Initial Report: Lion Finance Group PLC (LSE:BGEO), 116% 5-yr Potential Upside (Joshua HENG, Varsity Program)

Joshua HENG presents a "BUY" recommendation, pointing to economic tailwinds, the company's efficient business strategy and attractive price as reasons to expect significant upside.

Executive Summary

I am issuing a strong "BUY" recommendation for Lion Finance Group PLC (LSE:BGEO), with a bullish outlook projecting a 38% upside over the next three years and an added 117% upside over a five-year horizon. This recommendation is based on BGEO's demonstrated strengths: a robust business model, exceptional financials, and attractive valuation metrics that present a compelling investment case.

Lion Finance Group, formerly Bank of Georgia, stands out in the market with its rare combination of high growth, exceeding a topline growth of over 30% y-o-y, coupled with outstanding profitability, boasting net income margins of more than 55% in the past 3 years, resulting in a ROCE of 41.3% in FY23. Despite these strong fundamentals, the company is trading at a dirt cheap price of 3.29x PE ratio, suggesting it's undervalued standards in the market.

Company Overview

Lion Finance Group PLC, formerly known as Bank of Georgia Group, is a UK-incorporated financial services holding company with its registered office in London and corporate headquarters in Tbilisi, Georgia. The Group operates primarily in Georgia and Armenia, offering a wide range of banking and financial services through its main subsidiaries:

What does the new Lion Finance Group consist of?

Bank of Georgia: A leading universal bank in Georgia, providing retail, SME, and corporate banking services.

Ameriabank: A prominent bank in Armenia, offering retail and corporate banking services.

Galt & Taggart: An investment banking arm delivering brokerage and asset management services.

Belarusky Narodny Bank: A subsidiary operating in Belarus, extending the Group's regional presence.

Source: Lion Finance Group Quarterly Report 2024

The Group's diversified portfolio enables it to cater to a broad customer base across multiple markets.

Recent Developments

• Acquisition of Ameriabank: In May 2024, Lion Finance Group completed the acquisition of Ameriabank, a leading Armenian bank, for approximately $303.6 million. This strategic move expanded the Group's footprint in the Armenian banking sector, enhancing its regional influence.

• Rebranding Initiative: On February 6, 2025, the company rebranded from Bank of Georgia Group PLC to Lion Finance Group PLC. This rebranding reflects the company's broader regional presence and diversified financial services portfolio.

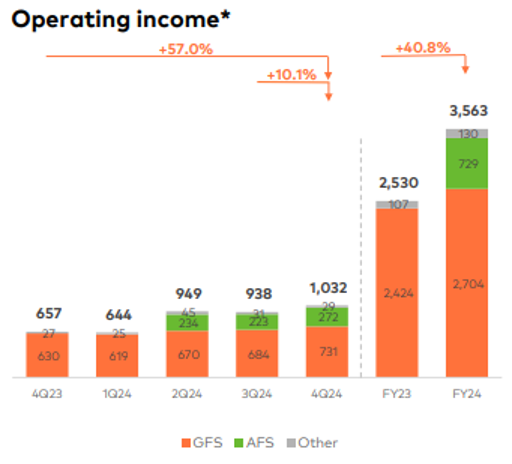

The Group hit record profit in FY24, driven by robust performance across its core business divisions.

Source: Lion Finance Group Quarterly Report 2024

Financial Performance

As of the fiscal year ending December 31, 2024, Lion Finance Group reported robust financial metrics:

• Revenue: GEL 2.553 billion, a 5.2% increase from GEL 2.426 billion in 2023.

• Operating Income: GEL 1.656 billion, reflecting a 3.5% rise from GEL 1.600 billion in the previous year.

• Net Income: GEL 1.397 billion, up 0.5% from GEL 1.390 billion in 2023.

• Total Assets: GEL 31.758 billion, marking a 2.5% growth from GEL 31.000 billion in 2023.

• Shareholders' Equity: GEL 5.020 billion, a 1.0% increase from GEL 4.970 billion in the prior year.

These figures underscore the Group's consistent growth trajectory and financial stability.

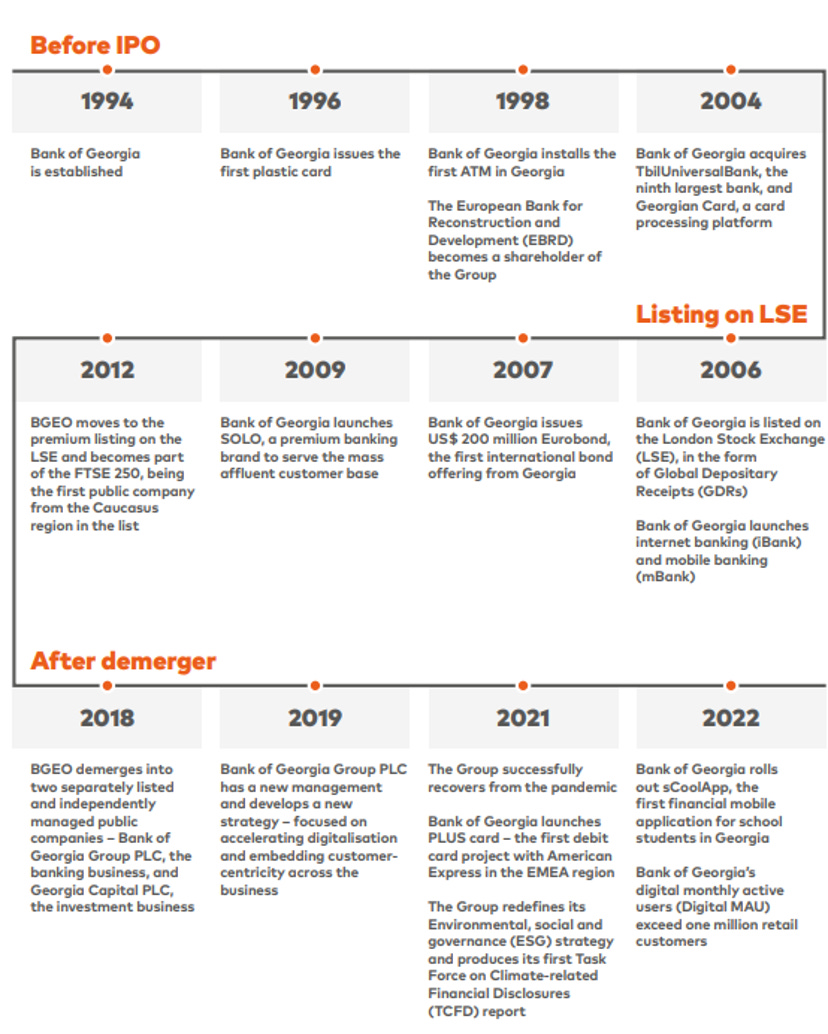

History

Early Establishment and Growth

The institution traces its origins to 1903, undergoing nationalization during the Soviet era and later reestablishing as Bank of Georgia in 1994. In 2001, it became one of the first entities to list on the Georgian Stock Exchange, marking a significant milestone in its commitment to transparency and growth. The subsequent merger with Tbiluniversalbank in 2004 expanded its footprint in the Georgian banking industry.

