Initial Report: Kingsoft (SEHK:3888), 56.2% 5-yr Potential Upside (China Tech Fund)

Not going soft on Kingsoft

Introduction to the Next Gen China Tech Fund

About

The inception of China Tech Fund was the shared idea between Shinya and Max while having a discussion about the exciting opportunity of the Chinese listed shares in the United States and Hong Kong. During these past two years, the Chinese government executed a total crackdown into the technology and real estate sector causing a hard deleveraging and share liquidation by foreign investors all around the world. The Hang Seng Index (HSI) fell approximately 50% and foreign investors totally lost confidence investing in the Chinese market. With the tightening of financial markets all around the world due to persistent high inflation, China remains firm on the decision to lower interest rate; however financial and psychological repercussions remain and market participation is fearful of allocating capital. With the previous successful execution of the inception of China 101010 Fund during the severe bear market during 2011-2012 period in China, China Tech Fund’s goal is to also replicate the success by capitalizing on the rare contrarian opportunity to buy into the highest quality internet technology companies in China and hopefully with a long term perspective (10 years) and patience to successfully compound capital by beating the benchmark indexes.

LinkedIn | Max Tai

About the Business

Our main conviction for Kingsoft is in its office software and services segment. We believe that there will continue to be strong growth in this revenue segment in the upcoming years.

Office software and services

Kingsoft is well-known as the “Microsoft of China” with its flagship product Word Processing System (WPS). WPS includes Word Doc, Presentation, Spreadsheet and PDF, and its features are highly similar to Microsoft. WPS adopts a freemium model where the software is free-to-use with limited features, and a premium paid version is required for access to more features such as ability to edit PDF file. In addition, WPS also makes money from advertisement revenue.

WPS is a high-quality product provided through both through PC and Cloud. In fact, WPS entered the mobile office market even before Microsoft Office did. In addition, WPS can support all main operating systems, including Windows, IOS, Linux and even Chinese homebred operating systems.

This office software and services segment currently makes up 51% of Kingsoft’s revenue in 2021. In addition, this revenue has been growing at such a high rate. From 2020 to 2021, this segment grew from RMB 2.25bn to RMB 3.26bn by 44.6%. The increase was mainly due to the continued fast growth of their individual subscription business, sustainable growth of their institutional subscription business and the explosive growth of institutional licensing business. In 2021, it was the first year that Kingsoft’s office software and services’ revenue even exceeded their online games revenue segment.

Online games and others

We are not as optimistic about this revenue segment, as its revenue has been fluctuating in previous years. Kingsoft’s most popular game is its iconic gaming series Sword Heroes (JX) Fate. It has achieved 3.3 million daily active users in East Asia as of April 2020. Their popularity in East Asia is examplified by JX I Pocket mobile game ranking the first in both the top free charts and grossing charts for iOS and Android apps in Vietnam. However, it seems to us that the total number of users has already peaked for their game in 2016. Given strong competition in the China gaming industry with players such as NetEase and Tencent, we do not have particularly strong faith in this revenue segment’s growth rate.

With this online games segment making up 49% of Kingsoft’s revenue in 2021, Kingsoft expressed the Intention to develop its core IP and continue to build new games genres and IPs to ensure a strong revenue stream from this revenue segment. However, our opinion is that this online games segment will gradually diminish and be dominated by Kingsoft’s office software and services segment that is currently growing at such a rapid pace.

Catalysts

Strong governmental support

In May 2022, the Chinese government ordered state-backed corporations and central government agencies to dump foreign-branded PCs and to opt for domestic alternatives that utilise domestic operating systems (OS). This means that we can expect at least 50 million PCs to be replaced and replaced with domestic softwares such as Kingsoft’s WPS instead of Microsoft. Therefore, we are optimistic that Kingsoft’s WPS will experience a huge rise in recurring revenue.

High product quality to rival Microsoft

While many chose Microsoft over Kingsoft in the early development of the Kingsoft, Kingsoft’s WPS product quality has improved significantly over time. Therefore, it is now not that far off from Microsoft, and is a lot more cost effective given it’s lower price.We believe once more China consumers utilise Kingsoft’s WPS under governmental pressures, they would switch over to WPS permanently.

Risks

Strong competition within the Chinese domestic market

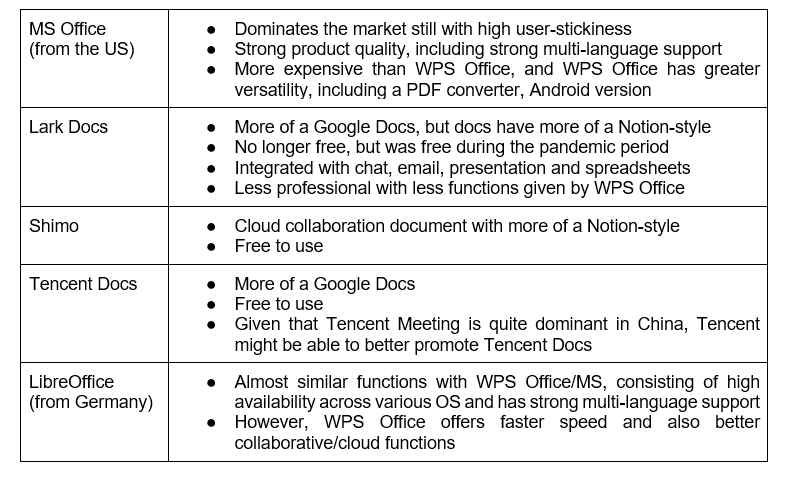

There are many strong competitors locally, with some of the key ones being:

However, WPS is one of the rare few with such a similar software style and high product quality as Microsoft, while being cheaper and domestically produced. Therefore, while we are concerned about the competition and need to continue to keep a lookout on new developments in the market, our opinion is that Kingsoft’s WPS is currently the best alternative to Microsoft in China as the Chinese government shifts state-backed corporations and central government agencies towards domestic softwares.

False sense of moat

Given similar product features with Microsoft, it seems like the only key moat that Kingsoft’s WPS has now is the Chinese government’s strategic decision to move towards domestic softwares. If the Chinese government changes their mind on this, Kingsoft would likely be badly affected. However, we believe this is unlikely because the Chinese government has just announced this decision, making it unlikely for them to change their mind anytime soon. Besides, there is no strong incentive for companies to switch from Kingsoft’s WPS back to Microsoft if their product qualities are so similar.

Ban of Kingsoft’s WPS outside of China

As China increasingly look inwards, other countries are starting to be more wary of China. In particular, US-China tensions have resulted in the United States banning the use of Kingsoft’s WPS in their country. However, given that Kingsoft’s WPS does not have a huge amount of revenue from overseas operations, as most overseas accounts are free version users that only make up a small amount of advertising revenue, this risk is not a huge concern.

Conclusion

Overall, we think that Kingsoft is a good buy due to its strong office software and services segment. Comparing Kingsoft with Microsoft and due to previous regulatory uncertainty in China that has largely stabilized, we also believe that Kingsoft is currently undervalued, making it an opportune time to buy into Kingsoft.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.