Initial Report: Glencore PLC (GLEN), 20% 5-yr Potential Upside (EIP, Sidhaarth VENKATARAMAN)

Glencore emerges as a resilient and forward-thinking player in the commodities market. Read on to see how Sidhaarth came to this conclusion!

LinkedIn | Sidhaarth VENKATARAMAN

Executive Summary

Glencore (GLEN) - Unleashing Value in a Global Resources Powerhouse

Glencore (GLEN), a Swiss commodities market leader, has evolved from a renowned trader and miner into a pioneering force in multiple areas. This report explores how Glencore's boldness translates into mutually beneficial partnerships, robust returns, and long-term value creation for investors during the transition to a new energy era.

One of Glencore's key strengths lies in its focus on the recycling market, where over 80% of the e-waste market remains untapped. By pioneering this area, Glencore is well-positioned to meet the increasing demand for transition metals, crucial for powering the transition to a low-carbon economy.

Glencore's strategic pillars encompass three key areas: enabling the decarbonization of global energy demand, meeting the continued demand for metals in everyday life, and responsibly addressing the energy needs of today. These pillars form the foundation of Glencore's growth strategy and highlight its commitment to sustainability and responsible resource management.

This report presents three investment theses that underpin Glencore's value proposition:

Capitalizing on Critical Energy Transition Metals: Glencore's expertise in the production and supply of essential metals positions the company to benefit from the increasing demand for metals required for the global energy transition.

Flexible Business Model with Key Insights and Adaptability: Glencore's ability to navigate changing market dynamics, coupled with its strategic insights and adaptability, enables the company to seize opportunities across commodity cycles.

Audacious Business Model and Risk-Taking History: Glencore's history of taking calculated risks and bold business decisions has allowed it to establish a competitive edge and generate superior returns.

While Glencore exhibits promising prospects, it is important to consider certain uncertainties:

High Reliance on Trading Energy Products: Glencore's significant revenue generation from trading energy products, such as thermal coal, may lead to potential re-ratings due to growing environmental concerns.

Regulatory and Legal Challenges: Operating in diverse geographies, including regions like Congo and Venezuela, exposes Glencore to regulatory and legal issues, necessitating careful consideration and risk management.

Cyclical Nature of the Business: Glencore's operations in both trading and mining sectors contribute to a balanced business model, mitigating some of the inherent cyclicality associated with the industry.

Incorporating our investment theses and appropriate assumptions into our discounted cash flow (DCF) model, we arrive at a target price of £526.74, representing a 20% premium over the current price of £438.95. This valuation reflects our confidence in Glencore's potential for sustained growth and value creation.

By delving into Glencore's strategic direction, risk management, and the catalytic role it plays in the critical transition to a new energy era, this report aims to provide investors with valuable insights to make informed investment decisions.

Company Overview

Glencore is a BBB+ rated diversified minerals company with a market capitalization of

£73.6B. It has high dividends, with a historical yield range of 4-7%. As the world’s largest commodity trading and mining company, Glencore has spent decades cultivating a reputation for making bold moves and taking calculated risks in the relentless pursuit of opportunity.

Led by CEO Gary Nagle and Chairman Kalidas Madhavpeddi, Glencore leverages its unparalleled global connections and logistical expertise to source the fuels and materials that support daily life around the world. Glencore turns the gears of the energy, transport, and finance industries through trading everything from coal to corn, oil, and ore. They deal in the building blocks of the modern economy and have helped countries secure resources critical for growth during times of scarcity.

What sets Glencore apart is its willingness to get its hands dirty through direct ownership of mining assets and risk taking mentality. Glencore has carefully assembled a world-class portfolio of copper, cobalt, zinc, nickel mines, and more from the Democratic Republic of Congo to Kazakhstan to Australia. These industrial assets provide not only physical commodities for marketing but also opportunities for optimization and vertical integration.