International Expansion and Listings

Demonstrating a forward-looking vision, Bank of Georgia launched its private banking services and issued debut corporate bonds on the Georgian Stock Exchange in the mid-2000s. A landmark achievement was its 2007 listing on the London Stock Exchange via global depositary receipts, representing the first international IPO from Georgia. This period also saw the issuance of the bank's first Eurobond and the establishment of strategic partnerships, notably with American Express.

Strategic Restructuring and Rebranding

In 2011, the formation of Bank of Georgia Holdings PLC in the UK facilitated a premium listing on the London Stock Exchange by 2012. A strategic demerger in 2018 led to the creation of two distinct entities: Bank of Georgia Group PLC, focusing on banking, and Georgia Capital PLC, dedicated to investment activities. This restructuring aimed to streamline operations and enhance focus on core business areas.

Regional Expansion

A significant milestone in the group's regional growth was the acquisition of Ameriabank, a leading Armenian bank, in May 2024 for approximately $303.6 million. This strategic move expanded the group's presence in the South Caucasus region, aligning with its vision of regional leadership in financial services.

Source: Lion Finance Group Annual Report FY23

Company Operations

Source: Lion Finance Group Quarterly Report 2024

Looking at financials alone, Lion Finance Group's expansion and growth is nothing short of extraordinary.

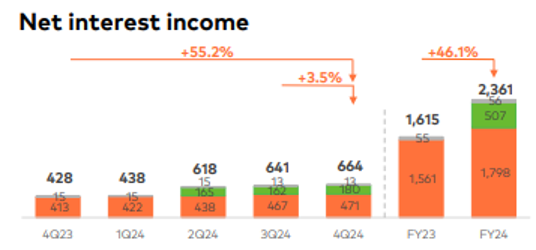

Net Interest Income: The Group reported a 55.2% y-o-y increase in net interest income for the fourth quarter of 2024, reflecting effective asset-liability management and favorable interest rate environments.

Consolidated Profit: Achieving a record consolidated profit of GEL 1.8 billion for FY 2024, the Group's profitability underscores its strong market position and operational efficiency.

Return on Average Equity (ROAE): The adjusted ROAE stood at an impressive 30.0% for 2024, indicating high returns on shareholders' equity.

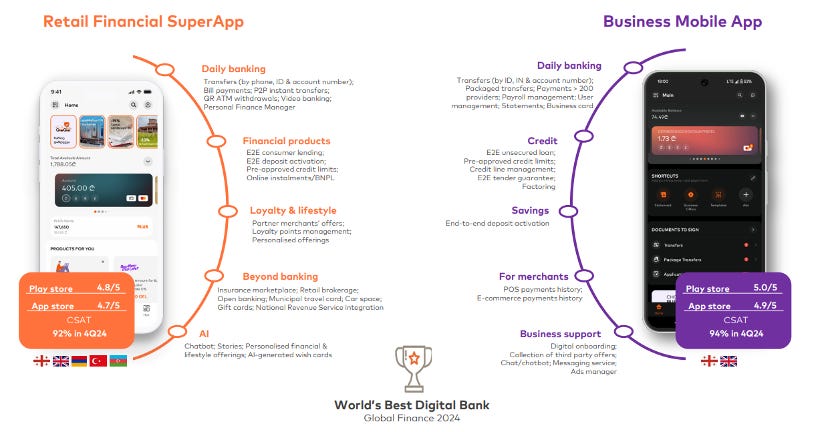

Digital Transformation

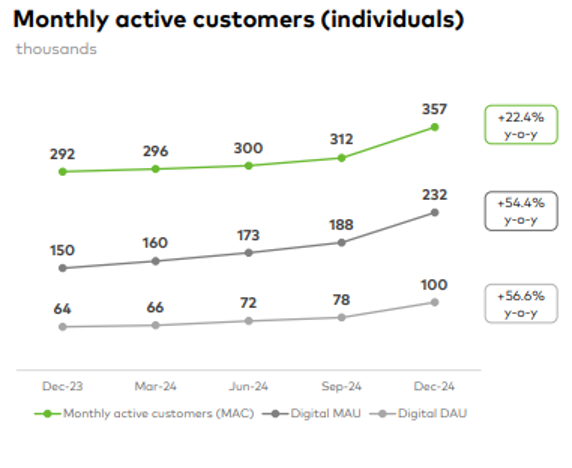

Increased Digital Engagement: Bank of Georgia's retail digital monthly active users (MAU) reached 1.6 million, a 17.5% year-on-year increase, while Ameriabank's MAU grew by 54.4% to 232,000 individuals. This surge in digital engagement highlights the Group's successful investment in digital banking solutions.

Additionally, in the short 6 months that it has acquired Ameriabank (the Armenian Banking arm of Lion Finance Group), Lion Finance Group boasts a 200,000 MAU increase and a 54% increase since its acquisition.

This amounted to Lion Finance Group (or Bank of Georgia at the time) being awarded the World's Best Digital Bank 2024 by Global Finance Magazine.

Source: Lion Finance Group

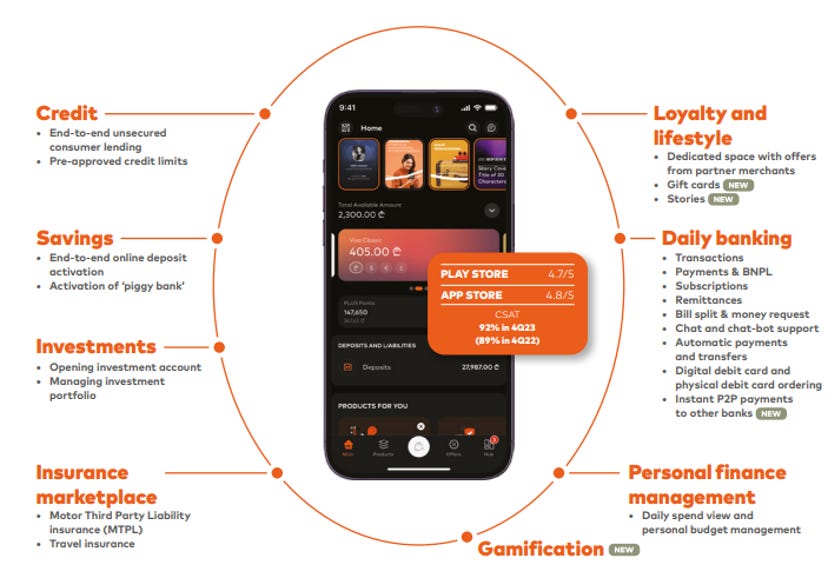

Lion Finance Group has outstanding service quality, as indicated by its digital banking performance:

• High Customer Ratings – The Retail Financial SuperApp and Business Mobile App have some of the highest ratings in the industry (4.7+ on iOS, 4.8+ on Android), demonstrating exceptional user experience.

• Exceptional Customer Satisfaction (CSAT) Scores – 92% (retail) and 94% (business) indicate that customers are highly satisfied with the platform's features, responsiveness, and ease of use.

