Initial Report: Kweichow Moutai Co., Ltd (600519.SS), 19% 5-yr Potential Upside (VIP SEA, Rebecca YANG)

Moutai is an established and well-loved brand. Let's see why Rebecca believes that it has short term and long term growth potential.

LinkedIn | Rebecca YANG

Summary

Steady business with high margins due to the fundamental luxury nature of the product. In the near term, the ongoing shift to direct sales channels and the now-complete range of products at various price points is going to drive profitability and build loyalty among the younger middle class. In the long term, sustainable growth has been strongly indicated by consumer attitudes to some of Moutai’s newer investments in themed products and digital experiences.

1. Business Model

Established in 1951, Kweichow Moutai Co., Ltd is China’s leading high-end baijiu (white liquor) producer, principally engaged in the production and distribution of Moutai liquor series products. In 2017, it became the world’s biggest liquor maker by market value, surpassing Diageo, the British owner of Johnnie Walker, Guinness and Tanqueray. It is also the most valuable company in China, overtaking tech giants Tencent and Alibaba.

The 53% alcohol content liquor of Feitian, its flagship product, is touted as the national spirit of China, is distilled from fermented sorghum and comes in several different varieties. Moutai is made exclusively in the town of Maotai in China's Guizhou province, given the complex production method, strict quality standards for ingredients, and limited natural resources. However, management has indicated that the land that meets production requirements has not been fully utilized and hence production capacity stands to grow further as a result of expansion of production facilities.

The company's main products portfolio consists of Kweichow Moutai liquors and other liquor series, including Moutai Feitian, Moutai 1935, Moutai Prince, Moutai Ying Bin Chiew and Lay Mau liquors. Products are priced in a range of $100 to $20,000, in different volumes and bottle sizes so that consumers can afford them at different price points. The company distributes its products within domestic market and to overseas markets, despite almost all (~97%) of its sales hailing from China alone.

Why is Moutai so expensive? Its prices are a combination of its limited supply, its long, labor-intensive, famously difficult-to-replicate manufacturing process, and how its sales and distribution network has been designed. From the selection of ingredients to the delivery of the finished product, the production cycle takes 5 years, consisting of seven distillations and passing through no less than 30 processes and 165 different procedures.

Kweichow Moutai’s sales structure largely consists of distributor sales and direct sales. In 2022, wholesale distributors accounted for 84% of sales volume and 60% of revenue. While direct sales made up only 16% of sales volume, their revenue contribution was 40%.

Launched in Q1 of 2022, its own online platform, “iMoutai”, accounted for about a fifth of direct sales in the first half of 2022, and as of May 2023 has roughly 40 million users and 23 billion yuan worth of sales. The company also launched 100ml bottles of Feitian iMoutai to introduce the younger crowd to Moutai. Interestingly, the app does not sell the full-sized flagship bottle of 500ml Feitian, which represents a strategically delayed decision for the company amid changes to its channel mix.

Distributor price = ¥969

Direct sales price = ¥1,499 (54.7% margin)

Resellers (黄牛’s) markup ex-factory prices from about ¥1,000 to the 2,500-3,000 range.

However, overall prices are tightly controlled by the company, one through carefully controlling supply and two through adjusting shipments to offline versus online retailers, since selling at lower base prices through online retailers like JD and Alibaba’s Tmall help bring down overall prices. When prices get too low, more products are supplied to offline retailers to bump up prices again.

2. Competitive Advantage

Moutai has been a long-standing market leader and enjoys a market share of roughly 26% in China’s baijiu market, compared to competitors such as Wuliangye (20%), Yanghe (16%) and Luzhou Laojiao (8%). Its competitive advantage comes from a few key aspects:

· Strong Brand Equity: Moutai is known as the favorite drink of Mao and as the “drink of diplomacy”. It was famously used to welcome Nixon on his historic trip to China in 1972, and again in 2013 when Xi met Obama in California. Even as the liquor has become more accessible to the masses, particularly Chinese males above 40, the prestige and rich history surrounding Moutai has cemented its position in the baijiu industry as well as in the Chinese psyche. Consumers rank Moutai 80% more differentiated than average baijiu brands, and Feitian has a 95% share of the Prestige segment.

Moutai’s enormous success with Moutai ice cream, Moutai 1935 and iMoutai further point to the observation that the younger generation has been drawn to baijiu despite relatively lacking such sentimental feelings. By engaging customers through “Double 11”-like digital sales promotions and using metaverse experiences to tell the story of Moutai’s origins. Its diversifying product mix and the increasing profitability of its series liquor is also contrary to comparable series products from competitors like Wuliangye.

What’s particularly clever about Moutai’s brand positioning is also its increasing association with Chinese culture. By tying in its promotional campaigns and products with the 24 solar terms and the Chinese Zodiac, not only is it differentiating itself in the eyes of younger consumers who have higher exposure to foreign high-end spirits, it ties its own significance and sophistication with that of Chinese culture, which young people are increasingly interested in celebrating.

