Initial Report: Grab Holdings Limited (GRAB), 50% 5-yr Potential Upside (EIP, Sooria C M R)

Sooria proposes that we Grab the chance on this one... what do you say?

LinkedIn | Sooria C M R

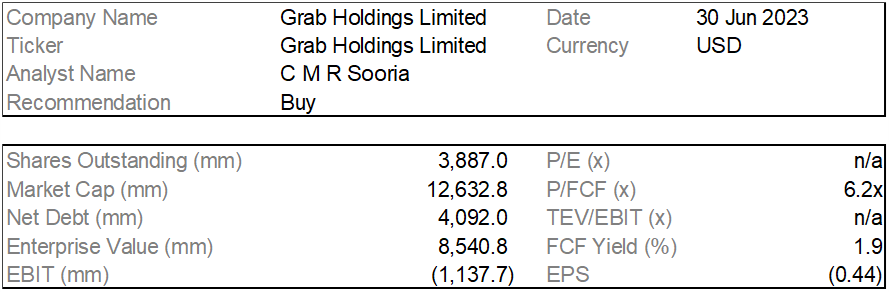

Key Information

Executive Summary

Grab Holdings (NASDAQ:GRAB) is a leading superapp in Southeast Asia, providing everyday services to millions of Southeast Asians. The business is split into 4 main segments: Deliveries, Mobility, Financial Services and Enterprise and New Initiatives. Revenue from Deliveries and Mobility contribute to over 90% of the total revenue while Singapore and Malaysia remain the largest markets for the company accounting for over 50% of the total revenue. With a strong opportunity to capture a greater market share by riding the digital wave in SEA, a well-formulated hyperlocal strategy and continued investments in technology and infrastructure, I initiate a buy recommendation for Grab.

Company Overview

Grab is one of Southeast Asia’s leading superapps, operating primarily across the deliveries, mobility and digital financial services sectors. It enables users to access drivers and merchant partners to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending, insurance and wealth management. Based on a research done by Euromonitor in Southeast Asia in 2022, Grab remains the category leader in Southeast Asia by Gross Merchandise Value (GMV) in online food delivery and ride-hailing.

a. Company History

In 2012, Grab first started off as the “My Teksi” app in Malaysia and was the brainchild of Mr Anthony Tan, founder and current CEO of Grab and Miss Tan Hooi Ling, co-founder and ex COO of Grab. Following its success and growth, it relocated its headquarters to Singapore in 2014 and expanded rapidly to other Southeast Asian countries such as the Philippines, Thailand, Indonesia, Vietnam, Cambodia and Myanmar. In 2016, My Teksi was rebranded as Grab. Between 2015-2018, Grab launched ventured to several new business streams such as delivery, financial and advertising services while improving its mobility division through new additions such as GrabHitch and GrabShare.

In 2018, Grab completed the acquisition of Uber’s business in Southeast Asia through an all-share deal and listed on the NASDAQ in 2021.

b. Business Segments

The business is split into 4 main segments:

i. Deliveries – The offerings within this segment include GrabFood, GrabKitchen, GrabMart, GrabExpress, and GrabKios. Revenue is generated from commissions and other fees from driver and merchant partners and consumers for connecting driver and merchant partners with consumers to facilitate delivery of a variety of daily necessities, including ready-to-eat meals and groceries, as well as point-to-point parcel delivery. Revenue from the deliveries segment is recognized on the completion of a successful transportation or delivery service by driver and merchant partners. The diagram below illustrates the economics of a typical deliveries order:

ii. Mobility – The offerings within this segment include GrabCar, GrabTaxi, JustGrab, GrabBike, three-wheel vehicles, GrabShare, and GrabRentals. Through GrabRentals, the company utilizes Grab’s fleet of cars to provide one-stop car rental to driver-partners.