• Comprehensive Banking & Lifestyle Integration – The Group goes beyond traditional banking by offering insurance, investment services, and municipal services, making it a one-stop financial ecosystem.

• AI-Powered Personalization – AI-driven features enhance customer experience, automate financial planning, and provide tailored product offerings, giving Lion Finance Group a strong competitive edge.

Retail Financial SuperApp (Consumer-Focused)

This all-in-one digital banking and lifestyle app integrates multiple financial functions:

• Daily Banking

○ Transfers via phone number, ID, or account number

○ Bill payments & peer-to-peer (P2P) instant transfers

○ QR & ATM withdrawals

○ Video banking services

○ Personal Finance Manager

• Financial Products

○ End-to-end (E2E) consumer lending

○ Digital deposit activation

○ Pre-approved credit limits

○ Online installments & Buy Now, Pay Later (BNPL) solutions

• Loyalty & Lifestyle Features

○ Exclusive offers from partner merchants

○ Integrated loyalty points system

○ Personalized customer offerings

• Beyond Banking Services

○ Insurance marketplace (financial protection services)

○ Retail brokerage (investment opportunities)

○ Open banking integration

○ Municipal travel cards and car space booking

○ Gift cards & National Revenue Service integration

• AI-Driven Features

○ AI-powered chatbot

○ AI-generated wish cards

○ Personalized financial & lifestyle recommendations

Business Mobile App (SME & Corporate Banking)

Daily Banking

• Transfers via ID, IBAN, or account number

• Packaged bulk transfers

• Payments to 200+ service providers

• Payroll & user management

• Digital business cards & account statements

Credit Solutions

• E2E unsecured business loans

• Pre-approved credit limits

• Credit line management

• Tender guarantees

• Invoice factoring

Savings & Investment

• Full digital deposit activation

For Merchants

• POS payments tracking (physical sales monitoring)

• E-commerce payments history (digital sales tracking)

Business Support

• Digital onboarding for businesses

• Collection of third-party offers (financial products & services)

• Chatbot & messaging service (customer communication)

• Ads manager (business growth & marketing tools)

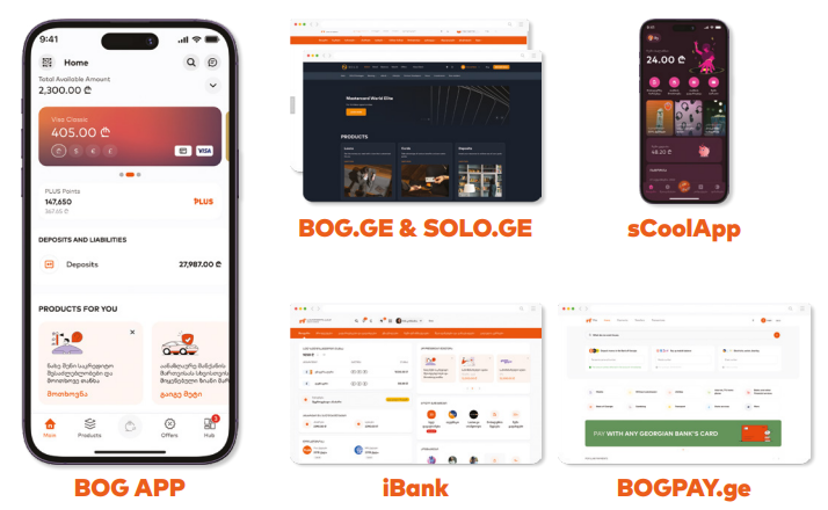

The cornerstone of their digital ecosystem is a global award-winning financial superapp – BOG APP. The aim is to use other digital channels for client acquisition and then migrate customers to BOG APP because they envision BOG APP as the go-to channel for an increasingly digital customer base. Their purpose is to transform the everyday experiences of customers by enabling them to effortlessly discover and secure daily banking services and relevant products with a single touch.

A Compelling Growth Story with a Strong Digital Edge

Strategic Priorities Driving Market Leadership

Lion Finance Group PLC (LSE: BGEO) is strategically positioned to dominate the banking sector across its core markets. The company’s vision is underpinned by three key priorities that reinforce its competitive advantage:

1. The Main Bank – The Group aims to integrate itself into customers’ daily lives by leveraging its robust digital and payments ecosystems. By embedding itself into routine financial activities, Lion Finance Group is ensuring long-term customer retention and increasing engagement across its digital platforms.

2. Excellent Customer Experience – The bank’s proactive approach to anticipating customer needs and tailoring relevant products has made it a market leader in user satisfaction. This client-centric strategy ensures that the Group captures new customer segments while deepening relationships with existing ones.

3. Profitable Growth – With a disciplined approach to capital allocation, the Group focuses on high-margin areas that maximize profitability. This approach not only ensures long-term sustainability but also delivers significant value creation for shareholders.

Strong Execution through Market-Leading Enablers

Lion Finance Group’s success is powered by a framework of enablers that amplify its ability to scale and innovate:

• Customer-Centricity – A deep understanding of consumer behavior drives product innovation and increased lifetime customer value.

• Data & AI – Leveraging AI and big data analytics, the Group optimizes credit decisions, reduces risks, and enhances operational efficiency.

• People & Culture – A high-performance corporate culture fosters talent retention and continuous business improvement.

• Brand Strength – A well-established and trusted financial brand bolsters consumer confidence and investor trust.

• Effective Risk Management – Disciplined risk control mechanisms safeguard profitability while allowing aggressive expansion in high-growth verticals.

Financial Targets Supporting a Strong Investment Case

Lion Finance Group has established ambitious yet highly achievable medium-term targets that reflect its operational excellence and growth potential:

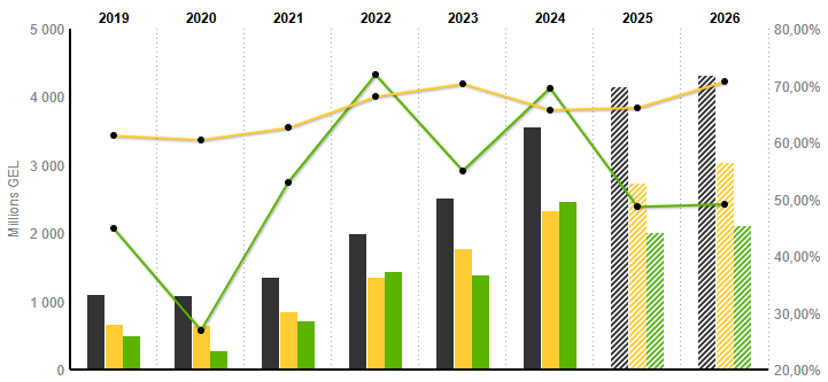

• ~15% Annual Loan Book Growth – The Group’s consistent loan book expansion underscores its ability to scale its lending portfolio sustainably while maintaining strong asset quality. This also ensures a consistent growth in its net interest income, which bolsters it's topline on it's income statement.

• 20%+ Return on Average Equity (ROAE) – With industry-leading profitability metrics, the Group remains an outperformer in the regional banking sector.

