Initial Report: EPAM System (NYSE: EPAM), 74% 5-yr Potential Upside (Jiayang SIM, EIP)

Jiayang presents a "BUY" recommendation due to its strong recovery play with growth potential and strategic positioning in IT and AI services.

LinkedIn: Sim Jia Yang 沈佳扬

Conclusion

This is a recovery play and buying at a cyclical low with no overblown valuation. The story here is that investors are not as hopeful for the IT service industry as growth has been muted. There were some rallies in the last few weeks as there could be some form of stabilization in the industry. But I think the information has not been priced in for the recovery play fully. Once growth returns and the macro environment improves, the share price could swing up again.

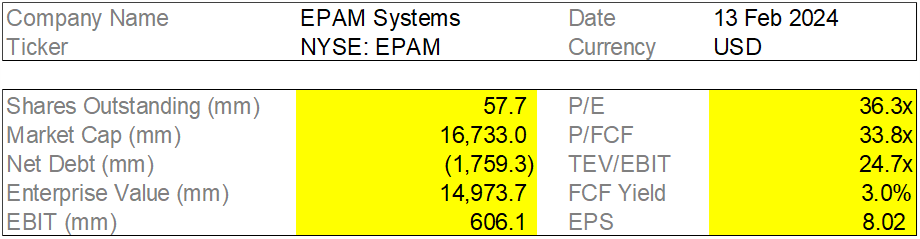

The TP by averaging both DCF EV/EBIT at 5-year CAGR of 14% at 28x exit multiple and 5 year forward EPS growing at 5 years CAGR of 17% at 35x exit multiple, with TP at 504 USD, giving an average return of 75%. The DCF Gordon's growth method wouldn’t be an effective valuation measure as the number of years to forecast would be hard to determine. On a multiple basis (DCF (DCF EV/EBIT, EPS) would be more apt as we are timing the recovery play, and we can look at cyclical across time to identify the attractive points to invest. I believe we are at that stage now.

Catalysts

Better than expected result for Earnings call (15(th) February 2024)

Revenue growth return to double-digit growth

IT spending starts to ramp up across companies (We can view this when Gartner’s forecast higher than expected IT spending)

The Fed reduce interest rate to boost economy, pushing sentiment higher

What’s EPAM?

EPAM is a digital pure-play IT Services provider. EPAM provides its clients with digital transformation services through its digital platform engineering and more custom software development offerings. In simple terms, a company wants to have software like SAP, and Salesforce, but they need a firm to help them customize the software to their business lines. That’s where companies like EPAM come in to partner with them and deliver that. There is more to IT consulting but that’s the gist.

Why should we invest?

There are several reasons:

We are at a cyclical low in IT spending, and I believe there could be a growth inflection within the next few quarters which will be beneficial to EPAM revenue growth, leading to multiple expansions.

EPAM is a solid company with a strong track record. It has been growing double-digit growth since 2011 and only the last 2 quarters declined. Its growth halt is not a temporary blip due to several reasons like the relocation of staff from Ukraine, and Belarus to other countries.

It is also well-positioned to capture AI trend demand from companies looking to upgrade their enterprises and need custom software for their firms.

Why did the share price fall in 2022?

Over the past ~2 years, EPAM has experienced a significant disruption of its operations and delivery professionals resulting from the conflict in Ukraine and greater unrest in Eastern Europe. As of year-end 2021, ~64% of EPAM’s delivery professionals were located in affected part of Eastern Europe (~24% in Ukraine, ~18% in Belarus, and ~23% in other parts of Eastern Europe) while the remaining ~36% were in the Americas (~9% in the U.S. and Canada, ~3% other Americas), India (~8%), Central and Western Asia (~4%), Poland (~6%), and East Asia and Australia (~2%).

What happened next:

EPAM set on a strategic plan to transition its delivery professionals to a more diverse set of geographies to rely less on the conflict-affected geographies. By year-end 2022, the largest decreases in delivery professionals have been in Ukraine (-15%), Belarus (-52%), and other parts of Eastern Europe (-45%) with the largest growth in Other Americas (e.g. South & Latin America) (+50%), Poland (+85%), India (+36%), Central and Western Asia (+253%) and East Asia and Australia (+18%).

Has the franchise been permanently affected?

