo Max offering AI-powered tools on top of Super’s features.

Business Segments

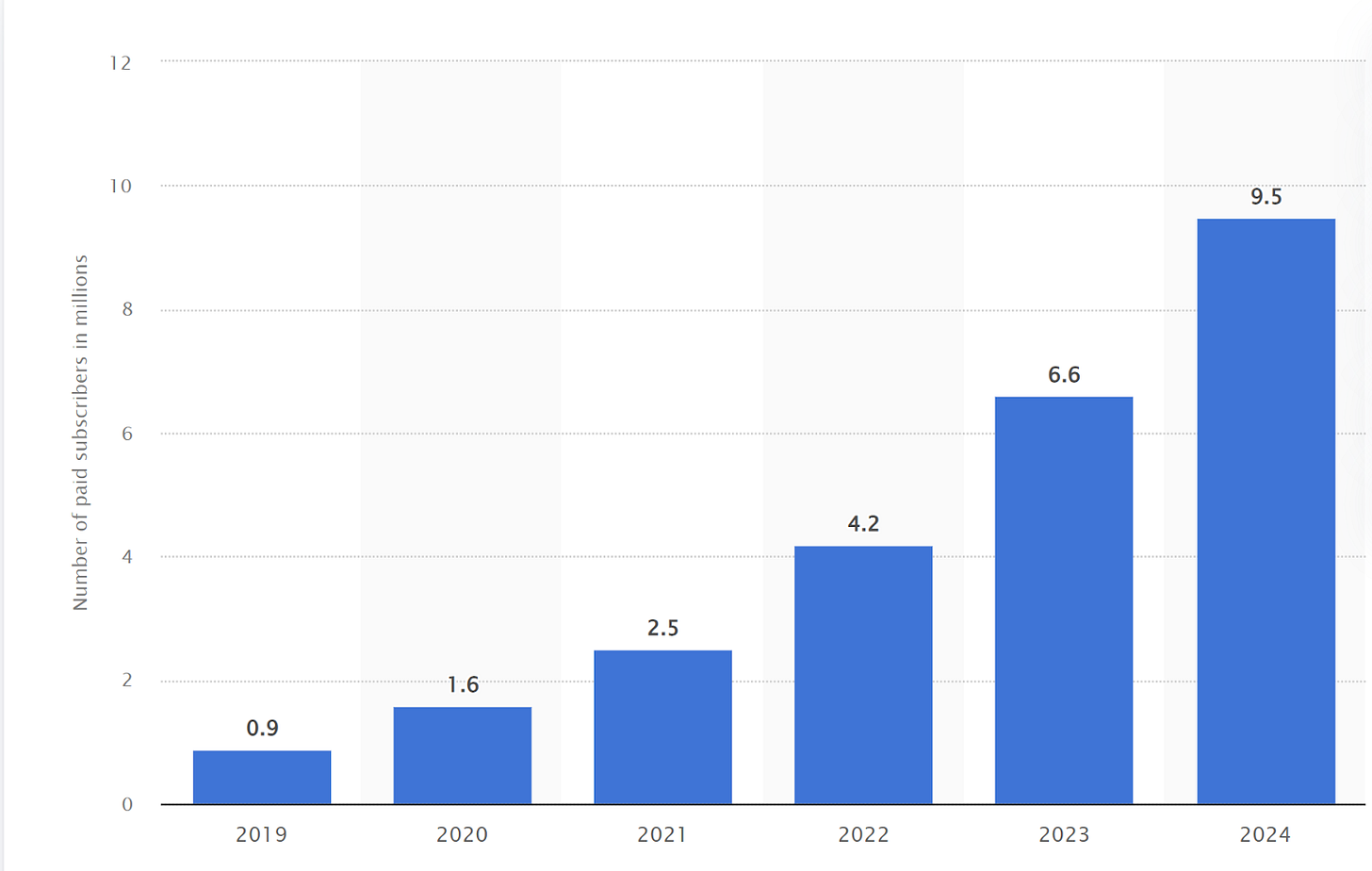

In 2024, Duolingo’s revenue was USD 748.0M, a 41% increase from 2023. The company has four predominant sources of revenues: Time-based subscriptions (81.21%), In-app advertising placement by third parties (7.34%), the Duolingo English Test (6.10%), and In-App Purchases (5.17%) (In-App Purchases refers to purchases like streak freezes, gems, and other gamified features). The majority of its revenue comes from paying subscribers (81.21%), which makes up about 8.8% of its LTM MAUs count, suggesting heavy reliance on a small proportion of paying users.

