Initial Report: JUMBO Group Ltd. (42R.SG), 83% 5-yr Potential Upside (EIP, Nicholas TAN)

Let's go big here at HOME (Singapore)!

LinkedIn | Nicholas TAN

Executive Summary

This report recommends a “Buy” on JUMBO Group Limited (SGX:42R) based on the following 4 investment theses:

Growing New Businesses To Diversify Revenue Streams Locally

Franchising As An Effective Overseas Expansion Strategy

Strong Competitive Advantages With Shareholder Alignment

Growing Middle-Class And Tourism In Asia, Amid Recovery From Pandemic

Company Overview

JUMBO Group Limited (“JUMBO” or “JUMBO Group'') is one of Singapore’s leading multi-dining concept F&B establishments. The Group operates and manages a network of restaurants in Singapore, the People’s Republic of China, and Taiwan. It maintains a portfolio of F&B brands – JUMBO Signatures, JUMBO Seafood, Mutiara Seafood, HACK IT, NG AH SIO Bak Kut Teh, Zui Teochew Cuisine, Chao Ting Pao Fan, Kok Kee Wonton Noodle, operates 3 Tsui Wah Hong Kong Style “Cha Chaan Teng'' outlets as a franchisee in Singapore and co-owns the Singapore Seafood Republic brand which has 3 outlets, operating under the franchise model in Japan. In addition, it sells packaged sauces and spice mixes through its lifestyle brand, Love, Afare, and offers catering services in Singapore. The company was founded in 1987 and is based in Singapore (JUMBO Group, 2022).

Stock Information

History

Business Segments

Revenue Segment by Countries

JUMBO Group operates outlets in Singapore, the PRC and Taiwan. The charts below illustrate the revenue breakdown by geographical location in FY2022 and FY2021.

Based on the charts, a large proportion of JUMBO’s revenue stem from its Singapore operations, followed by the People’s Republic of China (PRC) and Taiwan. JUMBO’s revenue from PRC decreased in FY22 due to the strict COVID-19 lockdowns, while that in Taiwan decreased due to the closure of JUMBO’s Taichung outlet. However, revenue from PRC is expected to grow and take a larger proportion of JUMBO’s total revenue from FY2023 due to the loosening of COVID-19 measures and pent-up demand from Chinese consumers.

Board of Directors & Key Management

The Board currently consists of 7 Directors, 3 of whom are independent. It is worth mentioning that Mr. Ang Kiam Meng is the spouse of Mdm. Tan Yong Chuan, Jacqueline and brother of Mrs. Christina Kong Chwee Huan.

Ownership Structure

Revenue Drivers

JUMBO Group’s multi-dining food concepts include (a) restaurants owned and operated by JUMBO, (b) restaurants operated by JUMBO as a franchisee (c) restaurants operated by joint ventures.

Owned & Operated

Restaurants owned and operated by JUMBO Group drive a significant part of revenue, with their bottom line directly impacting the Group’s financial performance. In particular, the Group's main brands - JUMBO Signatures, JUMBO Seafood, and Zui Teochew Cuisine - are driving significant revenue.

Operated by Franchisees

JUMBO expands its JUMBO Seafood and Ng Ah Sio Bak Kut Teh brands under a franchise model. For every franchisee’s outlet opened, JUMBO earns a one-off franchise income followed by recurring monthly royalty fees and sales of sauces and pastes from the Group to the franchisees.

Joint Ventures & Associates

In March 2018, JUMBO became a franchisee with Tsui Wah Holdings to bring the famous Hong Kong “Cha Chaan Teng” dining concept to Singapore. As of 2023, JUMBO Group operates 3 Tsui Wah outlets in Singapore - The Heeren, JEM & Jewel Changi.

The Group also co-owns 3 Singapore Seafood Republic outlets in Japan - Shinagawa, Ginza & Daimaru Umeda - with other Singapore-based seafood restaurants.

Cost Drivers

Several factors are identified to contribute to the Group’s rising operating costs. These cost drivers pose a significant challenge for JUMBO to remain competitive and maintain a sustainable profit margin.

Labour Cost

Due to the shortage of labour in Singapore’s F&B sector, many F&B businesses are forced to offer higher salaries to attract talents. The rise in labour cost is worsened by the Singapore Government's plan to raise the minimum qualifying salaries for Employment Pass (EP) and S-Pass holders. The trend of rising labour costs is also reported in other countries where JUMBO Group operates, such as Japan and China. Consequently, the shortage of local manpower and unfavourable foreign labour policy is expected to drive labour costs for JUMBO Group and other F&B businesses.

Cost Of Raw Materials & Consumables

The cost of raw materials and consumables has been rising as a result of commodities inflation. In particular, the price of rice, corn and wheat had increased relative to the pre-pandemic period. The price of fish and other seafood are also rising. This higher cost is attributed to various reasons, including undesirable weather conditions as well as rising labour and fuel costs (Neo, 2022).