Revenue is generated from commissions paid by driver partners and platform fees from consumers for the use of the platform. Revenue from the mobility segment is recognized net of driver partner and consumer incentives and upon the completion of each ride. Within the segment, revenue is also generated through rental fees from GrabRentals offering. The diagram below illustrates the economics of a typical ride:

iii. Financial Services – Within this segment, offerings include digital solutions to address the financial needs of our driver and merchant partners and consumers, including digital payments, lending, receivables factoring, insurance and wealth management. Revenue for this segment is primarily generated from transaction and commission fees. For payment services, revenue is driven by transaction fees from merchant partners and transaction platforms based on a percentage of transaction volumes. As for lending and receivables factoring, revenue is generated based on the interest income received from loans extended and from the factoring fee or discount when Grab purchases the receivables.

iv. Enterprise and New Initiatives – The key offerings within this segment are GrabAds, GrabMaps and other lifestyle offerings. GrabAds provides online and offline advertising solutions for brands across three categories: 1) mobile billboards, which turns the company’s fleet of vehicles into roving billboards to generate offline awareness, 2) in-car engagement and 3) in-app engagement, which includes merchants-featured advertising and other digital content through the app.

GrabMaps is a B2B offering providing base map data and map-making tools and software-as-a-service. Application Programming Interface (APIs), launched in January 2023, and Mobile Software Development Kits (SDKs) that remains in the testing phase, will allow developers and teams to enhance or build their own applications and geolocation capabilities leveraging GrabMaps technology, such as routing, search, traffic and navigation features.

Revenue from this segment primarily consists of advertising revenue earned from the GrabAds offering. Other revenue is generated from lifestyle and other offerings through the commissions that Grab receives when such services are sold through the platform.

Revenue Breakdown and Performance

Overall revenue for 2022 stood at S$1,433 million, increasing by S$758 million from S$675 million in 2021. Singapore and Malaysia remain the largest markets for the company accounting for over 50% of the total revenue in both 2021 and 2022.

Deliveries revenue was S$663 million in 2022 compared to a revenue of S$148 million in 2021. The increase was driven by an increase in deliveries GMV of 15%, to S$9.8 billion in 2022 compared to S$8.5 billion in 2021, driven primarily by increasing consumer demand and number of merchant-partners using the platform.

The increase in revenue for deliveries was primarily driven by contributions of S$334 million from Jaya Grocer, an increased Q4 performance and a disciplined approach to reducing incentives as a percentage of GMV as the company focuses on driving higher quality GMV transactions. Deliveries revenue as a percentage of deliveries GMV improved from 2% in 2021 to 7% in 2022 as the business gained network efficiency in its driver-partner base and was able to improve overall value proposition in terms of merchant selection, delivery performance and application experience on its platform.

Mobility revenue was S$639 million in 2022 compared to S$456 million in 2021, which was primarily due to ride hailing revenue increasing by S$154 million and rental income from motor vehicles increasing by S$28 million. The increase in revenue was primarily driven by the strong demand recovery following the easing of COVID-19 restrictions in 2022 as Southeast Asia opened up and lifted most travel and movement restrictions. GMV for mobility increased to S$4.1 billion in 2022 compared to S$2.8 billion in 2021, while mobility revenue as a percentage of mobility GMV remained consistent at 16% in 2022 and 2021.

Financial services contributed S$71 million to the revenue in 2022, increasing from the S$27 million in 2021. The increase was primarily due to a S$41 million growth in its lending business as loans disbursed grew 122% from 2021 to 2022.

Enterprise and new initiatives revenue was at S$60 million in 2022, increasing by S$16 million compared to S$44 million in 2021. The increase was primarily due to growth of GrabAds revenue by S$11 million with the expansion of product offerings.

Cost Breakdown

Total operating expenses stood at S$2,823 million for 2022, S$581 million higher than 2021’s S$2,242 million.

Cost of revenue, which accounts for 48% of the operating expenses, mainly comprises expenses attributable to the 4 revenue generating segments, primarily data management and platform related technology costs including amortization of technology and market activity related intangible assets, compensation costs (including share-based compensation) for operations and support personnel, payment processing fees, costs incurred in relation to its motor vehicle fleet used for rental services (including depreciation and impairment) and an allocation of associated corporate costs such as depreciation of right-of-use assets.

General and administrative expenses, which accounts for 23% of the operating expenses, primarily consist of compensation costs (including share-based compensation) for executive management and administrative personnel (including finance and accounting, human resources, policy and communications, legal, facility and general administration employees),

occupancy and facility costs, administrative fees, professional service fees, depreciation on certain administration assets, legal costs and allocation of associated corporate costs.

