Initial Report: Intuitive Surgical (ISRG) , 51% 5-yr Potential Upside (EIP, Gaius ANG)

Gaius issues a BUY recommendation for this company but would recommend slowing accumulating a position in this company over a longer time horizon.

Company Overview

Description

Intuitive Surgical, Inc. (ISRG) is a global technology leader in minimally invasive care and the pioneer of robotic-assisted surgery. The company's flagship product, the da Vinci Surgical System, revolutionizes surgery by enhancing precision, flexibility, and control, thus enabling complex procedures to be performed through a few small incisions. Intuitive Surgical's products combine advanced robotics, software, and 3D imaging to extend the capabilities of surgeons. The company focuses on continually innovating to improve patient outcomes, reduce recovery times, and enhance the overall surgical experience. As of June 2023, the company has placed over 8,285 systems worldwide of which 4,943 are in the United States and 3,342 worldwide ex-U.S., making it the robotic surgery company with the highest penetration not just in the U.S. but also globally.

Business Overview and Drivers

The company has one business segment, which is the sale and provision of services relating to its robotic surgery systems. It earns its revenue via recurring service revenue from O&M of the surgery robots as well as the leasing or sale of the robots.

Its revenue drivers are the ASP of surgical robot systems, the volume of systems sold or leased and the ASP of recurring O&M services.

Its cost drivers include spending on R&D, production of surgical robots and the cost of providing maintenance services.

Why this company?

In its Q3 earnings call, ISRG achieved $1,744 million in revenue (12% revenue growth) but underperformed Wall Street's estimates of $1,770 million, resulting in a short sell-off of the stock. This lower-than-expected revenue was the outcome of systems revenue having declined 11% from the previous year despite the number of systems being placed in hospitals having increased. This gave investors the impression that ISRG was selling its surgical systems for cheaper than before. I believed this created potential mispricing since, in reality, the reason for lower systems revenue was an increased proportion of new systems being leased. This was what sparked my initial interest in this company as I view the move to operational leases to be beneficial for the company, allowing for greater recurring revenue.

Source: ISRG Investor Presentation Q3 2023

Thesis

Market leader with a defendable position

ISRG is a market leader in the robotic surgery industry with an estimated global market share of 57% according to Medical Device Network. As the current market leader, it stands to benefit disproportionately from industry growth. I believe ISRG is also well-positioned to defend its market position for a few key reasons.

Firstly, the Da Vinci system the surgical system is the surgical system that is most widely covered in academic institutions with 100% of the largest U.S. Residency programs using ISRG systems, over 190 academic medical centers with robotics programs in the U.S. and over 828 Da Vinci and Ion systems installed in U.S. academic medical centers. This means that hospitals who are looking to adopt robotic surgery as part of their practice are most incentivised to adopt the Da Vinci system, since surgeons will already have had exposure, reducing the time and investment required to train surgeons.

Secondly, for healthcare institutions that have already adopted Da Vinci systems, the need for training also serves as a deterrent to switching systems since the cost involved and training required will be fairly prohibitive. The high switching costs thus make it unlikely for existing customers to switch.

Thirdly, the company has contracts in place for servicing its surgical robots as well as leases that ensure recurring revenue. ISRG is thus able to ensure that its revenues remain sticky and, thus far, contract renewal rates have seemed promising.

Lastly, the Da Vinci Surgical System is inherently an ecosystem that allows for different types of procedures to be performed with add-ons to enhance the capabilities of the robots. This makes it unlikely for hospitals already entrenched in the ecosystem to switch systems even if competitors come up with products that may be superior for specific procedures, since the Da Vinci Surgical System already provides an "all-in-one solution" with add-ons that should presumably be cheaper than acquiring an entirely new surgical robot.