The company first became profitable in 2023, generating a net income of USD 16.07M and continued to grow its profits to USD 88.57M in 2024.

Revenue Drivers

Duolingo’s main revenue drivers are:

MAU growth

Average revenue per user (ARPU) growth

MAU growth

Duolingo has been leveraging its large language learning database and A/B testing to find out what exactly attracts and retains users, making improvements and enhancing features accordingly to drive user engagement and growth. The company has been maintaining steady MAU growth for the past few years. In 2024, Duolingo achieved 116.7 million MAUs, a 32% YoY increase, contributing to the 41% YoY increase in revenue to USD 748M.

Duolingo’s MAUs growth not only increases ad revenue, but also serves as a funnel for paid users. Duolingo’s free tier lowers the barrier of using the app initially, “luring” users in to try its gamified language learning. In this case, existing users who have tried Duolingo and are hooked on the app are more likely to subscribe than new users who have not used the app before.

Geographically, the U.S. has been Duolingo’s largest market. However, most U.S. users tend to be recreational users whose spendings are discretionary as language learning is often pursued for personal development or travel, rather than out of necessity. This is in comparison with users from non-English speaking countries where Duolingo is used for learning English for academic, career or immigration purposes, which would be considered a necessity. Hence, Duolingo has been trying to expand its reach globally, focusing on markets like China, India, Japan, and Korea, where English learning is in high demand. For example, Duolingo has seen significant growth in the Chinese market, with a focus on localized content and strategies, including WeChat integration for user registration and weekly learning reports.

Apart from being a source of revenue priced at USD 70 a test, the Duolingo English Test (DET) also aims to strengthen Duolingo’s English learning for necessity, providing official certification for one’s English language proficiency recognized by over 5,000 universities and institutions worldwide. As complements in consumption, this can help further boost MAU growth in non-English speaking regions.

ARPU growth

There are two main levers to increase ARPU:

Conversion of Ad-supported free users to paying subscribers

Introduction of new higher-priced subscription tiers that offer more premium features

2a) Conversion of Ad-supported free users to paying subscribers

As compared to the paid segment, the free ad-supported segment generates lower ARPU. Hence, Duolingo’s aim is to maximise conversion of free to paid subscribers. To do so, Duolingo strategically places features like heart limits (which restrict lesson retries) and ads to encourage users to subscribe for an uninterrupted experience. Nonetheless, Duolingo aims for organic conversion, providing additional features like personalized practices and constantly enhancing them to increase the value proposition of the paid tier so as to drive conversion rates.

2b) Introduction of Duolingo Max, a new higher-priced subscription tiers that offers more premium features

In March 2024, Duolingo launched Duolingo Max, a subscription tier above the original Super Duolingo. On top of Super’s features, Max offers AI-powered tools like Explain My Answer, roleplay and on-demand video calls with AI character Lily for users to practice their conversational skills. This two-tier subscription model creates a barbell pricing strategy, appealing to both price-sensitive consumers who seek value and those willing to pay more for premium features. Super Duolingo is priced competitively at USD 12.99/month while Duolingo max is priced significantly higher at USD 34.99/month, generating a higher ARPU from users serious about language learning and willing to pay more for premium features to enhance their experience. This increase in ARPU in turn helps drive revenue growth.

Cost Drivers

Duolingo’s main cost drivers are Research and development (49%), General and administrative (32%), and Sales and marketing (19%).

As Duolingo focuses on growth and investments in AI to improve features, R&D expense is likely to remain as its biggest operating expense. While R&D expense and total operating expense have increased in absolute terms by 21% and 19.8% respectively from 2023, R&D expense and total operating expense as a percentage of revenue has declined, showing operating leverage.

In 2024, Duolingo’s adjusted EBITDA margin was 25.7%, continuing an overall upward trend since its IPO in 2021.

Industry Overview

Growth Trends

The global online language learning market was valued at about USD 15.1 billion in 2023 and is projected to grow at a CAGR of 13.3% from 2024-2032, achieving a market value of USD 46.5 billion by 2032. This growth is driven by factors like globalization, an increase in cross-border businesses and cultural exchanges.

Competitive Landscape

Duolingo is the world’s most downloaded language learning app, topping the education category in both Google Play Store and Apple App Store.

The online language learning market is highly-fragmented with many language learning apps available to users. Duolingo’s notable competitors include language learning apps like Babbel and Rosetta Stone. However, Duolingo stands out with its freemium model and unique gamification.