• 30-50% Dividend and Share Buyback Payout Ratio – A clear commitment to shareholder returns, combining dividends and buybacks to drive total investor value.

Source: Lion Finance Group Quarterly Report 2024

The strong digital engagement highlights the effectiveness of the Group’s digital banking ecosystem.

Higher growth in digital MAU (+17.5%) compared to overall MAC (+10.7%) suggests that customers are shifting towards digital channels, reducing reliance on physical banking locations.

Daily active user growth (+15.7%) indicates a higher frequency of transactions and interactions, which bodes well for cross-selling financial products.

Business customers are also adopting digital banking solutions at an accelerated pace, with a higher y-o-y growth rate than individual customers.

The increase in business banking activity suggests that Lion Finance Group is strengthening its foothold in SME and corporate banking.

A rising business user base opens up new revenue streams, including business loans, payment processing, and treasury services.

For its business customers:

Source: Lion Finance Group Quarterly Report 2024

Digital Payment Dominance – With strong double-digit growth in both POS and e-commerce, Lion Finance Group is the market leader in Georgia's acquiring business, benefitting from a secular shift towards digital transactions.

Additionally, Lion Finance Group holds a 57.1% market share in acquiring volumes, up 2.2 percentage points from the last FY.

Scalability & Recurring Revenue – The expanding merchant base and rising transaction volumes create a high-margin, recurring revenue stream, reinforcing earnings stability.

E-commerce as a Growth Driver – With online payments surging +41.8% YoY, the bank is well-positioned to capture further upside from the digital economy.

Source: IPM Georgia

Lion Finance Group prides itself on its core business element of being customer-centric, hence incorporating these frameworks to consistently boost NPS scores each month:

1. Engaging with customers proactively and responding in real time

2. Anticipating customer needs, wants, and future behavior

3. Harnessing strong human relationships with data analytics for dynamic customer insights

4. Investing in technology to deliver excellent customer experience

Source: S&P CapitalIQ, Author's Illustration

I've also charted a comparative analysis of the Price-to-Earnings (P/E) ratios for Lion Finance Group PLC (LSE: BGEO) and its close banking sector competitors from February 2024 to February 2025. The P/E ratio measures how much investors are willing to pay per unit of earnings, with higher values typically indicating strong growth expectations or premium valuations.

Lion Finance Group maintains a relatively stable and undervalued P/E ratio, hovering around 3.0x throughout the period. It also sits at the bottom of all its banking peers, indicating its undervalued status as a stock and attractive valuation levels relative to its earnings growth, making it a potential value play in the sector.

Hence, the stock is trading at a huge discount compared to some peers, presenting an opportunity for a high-growth, low-P/E financial stock.

Revenue Split by Geography

Lion Finance Group mainly operates in 2 countries: Georgia and Armenia.

• In February 2024, Bank of Georgia Group PLC announced its intention to acquire Ameriabank CJSC, the largest bank in Armenia, for approximately $303.6 million. This strategic move aimed to expand the Group's presence into the high-growth Armenian market. The acquisition was completed on May 24, 2024, marking a significant milestone in the Group's regional expansion efforts.

○ The acquisition of Ameriabank has significantly enhanced the Group's earnings, with Ameriabank delivering robust performance, including approximately 30% year-on-year loan growth. This expansion into Armenia has diversified the Group's business operations and opened new avenues for growth in the region.

Below is the asset split by countries as of Dec 2024:

Source: Lion Finance Group 2024 Annual Report, author's illustration

Market Analysis: Georgia

Georgia is a country in Eastern Europe and West Asia. It is part of the Caucasus region, bounded by the Black Sea to the west, Russia to the north and northeast, Turkey to the southwest, Armenia to the south, and Azerbaijan to the southeast.

Source: Britannica

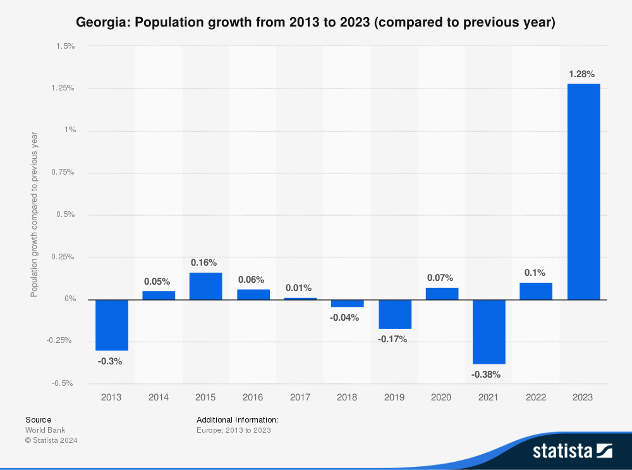

Population Numbers

As of 2024, Georgia's population stands at approximately 3.81 million, reflecting a stable demographic trend. Growth fluctuates between -0.3% to 1.28% in recent years, as a result of high rates of emigration out of the country.

Source: Statista

On the other hand, life expectancy in Georgia has shown a gradual increase over the past decades. In 2021, the average life expectancy at birth was 74.3 years, with males at 71.9 years and females at 76.8 years. This upward trend indicates improvements in healthcare and living conditions, reflecting an improvement in Georgians' standard of living.

Georgia's demographic profile is characterized by a relatively stable population with a median age of 37.0 years as of 2024. The working-age population constitutes a significant portion, aligning closely with the overall population trends. This stability suggests a balanced demographic structure, which is favorable for economic planning and development.

Age Structure

As of January 2024, Georgia's age structure is as follows:

• 0-14 years: 19.5%

• 15-64 years: 64.3%

• 65 years and above: 16.2%

The median age of the population is 37 years.

Source: PopulationPyramid

Implications for Lion Finance Group

This demographic profile indicates a balanced age distribution, with a substantial working-age population supporting economic activities and a significant proportion of youth, which lends Lion Finance Group a favourable advantage:

1. A stable consumer base

2. Technologically savvy, young consumer base likely to adopt its digital banking model

3. Increased demand for innovative financial products and services

The projected increase in life expectancy also could signal higher lifetime value (LTV) for Lion Finance Group's customers.

Economic Outlook: Georgia

Strong Economic Growth

Source: Geostat, IMF

Economic activity remained strong in 4Q24 with real GDP increasing by 8.4% y-o-y, contributing to a full year expansion of 9.5% y-o-y. Economic growth remained broad-based, with major contributions from the trade, transport, IT and other service sectors. Galt & Taggart forecasts a 5% real GDP growth in 2025, albeit with higher-than-usual uncertainty around the base case. Geopolitical instability in the wider region and domestic political tensions pose downside risks. However, a swift resolution of political uncertainties could lead to better-than-expected economic outcomes.

