Initial Report: Lamb Weston Holdings Inc. (NYSE:LW), 33% 5-yr Potential Upside (EIP, Nicole TAN)

Nicole presents "BUY" recommendation based on the company's strategic initiatives and strong financial performance.

LinkedIn: Nicole Tan

Executive Summary

Founded in 1950 and headquartered in Eagle, Idaho, Lamb Weston (NYSE: LW) is a global leader in frozen potato and vegetable products, serving the foodservice and retail sectors worldwide. The company operates through four key segments: Foodservice, Retail, Global, and Other, with Global contributing significantly to its revenue. Lamb Weston employs approximately 10,300 people and emphasizes sustainability across its operations, aiming to reduce environmental impact and engage in community initiatives.

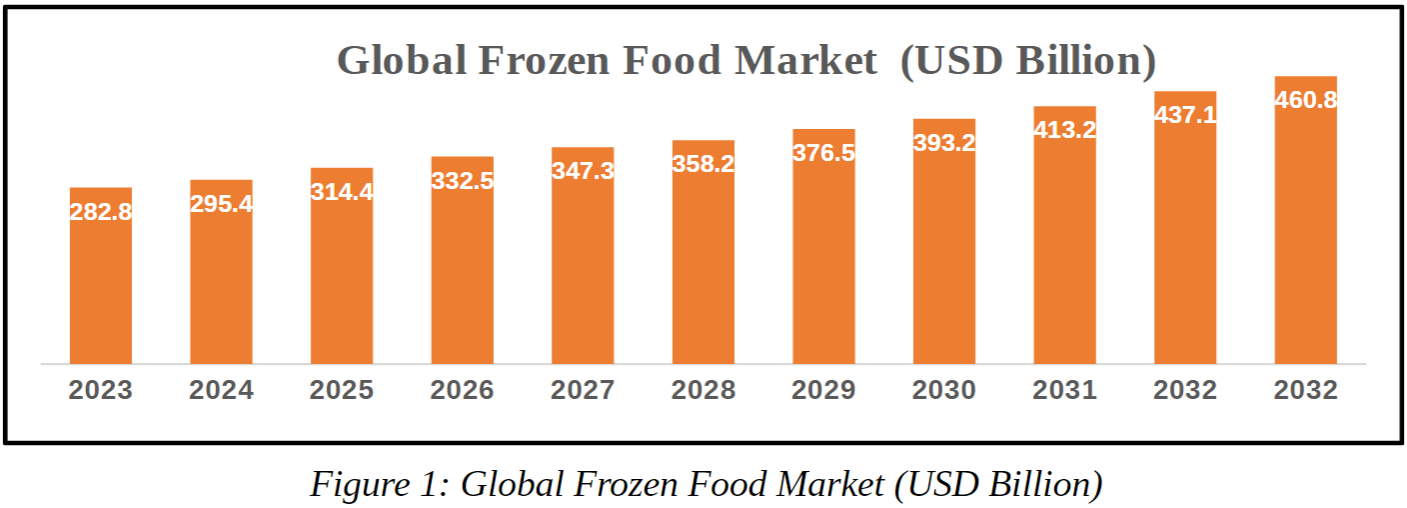

The global frozen food industry, valued at USD 282.8 billion in 2023 and expected to grow at a CAGR of 5.1% to USD 460.8 billion by 2033, is driven by changing consumer lifestyles and technological advancements in freezing technologies. Lamb Weston's investment thesis highlights its position as a leading supplier of frozen potato products globally. The company's recent expansions in Europe and China, coupled with investments in operational efficiency through technologies like ERP systems, support its growth trajectory. Strong financial metrics, including robust earnings before interest and taxes (EBIT) and a favorable P/E ratio, underscore its potential for future growth and shareholder value.