· Proven Pricing Power: As mentioned above, production capacities of Moutai are limited, with production volumes currently at upwards of 50,000 tons. Moutai has historically raised prices every year, between 16% to 32% each time, yet it has never faced a decline in demand for its products. Its strong pricing power has contributed to its incredibly high margins (average EBIT margins of 66%) that are more than 5 times higher than the global liquor industry average.

Its ever-increasing prices and scarcity add a financial characteristic to Moutai, making it more than just a consumer good. Moutai tastes better as it ages, which allows its price to increase over time. This makes Moutai a popular and extremely profitable investment. A 2009 bottle of Moutai retailing at ¥1,000 rose to ¥4,200 in 2020, offering a 15.6% Y-o-Y return. A bottle of rare 1935 Lay Mau edition was sold at a whopping US$1.55 million in 2011. Even trust fund companies in China offer Moutai financial products, buying, storing and selling Moutai in bulk to provide investors with 10-15% returns. The Covid-19 pandemic further increased the number of investors looking for a safe-haven amidst widespread uncertainty and a crippled property market.

Another interesting observation is how Moutai 1935 is able to directly compete with other 1000-yuan price point baijius from Wuliangye and Luzhou Laojiao, brands which have had to work their way up to the price range but now face intense competition from the wildly successful launch of Moutai’s own product at this price.

· Forward-looking management

Up to 600 people in Moutai’s management roles aren’t as senior as one would expect – most of them are in their 30s and 40s. Chairman Ding is in his 50s, and is the youngest-serving chairman in Moutai history. Although it is not a direct indication that the company will be innovative and forward-looking, the fact that its management and its target customer are very much aligned in terms of age and hence attitudes, as well as the fact that for a blue-chip business that doesn’t need to change much, Moutai’s newest investments to reach out to the younger generation are already a very strong indicator of how far into the future Moutai’s management is preparing its business for.

More recently, Moutai has partnered with China Merchants Capital and Goldstone Investment, the private equity arms of China Merchants Group and Citic Securities, to establish two investment funds. Each fund will have CNY5.5 billion (USD782.7 million), with Moutai providing 91 percent of the funding, to invest in biotechnology, next-generation information technology, new energy, new materials, high-end equipment, and mass consumption. Beyond potentially improving Moutai’s return on its huge amounts of capital, this move stands out further as an indicator that Moutai is serious about finding new avenues for growth even as its business, at its core, does not desperately need it just yet.

3. Risks

· Authorities influence on stock prices: In 2017, Moutai suffered a huge selloff (erasing $7.8 billion off its market cap in one day) after state-run news agency Xinhua, urged investors to take a more “rational view” of the company.

· Weak protection of minority shareholders’ rights: In 2019, it allowed the parent company to establish a wholly-owned subsidiary that is involved in selling Kweichow Moutai products. Sales amounting to about 13.6% of its net profit and 6.3% of its revenue in 2019 were taken away from the listed entity at the expense of minority shareholders. The deal was not tabled for shareholders’ approval as the amount was within the permissible threshold.

· Legal risks: In 2013, Kweichow Moutai was fined RMB247 million for allegedly breaching anti-monopoly regulations by setting a price floor for distributors. Each year, the company also has to spend millions of renminbi on anti-counterfeiting measures to stamp out fake Moutai.

· Weakening purchasing power: It is unclear whether the Chinese middle class is undergoing a consumption upgrade or downgrade overall. Moutai is still viewed as a premium drink for the elite in China, and much of its demand may stem more from its perceived value rather than a liking for its taste. In a macro environment where the middle class are struggling to stay in their position, more palatable and affordable alcoholic beverages may become winners instead.

· Stagnation in growth once Chinese market is exhausted: Moutai remains relatively unknown outside of China, where it will compete for brand recognition against an entire slew of Western liquors, many of which have penetrated the Chinese market via online retail and competing for the same customers. Compared to other Asian liquors like sake and soju, baijiu is generally less marketable due to the absence of distinctive and classic food pairings.

· SOE structure: Uncertainty arising from government interests may cause Moutai to alter business decisions based on government sentiment or the state of Moutai town/Guizhou province’s economy.

4. Growth Prospects

· Supply expansion: It is estimated that the current supply of Moutai can only meet one-third of the demand. The company is investing 15.52 billion yuan to expand its production facilities. It plans to build 68 new liquor plants, 69 storage facilities and other production infrastructure. The new facilities are expected to be completed in 4 years and add an estimated capacity of 19,800 tons a year.

· Shift in Distribution: Increasing direct sales (either via directly operated stores or its online platform) will create more room for sales growth because Moutai can be sold at higher prices.

· Next Gen: Widespread success of Moutai ice cream (produced by Mengniu) signals Moutai’s potential to tap into the young consumer market and overcome its old-timey strong liquor roots. I think this is important not only to make Moutai more familiar to the next generation of consumers, but to actually create new markets and accumulate experience in increasing the variety of Moutai products available to break into other potentially profitable markets where luxury Chinese food brands are lacking in.