Yes to a certain extent as relocation affects the employees’ location. While EPAM executed extremely well in the face of tragic conflict (~30% organic CC growth in 2022), part of its current growth pains is also due to the transition of its global workforce. With the “Great Relocation” completed, the management is refocusing on its business strategy and execution (adjusting the mix of engagement models, cost initiatives, investing in sales and its go-to-market model, etc.), and sees this as a likely positive as it should allow EPAM to innovate on new technologies (GenAI), execute more efficiently, and lead to greater partnerships with its clients and technology companies. Thus, the Russian impact is more or less mitigated.

Is EPAM a good business?

It is a good business in my opinion.

Firstly, we need to understand that IT service companies are only as good as their human capital quality. They are capital-intensive because of their huge manpower. In comparison, the largest IT service company is Accenture with 700,000 employees worldwide. EPAM has around 50k. This labor differential indication is already an indicator that growth would remain resilient. Moreover, Accenture is also growing at a low double-digit. This means that we don’t have to be worried about the growth trajectory for the long term.

Secondly, looking at human capital, it is known that EPAM human capital has one of the smartest talents. Their interview questions are known to be the most technical driven amongst its peers and they hire the top percentile candidates. Moreover, EPAM is also recognized to be a great place to work, keeping its talents happy. Even during the relocation, though some employees left due to special circumstances, the company spent out to help their employees settle in. You can look at EPAM’s achievements in their press release:

Thirdly, positioning. EPAM is also known to be a leader within well-known IT consulting firms with one of the highest capabilities amongst its peers despite its size, according to IDC. It has also partnered with some of the hyperscalers like Amazon and Microsoft for their AI endeavors and is also named 2023 Microsoft Partner of the Year. This achievements are nothing short of excellence.

Fourth, since 2022, EPAM has an impressive shareholder return track record. It consistently outperforms the markets even during its ‘great relocation.’

Industry:

Industry Market Size:

IT Services is a vast, $1.3 trillion fragmented market accounting for ~30% of IT spending. Over the last decade, the IT Services market has meaningfully grown its share of global $4-5tn IT spend, outpacing GDP growth at an accelerated pace. There should continued focus on digital transformation, cloud adoption and the boom in AI services to drive a forecasted ~9% CAGR through 2027.

The emergence of GenAI has created controversy regarding the value proposition of IT Services operators. AI Services is to become a sizable opportunity for the IT Services space, driving ~$450bn in spend by 2027 or ~20% of the estimated $2.1tn total IT Services spend in 2027.

Drivers:

Gartner estimates that the IT Services market is expected to grow at a ~9% 2022- 2027 CC CAGR globally & in the US ($550-600bn spend). This marks an acceleration from ~8% CAGR between 2017 – 2022 helped by the emergence of secular tailwinds including continued digital transformation and a meaningful boost from AI services.

IT Services companies are seen as experienced & trusted partners for technologies such as AI: Beyond cloud and SaaS applications, newer technologies such as artificial intelligence (AI), the metaverse, augmented reality (AR), machine learning (ML), robotic process automation (RPA) are spurring investment and research at enterprises as they are looking for ways to enhance their businesses and stay ahead of competition. IT Services companies’ intellectual property and industrial expertise can decrease the costs and overall risk in introducing and transitioning these technologies.

Help enable the digital transformation of the enterprise: Companies are continuing to transition from on-premise software licenses to next-generation cloud applications on account of the significant cloud benefits (decreased fixed costs, scalability, greater analytical insights, etc.) for their businesses.

Operators help facilitate cost savings: IT Services companies can enable significant cost savings (geographic labor arbitrage) and allow companies to scale up and down resources more rapidly, relative to in-house sourcing. Real-time collaboration tools Zoom (ZM, Buy), Teams, Google Meet and cloud technologies have diminished legacy frictional barriers and have enhanced the quality of outsourcing tasks to IT Service providers.

Companies benefit from scarcity of technical labor: IT Service companies allow their customers access to a pool of sourced and trained software developers and other technical labor, which have become increasingly scarce.

Competitor Analysis

Operating Efficiency:

Revenue per employee CAGR (Globant ranks 1st with ~10% CAGR between 2020-2022, followed by EPAM).

Employee attrition - Accenture (11%), Globant (10%) and EPAM (14%) have lower attrition than their peers. [EPAM’s slightly elevated attrition due to its employee transition period owing to the Eastern Europe conflict.]

In 2022, Accenture and EPAM had the highest revenue per employee ($88k and $82k, respectively) while Cognizant and Genpact had the lowest ($57k and $38k, respectively).

