Initial Report: Kaspi.kz (NASDAQ: KSPI), 117%% 5-yr Potential Upside (EIP, Dean Tay)

Dean presents a "BUY" recommendation based on Kaspi's fundamental strengths and long-term growth trajectory.

LinkedIn: Dean Tay

Executive Summary

I am issuing a strong "BUY" recommendation for Kaspi.kz, with a bullish outlook projecting a 68% upside over the next three years and an even more impressive 117% upside over a five-year horizon. This recommendation is rooted in Kaspi's demonstrated strengths: a robust business model, an exceptional management team, and attractive valuation metrics that present a compelling investment case.

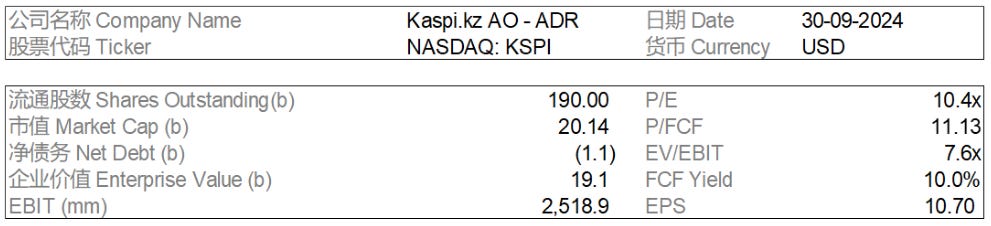

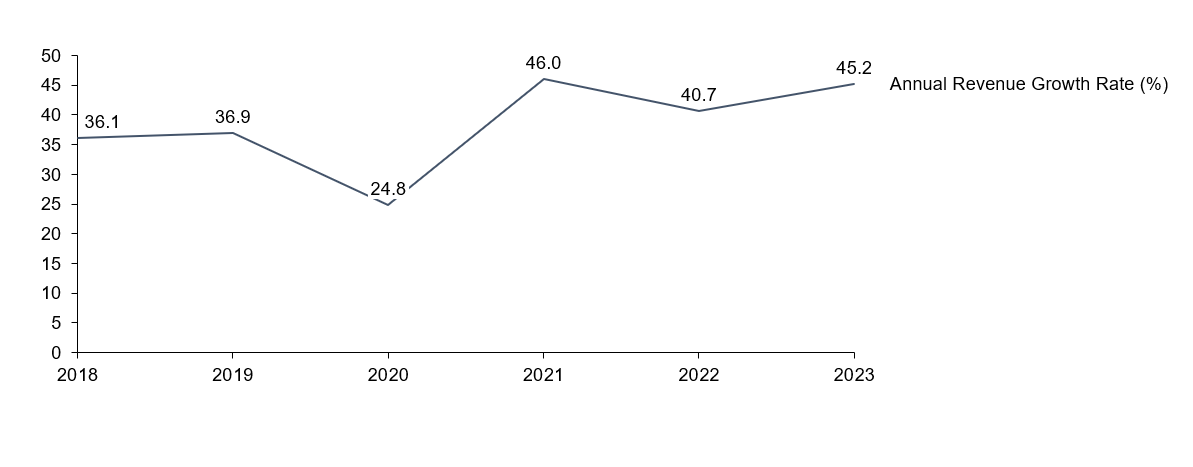

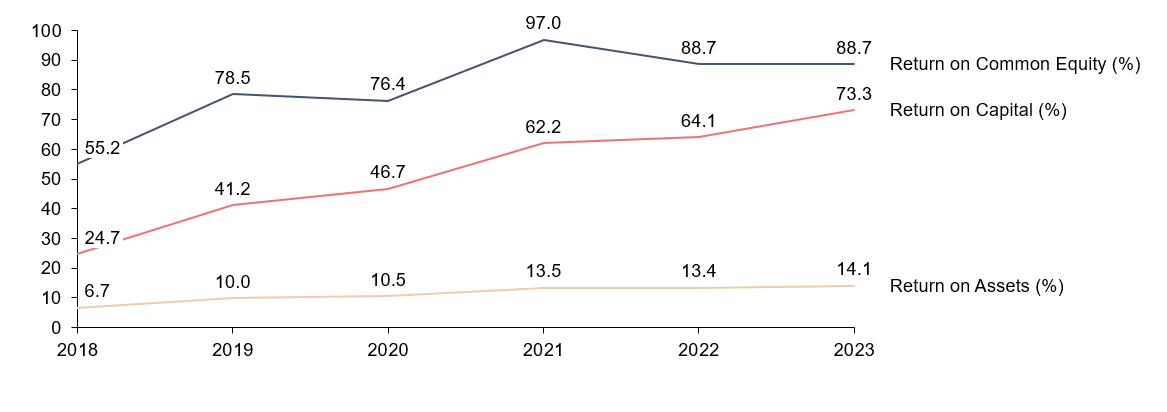

Kaspi stands out in the market with its rare combination of high growth, exceeding 30% year-over-year, coupled with outstanding profitability, boasting net income margins above 40%, resulting in an ROCE of 88.63% in FY23. Despite these strong fundamentals, the company is trading at a reasonable 10.4x price-to-earnings ratio, suggesting it may be undervalued at current levels.

Furthermore, the recent 17% decline in Kaspi's stock price, triggered by a short report, has created an appealing entry point for long-term investors. While I acknowledge that short-term market sentiment may remain cautious, I believe the market's reaction has been overly pessimistic. The management team's proven ability to navigate past crises effectively bolsters my confidence in their capacity to address current challenges and steer the company towards continued success.

Investors should be aware of potential near-term headwinds, including an expected deceleration in growth for the third quarter of 2024 and the possibility of lingering negative sentiment in the short term. However, I firmly believe that Kaspi's fundamental strengths and long-term growth trajectory far outweigh these temporary concerns.

Company Overview

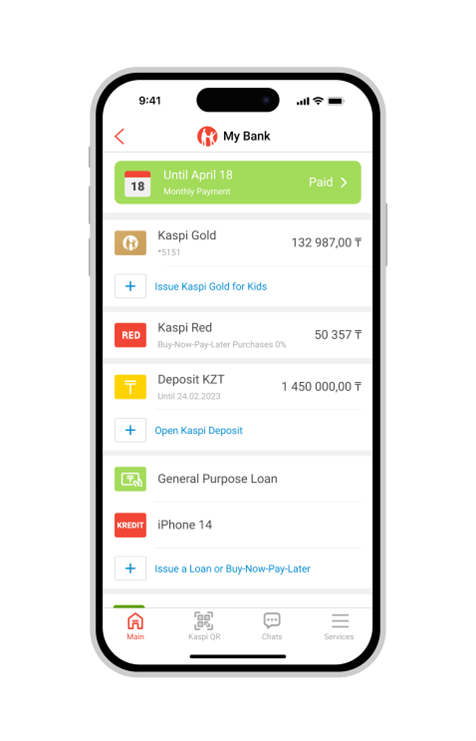

Kaspi.kz is a Kazakhstan-based fintech company that combines multiple services such as e-commerce, payments, lending and government services into one Super App platform.

Source: Kaspi Annual Report 2023

History

Kaspi.kz, Kazakhstan's largest fintech company, began its journey in 2002 when Vyacheslav Kim acquired a small bank called Kaspiyskiy. Initially, Kaspi operated as a traditional bank focusing on corporate clients and small-to-medium enterprises (SMEs). During Kazakhstan's economic boom in the early 2000s, driven by high oil prices, global banks were eager to invest in emerging markets, and Kaspi was poised to benefit. However, the 2008 global financial crisis changed the landscape dramatically.

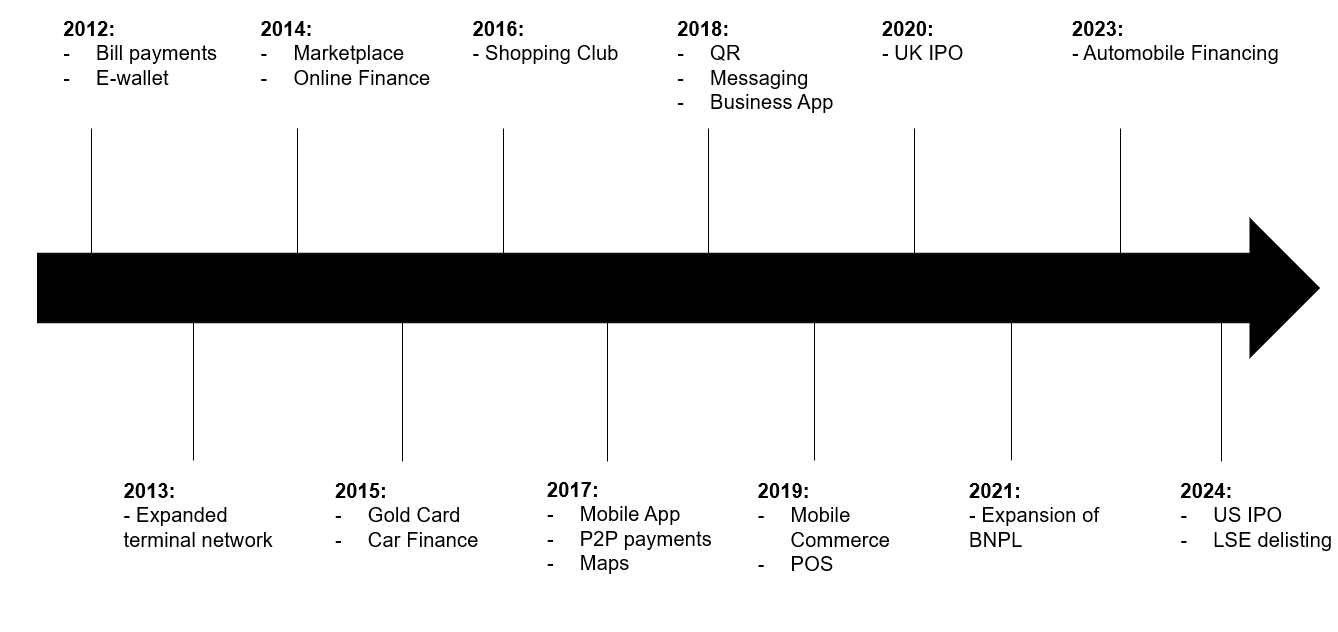

Under the leadership of Kim and CEO Mikheil Lomtadze, Kaspi pivoted away from commercial lending, recognizing an opportunity to focus on retail banking. This shift marked the beginning of a strategic transformation. The company’s first major move was launching a mass-market credit card business in 2008, followed by the introduction of digital products such as an online bill payment system in 2012, an online marketplace in 2014, and mobile applications in 2017.

Kaspi's transition from a traditional bank to a digital-first company was driven by an innovative approach to customer service. The leadership team re-engineered the company with cross-functional teams responsible for creating products that customers genuinely needed and loved. This customer-centric focus led to a series of bold decisions, such as exiting commercial loans and cutting product lines that weren’t popular, including a credit card product that had amassed over 1 million users.

Over time, Kaspi evolved into a "super app" that now offers a wide array of financial and commerce services. The company's ecosystem includes consumer loans, e-commerce, payments, and peer-to-peer mobile transactions. Kaspi’s transformation has made it a key player in Kazakhstan's fintech landscape, known for its speed, simplicity, and innovation in digital financial services.

Kaspi's product timeline can be summarised in the diagram below:

Corporate Structure

Below outlines the structure of Kaspi.kz:

Source: Kaspi

Operating Segments

Kaspi.kz offers a range of services in Kazakhstan, focusing on payments, marketplace, and fintech solutions for both consumers and merchants. It operates through three main segments:

Payments Platform: Facilitates transactions between customers and merchants. It includes shopping transactions, bill payments, and peer-to-peer transfers. Merchants can accept payments online and in-store, issue invoices, pay suppliers, and track turnover. Proprietary data helps inform business decisions. This segment contributes to 25% of total revenue and 36% of net income as of Dec 2023.

