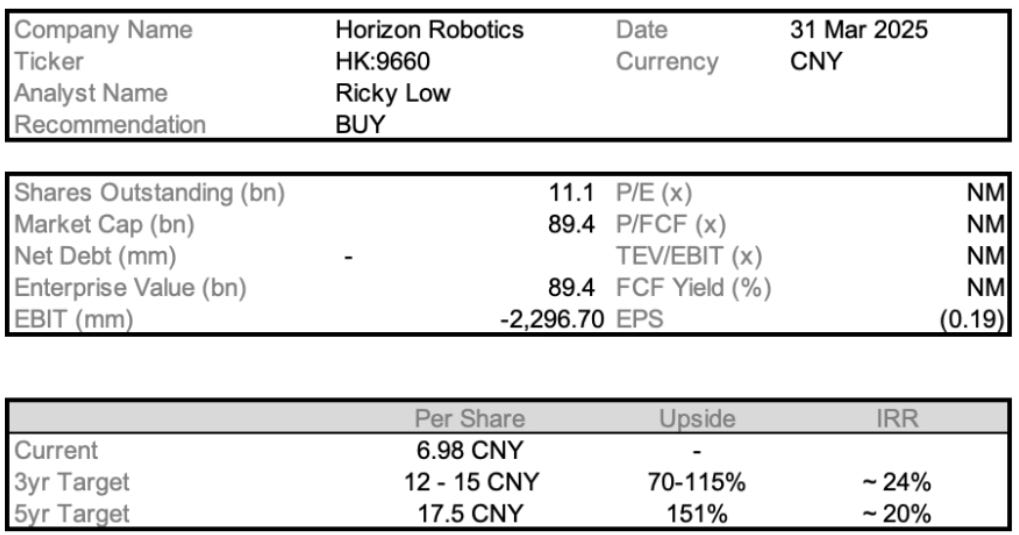

Initial Report: Horizon Robotics (9660.HK), 151% 5-yr Potential Upside (Ricky LOW, SC VIP)

Ricky LOW presents a "BUY" recommendation for Horizon Robotics based on its strong partnerships, proprietary technology, and rising demand for Level 2/3 automation.

Elevator Pitch:

Horizon Robotics (9660.HK) is a leading domestic player in China’s rapidly growing autonomous driving ecosystem, offering AI chip solutions well-aligned with national policy and EV market tailwinds. With strong partnerships, proprietary technology, and rising demand for Level 2/3 automation, Horizon is poised to deliver outsized growth in the next 2–3 years—supporting a BUY in the short term.

However, we recommend a HOLD in the long term as global giants like NVIDIA gain ground in higher-level autonomy, and Horizon faces execution risk in scaling R&D, defending margins, and expanding beyond China’s borders—all while trading at a premium valuation already pricing in strong future performance.

Company Analysis

Horizon Robotics Overview

Founded in 2015, Horizon Robotics is a leading Chinese developer of artificial intelligence (AI) chips and solutions for advanced driver-assistance systems (ADAS) and autonomous driving (AD). The company specializes in creating integrated hardware and software platforms, notably the Journey™ system-on-chip (SoC) series, which are widely adopted by major automotive manufacturers.

Management & Company Ownership

Management Quality:

Dr. Yu Kai, CEO and Co-founder, is a prominent figure in artificial intelligence and autonomous driving. From 2012 to 2015, he led Baidu's Institute of Deep Learning (IDL), initiating projects like Baidu's autonomous driving team and the deep learning platform PaddlePaddle. His leadership earned his team Baidu's highest award three times.

In 2015, Dr. Yu founded Horizon Robotics, focusing on energy-efficient computing solutions for smart vehicles. The company has launched automotive processors such as Journey 2, Journey 3, and Journey 5, collaborating with over 20 vehicle companies and achieving cumulative shipments exceeding 2 million units.

Profitability

Financial Key Stats

Financial Snapshot (CNY, FY Ending Dec 31):

Revenue grows sharply from CNY 499.9M (2021) to CNY 10.56B (2027), with peak growth in 2026.

Gross profit margins stay strong (~70%+).

EBITDA & EBIT remain negative through 2025, turning positive by 2027, signaling a turnaround.

Net income swings from deep losses to CNY 1.58B profit in 2027.

EPS stays negative until 2027, when it turns positive (CNY 0.15)

Key Observations:

Liquidity:

Current Ratio (13.5x in 2024) and Quick Ratio (12.6x in 2024) reflect a sharp improvement from prior years (0.3x in 2022–2023),

indicating strong short-term financial health following Horizon’s IPO, which significantly boosted its cash reserves.Leverage:

Debt-to-Equity became measurable at 6.4% in 2024, after being Not Meaningful (NM) in previous years due to negative equity from pre-IPO preferred shares.

