Initial Report: Itron Inc. (NSYE:ITRI), 77% 5-yr Potential Upside (Ye Taut YE, EIP)

Ye Taut YE presents a "BUY" recommendation for ITRON Inc. based on surging energy demand and energy infrastructure overhauls in line with technological advancements and decarbonisation efforts.

Today, AI is incredibly essential to our lives, but do you know how much energy it consumes? Every image prompted by Stable Diffusion's open source XL consumes as much power per image as required to fully charge a smartphone, and to even train an AI model like GPT-3 takes 1,300 MWh of electricity, almost as much power consumed by 130 US homes a year. As AI adoption accelerates, global energy demand is poised to skyrocket, straining aging grids already struggling with renewable integration and EV adoption. This crisis demands smarter energy ecosystems, and Itron is at the forefront of this transformation.

Itron is a U.S.-based technology leader specializing in electricity, water, and gas utility management. By harnessing Industrial Internet of Things (IIoT) innovations to build intelligent infrastructure and smart city ecosystems, Itron has established itself as a global pioneer in sustainable resource management, backed by over 40 years of industry expertise.

Company Overview

Itron has 3 operation sectors:

Device Solutions: This sector includes hardware products used for sensing, measurement or control. These devices are standard endpoints and communicating meters that are not part of Itron’s end-to-end solutions and are designed for use with non-Itron systems.

Networked Solutions: This sector is an end-to-end solution for acquiring and transporting application-specific data. This sector includes Industrial Internet of Things (IIOT) such as Automated Meter Reading (AMR), Advanced Metering Infrastructure (AMI) and Distributed Energy Resource Management (DERM).

Outcomes: This sector includes value-added, enhanced software and services, artificial intelligence and machine learning to manage and interpret raw data. This allows for high-value use cases like maximizing profitability and resource efficiency. This sector goes hand-in-hand with Networked solutions and other third-party products as well.

Revenue Drivers

Revenue grew by 12% from 2.17 billion in 2023 to 2.44 billion in 2024. To show operational efficiency being implemented in 2024, the profit increases by 18% from 713 million to 839 million. Accelerating and taking advantage of energy transitions, Itron's backlog hit record backlogs of 4.7 billion, with over 1.8 billion dollars worth of contracts expected to be fulfilled in 2025.

One of the biggest revenue drivers come from Networked solutions and it has increased over 6%, however the operating margin has decreased 30 bips signalling an increase in operating expenses. However the biggest growth is seen in the outcome segment with its revenue increasing by 25% and reaching record quarterly revenue at 91 million dollars.

Competitor analysis

Itron operates in the smart infrastructure and utility solutions sector and competes with some of the better known companies like Schneider Electric and Siemens and Honeywell International. However, what sets Itron apart from its competitors is it is a pure-play utility infrastructure company.

Comparing Itron to one of its closest competitors, Landis+Gyr, whose scope overlaps with Itron's business segments. However, Landis+Gyr's main revenue comes from electricity metering and grid software, while Introl has a more balanced mix of electricity, water and gas. More notably, Itron also has nearly twice as much backlog as Landis+Gyr.

With Itron's ability to offer its cutting-edge technology at affordable prices, Itron manages to win some of it's crucial projects with the Western Area Power Administration to replace the failing advanced metering infrastructure system with Itron's latest technology.

Investment thesis

The global energy sector is undergoing unprecedented transformation, positioning companies like Itron at the forefront of critical infrastructure innovation. Macro-level trends reveal that electricity demand is surging due to technological advancements and decarbonization efforts, all while existing grid infrastructure struggles to keep pace. This highlights Itron’s potential to deliver scalable solutions for a more efficient and resilient energy future.

A typical electricity grid has 4 key technology components: Generation, Grid ( Transmission and Distribution ) and Demand. Itron places its main focus on smart distribution of electricity, connecting generators and the recipients efficiently. This will ease the strain on the current aging infrastructure and also make the future infrastructure more resilient

Power transformers, underground cables, and overhead lines form the backbone of modern energy grids, yet their aging infrastructure poses significant risks to reliability and efficiency. Designed with lifespans of 30–40 years for transformers, 40–50 years for underground cables, and 50–60 years for overhead lines, these critical components are increasingly operating beyond their intended service periods.