Marketplace Platform: Connects merchants and consumers both online and offline. It supports an omni-channel strategy to boost merchant sales, allowing consumers to purchase products and services anytime with free delivery. Kaspi Travel offers bookings for flights, holidays, and rail tickets. The platform enhances sales by integrating payments, fintech products, advertising, and delivery services. This segment contributes to 53% of total revenue and 35% of net income as of Dec 2023.

Fintech Platform: Provides consumers with buy now, pay later (BNPL) options, financing, and savings products. Merchants receive finance services through super apps like the Kaspi.kz Super app. This segment also covers banking, asset management, real estate, payment processing, online travel, and information services. This segment contributes to 23% of total revenue and 29% of net income as of Dec 2023.

The company also has a 4th segment: government services which do not contribute to revenue, but plays a significant role in customer acquisition and retention.

Payment Infrastructure and Financial Services

The platform connects the company's customers, comprising of both consumers and merchants, to facilitate cashless, digital payment transactions. Payments is Kaspi˖'s most profitable and second fastest growing business segment.

Source: Kaspi

Kaspi's payment ecosystem has demonstrated remarkable growth across key metrics, underscoring its expanding market dominance. The company's Total Payment Volume (TPV) has experienced substantial year-over-year increases at a CAGR of 69.4% from 2019 to 2023, reflecting the growing adoption and usage of Kaspi's payment solutions. Kaspi's revenue-generating TPV represented approximately 58% of all transactions that were conducted in Kazakhstan through mobile devices and the internet.

Source: Kaspi

This surge in TPV is closely tied to the impressive growth in both active consumers and merchants within the Kaspi network with a CAGR of 27.4% and 141.4% from 2019 to 2023.

Key products and services in the payments segment include:

Consumer-facing

P2P payments - enables consumers to transfer and receive money from other consumers instantly (similar to Paynow/Paylah in Singapore, and WeChat in China)

Kaspi QR technology - enabling end-to-end payments functionality between consumers and merchants using the Kaspi.kz and Kaspi Pay Super Apps, without the need for a card

Source: Kaspi

Kaspi Gold - a digital account and pre-paid debit card that consumers use to make everyday transactions in-store and online with Kaspi QR.

This is used predominantly for payments with merchants which do not have Kaspi Pay or for overseas transactions) that our consumers can use to pay for purchases online and in-store.

Consumers can top up Kaspi Gold through (i) the Kaspi.kz Super App from any Mastercard/Visa card, (ii) its network of Payment Kiosks and ATMs, or (iii) automatically through payroll systems

Source: Kaspi

Bill payments - enables consumers to pay recurring bills through the Kaspi.kz Super App, commission-free for services such as mobile, utilities, public transportation, internet and cable TV, education, health and beauty, financial services and taxes

Source: Kaspi

Merchant-facing

POS network - provide a convenient way for merchants to accept in-store and online payments from consumers using Kaspi QR technology, Kaspi Gold debit cards and third- party bank cards

Includes m-POS and Smart POS, Kaspi's physical and app-based POS terminals respectively

Kaspi Pay Mobile POS is a proprietary mobile application, available on iOS or Android devices and is aimed at SMEs and merchants with low transaction intensity.

Kaspi POS Terminal has pre-installed Kaspi POS software and is designed to create convenient ways for merchants to accept payments in a high-transaction intensity environment, for example supermarkets. Kaspi POS Terminal enables merchants to receive payments from any bankcard and the Kaspi Gold pre-paid debit card or from Kaspi.kz Super App through Kaspi QR technology.

Source: Kaspi

B2B payments - enables suppliers and merchants to digitally issue and instantly settle invoices seamlessly between themselves

Kaspi Pay is a digital finance mobile application that helps merchants manage business finances and transactions digitally. Merchants can view real-time transactions on Kaspi's Payments and Marketplace Platforms, make payments and transfers, track their finances, and generate account statements.

Pricing and Monetization

Source: Kaspi

Kaspi monetizes its services through various channels for the payment platform:

Consumer fees for external bank transfers (2.8%)

Kaspi QR consumer transaction (0.95%)

Kaspi Gold transaction via physical card (1.7%)

Kaspi's revenue take rate on TPV of 1.3% is competitive with, and in some cases exceed, those of global payment peers like Nuvei, Mastercard, Visa, and Adyen.

Fintech Platform

Kaspi˖s Fintech segment is its consumer lending and deposit businesses. The platform enables consumers to access instantly and seamlessly, primarily through Kaspi.kz Super App, the Company’s digital finance products, including consumer finance and deposit. Fintech is Kaspi˖s largest, but slowest growing and least profitable (from a margin perspective) operating segment, accounting for 54% of revenue and 35% of net income, in 20˖23. It is notable that Kaspi originates 100% of loans from its own balance sheet (vs 2% for Ant/Alipay).

Kaspi's fintech platform has shown impressive growth, particularly in its Total Finance Volume (TFV), which serves as a key indicator of the platform's financial services adoption and usage. The TFV has exhibited strong year-over-year growth at 39.8% CAGR from 2017 to 2023, reflecting the increasing popularity and trust in Kaspi's lending and financial products.

Source: Kaspi

The trend of total active consumers parallels that of TFV, with a 22% CAGR from 2019 to 2023.

Source: Kaspi

Key products and services in the fintech segment include:

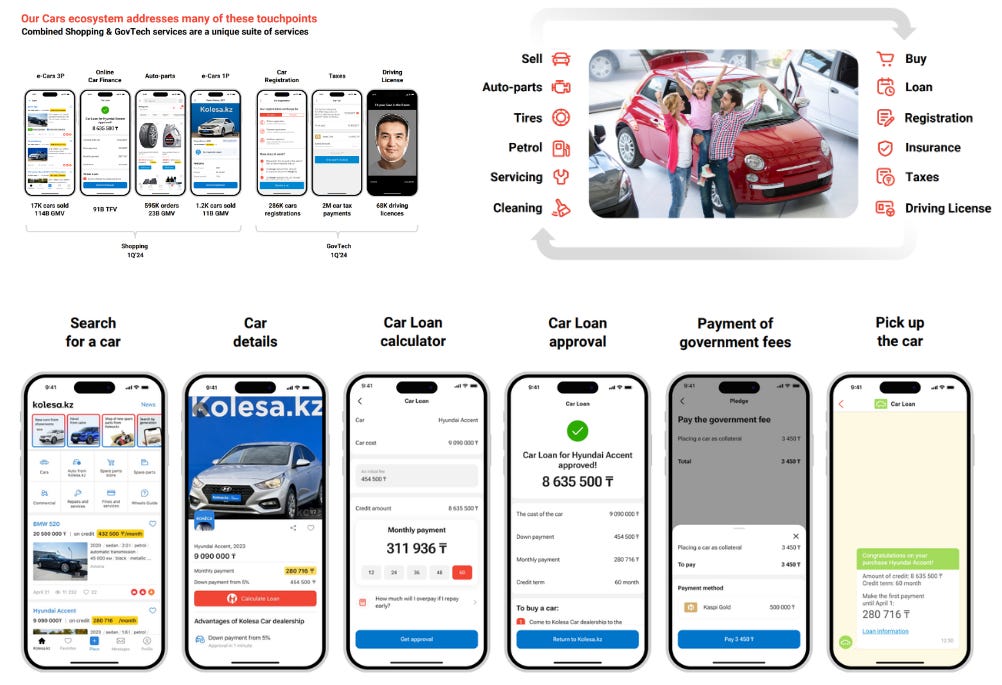

Car financing - online car loans for purchases through Kolesa.kz (a leading classified group that Kaspi acquired a majority stake in Jul 2023 - to be elaborated under "Marketplace")

In order to secure financing, a consumer can select a car on Kolesa.kz and seamlessly apply for a loan originated through the Fintech Platform for the maximum term of 60 months.

The loan approval process takes less than one minute, which then allows the consumer to complete the car purchase funded by Kaspi.kz via the Kolesa.kz website or the respective mobile application.

Kaspi then credits the purchase price to the seller’s account. Purchased cars act as security for the financing provided.

Consumers may prepay car loans without any penalty prior to contractual maturity.

General Purpose Loans - loans extended to consumers for day-to-day purchases outside of the Marketplace Platform

Source: Kaspi

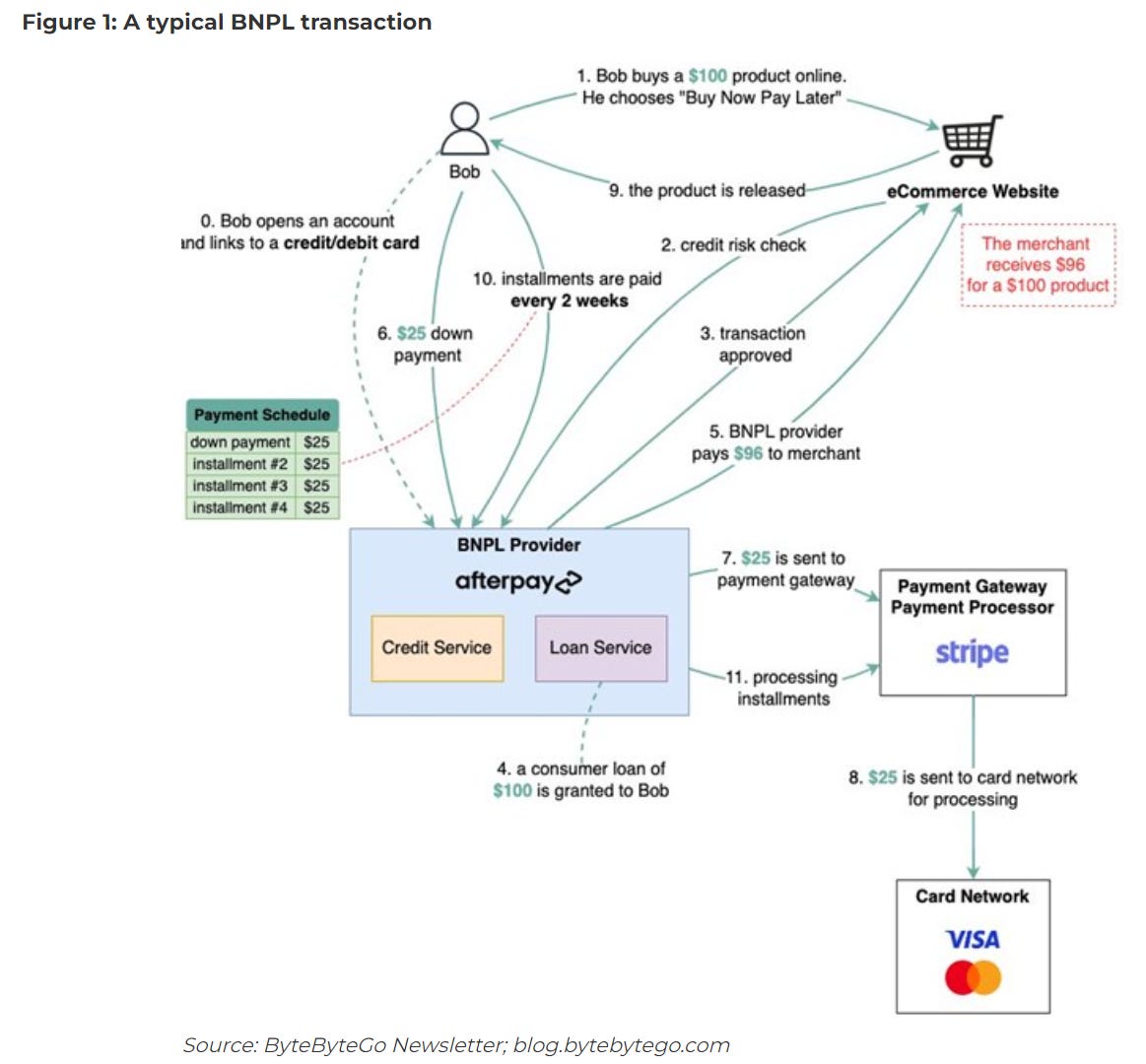

Buy-now-pay-later - unsecured financing for Marketplace platform, provided for a period of up to 3 months, and from 6 to 24 months in specific promotion periods. Buy-now-pay-later products with a maturity of less than three months are provided to consumers interest free.