Over the years, Glencore has weathered many storms from volatile commodity prices to geopolitical tensions to operational challenges at their sites. Through prudent risk management, a decentralized business model, and sheer determination, Glencore has endured and emerged stronger after each crisis. Now the company's focus remains on responsibly supplying the metals and energy for the transition to a low-carbon future while meeting the world's ongoing need for resources.

With a thirst for opportunity and a proven ability to adapt to dynamic markets, Glencore shapes the way raw materials flow around the world. They provide the inputs enabling advancement in richer, greener, and more sustainable societies.

Business Segments

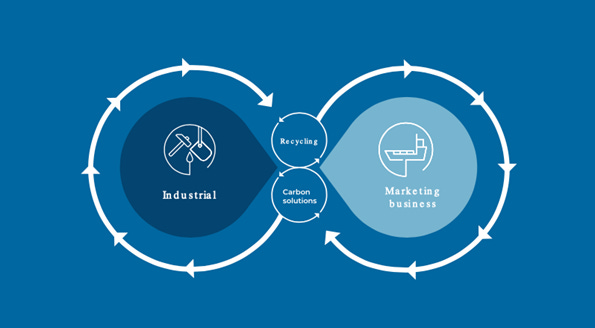

Glencore’s business can be broken down into 2 key segments: Marketing, and Industrial.

Marketing:

Glencore's marketing activity revolves around trading commodities and taking advantage of short-term price fluctuations in the market. This trading function is at the core of Glencore's business model and represents its original focus before expanding into mining operations. The company's marketing division plays a crucial role in connecting producers and consumers, facilitating the efficient movement of commodities and optimizing the value chain.

The marketing segment encompasses a broad range of commodities, including metals, minerals, energy products, and agricultural goods. This wide scope allows Glencore to leverage its expertise and market knowledge across multiple sectors. The company's ability to manage supply chains, provide risk management solutions, and offer financing and logistical support strengthens its position as a leading global commodity trader.

Industrial Activities:

This is where the company gets its hands dirty. Glencore's industrial activities involve the physical production and extraction of various metals, minerals, and energy products. The company operates mines, processing facilities, and other industrial assets worldwide. By engaging in industrial activities, Glencore gains control over the entire value chain, from extraction to processing and distribution.

In the metals sector, Glencore is a prominent producer of copper, cobalt, zinc, nickel, and ferroalloys. These metals are essential components in various industries, including electronics, automotive, construction, and infrastructure.

In the energy sector, Glencore is a major player in coal production, with mines located across different regions globally. While coal has faced increased scrutiny due to environmental concerns and the transition to cleaner energy sources, Glencore has been actively managing its exposure to coal and diversifying its portfolio to include other energy products, such as oil and natural gas.

By engaging in industrial activities, Glencore not only captures value from the production and sale of commodities but also maintains a strategic position in the supply chain, allowing the company to have greater control over pricing, quality, and market access.

These two broad categories, marketing and industrial, complement each other within Glencore's business operations. The marketing segment provides flexibility and agility to capture short-term market opportunities, while the industrial segment ensures long-term stability and control over the production and extraction of key commodities.

Revenue Drivers

Commodity prices: The primary revenue driver for Glencore’s marketing segment is the prevailing price of commodities.

Global demand and supply dynamics: This is influenced by several factors such as population growth, globalisation, infrastructure development, transition to green energy sources, and more.

Production volumes: Higher production volumes are driven by increased mining and extraction activities. The company’s ability to efficiently manage production operations and optimise output levels is a crucial revenue driver.

Cost Drivers

Production and Operating Costs: The cost of production, including expenses related to mining, processing, transportation, and labour, significantly impacts Glencore's profitability. Fluctuating costs of raw materials, energy, equipment, and labour can influence the company's overall cost structure.

Currency Rates: Glencore operates in multiple countries and conducts business in various currencies. Changes in exchange rates can impact the company's cost structure, particularly when it comes to purchasing raw materials, equipment, and services. Currency fluctuations can affect the competitiveness of Glencore's products in international markets.