Sales and marketing expense, which accounts for 10% of the operating expenses, primarily consists of advertising costs and compensation costs (including share-based compensation) to sales and marketing employees. The company is expected to continue to invest in sales and marketing expenses to attract and retain platform users and increase its brand awareness.

With the Company’s recent cost cutting measures including laying off 11% (1000 employees) of its total workforce, the operating expenses for 2023 is expected to reduce significantly.

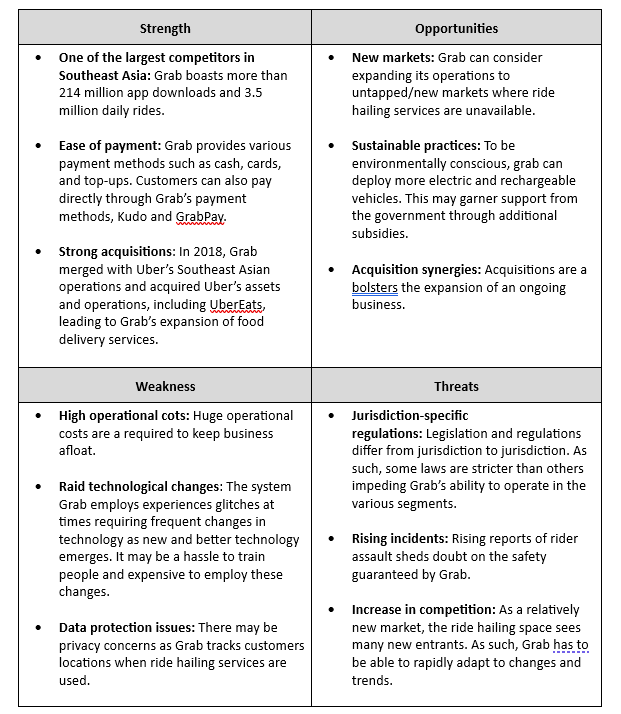

Key Competitors and SWOT Analysis

a. Gojek

Gojek was founded in 2009 and in 2015, it launched four software solutions for ride-hailing, food delivery, shopping, and payment. In Jakarta, Gojek emerged as a result of hazardous traffic conditions with only 20 motorbike drivers in the beginning. Later, Gojek shifted to multi-services and partnered with Singapore’s DBS Bank. Aside from Indonesia, Gojek currently operates in Singapore, Vietnam, Thailand, and the Philippines. In 2021, Gojek merged with Tokopedia, an Indonesian giant resulting in a total of $18 billion in value for the companies. It was the first IPO by a tech startup company in Indonesia. After five years, Gojek is valued at over US$ 10 billion and offers over 20 services. In 2020, with more than 1.8 billion transactions, Gojek generated over $22 billion in total revenue. Their apps have more than 190 million users and an average of 100 million monthly transactions. Gojek has an estimated one million drivers and over two million driver-partners. Further, the Go To group is projected to reach more than $300 billion in gross domestic value in 2025.

b. Food Panda

Foodpanda is a subsidiary of Delivery Hero, a German-based company, was launched in Southeast Asia in 2012. Foodpanda is the biggest food and grocery delivery app in an estimated 12 countries. Unlike its top competitors in Southeast Asia, Foodpanda’s focus is mainly on food and groceries.

Between 2020 and 2021, Foodpanda was able to partner with more than 30,000 SME food shops and over 80,000 riders. It generated more than $2.5 billion in gross merchandise value with over 3,000 people employed. Although Foodpanda is successful, it has had its fair share of struggles including controversies and boycotts due to political issues, issues with employee management, and high commission rates.

c. Line

LINE initially an instant messaging software, expanded into the transportation industry in 2015 and later developed into a superapp similar to Grab. In Southeast Asia, LINE operates in Malaysia, Thailand, and the Philippines.

LINE is differentiated from its competitors in the fact that it requires the food establishment to carry out the delivery process. In 2021, LINE reported an estimated 180 million users and over 50,000 riders.