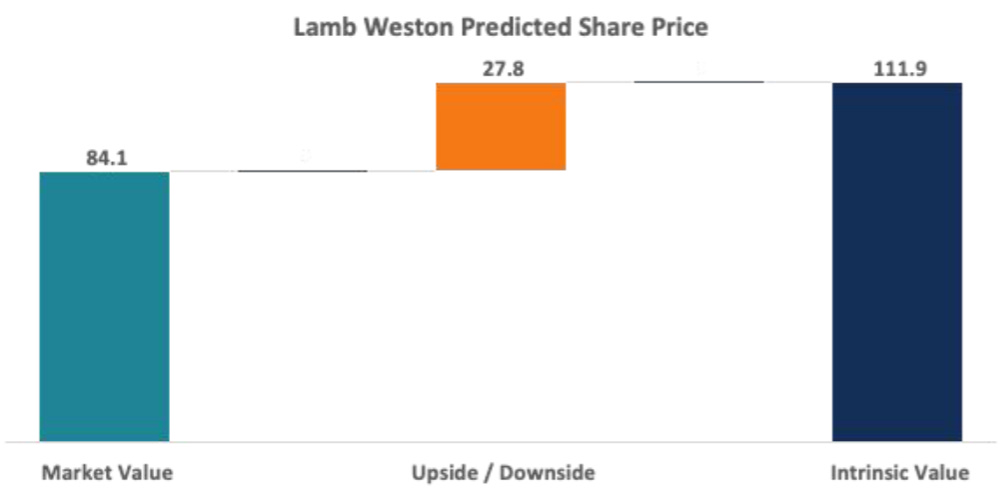

Using a discounted cash flow (DCF) model, Lamb Weston shows a potential upside, reflecting investor confidence in its strategic expansions and operational efficiencies. However, risks such as climate change impacts on potato supply chains and supply chain disruptions are acknowledged, with proactive measures in place to mitigate these challenges. Lamb Weston's ESG assessment focuses on reducing environmental footprint through sustainable agricultural practices, enhancing community engagement, and maintaining ethical governance standards. Opportunities exist to further enhance biodiversity conservation and scale sustainable practices globally.

Overall, Lamb Weston is positioned as a resilient leader in the global frozen food industry, leveraging its market leadership, strategic expansions, and commitment to sustainability. Despite challenges, the company's strategic initiatives and strong financial performance underscore its potential for long-term growth and value creation in the competitive landscape of frozen potato and vegetable products.

1. Company Overview

Founded in 1950 and headquartered in Eagle, Idaho, Lamb Weston (NYSE: LW) is a global leader in frozen potato and vegetable products. The company supplies restaurants and retailers worldwide with innovative offerings from 27 strategically located production facilities. With approximately 10,300 employees, Lamb Weston emphasizes sustainability in its operations, aiming to reduce environmental impact. It holds a prominent market position as the leading supplier in North America's frozen food category and ranks second globally in frozen potatoes. The company is committed to community engagement, with employees contributing over 942 volunteer hours annually, and invests approximately $946,000 yearly in philanthropic initiatives.