SWOT Analysis

Porter's 5 Forces

(Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry)

Threat of New Entrants: LOW-MID

High capital requirement: Require specialized skills in consultants but there are so many consultants in the market which can be employed easily

Economies of Scale: Service cost is spread over large employees and is difficult for new entrants to compete on cost

Client Relationship: It would be difficult for new firms to break the long-standing relationships that EPAM has

Achievements: Top IT servicing Vendor in Europe

Account Management Quality: EPAM received an above-average rating of 87%

Service Delivery Quality: EPAM received an above-average rating of 86%

General Satisfaction: EPAM received an above-average rating of 82%

Digital Transformation: EPAM received an above-average rating of 82%

Application Services: EPAM received an above-average rating of 82%

Transformative Innovation: EPAM received an above-average rating of 79%

Brand reputation: Strong brand and takes a while to establish credibility (Founded in 1993)

Supplier Power: LOW

Diverse supplier base: EPAM has about 50 suppliers of software providers, tech and service companies which reduce its bargaining power

Low switching cost because the products are inherently non-physical

Long-term relationships which are aimed to be mutually beneficial

Customization of suppliers’ products for clients reduce bargaining power

Buyer Power: MID

Diverse clients: EPAM has 280 key clients

Low switching cost: IT services operate in a fragmented industry and the choice to switch more easily

Again, long-term relationship may reduce bargaining power

Transparency of business is high, giving buyers more power

EPAM’s ability to generate and create value for customize needs reduce buyer’s power but I think the value added can be replicated in other IT consulting firms as well

Threat of Substitution: LOW-MID

EPAM offers a wide array of services that competitors may not be in the industry to compete

Customers are happy and also being awarded one of the top IT vendors is nothing small to sniff at

Strong brand and similar reasoning as above

Industry Rivalry: HIGH

There are many competitors out there with aggressive pricing

Low buyer’s switching cost

Talent and companies acquisition bidding war

Building relationships with clients seems to be fierce

Therefore, EPAM is a strong competitor in a fragmented and competitive industry but it has a good positioning (brand, track record, client r/s) to maintain its strength in the applied development as the market size pie expands. I believe market share loss and competition won’t be a big problem.

Forecast Expectations

I didn’t put a very aggressive forecast into my revenue segments. The highest 5-year revenue CAGR for revenue vertical is ‘Emerging Verticals’ at 12.83% whereas the lowest is ‘Software & HI tech’ at 6.11%. And, total 5-years CAGR revenue growth is at 10.3% only. If we look at the historical growth before 2022, revenue growth has always been good for double-digit growth. Part of its reduction was because of the recovery playing out after 2-3 quarters before going back to normalcy. Thus, my assumptions won’t be meaningful by putting historical growth data, and by being conservative, we can take care of our downside.

Where are we in the cycle and how’s valuation looking?

It’s not an easy answer without looking at historical growth rates and other companies. Looking at all the red circles, the decline on average lasts about 1-3 quarters. Since then, EPAM has declined by about 2 quarters at the moment. We can expect recovery to be pretty soon in about 1-2 quarters.

Forward PEG is also at a cyclical low which is encouraging as this means that our downside is covered rather well. This also means growth expectations also seems to be healthy.

NTM P/E no doubt looks expensive at 29.6x. However, considering that valuation also has been maintaining around this range since 2022 means that the market is still willing to pay a higher premium because of the franchise quality EPAM has. The only time it went below 20x was when the Russia franchise was damaged due to the Russian war. Besides with the great relocation coming to an end, and the turning of IT spending should increase the multiple back to higher levels as seen in historical data above. I am expecting a re-rating to 35x which will give a 90% return.

FCF yield based on history looks rather attractive despite low absolute yield. Its median FCF yield is between 0.65% to 0.71%. Its current yield is between 1.32% to 1.48%, double of its median.

DCF analysis gordon growth method looks fairly valued as wellI think valuation only gives you the tools to value what's available information. But if we look at Accenture as a case study, a company with a long track record and still growing at double digit. A 10 year DCF gordon growth analysis becomes a pretty “useless” tool as the number of years to forecast is limited to 10 years and we just need to ensure that the IT demand services return and EPAM is ready for it which will send share price flying back to its former glory…

Bull-bear:

In the bear case scenario, forward P/E goes into 20x, which only happens once and it was because of a special situation like war, the exit P/E EPS 5-year upside is at 8.5%, despite having conservative revenue growth. Also, forward EV/EBIT at 21x, which is a historical low, gives us a 35% upside. I do think that the downside is well-covered. Once growth returns back, multiple expansion to 35x looks feasible.

