Initial Report: Intuitive Surgical (NASDAQ: ISRG) , 115% 5-yr Potential Upside (HO Jo Vial, SC VIP)

HO Jo Vial presents a "BUY" recommendation for Intuitive Surgical based on its Ion system driving a flywheel effect, and untapped growth potential in a multitude of countries.

Initiate coverage on Intuitive Surgical. (NASDAQ: ISRG) with a Buy recommendation and a five-year price target of $1057 based on a 55x P/E multiple on FY28E figures, implying a 115% upside from the March 29, 2025, closing price of $491.84 (equivalent to a 17% IRR).

Company Overview

Intuitive Surgical(NASDAQ: ISRG) is a company that represents best-in-class robotic surgery equipment & robotic surgery. It is a monopoly in the robotic surgery space, with an estimated 90% of market share belonging to it (Joe Thomas, equity analyst at ninety one).

The first robotic surgery performed on a grape. This was when ISRG was first propelled to the public’s attention.

ISRG began in the late 1980s when robotic-assisted surgery was emerging at the former Stanford Research Institute (SRI) in Silicon Valley. The technology received early funding from various sources, including the National Institutes of Health and the US Defense Advanced Research Projects Agency, which was interested in systems for battlefield surgery.

In 1995, Intuitive Surgical Devices was officially founded, commercializing what was then known as the SRI system. The company began testing the first da Vinci surgical system in 1997, with the initial procedure—a cholecystectomy.

The company's growth accelerated rapidly after receiving US FDA clearance for the first da Vinci surgical system in 2000, which allowed for general laparoscopic surgery applications.

That same year, Intuitive Surgical completed its initial public offering, raising $46 million to fuel further development and market expansion. The FDA subsequently approved the system for prostate surgery in 2001, followed by approvals for thoracoscopic surgery, cardiac procedures, and gynecologic procedures in later years.

History of products:

Early Prototypes: Lenny and Mona (1995–1999):

Source: Research Gate

Their first prototype, Lenny (short for Leonardo da Vinci), emerged in 1997 as a three-arm system with two instrument arms and one camera arm clamped to the operating table. However, Lenny’s mechanical instability limited its clinical utility.

Source: research gate

In 1997, Intuitive introduced Mona (named after the Mona Lisa), which featured exchangeable instruments and improved stability. Mona achieved a milestone in March 1997 with the first robotic cholecystectomy in Belgium. Despite this success, Mona’s camera arm required manual control by a bedside surgeon, highlighting the need for further refinement.

First-Generation da Vinci (dV) System (1999–2006):

The da Vinci Surgical System debuted in Europe in 1999 after human trials in Germany, France, and Mexico. Its first commercial sale was to Leipzig Heart Center in Germany, where it facilitated minimally invasive cardiac procedures. In 2000, the U.S. Food and Drug Administration (FDA) cleared da Vinci for general laparoscopic surgeries, marking its entry into the American market.

Source: wikipedia. The first da vinci system

In 2001, FDA expanded approvals to prostatectomies, followed by cardiac and gynecologic procedures. By 2003, Intuitive merged with rival Computer Motion, who actually sued ISRG originally for stealing its design, but this consolidation created the robotic surgery monopoly giant, and also phased out the ZEUS system used by Computer Motion.

Second and Third Generations: Enhanced Precision and Versatility

da Vinci S (2006)

Source: Researchgate

The da Vinci S, launched in 2006, introduced:

High-definition (HD) 3D vision for improved anatomical visualization.

Streamlined setup with a smaller footprint and interactive touchscreen

da Vinci Si (2009)

Source: Auxo Medical

The 2009 da Vinci Si added critical advancements:

Dual-console capability for collaborative surgery and training

Firefly Fluorescence Imaging, enabling real-time visualization of blood flow and tissue perfusion

Fourth-Generation Systems: Specialization and Single-Port Innovation.

The latest generation of da Vinci products which are currently in use now.

da Vinci Xi (2014)

Source: Intuitive website

The da Vinci Xi addressed multi-quadrant access challenges with:

Overhead instrument arms for greater anatomical reach

Integrated Table Motion, synchronizing robot positioning with operating table adjustments4.

Laser targeting for optimal port placement

da Vinci SP (2018)

Source: intuitive website

Developed over 12 years, the da Vinci SP (Single-Port) system, cleared in 2018, revolutionized narrow-access surgery:

Single articulating arm with three multi-jointed instruments and a 3DHD camera inserted through a 2.5 cm port

360° articulation enabling complex manoeuvres in confined spaces (e.g., transoral and colorectal procedures)

Reduced external collisions through compact arm design

da Vinci X (2018):

Source: Intuitive website

Key Features:

At that time, it was designed as a cost-effective option with advanced robotic-assisted surgical technology. It is marketed as a cost effective option compared to da vinci X

Shares the same vision cart and surgeon console as the flagship da Vinci Xi system, enabling upgrades as needed.

Source: MDPI, 2023

Fifth Generation (current upgrade cycle):

Da Vinci 5:

Source: intuitive website

Key Features

Force Feedback Technology:

A major innovation in the da Vinci 5 system, allowing surgeons to sense tissue resistance during procedures.

Force Feedback in the da Vinci 5 allows surgeons to sense (feel their impact as if they are pulling the skin tissues through the machine) tissue resistance during procedures, potentially reducing tissue trauma by up to 43% compared to previous models

Improves precision and safety for delicate surgeries, such as thoracic or gynecological operations

Enhanced 3D Visualization:

High-definition stereoscopic imaging provides crystal-clear, magnified views of surgical sites

Improved depth perception aids in complex dissections and suturing.