Unlike its competitors, which run entirely on a paid subscription model offering only time limited free trials, users can access basic features and learn a language for free on Duolingo. This counter-positioning helps attract users to the app, which in turn serves as a funnel for its paid subscriptions, driving both revenue and user growth.

As for its unique gamification, it appeals to people’s short attention span and desire for thrill and entertainment. In comparison, Duolingo’s competitors deliver language learning content largely through traditional ways like teaching videos, making Duolingo’s gamified learning a unique selling point in the language learning market.

Additionally, in terms of downloads, Duolingo, with over 500 million downloads, surpasses its competitors by at least 10 to 50 times - Babbel, its strongest competitor, only has 50 million downloads which pails significantly in comparison. Being the largest player in the online language learning market enables Duolingo to tap on the network effect, creating a self-reinforcing cycle that continuously propels user growth, a key factor for revenue growth.

Investment Thesis

1. Effective use of AI to enhance content creation and user experience

1.1 Accelerate content creation

Leveraging AI, specifically Large Language Models (LLMs), Duolingo has been able to expedite the development of new lessons and courses, increasing output by tenfold as compared to a few years ago. This enables faster expansion into new languages and subjects, allowing Duolingo to scale and serve more users, which in turn drives revenue growth.

1.2 AI-Powered Personalization & Adaptive Learning

Duolingo utilizes “BirdBrain”, its AI engine, to tailor lessons to individual users by analyzing their performance and adapting content accordingly. Analyzing over 500 million lessons each day, “BirdBrain” is able to effectively gauge users’ proficiency and ensure that content remains challenging but not frustratingly difficult. This personalization enhances user engagement as seen from how Duolingo’ DAUs growth (51%) significantly outpace its MAUs growth (32%), indicating strong app stickiness.

Duolingo’s integration of AI has also enabled it to roll out more premium features and create a new subscription tier, Max, to cater to serious learners looking for a highly personalized learning experience. These are the three main AI-powered additions in Max:

Explain My Answer: provides users personalized feedback on their answer, whether right or wrong → helps users further deepen their understanding of the language

Roleplay: allows learners to practice real-world conversation skills with its AI characters by guiding them through various scenarios like ordering a coffee or going furniture shopping

Video call with Lily: enables users to practice their conversational skills judgement-free via on-demand video calls with AI character Lily

Referencing earlier sections on revenue drivers and ARPU, Duolingo’s addition of more premium features and launch of a new subscription tier allows it to further segment its customers and employ a barbell pricing strategy, providing services and setting prices more finely according to users’ needs and willingness to pay. By adding a more premium subscription option and providing more personalization, Duolingo not only improves user engagement, but also reaps higher ARPU from serious learners who are willing to pay higher prices for a corresponding increase in learning experience. This helps boost revenue growth at a faster rate as seen from how Duolingo’s subscription revenue grew by a 50% YoY in 2024, outpacing its YoY paid subscribers growth of 43%.

Currently, Max represents about 5% of Duolingo’s total subscribers, of which I believe still has a lot of room for growth given its unique value proposition and the company’s heavy investments in AI.

However, for Duolingo Max or AI in general to be a source of growth, it not only has to boost revenue but also do so at reasonable costs. According to CFO Matt Skaruppain in the fourth-quarter 2024 earnings call, gross margins are expected to shrink by 300 basis points in the first half 2025 due to upfront investments in AI and Max, but are expected to improve in the second half of the year as the company optimizes AI costs. I believe while costs may increase in the short run, in the long run, the value AI brings could outweigh its costs, resulting in a net gain for the company. Nonetheless, as Max was only launched a year ago in March 2024, it may be a bit hard to accurately evaluate its success and effectiveness now. Duolingo’s use of AI and its cost effectiveness remains to be monitored in the upcoming quarters - ideally, we would want to see clear improvements in not only revenue but also profitability from these investments.

2. Strategic horizontal expansion into adjacent educational domains, increasing, boosting value proposition to users

Apart from its core of language learning, Duolingo has diversified into adjacent educational domains like new subjects (Duolingo Math and Music), early childhood education (Duolingo ABC), and language proficiency certification (Duolingo English Test, DET), furthering its growth opportunities and reinforcing its long-term value proposition

2.1 Total Addressable Market (TAM) Expansion

According to Spherical Insights, the global e-learning market was valued at USD 305.97 billion in 2023, and is expected to reach USD 1515.97 billion by 2033 with a CAGR of 17.35% from 2023-2033. As for the professional certification market, it is expected to grow from USD 6.76 billion in 2025 to USD 8.92 billion by 2029 at a CAGR of 7.18%. Hence, this strategic expansion would enable the company to significantly increase its TAM - by venturing into new domains like math and music, childhood literacy and language certification, Duolingo can expand its user base beyond language learners, capturing a broader demographic spanning children, students, professionals, and lifelong learners.