Strong top-down growth drivers

The robotic surgery industry is a rapidly growing industry forecasted to experience continued growth. Long-term growth drivers for this industry include population growth, increasing demand for healthcare, a wealthier middle-class able to afford higher quality healthcare as well as increasing access to healthcare worldwide. In the shorter term, demand for robotic surgery in developed nations is expected to grow rapidly. According to Next Move Consulting, the global surgery robot industry is estimated to grow to US120bn by 2030, almost doubling from 2022. Oliver Wyman projects this to be even higher with a CAGR of 11.0%, while Research and Markets projects this to be as high as 17.2%. As a market leader, ISRG is positioned to benefit disproportionately from this growth.

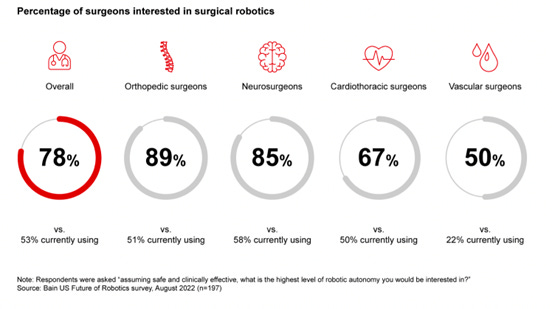

Research by Bain has also found that there is room for growth even in the U.S. market, with a high percentage surgeons expressing interest in surgical robotics well above the current adoption rate.

Furthermore, I would like to highlight that this encompasses just the U.S. market. In other geographies where adoption is lower, I believe the room for growth in penetration rate would be significantly higher.

There has also been strong growth in worldwide robotic surgery procedures across a variety of specialties.

Source: ISRG Investor Presentation Q3 2023

Strong Balance Sheet Capable of Weathering Storms

ISRG is unique in that it has taken on no debt financing and has achieved its growth using cash and equity financing. Over the years, ISRG has maintained a healthy and growing cash balance. It has even taken on short-term investments to generate further cashflow.

ISRG is thus well-positioned to access debt financing if required to drive its growth. In this high-interest environment, not having debt obligations is also seen as a good thing and I believe investors will be willing to pay a premium for both the company's lower interest expense as well as not being subordinated to debt-holders of the company.

Valuation

I used a DCF valuation to value the company and assumed a revenue growth of 17.2% per year, which was the industry growth projection by Research and Markets. While this number is a rather aggressive choice as an industry growth rate, I used this number as I believed ISRG would benefit disproportionately from industry growth.

With a closing share price from 29 December 2023, this gives an immediate upside of 13%, a 1Y upside of 20% and a 5Y upside of 51%. A risk-free rate of 3.92% was used, derived from US 10Y Treasury Bond yields at the time of the valuation. For the market return, I used the iShares U.S. Medical Devices ETF 5Y performance as I believed the 10Y performance to be less reflective owing to a very different economic climate.

Risk and Mitigation

Technology Risk

Disruption: ISRG's advantage is contingent on its ability to pursue effective R&D and maintain the relevance of its surgical systems. Innovations in robotic surgery can make its technology obsolete and hurt the company's top-line.

Mitigation: ISRG invests heavily in R&D and has demonstrated the ability to translate that to revenue, reflected in its ROIC of 18.19%, calculated using TTM income statement data.

ESG Risk

Controversy: As a market leader, ISRG could be tempted to use predatory pricing or other anticompetitive behavior to maintain its position. Being in the medical industry, there are also social and ethical concerns regarding the pricing of its products.

Mitigation: This is a risk that is difficult to mitigate and I believe it is important for it to be continuously monitored. I believe ISRG's current performance to be acceptable with room for improvement.

ESG

The company releases an annual ESG report in alignment with leading reporting frameworks such as the Task Force on Climate-Related Disclosures (TCFD) and the Global Reporting Initiative (GRI).

The company has programs in place to ensure its practices are sustainable. Over 99.9% of proprietary waste collected by vendors in North America are recycled and 100% nonpotable water is used for native/adaptive demand for landscape planting. The company has also made over 95% of the surgeon console, 60% of the patient side cart and 20% of the vision side cart components recycleable.