Regulatory and Compliance Costs: Compliance with environmental, health, safety, and other regulatory requirements incurs costs for Glencore.

Geopolitical and Market Risks: Geopolitical factors, including political instability, trade policies, and sanctions, can impact Glencore's operations and cost structure. Changes in market conditions, such as supply chain disruptions, trade disputes, and geopolitical tensions, may lead to increased costs related to logistics, transportation, and risk management.

ESG Considerations to Note

UN Sustainable Development Goals focus areas for Glencore

Principle 1: No poverty

Principle 10: Reduced Inequality

Principle 16: Peace, Justice and Strong Institutions

Principle 17: Partnership for the Goals

Effects of heavily carbon intensive business on the climate

Glencore is the world’s biggest shipper of the dirtiest fossil fuel, coal. Record prices of the commodity has helped add massive profits to its bottom line.

With Glencore’s development of thermal coals mines, shareholder resolutions have been filed in the past asking Glencore to reveal how production and capital expenditure plans align with the Paris climate accord to keep global warming to 1.5 degrees.

Several key investors, from HSBC Asset Management, Swiss based Ethos Foundation, and more are active in investment stewardship, encouraging more transparency and material actions on the company’s part.

Glencore pledges to hit net zero carbon emissions by 2050 and responsibly run down its mines producing thermal coal, the most polluting fuel, by 2040s.

12 of its coal mines are on track for closure by 2035 and the company is on track to reduce emissions by at least 15% by 2026

Multi-pronged approach to gradually reduce carbon intensive production

Playing a part in creating a more circular and sustainable economy

Accelerating circularity of critical metals, seeing significant value in capturing recyclable materials across the lifecycle, aim is to achieve full circularity.

In 2021, Glencore's copper, nickel and precious metal recycling recovered over 130 kilotons of metals including 41 kilotons of copper, 4.4 kilotons of nickel, and over 1.5 million ounces of gold and silver. Cobalt recovery was 1.5 kilotons. This demonstrates the scale of Glencore's existing recycling operations.

Glencore’s investments in this area seem promising. While recycling is still a lesser known part of the company compared to its mining and marketing divisions, this can be seen as a key enabler in the transition to a low carbon economy. They’ve neatly integrated their primary business with the recycling aspect, with their smelting and refining capable of handling a wide range of complex inputs. This means that the primary assets that they’ve always had can also handle recycled metals on top of the inputs from their mining operations, which gives them an edge over ordinary recycling only competitors.

They see themselves as a lifetime custodian of the metals they handle, and are actively heavily investing in testing and R&D to improve recycling of more complex materials.

Significant social progress to local economies around the world (of course, with a few attached concerns)

A significant proportion of Glencore’s assets are located in more challenging socio-political circumstances with a history of conflict, limited basic services and weak rule of law. Glencore’s approach is highly customised and informed by local context.

Some examples of their impact include:

Increased access to education: Creation of e-learning system in South Africa and Mobile School Bus in Peru.

Supporting local businesses: Their company Home Smelter makes regional sourcing of goods and services a priority, with over 45% (83M) coming from local businesses.

Unfortunately history of human rights complaints does exist for the company

UK Government accepted humans right complaints against Glencore for toxic wastewater spills in Chad resulting in dozens of villagers including children claiming the suffered severe burns, skin lesions and sickness after contact with the contaminated water. Livestock drinking from the river also died. Residents claimed the wastewater basin was leaking for weeks already, but Glencore failed to properly address the problem or warn the locals.

Overall seems to be significant pros, but also high impact cons that result on local economies from Glencore’s presence.

Audacious business model with aggressive origins, pushing the limits of what is allowed in modern global economy ethically (corruption, bribery and testing the boundaries of the law)

Glencore agreed to pay over $1.1B for foreign bribery and market manipulation schemes in 2022. They were found to engage in long running bribery and price manipulation conspiracies, but have agreed to cooperate in any ongoing investigations and prosecutions relating to their misconduct, and strengthen their compliance program.