Workflow Efficiency:

Over 150 design innovations to streamline setup and operation

Increased computing power (10,000x greater than previous systems) enables advanced AI tools for augmented reality, data analytics, and machine learning

Ion robotic bronchoscopy:

This is a new product group launched by intuitive recently, away from its dv, this has opened bronchoscopy options for the system which has not been previously explored by the da Vinci system.

Crucially, what the Ion bronchoscopy system is able to do is minimally invasive biopsies in the lung or bronchoscopies. Bronchoscopy is a medical procedure where a thin, flexible tube (bronchoscope) is inserted through the nose or mouth to visualize the airways and lungs, aiding in the diagnosis and treatment of respiratory conditions. Crucially, this helps you detect lung cancer.

Source: statista

Lung cancer is a giant problem in the cancer world, with c.20% of deaths attributed to it. There are direct and indirect causes to lung cancer, the most notable being smoking. Smoking increases one’s chance of getting lung cancer by 15-25x, and with an estimated 1.18bn smokers in the world, the potential market for lung cancer detection is potentially very big.

source: statista. Although the number of smokers are on a downward trend, specifically the number will still be in the trillions, sufficient a bed enough for the ion to enter and address.

On an indirect scale, there is natural occurring lung cancer. While smoking is the primary cause of lung cancer, it's estimated that about 20% of lung cancer cases occur in individuals who have never smoked. This is particularly common for females.

Source: intuitive website

Key Features

Ultra-Thin Catheter:

Measures just 3.5 mm in diameter with a 2 mm working channel

Articulates up to 180° in any direction, enabling access to all lung segments.

Shape-Sensing Technology:

Provides real-time feedback on catheter positioning by calculating its shape hundreds of times per second7.

Ensures stability during biopsy procedures.

PlanPoint Software:

Generates a detailed 3D airway map from CT scans for pre-procedure planning

Offers GPS-like navigation during bronchoscopy.

Integrated Vision Probe:

Provides direct visualization of airways during navigation to nodules

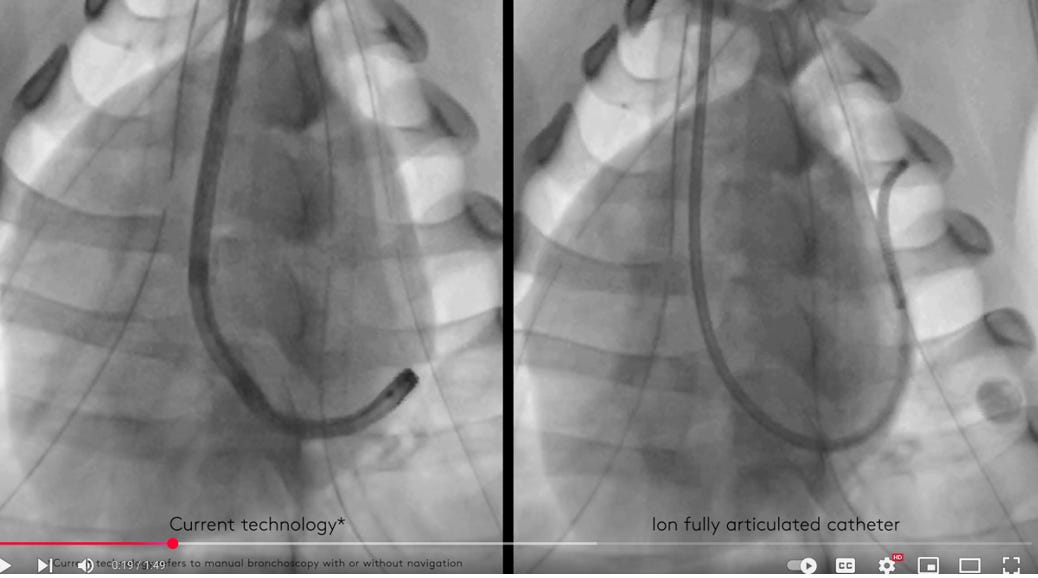

The problem with current bronchoscopy methods?

Source: Business Breakdowns, Intuitive surgical

How does Ion do it better?

As seen from the video, current bronchoscopy methods is such that the rod is rigid. If the module were for instance up in the ribcage, it would be extremely difficult for it to reach the module to even test for cancer. Ion, however, has the capability to be able to properly bend to reach these modules and test for them as it is fully articulable from its features. This allows for more accurate bronchoscopies and early detection of lung cancer.

Systems:

Every da Vinci system has the following consoles required of it:

Source: Images from science direct. The SI robotic surgery system.

As the current monopoly player in the robotic surgery market, ISRG has 4 main da vinci systems in its current product suite:

Da vinci x

Da vinci xi

Da vinci SP

Da vinci 5

ISRG is also releasing its new robot specifically for bronchoscopy:

Ion Robotic Bronchoscopy

Surgeries:

To properly identify the market that ISRG will be able to capture, we need to examine the type of surgeries that ISRG is currently optimized for. The surgeries that intuitive systems can do are:

Bariatric Surgery

Helps with weight loss by making the stomach smaller (like creating a tiny pouch) or rerouting food to absorb fewer calories.