On the social front, ISRG was named a top-scoring company on the Disability Equality Index which measures companies actions to achieve disability inclusion and equity in the workplace. The company has also raised over $20 million to support patient care and vaccinations during the COVID-19 pandemic.

With regards to governance, ISRG's board is diverse, with 27% of the board represented by people of colour and 36% of them being women.

I believe, in general, ISRG has done well on most fronts.

However, in 2021, the ISRG was sued for anticompetitive behavior in the robots aftermarket business and overcharging hospitals for replacement parts. There were also accusations of the company shutting down surgical robots mid-surgery.

In light of full disclosure, here are the links to the articles:

• https://medcitynews.com/2021/07/hospitals-sue-surgical-robot-maker-saying-it-forced-them-into-restrictive-contracts/

• https://www.medpagetoday.com/special-reports/exclusives/93564

My opinion is that some of these allegations may be unfounded since ISRG has stated it does not have the ability to shut down robots remotely and that these issues could have been caused by improper maintenance and use of third party maintenance services.

While pricing for the maintenance and servicing contracts are steep and the contracts could be deemed rather restrictive, the practice of selling a product at lower cost and charging more for O&M or subsequent replacement parts is not a particularly new practice. Printer companies have long been selling printers at a loss and recouping that loss through the sale of ink cartridges, even incorporating microchips into ink cartridges to ensure third-party ink cartridges are not used.

I view ISRG's ESG performance to be acceptable and overall think the company has done a reasonable job navigating the complex and challenging medical services industry.

Closing Remarks

I started looking at this company around the time its Q3 financial results were published. The share price then was around ~US280. While the share price has run up significantly since then and (with hindsight) I wish I executed a position in the company earlier, I still believe the company has room for further upside and will maintain its position as market leader through its superior technology. The robotic surgery industry is a rapidly growing industry and fits into BCG's criteria of a star company, which is personally my favorite type of company to invest in.

Overall, I issue a buy recommendation for this company but would recommend slowing accumulating a position in this company over a longer time horizon while monitoring its position as market leader as well as how it handles controversy regarding its business practices.

Appendix

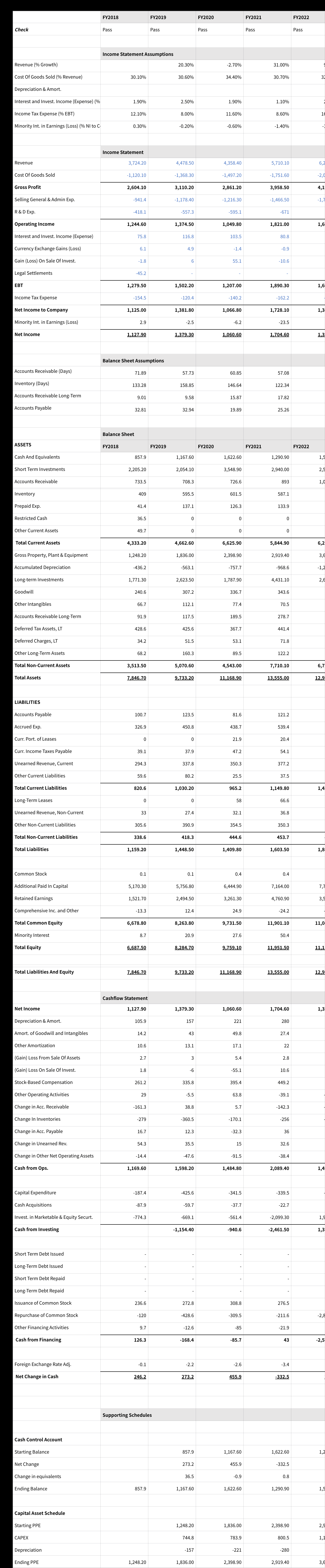

Historical Statements

Projections

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.