Initial Report: Freshpet, Inc. (NASDAQ: FRPT), 109% 5-yr Potential Upside (TOH Cheng Ze, SC VIP)

TOH Cheng Ze presents a "BUY" recommendation based on Freshpet's innovative retail strategy, scalable profitability and structural tailwinds.

1. Executive Summary

I am initiating coverage on Freshpet (FRPT) with a BUY recommendation. The stock is down ~42% YTD, driven by (1) a miss in Q4 2024 earnings and (2) softer-than-expected 2025 guidance, which have raised concerns over growth momentum. However, I believe these are temporary setbacks. Freshpet remains a category-defining brand with a proven growth engine, emerging operating leverage, and a clear runway for long-term expansion.

2. Company Overview

Freshpet, Inc. (“Freshpet”) manufactures and sells premium fresh pet food using natural and high-quality ingredients to create nutritious meals for pets. Founded in 2006, the company has established itself as a market leader in the U.S. fresh and frozen branded dog food segment, commanding an impressive market share of 96%.

Product Offerings

Freshpet’s offerings—sold under brands like Freshpet Select, Vital and Nature’s Fresh—include dog food, cat food and dog treats in ready-to-serve formats such as rolls, patties and bites. The company generates revenue primarily from dog food products (96% of 2024 revenue).

Distribution Model

Freshpet operates a vertically integrated model. Freshpet has three core manufacturing hubs: (1) Bethlehem Kitchen (Pennsylvania) – 6 lines, (2) Ennis Kitchen (Texas) – 5 lines: and (3) Kitchen South (Texas) - 3 lines. It manufactures the products in its own kitchens and distributes them primarily through 36,500 company-owned refrigerated coolers located in more than 28,000 brick-and-mortar retail stores such as grocery stores, mass merchandisers, club stores and pet specialty. The company has a direct-to-consumer (DTC) presence through its online channels, offering subscription-based delivery services. It also distributes its products via Chewy, a leading e-commerce platform for pet products. The company primarily competes in the US market (98% of 2024 revenue), with operations in Canada and Europe as well.

Financial Highlights

Freshpet has delivered robust top-line growth, with revenue increasing at c.32% CAGR from $319 million in 2020 to $975 million in 2024. The growth has been fuelled by new store additions, increased fridge placements per store and rising consumer demand for fresh pet food. The company saw adjusted EBITDA rose from $20 million in 2022 to $162 million in 2024 and posted its first annual net profit of $46.9 million in 2024.

The primary revenue drivers are: (i) Household penetration, (ii) Buy rate and (iii) No. of stores/fridges.

Every new fridge placed in a store creates a new point of sale and brand visibility.

More and more consumers are purchasing Freshpet products and are buying more when they do.

3. Industry Overview

US Pet Food Market

In the U.S. alone, the pet food market is valued at $54 billion annually and is projected to reach $77 billion by 2029. Of which, the dog food category accounts for $37 billion, with Freshpet holding a 3.4% share of the segment. As pets are increasingly viewed as family members, humanization trends are driving a shift towards premium and health-focused diets.

The key drivers of growth in the pet food market are:

Rising pet ownership (Currently at 66% of U.S. households)

Growing demand for premium and organic pet food

Heightened focus on pet health and wellness (Pet owners are more educated and proactive on pet care)

Within the broader pet food market, Freshpet primarily competes in premium fresh/frozen food – a niche and fastest growing segment of pet food, which is expected to reach a TAM of $5 billion in 2027. Dollar sales for fresh dog food have risen 86.5% and those for fresh cat food have risen 53.8% from 2021 to 2023. These growth rates far outpace the broader pet food market and will continue to do so.

Competitive Landscape

Freshpet’s competitors can be viewed in two categories:

Traditional Pet Food Brands

The U.S. pet food market is dominated by two major players, Nestle Inc. (Purina) and Mars Inc. (Pedigree, Royal Canin), which together command a combined market share of 61%. Other notable competitors include Colgate-Palmotive (Hill’s Science Diet) and General Mills Inc. (Blue Buffalo). While Mars introduced Cesar Fresh Chef in 2021and General Mills launched fresh dog foot products in 2023, these efforts have yet to replicate Freshpet’s success in the fresh pet food category. Freshpet’s first-mover advantage and proprietary cold chain logistics have proven difficult for competitors to enter and compete in this segment.