Sanctions are a favoured tool for the US to exert its influence beyond borders, rather than just cutting off supply. Glencore has found this to be significantly profitable, acting as a bridge between the sanctioned and international markets. It has not hesitated to tread where others would[#S1] fear, with examples including working closely with Dan Gertler, an Israeli businessman who was known for corrupt and opaque mining deals.

The company was named in a lawsuit linked to Venezuela’s state oil company PDVSA, alleging traders bribed employees to provide inside information.

Investment Thesis

Capitalizing on Critical Transition Metals

Glencore offers investors a unique opportunity to gain exposure to critical metals that are pivotal for the energy transition. Glencore stands at the forefront of supplying metals like copper, cobalt, nickel, and zinc, which play an indispensable role in renewable energy, electric vehicles, and battery technology.

Rising Demand for Transition Metals: The transition to sustainable energy and transportation systems is gaining momentum worldwide. There is massive untapped potential in the renewable and clean energy space as shown in the chart above. This transition requires an abundant supply of key metals, making Glencore's production of copper, cobalt, nickel, and zinc highly valuable.

Copper: The International Copper Association estimates that the global demand for copper is expected to increase by 31% by 2030, driven primarily by renewable energy and electric vehicle infrastructure projects.

Cobalt and Nickel: BloombergNEF projects that the demand for cobalt and nickel for electric vehicle batteries will increase by over 400% and 200%, respectively, by 2030.

Zinc: According to the International Zinc Association, the demand for zinc in renewable energy infrastructure and electric vehicle production is expected to grow by 2-3% annually.

Benefitting from Transition Trends: Glencore's strategic focus on transition metals enables it to align with the evolving energy landscape and capitalize on emerging market opportunities. The company's diversified portfolio of metals ensures its involvement in multiple stages of the value chain, from production to distribution.

Glencore produced approximately 1.45 million metric tons of copper, 37,800 metric tons of cobalt, 121,200 metric tons of nickel, and 1.19 million metric tons of zinc in 2021, making it one of the largest producers of these metals globally.

Glencore's focus on critical transition metals aligns with the growing investor interest in sustainable investments. As the energy transition gains momentum and environmental considerations become increasingly important, companies driving positive environmental change are expected to attract increased attention from investors.

Conclusion: Glencore's prominent role as a major producer of critical transition metals positions it to benefit from the accelerating energy transition. With the world turning greener as it gets more environmentally conscious and the accompanied expected surge in demand for metals like copper, cobalt, nickel, and zinc, Glencore has the potential to generate long-term value for shareholders. By capitalizing on the growing demand for transition metals, Glencore is well-positioned to support the energy transition and deliver favourable financial returns.

Investment Thesis: Flexible Business Model with Key Insights and[#S2] Adaptability

Trading and Logistics Expertise:

Glencore's extensive trading operations cover a diverse range of commodities, including metals, minerals, energy products, and agricultural goods. The company's annual trading volume exceeds 200 million metric tonnes.

Glencore's long-standing presence in the commodities trading industry has provided it with deep market insights and expertise in navigating global commodity flows, pricing dynamics, and supply and demand fundamentals.

The company's trading activities span across multiple geographies (as shown on the map above), allowing Glencore to capture opportunities and optimize its trading strategies in various markets.

Glencore's established networks and infrastructures give it a competitive advantage, as replicating such a vast and interconnected trading ecosystem would be challenging for new entrants.

Market Intelligence and Relationships:

Glencore's global team of experts, supported by extensive research capabilities, provides the company with valuable market intelligence on emerging trends, price movements, and supply-demand imbalances across the resources industry.

The company has fostered long-term relationships with key producers and end consumers worldwide, enabling Glencore to access reliable supply sources and maintain strong customer relationships.

By closely monitoring market sentiments on a ground level and macroeconomic factors, Glencore can anticipate changes in commodity prices and market conditions, allowing the company to make informed decisions regarding marketing, investing, and operational strategies.