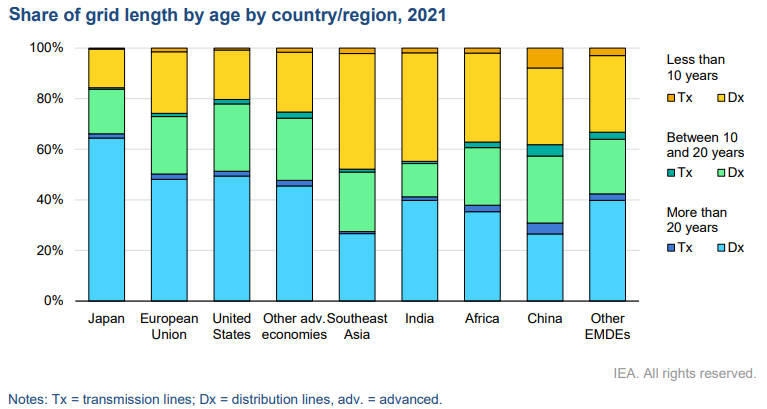

For instance, in regions like the EU and U.S, over 50% of transmission and distribution infrastructure is more than 20 years old, with many transformers and cables nearing their design lifetimes. Aging transformers, which are often 40+ years old in advanced economies, struggle to handle modern loads from renewables and EVs, while underground cables degrade silently, risking costly failures. Overhead lines face stress from extreme weather and bidirectional power flows from distributed solar and wind. This mismatch between aging hardware and 21st-century demands underscores the urgency of replacing legacy systems and integrating smart technologies to enhance resilience, reduce energy losses, and support decarbonization goals.

As per the graph below, investments in smart meters surged to $22 billion in 2022, taking up nearly 30% of the investments, as utilities prioritized real-time consumer energy monitoring. These devices are critical for demand-response programs, enabling households and businesses to reduce peak loads as aging grids strain under rising EV and HVAC demands.

The funding for automation systems grew steadily, reaching $22 billion in 2022, driven by the need for remote grid control and predictive maintenance. These systems minimize outages by autonomously rerouting power during faults, which are vital to capabilities of grids with 40-year-old transformers and overhead lines.

Networking and communications reached $8 billion in 2022, but only seeing little growth despite its integrating distributed renewables, coordinating EV charging, and transmitting data from smart meters to control centers.

Surging Demand from Data Centers, AI, Cryptocurrencies and Electric vehicles The digital revolution is a primary catalyst for rising energy needs. Data centers, artificial intelligence (AI), and cryptocurrency operations are projected to consume over 800 TWh of electricity in their base case, nearly doubling from 460 TWh in 2022. To put this in perspective, this increase equates to adding Sweden’s entire annual electricity demand to the global grid—a surge that existing infrastructures are not prepared to support.

Simultaneously, the rapid adoption of electric vehicles (EVs) is reshaping energy dynamics. Under the Stated Policies Scenario (STEPS), EV electricity demand is forecasted to skyrocket from 120 TWh to 2,000 TWh—a 15-fold increase. Even under conservative estimates, EV consumption could surpass 1,000 TWh by 2030, representing a tenfold jump from 2023 levels. This growth not only highlights the urgency of grid modernization but also exposes a critical vulnerability: without intelligent energy management systems, the transition to EVs will put a strain on aging infrastructure.

The escalating global energy demand—driven by AI, EVs, and renewables—coupled with aging infrastructure incapable of supporting 21st-century needs, underscores an urgent imperative: the transition to smart, adaptive electrical grids is no longer optional. Itron, with its expertise in IoT-driven grid modernization, real-time data analytics, and resilient energy management systems, is uniquely positioned to lead this transformation, turning grid vulnerabilities into opportunities for innovation, efficiency, and sustainable growth in an increasingly electrified world.

