Initial Report: Fawry (FWRY), 38% 5-yr Potential Upside (EIP, Fernando KHO)

Fernando thinks that Fawry's robust net income growth and favorable valuation metrics compared to industry peers underscore its investment potential in Egypt's dynamic fintech landscape.

1. Executive Summary

Fawry (CASE:FWRY), a digital payment and financial services platform based in Egypt, is a leading player in the rapidly evolving fintech landscape. With a diverse portfolio of B2B2C, B2C, and B2B solutions, Fawry serves approximately 50 million users and operates 320,000 service points. Its revenue primarily derives from transaction and subscription fees (85%), with microfinance and insurance also contributing significantly. Fawry's strengths lie in its high market penetration in Egypt, strong brand recognition, and diversified offerings.

Egypt's growing population and increasing digital adoption present significant growth opportunities. Fawry is well-positioned to capitalize on the expanding digital payment sector, with a particular focus on banking services. With only 22% credit card penetration in Egypt, there is substantial room for growth. Moreover, Fawry's close relationship with regulators and the government's emphasis on financial inclusion further enhance its prospects. Despite some challenges, Fawry offers an attractive investment opportunity, with an intrinsic value of USD 0.22 per share, representing a 38% upside from the current share price. Its robust net income growth and favorable valuation metrics compared to industry peers underscore its investment potential in Egypt's dynamic fintech landscape.

2. Company Overview

a. Business segments

Fawry (CASE:FWRY) is a publicly listed digital payment and financial services platform based in Egypt. Fawry’s current ecosystem includes B2B2C, B2C, and B2B solutions. Founded in 2008 and based in Cairo, they offer (more on Appendix 1):

○ Payment services and money transfer facilities for consumers and businesses. Services available include bill payment, online payment to merchants and e-commerce sites, money transfers between users, and prepaid cards for purchases (similar to a debit card). They also provide investment and savings services.

○ Microfinance and other financial services such as insurance and loans

The company derives its revenue from transaction fees (varying, from about 1.5 – 3.0%), subscription fees (for business services such as Point of Sales / POS), and interest fees from microfinance. They currently serve c.50m users and c.320k service points. Transaction and subscription fees formed c.85% of the revenue, while insurance and microfinance contributed c.0.6% and c.11.0% in FY2022 respectively.

b. ESG considerations

Fawry has an ESG (Environmental, Social, and Governance) risk rating that provides insights into its sustainability performance. According to Sustainalytics, Fawry's ESG risk rating is positioned at 26.9, which falls under the 'Medium Risk' category. This rating situates Fawry at 949 out of 1105 companies in the Software & Services industry group and 9044 out of 15841 in the global universe. This assessment suggests that while Fawry is managing its ESG responsibilities to a certain extent, there's room for improvement, especially when compared to its industry peers.

In addition to this, Craft.co reports Fawry's ESG rating as between 40-49 out of 100. This rating further aligns with the notion that Fawry is making efforts in managing its ESG responsibilities, but there are areas where it could enhance its practices.

These ratings provide a broad view of how Fawry is perceived in terms of ESG performance, reflecting aspects like its environmental impact, social responsibility, and governance structure. For companies and investors prioritizing sustainability and ethical practices, such ratings are crucial in decision-making processes.

3. Competitor Analysis

a. Market Analysis

Egypt's Growing Population. Egypt's population has witnessed substantial growth, rising from 72.2 million in 2006 to 102.1 million in 2021, resulting in a compound annual growth rate (CAGR) of 2.3% over 15 years. Furthermore, it is projected to continue its upward trajectory, reaching 118.4 million by 2028, with an expected CAGR of 2.1% from 2021 to 2028. Egypt’s emerging new millennial population is expected to be more aware of new technology in daily life.