Glencore's superior edge in market intelligence and strong relationships build a network effect and provide it with a competitive edge in identifying and capturing lucrative commercial opportunities as they arise.

Logistical Capabilities:

Glencore's logistical capabilities are a critical component of its business model, ensuring the efficient movement and delivery of commodities to customers worldwide.

The company owns and operates a diverse fleet of vessels, including dry bulk carriers, tankers, and barges, enabling it to transport commodities across different regions and cater to varying customer requirements.

Glencore's strategically located storage facilities and terminals near key trading hubs and production centers enhance its operational efficiency and enable timely deliveries.

The company's advanced tracking and monitoring systems provide real-time visibility into the movement of commodities, enhancing operational control, risk management, and customer service. Most importantly, they provide another dimension to ground level commodity insights.

Margin Stability and Risk Management in Trading Business:

Glencore's trading and marketing segment provides a source of stable margins, as it leverages its own market insights, supply chain management, and risk management strategies.

The company employs hedging programs and long-term supply agreements to mitigate commodity price volatility and minimize downside risks.

Glencore's risk management framework encompasses comprehensive risk assessments, compliance procedures, and internal controls, ensuring the effective management of market, credit, operational, and regulatory risks.

The company's global optionality and diversified portfolio enable it to adapt to changing market conditions and capture value across different commodity cycles.

Investment Rationale:

Investing in Glencore based on its trading and logistical strengths provides a compelling investment thesis. The company's deep market insights, extensive trading capabilities, and established relationships allow it to navigate volatile market conditions and capture opportunities across the commodity value chain. Glencore's logistical expertise ensures reliable and efficient delivery of commodities, while its risk management strategies provide stability and mitigate downside risks.

Investment Thesis: Audacious Business Model and Risk-Taking History

Historical Success:

Glencore's audacious business model and risk-taking history have historically yielded favourable outcomes for the company. One notable example is Glencore's decision to acquire Xstrata in 2013, creating one of the world's largest diversified mining companies. This bold move allowed Glencore to expand its asset base, diversify its commodity portfolio, and capture synergies, resulting in enhanced operational efficiency and increased shareholder value.

Opportunistic Mindset:

Glencore has demonstrated an opportunistic mindset, viewing market uncertainties and geopolitical events as potential business opportunities. During the Russian-Ukraine crisis in 2014, when many companies were cautious and scaling back operations, Glencore saw an opportunity to increase its presence in the region. The company acquired a stake in Rusal, a leading Russian aluminium producer, and entered into off-take agreements, securing a long-term supply of aluminium at favourable terms.

Risk Management:

While Glencore embraces audacity, it also maintains a disciplined approach to risk management. The company conducts thorough due diligence and risk assessments before embarking on major investments or strategic initiatives. Glencore actively monitors market conditions, geopolitical risks, and regulatory changes to proactively manage potential risks and mitigate their impact on its operations and financial performance.

Diversification and Vertical Integration:

Glencore's audacious business model is supported by its diversified operations across multiple commodities and geographic regions. The company's vertical integration strategy, with involvement in mining, processing, trading, and marketing, provides a competitive advantage and enables it to capture value throughout the commodity value chain. By diversifying its operations, Glencore minimizes exposure to individual commodity price fluctuations and market-specific risks, enhancing its resilience in the face of changing market dynamics.

Investment Rationale:

Investing in Glencore based on its audacious business model and risk-taking history offers the potential for enhanced returns and shareholder value. The company's successful track record of seizing opportunities and strategically managing risks reflects its ability to adapt to evolving market conditions. Glencore's audacity is complemented by its disciplined risk management practices, ensuring a balanced approach to its ventures. However, it is important to recognize that audacity comes with inherent risks.

Valuation

By applying a discounted cash flow (DCF) model tailored to Glencore's unique characteristics, we aim to shed light on its intrinsic value and offer valuable insights.