Resilient external sector

External merchandise trade maintained strong performance in 4Q24, driven by consistently high levels of re-exports and increased commodity prices. During the same period, imports of goods accelerated amid strong consumption spending. Overall, exports and imports increased by 7.8% and 8.5% y-o-y, respectively, in 2024. Tourism revenues continued to grow steadily, delivering a 7.3% y-o-y increase in 2024, with annual tourist visits surpassing the pre-pandemic level for the first time. Proceeds from other service exports, particularly from transport services, also remained strong. Money transfers declined by 18.9% y-o-y in 2024 as migrant related one-off inflows from Russia during 2023 were eliminated, and were partially substituted by steadily increasing transfers from the EU, US and Israel. Taken together, external sector inflows are expected to remain resilient, supported by diverse income sources and geographical regions

Low inflation and prudent monetary policy

Source: Geostat

Inflation remained low in 4Q24, supported by subdued domestic price pressures and declining fuel prices in international markets. Headline CPI inflation was 1.9% y-o-y in December 2024, below the National Bank of Georgia’s (NBG) 3% target. In 2025, inflation is expected to pick up slightly due to last year’s low base and increased exchange rate volatility, but it is projected to return to the target level by the end of the year. The NBG has kept its policy rate at 8.0% since May 2024, as inflationary risks remain.

Strong fiscal discipline

In 2024, Georgia’s strong budget performance persisted, with tax revenues rising 18.0% y-o-y, driven by robust economic growth and the previous year’s amendments to the corporate income tax code. The Government remains committed to fiscal consolidation, with the fiscal deficit planned at 2.5% of GDP in 2025, matching the 2024 level. The government-debt-to-GDP ratio is set to decline further to 35.9% in 2025, providing more fiscal space to respond to potential future shocks.

Though political developments in Georgia have been top-of-mind recently, the economy has continued to be robust throughout the uncertainties, and Bank of Georgia continues to operate as usual.

Baseline expectation for real GDP growth remains 5% for 2025, on top of the 9.5% economic growth achieved in 2024. In this environment, Bank of Georgia maintained higher-than-usual liquidity levels, reinforcing resilience while resulting in associated costs, which slightly drove down the net interest margin in the fourth quarter, while the core lending margin remained stable.

Conclusion

Given these favorable conditions, Lion Finance Group is in a prime position to capitalize on economic tailwinds, expand its market share, and sustain long-term profitability. Investors should recognize the bank’s strong earnings potential, resilient risk management, and ability to leverage Georgia’s economic growth for sustained expansion.

Market Analysis: Armenia

Armenia is a landlocked nation situated in the South Caucasus region of Eurasia. It shares borders with Turkey to the west, Georgia to the north, Azerbaijan to the east, and Iran to the south. Despite its modest size, Armenia boasts a rich cultural heritage and a diverse landscape.

Source: Wikipedia

Population and Demographics

Georgia is a country in Eastern Europe and West Asia. It is part of the Caucasus region, bounded by the Black Sea to the west, Russia to the north and northeast, Turkey to the southwest, Armenia to the south, and Azerbaijan to the southeast.

Source: Britannica

Population Numbers

As of 2024, Armenia's population is approximately 2.78 million, reflecting a stable demographic trend with minimal growth in recent years. The United Nations also projects Armenia's annual population growth rate to be about 0.5% year-on-year.

The population density in Armenia is about 104 people per square kilometer, with 63.1% of the population residing in urban areas, totaling approximately 1.88 million individuals.

Source: Statista

On the other hand, life expectancy in Armenia has shown a gradual increase over the past decades. In 2024, the average life expectancy at birth is estimated at 76.7 years.

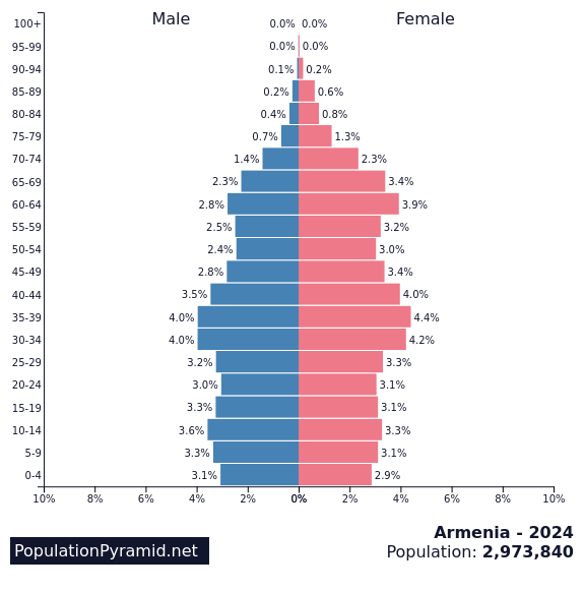

Age Structure

As of January 2024, Georgia's age structure is as follows:

• 0-14 years: 20%

• 15-64 years: 66%

• 65 years and above: 14%

The median age of the population is 36.6 years.

Source: PopulationPyramid

Implications for Lion Finance Group

This demographic profile presents several opportunities for Lion Finance Group:

• A consistent population size ensures a reliable market for financial services.

• Youthful, Tech-Savvy Demographic: With 20% of the population under 14 and a median age of 36.6 years, there is a significant segment likely for an uptake for Lion's digital banking solutions.

• Demand for Innovative Financial Products: The substantial working-age population (66%) indicates a robust demand for diverse financial products and services.

In summary, Armenia's demographic landscape in 2024 offers a favorable environment for Lion Finance Group to expand its digital banking services and cater to a diverse, tech-oriented clientele.

Economic Outlook: Armenia

The recent signing of the Charter on Strategic Partnership between Armenia and the US, ongoing EU visa liberalisation talks, and the Armenian government’s approval of a bill to initiate its EU accession bid all reinforce the country’s positive outlook. Armenia’s real GDP grew by 5.9% in 2024, and with ongoing structural reforms expected to further enhance the resilience and capacity of the Armenian economy, the IMF projects real GDP growth of 4.9% in 2025.

Robust economic growth

Economic growth continued to moderate in 4Q24 as one-off factors, including migrant inflows and the re-export of precious metals. Meanwhile, a supportive fiscal stance and easing monetary policy continued to support the economy. Real GDP increased by 3.7% y-o-y in 4Q24, following a 6.1% rise in the previous quarter. For the full year 2024, real GDP grew by 5.9%, following the 8.3% expansion recorded in 2023. The IMF projects real GDP growth of 4.9% for 2025. Macroeconomic policies remain prudent, underpinning the resilience of the Armenian economy.

Low inflation and easing monetary policy

Source: National Statistical Service of the Republic of Armenia

In 2024, inflation remained low, supported by declining food and commodity prices. Headline CPI inflation was 1.5% y-o-y in December 2024, below the Central Bank of Armenia’s (CBA) 4% target (the target was revised to 3% since January 2025). Amid subdued price pressures, the CBA continued its gradual monetary easing, cutting the refinancing rate by a cumulative 2.25 ppts to 7.0% in 2024, following a reduction of 1.5 ppts in 2023.

Conclusion

The Armenian growth story remains sound. The combination of strong economic growth, financial stability, and an expanding digital financial ecosystem positions Lion Finance Group PLC as a key player in Armenia’s evolving banking landscape. With a rising demand for digital banking, an increasing working-age population, and macroeconomic policies supporting financial sector expansion, Lion Finance Group is well-positioned to capture market share, increase transaction volumes, and drive sustained profitability in Armenia.