Kaspi Red Shopping Club

Kaspi Red Shopping Club is a subscription-based programme which allows consumers to have a pre-approved revolving shopping limit and make purchases on the Marketplace Platform free of any interest through a buy-now-pay-later product, for a period of up to three months.

Kaspi offers free membership for the first year. If the consumer uses the services of the Kaspi Red Shopping Club, for each subsequent year we will charge a membership fee which varies depending on the shopping limit chosen by the consumer (ranging from KZT50,000 to KZT150,000).

Kaspi deposits - customer deposit accounts available through the Kaspi.kz Super App.

Kaspi Deposit accounts are predominately denominated in tenge and U.S. dollars and are current and term accounts

Merchant finance - a working capital finance product for merchants operating in the Payments and Marketplace Platform with a targeted yield of 15-20%.

The service enables merchants to drawdown a facility of up to 20% of GMV and TPV generated by the merchant through the Payments and Marketplace Platforms. The financing will be provided in local currency and we expect the average amount to be around U.S.$10,000 equivalent. The maturity of each drawdown is up to six months and is automatically repaid daily from the merchant’s GMV and TPV with Kaspi.kz. Online Merchant Finance is provided fully online through Kaspi Pay Mobile App.

Lending is linked to transaction activity through Kaspi's Super App, in this case a merchant’s turnover through Kaspi.kz Pay or Kaspi Marketplace. Merchant financing is also low risk, with repayments taken directly from the merchant’s sales transacted through Kaspi.kz.

Pricing and Monetization

The Fintech Platform primarily generates interest revenue, fees from consumer finance loans and Kaspi Red Shopping Club membership and other fees.

Marketplace Platform

The platform allows consumers to buy a broad selection of products and services from a variety of online and offline merchants. Marketplace is Kaspi'˖s fastest growing segment. Kaspi reports four main businesses within Marketplace: m-commerce (in-store and services), e-commerce, Travel, and Grocery.

Kaspi's Marketplace segment has demonstrated remarkable growth, with its Gross Merchandise Value (GMV) serving as a key indicator of the platform's expanding reach and consumer adoption. The GMV has shown impressive 58.44 CAGR from 2017 to 2023, reflecting the platform's success in capturing a larger share of Kazakhstan's e-commerce market.

Source: Kaspi

This growth is similar for the marketplace active consumers and merchants as seen below.

Source: Kaspi

Note: Kaspi did not report active merchants in the marketplace for 2023

Key products and services in the marketplace segment include:

1P marketplace

Kaspi operates an e-Grocery platform that allows consumers to order groceries through the app with free home delivery within 24h.

This was after an acquisition of an 51% stake in Magnum E-commerce Kazakhstan from Magnum Cash & Carry LLP for KZT 5000 million on February 24, 2023.

Kaspi is responsible for the frontend user experience, product assortment, and pricing, while Magnum provides grocery expertise and leading purchasing terms. Magnum owns a 10% equity stake in Kaspi˖s eGrocery segment.

Source: Kaspi

3P marketplace

e-Commerce - consumers are able to select, purchase and receive products through the Kaspi app, powered by fintech and payments platform

The take rate depends on the specific vertical; it ranges from 5.0% (for electronics) to a percentage level in the mid-teens (for jewellery).

A variety of fulfilment options, including in-store pick-up or delivery by merchant or by Kaspi Delivery (to be elaborated below)

Source: Kaspi

m-Commerce - consumers are able to research goods and merchants in the app and complete purchases at the merchant's physical location with Kaspi QR and BNPL products

Mobile Commerce is done through the Kaspi Red Shopping Club (a subscription-based service), which has a dedicated section for merchants and consumers in the Super App and is organised around popular shopping and lifestyle categories, which are not necessarily listed on the e-Commerce platform.

Such categories include, among others, supermarkets, restaurants, petrol stations, medical services and beauty salons.

Kaspi Travel - consumers are able to purchase rail and air tickets, as well as international package holidays within the Kaspi.kz Super App, with payments fully integrated with Kaspi Gold and BNPL products.

Included in July 2020 when Kaspi.kz acquired a 100% share of LLC Traveleasy, whose primary business is selling online airline and railway tickets. Thereafter, the company started expanding into rail and more robust vacation packages. Most rail and airline tickets sold facilitate domestic travel, though anecdotally, Turkey, Egypt and Dubai are popular vacation destinations for Kazakhstanis Kaspi entered the sector via acquisition, picking up Santufei, a Kazak player in the space.

Kaspi processed KZT 231 billion in travel volume in ˖22, accounting for roughly 25% of all travel spend in Kazakhstan, and KZT 353 billion in travel volume in ˖23, up 57% from the previous year

Take rate for travel: 7.9% (according to Q2 2024 earnings call

Source: Kaspi

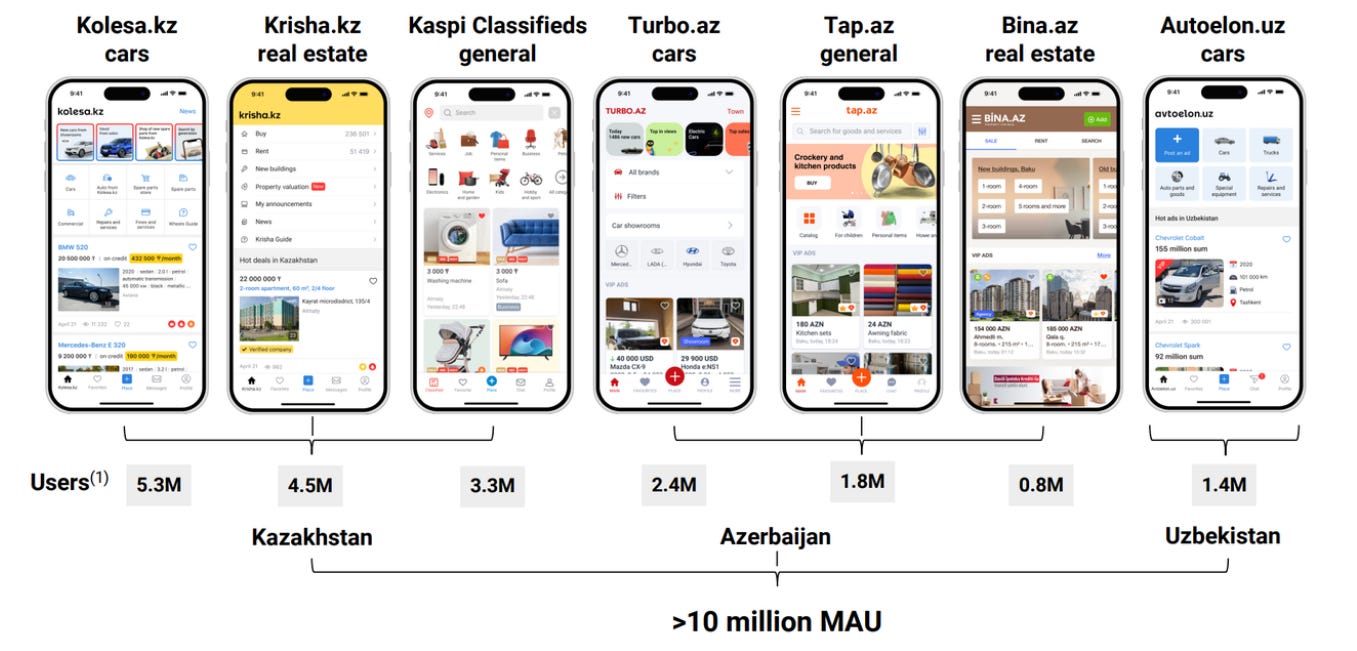

Kaspi Classifieds - consumers and businesses can advertise their used and new goods, services and jobs to consumers, including car and real estate with the Kolesa.kz and Krisha.kz acquisitions

This process began in 2019 with the acquisitions of three classifieds companies in Azerbaijan - turbo.az (cars), bina.az (real estate) and tap.az (general). Then in late 2022, Kaspi Classifieds (general) was launched in partnership with Kolesa, a leading classifieds in Kazakhstan which Kaspi’s CEO, Mikhail Lomtadze, already had an 11% interest in. Roughly a year later in the fourth quarter of 2023, Kaspi acquired a 40% stake in Kolesa, effectively giving them a controlling interest when considering Lomtadze’s stake.

Kolesa owns Kazakhstan’s no. 1 car classifieds site, kolesa.kz (13x better known than the next biggest) and Kazakhstan’s no. 1 real estate classifieds site, krisha.kz (4.6x better known than the next biggest). They also own the leading car classifieds in Uzbekistan, avtoelon.uz, which will provide a nice foothold for Kaspi.

Source: Kaspi

Car e-commerce

Facilitates buying and selling used cars by integrating the search, selection and legal registration steps required

Delivery services - Kaspi Delivery is a service that allows the reliable delivery of any product on the Marketplace to more than 150 towns and cities in Kazakhstan.

Kaspi collaborates with more than 60 local logistics companies, including well-known names like DHL, DPD, KazPost, and Pony Express. This network employs around 2,500 couriers and 5,000 delivery personnel, primarily from small and medium-sized businesses.

Two delivery options: Delivers straight to door or to Kaspi's own postomats (automated parcel machines) that improve courier efficiency, reduce last-mile delivery costs and improve consumer convenience.

Source: Kaspi

Some performance metrics include: 96% of e-Commerce orders were delivered through Kaspi Delivery, 51% of orders were delivered within 48 hours, 88% of orders were delivered free of charge for the consumer.

It is important to note that the delivery times are impressive, considering the size of Kazakhstan (below picture for reference)

Source: Very Good Value on Substack

Source: Kaspi 2023 ESG Report

Advertising services - advertising campaigns on the platforms, which may display ads on the Kaspi.kz Super App to users through product searches, suggested products and banner ads.

Two forms of ads - product ads and brand ads

Product ads

Brand ads

Source: Kaspi Q2 2024 Report

Promotional periods such as Kaspi Juma, a 3 day national shopping festival (Kaspi's version of 9.9 / 10.10 / 11.11 in the context of Shopee or USA's Black Friday or China's Single Day)

Kaspi Juma usually takes place twice a year, in the summer and the autumn, and allows consumers to purchase any goods from participating merchants via a buy-now-pay-later consumer finance product with interest-free instalments for up to 24 months. This will be changed to thrice a year from 2024 onwards to cater to the different seasonalities in the year as mentioned in its earnings call.

Kaspi Juma contributes to a significant amount of GMV in a year (with 14% GMV contribution in 2019 and 14.2% GMV contribution in 2023)

As Kazakhstan's largest shopping festival, merchants pay on average double the seller fees to participate in Kaspi Juma.

Government Services

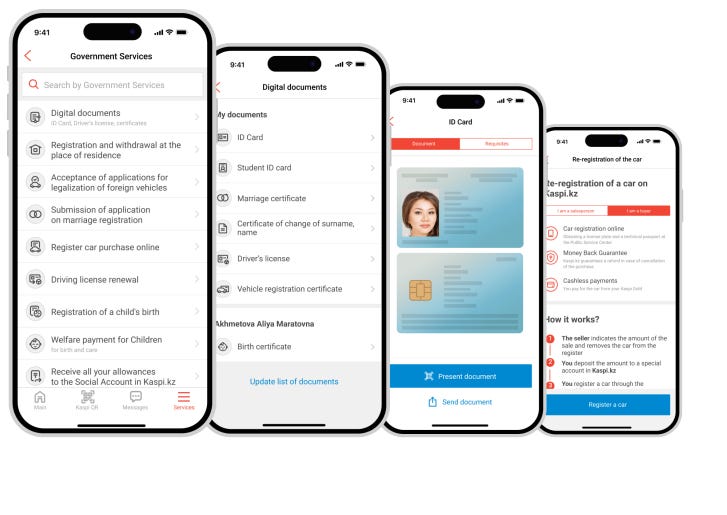

Kaspi's GovTech platform, while not directly contributing to the company's revenues, plays a crucial role in enhancing user engagement and solidifying Kaspi's position as an indispensable part of Kazakhstan's digital infrastructure.