The current ratio reflects a conservative capital structure with minimal reliance on debt.

Industry

5. Industry Analysis and Competitive Landscape

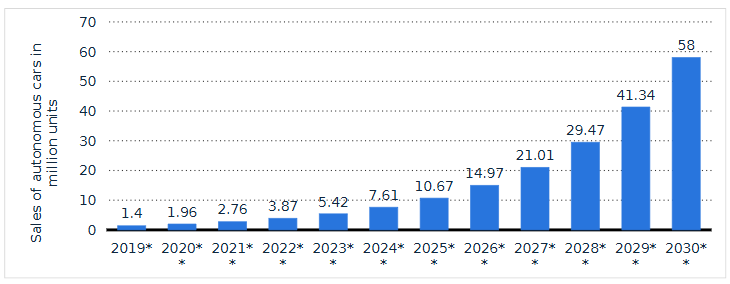

Projected sales of autonomous vehicles worldwide from 2019 to 2030 (in million units)

China has the potential to become the world's largest market for autonomous vehicles, according to consultancy McKinsey & Company, which estimates that such vehicles will make up for more than 40 percent of new vehicle sales in China by 2040.

Number of Automobiles in China 2011 - 2024

Car Parc in China (2024 Overview)

As of 2024, China’s car parc — the number of registered motor vehicles in use (excluding motorcycles and agricultural vehicles) — reached 353 million, more than doubling over the past decade. This growth is fueled by rapid new vehicle registrations, with over 21 million small passenger vehicles registered in 2023 alone.

Automation Levels (1–5)

The SAE (Society of Automotive Engineers) defines six automation levels (0–5) for vehicles, outlining their autonomy capabilities:

Level 1 – Driver Assistance:

Assists with either steering or acceleration; the driver retains full control.Level 2 – Partial Automation:

Manages both steering and acceleration but requires driver oversight (e.g., Tesla Autopilot).Level 3 – Conditional Automation:

Handles all driving tasks in specific conditions; the driver takes over when prompted.Level 4 – High Automation:

Fully autonomous in designated areas or scenarios, no driver intervention needed.Level 5 – Full Automation:

Completely autonomous in all conditions, no driver required.

How It Works

Autonomous vehicles use sensors, AI, and real-time data to perceive their surroundings,

make decisions, and perform driving tasks, with higher levels reducing human input.

Competitive Landscape:

Global Players:

• NVIDIA: Drive Orin / Drive Thor (high-performance autonomous driving platforms)

• Mobileye (Intel): EyeQ series (vision-based ADAS chips)

• Qualcomm: Snapdragon Ride (ADAS + infotainment integrated SoC)

Domestic Competitors:

• Huawei: ADS with Ascend chips (integrated autonomous driving solution stack)

• Black Sesame Technologies: Huashan chip series, competing in ADAS compute

• SemiDrive (芯驰科技): Auto-grade processors for intelligent cockpit and driving control

• Thunder Software Technology Co., Ltd. (SZSE:300496): Provides intelligent driving middleware and embedded platforms

• Hesai Group (NASDAQ: HSAD): Specializes in LiDAR hardware used alongside ADAS chips

• Black Sesame International Holding Limited (SEHK:2533): Listed arm of Black Sesame with AI chip focus

In the rapidly evolving Chinese market for Advanced Driver Assistance Systems (ADAS) and Autonomous Driving (AD) solutions, Horizon Robotics has solidified its position as a leading provider. According to China Insights Consultancy (CIC), Horizon was the second-largest and the top ADAS solutions provider to Chinese Original Equipment Manufacturers (OEMs) in 2023 and the first half of 2024, achieving market shares of 21.3% and 35.9%, respectively. Furthermore, during these periods, Horizon ranked fourth among all global ADAS and AD solution providers in China, with market shares of 9.3% and 15.4%, respectively.

Horizon’s success can be attributed to its first-mover advantage, deep industry experience, and local expertise. The company offers a diverse product portfolio, encompassing low to high-level smart driving scenarios, all underpinned by proprietary software and hardware technologies. Committed to enhancing driving safety, convenience, and comfort, Horizon aims to make smart driving accessible to a broader consumer base.

Valuation

Valuation Multiples:

My Assessment:

Slight Over Valuation

Premium Valuation: Horizon trades at ~32.2x LTM revenue, far above the peer median (6.1x) and mean (19.4x), but still lower than Black Sesame’s extreme multiple.