Sources: Geostat, NBG, Armstat, CBA

Additionally, both markets are encountering resilient external sector inflows supporting growth and underpinning local currency stability in Georgia and Armenia.

Industry and Competitive Analysis

The banking system remains the biggest part of the Georgian financial market. As of 30 September 2023, there were 15 commercial banks operating in Georgia, while the number of banks was 14 in the same period of 2022.

Source: KPMG

Additionally, this chart indicates that JSC Bank of Georgia and JSC TBC Bank dominate the market, holding the largest total assets and loan portfolios.

Both banks also report significant total income, as represented by the highest plotted points on the right axis.

Their total equity is also the highest among competitors, indicating strong financial stability and capital reserves.

Source: S&P Global Market Intelligence

Banks operating in Georgia jointly posted net profit of 2.3 billion lari and net interest income of 3.2 billion lari for the first nine months of 2024, according to Georgia's central bank data. Both metrics were nearing the results for FY2023 and have already exceeded the sector's performance from previous years.

Economic risks for banks operating in Georgia are balanced, according to an Oct. 22 S&P Global Ratings report. Lenders are supported by good macroeconomic growth prospects, although increased domestic political and policy volatility could present a downside risk to macroeconomic projections, it said days before the elections.

Assets

As of 30 September 2023 Bank of Georgia had the highest value of assets - about GEL 29.03 billion, which is 38.8% of the total assets of the banking sector. Paysera Bank Georgia had the lowest level – GEL 0.007 billion (0.01% in total assets). It is worth mentioning that, in the same month, the top two banks (ranked by assets) held 76.9% of the assets of the banking system, while the top five banks held 89.6% of the total assets. This indicates a duopolistic nature in the Georgian financial field, creating an opportunity for Lion Finance Group to capitalise with more aggressive loan acquisition methods and sales.

Loan Portfolio

The total amount of loans issued at the end of the 3rd quarter of 2023 amounted to GEL 47.69 billion (Q3 2022: GEL 42.43 billion). The majority of the loans were borrowed by households (54.2%), trade (9.6%) and industry (8.3%), while education held less than 0.54% of the total loans issued as of 30 September 2023.

Source: KPMG

As at 30 September 2023 the Herfindahl-Hirschman Index amounted to 2,996, which implies that the Georgian banking sector is highly concentrated.

Deposits

Non-bank deposits represented 80.62% of the total liabilities of the banking sector (GEL 51.11 billion). 50.8% of the deposits were placed in foreign currencies, while the remaining 49.2% in national currency, compared with 58% and 42% for the Q3 2022, respectively. 39.3% of the total deposits were time deposits, while current accounts and demand deposits represented 30.7% and 30% of the total deposits, respectively. Around 44.1% of the time deposits were placed in foreign currencies, while 55.1% of total of current accounts and demand deposits were placed in foreign currency.

Source: KPMG

Liabilities

As of 30 September 2023 the banking system total liabilities grew by 8.67%, compared with the same figure as of 30 September 2022, to reach GEL 63.39 billion.

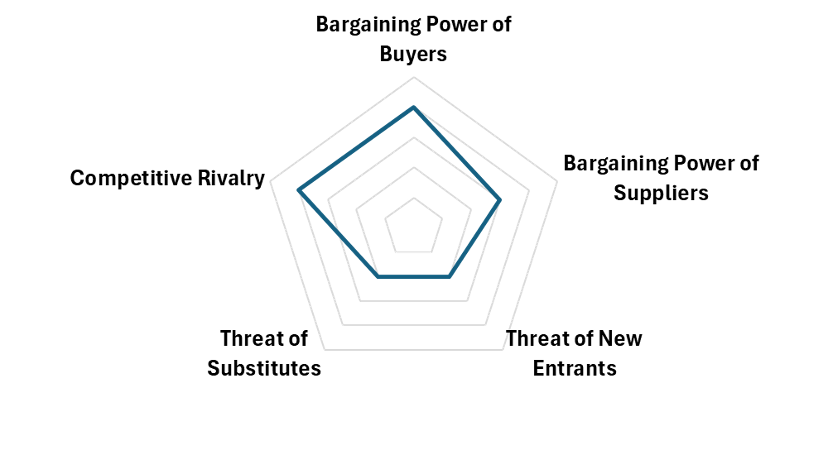

Economic Moat and Competitive Advantage

Network Effects

Banking Super-App: For Retail Banking

The largest moat that Lion Finance Group has is the network effects of its financial super app.

Source: Lion Finance Group

Lion Finance Group's daily banking, investments, credit, insurance , and finance platforms are highly interrelated. The growth and development of one platform naturally support and accelerate the growth of the others, reinforcing a virtuous cycle. For example, a consumer using Lion Finance Group for managing personal finances can seamlessly browse the insurance marketplace for products. Once a decision is made, the user can easily complete the transaction through Lion Finance Group's integrated transaction system, given that their financial information is already stored in the app.

These synergies encourage consumers to transact and interact more frequently on anything finance related to Lion Finance Group, increasing the average number of monthly transactions per user. Frequent consumer engagement is key to the effective cross-selling and upselling of products.

Some of the policies it rolled out include:

Source: Lion Finance Group

This creates 'sticky' consumers with high life-time values and happy consumers, as Lion Finance Group sets itself up as a one-stop shop for anything finance related. This seamless integration fuels a self-perpetuating cycle: the more a user engages with one service, the more they are likely to explore and use others. For instance, a user who starts with peer-to-peer (P2P) payments might soon begin engaging Investment services or Daily Personal Banking services.

Source: Author's Illustration

This financial ecosystem also reduces the likelihood of users seeking alternatives, as Lion Finance Group already fulfills a wide array of daily needs while offering unmatched convenience. Depth and breadth in which competitors need to expand into is unmatched for Lion Finance Group, thus improving it's standing on the 'Threat of New Entrants" and 'Threat of Substitutes' under Porter's Five Forces.

There is also evidence in the numbers behind this success, with a 21% increase y-o-y of digital MAU (monthly active users) and Lion Finance capturing a 75% market share of ALL digital MAU in total active retail customers in Georgian markets.

Banking Super-App: For Business Banking

Source: Lion Finance Group

Bank of Georgia is the leading payments acquirer in Georgia. By prioritising user experience and service quality, the Bank has been focused on increasing digital payments by encouraging more individuals to use cashless payment methods and expanding the network of merchant clients. Bank of Georgia also empowers merchants to embrace digitalisation, driving the growth of e-commerce businesses in Georgia.

What once was TBC Bank Group dominating Georgia, was taken over by Bank of Georgia Group

Source: S&P Global Market Intelligence

Source: Bank of Georgia

In recent years, while TBC Bank Group, Bank of Georgia's biggest competitor in the Georgian financial services sector, held the largest loan book in Georgian Lari, Bank of Georgia's loan book has been catching up aggressively, growing by 63.4% year over year as of Sept. 30, driven largely by the consolidation of Ameriabank but also by a 23.6% increase within its Georgian operations.

The bank confirmed its medium-term annual lending growth target of roughly 15%, revised in the second quarter from about 10% following the Ameriabank acquisition.