Industry Outlook

Singapore

JUMBO Group focuses on three key market segments for its local businesses – (a) tourists, (b) business crowds and (c) locals.

Bullish View For Singapore’s Tourism Industry

The Singapore Tourism Board (STB) forecast a bullish outlook for the Singapore tourism industry, with International visitor arrivals to Singapore expected to hit 12 million to 14 million in 2023 and achieve full tourism recovery by 2024 (Raguraman, 2023). Tourism receipts are also anticipated to climb to $18 billion to $21 billion. While the numbers remain a fraction of pre-Covid-19 tourism performance figures, it is a significant improvement from the pandemic period of 2020-2021. Some driving factors for the tourism industry include no new Covid-19 variant of concern, China’s continued reopening and international flight capacities continuing to be ramped up (Raguraman, 2023). The tourism recovery in 2023 will be further fueled by a $110 million injection – part of the $500 million set aside by the Government to boost the industry – for revitalising business and leisure activities over 2023 and 2024. Furthermore, STB also opined that Inflationary pressures will have a relatively small impact on inbound tourism in 2023, especially for Singapore’s key markets, such as Southeast Asia countries and China (Raguraman, 2023).

Resumption Of Dining-In Options With No Limit

The Singapore Government lifted most of the COVID-19 restrictions, effective from 26 April 2022. Specifically, the removal of social group size limits and safe distancing requirements will effectively increase JUMBO’s total capacity, and hence increase the revenue generating potential of its local outlets. The 100% return of the workforce offers JUMBO even more optimism as the outlets located within the CBD district have the capacity to cater to business crowds. Dispensing with the capacity limits for events will also likely help boost volumes for JUMBO’s events and catering business.

China

The outlook for China's market is also cautiously optimistic after the Chinese government’s easing of COVID-19 policies at the end of December 2022 and the subsequent reopening of travel borders.

A Cautiously Optimistic View

Despite the promising upturn in macroeconomic and consumption indicators during the first half of 2023, the report maintains a "cautious optimism" view regarding China's consumption recovery in the near future.

An assessment conducted by McKinsey in July 2023 reveals a softer outlook among consumers and businesses concerning China's economic resurgence. An informal exchange with a restaurant manager located in China also indicates that the F&B industry within China has been performing poorly since April.

Nevertheless, the prevailing economic and consumption data for the first half of 2023 have displayed a favourable trajectory, underscoring an optimistic perspective. Notably, food service sales, encompassing restaurants and nightlife establishments, have demonstrated a double-digit growth. A survey administered to Chinese consumers in May by McKinsey's ConsumerWise insights team also revealed that 68% of respondents expressed intentions to indulge themselves. Unsurprisingly, travel and dining rank top for categories Chinese consumers intend to spend on (Zipser, 2023).

A surge in domestic travel to tier-1 cities and popular tourist destinations is also fueling China's tourism industry, effectively approaching pre-COVID levels. Despite elevated costs and visa-related challenges, international travel is also rapidly recovering. These trends are anticipated to encourage greater footfall, particularly in tourist attraction sites such as the Universal Beijing Resort, where a JUMBO outlet is situated.

Furthermore, recent simulations from the McKinsey Global Institute (Zipser, 2023) posit a projection of 50 million additional households to the upper-middle-class by 2025, which constitutes the main urban household demographic. This segment has the potential to stimulate consumption growth and shape an increasingly consumption-driven economy in China.

Considering these positive indicators, and despite the prevailing challenges, the report upholds a positive medium-term outlook concerning China's consumption landscape.

Taiwan

Positive outlook is also observed in Taiwan due to the ease of pandemic controls and greater domestic consumption.

End of COVID-19 Controls & Higher Domestic Consumption

Similarly, the easing of COVID-19 controls has boosted Taiwan's retail and food & beverage sectors. According to Taiwan’s Ministry of Economic Affairs (MOEA), January-February revenues in the food & beverage sector rose 20.6% relative to the previous year to reach a record NT$178.2 billion, indicating a positive growth outlook for the year. Also riding on the waves of higher domestic consumption, restaurants in Taiwan recorded a sales rise by 21.4 percent to NT$152.0 billion between January and February.

Change In Perception Of Franchising

In addition to the positives across JUMBO’s market and geographical segments, there are also changes in the perception of franchising as an expansion strategy that supported JUMBO’s growth in the short run.

Pandemic accelerates franchising in Asia

The concept of franchising has gained momentum in Asia during the pandemic as a means of controlling operating expenses and bottom-line management. The savings stems from management fees, manpower costs, lower operating expenses and other income sources. As an asset-light business model, franchising is expected to continue growing in Asia. This change in perception of franchising enhances the ease of JUMBO’s expansion strategy into other Asian countries.