To initiate the valuation process, we delve into Glencore's historical financial data, industry dynamics, and macroeconomic factors to craft a comprehensive forecast of the company's future cash flows. Drawing upon Glencore's resilient track record and its strategic position within the natural resources sector, our projections capture the anticipated revenue growth, operational efficiencies, and investment requirements. Below, we can see a strong growth in projected free cashflow trend over the next 5 years, with an average annual growth of 50%.

Building upon the forecasted cash flows, we extend our valuation horizon by assuming a perpetual growth rate at a slight premium over the average UK Central Bank rate for Glencore. This growth rate reflects the company's ability to maintain a sustainable competitive advantage in the long term. Considering Glencore's strong market position, global reach, and commitment to innovation, our assumption aligns with its potential to capitalize on evolving market demands and emerging opportunities.

To determine the discount rate in our DCF model, we calculate the Weighted Average Cost of Capital (WACC) for Glencore.

(With reference to alphaspread.com)

Incorporating our investment theses with appropriate assumptions into our DCF model, we arrive at a target price of 499.87 after 3 years, and 526.74 after 5 years, a premium of 20% over the current price of 438.95.

Risks

Navigating Uncertainties: Things to keep in mind

High Reliance on Trading Energy Products (Thermal Coal): Glencore's significant reliance on trading energy products, particularly thermal coal, poses a potential risk due to increasing environmental concerns and the global transition towards cleaner energy sources. Changes in regulations or market sentiment towards carbon-intensive fuels could lead to re-ratings and reduced demand for these products, impacting Glencore's revenue stream.

Regulatory and Legal Issues: Operating in a diverse range of geographies, including countries like Congo and Venezuela, exposes Glencore to regulatory and legal uncertainties. The company may face challenges related to compliance with local laws, political instability, corruption risks, and evolving regulatory frameworks. These factors can create uncertainties and potential disruptions to Glencore's operations and financial performance.

Cyclical Nature of the Business: Glencore operates in commodity markets that are inherently cyclical, experiencing fluctuations in demand and prices. Economic downturns, geopolitical tensions, and supply-demand imbalances can affect the profitability of its mining and trading activities. However, Glencore's diversified business model, encompassing both trading and mining operations, provides some balance by mitigating the impact of price volatility and offering opportunities for arbitrage. Also if timed right to a certain extent, investors can aspire to take advantage of these cycles to maximise their returns.

Conclusion

In conclusion, Glencore emerges as a resilient and forward-thinking player in the commodities market, capitalizing on critical energy transition metals and demonstrating a flexible business model that harnesses key insights and adaptability. The company's audacious approach, coupled with its history of calculated risk-taking, has established a competitive edge and positioned it for long-term success. Incorporating our investment theses and appropriate assumptions into our valuation, we see significant potential with a target price of £526.74 (20% upside), reflecting our confidence in Glencore's ability to generate sustained growth and create value for investors.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

[#S2]Trading Volume by Commodity:

This chart illustrates the significant trading volume of Glencore across different commodities, showcasing the company's diverse trading capabilities and market reach.

[Insert Chart: Trading Volume by Commodity]

The chart demonstrates Glencore's ability to capture opportunities and optimize its trading strategies in multiple commodity sectors, including metals, minerals, energy products, and agricultural goods. The substantial trading volumes across various commodities indicate the company's deep market presence and extensive trading expertise.

Global Presence and Market Access:

This chart showcases Glencore's global presence, highlighting its offices, production assets, and key markets worldwide.

[Insert Chart: Glencore's Global Presence]

The chart emphasizes Glencore's extensive network of operations, which enables the company to leverage regional expertise, establish strong relationships with key producers and end consumers, and access diverse markets. This global presence and market access contribute to Glencore's market intelligence, enabling it to anticipate market trends, identify emerging supply-demand imbalances, and make informed trading decisions.

These charts visually reinforce Glencore's trading and logistical strengths, providing tangible evidence of the company's market reach, trading volumes, and global presence. They serve as additional support for the investment thesis, showcasing Glencore's ability to effectively navigate global commodity markets and leverage its trading expertise for sustainable returns.