Environment, Social and Governance

ESG Scores from various ESG rating agencies score it positively for ESG criteria for the business.

Source: Lion Finance Group

ESG Theses

ESG Thesis 1: Strong Sustainability Initiatives and Low Carbon Exposure

Lion Finance Group (LFG) has embedded environmental sustainability into its core strategy, making it a leader in low-carbon financing. Having “integrated sustainability into every aspect of our business” and committed to cutting its carbon footprint, LFG has taken concrete steps to reduce climate risk:

• Minimal Fossil Fuel Exposure: As of end-2023, 0% of LFG’s loan portfolio is exposed to coal or oil & gas exploration – the bank has “no exposure to… fossil fuels or electric utilities using coal”. This prudent stance shields it from transition risks that many peers still face. (For example, some emerging-market banks have 4% of loans in carbon-intensive sectors, a contrast to LFG’s zero coal/oil lending.)

• Greener Loan Book: LFG is actively growing its green finance portfolio. Outstanding green loans reached ₾752 million (≈3.7% of total loans) in 2023, up from 3.0% in 2022. These funds support renewable energy and energy-efficient projects – financing solar panel installations and large hydropower plants – under its “Energy Credit” program. Such sustainable finance initiatives not only help the environment but open new business opportunities.

• Climate Risk Management: The group integrates climate considerations into risk processes. In 2023 it expanded from top-down portfolio analysis to bottom-up client-level climate risk assessments in due diligence. Since 2013 LFG has embedded Environmental & Social (E&S) risk checks in its underwriting, guided by IFC and EBRD standards. This rigorous approach ensures high-risk polluting projects are screened out, protecting asset quality.

Peer Comparison: LFG’s carbon-conscious approach is ahead of many competitors. Even industry leaders are just catching up – e.g. Kazakhstan’s Halyk Bank won “Best Bank for ESG 2022” for fusing strong environmental commitments with its banking business, including issuing the country’s first green bond to fund sustainable project. While peers like Halyk are improving, LFG already boasts a loan book with only 17.9% “carbon-related” assets (mostly in indirectly CO₂-linked industries) and no direct fossil fuel loans. This positions LFG as a low-carbon leader in finance. Leadership reiterates that these efforts are not just ethical but strategic – “supporting a low-carbon… economy” is seen as crucial for future growth. By proactively greening its portfolio and reducing climate risk, LFG stands out in the sector and appeals to ESG-minded investors.

ESG Thesis 2: Empowered Workforce, Inclusive Finance, and Community Impact

Lion Finance Group demonstrates a strong social ethos through its focus on employees, customers, and communities. “We are committed to ensuring inclusion and equal opportunities in our organisation… we do not tolerate discrimination on any grounds”, the company affirms, reflecting a robust human capital strategy. Key aspects of LFG’s social performance include:

• Diverse & Engaged Workforce: Women comprise 69% of LFG’s total employees, indicating a diverse workforce, and 51% of senior managers are female. While women hold 27% of executive management roles, LFG is working to improve gender balance at the top. This female representation is on par with regional peers (TBC Bank’s staff is ~71–72% female), though LFG slightly outpaces TBC in women at senior levels (51% vs ~40% at TBC mid-management). LFG also invests heavily in talent development – its “Leaderator” internship programme has had 376 participants since 2017, with 79% hired into full-time roles. Such outcomes indicate high employee engagement and a strong pipeline of young talent. Regular staff feedback channels (interviews, surveys, even a CEO video blog) ensure employee voices are heard, supporting morale and retention.

• Financial Inclusion & Customer Impact: LFG strives to make banking accessible to all segments. It offers free or low-cost accounts and debit cards in Georgia, with special packages for students (including a dedicated “sCoolApp” for youth financial education). The bank leverages technology to reach underserved groups – customers can use the mobile app with no data or WiFi needed, enabling rural or low-income users to bank digitally. Digital onboarding and tutorials help first-time users adopt online services. Thanks to these efforts, Lion’s user base is broad: it counts roughly 2.4 million monthly active retail customers, a significant portion of the population in its core market. This inclusive approach parallels peers like Kaspi.kz, whose mobile-only super-app capitalizes on Kazakhstan’s 71% internet penetration to bring banking and payments to millions. LFG’s emphasis on customer-centric innovation (e.g. gamification, new SME deposit tools) has driven deep engagement, evidenced by its goal to be the “main bank in customers’ daily lives” through a seamless digital experience.

• Community Engagement – Education Focus: LFG targets education as its primary social cause, recognizing that “countless opportunities [are] made possible with access to high-quality education”. The bank has launched programs to improve educational outcomes across Georgia:

○ STEM Education: Partnership with a leading school to offer a 1-year online STEM course to students. In 2023, up to 400 students enrolled, with ~100 students sponsored by Bank of Georgia (LFG’s subsidiary) – directly expanding access to tech and science training.

○ School Libraries (“Ideatheca” project): Since 2016, LFG has helped establish 16 modern libraries in underserved regional schools, benefiting 7,000+ students with access to books and technology. This investment creates learning hubs beyond the capital and encourages a reading and teamwork culture among youth.

○ Scholarships and Competitions: The bank sponsors scholarships (e.g. Chevening) and academic competitions, engaging hundreds of young people annually. These initiatives position LFG as a community leader in education and workforce development.

ESG Thesis 3: Robust Corporate Governance and Risk Management

Lion Finance Group’s governance framework is a pillar of its investment case, marked by an independent board, strong oversight practices, and a commitment to transparency. Management explicitly links governance to financial success: “We believe understanding and managing ESG risks is crucial to maintaining our financial strength, our approach to ESG has been integrated across the business.” Key governance strengths include:

• Independent, Experienced Board: LFG adheres to UK corporate governance standards (as a London-listed company), with a majority-independent Board of Directors. The Board is led by an independent Chairman (separate from the CEO), and includes a Senior Independent Director role for additional oversight. In fact, the company has eight independent non-executive directors, bringing diverse international expertise (e.g. former executives from European banks and corporates). Recent appointments, such as a new independent director in 2024, show proactive refreshment and commitment to high governance standards. This contrasts with some peers – for example, Kaspi.kz’s board is co-founder-led, with its founder serving as Chairman and the CEO being the other co-founder, a structure that can concentrate power and drew a low governance rating (Kaspi’s governance score is only 22/100). LFG’s fully independent board structure, by comparison, earns investor confidence and contributes to its strong governance ratings.

• Board Committees and ESG Oversight: LFG’s Board has specialized committees (Audit, Risk, Nomination, Remuneration, etc.) to ensure rigorous oversight of management. Notably, the Board embedded sustainability into its purview – in 2023 the Group created an internal ESG & Sustainability function

Investment Theses

1. Efficient business strategy that is able to rapidly scale services profitably

Lion Finance Group shown remarkable strategy to transform and scale new products into new markets while maintaining profitability.

Given its acquisition in May 2024, Lion Finance Group took over operations of Ameriabank, a leading Armenian bank, for approximately $303.6 million. This strategic move expanded the Group's footprint in the Armenian banking sector, enhancing its regional influence.