Competitor Positioning

Porter’s 5 Forces

Threat of Substitutes – Low

The JUMBO brand name has established itself as one of the key providers of authentic Singaporean cuisine not only in Singapore but in other markets like China. Even though alternative seafood outlets serving similar cuisine have sprung up, JUMBO’s strong brand equity has given it a formidable economic moat to attract customers. Operating in the industry for 31 years, its well-established branding enables it to retain a loyal local customer base.

Bargaining Power of Suppliers – Low

JUMBO’s suppliers of raw materials, primarily seafood, come from across Southeast Asia, such as Malaysia, Indonesia and The Philippines, where the industry is fragmented with numerous suppliers. Prices are set by market forces and no individual suppliers are unable to significantly influence prices nor control a large market share.

Threat of New Entrants – Medium

While the industry has low barriers to entry, it is costly for new entrants to match the size and scale of JUMBO’s operations. Competitors would also need to build up a brand image to rival that of JUMBO’s, compete for manpower in Singapore’s tight labour market and incur high rents to secure strategic locations. Hence, new entrants are unlikely to gain significant market share in the short term. However, JUMBO should beware established international brands that are expanding into Singapore, as these popular overseas brands have the ability to create a lot of “hype” and capture market share swiftly.

Competition Within the Industry – High

Given Singapore’s “Food Paradise” status, consumers are spoilt for choice when it comes to dining options. With the plethora of cuisines available, industry players seek to differentiate themselves by providing unique services and products (e.g. HDL’s exemplary service or Salted Egg Yolk food items). Major established players have developed their niches and have become well known for their speciality cuisine. JUMBO needs to consistently innovate to better cater to customers needs, while pursuing a diversification strategy by developing other brands in its stable.

Bargaining Power of Buyers - Medium

With its brand being synonymous with chilli crab, an iconic dish in Singapore, JUMBO has greater control over pricing. However, with other industry players, such as No Signboard Seafood, becoming more established and offering similar dining experiences, these substitutes confer consumers with some degree of bargaining power.

Economic Moat

The strong industry recognition and expanding customer base accumulated over the years confers JUMBO Group with a strong brand equity. By leveraging this formidable economic moat confers JUMBO with the ability to attract and retain customers. Specifically, its JUMBO Seafood brand is associated with Singapore’s iconic dish of Chili Crab and has attracted many locals and tourists to visit their outlets both locally and overseas. Furthermore, its consistently high standard of food and services also develops an extensive base of recurring customers for JUMBO.

To some extent, JUMBO Group also achieves economies of scale by operating on a large and efficient scale through its central kitchen. JUMBO Group established a central kitchen in 2008 to uphold the consistency and quality of their signature dishes (which reinforces their brand equity). Maintaining a central production facility also enables JUMBO to increase productivity and lower cost through centralised production and standardisation of operation processes. Achieving economies of scale is particularly important for restaurant operators as there are low profit margins.

Financial Analysis

Profitability

Revenue

JUMBO Group’s revenue and net income has gradually increased since easing of COVID-19 restrictions in the later half of FY2022, reaching $85.9 Million and a net income of $7.9 million in the first half of FY2023. These results show that JUMBO is on track for earnings to recover to pre-Covid levels in the near future.

Gross Profit Margin

Despite rising input costs, JUMBO still maintains a relatively gross profit margin within a range of 62.90% to 64.90%. This is partly attributed to the Group’s operating leverage due to higher customer volume as well as price hikes in tandem with higher demand.

Operating & Free Cash Flow

JUMBO’s operations are generally cash-generative, producing an operating cash flow of approximately S$4.7m in FY2021 and S$20.5m in FY2022, and S$23.5m in the first half of FY2023. Free cash flows are negative in FY 2020 and FY2021 due to the pandemic implications and investments in more outlets and brands.

Liquidity

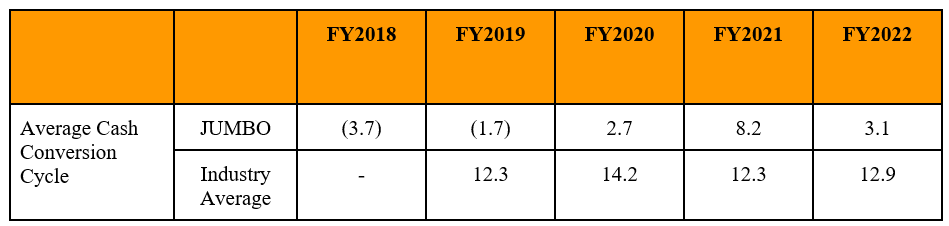

JUMBO Group maintains a shorter average cash conversion cycle compared to the industry average of the restaurant industry in Asia. This means that JUMBO takes a shorter time to convert its investments in inventory to cash, suggesting strong management effectiveness.