Fresh Pet Food Competitors

Freshpet dominates the fresh dog food category with a staggering 96% market share by operating a retail-first distribution model. In contrast, competitors such as The Farmer’s Dog, Ollie and Nom Nom are primarily DTC brands, shipping frozen pet food to customers on a subscription basis. JustFoodForDogs has retail presence through Petco and its own kitchens but lacks the scale of Freshpet’s extensive in-store footprint.

Freshpet’s products are priced at a premium compared to traditional pet food but remain more affordable than most DTC brands.

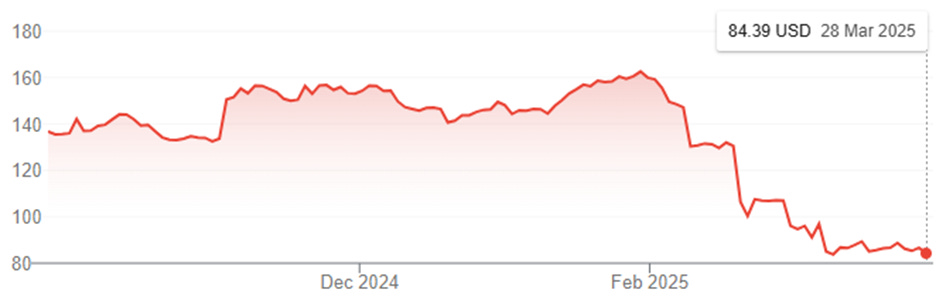

4. Stock Price

Freshpet is currently trading at US$84, representing a ~48% decline from its high of US$162 in Jan 2025. The sell-off was triggered by disappointing 4Q24 results, with revenue and earnings falling short of street’s expectations. The latest 2025 guidance implies 21%-25% y/y revenue growth to reach $1.18b-$1.21b, which are slightly below consensus estimates. Concerns about the company’s prospects and top-line growth have led to price target cuts by the sell-side analysts.

5. Investment Thesis

Fridge Strategy as a Retail Moat

The company have built over 36,000 refrigerated fridges across retailers like Walmart and Target. I see them as mini Freshpet stores inside high-traffic aisles, giving the brand exclusive shelf space. Freshpet takes full ownership of the fridge network, where they purchase, install, service, and restock each unit of products. The cash-on-cash payback period for the average Freshpet Fridge installation is less than 12 months.

This physical infrastructure is not easy to replicate. If a new brand wants to compete in fresh pet food in physical retail space, they’d have to convince retailers to give them fridge space by proving success of their products as well as built cold chain logistics to handle stocking, transporting, and merchandising. Freshpet has a first move advantage in this area and established relationships with retailers, which makes it harder for new entrants to gain traction.

In top locations, 22% of stores now have two or more fridges because confidence in the growth of the fresh category has grown considerably. Instead of focusing solely on increasing store count, management’s strategy is to go deeper where it’s already working. By adding more fridges in stores with strong demand, they can (i) add more SKUs, (ii) prevent out-of-stocks, and (iii) improve brand equity – all for the aim of driving sales velocity.

Furthermore, the retail presence through the fridge infrastructure gives a competitive edge in terms of convenience and brand visibility over DTC brands like The Farmer’s Dog and Ollie who require subscriptions commitments and advance planning. Pet owners can simply grab fresh pet meals during routine grocery trips to retail chains.

Market Leader in a Structually Growing Category

Freshpet is the undisputed leader in the U.S. premium fresh dog food category — and what makes the story compelling is that it's not just competing in the space, it's creating it. As a pioneer, Freshpet has taken on the heavy lifting of educating pet parents, building a nationwide cold-chain supply network, and establishing a branded in-store presence through its proprietary refrigerated fridges. It is expanding the TAM for fresh pet food itself.

From a distribution standpoint, Freshpet continues to widen its reach. By the end of 2024, the company had achieved 77% All Commodity Volume (ACV) in the grocery channel — meaning its products are stocked in retailers that account for over three-quarters of total grocery sales. Across all channels (xAOC), including mass merchants and club stores, Freshpet's distribution stood at 66%, leaving significant runway for further expansion. There is a noticeable shift in how grocers view the fresh pet food category with increasing buy-in from retail partners.