This innovative platform seamlessly integrates a wide array of government services into the Kaspi.kz Super App, offering users unprecedented convenience in accessing essential public services.The platform's functionality is extensive and user-centric.

For individual consumers, it serves as a digital hub for storing and accessing ID documents, renewing driving licenses, transferring car ownership, registering marriages, and obtaining birth certificates. Entrepreneurs benefit from streamlined processes for business registration, tax calculations, payments, and report filings.Kaspi's close collaboration with government agencies, particularly the Ministry of Digitalisation, ensures the continuous expansion of high-frequency GovTech services within the Kaspi.kz and Kaspi Pay Super Apps.

Source: Kaspi

In 2023, the most widely utilized services included digital document management, car ownership registration, driver's license issuance, and new business registration.

Source: Kaspi

Kaspi's integral role in Kazakhstan's economy cannot be overstated. Its deep integration into both the private and public sectors positions the company as a vital component of the nation's digital ecosystem. This strategic importance suggests that, if ever necessary, Kaspi could potentially rely on support from the Kazakh government, further underlining its stability and long-term prospects.

Kaspi˖s two-sided network consists of Kaspi.kz Super App (for consumers) and Kaspi Pay Super App (for merchants). The following image summarises the different offerings for both consumers and merchants, in the 4 segments as mentioned above.

Source: Kaspi, author's illustration

Revenue Split by Geography

Kaspi operates in 3 countries: Kazakhstan, Azerbaijan and Ukraine.

Kaspi entered Azerbaijan in September 2019 through the acquisition of three leading marketplace platforms (Turbo.az (a car marketplace), Tap.az (a used and new items marketplace) and Bina.az (a real estate marketplace)). This expanded their addressable market by 10 million people

Kaspi entered Ukraine in October 2021 when it acquired 100% of Portmone Group, a payments company operating in Ukraine.

Kazakhstan remains the largest contributor to Kaspi's revenues at 99.6%, with Azerbaijan and Ukraine both taking up 0.2% of total revenues.

Below is the revenue split by countries in Dec 2023:

Source: Kaspi 2023 Annual Report, author's illustration

Country Analysis: Kazakhstan

Located in Central Asia, Kazakhstan is a land-locked country bordering Russia, China, Kyrgyzstan, Uzbekistan and Turkmenistan.

Population and Demographics

Kazakhstan boasts a population of approximately 20 million as of 2024. The country's largest urban centers are:

Almaty: 2.16 million

Nur-Sultan (formerly Astana, the capital): 1.35 million

Shymkent: 1.19 million

These cities also serve as the primary operational hubs for Kaspi.

Source: Kazakhstan Discovery, author

Population Numbers

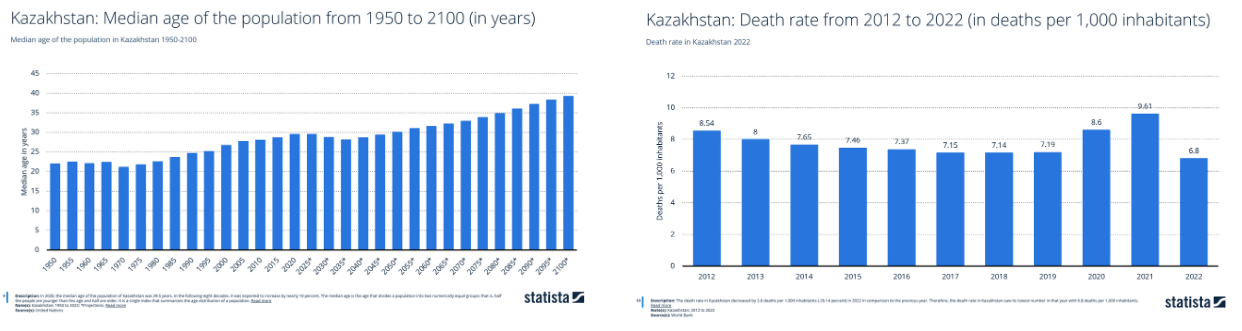

Kazakhstan's population is projected to increase from 18.51 million in 2019 to 21.12 million by 2029. The country has maintained a relatively stable population growth rate of around 1.5% from 2013 to 2023. As of 2024, the population stands at 20.59 million, with a 1.29% annual growth rate.

Source: IMF, Statista

Life expectancy in Kazakhstan has been on an upward trajectory and is expected to continue rising until 2100. Death rates have been steadily decreasing, with the exception of a temporary increase during the COVID-19 pandemic in 2020 and 2021. The long-term demographic outlook appears favorable, with working-age population growth aligning closely with overall population growth.

Source: IMF, Statista

Age Structure

As of January 2023, Kazakhstan's age structure is as follows:

0-14 years: 29.5%

15-64 years: 62%

65 years and above: 8.5%

The median age of the population is 30 years.

Source: Wikipedia

This demographic profile presents a favorable environment for Kaspi, offering:

A stable consumer base

A young population likely to embrace digital adoption

Increased demand for innovative financial and non-financial products and services

A tech-savvy younger demographic more open to digital financial services and mobile apps

The projected increase in life expectancy suggests a potentially high lifetime value (LTV) for customers.

Population distribution

As of August 1, 2024, Kazakhstan's population distribution is:

Urban: 62.7%

Rural: 37.3%

Projections estimate that the urban population will reach approximately 69.1% by 2050.

Source: Bureau of National Statistics

Internal migration has seen a significant uptick, with the number of people moving within the country increasing by 1.7 times compared to the same period in 2023. Four regions have experienced positive net population migration:

Astana: 29,305 people

Almaty: 15,750 people

Shymkent: 4,562 people

Almaty region: 1,258 people

Notably, these regions align with Kaspi's primary service areas.

Source: Bureau of National Statistics: the migration of the population of the Republic of Kazakhstan (January-June 2024)

The ongoing urbanization trend in Kazakhstan creates a favorable environment for digital-first companies like Kaspi, positioning them to capitalize on the changing needs and behaviors of Kazakhstan's growing urban population.

Digital Service Adoption

Urban populations typically demonstrate higher rates of smartphone ownership and digital service usage.

This trend aligns well with Kaspi's digital-first business model, potentially expanding their user base in urban centers.

Changing Consumer Behavior

The shift towards urban living is primarily driven by a quest for efficiency and convenience, rather than laziness.

Urban lifestyles, characterized by longer working hours and faster pace, are creating new consumer needs and preferences.

E-commerce and digital services are increasingly seen as time-saving solutions for busy urban dwellers.

As the e-commerce director of retail store "Kerege" notes:

"In Astana, the busy lifestyle has fueled the growth of e-commerce. With people constantly working, shopping online has become a convenient way to unwind. It's no longer just women; even men find relaxation in browsing online marketplaces from the comfort of their homes. This shift reflects a broader trend of convenience driving e-commerce growth in Kazakhstan."

Market Opportunities

The concentration of population in urban areas creates dense markets, beneficial for businesses like Kaspi.

Urban consumers are more likely to embrace new technologies and services, providing a fertile testing ground for innovative products

Other Factors

Beyond the growing young population and increasing urbanization, several factors contribute to the strong growth potential for consumer-based internet businesses like Kaspi:

Increasing data availability (4G and 5G)

Rising banking penetration

Growing debit and credit card adoption

Overall consumption growth

Internet and Mobile Usage

Kazakhstan demonstrates impressive internet and mobile usage statistics:

Internet penetration: 92.3% as of early 2024 (18.19 million users) - this is the largest in Central Asia

Mobile internet usage: 71.5% as of January 2024 (14.10 million social media users)

Smartphone adoption: 83% as of 2023 and expected to increase to 86% in 2025

Average daily time spent using the internet and mobile phones in Kazakhstan: 3.4h and 6h respectively

These high penetration rates provide a substantial potential user base for Kaspi.kz's digital services and align well with their mobile-only super app strategy. Furthermore, the rapid rollout of 5G is expected to significantly increase mobile internet speeds. It also provides a good backdrop for companies like Kaspi to capture significant portion of time spent online.

It is also pertinent to note that Kaspi is mobile only, and the above trends are tailwinds for Kaspi's continued adoption.

Consumer Expenditure

The average annual wage was approximately KZT 3.7 million, or approximately $8,000, in 2022. Annual wages in Kazakhstan increased at a 15% CAGR from 2017 to 2022 – see Figure 6,a v e r a g e An n u a l g e AW below. Interestingly, most families own their homes outright (i.e., no mortgage or rent payments), and it is common for children to live with their parents through their late 20s (until they marry). As such, a relatively large proportion of income is available for consumption spend.

In summary, Kazakhstan's demographics provide several favorable factors that support Kaspi.kz's growth potential. These demographic factors contribute to a favorable environment for Kaspi.kz's super app model, supporting its potential for continued user acquisition, engagement, and revenue growth in the Kazakhstan market.

Political Landscape and Government

Kazakhstan's political history has been marked by a gradual transition from Soviet rule to independence, followed by a long period of authoritarian leadership under Nursultan Nazarbayev.

History

Soviet Era and Independence

Kazakhstan was part of the Soviet Union from 1936 to 1991. During this period, it was governed as the Kazakh Soviet Socialist Republic. In December 1986, mass demonstrations by young ethnic Kazakhs took place in Almaty to protest Moscow's appointment of a non-Kazakh leader, signaling growing discontent with Soviet rule. As the Soviet Union began to dissolve, Kazakhstan declared its sovereignty within the USSR in October 1990. Following the failed coup attempt in Moscow in August 1991, Kazakhstan declared full independence on December 16, 1991.

Nazarbayev Era (1991-2019)

Nursultan Nazarbayev, who had been the leader of the Kazakh Communist Party since 1989, became Kazakhstan's first president after independence. Under his leadership, Kazakhstan implemented significant economic reforms to transition from a Soviet command economy to a market economy. However, political reforms lagged behind economic changes. Nazarbayev ruled in an authoritarian manner, consolidating power and limiting political opposition. Key developments during his rule included:

The adoption of a new constitution in 1995, which expanded presidential powers.

Moving the capital from Almaty to Astana (now Nur-Sultan) in 1997.

Constitutional changes in 2007 that allowed Nazarbayev to be president for life

Elections that were consistently criticized by international observers for falling short of democratic standards

Post-Nazarbayev Era (2019-Present)

In March 2019, Nazarbayev unexpectedly announced his resignation. Kassym-Jomart Tokayev, the former Senate chairman, became interim president and won the subsequent election in June 2019. Under Tokayev's leadership, Kazakhstan has begun implementing some political reforms:

Constitutional amendments in 2022 reduced presidential powers and increased the authority of parliament

The presidential term was limited to a single seven-year period

Efforts have been made to foster a culture of opposition and loosen rules on forming political parties

Source: BMI

However, the country still faces challenges in fully transitioning to a democratic system. The ruling Amanat party (formerly Nur Otan) continues to dominate parliament, and while there are now more parties represented, true opposition remains limited.

Internal Reforms and Liberalization under the "New Kazakhstan" reform programme

Tokayev's administration is committed to a medium-term reform program targeting both political and economic sectors. Key aspects include:

Reducing the influence of former President Nazarbayev's legacy.

Decentralizing power from the presidential office.

Increasing transparency and operational efficiency in the economy.

Attracting foreign investment for economic diversification.

The government's economic reform program focuses on:

Reducing dependence on the energy sector (currently over 50% of GDP).

Diversifying economic partnerships to mitigate risks associated with Russian trade due to the Ukraine war and sanctions.

Three key areas of focus:

Infrastructure Development: Modernizing transportation, water management, and digital infrastructure to support economic growth and resource efficiency.