LINE saw a breakthrough in 2021 when it generated its first profit of over US$ 110 million in comparison to a $411 million loss in the previous year. LINE also garnered $2.36 billion in revenue, a 56% year-on year increase.

d. Deliveroo

Deliveroo operates in Europe, Middle East, and Southeast Asia. Besides food delivery, it also provides platform for grocery shopping. Deliveroo has yet to be profitable despite its promising start as it has been experiencing losses though it has lowered from $300 million in 2019 to $200 million in 2020. The company opened its initial public offering, which was said to be the worst IPO but was eventually successful after its valuation rose to $7.6 billion. As the company’s good standing in Singapore continues, has the potential to penetrate into the neighbouring countries.

e. ComfortDelGro

The ComfortDelGro is a result of a merger between Comfort Group and DelGro providing ride-hailing services in Singapore, Malaysia, Vietnam and some parts of China. Post merger, the group boasts over $1 billion in capital and an army of transport services, including buses, taxis, car rentals, and even vehicle maintenance. It operates approximately 40,000 vehicles in its markets. Unlike its competitors in Southeast Asia, Comfort is a well-known bus operator and offers car leasing, rentals, automotive, and inspection services.

ComfortDelGro has an excellent financial record, with over $210 million in profit in 2021, twice that of in 2020. The launch of its new app CDG Zig offering ride hailing and restaurant reservation services is thought to increase user base in the near future.

Investment Thesis

Low overall digital penetration in Southeast Asia presents Grab with an opportunity to capture greater market share

Based on an article published by Kearny, the digital penetration of food deliveries, mobility and digital payments remain low is Southeast Asia despite the digital economy growing rapidly at a rate of 17%, outpacing US (7%), Europe (10%), and China (13%).

Nevertheless, with the pandemic serving as a catalyst, according to a report jointly published by Google, Temasek, and Bain & Company, an increase in the use of digital services is indicative of an upcoming “Digital Decade” in Southeast Asia, where its internet economy could reach a GMV of US$1 trillion by 2030. Of these digital services, e-Commerce and food delivery are the primary drivers of growth; both services are the mainstays of super apps, highlighting Grab’s opportunity to capture a greater market share through its outsized role in bringing about the digital decade.

Grab’s hyperlocal approach allows it to grow organically across multiple geographies

Grab’s hyperlocal approach essentially stems from its view that every country that it operates in is different. The differences ranges from consumer preferences, regulations to infrastructures and systems. Grab employs locals in each region led by local leaders to conduct its operations. Furthermore, it has also built strong relationships across the region, as local collaborations are vital to its sustained performance.

Furthermore, with the user experience customised to each region, Grab aims to solve the problems of each region on a targeted basis as opposed to adopting a “one-size-fits-all” approach. For example, in Singapore, Grab combined taxis and private cars into a single fixed upfront fee supply pool under JustGrab because it realized that passengers were

generally indifferent to the type of car that picked them up, so long as it was the fastest to arrive and there was upfront certainty over fares.

Through these approaches, Grab is able to grow organically across multiple geographies as it continues to solve the problems and improve the livelihood of its partners and consumers.

Continued investments in technology and infrastructure to increase consumer offerings and retention rates

Grab continues to invest in technology and infrastructure to increase consumer offerings. This will directly improve the performance of Grab as seen from the diagram below.

As Grab continue to introduce more services, consumer retention rates increases with the number of users using multiple offerings increasing steadily as seen below:

Valuation

Using a comparable valuation method, I used a range of companies with a similar business model as Grab including Comfort Delgro, Sea Limited, GoTo, Delivery Hero (Parent Company of Food Panda) and deliveroo. From the analysis, I was able to derive an average 1Y forward share price of US$3.87 based on the projected Revenue and EBITDA figures for 2023. This presents an upside of 20%.

Risks and Mitigation

Failure to meet growth expectations / achieve profitability

Although Grab has grown rapidly, it is still in a fairly early stage of growth. As such, its business, financial condition, results of operations and prospects could be affected if its business or superapp platform fails to grow, does not meet expected growth projections, or fails to profit. This is especially since its business in Southeast Asia and superapp platform are relatively new. There is no assurance of growth or profitability across its business platforms. Further, with an unpredictable market, it cannot be assured that the market will always be receptive to Grab’s new offerings. Macroeconomic factors may also affect discretionary consumer spending, which in turn could impact consumer demand.