Strong Market Expectations: Investors are pricing in substantial growth and market leadership in ADAS, especially within China.

Investment Thesis 1: Horizon has significant market leadership in China’s Smart Driving Ecosystem

Horizon Robotics is well-positioned to capitalize on China’s explosive growth in smart driving, supported by a domestic-first chip policy and intensifying demand for Level 2/3 autonomous driving technologies.

• Strong National Tailwinds: As China aggressively pushes for mass adoption of smart driving technology, autonomous-driving systems have become the “brain” of next-gen EVs. The Chinese government is supporting this shift through policies, EV subsidies, and a preference for domestic supply chains.

• Rising Competition with Foreign Giants: According to South China Morning Post (Che Pan, 2024), Nvidia has signed major Chinese EV makers

like Li Auto, Geely, Xiaomi, and Great Wall Motors to its Drive Thor system — reinforcing the strategic importance of the ADAS/AV chip space. However, the report also underscores rising competition with local players like Horizon Robotics, who are embedded in the domestic ecosystem and benefit from stronger policy alignment.

• Home-Field Advantage: Despite Nvidia’s technical lead and ~52% market share in high-end Navigate-on-Autopilot (NoA) solutions (Gasgoo Institute, SCMP, 2024), local analysts such as Brady Wang from Counterpoint emphasize

that Chinese chipmakers like Horizon are rapidly gaining ground, supported by local OEM preferences, tighter software integration, and regulatory familiarity.

• Sticky Partnerships: Horizon’s deep integrations with BYD, Li Auto, and other OEMs, along with its Carizon JV with Volkswagen, grant it strategic lock-in opportunities and preferred supplier status across a growing base of mass-market EVs.

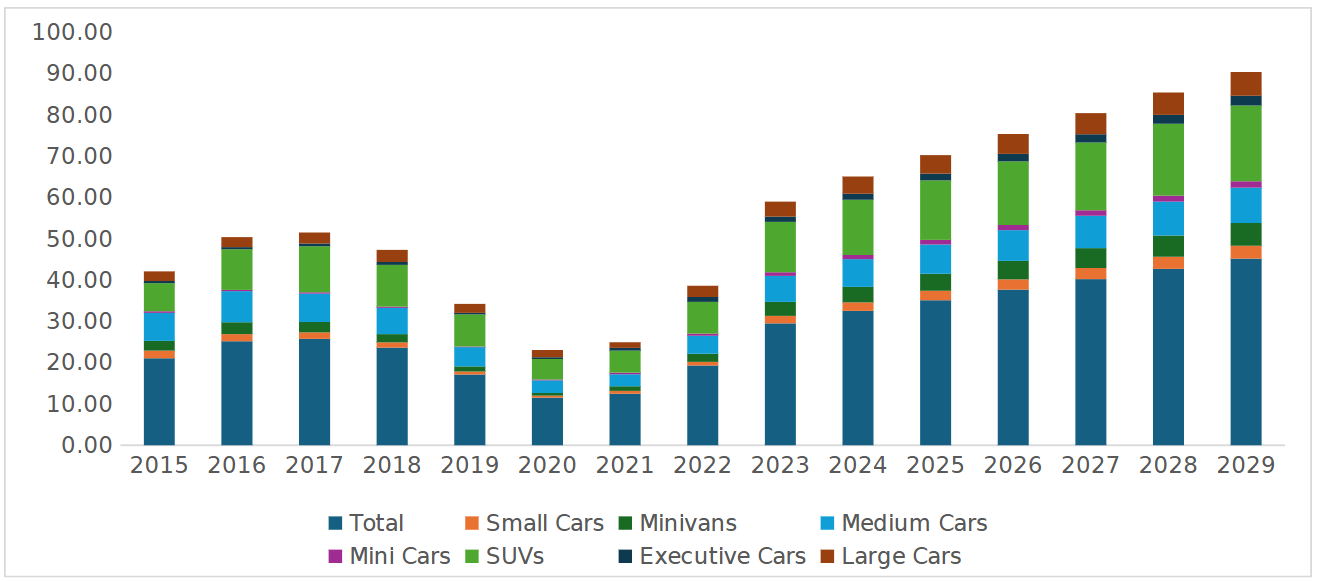

Investment Thesis 2: The Chinese Market for Autos have been steadily climbing.

Number of smartphones sold to end users worldwide from 2007 to 2023 (in million units) (Statista Market Insights, 2025)

Passenger Cars Market Outlook (2025–2029)

• Total Market Revenue (2025): Projected to reach US$821.9 billion.