Energy Trade Diversification: Emphasizing renewable energy sources, exploring nuclear options, and expanding export markets to enhance energy security and sustainability.

Strategic Partnerships: Collaborating with international organizations and participating in global initiatives to access expertise, funding, and markets, while reducing dependence on Russia.

Other key areas:

Focus on Digital Development and Fintech: Kazakhstan has made progress in developing a supportive regulatory environment for fintech, notably benefiting companies like Kaspi.kz. Legislative reforms and initiatives like the "Digital Kazakhstan" program have fostered the growth of the fintech sector. Additionally, the government has launched an ambitious plan to roll out 7,000 5G base stations by 2025, though delays in infrastructure deployment could hinder progress. Tokayev has also called for a new banking law to support fintech development and increase lending to the real economy. The introduction of the digital tenge and efforts to digitize tax administration aim to improve transparency and reduce corruption. However, despite the rapid growth in e-commerce and digital payments, Kazakhstan remains behind regional and global peers in digital infrastructure. This provides a considerable runway for digitalization, both for the country and for Kaspi.kz, which stands poised to capitalize on this growth.

Privatization and Economic Liberalization: Efforts to liberalize the economy have included privatizing state-owned enterprises, though progress has been slow. Recent IPOs, such as those by KazMunayGas and Air Astana, reflect the government’s cautious approach to privatization, where only a small portion of shares are floated publicly. The state remains reluctant to relinquish control over key sectors of the economy, and significant progress on diversification and privatization is unlikely in the short term.

Support for SMEs: Tokayev’s economic reforms will support small and medium-sized enterprises (SMEs), aligning with Kaspi.kz’s marketplace platform. In order to reduce administrative barriers, the Government is working to introduce a new regulatory policy in the field of entrepreneurial activity. As part of this work identified 10.1 thousand unnecessary requirements for business. Today about 90% of such requirements have been canceled at the subordinate legislation level. The share of SMEs in the economy of Kazakhstan by 2030 will amount to 40%. This was announced by the Minister of National Economy of the Republic of Kazakhstan Alibek Kuantyrov at a meeting of the Government. Alibek Kuantyrov reported that in 2022 within the framework of SME support 46 thousand projects for the amount of loans over 1.3 trillion tenge were subsidized and guaranteed. For 5 months of this year subsidized and guaranteed more than 10.2 thousand SME projects for the amount of loans of more than 586 billion tenge. For the current year for these purposes allocated more than 266 billion tenge of budget funds, which is almost 96 billion tenge more than last year. Application of the regime is allowed at income up to 2 billion tenge. Taxpayers are exempt from VAT and social tax. The tax rate is flexible: in the amount of 4% of turnover. At the same time, the rate can be reduced to 2% based on the decision of the Maslikhat. In addition, since this year a single payment from the labor payment fund for micro and small businesses has been introduced. The total rate is reduced from 34.5% to 20%. Instead of 6 payments 1 payment will be paid," the Minister of National Economy noted.

Key Issues and Risk Factors

Kazakhstan's ambitious reform agenda, while promising, carries significant risks.

Political Stability: Tokayev’s political future largely depends on his ability to navigate inter-elite competition and maintain control over factions loyal to former president Nursultan Nazarbayev. The social and political unrest seen in January 2022 also highlighted the significant, unresolved grievances of the population, such as demands for transparent governance, economic stability, and improved living standards. The country’s transition to green energy, including a controversial nuclear power plant project involving Russia, raises concerns about sovereignty and safety, further complicating social tensions. Additionally, fiscal reforms, while aimed at improving budgeting processes and reducing quasi-fiscal activities, may not fully resolve the country’s economic vulnerabilities. Kazakhstan’s reliance on volatile oil revenues and the decline in tax revenues pose risks that could fuel further unrest.

Economic Growth and Living Standards: Improving living standards, managing inflation, and ensuring macroeconomic stability are central to Tokayev’s short-term economic goals. However, deep-rooted corruption within state institutions will continue to hinder governance reforms, despite pledges to reduce inequality.

Labour and Social Unrest: Labour strikes, especially among oil workers, are expected to continue, posing a minor but persistent risk to social stability. Public dissatisfaction remains high, particularly in regions heavily reliant on oil exports.

Source: BMI

In the short term, Kazakhstan's economic policy will prioritize maintaining macroeconomic stability, improving living standards, and controlling inflation. The success of these efforts will depend on effectively managing internal and external risks. While the government's economic goals are ambitious, their full realization will likely take time.

Foreign Policy Dynamics and Regional Position

Kazakhstan's geopolitical landscape is undergoing significant changes, shaped by its historical ties to Russia, strategic location, and evolving multi-vector foreign policy. The country currently finds itself in a delicate position, balancing its dependence on Russia with the need to diversify its economic and diplomatic relationships.

At present, Kazakhstan's energy sector remains heavily reliant on Russia. Approximately 90% of its oil exports flow through the Caspian Pipeline Consortium (CPC), which traverses Russian territory and is partially owned by Moscow. This dependency has been highlighted by past pipeline interruptions, which have demonstrated Kazakhstan's vulnerability. A potential shutdown of this crucial export route could jeopardize up to 57% of the country's exports, significantly impacting its GDP. The ongoing Russia-Ukraine conflict has further complicated Kazakhstan's foreign policy strategy.

While maintaining cordial relations with Russia, Kazakhstan faces an urgent need to diversify its transport and infrastructure links away from Moscow, particularly in light of increasing economic sanctions against Russia. This situation has pushed Kazakhstan to seek alternative partnerships and routes for its economic activities.Interestingly, the current geopolitical shifts may present opportunities for Kazakhstan. As Russia's influence in Central Asia declines due to its military challenges in Ukraine, Kazakhstan is positioning itself to take on a more prominent leadership role in the region. This evolving dynamic is evident in Kazakhstan's recent diplomatic efforts, such as its key role in facilitating EU-mediated peace talks between Armenia and Azerbaijan.Kazakhstan's response to the Ukraine conflict further illustrates its nuanced approach to foreign relations. The government has refused to recognize Donetsk and Lugansk as independent regions and has abstained from voting on the conflict. While abstention is not outright rejection, it marks a significant departure from Kazakhstan's previous approaches to international relations.

Moreover, Kazakhstan has emerged as a crucial transit hub for Russian businesses affected by international sanctions. This role is strengthening Kazakhstan's trade ties, particularly with European nations, and provides an opportunity for the country to diversify its economy beyond its traditional reliance on oil and gas exports.

Research by Roman A. Yuneman on Kazakhstan's multi-vector foreign policy reveals some surprising insights. Contrary to expectations, China, rather than Russia, appears to be the main vector of Kazakhstan's foreign policy. The study, based on voting patterns on international resolutions, shows that Kazakhstan's positions align most closely with China.

Furthermore, Kazakhstan carefully avoids offering explicit support to Russia on initiatives related to armed conflicts, including the situation in Ukraine. This evolving geopolitical landscape presents Kazakhstan with an opportunity to reshape its relationships with major powers. By leveraging its strategic position in the Caspian region, Kazakhstan can potentially balance its interests between Russia, China, and Western partners, thereby strengthening its position on the global stage and fostering greater economic and diplomatic independence.

Economic Outlook

Economic Growth

Kazakhstan's economic growth is expected to slow from 5.1% in 2023 to 4.1% in 2024, largely due to fiscal tightening. The government has reinstated fiscal rules to control spending and reduce the budget deficit over the next decade. As a result, household transfers will remain low, which will limit domestic demand growth. Although easing inflation and lower interest rates may cushion the effects of fiscal tightening, wealth inequality could restrict the benefits to a small portion of the population. This could challenge growth with social instability.

Source: BMI

Growth is expected to pick up again in 2025, with a projected rate of 5.4%, driven by the government’s continued efforts to diversify the economy. Although the contribution of fixed capital formation to growth will decrease as state-backed projects dominate investments, capital formation is expected to remain robust.

Source: BMI

In the medium term, economic growth is expected to average 4% from 2025 to 2028, driven by increased oil production, strong exports, and favorable trade relations with China and the EU.

Note: Projections differ based on source

Source: EIU, IMF, Statista

Kazakhstan’s GDP per capita was estimated at $12,993 in 2023, supported by the recovery in global oil prices. GDP per capita is expected to exceed its previous peak of $13,000 by 2024, as economic growth and rising household incomes continue. Urbanization and higher income levels in major cities will create expanded market opportunities, especially in non-food sectors.

Inflation

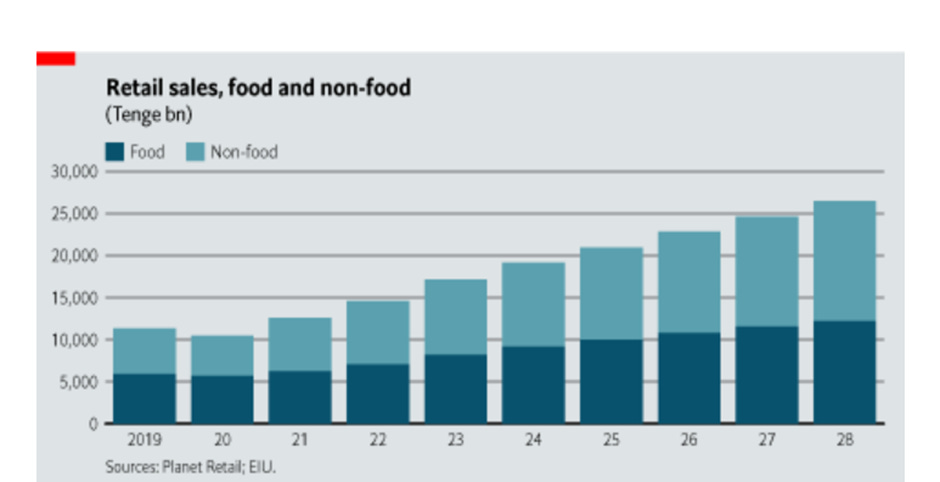

Inflation, which averaged 14.5% in 2023, is expected to decline to 8.7% in 2024 and further moderate to around 5%. Persistent inflationary pressures is driven by strong consumer demand and ongoing reforms in energy pricing. High prices, especially for food and fuel, will continue to affect consumer sentiment and increase demand for lower-cost goods. Real retail sales are forecasted to grow by 2.5% annually, while nominal sales in local currency are expected to increase at a compound annual growth rate (CAGR) of 9.1% through 2028.

Source: Statista, IMF

This of course impacts the results for Kaspi. For example, the marketplace GMV will increase by increased volume and increased prices which are partially related to inflation. We need to take this into account when assessing future growth prospects for the company, especially when looking at the performance of the year 2022 and this year.

Disposable Incomes

Kazakhstan's economic landscape is poised for significant growth in the coming years, presenting a promising outlook for Kaspi's expansion. From 2024 to 2028, real personal disposable income is projected to increase by 1.4% annually, while the proportion of households earning over $25,000 per year is expected to nearly double from 23% in 2023 to 42.2% by 2028. This economic uplift is likely to fuel increased spending on discretionary and luxury items, with non-food retail sales projected to rise from 52% of total sales in 2023 to 54% by 2028.

Source: EIU

In this thriving economic environment, Arthur D. Little, a renowned international management consulting firm, forecasts Kazakhstan's nominal retail and servicing spend to grow at mid-teens rates, reaching an impressive KZT 77 trillion (approximately $170 billion) by 2027. This robust market growth sets the stage for Kaspi's continued expansion.

As Kazakhstan's economy continues to develop and consumer spending patterns evolve towards discretionary and luxury items, Kaspi stands to benefit significantly from these trends, particularly in the rapidly growing e-commerce sector and related services such as B2B payment solutions and merchant financing.

Currency

The National Bank of Kazakhstan (NBK) heavily manages the Kazakh tenge, but the currency remains vulnerable to frequent devaluations during risky external conditions. The last major devaluation occurred in 2015 when the NBK abandoned its USD peg due to historically low oil prices, which depleted the Bank's foreign exchange reserves.