Examples:

Gastric bypass: Connects a small stomach pouch directly to the intestines.

Sleeve gastrectomy: Removes most of the stomach, leaving a banana-shaped tube.

Cardiac Surgery

Fixes heart issues, like repairing a leaky heart valve (mitral valve).

Colorectal Surgery

Removes diseased parts of the colon (large intestine) or rectum, often for cancer or blockages.

General Surgery

Hernia repair:

Fixes a hole where organs poke through muscle (like a bulge in the groin or belly).

Gallbladder removal:

Takes out a small organ that stores bile (often due to painful stones).

Gastrointestinal resections:

Removes damaged parts of the stomach or intestines (e.g., for cancer).

Liver/pancreas surgery:

Removes tumors or fixes blockages in these organs.

Gynecology Surgery

Hysterectomy:

Removes the uterus (often for fibroids or cancer).

Myomectomy:

Removes uterine fibroids (non-cancerous growths causing pain).

Sacrocolpopexy:

Lifts sagging pelvic organs (like the bladder) back into place.

Endometriosis resection:

Removes painful uterine tissue growing outside the uterus.

Head and Neck Surgery

Treats throat or mouth cancers through the mouth (no face/neck cuts).

Thoracic (Chest) Surgery

Lung resection:

Removes part of a lung (e.g., for cancer).

Esophageal surgery:

Fixes the swallowing tube (e.g., for cancer or acid damage).

Lung transplant:

Replaces a diseased lung with a donor lung (rare, but da Vinci assists with steps).

Urology Surgery

Prostatectomy:

Removes the prostate gland (for cancer).

Nephrectomy:

Removes a kidney (e.g., for cancer).

Cystectomy:

Removes the bladder (for cancer).

Pyeloplasty:

Fixes a blocked kidney drainage system.

Source: intuitive website

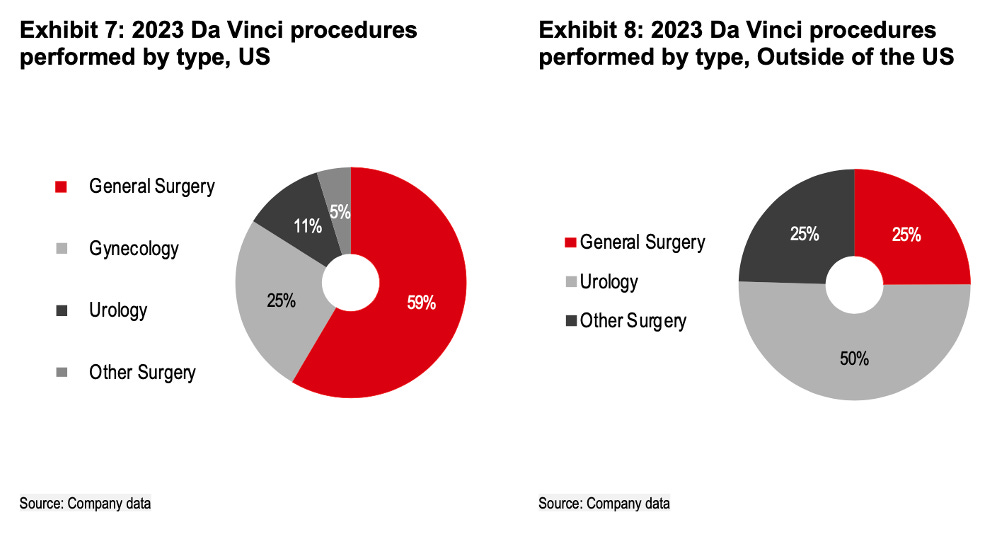

In layperson terms, essentially these are the operations that ISRG is able to do. Specifically, what ISRG especially focuses on (despite the other areas it is trying to grow) is urology and gyncology, and general surgery and its other procedures accompany a large chunk of da vinci’s surgery types.

Specifically, the common denominator amongst all these surgical functions is that it is performed through minimally invasive surgery.

Source: intuitive

Da vinci machines specifically use minimally invasive surgery, which involves a keyhole insertion into the patient’s body. Subsequently, the machine can use its robotic arms to be able to enter this keyhole.

Source: HSBC, Intuitive. Da vinci’s main products in both US and ex-US.

For information of how this looks like, there is a video of the robot in action. However, it might be a bit graphic for some users.

Surgeons have previously done minimally invasive surgery through means of laparoscopic surgery which is the use of their hands instead of a robotic system like the da vinci helping them. Despite that, surgeons, due to ergonomic strain, technical limitations, and sensory deficits actually suffer for each surgery.

Surgeons must work in awkward positions for extended periods, leading to chronic back, neck, and shoulder pain that can shorten careers. It has also been reported that after two procedures, they would need to meet a physiotherapist.

Additionally, 2D imaging hampers depth perception, while unstable camera control by assistants (real humans have to actually hold the camera into the body in lap surgery) can disrupt visibility.

Source: science direct

Ultimately, this has resulted in surgeons actually switching to the da vinci, and unsurprisingly, enjoying its benefits to a larger extent.