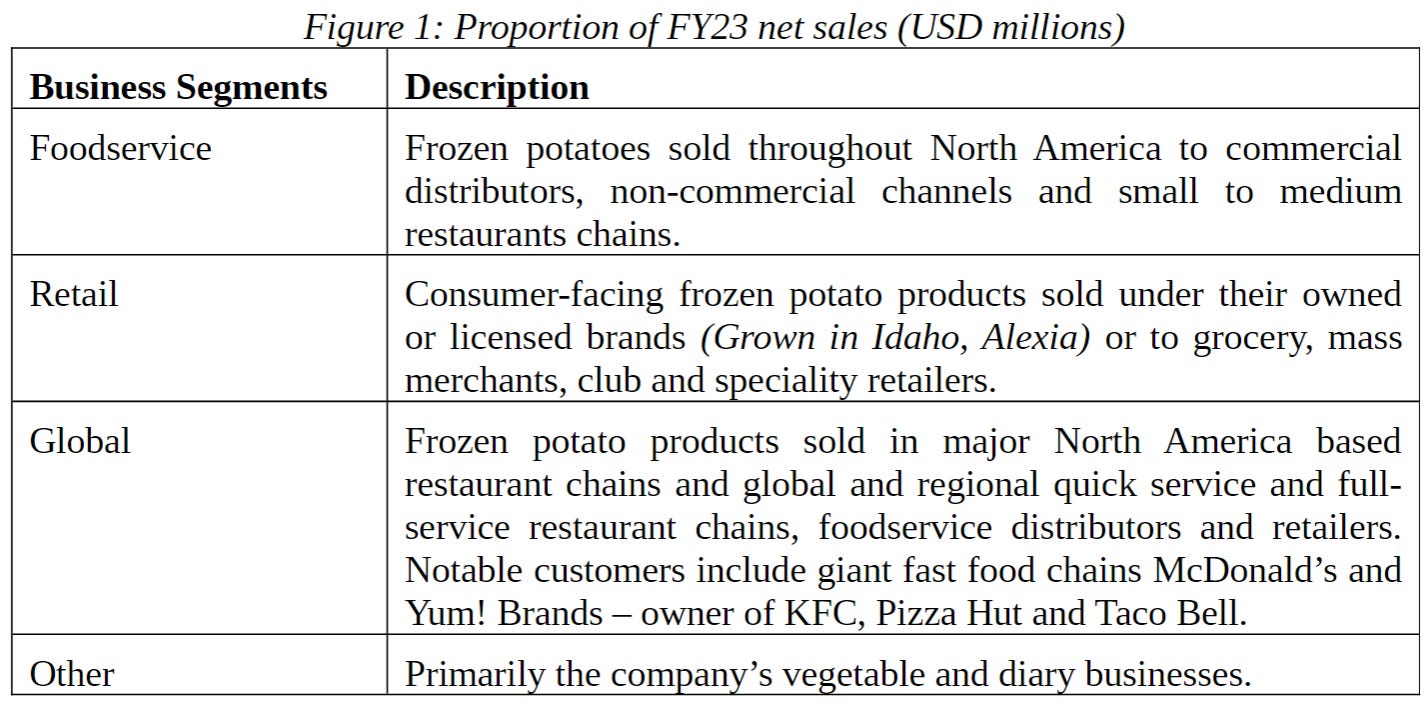

1.1 Business Segment

LW’s business model is comprised of four segments: Foodservice, Retail, Global, and Other, with Global responsible for the main bulk of the business. In FY23 alone, Global accounted for 55% of the net sales.

1.2 Company Financials

A breakdown of LW’s financials has been generated to enable a more comprehensive understanding of its financial performance.

LW’s revenue steadily increased post-pandemic, generating their strongest performance in FY23 at USD5,351 million, which was a 31% growth from the previous year. This largely stems from the rise in demand of the company’s frozen potato products.

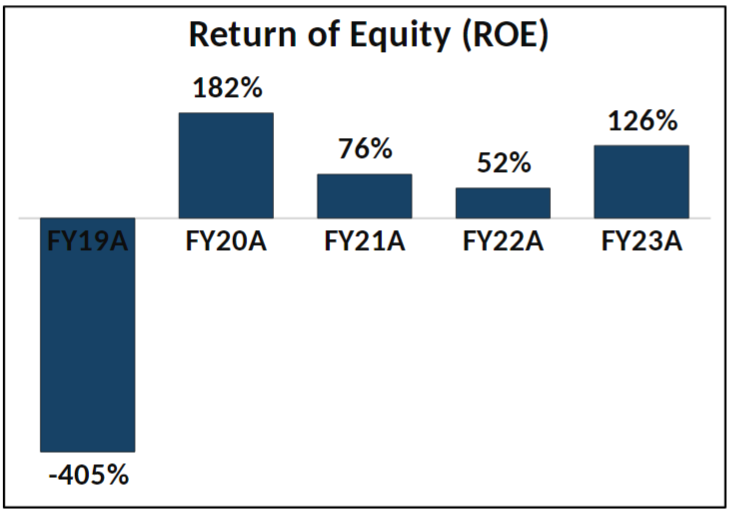

The generally uptrend ROE reflects that LW is becoming more profitable and is recovering extremely well from the post-pandemic. Notably, LW’s FY2023 ROE is 10x higher than the industry average of 12%, which suggests that a high amount of debt financing may be in play.

While still largely higher than the industry average of 0.83, LW D/E ratio has been steadily decreasing over the past few years and becoming less leveraged, highlighting that the company has become less reliant on borrowing and may be in a better financial position.

LW’s interest coverage ratio is generally positive and indicates that the company has a favourable debt servicing ability and is able to easily obtain financing. As of FY23, its EBIT can pay its interest expense 12x over. This is mainly due its EBIT multiplying 3x from FY22 to FY23. Still, the company may need to leverage its capital more efficiently to generate greater returns.

2. Industry Overview

2.1 Market Size

In 2023, the global frozen food industry was a valued at USD282.8 billion and is expected to grow as CAGR of 5.1%, and potentially reaching USD460.8 Billion in 2033.

2.2 Growth Drivers

The rise of the global frozen food market has been driven by changing lifestyle habits and advancement in technology.