By focusing on its most valuable customers, expanding into underpenetrated retail formats, and continuing to invest in brand equity, Freshpet is well-positioned to drive sustainable, long-term revenue growth in a category it helped invent.

Scalable Profitability and Operating Leverage

Freshpet now has a clear runway for profitable scale. The company’s performance in 2024 marked a turning point where it proved that the business model can deliver attractive margins and cash flow at scale — in fact, it hit long-term margin targets years ahead of schedule. In recent times, management has consistently shown they can add production capacity on time and on budget. In 2024, Freshpet achieved over 99% fill rates, fulfilling most customers orders in full and on time while also growing volume by 26%. Previously during covid, there were shipment shortfalls, failure to raise prices to offset inflation in a timely manner and significant inefficiencies that weighed on profitability.

Management’s track record of execution gave me confidence in their ability to manage capex to support future demand without overbuilding capacity or straining margins. Management is targeting a 22% Adj. EBITDA margin by 2027, and given recent outperformance and upward revisions to guidance, I believe that goal may be conservative. Margin improvement in 2024 was significantly driven by 440 bps in commodity cost savings, along with 150 bps each from quality and logistics efficiencies, which comes from Freshpet’s operational experience to manage the supply chain effectively.

If Freshpet continues to deliver strong growth, I see significant operating leverage ahead through better absorption of plant costs and G&A expenses (excluding advertising, which is expected to scale more in line with revenue). As the capex cycle slows down, we would likely see high operating cash flow beyond 2026.

6. Valuation

DCF

Assuming management delivers on its 2027 target of $1.8 billion in net sales and an adjusted gross margin of 48%, I expect free cash flow to turn positive by 2026, as operating leverage kicks in and capex declines. Using DCF, there is a ~38% upside to the current trading price at $84.

Comps

Freshpet trades at a premium relative to peers – 20.1x NTM EV/EBITDA vs peer median of 13.6x, and 63.3x NTM P/E ratio vs peer median of 19.8x. This premium is warranted given market’s expectation of Freshpet's high earnings growth and margin expansion going forward.

Given that Freshpet’s gross margin is near the top of the peer range and as operating leverage plays out, the net profit margin will converge upwards to its peers. Freshpet’s PEG ratio of 0.5x (FY27) is the lowest among peers, suggesting the stock is undervalued relative to its long-term growth potential.

I apply a 14.7x EV/EBITDA multiple to Freshpet’s FY27 and FY29 estimated EBITDA. The multiple represents a forward-looking estimate of where the market could reasonably value a mature business once it reaches >22% EBITDA margins and begins generating sustainable free cash flow from FY2026 onward.

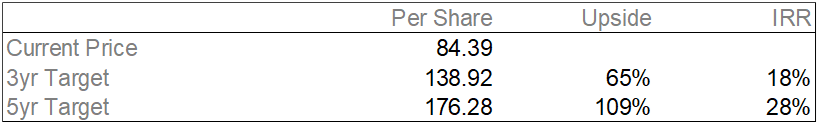

Applying a 50/50 weighting between DCF and comps-based valuation, I arrive at a 3-year target price of $138.92 and a 5-year target of $176.28.

7. Risk

Rising Competition in Fresh Pet Food

While Freshpet currently dominates the U.S. fresh pet food space with 96% market share, the category is attracting renewed interest from major CPG players. Notably, Colgate-Palmolive recently announced its acquisition of Prime100, a leading fresh pet food brand in Australia offering both refrigerated and shelf-stable products. This implies potential for new entrants with deep pockets to challenge Freshpet’s dominance in this space over time.

Food Safety & Brand Risk

As a fresh, refrigerated product, Freshpet faces heightened food safety risks relative to dry kibble competitors. A contamination incident or recall could lead to reputational damage, legal liability, and lost shelf space. There have been past incidents involving voluntary recalls due to potential contamination (e.g., in 2022), and any recurrence could shake consumer trust in a category where health and safety are central to the brand promise.

Execution Risk

Management has set ambitious targets for 2027, including: $1.8 billion in net sales, 48% adj. gross margin, 22% adj. EBITDA margin and 20 million households using Freshpet products. These targets require coordination and success across multiple fronts: (i) capacity ramp-up, (ii) supply chain discipline, (iii) advertising and production innovation to acquire customers and (iv) retail execution.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.