How it does business:

Source: intuitive

The "services" component of Intuitive's revenue breakdown refers to the maintenance contracts and technical support provided for the installed base of da Vinci systems. These service agreements, which can cost between $100,000 and $170,000 per system annually, ensure that the sophisticated robotic platforms remain in optimal working condition

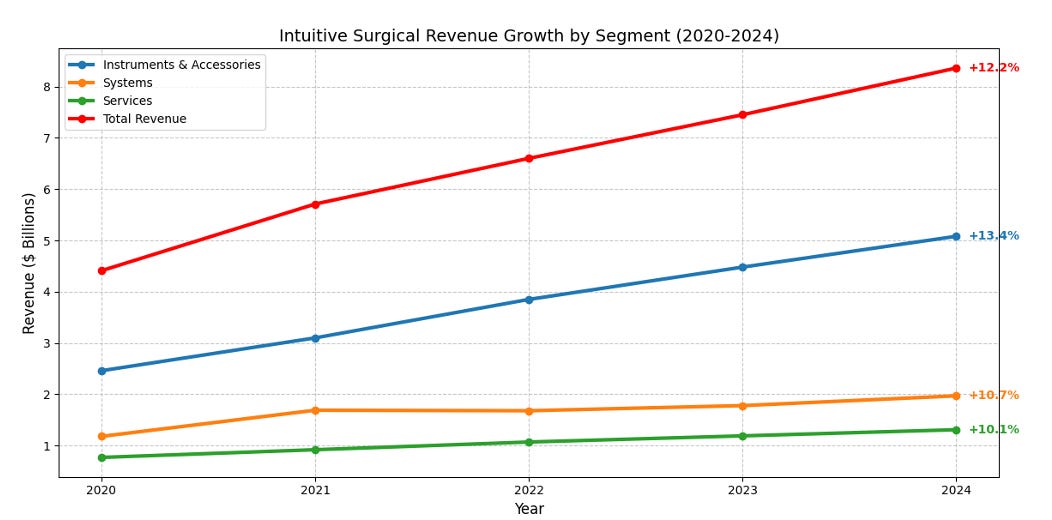

Despite its main business being the monopoly player in robotic surgery, the main bulk of revenue is interestingly not in the systems it provides (dV, ion etc only makes up 23.6% revenue in 2024), but its instruments and accessories business.

ISRG’s business model is through a “razor blade” model. At its core, this model involves selling a high-value product (the "razor") that creates a long-term need for complementary, consumable goods (the "blades"). Just like in razor blade business, the “blade” in this case is the bulk of its revenue.

In Intuitive's case, the da Vinci surgical system serves as the razor, which despite its price is actually not the area the company gets its most margins in.

da Vinci Xi: Estimated range between $1.5 million and $2.5 million.

da Vinci X: Estimated range between $0.8 million and $1.8 million.

da Vinci Si: Estimated range between $0.5 million and $2 million.

(source: R2 surgical)

Once a hospital or surgical center invests in this sophisticated robotic platform, they become reliant on Intuitive for the specialized instruments, accessories, and services required to operate and maintain the system.

These consumables, which include items like EndoWrist instruments designed for specific surgical procedures, must be replaced after a limited number of uses – typically 10 to 15 times. This creates a steady, predictable income stream for Intuitive, with the average revenue per procedure hovering around $1,840 as of 2024.

These are the disposable, resusable products. These products, because of their electronic nature, has a smart tag which only has set uses after which it will not allow the doctor to use it for the next surgery as it has used its limited numbers of users.

Source: intuitive, vessel sealer

Energy Instruments: SynchroSeal and Vessel Sealer Extend for cutting and sealing tissue

Source: intuitive

Clip Appliers: For securing blood vessels and tissue structures

Needle Drivers: Enabling suturing at multiple angles

Graspers: For manipulating and retracting tissue

Scissors: Used for cutting and dissection

Bipolar and Monopolar Instruments: For coagulation and cutting

Suction and Irrigation Tools: Controlled at the surgeon console

For ion:

Flexision Biopsy Needles: Single-use needles designed specifically for the Ion system to collect tissue samples

Ion Peripheral Vision Probe: Provides visualization during bronchoscopy procedures

Catheter: The fully articulating, ultra-thin (3.5mm) catheter that can bend 180° in any direction

Intuitive approach to the market:

Source: intuitive

Intuitive has seen a giant burst in terms of surgeries done through the da vinci machine through the years, despite a small blip in 2020, the company persisted with impressive da vinci surgery growth which is leading the robotic surgery company to win more with higher revenues through more surgeries.

Source: Business Breakdowns

ISRG is adopting two key strategies that it is using to field competition amongst surgeons and hospitals who think it’s initial cost for the da vinci might be too high (more later at risks section).

Leasing options

Source: medtech dive, newswire, intuitive

Instead of the $1.5 to $2 million upfront purchase for a da Vinci system, which many healthcare workers are concerned about, healthcare facilities can opt for more flexible payment options. These include monthly or quarterly fees, and even usage-based leases where payments are tied to procedural volume.

In 2024, 776 da Vinci systems were leased, representing 51% of total placements. This is a significant increase from the 659 systems leased in 2023. Usage based leases rose as well, which jumped from 355 in 2023 to 467 in 2024. Today, leased systems account for approximately 25% of Intuitive's installed base, totaling over 2,200 systems.

Ultimately, with the concern of high costs, more hospitals are being willing to take up leased da vinci systems, as seen from the percentage of leased da vinci systems increasing to 51% from 32% in 2019.

This is a hedge through both recessionary and boom conditions as having the ability to lease a da vinci helps provide many cost benefits to hospitals and is an all-weather strategy.