2.2.1 Changing lifestyle habits

Due to an increasingly urbanized lifestyle, with over 50% of the world’s population living in urban areas, consumers are more likely to opt for quicker and more convenient solutions. The rise in demand for ready-to-eat meals, with the industry expected to grow at a CAGR of 12.35%, largely contributes to the growth of the frozen food industry. Furthermore, statistics show that 27% of the global population shops online. With the prevalence of online shopping, consumers can now easily order a wide range of frozen foods and have them delivered to their front doors. The culmination of various modern lifestyle factors has fueled the growth of the frozen food industry.

2.2.2 Technological advancement

The advancements in freezing technologies are not just improving the quality of frozen foods; they’re also driving the growth of the frozen food industry. Techniques like quick freezing and cryogenic freezing preserve the taste, texture, and nutrients of foods, making them more appealing to consumers. This increased appeal translates to higher demand for frozen foods, boosting industry growth. Additionally, these freezing methods help extend the shelf life of products, reducing food waste and enhancing sustainability. With better machinery to apply these techniques at a larger scale, companies can meet growing demand more efficiently, further fueling industry expansion, which can drive the overall growth and sustainability of the frozen food industry.

2.3 Competitor Analysis

The following competitor analysis enables a more comprehensive understanding of LW’s competitiveness and relative overall financial positioning.

Market Capitalisation: Despite not being the largest, Stride’s market capitalisation of USD12,420 million suggests that the company holds a solid position in the market, reflecting investor confidence in its business model and growth prospects.

Net Debt: In comparison to many of its competitors, Stride has a relatively higher net debt of USD 3,157 million, indicating weaker liquidity. However, the company has been seen to be able to service its debt, and is also rapidly progressing to be less reliant on borrowing (Section 1.2), which helps to reduce concerns around its financial position.

EBIT: LW's robust EBIT of $882 million underscores its operational efficiency and profitability within the frozen food sector. The company's ability to generate strong earnings before interest and taxes demonstrates its competitiveness and ability to navigate market challenges while delivering value to shareholders.

P/E ratio: In particular, the company is appealing due to its relatively low P/E ratio of 11.5, suggesting that the company's stock is undervalued compared to its earnings potential. This presents an opportunity for investors to acquire shares at an attractive valuation, potentially realizing capital appreciation as the company continues to execute its growth strategy and capitalize on emerging market trends.

EPS: Furthermore, LW’s EPS of $1.20 highlights its ability to generate substantial earnings per share, translating into relatively more tangible returns for shareholders. This stronger earnings performance, coupled with the company's solid fundamentals and strategic positioning in the frozen food industry, bodes well for its growth trajectory and long-term value creation.

Overall, LW has proven itself to be a company that is poised for strong future growth.

3. Investment Thesis

3.1 Leading Supplier of Frozen Potato Products

Lamb Weston is positioned as the leading global supplier of frozen potato products, distinguished by over 60 years of industry expertise and a robust reputation for delivering high-quality offerings. With a dominant presence in more than 100 countries, the company holds significant brand recognition and consumer preference. As the top supplier in the US and second globally in the frozen potato category, Lamb Weston sells approximately 60 million portions of fries daily, showcasing its sensitive market reach and operational scale. Beyond its market leadership, Lamb Weston’s commitment to innovative product development and sustainable agriculture practices reinforces its competitive edge, promising potential growth and profitability in the expanding global food market.

3.2 Global Expansion and Synergistic Growth

Following the acquisition of full ownership of Lamb Weston/Meijer in Europe, as well as the opening of the company’s new processing facility in China’s “potato capital”, Ulanqab, Lamb Weston has significantly expanded its global manufacturing footprint. This strategic move not only enhances their production capabilities in Europe and Asia but also strengthens their overall global market presence. By fully consolidating these facilities into its operations, the company can not only widen its global market share but also better achieve economies of scale and synergies across its global supply chain. This provides potential for enhanced profitability through geographic diversification and increased global market penetration.

3.3 Increased Operational Efficiency

Lamb Weston is committed to technological advancements, such as the implementation of a new ERP system, aimed at improving operational efficiency and reducing costs over the long term. Although the transition has encountered initial challenges, such as lower customer order fulfillment rates leading to a $135 million impact on shipments and net sales in the fiscal third quarter, these investments are expected to streamline processes, enhance inventory management, and improve overall customer service in the long run. As Lamb Weston continues to optimize its supply chain and operations, sustainable long-term growth and profitability are foreseeable.

4. Valuation

Figure 3: LW Valuation

A discounted cash flow (DCF) valuation model was used to value the business. Using conservative financial estimates and valuation multiples to forecast for the next 5 years, a 33.03% upside was derived.