Source: JP Morgan

While the risk of such an event is currently low, given the tailwinds oil prices are experiencing from the Middle East geopolitical crisis, the country's rising import needs amid an infrastructure construction boom and robust demand are expected to keep the current account in deficit over the coming years, placing depreciatory pressures on the tenge.

Analysts forecast the Kazakh tenge to trade within the range of KZT430-450 per USD over 2024 and 2025. The currency has appreciated modestly in the first four months of 2024, moving from KZT453.00 per USD in late December 2023 to KZT441.44 per USD by the end of April 2024, a 3.0% appreciation.

This appreciation is partly attributed to lower net-purchases and sales in USD terms in early 2024, reducing USD demand relative to KZT.The tenge's short-term outlook is closely tied to global oil prices and Kazakhstan's external trade. After declining by 6.4% on an annual average basis in 2023, Kazakh export growth has picked up modestly by 1.0% in the first two months of 2024. Oil exports, a key component of Kazakh trade, have risen by 8.1% in the same period, supported by upward pressures on global oil prices due to escalating geopolitical risks in the Middle East.

Experts expect global oil prices to remain slightly elevated in 2024 compared to 2023, supporting the view that Kazakhstan's export growth will accelerate to at least 10.0% in the year following a 7.0% decline in 2024. Firmer exports are expected to shore up demand for the KZT, anchored by the legal requirement for traders to transact solely in the local currency with Kazakh entities.

Over the medium-to-long term, depreciatory risks facing the KZT are expected to rise due to Kazakhstan's growing external financing needs. While the current account deficit is projected to narrow slightly in 2024 compared to 2023, from 3.3% to 2.7%, this shortfall is expected to persist over the coming years with modest widening likely as the country's imported capital needs increase amid infrastructure development and economic diversification goals.

Moreover, the country's substantial external debt load (72.0% of GDP as of 2023) will add pressure on the KZT amid rising debt servicing needs. In 2024 and 2025, a total of USD21.8bn worth of USD-denominated debt, which is 13.0% of the total external debt load, is due to be rolled over.

Given these increased financing needs, analysts expect the tenge to move closer to the KZT460-500 per USD range in 2025.Despite floating freely since 2015, the NBK manages the currency closely with various capital control measures and market interventions using foreign reserves. The NBK's gross international reserves stand at USD37.8bn, providing over 5.0 months of import cover. However, only 42.0% of the gross reserves are composed of readily available liquid foreign currency, reducing the cover to around 3.0 months. Liquid reserves held by the NBK have reduced materially since the 2015 currency devaluation and subsequent periods of oil price declines. While severe risks to the tenge are not immediately expected in the short-to-medium term, the NBK has less room to intervene in such an event.

An additional source of risk to Kazakhstan's external sector and the KZT is the country's continued trade and strategic dependence on Russia. Around 90% of Kazakh oil continues to be piped through the Caspian Pipeline Consortium that runs through Russia. This not only exposes it to the chances of secondary sanctions but also requires Kazakhstan to maintain a balanced and broadly positive relationship with Russia.

Industry and Competitive Analysis

Payments

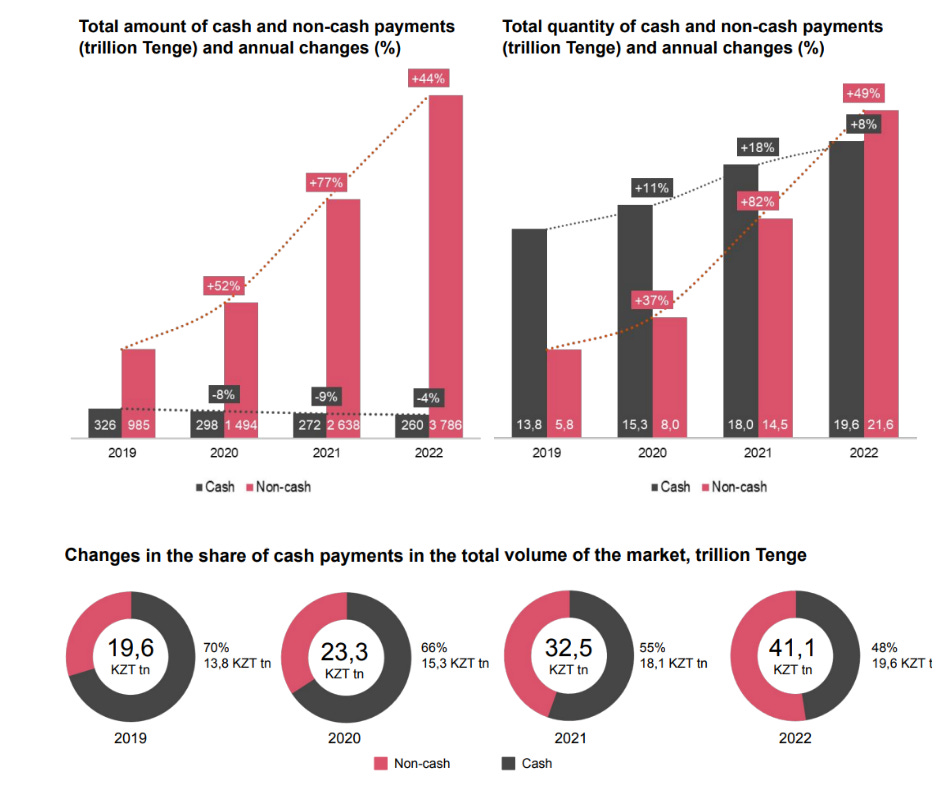

Kazakhstan's payment landscape has undergone a dramatic transformation in recent years, with digital payments rapidly displacing cash transactions. In 2022, the total payment market in Kazakhstan reached 41.1 trillion Tenge, growing by 8.6 trillion Tenge from 2021. While this represents a significant increase, the growth rate moderated to 27% in 2022, down from 40% in 2021. The shift towards digital payments has also been swift and comprehensive. In 2022, digital payments accounted for 83% of all payments in Kazakhstan's economy, with cash payments reduced to just 17%. This represents a dramatic change from 2018, when cash payments were as high as 66%.

Source: PwC

A pivotal moment occurred in 2022 when non-cash payments surpassed cash withdrawals from ATMs for the first time, reaching 21.6 trillion Tenge, a 49% increase from the previous year. This shift reflects the country's growing digitalization, the expansion of e-commerce platforms (accelerated by the pandemic), and the proliferation of diverse payment methods.

Source: PwC

As of August 2024, the National Bank of Kazakhstan reported that the majority of non-cash transactions were conducted via Internet/mobile banking, accounting for 80.3% of transactions and 90.8% of transaction volume. POS terminals followed, representing 19.6% of transactions and 8.9% of volume.

Payments players in Kazakhstan

This digital transformation has benefited various players in the Kazakh financial sector, with Kaspi.kz emerging as a standout performer. However, competitors like Halyk Bank have also experienced significant growth, albeit not to the same extent as Kaspi. According to the government, Kaspi.kz and Halyk Bank together handles around 80% of payments in Kazakhstan.

While the threat of international competition appears limited due to Kazakhstan's relatively small market size and the complexities of entering a market with established local players, some domestic competitors are worth noting. Onai, originally a national bus-card company, has begun leveraging its extensive user base to expand into the broader payments space. With millions of users already familiar with its platform through public transportation, Onai possesses a significant potential customer base and a track record of successful product implementation.

Another notable competitor is Choco, which has developed products similar to Kaspi's offerings in areas such as marketplace and payments. However, Choco's strategic approach differs from Kaspi's in that it has not integrated its various services into a unified ecosystem, a decision that may have limited its competitive impact.

Despite these local challengers, Kaspi's position remains strong. The company's growing market share, combined with its competitive advantages and integrated ecosystem approach, provides a robust defense against current and potential competitors. The ecosystem strategy, in particular, has created significant switching costs for users, further entrenching Kaspi's market position. More importantly, Kaspi has captured a large part of the payments value chain as seen below and established almost a monopolistic position in payments.

Source: Atmos Invest on Substack

This has allowed it to displace Visa and Mastercard in Kazakhstan in its early days.

Source: Kaspi

Fintech

The overall health of Kazakhstan's banking sector appears robust, despite facing various economic challenges. Loan growth is projected to reach 17.1% in 2024, buoyed by a reduction in subsidized lending and a more relaxed monetary policy. The sector's resilience is further evidenced by the low level of non-performing loans, which stand at just 2.9%, a significant improvement from the 20% seen in the mid-2000s. This transformation is largely attributed to the National Bank of Kazakhstan's reform efforts, which have substantially enhanced regulatory practices.

Profitability in the banking sector remains strong, with a return on equity of 38.0% reported in 2023 and net interest margins of 6.4 percentage points. While the National Bank's policy easing may impact profitability to some extent, the sector is expected to maintain its stability in the coming months.

Source: BMI

Fintech and loan players in Kazakhstan

Kazakhstan's banking landscape is characterized by a mix of established institutions and innovative fintech players, with 22 banks operating in a sector dominated by a few key players. At the forefront is Halyk Bank, which holds a commanding position with over 30% market share in both loans and deposits across most segments of the banking system. However, this landscape is far from static, with recent political developments potentially paving the way for improved competition and efficiency gains monetization.

In this competitive environment, Kaspi Bank has emerged as a formidable challenger, particularly in the retail banking sector. While Halyk Bank maintains its overall leadership, Kaspi has carved out a significant niche, especially in consumer-focused services. Kaspi now stands as the second-largest bank in Kazakhstan by total assets and retail deposits, holding a 22% market share in the latter. Perhaps most notably, it has established itself as the largest local bank for unsecured consumer loans, a testament to its strong focus on retail banking and digital services.

Kaspi Bank's success in this competitive landscape can be attributed to its innovative approach and focus on digital services. Unlike traditional banks, Kaspi has achieved 100% digitalization of its services, compared to Halyk's 59%. This digital-first strategy allows Kaspi to offer superior customer experiences, such as approving loans within minutes, while traditional banks may take up to a week for the same process.

Looking ahead, Kaspi appears well-positioned to expand its services, potentially moving into the SME finance market through its merchant Super-app. This could further challenge Halyk's market leadership in various segments. Additionally, Kaspi's structure allows it to benefit from interest earned on user balances in transaction accounts, providing an additional financial advantage.

However, apart from Halyk, other players like Forte Bank (with its ForteMarket initiative), Home Credit Bank, and Alfa Bank are also vying for market share in the evolving fintech and loan market.

Marketplace

Market Size

Below is a table by JP Morgan and ADL that outlines the marketplace addressable market:

Source: JP Morgan

Retail spending is projected to account for 16% of Kazakhstan's GDP in 2023, aligning closely with the United States' retail sector contribution.

In 2022, e-commerce purchase volume reached KZT 1.3 trillion, representing approximately 7% of total retail sales. A compound annual growth rate (CAGR) of 38% is expected for e-commerce through 2027. By 2027, e-commerce is projected to reach KZT 6.9 trillion, accounting for about 21% of total retail sales. This is in line with the Russia (20%) and US (26%)

In 2022, e-grocery sales volume was KZT 50 billion, less than 0.8% of total grocery sales. An impressive CAGR of 68% is forecasted for e-grocery through 2027. By 2027, e-grocery is expected to reach approximately KZT 600 billion, representing about 5% of total grocery sales.