Upgrade clauses in agreements with hospitals

Intuitive has incorporated upgrade clauses into their contracts. Unlike having to chase an upgrade cycle, these clauses mitigate the risk of technological obsolescence, especially in rapidly evolving field of medical technology.

Under these agreements, hospitals can transition to newer systems, such as the recently launched da Vinci 5, without incurring financial penalties. For instance, hospitals that purchased da Vinci Xi systems can defer part of the purchase price to secure future upgrade rights to the da Vinci 5.

Despite costing 15-30% more than the Xi model, hospitals with existing Xi systems can upgrade by paying only the price difference, avoiding the need for a full repurchase.

This also smooths out the company's financial reporting by deferring recognition of about 30% of system revenue until upgrades occur.

Moats:

ISRG as a monopoly has moats that make it nigh insurmountable for challenges in robotic surgery to overcome. These moats are interestingly, from the side of doctors themselves as da vinci was the first mover as well as is the best product currently in the market.

Surgeons demand for da Vinci

Source: business breakdowns

With over 66,000 surgeons trained globally on da Vinci platforms before leaving school, ISRG has cultivated a generation of "da Vinci natives" who have built their careers and reputations around mastery of this technology. Basically, doctors are trained on robotic platforms and if they need to change to traditional laparoscopic surgery techniques it will be challenging for them.

The system's has over 38,000 peer-reviewed studies, making it the gold standard in minimally invasive surgery. For many surgeons, proficiency with da Vinci has become not just a skill, but a career differentiator, attracting patients and opening doors to prestigious positions.

This dynamic creates a self-reinforcing cycle: hospitals invest in da Vinci to attract top talent, which in turn drives more procedures and further entrenches the technology.

Hospital consolidation

The consolidation of hospitals into larger systems has been a boon for Intuitive Surgical. Where once they might have had to negotiate contracts with dozens of individual hospitals in a single city, they now often deal with a single entity representing an entire network.

For instance, Northwell Health in New York City, which began as a merger of a few hospitals, now encompasses 23 or 24 facilities. This consolidation simplifies negotiations, allowing Intuitive to work with one set of lawyers and terms for an entire system, streamlining their business processes.

Intuitive has adapted its sales structure to match this new reality. They assign dedicated representatives to major hospital groups, with regional representatives supporting larger networks. For example, a lead negotiator might work directly with a national system like Tenet Healthcare, then disseminate the details of the agreement to regional representatives who ensure local hospital administrators understand and implement the deal.

Source: KaufmanHall

Current market conditions indicate a rise in M&A activity, specifically, acquisitions of more hospitals by large brands.

The reason given for this is attributed to a ‘record’ number of distressed providers. This is resulting in 72 hospital mergers, up 65 hospital mergers in 2023. This dynamic is actually positive for the market as larger consolidated names are being absorbed by cash rich hospitals who are likely to already have contracts with ISRG, such as HCA, UHA and Tenet, which have all exclusive contracts with ISRG already.

Being able to add to their hospital portfolios with the latest robotic surgery techniques is something they are likely to do. As a bonus, some of these companies already have exclusive provisions of long-term sole source robotic surgery providers with ISRG.

Source: In practise interview with ISRG

Thesis 1: Ion represents a flywheel effect

Intuitive Surgical’s Ion endoluminal system is a strategic entry point into hospitals, creating a "flywheel effect" that drives adoption of their flagship da Vinci systems.

Early Cancer Detection → Surgical Intervention

Ion enables minimally invasive biopsies of peripheral lung nodules, where 70% of lung cancers originate.

Hospitals using Ion to detect lung cancer often require follow-up surgeries (e.g., lymph node resection, tumor removal), creating demand for da Vinci systems for thoracic procedures.

Example: NYU Langone performed the first fully robotic lung transplant using da Vinci Xi after Ion-guided diagnosis

Ion can detect biopsies nodules as small as 6mm with 83% diagnostic yield (vs. 60–70% for manual methods).

Here is an extract from a video which talks about Ion, specifically:

Source: Ochster Health

Ultimately, this reflects a new dynamic that I feel has not been understood by most investors yet. Through ion bronchoscopy, there is clear detection of these modules which will be treated likely through another robotic surgery procedure, namely, the da vinci. Crucially, the da vinci is able to do a lymph node dissection, which is the next step after realising there is a cancerous node.

This creates a compounded effect, first on the side of the ion being able to detect, and subsequently the da vinci being used. This is essentially 2 procedures which would be able to increase the revenues ISRG is able to earn from this.