More about EPAM:

Business Lines:

Engineering: EPAM builds enterprise technologies to help improve its clients’ business processes by offering customized analytics, cross-platform migration, implementation and integration. EPAM’s solutions aim to cover the full lifecycle of infrastructure management (e.g. application, database, network, server, storage and systems operations management, etc.) as well as offering monitoring, incident notification and resolution solutions. Moreover, EPAM delivers maintenance and support services which decrease its clients’ time and costs to run and support their IT systems.

Operations: EPAM offers proprietary platforms, engineering capabilities and automation services to improve customer experiences and delivering greater product value.

Optimization: This offering primarily includes transforming legacy processes and deliver streamlined operations that increase revenues and reduce costs for EPAM’s customers. EPAM helps its clients improve their software testing methodologies through application testing, test management, automation and consulting services.

Consulting: In recent years, EPAM added consulting primarily as a complement to its engineering expertise. Its consulting services can lead to stronger client relationships and more high-touch services.

Design: EPAM’s digital and service design practice provides strategy, design, creative and program management services for customers looking to improve the user experience.

Category Mix:

EPAM benefits from a strong category mix with nearly 75% of its categories in Application Implementation & Managed Services, which are expected to grow high-single-digits over the next 5-years (e.g. custom application implementation, which is expected to grow at ~9% 5-year CC CAGR).

Other key updates:

Making Strides in AI. Management has not quantified GenAI impact. However, it does vow to “make AI real.” As part of this focus, it notes that several of its labs and centers of excellence have created IP used to productize its learnings and to share them with its clients through open-source initiatives. From a revenue perspective there are several proof of concept projects occurring. Two recent partnerships with Google Cloud and AWS, and the partnership expansion with Microsoft, all focusing on the development of AI, ML, and analytic cloud services. We see EPAM increasing its product and solution velocity and continuing to iterate on next generation technologies

EPAM benefits from a strong category mix. Analyzing category mix across the industry shows that nearly 75% of EPAM’s categories are in Application Implementation & Managed Services. These are very strong categories which are expected to grow high-single-digits (~7%) over the next 5-years. The other large exposure of ~20% is towards consulting. This is a strong category (e.g. where Accenture is very dominant), which should be growing in the low double digits over the next 5-years (est. ~12%).

EPAM is ready to address demand as it strengthens. In 2022, EPAM set on a strategic plan to transition its delivery professionals to a more diverse set of geographies and to rely less on the conflict affected geographies of Eastern Europe. Its labor transition is largely completed, which has helped accelerate its geographic delivery diversification. Before the war, 64% of EPAM’s delivery professionals were in Ukraine, Belarus, and other parts of Eastern Europe (e.g. Russia) whereas it was ~40% by year-end 2022. Overall, EPAM relocated about 14K employees from Russia and Belarus and expanded into Poland, W. Europe, the Americas, and Asia.

Cost-cutting efforts can be used for reinvestment. EPAM recently elevated its focus on aligning its cost structure, initiating a cost optimization program designed to reduce operating costs by 2.5-3%. This can help save about $100+ million and allow EPAM to further invest in 2024. Management aims to use funds for demand generation programs, like partnership programs, sales capabilities, generative AI, and consulting.

Risk

EPAM figures remain elevated against a challenged macroeconomic backdrop, particularly as we have yet to see signs of an inflection across digital engineering IT budgets

Geographic expansion efforts across newer geographies such as India and Latin America may be challenging given the competitive landscape amongst incumbents, particularly as demand for technical talent remains fierce.

Other important data for reference:

Human Talent:

Geographic Mix:

EPAM’s revenues are sourced from multiple countries, which the company assigns into four geographic markets: Americas, EMEA, APAC and Central Eastern Europe (CEE). EPAM’s segments are not based on the geographic location of the customers, but are based on the location of the Company’s management responsible for a particular customer or market.

Customer Mix:

EPAM also benefits from having a relatively low customer concentration. For example, ~65% of its 2022 revenue is generated from customers outside of its top 20 largest, with its top 5 customers accounting for ~16% of its 2022 revenue (down from ~18% in 2021 and ~22% in 2020), customers 6-10 for ~7%, and customers 11- 20 for ~11%.

Similarly, EPAM had 49 customer accounts of >$20mn of 2022 revenue with a longtail of smaller customer accounts (~185 customer accounts ranging from $500k to $1mn and ~303 ranging from $1mn to $5mn).

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.