Higher Financial Inclusion Rate. From 2016 to 2022, the Central Bank of Egypt's data revealed a significant 147% increase in the number of Egyptians with access to banking services, totaling 42.3 million people in 2022. This figure represents 64.8% of the 65.4 million eligible adults aged 16 and older. The growth in banked Egyptians was mainly attributed to the rising usage of mobile wallets and prepaid cards. Mobile wallets surged by 54%, going from 19.8 million in 2020 to 30.4 million by the end of 2022. Similarly, the total number of prepaid cards increased by 31%, rising from 21.9 million cards in 2020 to 28.6 million cards by the close of 2022.

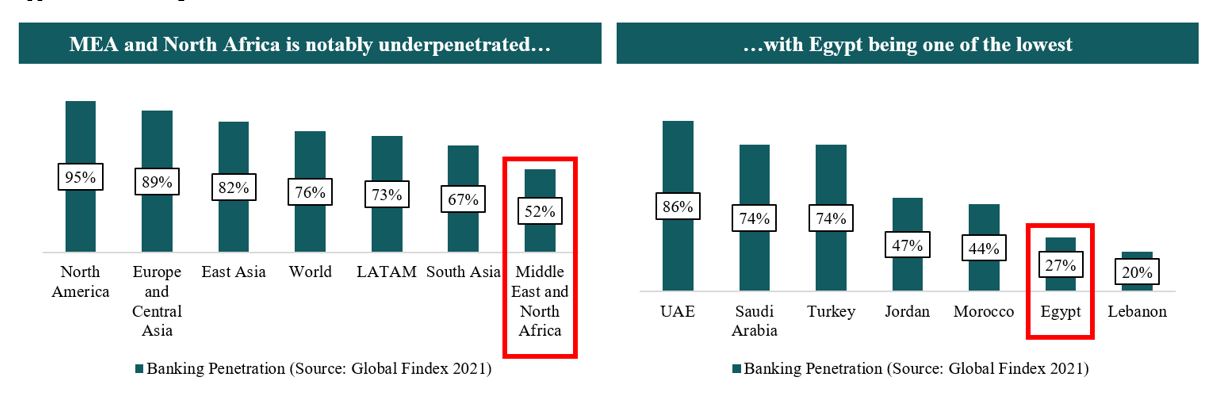

Global Growth of Banking Penetration. Account ownership is a vital aspect of financial inclusion, acting as the gateway to accessing and utilizing financial services for development. People with formal accounts, whether with a bank or a regulated institution, can store, transfer, and receive money, which empowers them to invest in health, education, and businesses.

The latest 2021 Global Findex Database from the World Bank, based on a survey of 125,000 adults across 123 economies, demonstrates a global surge in account ownership. In 2021, nearly 76.2% of adults globally (27.4% in Egypt) possessed either a bank or mobile account, a substantial increase from the 51% reported in 2011. Historically, many adults in developing countries lacked accounts, but financial inclusion is now rapidly on the rise. Additionally, account ownership in developing economies grew from 63% to 71% between 2017 and 2021

b. SWOT Analysis

c. Existing Competitors

In Egypt, there are few competitors of Fawry, but they are mostly either smaller in size or not having strong service diversification. As such, we can foresee that Fawry is on a good position to tackle the competitive landscape.

4. Investment Thesis

a. Investment Thesis 1 - Strong consumer growth will support Fawry’s payment services front

As discussed in the market trend section, Egypt is going through a phase where the growing population is coupled with higher digital adaptation, which would fuel higher adaptation of digital wallets. With regards to Fawry’s different business lines, we therefore can forecast:

○ Alternative Digital Payments (c.58% of total revenue), which allows customers to pay for their bills through applications or POS terminals. In this segment, as more people need to fulfill their needs, it is expected to have higher adaptation. When people shift from the traditional way of paying their bills (e.g., via counter payment), Fawry would enjoy higher utilization. However, as more traditional banks and other fintech applications appear, this segment is expected to grow at a slower rate moving forward