Inventory Turnover

As seen in the table above, JUMBO maintains a consistently higher inventory turnover ratio compared to its peers in the restaurant industry in Asia. This indicates that JUMBO is more efficient in selling its products and generating a healthy amount of revenue than its competitors.

Investment Theses

This report recommends a "Buy" on JUMBO Group (SGX:42R) based on the following 6 investment theses:

Growing New Businesses To Diversify Revenue Streams Locally

This report opined that JUMBO Group has significant potential to expand its market reach and boost its revenues and margins by tapping into new customer segments and embracing innovative dining concepts.

In addition to its primary seafood business, JUMBO Group boasts a diverse portfolio of different brands, offering a variety of dining experiences and cuisines. By branching out beyond its core seafood restaurants, JUMBO Group can attract a broader customer base and cater to a larger audience. For example, the Group features Cantonese and Teochew dining concepts through its flagship brands like Chui Huay Lim, Zui Yu Xuan, Chao Ting, and Tsui Wah, effectively appealing to a wider group of consumers. Additionally, the Group's premium dining concept at Marina Bay Sands, JUMBO Signatures, has proven successful. This diversification is exemplified by the recent opening of the Halal-certified seafood restaurant, Mutiara Seafood, in 2023, catering specifically to the Muslim community and contributing to JUMBO's overall growth.

Furthermore, JUMBO has successfully diversified into the local mass market with its Kok Kee Wonton Noodle and Lau Lim Mee Pok outlets. This expansion strengthens JUMBO's presence in the local F&B scene, offering day-to-day comfort food options through its "hawker" brands. While hawker businesses may have narrower profit margins than full-service dine-in restaurants, the high footfall and fast turnover of these concepts can still maintain profitability. The increased number of Kok Kee Wonton Noodle stalls (to 8) since JUMBO's acquisition in 2020 is a testament to this strategy, and the Group plans to continue expanding these brands locally and internationally through its successful franchising track record (JUMBO Group, 2021).

Furthermore, JUMBO Group's catering arm, JUMBO Catering, provides services for private functions, business conventions, and corporate events. With large order sizes, catering orders can be highly lucrative, and the potential for recurring corporate customers further secures a sustainable revenue stream. Catering also serves as a form of marketing, indirectly driving in-store sales by introducing potential new customers to the restaurant's products.

In addition to its restaurant ventures, JUMBO Group operates a lifestyle brand called Love, Afare, which commercialises a range of products, including packaged sauces, spice mixes, snacks, tea, and merchandise, showcasing Singapore's authentic food flavours and culture. This lifestyle brand not only attracts tourists but also caters to individuals who prefer cooking at home.

In summary, JUMBO Group's strategic expansion into new dining concepts, the local F&B scene, catering services, and lifestyle products all contribute to its potential for top-line growth and sustained profitability in the ever-evolving food industry.

Franchising As An Effective Overseas Expansion Strategy

Additionally, the report views JUMBO Group's adoption of the franchising model as a highly effective expansion strategy which expands its market presence while driving revenue growth.

JUMBO Group has successfully implemented franchising for its JUMBO Seafood and NG AH SIO Bak Kut Teh brands. This approach not only minimises costs and risks associated with owning outlets but also enables the company to achieve broader geographic coverage and market penetration in a shorter time frame. A prime example of this model's effectiveness is the rapid global expansion of Haidilao (2017), which also employed franchising as a means of growth.

Moreover, the franchising business model proves to be less capital-intensive, allowing JUMBO Group to allocate resources more efficiently across various business functions and maintain a more liquid position.

Beyond contributing to top-line growth, franchising diversifies JUMBO Group's revenue streams by earning upfront franchise fees and a percentage of sales from franchisees. This diversification reduces reliance on company-owned outlets, creating a more stable and sustainable revenue base.

Expanding overseas through franchising is particularly advantageous as franchisees can leverage their local market knowledge and understanding, enabling JUMBO Group to tailor its offerings to specific regional preferences and cultural nuances. For instance, a JUMBO-owned outlet in Xi'an, China, which opened in May 2018, saw a larger-than-normal decline in sales in the months following its opening (The Fifth Person, 2020). After conducting a study of consumer tastes in the region, JUMBO concluded that their signature chilli crab was too sweet for the liking of many locals. While the outlet did not alter the recipe much to maintain the integrity of the dish, they switched to promoting other savoury dishes like the black pepper crab. Such cases highlighted the importance of catering to local tastes. Under the franchise model, such incidents can be mitigated as franchisees are better equipped to adapt the menu, marketing, and customer experience to suit the target market's preferences.

It is also noteworthy that JUMBO Group is not the first Singapore-based F&B company to adopt franchising as an expansion strategy. Other successful examples include Crystal Jade (Crystal Jade, n.d.) and Ya Kun Kaya Toast (WIPO, 2021), which have expanded into various Asian countries through franchising.