Valuation

Current Valuation Metrics:

P/E of Itron = 20.05

Current P/E of Itron = 20.05

TTM P/E of Itron = 20.04

P/E 5 fiscal year low = 20.97

Peer Comparison (P/E Ratios):

GE = 33.09

Badge Meter Inc = 44.65

Landis+Gyr = 15.32

Siemens AG = 23.13

Peer Average = 29.05

Taking a modest P/E ratio of 25 against the average P/E ratio of 29,

Using Itron's earning estimate for 2028 is 3 billion USD and 2030 with 3.4 billion,

The price target for 3Y would be 163.25, with an upside of 57%

The price target for 5Y would be 212.89, with an upside of 77%

Risk and Mitigation

Itron's Ability to Innovate at Pace

The rapid evolution of grid technologies demands relentless innovation. Itron risks falling behind if it cannot scale R&D efforts to match competitors like Siemens and startups specializing in niche solutions like AutoGrid’s distributed energy software. Legacy systems, such as Itron’s OpenWay Riva platform, may also slow integration with next-gen tools like virtual power plants (VPPs) or blockchain-enabled energy trading. To mitigate this, Itron has prioritized strategic partnerships (e.g., collaborating with Microsoft Azure for cloud-based analytics) and agile R&D cycles, allocating over $200 million annually to innovation. Recent launches, such as its Distributed Intelligence Platform, embed edge computing directly into meters, enabling real-time grid optimization without centralized servers. Additionally, Itron acquires niche innovators (e.g., SELC, a Brazilian smart grid firm) to inject fresh expertise and accelerate time-to-market for critical upgrades like wildfire detection sensors.

Implementation Risks in Real-World Grids

Deploying Itron’s solutions in aging grids poses significant technical hurdles. For example, retrofitting 50-year-old substations with IoT sensors may require costly custom engineering, while fragmented utility standards complicate interoperability. In emerging markets like India, where grids mix Soviet-era infrastructure with modern renewables, scalability challenges persist. Itron addresses these risks through modular, backward-compatible designs, such as its OpenWay Riva IoT meters, which integrate with legacy analog systems while supporting future upgrades. The company also runs pilot programs (e.g., Texas microgrid projects) to stress-test solutions in diverse environments before large-scale rollout. To ease adoption, Itron offers utility Grid Performance Contracts, sharing upfront costs in exchange for long-term efficiency savings. For behavioral resistance—like consumer distrust of demand-response programs—Itron invests in user education and transparent data governance, ensuring customers retain control over their energy usage.

Market Capture against alternatives

Itron faces fierce competition from low-cost hardware providers (e.g., Chinese smart meter giants) and legacy vendors like GE, which leverage long-standing utility relationships. Open-source platforms like Linux Foundation’s LF Energy further threaten Itron’s proprietary model by offering free, community-driven grid software. To counter this, Itron emphasizes differentiation through integration, positioning its end-to-end ecosystem (meters, software, cloud analytics) as a critical solution for utilities seeking simplicity. Strategic alliances with cloud giants (AWS, Azure) and EV charging networks (ChargePoint) expand its value proposition beyond hardware. Itron also targets underserved markets, such as Africa and Latin America, with cost-flexible pricing models (e.g., leasing smart meters as a service) to undercut regional competitors.

ESG assessment

Itron’s 2023 sustainability efforts underscore its commitment to driving environmental and social impact. Through advanced metering solutions, demand response programs, and prepayment technologies, the company helped customers avoid 6.8 million metric tons of greenhouse gas emissions, which is equivalent to removing 1.6 million gasoline-powered cars from the road annually. Beyond environmental innovation, Itron prioritizes its workforce and communities: 90% of employees report positive work experiences and intend to stay, while corporate philanthropy and educational outreach surpassed $1 million in contributions.

Internally, Itron has achieved significant strides in reducing its operational footprint, reducing Scope 1 and 2 emissions by 50% being five years ahead of schedule and certifying 88% of manufacturing facilities to ISO 14001 standards. The company also maintains rigorous governance, with one-third of its Board of Directors comprising women and 100% employee completion of Global Code of Conduct training. Ranked in MSCI’s “AA Leader” category and Sustainalytics’ “Low Risk” tier, Itron combines environmental accountability with ethical leadership, aligning its roadmap to achieve Net Zero emissions by 2050 while fostering trust and transparency across its operations.

Conclusion

The energy transition is not a distant trend but an urgent reality. Itron’s ability to marry resilience (modernizing grids), efficiency (AI-driven analytics), and sustainability (Net Zero roadmap) positions it as an indispensable partner for utilities and governments worldwide. While execution risks persist—particularly in scaling R&D and navigating geopolitical headwinds—Itron’s $4.7B backlog and sector-specific focus provide a robust foundation for long-term value creation. Investors betting on the smart grid revolution will find few companies better equipped to electrify the future than Itron.