Source: intuitive

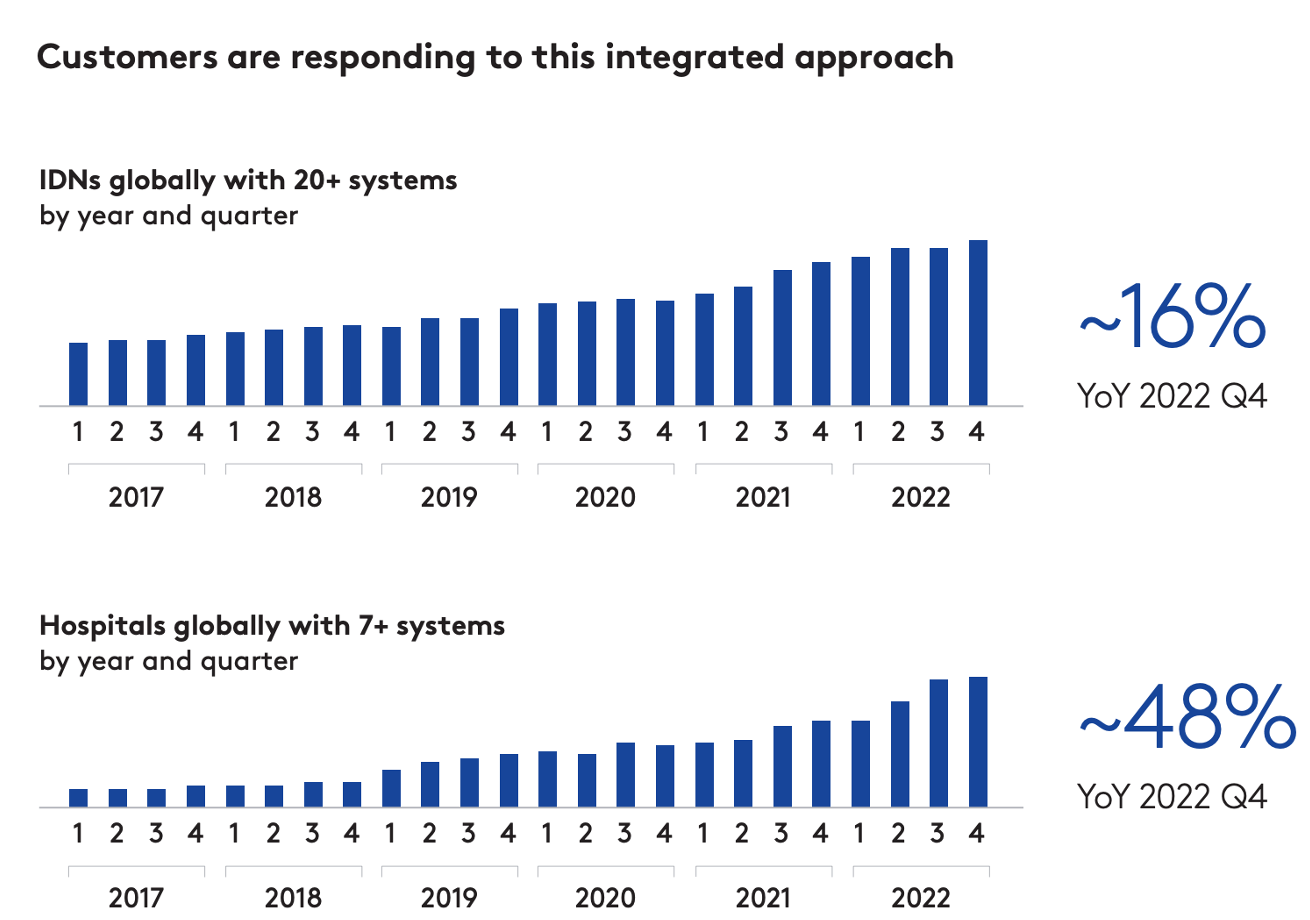

As to why clients would use an integrated ISRG suite of systems and products, it is because hospitals and IDNs( integrated delivery networks) will get multiple systems instead of one. There has been a raised trend of hospitals getting multiple systems, over 2022-2017, which include the COVID-19 pandemic, ISRG customers grew their use of our ISRG products in procedures at a CAGR rate of 16 percent. In 2022, ISRG saw a return to pre-pandemic growth of 18 percent year-over-year.

Why would a customer want to have both systems? The answer is two-fold.

Volume purchases

Source: In practise interviews with former VP clinical sales intuitive

There is volume to be extracted from the procedures, which would make the hospital more incentivised to buy more, have more procedures, and do more with intuitive. This extends across systems, such as dV and ion systems, which essentially reinforces each other.

Hospitals want to be marketed as visionary for clients to come.

Source: In practise interviews with former VP clinical sales Intuitive

From a marketing standpoint, it also makes operational sense for hospitals to load up on both robotic surgical devices. When it has multiple robotic devices, hospitals which are marketed for their care and standards are able to live up to this standing.

The interview mentioned that different robots would be purchased, such as Medtronic and Cambridge medical. I believe they are used more as show-pieces than anything, and the operational machines will be those from ISRG.

This is because the best-in-class machines are from ISRG. Surgeons have been trained to use it, and there is wide medical consensus that ISRG has the best machines for robotic surgery.

If there is widespread dV training, switching costs to learn another machine type interface with different UX might be high, especially since this has been taught to surgeons since medical school (in the US).

So a hospital might load up on other robotic devices, but to be able to perform at their best and ensure the best patient recovery rates, they will use machines that will come from ISRG exclusively.

Source: Intuitive

More importantly, procedures are up.

Source: Intuitive

specifically, what we have to look at is how well utilised these ions are. With a procedure/ion steadily increasing, the increased utilisations will soon see a reflection of more dv systems used as well.

Therefore, the flywheel that exists will look something akin to:

Thesis 2: Many untapped countries, growth potential

Last few years have seen virtually no change in revenue mix change in terms of what ISRG is able to capture outside of the US. It’s revenue mix for its main markets stay the same.

For the year 2024, the number of da vinci in the US is significantly higher than anywhere it might see procedures in. This is roughly a 67/33% split in terms of its distribution of da vinci surgical systems, which does show an encouraging sign that roughly all the da vinci surgical machines are producing an approximately similar revenue to maintain this revenue mix shown above.