The effectiveness of JUMBO's franchise strategy is evident in the addition of six JUMBO Seafood franchised outlets since the start of FY 2022, bringing the total to 23 outlets across 12 Asian cities (JUMBO Group, 2023b). The company intends to further expand the JUMBO Seafood footprint in Asia, capitalising on its accolades such as winning the Franchising and Licensing Awards (FLA Awards) for International Franchisor of the Year and Franchisor of the Year. NG AH SIO Bak Kut Teh also received recognition with FLA's Promising Franchisor of the Year and Innovation Business awards.

While franchise revenue currently constitutes a smaller proportion of JUMBO's overall revenue, it is anticipated to grow as more franchise outlets open across Asian countries.

Strong Competitive Advantages With Shareholder Alignment

The report also believes that JUMBO Group possesses strong competitive advantages, supported by strong shareholder alignment, which will fuel increased sales and bolster confidence in the company's future performance.

JUMBO Group has successfully established a strong brand presence through its flagship brand, JUMBO Seafood. This Singapore-based Chinese seafood restaurant is renowned for its exceptional food quality and dining experience. With a well-established market position in Singapore and growing recognition internationally, JUMBO Group is well-positioned to leverage its brand equity, attracting inquisitive tourists and individuals to visit its outlets and driving revenue growth.

Another key factor contributing to JUMBO Group's competitive edge is its ability to continually innovate and offer new menu items in the highly competitive food and beverage industry. The Group's in-house R&D kitchen has been remarkably successful in creating new customer favourites, exemplified by innovative Chili crab items such as Baked Jumbo Chilli Crab Puffs, Pan-fried Jumbo Chilli Crab Buns, and Chilli Crab Meat Sauce With Sliced Fried Mantou, as well as exclusive dishes like Cod Fish Otah In Coconut and Boston Lobster Fragrant Rice In Seafood Broth (Wong Ah Yoke, 2019). By introducing fresh and exciting dishes and catering to evolving tastes, JUMBO Group can not only attract new customers but also foster greater customer loyalty, leading to increased sales.

Furthermore, these competitive advantages are reinforced by significant shareholder alignment. Mr. Ang Hong Nam, the founder of JUMBO, holds a 1.6% direct stake and owns 45.5% through a holding company, JBO Pte Ltd. Additionally, his son, Mr. Ang Kiam Meng, is the Group's CEO and owns 1.6% of JUMBO Group Limited. Apart from mitigating the principal-agent problem, this strong insider ownership serves as a clear indicator of management's unwavering belief in the company's growth potential. This belief is further affirmed by JUMBO Group's recent share repurchase announcement.

In conclusion, the combination of a well-established brand presence, continuous innovation, and significant shareholder alignment bodes well for JUMBO Group's ability to generate increased sales and instil confidence in the company's future performance.

Growing Middle-Class And Tourism In Asia, Amid Recovery From Pandemic

Lastly, this report argues that the favourable macroeconomic conditions in Asia offer JUMBO Group numerous potential growth opportunities.

Over the past two decades, sustained economic growth in Asia has resulted in increased purchasing power and disposable income for consumers, leading to the rise of a thriving middle-class population. With a growing percentage of affluent consumers, the Asian middle-class is now driving demand and influencing global consumption patterns across various sectors, including travel and dining. This presents a valuable opportunity for JUMBO Group to tap into the expanding middle-class population and drive higher consumption volumes in both their local and overseas outlets.

In particular, the burgeoning middle class in China is poised to contribute to higher revenue for the Group. According to a simulation by McKinsey Global Institute (Zipser, 2023), 50 million additional households will join China’s upper-middle-class by 2025. The 2023 China's Future Consumer Report by the Boston Consulting Group (Chen et al., 2023) also projected 80 million people added to the middle and upper classes from 2022 to 2030. By establishing a strong market presence, JUMBO Group can benefit from increased revenue streams and economies of scale.

The expanding middle-class demographics in other emerging Asian markets also offer additional revenue potential for JUMBO Group through its franchise model. Under this model, the Group derives 3-5% of franchisees' revenue, leading to higher royalty income and improved gross margins with an upswing in dine-in customers. The desirable macroeconomic environment further creates opportunities for JUMBO Group to generate more revenue from increasing numbers of franchise outlets.

Moreover, revenue growth is expected to be further fueled by the global recovery from the COVID-19 pandemic. As travel borders and international routes open up, JUMBO Group will experience increased sales in their Singapore outlets, driven by higher tourist volumes and local demand.

With the relaxation of domestic pandemic restrictions in China, JUMBO's outlets in the country are anticipated to drive more sales and continue on the path to recovery as Chinese consumers release their pent-up demand after more than two years of lockdown. Specifically, JUMBO Seafood's outlet in Universal Beijing Resort, a theme park and entertainment complex, is expected to boost sales amid higher footfall from theme park visitors.