E-commerce landscape in Kazakhstan

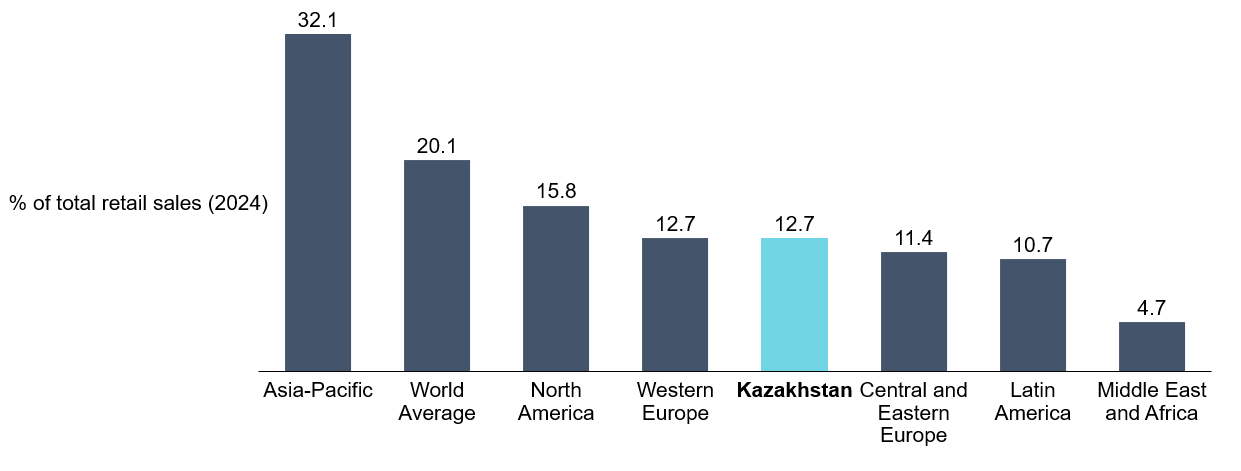

Kazakhstan's e-commerce market has been experiencing rapid growth in recent years. In 2023, the total volume of retail e-commerce reached 2.44 trillion tenge ($5.3 billion), representing a 79% increase compared to 2022. This surge in e-commerce sales has significantly increased its share of total retail trade, reaching 12.7% in 2023, up from 12.5% in 2022.

The market is expected to continue its strong growth trajectory. Forecasts predict the e-commerce market in Kazakhstan will reach $1.23 billion in revenue by 2024, with a compound annual growth rate (CAGR) of 17.7% from 2024 to 2028. Recognizing the sector’s importance for economic growth, the Kazakh government aims to increase the share of e-commerce in retail to 20% by 2030. This ambitious target involves developing local warehousing, logistics infrastructure, and enhancing consumer protection.

Central and Eastern Europe, where Kazakhstan is located, is one of the least penetrated regions for e-commerce, with online retail representing only 11.4% of sales in 2024—compared to the global average of 20.1%. This low penetration highlights significant growth potential for the region, and especially for Kaspi’s operations.

Source: eMarketer, author's own illustration

In Kazakhstan, the largest share of total retail sales of goods through e‑marketplaces were phones and gadgets at 27.5%, appliances at 11.6%, computer goods and software at 10.1%, and auto goods at 7.9%.

Source: HKTDC Research

E-commerce players in Kazakhstan

Merchants

Small businesses account for 92.8% of the total retail e-commerce volume in Kazakhstan, making them a vital segment for Kaspi's marketplace. Many of these small enterprises lack the resources to develop their own websites or marketing channels, relying heavily on social media platforms like TikTok and Instagram for promotion. Kaspi’s marketplace provides a vital platform for these businesses, enabling them to scale without the need for extensive infrastructure. According to Kaspi, their advertising services have been multiple times more efficient than traditional social media.

According to Euromonitor, Kaspi dominates the e-commerce market in Kazakhstan, with a market share of 57.7% in 2023, up from 51.4% in 2022. This dominance is notable considering Kazakhstan's fragmented e-commerce ecosystem, which comprises about 20 online marketplaces and 2,000 e-commerce sites. Competitors include prominent players like AliExpress, Wildberries, Ozon, and Zoodmall, along with local platforms such as Halyk Market, Jusan Market, and Forte Market. Despite the crowded field, Kaspi has managed to stand out by leveraging its logistics capabilities, economies of scale, and an expansive network of local merchants.

Source: Euromonitor

Competitive Challenges

While Kaspi holds a commanding position, the e-commerce marketplace is highly competitive and lacks strong barriers to entry. Unlike its payments business, where Kaspi has created a robust network effect, the marketplace side faces significant competition from both domestic and international players. Major competitors like Wildberries and AliExpress offer similar services, and customers are often indifferent about which platform they use, focusing more on price and convenience.

The commoditized nature of marketplaces, where customers can easily compare prices across platforms, makes it difficult for Kaspi to build the same network effects as it has in its payments business. Moreover, unlike companies like Amazon that invest heavily in logistics infrastructure, Kaspi does not manufacture or warehouse its products, relying instead on third-party retailers.

However, one area where Kaspi has been able to carve out a competitive edge is through its logistics capabilities. Much like Amazon, Kaspi has built a well-developed network of postomats (self-service parcel lockers), warehouses, and fulfillment centers, enabling quicker delivery at lower costs to merchants. This logistics infrastructure is critical in a country like Kazakhstan, where the vast geographic distances and underdeveloped transportation infrastructure present significant challenges for efficient e-commerce operations. While Kaspi has capitalized on these advantages, expanding logistics capabilities beyond major cities like Almaty and Astana remains a significant growth opportunity, particularly as rural areas become more integrated into the digital economy.

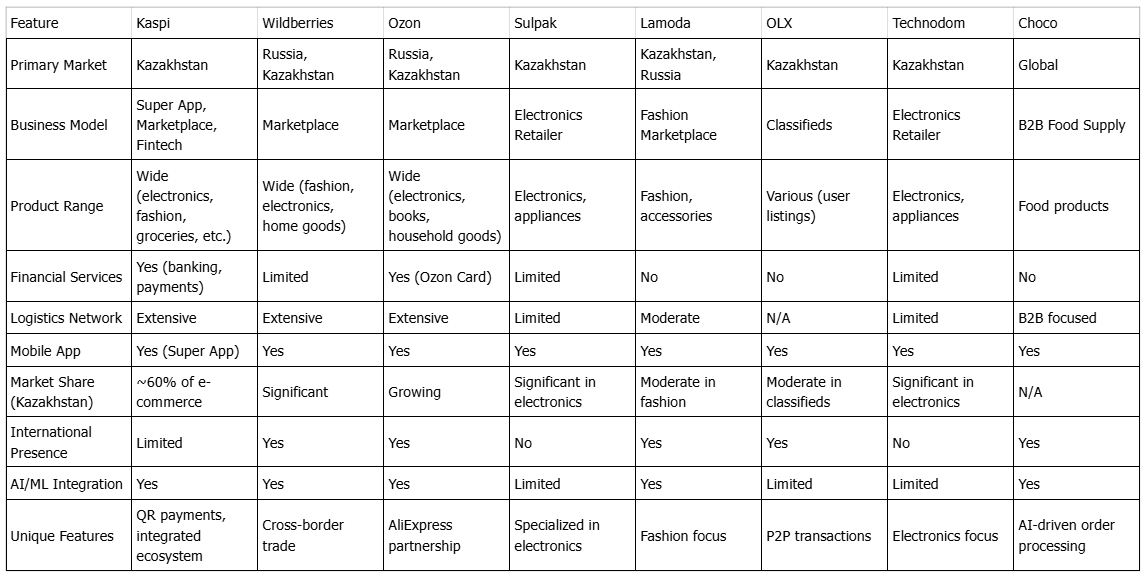

The below table highlights the differences between the prominent players in Kazakhstan:

Competing against foreign competitors

Local players, including Kaspi, enjoy advantages in logistics, faster delivery, and easier returns, which are critical factors for Kazakh consumers. Furthermore, the devaluation of the local currency makes foreign retailers more expensive, which can drive more consumers to domestic platforms. However, foreign competition, especially from China, remains strong. Companies like Alibaba are improving their logistics infrastructure with new fulfillment centers, enabling faster cross-border deliveries at competitive prices. Currently, cross-border e-commerce accounts for a higher sales value than domestic e-commerce, a trend that may continue as Chinese players optimize their supply chains. t the Russian players are more sophisticated at logistics and investing in a warehousing-heavy model

Moat and Competitive Advantage

Network Effects

Across segments

The largest moat that Kaspi.kz has is the network effects of its super app.

Source: Kaspi

Kaspi’s payment, marketplace, and finance platforms are highly interrelated. The growth and development of one platform naturally support and accelerate the growth of the others, reinforcing a virtuous cycle. For example, a consumer using Kaspi for managing finances can seamlessly browse the Marketplace for products. Once a purchase decision is made, the user can easily complete the transaction through Kaspi’s integrated payment system, given that their financial information is already stored in the app.

The interactions between Kaspi's various platforms create a self-reinforcing flywheel that drives profitable growth and provides significant competitive advantages, such as lower costs. Here's how the flywheel turns:

The large base of active consumers, combined with a variety of convenient payment and financing options, drives higher consumer spending on the Marketplace.

This increased spending on the Marketplace Platform boosts transaction volumes across the Payments Platform and increases demand for financing through the Fintech Platform.

The growing consumer activity attracts more merchants to the Marketplace, expanding product selection and enhancing price competitiveness. As more merchants join, the platform becomes even more attractive to consumers, creating a positive feedback loop. Merchants recognize the value of Kaspi’s extensive user base and are often willing to pay higher commissions for access to it.

These synergies encourage consumers to transact and interact more frequently with Kaspi.kz, increasing the average number of monthly transactions per user. Frequent consumer engagement is key to the effective cross-selling and upselling of products.

This seamless integration fuels a self-perpetuating cycle: the more a user engages with one service, the more they are likely to explore and use others. For instance, a user who starts with peer-to-peer (P2P) payments might soon begin shopping on the marketplace or utilizing Kaspi’s "Buy Now, Pay Later" (BNPL) services.

This all-encompassing ecosystem also reduces the likelihood of users seeking alternatives, as Kaspi fulfills a wide array of daily needs while offering unmatched convenience. Standalone competitors struggle to replicate this breadth of services.

The customer stickiness that Kaspi possess and increasing engagement can be seen with the ratio of Daily Active Users (DAU) and Monthly Active Users (MAU) of 65%, which only trails behind WeChat.

Source: Kaspi 2023 Annual Report

There are benefits to such network effects:

Kaspi’s fintech products, such as BNPL and consumer loans, benefit from the company's cross-selling strategy. Once consumers are using Kaspi’s payments or marketplace services, they are targeted with relevant fintech offerings, allowing Kaspi to grow its fintech segment with minimal customer acquisition costs. By leveraging consumer data gathered from payments and marketplace transactions, Kaspi can price risk more effectively than competitors, further driving adoption of its financial products. o, Kaspi knows how much money you're making on revenue line. Now you are starting to work with Kaspi to pay for your goods that you are getting either from manufacturer or distributor. You might have working capital needs. Kaspi may extend you a loan because they see everything and then they will just subtract it from your revenue coming in when you make those sales. Kaspi is learning right now about that product line, so, in the next couple year, maybe two years, we will learn a lot more, maybe even faster. But that is another way to increase your stickiness of a customer from business-to-business perspective.

, having a large customers base makes it very easy for new services to scale rapidly and be used by consumers quickly. Kaspi Travel is a good example. After two years after launching, they managed to sell over 11 million tickets annually.

Exceptional scalability and near-zero marginal cost structure. At the core of this advantage is Kaspi's ability to serve additional customers and introduce new services with minimal incremental costs, allowing the company to rapidly deploy and integrate new offerings across its large, established network. New customers and services contribute significantly to revenue without proportional increases in costs, resulting in high contribution margins. This dynamic sets the stage for exponential growth potential, as the combination of an expanding user base and growing service offerings can lead to multiplicative revenue increases. Moreover, the low-cost structure allows Kaspi to offer competitive pricing while maintaining profitability, further strengthening its market position.This scalability and cost efficiency further create a virtuous cycle for Kaspi. As the company grows its user base and expands its service offerings, its competitive advantage strengthens, solidifying its market position and erecting formidable barriers to entry for potential competitors

Silos in each business segment

Payments Segment: Two-Sided Network Effect

Kaspi's payment network is the cornerstone of its ecosystem. It has created a two-sided network effect where both consumers and merchants drive each other’s adoption:

Consumers use Kaspi Pay for the convenience and ubiquity of its payment solutions, such as in-store QR payments, P2P transfers, and bill payments, which are often commission-free and deeply integrated into daily life.