○ Banking Services Segment (c.33% of total revenue), where Fawry provides payment for retail transactions and other financial services (KYC, cash-in cash-out services, deposit and loan settlement), shines the most. As the digital economy of Egypt keeps growing (supported by the growing population and support towards the digital economy), Fawry is well-positioned to capture the industry. On average, credit card penetration across countries sits at 45%, while Egypt’s current state is 22% (Appendix 2) - presenting ample room for Fawry to grow. Its comprehensive offerings provide a solid competitive advantage compared to other players

In short, it is reasonable to see that Egypt’s digital economy is growing at a promising pace, with Fawry being able to capture the growth.

b. Investment Thesis 2 – A solid relationship with regulators will secure the way forward

Fawry has a solid track record in engaging with the government, which is a crucial regulatory stakeholder in considering an investment in a fintech company. To date, there have been pieces of evidence that Fawry is ahead in securing permits for new products, a crucial ability for an innovation-based company. Some examples include:

○ In August 2023, Fawry Microfinance secured preliminary approvals from the FRA to expand its portfolio by adding SME financing, aligning directly with the company's long-term growth strategy of diversifying revenue streams and reaching untapped market segments across the country. It is believed that this move will help support the company's margins in the forthcoming period

○ In March 2022, The National Bank of Egypt (NBE) increased its stake in Fawry, following a recent move by Banque Misr to double its holdings. NBE paid over EGP 1 billion at EGP 10.25/share, resulting in a total stake of 6.1%

In the past few years, the government has put an emphasis on financial inclusion, known as the “Financial Inclusion Strategy”, in which they aim to expand access to financing for MSMEs and stimulate the banking usage of people. Fawry, with its wide offering, seems to align with the majority of these goals, securing their “importance” in the years ahead.

5. Valuation

From the fundamental analysis based on the previous investment theses as projection, it is calculated that Fawry’s intrinsic value to be USD 0.22/share, implying 38% upside from 30 December 2023 share price. The projection mainly utilizes the total market available (e.g., Egypt’s GDP) and assumptions on how Fawry can utilize the growth of those indicators. The upside indicates the optimism that Fawry can grow their business, mainly on banking sector.

Looking at the comparable companies, Fawry also showed a promising investment potential. Despite having significantly greater net income growth rate (c.147% vs c.37% of the rest of the industry), they are trading at 23.5x - roughly near the median of the comparable companies of 23.3x. Moreover, the low EV/EBITDA (c.12x compared to 19.7x median) could signal an undervalued stock at the moment – attributable to Fawry’s notable gross margin.

Looking at fintech-specific metric, as a full-fledged banking sector, P/BV will suit Fawry the best. P/BV wise, Fawry slightly higher than the median – indicating efficiency in generating value from assets.

6. Risks and Mitigation

a. Risks

○ Market Concentration Risk: Fawry has a high reliance on the Egyptian market, with limited exposure to overseas markets. This concentration increases vulnerability to local economic and political instabilities.

○ Competition: The increasing competition from other fintech providers could erode Fawry's market share, particularly as the fintech landscape evolves rapidly.

○ Cybersecurity Threats: Given Fawry’s digital nature, ongoing cybersecurity threats pose a significant risk. Any breach could lead to loss of trust and financial damages.

○ Economic Slowdown: Fawry's revenue is tied to consumer consumption; thus, any economic slowdown in Egypt could directly impact its financial performance.

○ Management Complexity: Managing a diversified business requires strong and effective management. Mismanagement could lead to inefficiencies and loss of focus.

b. Mitigation

○ Diversification of Offerings: Fawry’s diverse offerings across payment services, microfinance, and other financial services reduce dependency on a single revenue stream.

○ Strong Brand and Market Penetration: Fawry has a strong brand name and high market penetration rate in Egypt, which provides a competitive advantage and customer loyalty.

○ Regulatory Relationships: Fawry’s solid track record and relationships with government and regulatory bodies can help in navigating regulatory changes and securing approvals for new products.

○ Growth in Digital Economy: As Egypt’s digital economy grows, Fawry is well-positioned to capitalize on this trend, especially with the rising adoption of digital wallets and banking services.