Therefore, this report strongly believes that the current favourable macroeconomic environment in Asia will greatly support JUMBO Group's growth by bolstering sales and profitability.

Valuation

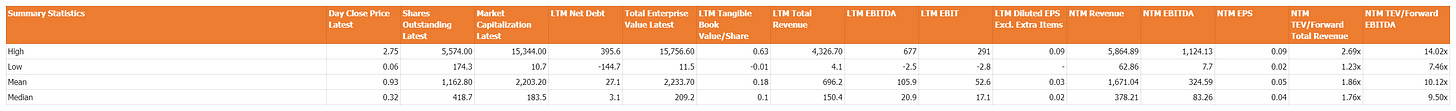

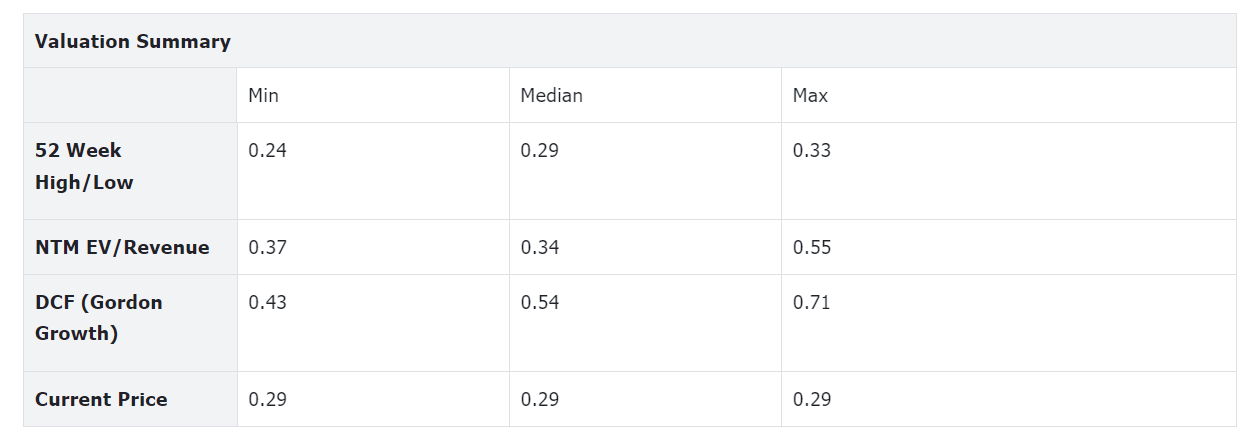

Relative Valuation

DCF Valuation

JUMBO Group's current stock price stands at SGD$0.29. Our Discounted Cash Flow (DCF) model projects that JUMBO's share value will increase to $0.38 in 3 years and $0.53 in 5 years, accompanied by an internal rate of return (IRR) of 9.72% and 12.99% respectively.

While it's evident that JUMBO's share price experienced declines in the pre-COVID era, this was primarily attributed to the company's ambitious expansion strategy. JUMBO pursued growth through organic expansion, strategic mergers & acquisitions, and enhancing its infrastructure & capabilities. One notable example was the acquisition of the Kok Kee Wonton Noodle brand in 2020 for $2.1 million. These growth investments caused share prices to dip as JUMBO paid a premium price for its expansion endeavours.

In the post-pandemic period, the decision to suspend the dividend payout policy may have contributed to the decline in share price. While it is uncertain when Jumbo's management will resume their pre-pandemic 70% dividend payout ratio, which will result in a dividend yield of 45, this report is of the view that the cancellation of JUMBO Group’s dividend payout policy is temporary. We believe that JUMBO Group is seeking to conserve liquidity to support working capital requirements, fuel further growth investments, and undertake developments in both local and overseas markets, including the PRC and Taiwan. The company has indicated that once it returns to profitability in the near future, the board of directors will consider reinstating dividend recommendations to shareholders. As a result, the report maintains a positive outlook, predicting a rise in JUMBO's share price moving forward.

Another critical consideration lies in the scalability of JUMBO Group's flagship brands, notably JUMBO Seafood. Chinese restaurants, including JUMBO Seafood, are notoriously challenging to scale due to their reliance on skilled chefs to ensure consistency in taste, unlike fast-food chains that can replicate their offerings easily. Additionally, the long tails of other brands within the Group, each with only one store, seems to affirm the challenge of scalability.