To mitigate these risks, Grab may implement measures to increase the scale of the driver- and merchant-partner base to grow and scale its business, manage promotion and incentive spending and reduce corporate and other costs. Incentives offered to driver-partners, merchant-partners and consumers have been a driving force for Grab’s growth. This is evidenced by the revenue growth through the pre-emptive investment, expanding the supply of active drivers on the platform to support recovery in mobility demand.

Intense competition across market segments

The segments and markets in which Grab operates are heavily competitive and are marked by unpredictable user preferences, fragmentation, and introductions of new services and offerings. Grab competes both for driver- and merchant-partners and for consumers accessing offerings through its platform. Its competitors may be well-established or new entrants and focused on providing low-cost alternatives or higher quality offerings, or a combination thereof. Further, these competitors in some geographic markets may also have competitive advantages like better brand recognition or may implement more attractive innovations, which may render the Grab’s offerings unattractive or reduce its ability to differentiate its offerings.

To mitigate this risk, Grab may expand and diversify its deliveries, mobility, financial services and other offerings, which include innovating in new areas and manage price sensitivity and driver- and merchant-partner and consumer preferences by segment and geographic locations in order to increase market penetration within markets.

Legal and regulatory risks

The laws and regulations across the deliveries, mobility and financial services sectors that Grab operates in are still evolving. New regulations may be introduced in areas such as: 1) deliveries, mobility and/or financial services offerings; 2) data privacy, data localization, data portability; 3) gig economy regulations; 4) anti-trust regulations; 5) foreign ownership restrictions; 6) artificial intelligence; 7) safety, health, environmental regulations; 8) regulations regarding the provision of online services etc that turn to be unfavourable to the company. Further, incorrect interpretation of evolving regulatory needs may pose a material risk to the company.

To mitigate this risk, Grab should implement a robust jurisdiction specific regulatory risk management system to track, monitor, and analyse market changes and assess their potential impact on the business. It should be quick to continuously update business policies to ensure compliance with government or market regulator standards and regulations.

ESG Assessment

Grab has a strong focus on ESG, with its three-pronged focus on Partners, Platform and Planet.

The company has reported that more than 48,000 tonnes of Greenhouse Gas (GHG) emissions were reduced through zero-emission transportation modes (walkers/cyclists), low emission rental vehicles (EVs/hybrids) and efficiency optimisation. Furthermore, 100% of electricity used in all Grab corporate offices globally are powered by renewable energy since 2021. While these efforts are commendable, more can be done in line with companies such as Uber which has committed to transitioning its fleet to electric and zero-emission vehicles becoming the first major ride hailing company to commit to true net-zero emissions without relying on carbon offsets.

With a strong focus on empowerment, Grab has over 2,100 persons-with-disabilities registered as part of its partners pool. Furthermore, it provides its partners with lots of opportunities for learning and development with more than 1 million partners having taken at least 1 course to upskill themselves. While these are some of the positive metrics, the company can look into its compensation schemes as it should be noted that in 2022, Media outlets reported that around 800 GrabFood and GrabMart delivery drivers started a protest on 3 November 2022 in Bangkok, Thailand over changes in the company's delivery service policies that impacted their earnings. According to the workers, the company enforced a zoning system that forced delivery drivers to compete for shifts and work on a certain schedule. The delivery drivers claimed that the new policies restricted their rights and harmed their income.

On the front of Governance, there is an established Ethics, Risk and Sustainability Council as well as a Regional Sustainability team which manages and coordinates the implementation of our ESG strategy and programmes across the region, with cross-functional working teams across different business units. However, it should be noted that the chairman and CEO are the same person. There is a lack of check and balance in this case with conflicts of interest arising.

Conclusion

In conclusion, while Grab to expected to remain has a market leader in the digital ecosystem of Southeast Asia, its share price performance hinges on its ability to turn the business into becoming profitable. While the cost cutting measures are a welcome call, it should not hamper its ability to continue forefronting new innovations and developments.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

References:

Grab Annual Report for FYE 2022 - https://investors.grab.com/static-files/fe264b6d-a6b6-4322-8481-367260940cbc

Grab Q1 Earning Call and Presentation - https://investors.grab.com/static-files/1aa1d216-565d-4595-bccf-effb3265ec51

Grab ESG Report 2022 - https://assets.grab.com/wp-content/uploads/media/si/reports/2022/Grab-ESG-Report-2022.pdf

HSBC Global Research Initiation Report 2022