This also shows an extremely large potential for ISRG to grow and span out to the rest of the world. It has already received widespread medical acclaim in medical literatures and journals, and has been trial tested in, of all places, the US. If it can incept in the US market, then the world’s best robotic surgery company will surely make in roads to the other markets.

Source: statista

Source: American hospital association, statista

The number of official US hospitals is only 2.83% of all hospitals in the world. Of course there can be arguments that will mention how US GDP per capita is very high and how US hospitals are higher in terms of profit demanding, but this is insufficient to represent the shortfall for just how large the potential actually is for ISRG. This is especially since larger medical targets that also represent high spending have not even been incepted, such as Singapore or Switzerland.

Instead, markets where intuitive has been making main footholds in are South Korea, Taiwan, the UK and to an extent India. Many high purchasing areas have still not entered.

I also interviewed two Singaporean medical students to better understand how much ISRG has incepted into Singapore to understand its future market potential in this area. Interestingly the conversation showed how much the Singapore government, despite its emphasis on health and medical tourism, hasn’t even seen the adoption of ISRG systems in public widespread use, which makes me optimistic on its growth prospects.

Interview:

Me: Help me to understand, you’ve not seen a da vinci surgical system before?

Medical Student: Not in Singapore, only in videos. The only da vinci machine that I know is in Singapore is in Mount E (a private hospital). I think they only have 1 of that.

Me: So public hospitals have overall yet to adopt this?

Medical Student: Correct. They have not implemented it, although we are being trained on robotic surgery platforms, VRs, etc.

Me: Can you think of any proposed impediments there would be for the adoption of robotic surgeons in Singapore?

Medical Student: I think the cost of the dV is quite large. Hospitals might not be able to adopt it.

Me: They are about 1.5mn – 2mn.

Medical Student: That’s quite a large cost. I guess most countries are facing this as well. This includes Singapore.

Me: But surgeons get paid quite a lot per procedure right?

Medical Student: That’s also a good point. They get paid about SGD20,000 per surgery. I guess maybe the cost case must be more defined for hospitals in Singapore to adopt them.

The other medical student shared similar sentiments, reflecting an overall large appetite from the government although ISRG has yet to enter Singapore in mass yet. To note, they could not name the provider of their VR training materials although this is likely ISRG as well, as they have partnerships with Duke-NUS, a Singaporean medical school. (Duke-NUS, neurosurgical partnerships)

The amounts that surgeons get show, perhaps, that the 1.5mn for the hospital might not be a large figure for a Singaporean hospital. But assuming that this is still a concern for the Singaporean doctor, there are ways to get around cost concerns.

Leasing agreements

Looking at the issue of cost, then. Hospitals might be slightly reluctant to adopt dV as it is quite a heavy fixed cost of 1.5mn++ per machine. Although ISRG might be collecting most of its sales through its instruments, the ISRG’s cost is nevertheless given opponents an opportunity to enter and attack its high cost value. For instance, Medtronic’s Hugo is estimated to cost around 0.7mn only.

Thankfully, ISRG already went through the problem with its test bed of the US, which is why I am confident it can navigate providers like the Singaporean medical system and negotiate the costing arrangements with them.

Source: in practise intuitive surgical interview

In 2013, ISRG already saw a slowdown in terms of sales. This was because US hospitals realised that there were large cost concerns with regard to ISRG’s robotic surgery. Here’s Intuitive’s strategy around the cost conversation:

Step 1: Direct the conversation to an expert who has done this before

Source: In practise interview ISRG

Step 2: Analyse clients financials, at times, tell them where they’re wrong

Source: In practise interview ISRG

Step 3: Break down the numbers, the advantage afterwards (interestingly) goes to the robot:

Source: In practise, ISRG

Step 4: Grateful clients (or employees of the hospital) buy more robots

Source: In practise, ISRG

The introductorily person usually gets elevated in the role, to become in a capability that will bring them closer to ISRG and will allow them to purchase more ISRG systems.

Markets incepted:

Other misc regions:

Direct Market Entry: Acquiring distributors in Italy, Spain, Portugal, Malta, and San Marino (closing 2026). (Intuitive, 2025). This consolidates control over pricing, training, and customer relationships.

This shows growth potential and a desire from ISRG to expand as well, as has much of the market yet to cover, through acquistions of ab medica, Abex, Excelencia Robotica among others.

Despite what all press releases say, ISRG is still in a phase of growth because of the sheer number of countries it has yet to cover.

Risks: Fierce competition from robotic surgery providers might squeeze margins

Competitors like Medtronic (Hugo), J&J (Monarch), and CMR Surgical (Versius) threaten ISRG’s market dominance by offering lower-cost robotic systems. The fear is that price wars could erode ISRG’s industry-leading margins (67–69% gross margins in 2024), especially since Hugo is being marketed as an alternative to dV because of its price point (around 0.9-1.2mn).

Despite that, it is almost irrefutable that the company with better product is dV, as well as its backing from its thousands of medical articles due to it being in the market for so long.

ISRG’s competitive moat remains robust due to surgeons being trained on ISRG software, and likewise, a similar interface to dV/ion. It is very hard to break out of an existing ecosystem due to your familiarity to it.

Research articles have suggested that people prefer robotic surgery – with caveats. Journal and medical reports such as Consumer acceptance of robotic surgeons in health services (Mar Souto-Romero, Jorge Pelegrín-Borondo) suggest that there is a relationship between robotic surgery and their proposed providers.