Recognizing the importance of learning and development to enhance scalability, JUMBO Group has taken significant effort in establishing a comprehensive series of training and career development programs. These initiatives aim to attract and retain top talent that could support the company's growth trajectory. The Group is currently undergoing a restructuring of its training and career development processes, with the expectation of providing a full range of training programs by FY2024. These programs will cover diverse areas, including hard skills, soft skills, language proficiency, and leadership capabilities. JUMBO Group has also embraced digital technologies to streamline its learning initiatives. The development of its proprietary learning management system has provided users with standardised training materials for crucial courses, such as "Restaurant Operations Full Service". This platform is set to be made available to all service teams at their Singapore full-service outlets in Q1 of FY2023, enhancing operational consistency and efficiency. Furthermore, JUMBO's efforts to enhance scalability extend to the implementation of the "Train-the-Trainer" Program launched in Q3 FY2022. This program identifies and nurtures potential outlet trainers. Successful candidates from this course are entrusted to become outlet trainers, enhancing the transfer of knowledge and expertise across the organisation. Notably, JUMBO Group's emphasis on talent development was recognized during the 2019 National Day Rally speech by Prime Minister Lee Hsien Loong. The company was cited as an example of success in training and developing local talent, leading to growth and global expansion of local companies. We believe that JUMBO Group's emphasis on talent development will play a significant role in mitigating this industry-wide challenge and supporting the company's continued growth in the future.

Risks & Mitigation

ESG Consideration & Assessment

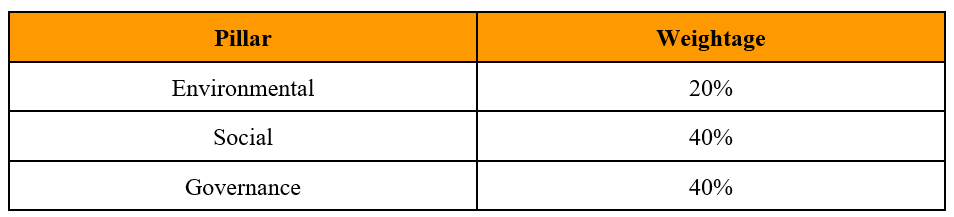

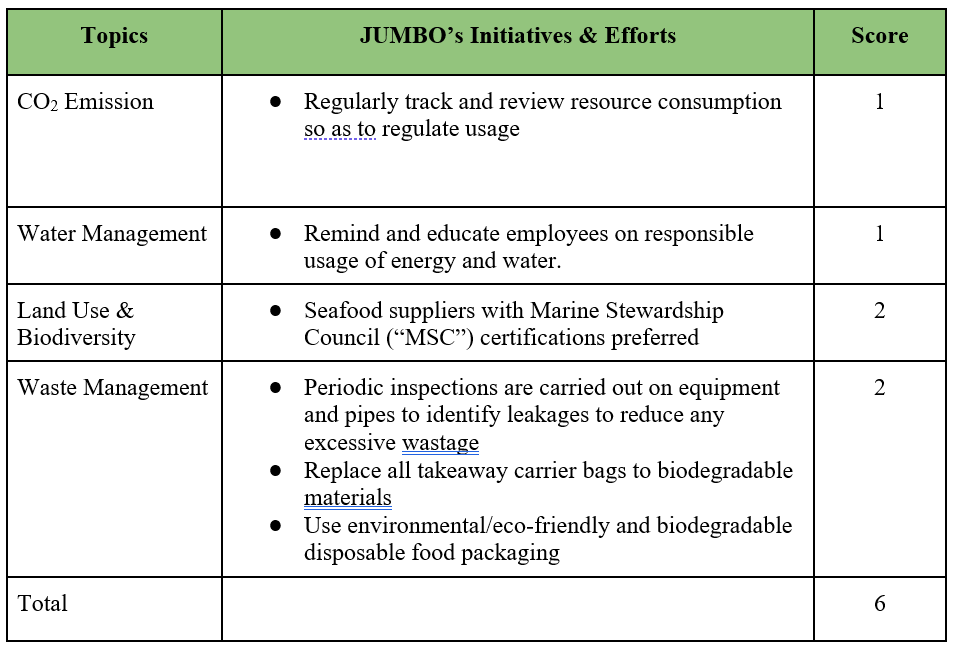

The following weighted scoring table is used to calculate JUMBO’s ESG performance:

The various topics in the Environment, Social and Governance pillars are rated on a scale of 1 to 3 (Refer to Appendix for rubrics). The scores from the individual topics will then be added up together to form the pillar score. A final score will be tabulated by summing the values of the ESG pillar scores multiplied by their respective weightages.

Environmental Pillar

Social Pillar

Governance Pillar

Overall Score

Environment Pillar = 6 (out of 12)

Social Pillar = 20 (out of 27)

Governance Pillar = 7 (out of 9)

Total Score = 12*20% + 27*40% + 9*40%

= 16.8

JUMBO’s ESG Score = 6*20% + 20*40% + 7*40%

= 12 or 71.4%

Based on the scoring system, JUMBO Group is performing relatively well in terms of ESG. The Group is also proactively seeking ways to mitigate risks while capturing opportunities in relation to ESG through initiatives and programs.