Expansion into adjacent educational domains can also promote cross-selling as users who start with one subject are likely to explore others, boosting ARPU. Duolingo may also explore bundle subscriptions to further enhance its value proposition and ARPU. As of 2024, Duolingo Math and Music have a combined of three million DAUs, showing strong early adoption and user interest.

However, as Duolingo is focusing on its main offering of language learning, ramping up investments in AI to improve its newly launched subscription tier Max, potential in its alternative offerings has largely remained untapped. Nonetheless, Duolingo’s horizontal expansion into adjacent educational domains is a step in the right direction and presents immense opportunities for growth.

2.2 Differentiation through DET

Apart from being a source of revenue priced at USD 70 a test, the Duolingo English Test (DET) also serves as a way for Duolingo to differentiate itself from competitors. Recognized by over 5,000 universities and institutions worldwide, DET helps establish credibility for Duolingo as a language learning service provider and improve users’ perceived quality of its content. This enables it to stand out from competitors, potentially capturing a larger market share.

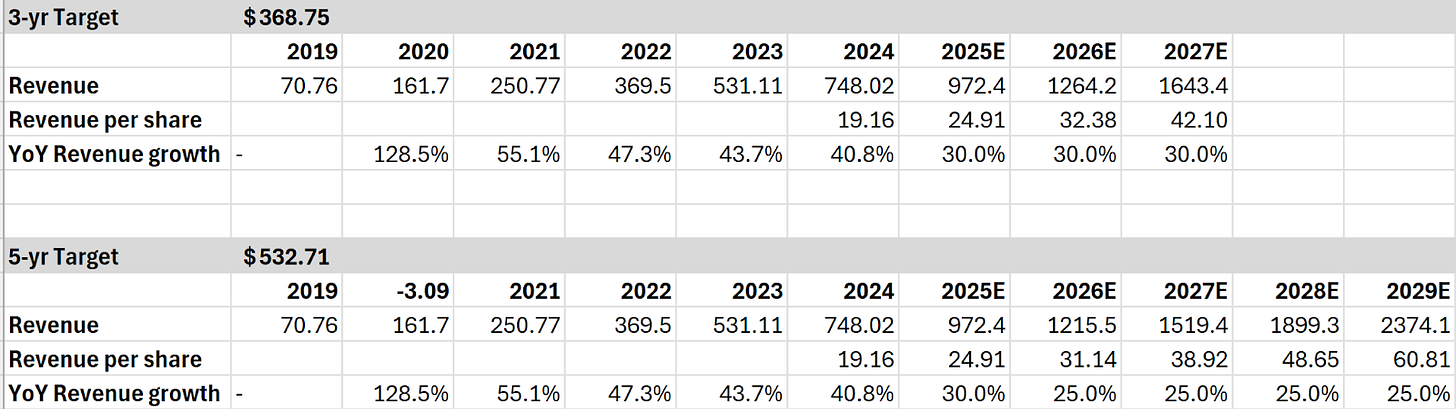

Valuation

With Duolingo’s strong and growing user base, I estimate a 3Y revenue CAGR of 30% and a 5Y revenue CAGR of 25% (vs 3Y average CAGR of 44%). I estimated a CAGR value slightly below its 3Y average as the company has been seeing a slowdown in revenue growth rate, with an average 9% slowdown from 2022-2024. With an average price-to-sales ratio of 8.76x (2021-2022), the implied 3Y and 5Y share price are $369 and $533 respectively.

Risks & Mitigation

1. Heavy reliance on a small number of paying subscribers

Risks:

While Duolingo has a massive user base, only a small percentage (8.8%) are paying subscribers. This reliance on a small proportion of its users makes revenue highly vulnerable to subscriber growth slows or churn increases.

Mitigation:

Duolingo’s annual paid subscriber count has been steadily increasing over the past few years, growing at about 1.5x every year. The company’s roll out of Max, its more premium AI-powered subscription tier, also serves to further fuel subscriptions by providing a higher value proposition. Additionally, making up only about 6.10% of its revenue in 2024, Duolingo’s other sources of revenue like DET remain largely untapped. The company could work to improve its other revenue streams to reduce reliance on paid subscribers and improve revenue predictability.