Merchants are incentivized to adopt Kaspi Pay because of the sheer number of consumers using it, especially since Kaspi controls both sides of the transaction with its POS terminals.

As more merchants accept Kaspi Pay, it becomes even more convenient for consumers to use the platform, which in turn attracts more merchants. This self-reinforcing cycle creates a high barrier for other payment services to compete, especially given Kaspi’s wide reach and track record of innovation.

Additionally, Kaspi’s closed-loop payment system (where most transactions happen within its ecosystem) further strengthens these network effects. Consumers using Kaspi's Buy Now Pay Later (BNPL) or Kaspi Gold products must transact through Kaspi’s platform, which increases the volume of transactions and deepens the integration between Kaspi’s payments, marketplace, and fintech segments.

Marketplace Segment: Pseudo-Exclusivity and Economies of Scale

Kaspi’s marketplace benefits from its vast consumer base, particularly because many users are acquired through the payments segment at minimal cost. This creates organic traffic for the marketplace, giving it a significant advantage over competitors. Merchants, who typically list on multiple platforms, prioritize Kaspi due to its high order volume and extensive customer base. In fact, 33% of merchants’ revenues come through Kaspi’s platform, leading to high retention rates of 99%.

Although merchants are not contractually exclusive to Kaspi, the platform creates pseudo-exclusivity by generating a disproportionate share of their sales. This leads merchants to invest more time, inventory, and marketing into Kaspi's marketplace, reinforcing the platform's dominance. The more merchants invest in Kaspi, the more selection and convenience consumers enjoy, creating a virtuous cycle of user and merchant growth.

Furthermore, Kaspi’s logistics infrastructure—including fast and free delivery—enhances the user experience and keeps consumers loyal. Similar to Amazon’s model, Kaspi’s scale allows it to offer competitive shipping solutions that are difficult for smaller platforms to replicate.

The closed-loop nature of Kaspi’s ecosystem is critical here. For example, customers using Kaspi's marketplace must use its fintech or payment products, which ensures high usage of these services. The more customers engage with Kaspi’s fintech offerings, the more valuable the entire ecosystem becomes, as it reduces friction for transactions across the platform.

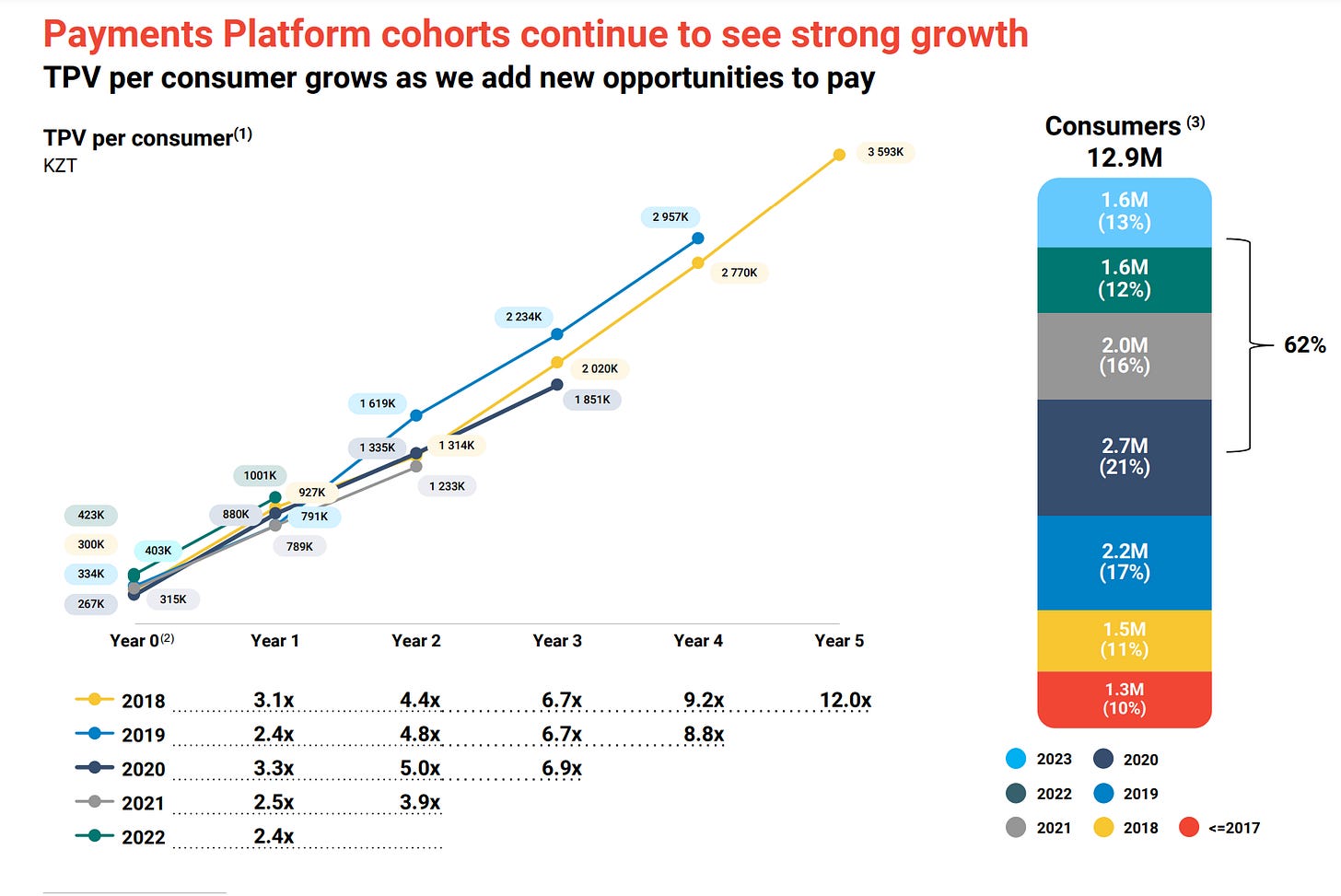

Kaspi's cohort analysis indicates strong and sustained growth across consumer cohorts for both their Payments and Marketplace platforms:

For the Payments Platform:

TPV per consumer grows significantly as cohorts mature, showing increasing usage over time.

The 2018 cohort, for example, increased TPV per consumer by 12x by Year 5.

Even older cohorts like 2017 and earlier continue to show growth in TPV per consumer year-over-year.

Newer cohorts are starting at higher TPV levels and growing faster than older cohorts did at the same stage.

Source: Kaspi

For the Marketplace Platform:

GMV per consumer also shows strong growth as cohorts mature over time.

The 2018 cohort increased GMV per consumer by 4.4x by Year 5.

Newer cohorts are starting at higher GMV levels compared to older cohorts at the same stage.

50% of Marketplace consumers are from the 4 most recent cohorts, indicating significant room to grow as these cohorts mature.

Source: Kaspi

Overall, the cohort analysis demonstrates:

Increasing engagement and spend from existing customers over time

Faster growth trajectories for newer cohorts

Continued growth potential as newer, larger cohorts mature

Strong retention and increasing value of customer relationships over multiple years

Growth Catalysts

Expansion into new geographies

Kaspi is well-positioned for regional expansion, leveraging its proven ecosystem and market leadership in Kazakhstan to tap into new high-growth markets. In April 2024, Kaspi partnered with Alipay to enable QR code payments across China, signaling the company’s ambition to expand its payment services beyond its home market. This partnership opens up access to the massive Chinese consumer base, potentially driving transaction volumes and cross-border growth.

In parallel, Kaspi has also adopted an innovative market entry strategy in Azerbaijan, starting with e-commerce and gradually layering in fintech services. This reversal of its traditional approach demonstrates the company’s adaptability in addressing diverse market dynamics. By acquiring key local players in categories like automotive and real estate listings, Kaspi is building a foothold in Azerbaijan, which could serve as a gateway for further expansion into neighboring countries like Georgia, Armenia, and even Turkey.

Uzbekistan, with a larger population but a smaller economy compared to Kazakhstan, represents another attractive target for Kaspi. The country’s growing economy and similar political structure make it a promising market for future growth. Kaspi’s interest in participating in the privatization of Uzbekistan’s leading payment system, Humo, highlights its strategic focus on expanding its payment infrastructure in the region.

Additionally, Kaspi’s prior acquisition of Ukraine’s Portmone Group, a fintech offering P2P and bill payments, provides a long-term growth opportunity once the geopolitical situation stabilizes. Despite current uncertainties, Ukraine’s pre-war GDP of nearly $200 billion and relatively weak competition in the digital finance space make it an attractive future market for Kaspi.

While Kazakhstan remains Kaspi’s primary focus, gradual expansion into these surrounding countries, coupled with favorable government privatization initiatives and strategic partnerships, will help the company capture new growth opportunities. The characteristics of CIS countries makes these markets easier to scale and localize compared to more diverse regions like Southeast Asia:

Population Composition in CIS Countries

Predominantly Slavic and Turkic ethnic groups, creating relatively homogeneous populations within individual countries.

Russian language acts as a common lingua franca, making communication and business operations more streamlined across the region.

Impact: This population homogeneity could simplify product localization and marketing strategies, allowing for more efficient and cost-effective scaling.

Religious Landscape

Dominated by Orthodox Christianity and Islam, with limited religious diversity within most CIS countries.

Impact: The relatively uniform religious landscape reduces the need for highly tailored messaging, making it easier to implement standardized marketing campaigns across the region.

Economic Development

CIS countries share a common history of Soviet-era economic planning, leading to a more uniform level of economic development across the region.

Impact: This consistency in economic development creates fewer disparities in market demand, making it easier for Kaspi to implement uniform business strategies.

Urbanization and Digital Landscape

Urbanization levels across CIS countries are more consistent compared to other regions.

The digital landscape is also relatively uniform, with similar levels of digital infrastructure development.

Impact: These factors allow for consistent urban-focused growth strategies, as well as easier implementation of digital marketing and e-commerce initiatives. Kaspi can efficiently roll out its digital platforms with fewer regional adjustments.

This positions Kaspi to replicate its successful super-app model across the region, driving sustained growth for the company.

However, Kaspi’s growth strategy is around acquiring or developing in-house almost all products it offers on the platform. With the exception of partnerships with government agencies on tax and traffic fine collections, Kaspi owns supply end-to-end. This approach is hard to scale when expanding abroad, as it will be faced with high costs, integration challenges and protectionist/regulatory pressure

Cross-selling into higher yielding verticals

Kaspi's cross-selling strategy has emerged as a powerful growth catalyst, propelling the company to new heights by leveraging its integrated ecosystem of Payments, Marketplace, and Fintech platforms.

Kaspi's strength lies in its comprehensive ownership of the entire transaction process and ability to capture multiple steps in the supply chain. By providing a marketplace for purchases, a payment method, and financing options, Kaspi creates numerous touchpoints for cross-selling opportunities, maximizing its profit potential from each consumer. This integrated approach allows a single transaction to generate revenue through multiple channels, allowing Kaspi to benefit more than once from each transaction

One example is the cars segment, one that the company is focusing on building out currently.

Source: Kaspi

The company's ecosystem synergy is particularly noteworthy, with significant potential for growth as it encourages users of one platform to adopt the others. As of Q3 2021, only 40% of customers were using all three platforms, indicating substantial room for expansion. However, it is worth noting that this 40% figure is from 2021, so the current percentage may have changed since then as Kaspi.kz has continued to grow and promote adoption across its ecosystem. Nevertheless, I believe there is significant white space that Kaspi can tap on.

Another example is the BNPL product, Kaspi's approach to BNPL is particularly innovative. Rather than focusing on maximizing standalone yields, Kaspi uses BNPL as an engine to drive average transaction value and volume across its entire platform, via 3 touchpoints for Kaspi: providing a place to purchase, a method to purchase and the means to fund that purchase. . This strategy has allowed Kaspi to thrive even as global BNPL giants struggled with profitability.

Source: Vergent Asset Management