5. Historical Financials

· Spike in sales growth in 2017: Driven by 40% increase in Moutai liquor sales revenue and doubling of sales volume of Series products, leading to an almost tripling of sales revenue retail for a ninth of the flagship liquor even after ASP increase of 27% and lower margins in the Direct-to-Consumer channel. Inventory Days dropped significantly in 2017 but was able to sustain at ~30% all the way to 2022.

o Explanation:

1. Pivotal shift in Moutai’s target consumer:

Moutai experienced several sluggish years when lavish spending was hit by a government crackdown on corruption. As the go-to liquor for official Chinese banquets and business dinners, losing the source of almost 50% of its sales was a big blow. Prices dropped from around 2,000RMB to 830RMB. 2017 was the year Moutai management clearly stated that private and business consumption had become the main drivers of growth.

To promote the liquor to the new target consumers, Moutai shelled out a huge amount for a premium ad slot just before the start of CCTV’s flagship news program, at 7pm. Distributors were reporting that corporate demand was able to account for more than 50% of Moutai’s consumption by 2018.

2. Post-bubble recovery:

Moutai liquor itself experienced a bubble in 2012. People were buying Moutai to hoard and speculate, so when the price of Moutai crashed in 2013, there was a huge excess of baijiu in the market, applying further downward pressure on prices and demand. By 2017, the recovery in demand resulting from the digestion of excess inventory helped Moutai maintain higher prices, given the relative inflexibility of its production expansion mentioned earlier.

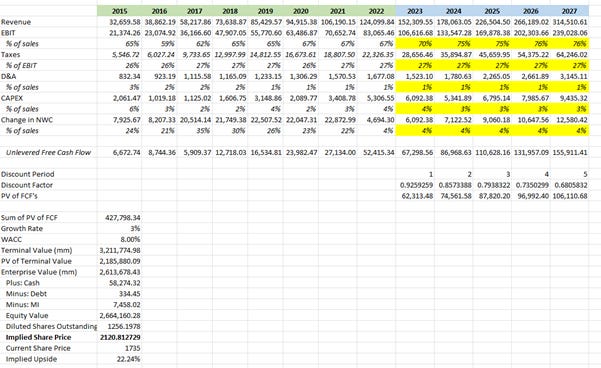

6. Financial Forecasts and Valuation

· Forecasting Moutai’s sales revenue is mostly about forecasting price, since sales volume tends to stay at ~80% of production 4 years ago. From 2000 to 2022, the ex-factory price of Feitian Moutai increased by 423.89%. During the same period, the disposable income of urban residents increased by 684.76%, so Moutai’s price hikes did not exceed the increase in disposable income of urban residents.

· If we match the increase in disposable income of urban residents, the current ex-factory price of Feitian Moutai should reach 1,452 yuan, which is 49.84% higher than the current ex-factory price, and the terminal retail price should reach 2,246 yuan.

· In the past few years, Kweichow Moutai has increased sales prices by adjusting sales channels and other methods, enabling it to achieve steady growth without a large release of production capacity.

· The huge price difference between the current suggested retail price (1499 yuan) and the terminal retail price (2800 yuan) is a good sign for Moutai to further increase prices, since this difference is currently pocketed by distributors.

· In addition to filling the thousand-yuan category of baijiu products and providing more room for Feitian Moutai’s price hikes, Moutai 1935 may also become a sub-high-end or even high-end price benchmark, so that the price increase of products with this price range can no longer be anchored by Feitian Moutai, restricting other baijiu company’s ability to raise prices (since its common practice in the industry to raise prices whenever Moutai does).

· Distribution channels: Series liquor is still very much dependent on distributors, because its weaker brand power needs down selling from flagship liquors. Even though Moutai will shift a large portion of its sales to direct channels, it will need to maintain its relationships with distributors or risk losing key distributors to competitors, like Wuliangye lost Yinji Group’s exclusive distribution to Moutai in 2013. iMoutai will be an extremely important channel for Moutai to boost sales and sell more to the younger crowd.

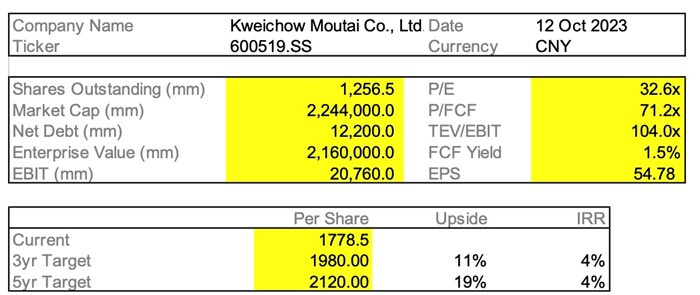

· Valuation (DCF Method): 5Y TP of 2,120RMB

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

How come supply can only meet 1/3 of demand as you state in your analysis