5. Risks

5.1 Climate Change

LW's reliance on specific regions known for optimal potato-growing conditions exposes it to the risks associated with climate change. Unpredictable weather events, such as extreme heat, droughts, heavy rainfalls, and flooding, can adversely affect potato crop performance. For example, the poor quality of the crop in the Pacific Northwest in 2021 resulted in lower raw potato utilization rates and increased production costs. Moreover, the geographic concentration of ideal growing conditions in regions like Washington, Idaho, and Oregon in the U.S., as well as certain European countries, amplifies the risk of unfavorable crop conditions impacting production capabilities. These climate-related challenges not only disrupt LW's potato supply chain but also strain its ability to meet customer demand, potentially leading to decreased profitability.

5.2 Supply Chain Disruptions

LW’s supply chain is vulnerable to disruptions caused by unforeseen events such as natural disasters and labor shortages. Such disruptions impede the timely delivery of raw materials and finished products, leading to production delays, increased costs, and diminished profitability. The previous COVID-19 pandemic and ongoing war in Ukraine have already impacted the company’s supply chain, resulting in temporary workforce disruptions, labor shortages, and increased transportation and warehousing costs. Furthermore, any failure by LW’s suppliers, logistics service providers, or distributors to deliver products or services in a timely or cost-effective manner escalates operating costs, squeezing profit margins and undermining the company's competitive position.

6. ESG Assessment

6.1 Environmental Assessment

Goal: LW aims to reduce water, nitrogen, and AI pesticide use by 5% per ton of crop harvested by 2030.

Assessment:

LW is on a positive trajectory towards achieving its sustainability goals related to synthetic fertilizer and pesticide reduction by 2030, based on the following efforts:

Integrated Pest Management (IPM): Lamb Weston excels in implementing IPM practices, such as pest scouting and monitoring technologies. They use field observation apps and collaborate with agricultural extension agencies to create insect heat maps. This approach minimizes synthetic pesticide use by targeting treatments only when necessary, reducing environmental impact while maintaining crop health.

Technological Innovation: The company leverages cutting-edge technologies to optimize agricultural practices. For instance, in regions like Shangdu, Inner Mongolia, Lamb Weston has adopted drip irrigation, significantly improving water efficiency and reducing its environmental footprint.

Regenerative Agriculture: Lamb Weston prioritizes regenerative agriculture practices to enhance soil health and reduce reliance on synthetic inputs. By matching potato varieties to soil types and climates, they promote resilience, minimizing fertilizer needs. Monitoring soil organic matter over time demonstrates their commitment to sustainable land management, contributing to long-term soil fertility and productivity.

Areas for Improvement:

Biodiversity Conservation: While Lamb Weston acknowledges the importance of biodiversity, it could expand conservation efforts by enhancing habitat preservation and promoting diverse crop rotations. Strengthening partnerships with universities and conservation organizations could further biodiversity research and implementation of best practices.

Scaling Sustainable Practices: To maximize impact, Lamb Weston could scale sustainable practices uniformly across all regions, especially in high-water-risk areas like Hermiston, Oregon. Ensuring consistent adoption of advanced irrigation and regenerative agriculture practices throughout their global supply chain would enhance sustainability and resilience.

6.2 Social Assessment

Goal: LW aims to protect and enhance the livelihoods of its global teams and positively impact the communities where it operates, striving for zero safety or environmental incidents.

Assessment:

LW demonstrates a commendable commitment to safety through continuous improvement initiatives:

Culture of Proactive Safety: Lamb Weston has cultivated a proactive safety culture, empowering every team member to prioritize safety. They exceed regulatory standards set by organizations like OSHA, EPA, and the UK’s Health and Safety Executive (HSE), committing to the highest levels of safety.

Global Standards and Compliance: The company has implemented global EHS standards based on ISO 45001 and ISO 14001 principles, covering a wide range of safety and environmental management systems, including behavioral observations, corrective actions, incident management, compliance audits, and metrics. This ensures consistent safety practices across diverse operational environments.

However, while Lamb Weston recognizes the uniqueness of each facility's layout, personnel, and operational hazards, ensuring that safety measures are effectively tailored to these specific contexts is crucial. There may be opportunities to further customize safety goals and strategies to better fit local conditions and potential risks.

6.3 Governance Assessment

Goal: Integrity is a core value at LW, which is committed to acting ethically in every endeavor.