Conclusion:

In summary, this memo recommends a “buy” on JUMBO Group (SGX:42R) based on 4 investment theses. The target price for JUMBO in 3 and 5 years is computed to be $0.38 and $0.53 respectively. From an ESG perspective, JUMBO is also performing relatively well, scoring 71.4% based on the scoring system.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

Reference:

Chen, C., Li, S., Li, F., & Chen, B. (2023). The next chapter in China’s consumer story. BCG Global. https://www.bcg.com/publications/2023/next-chapter-in-chinese-consumer-market

Crystal Jade. (n.d.). HERITAGE. https://vn.crystaljade.com/our-heritage/

Focus Taiwan CNA English News. (2023, March 25). Retail, food & beverage sales boosted by eased COVID-19 controls. Focus Taiwan CNA English News. https://focustaiwan.tw/business/202303250009

Hamdi, R. (2023). Pandemic accelerates franchising in Asia. www.hotelinvestmenttoday.com. https://www.hotelinvestmenttoday.com/Development/Franchising/Pandemic-accelerates-franchising-in-Asia

JUMBO Group. (2021, January 29). 6th ANNUAL GENERAL MEETING [Press release]. https://jumbogroup.listedcompany.com/newsroom/20210129_175235_42R_ZO6PIQ7HLI7YO6VI.2.pdf

JUMBO Group. (2022, April 5). JUMBO OPENS TWO MORE KOK KEE WONTON NOODLE STALLS, BRINGING NETWORK IN SINGAPORE TO EIGHT OUTLETS [Press release]. https://jumbogroup.listedcompany.com/newsroom/20220405_182913_42R_RD6V4E1ZR0NUGP49.1.pdf

JUMBO Group. (2022). ANNUAL REPORT 2022. JUMBO Group. https://ir.listedcompany.com/tracker.pl?type=5&id=263425&m=696e7f3ad4551ba547be7d22b7d358fa55c3ba29b7c1ffc01bc03c2f0249fa43&redirect=https%3A%2F%2Fjumbogroup.listedcompany.com%2Fnewsroom%2F20230116_235634_42R_ATSEQO9BUQQB8GW1.1.pdf

JUMBO Group. (2023a, March 6). JUMBO GROUP OPENS ITS FIRST HALAL SEAFOOD RESTAURANT, MUTIARA SEAFOOD, AT WISMA GEYLANG SERA [Press release]. https://jumbogroup.listedcompany.com/news.html/id/2429869

JUMBO Group. (2023b). Sustainability Report 2022 - Dawn Of A New Era. In JUMBO Group. https://jumbogroup.listedcompany.com/newsroom/20230228_200119_42R_JL70LK9S6T8CEJSD.1.pdf

Neo, C. C. (2022, November 19). Why fish in Singapore is more expensive, and the prospect of prices remaining high. Channel News Asia. https://www.channelnewsasia.com/cna-insider/why-fish-singapore-expensive-prices-malaysia-seafood-farms-3061431

Quek, E. (2020, November 28). Jumbo Group to acquire Kok Kee Wanton Noodle for $2.1m. The Straits Times. https://www.straitstimes.com/life/food/jumbo-group-to-acquire-kok-kee-wanton-noodle-for-21m

Raguraman, A. (2023b, January 17). S’pore’s 2023 visitor arrivals to double to over 12m, full tourism recovery expected by 2024: STB. The Straits Times. https://www.straitstimes.com/singapore/consumer/s-pore-s-2023-visitor-arrivals-to-double-to-12-14m-full-tourism-recovery-expected-by-2024-stb

The Fifth Person. (2020, October 20). 10 Things I Learnt From The 2019 JUMBO Group AGM (SGX: 42R). Seedly. https://blog.seedly.sg/how-to-invest-in-jumbo-group-agm-sgx-42r/

WIPO. (2021, August 25). From a lone stall to international success. World Intellectual Property Organisation. https://www.wipo.int/ipadvantage/en/details.jsp?id=2573

Wong Ah Yoke. (2019, January 26). Chilli crab comes as dim sum at Jumbo Seafood’s Ion Orchard outlet. The Straits Times. https://www.straitstimes.com/lifestyle/food/chilli-crab-comes-as-dim-sum-at-jumbo-seafoods-ion-orchard-outlet

Zipser, D. (2023). China Brief: The Return of the Chinese Consumer? McKinsey & Company. https://www.mckinsey.com/cn/our-insights/our-insights/the-return-of-the-chinese-consumer

Zipser, D. (2023). China consumption: Still cautiously optimistic? McKinsey & Company. https://www.mckinsey.com/cn/our-insights/our-insights/china-consumption-still-cautiously-optimistic

Appendix:

Rating Rubric for ESG Rating Score