2. AI Disruption

Risks:

While AI can act as a growth propeller for Duolingo, enabling it to accelerate content creation and improve personalization, it can also pose a competitive threat. Free AI-powered language models and chatbots, like ChatGPT and Google’s AI tools, could similarly provide learners with real-time conversation practice and personalized learning, reducing the need for subscription to unlock these features. This could erode Duolingo’s competitive edge and limit its pricing power for Duolingo Max, which is priced at a premium of USD 34.99/month currently.

Mitigation:

Having the largest language learning user database, Duolingo’s personalization features is likely to remain superior as compared to free open-source AI models who do not specialize in language learning. Moreover, its unique gamification remains a key differentiating factor that attracts new users. Familiarity with the app, and learning history and streaks stored in the app are likely to urge users to subscribe for more personalized learning rather than turn to another platform where it may be free but requires users to restart their progress. Hence, while AI may pose a competitive threat, Duolingo’s value proposition still remains unique and compelling.

ESG Considerations

Environmental

While Duolingo's environmental risks tied to AI adoption are relatively limited compared to traditional industries, its growing use and investments in AI may increase its environmental risks. Training and deploying AI models requires significant computational power, which can lead to increased energy consumption and carbon emissions. Currently, Duolingo relies on cloud providers like AWS whose data centers account for about 1% of global electricity demand. As AI integration deepens, concerns over sustainability and the environmental footprint of data centers could become a reputational and regulatory risk for Duolingo.

Social

Duolingo’s core business of providing free and affordable language learning services generates societal good - language learning, especially English, which is the top learnt language in Duolingo, is often key to social mobility and cultural integration.

To further its reach and impact, Duolingo has also been partnering with the International Rescue Committee (IRC) since 2020 to provide quality language learning for refugees. Additionally, the company has established a DET fee waiver program where free tests are provided every year to refugees and low-income test takers. As of 2023, Duolingo has provided 50,000 free tests, worth nearly $2.5 million, to test takers in over a hundred countries. These test takers then went on to apply to over 3,500 universities around the world, highlighting Duolingo’s social impact.

Governance

Stock-based compensation (SBC):

Duolingo’s stock-based compensation (SBC) is 14.7% of revenue in 2024 and averages around 15% for the past five years, exceeding the industry average of 6% for tech companies. While high levels of SBC help align employee incentives with shareholder interests, excessive SBC may risk dilution of existing shareholder value.

Management Ownership & Pay Structure:

Duolingo remains a founder-led company where Co-founders Luis von Ahn and Severin Hacker serve as CEO and CTO respectively and collectively own 35.5% of shares. As for capital allocation and pay structure, CEO Luis von Ahn’s total compensation was USD 766k in 2023, which is unusually low for a tech CEO and below the average for companies of similar size in the U.S. However, this is offset by his USD 993.6 million equity stake. Such management ownership and pay structure tied to company performance helps align management interests with shareholders, ensuring the long-term growth of the company and value to shareholders.

Conclusion

Duolingo presents a compelling investment opportunity driven by its effective use of AI to drive user engagement and growth, strategic expansions to adjacent educational domains and ability to increase operating leverage which suggests good cost controls. Nonetheless, its heavy reliance on a small proportion of paying users is a key risk to be considered. In this aspect, Duolingo has been trying to increase its paying subscriber count and ARPU by launching Max, its new, more premium subscription tier. However, the cost-effectiveness of Max is yet to be known due to its recent launch. Hence, Max’s performance and its effect on revenue and profitability is a key aspect that investors should monitor closely in the upcoming quarters.

References

https://www.statista.com/statistics/1248107/share-of-duolingo-revenues-by-segment/

https://investors.duolingo.com/static-files/0d4a8a6c-ed74-436c-89ad-c77463457c6e

https://vbench.virtuaresearch.com/IR/IAC/?Ticker=DUOL&Exchange=NASDAQGS#

https://blog.duolingo.com/2024-duolingo-language-report/

https://blog.duolingo.com/duolingo-max/

https://www.statista.com/statistics/1309610/duolingo-quarterly-mau/

https://www.snsinsider.com/reports/online-language-learning-market-1260

https://www.emarketer.com/content/duolingo-focuses-on-ai-expansion-over-cost-management

https://yourstory.com/2024/08/green-owls-secret-duolingo-built-77-billion-empire

https://www.statista.com/statistics/1248043/duolingo-annual-paid-subscribers/

https://investors.duolingo.com/static-files/14890367-ff8c-446e-a564-410450a2f51f

https://www.barrons.com/articles/stock-based-compensation-tech-34de326d

https://simplywall.st/stocks/us/consumer-services/nasdaq-duol/duolingo/management

good write-up!