Do People Prefer Robotic Surgery?

It depends : Acceptance hinges on practical benefits (ease, effectiveness) and social validation, but is tempered by perceived risks and design choices. While robotic surgery is viewed positively when seen as efficient and low-effort, concerns about safety and overly human-like interactions may limit enthusiasm.

Lastly, the journal concluded that Robotic surgery acceptance is context-dependent. To improve adoption, developers should prioritize user-friendly design , demonstrate safety , and avoid overly anthropomorphic features that might trigger discomfort. Marketing should emphasize practical benefits and address risk perceptions.

The one robot surgery provider that is doing specific marketing for their own robots (grape video etc.) and has demonstrated safety track record is only Intuitive. Not Stryker, J&J or otherwise.

Risk: GLP 1 might reduce topline growth stemming from bariatric surgery

Weight-loss drugs like Ozempic/Wegovy could reduce demand for bariatric surgeries (4–5% of ISRG’s procedures est), impacting revenue growth. This has been the narrative which has been pushed out by the market and has actually seen ISRG share price take a hit when announcement of GLP 1s.

However, take note that this is a very small section of their revenue, as most of their revenue is through urological and gynaecology procedures. Therefore, any risks stemming from these areas are small in general and will not affect much top line as a result.

Moreover, greater unsettlement of Novo share price could negatively affect market sentiment towards GLP 1 and its overall thought of effectiveness (especially since it has been out in the market only a short amount of time), which could possibly strengthen ISRG valuations.

ISRG acknowledges short-term bariatric slowdown but projects increased demand long-term as patients discontinue drugs due to:

Cost: GLP-1s cost $10K–$15K/year vs. one-time surgery.

Compliance: 60–70% discontinuation rates within 1–2 years.

GLP-1s also do note have fully backed medical reports stating their effectiveness after going off it, whereas bariatric procedures are one-time only.

Financials:

The $8.83 billion cash position with minimal debt provides Intuitive with unparalleled flexibility in an increasingly competitive landscape. This war chest enables:

The recent purchases of distributors in Italy, Spain, and Portugal for €290 million demonstrate how Intuitive is using its cash to secure direct market control in key European regions.

This cash buffer protects against potential competitive price pressures from players like Medtronic's Hugo or CMR Surgical's Versius, allowing Intuitive to preserve margins while competing aggressively when necessary

The 29% year-over-year growth in net income (to $2.32 billion) and margin expansion (from 25% to 28%) demonstrate the power of Intuitive's business model:

The margin expansion occurred despite competitive pressures, confirming surgeons and hospitals continue to value Intuitive's technology despite lower-priced alternatives.

Gross margins at 69.1% demonstrates sheer pricing power and ability to show its moat.

Despite pressures from other robotic surgeons which threaten to push gross margins down to 67 – 68 % in 2025 which caused stock to tank upon management announcement, this is, if anything, short term as outlined by how ISRG has already moved into the medical field so much earlier in advance (see risks).

Valuation:

Buying opportunity:

Intuitive Surgical's stock declined approximately 2.2% following its Q4 2024 earnings announcement, despite delivering impressive results that beat expectations. Thereafter, stock tanked c.14%, after management guided lower margins than expected at 67-68% although its current margins stand at 69%.

This is probably due to fears of pricing power due to market competition with Stryker, Medtronic etc.

However, what this dynamic fails to note is that the competition fears are quite overblown. Particularly, fears of Stryker is unfounded because it only allows for orthopedic surgery. Medtronic does budget robotic surgery and J&J’s robot has yet to even pass most FDA hurdles. See risks for an analysis of market competition.

ISRG’s 5 year average PE is c.70x.

Despite that, I presumed a PE re rating to more acceptable levels by 2028, to about 50x (ISRG should trade like a highly rated tech stock as it is not fully medical and operates more like a technological wonder through its dV and ion systems, at that point).

Other assumptions are laid out here. The thesis is incorporated through

Higher base dV systems which causes increases in number of dV systems, a conservative move given widespread adoption in many more countries

Revenue/machine increasing because of more procedures precipitated by the ion flywheel.

Catalysts:

Full Global Launch of da Vinci 5 (Mid-2025)

Current Impact: Already placed 362 da Vinci 5 systems in 2024 despite limited rollout, with 174 in Q4 alone.

Future Potential: Full production capacity will enable global expansion, with regulatory submissions already completed for CE Mark (Europe) and progress in Japan.

The force feedback technology and 10,000x greater computing power represent significant competitive advantages that could accelerate replacement cycles and expand the addressable procedure market

Ion Platform Expansion into Therapeutic Applications

Current Progress: Ion procedures grew 78% in 2024, with international expansion gaining momentum in Europe, Korea, and China

Future Potential: CEO Gary Guthart indicated Intuitive is working toward "additional indications for the [Ion] platform inside the lung," beyond just diagnostic biopsies

Expanding from diagnostics to treatment would significantly increase the revenue per Ion procedure and strengthen the Ion-to-da Vinci flywheel effect

Further country inception of ISRG systems

The lack of many countries even having the dV system, despite it being in its 4(th) generation, is something ISRG management is hoping to address with its purchase of more European suppliers.

With greater medical adoption and time in the market, more medical journals and reports and documents, it is hoped that more country regulations will allow and approve the dV into their country.

Medical board approvals to enter more countries could gradually cause positive top line growth.

90% market share is massive! Great post