○ Alignment with National Goals: Fawry’s alignment with the Egyptian government’s Financial Inclusion Strategy can provide long-term stability and support.

○ Financial Resilience: The company’s strong financial performance, as indicated by robust net income growth and favorable valuation metrics, suggests resilience and potential for continued growth.

○ Expansion Opportunities: While currently concentrated in Egypt, there is potential for regional expansion, leveraging its existing technology and expertise.

○ Investment in Cybersecurity: Continuous investment in strengthening cybersecurity measures can mitigate risks associated with digital threats.

○ Efficient Asset Utilization: Fawry’s efficiency in generating value from assets, as indicated by its P/BV ratio, suggests sound financial management practices.

In conclusion, while Fawry presents several risks typical of a fintech company in an emerging market, its diversified business model, strong market position, regulatory alignment, and financial resilience offer significant mitigations. Investors should weigh these risks against the potential growth opportunities in Egypt's expanding digital economy.

7. ESG Assessment

Fawry, a prominent player in the electronic payment services sector in Egypt, exhibits a noteworthy approach to Environmental, Social, and Governance (ESG) factors. This report delves into Fawry's contributions and practices in each ESG aspect, underlining the company's current standing and potential areas for improvement.

a. Environmental Impact:

Fawry’s adoption of digital payment solutions marks a significant stride in environmental sustainability. The shift from conventional, paper-intensive transaction methods to electronic mediums is a notable contribution toward reducing paper waste and associated carbon emissions. While specific metrics detailing Fawry’s environmental achievements, such as exact carbon emission reductions or energy efficiency improvements, are not publicly available, the underlying impact of their digital services on environmental conservation is implicit.b. Social Contribution:

Fawry's network, encompassing various retail points like groceries, pharmacies, and post-offices, notably enhances financial accessibility. This widespread network is instrumental in penetrating underserved and remote areas, thereby bolstering financial inclusion and supporting community empowerment. Such initiatives are pivotal in addressing the 'Social' criterion of ESG, highlighting Fawry's commitment to fostering societal well-being and economic development within Egypt.c. Governance Practices:

Regarding governance, Fawry's practices encompass management of relationships with stakeholders, including employees, suppliers, and communities. While the report lacks specific details on Fawry's internal governance mechanisms, governance in a broader ESG context involves evaluating company leadership, executive compensation, audits, and shareholder rights. These factors are crucial in assessing a company's accountability, transparency, and ethical conduct.d. ESG Risk Rating:

As per Sustainalytics, Fawry’s ESG risk rating stands at 26.9, classified under the 'Medium Risk' category. This rating implies a balanced but improvable approach to ESG responsibilities. In the Software & Services industry group, Fawry is ranked 949 out of 1105, indicating moderate performance in ESG practices compared to its industry peers.

8. Conclusion

In summary, Fawry (CASE:FWRY) stands out as a formidable player in Egypt's fintech sector hence we are recommending BUY or go with the investment. With a diverse range of financial services, Fawry is strategically positioned to capitalize on Egypt's expanding population and increasing digital adoption. Its strengths include high market penetration and strong brand recognition, though there are concerns regarding overreliance on the domestic market and the need for effective management.

Fawry's investment theses discussed point to significant growth potential, especially in the digital payment sector. The company's alignment with government regulations and its ability to secure permits for new products further enhance its investment appeal. With limited competition in Egypt and a substantial user base, Fawry's comprehensive financial services give it a competitive advantage. Financial analysis also suggests an attractive upside potential, backed by robust net income growth and favorable valuation metrics compared to industry peers. Moreover, Fawry's mission aligns with the goal of promoting financial inclusion, making it a promising choice for those focusing on this theme. Overall, Fawry offers a compelling opportunity in Egypt's evolving fintech landscape, driven by its diverse services, market positioning, and growth potential in a rapidly digitalizing economy.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.