Lamb Weston has made exemplary efforts to promote ethical integrity through training, leadership commitment, and robust reporting mechanisms:

Comprehensive Ethics Training: Lamb Weston demonstrates a strong commitment to ethics training from the start of employees' tenure. New hires receive training on the company's Code of Conduct, covering harassment, discrimination, and information security. Annual refresher courses reinforce ethical guidelines, while salaried staff receive additional training on anti-bribery and export compliance.

Leadership Commitment: Ethical behavior is reinforced by senior leadership, including the CEO, General Counsel, and Chief Compliance Officer. Initiatives like the "We Choose Integrity" video series and Annual Ethics and Compliance Week underscore the importance of ethics throughout the organization, fostering a culture that promotes and celebrates ethical conduct.

While internal ethics training and reporting are robust, engaging more actively with external stakeholders, such as suppliers and local communities, could further enhance overall ethical integrity.

7. Conclusion

In conclusion, Lamb Weston (NYSE: LW) stands as a formidable leader in the global frozen food industry, drawing from over seven decades of expertise in delivering high-quality potato and vegetable products worldwide. With a robust business model across foodservice, retail, and global markets, the company is well-positioned to capitalize on the growing demand for convenient, high-quality frozen foods.

Lamb Weston’s commitment to sustainability, operational excellence, and community engagement reinforces its resilience and long-term growth prospects. Despite challenges posed by climate variability and supply chain disruptions, the company's proactive approach to risk mitigation through technological investments and strategic expansions bolsters investor confidence.

Looking ahead, Lamb Weston remains focused on driving innovation, enhancing operational efficiencies, and scaling sustainable practices across its global footprint. By aligning these efforts with evolving consumer preferences and industry trends, Lamb Weston is poised to sustain its competitive edge and deliver continued value to shareholders, customers, and stakeholders in the dynamic frozen food industry landscape.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

8. References

LambWestonHoldingFY2023AnnualReport.(n.d.).https://www.annualreports.com/HostedData/AnnualReports/PDF/NYSE_LW_2023.pdf

Progress together: Lamb Weston ESG Report. Progress Together | Lamb Weston ESGReport. (n.d.). https://esg.lambweston.com/

Siegner, C. (2018, January 5). Lamb weston sales, income jump amid strong potatodemand. Food Dive.https://www.fooddive.com/news/lamb-weston-sales-income-jump-amid-strong-potato-demand/514012/#:~:text=Two%20of%20its%20largest%20customers,Taco%20Bell%20fast%2Dfood%20chains.

USAStockMarket

.(n.d.).https://www.gurufocus.com/industry/usa/consumer-defensive

Sarath.(2024,June3).Debt to equity ratio by industry.Eqvista.https://eqvista.com/debt-to-equity-ratio-by-industry/

Food Engineering. (2024, May 13).Frozen Foods Market Analysis released. FoodEngineeringRSS.https://www.foodengineeringmag.com/articles/102151-frozen-foods-market-analysis-released

Ready-to-eat meals - worldwide: Statista market forecast. Statista. (n.d.).https://www.statista.com/outlook/emo/food/convenience-food/ready-to-eat-meals/worldwide

Urbandevelopment.WorldBank.(n.d.).https://www.worldbank.org/en/topic/urbandevelopment

Fokina, M. (2024, March 7).Online shopping statistics: Ecommerce trends for[WCYEAR]. Tidio. https://www.tidio.com/blog/online-shopping-statistics/

Lambweston.(n.d.).https://investors.lambweston.com/~/media/Files/L/Lamb-Weston-IR/documents/Lamb_Weston_Fact_Sheet_2817.pdf

Lamb Weston Holdings, inc. - lamb weston holdings completes acquisition of theremaining interests in European joint venture Lamb-Weston/Meijer. (n.d.).https://news.lambweston.com/newsroom-home/press-release-details/2023/Lamb-Weston-Holdings-Completes-Acquisition-of-the-Remaining-Interests-in-European-Joint-Venture-Lamb-WestonMeijer/default.aspx

Lamb Weston opens state-of-the-art potato processing plant in China’s “PotatoCapital.”PotatoNewsToday.(2023,November6).https://www.potatonewstoday.com/2023/11/06/lamb-weston-opens-state-of-the-art-potato-processing-plant-in-chinas-potato-capital/

Garland, M. (2024, April 9).ERP transition woes batter Lamb Weston’s financialperformance. Supply Chain Dive. https://www.supplychaindive.com/news/lamb-weston-erp-transition-q3-challenges/712459/