• Market Growth: Expected CAGR of 6.38% from 2025 to 2029, driving revenue to approximately US$1.1 trillion by 2029.

• Largest Segment: SUVs lead the market with an estimated value of US$341.6 billion in 2025.

• Unit Sales Forecast: Total passenger car sales are expected to hit 45.19 million vehicles in 2029.

• Average Vehicle Price (2025): Volume-weighted average price is forecasted at US$23,390 per vehicle.

• Top OEM by Market Share (2025): BYD is expected to command a 11.9% unit sales share, and a 14.4% value share of the market in the selected region.

• Global Revenue Leader: China is projected to generate the highest revenue globally, amounting to US$822 billion in 2025.

Why HOLD in the Long Term

While Horizon Robotics is well-positioned to capture near-term upside within China’s growing smart vehicle landscape, a HOLD recommendation is warranted in the long term due to rising structural challenges in technology competitiveness and market dynamics.

1. Rapid Technological Evolution and Product Pressure

The autonomous driving space is evolving rapidly, especially in the transition from Level 2/3 to Level 4 and eventually Level 5 automation. To remain relevant, Horizon must invest heavily in continuous R&D to upgrade its Journey chip series to meet the compute and safety demands of higher-level autonomy. This involves developing more advanced system-on-chip (SoC) platforms, achieving higher TOPS (trillions of operations per second), and ensuring deep integration of AI software stacks—each of which requires significant time, capital, and execution capability.

2. Customer Demands Will Evolve Beyond Horizon’s Current Offerings

Key domestic partners like BYD and Li Auto—leaders in China’s EV segment—are not static in their product expectations. As these automakers scale globally and begin developing premium vehicles with more advanced driving capabilities, they will increasingly demand more powerful and globally validated ADAS/AV chipsets. This raises the likelihood of them turning to Nvidia’s high-performance Drive Orin and Drive Thor platforms, which currently dominate in compute power and global validation. In fact, Nvidia has already signed partnerships with several top Chinese OEMs, including Li Auto and Xiaomi, underscoring Horizon’s vulnerability at the upper end of the market.

Adoption of NVIDIA's Advanced Platforms by Chinese Automakers

Li Auto's Integration of NVIDIA DRIVE Thor: Li Auto has selected NVIDIA's DRIVE Thor centralized car computer for its next-generation vehicles, aiming to enhance automated and assisted driving capabilities.

Great Wall Motor and Xiaomi's Use of NVIDIA DRIVE Orin: Both companies have adopted NVIDIA's DRIVE Orin platform to power their autonomous driving systems, highlighting a trend among Chinese EV manufacturers to leverage NVIDIA's advanced AI technologies.

3. Global Expansion Remains Uncertain

While Horizon benefits from policy alignment and local OEM integration in China, its global competitiveness is less certain. Competing with established global leaders like Nvidia, Qualcomm, and Mobileye—who have deep software ecosystems, strong global OEM ties, and first-mover advantages in mature markets—will be a formidable challenge. Without compelling global traction or diversification beyond China, Horizon’s long-term growth could plateau.

4. Valuation Already Prices in Perfection

At 21.36x forward revenue, Horizon is trading well above the peer median of 5.21x, suggesting the market has already priced in strong growth and dominance. Any hiccups in technology roadmap execution, customer retention, or global expansion could lead to material downside risk in the long run.

Summary

While the short-term outlook for Horizon is strong, the long-term investment case hinges on the company’s ability to continuously innovate and defend its market share amid intensifying global competition. Until Horizon can demonstrate clear leadership in L4–L5 capabilities and international scalability, we advise maintaining a HOLD position beyond the 2–3 year horizon.

Conclusion

In light of Horizon Robotics’ strong market leadership, robust product portfolio, and its alignment with China’s national push for autonomous driving, we issue a BUY recommendation in the short term (2–3 years). The company is well-positioned to capture outsized value as China’s smart driving ecosystem rapidly expands, underpinned by supportive policy, domestic OEM demand, and a growing car parc. Despite being currently unprofitable, Horizon’s revenue trajectory, improving margins, and sticky partnerships with leading automakers point to a compelling growth story. However, in the long term, we recommend a HOLD position due to intensifying competition from global players such as Nvidia and Mobileye, Horizon’s rich valuation relative to peers (21.36x forward revenue vs. peer median of ~5.2x), and uncertainties around global expansion. While Horizon remains a strategic domestic champion, its ability to sustain leadership in a highly dynamic and capital-intensive space will be key to justifying long-term upside.