Source: Ameriabank

Source: Ameriabank

Within the year of taking over operations, the Ameriabank, consequently the Armenian banking arm of Lion Finance Group saw a 22.4% y-o-y increase in MAU of roughly 60,000 monthly customers, with a digital DAU of 56.6% y-o-y increase on the same note.

Additionally, digital uptake for the bank's digital MAU increased from 51% to 65%, within a span of a calendar year.

As management saw immense opportunity in the Amernian banking story, Ameriabank was incorporated into the group. The bank, in silos, has a ROE of over 20% and it’s currently growing its loan book by 6% on a constant currency. As this was an acquisition, it also presented itself as a problem to Lion Finance Group's management to be an expansion into a completely new geographical market, let alone economic market.

Ameriabank’s acquisition was made for 0.65x P/B (Price-to-book, or PTB ratio), or 2.6 times P/E. That means that in less than 3 years of profits, the company will get back the price it paid, a monumental acquisition price for a leading bank, an a devastatingly aggressive opportunity for the Banking Group to expand within the region.

2. Demonstrated unbeaten, superior financial and technical aspects of the stock, relative to its peers

I will not even touch on it's P/E ratio, as I do believe that it's numbers speak for itself in the table below illustrating it's ratios and financials relative to the other banking peers.

Source: Finchat

Despite the company growing revenues over 35% y-o-y during the past 3 financial years, compared with 20.9% growth for TBC, the ROE of the company is among the highest of any peer, including big well-known banks. It currently sits at 30% trailing-twelve-months, with a P/B ratio of just 1.2x.

On the contrary, the company is amongst the lowest leveraged banks in the world, with an assets-to-equity ratio of seven times. In simple terms, BGEO obtains more than twice the profitability of ING with almost one-third of the leverage.

Source: Lion Finance Group

Regarding its dividend policy, the company is committed to paying out 30% to 50% of the net income in dividends and buybacks. Currently, the company is paying a dividend of 4%. To add icing on the cake, it has also managed to reduce the amount of shares outstanding by 9.4% in 3 years.

Source: S&P Global Market Intelligence

Bank of Georgia PLC Outperforms All Comparisons

• BoG's stock price increased significantly over the year, surpassing both the FTSE 100 and the EURO STOXX Banks Index.

• While TBC Bank Group struggled with volatility and a significant drawdown mid-year, BoG maintained a strong upward trajectory.

• At its peak, BoG's stock price surged more than 50%, demonstrating superior capital appreciation compared to peers.

• Additionally, BoG proven itself as a best-in-class financial stock, consistently outperforming broader European banks (EURO STOXX Banks), and UK markets (FTSE 100)

Source: S&P CapitalIQ, Author's Illustration

Among it's regional peers, Lion Finance Group also performs as the cheapest, most valued stock in terms of P/E ratio, representing an untapped opportunity for hidden value.

Personally, the company should trade at a P/E multiple of 6x, in line with its peer TBC. This would already mean an immediate upside of 73%. But more interestingly, the company expects to increase its annual loan book growth by 15%. If we translate this to EPS growth, which is below the historical average, we would have a two-year upside of 129%, or an Annual Rate of Return of over 50%, disregarding the effect of dividends and buybacks.

Additionally, Lion Finance Group presents itself as a leader in it's peers when it comes to the financials of the company, having superior net income margins by over 20% to its biggest competitor TBC Bank, as well as having explosive revenue growth of 40% and averaging 30% top-line growth y-o-y in the past 3 fiscal years. The net income growth was also supplemented by a 78% growth, dominating it's peers.

Peers were selected based on similar market capitalisation in neighbouring Eastern European countries.

3. Placing their customers first, the bank's business was primed to succeed

As the bank rolled out a three-pronged approach in strategic priorities:

1. The main bank in customers’ daily lives

2. Excellent customer experience

3. Profitable growth

In that order, the bank's priority was always to enhance customer experience. This was done by anticipating customer needs and wants and providing relevant products and services.

Through the implementation of comprehensive organisation-wide processes, including regular customer experience reviews at management level and the integration of Customer's Satisfactions into employees' key performance indicators (KPIs) to actively respond to customer feedback, Lion Finance Group has evolved into a truly customer-centric company.

NPS remained at a high level throughout 2023 and stood at 59 at year-end, broadly stable versus prior year.

Source: Bank of Georgia

This was also done by rolling out policies and programs that emphasised customer satisfaction, such as a new PLUS credit card. PLUS is the first American Express debit card project in EMEA and the second globally. The PLUS card enables customers to get more benefits, especially in daily use categories, due to lower transaction costs.

Bank of Georgia also launched BNPL for in-store payments, on top of already offering BNPL online. BNPL, available at more than 500 merchants, allows four equal payments spread across four months to be paid back over time, with no interest paid by the consumer.

Source: Bank of Georgia

This saw a repeat rate of 43.5% and 35K customers using BNPL in 2023.

In Premium Banking, BoG also goes beyond just partnering with merchants for lifestyle offers. They not only offer special deals, but also create experiences in travel, entertainment, education and wellbeing. In 2023, in response to customer feedback, BoG expanded the range of SOLO offers to better reflect the diverse preferences and requirements of customers. SOLO is the premium banking arm for BoG.

Source: Bank of Georgia

Source: Bank of Georgia

This ultimately amounted to a 10.7% increase in monthly active customers (MACs), showcasing the Group's strategic prowess and priorities in placing customers at the heart of the business.

Financials

Historical Revenue

Lion Finance Group has demonstrated strong income growth across its business segments from 2023.

Source: Lion Finance Group

Net interest income has supplanted a big portion of the operating income.

Source: Lion Finance Group

Profits also soared in FY24 compared to FY23, mainly due to its timely acquisition of Ameriabank and the entry into a neighbouring market, as well as its robust growth on its top-line.

Source: Lion Finance Group

The table above also depicts the Finance Group's revenue and income growth over each financial year, with revenues steadily growing at about 30%, with a minimum of 13% growth barring 2020 due to the financial impact of COVID-19. Despite that, gross loans still average a 16% growth y-o-y.

Historical Net Margins

Lion Finance Group has demonstrated impressive net income margins in recent years, averaging about 60-70% net income, reflecting its strong financial performance and efficient business model.

Source: S&P Market Intelligence

The table also illustrates Lion Finance Group's superior net income margins and an average ROE of 29.1%, indicating its robust financial performance and ability to drive returns based on its already growing equity pool.

Cost Structures

1. Interest Expenses: This is the largest cost directly deducted from gross revenue (interest income) to arrive at net revenue. Lion Finance’s interest expense surged in the latest year, reflecting strong growth in interest-bearing liabilities: the group’s loan book expanded 66% year-on-year (due in part to Ameriabank’s integration), funded by a larger deposit base and new debt issuance. Total interest expense was about GEL 1.46 billion in FY2024, up 31% from the prior year.

a. The main components were: Interest on Customer Deposits: With client deposits up 23% YoY to GEL 24.05 billion, the cost of paying interest to depositors rose substantially. Deposit interest rates averaged around 4.0% in 4Q24, contributing to higher interest costs as customers shifted to higher-yield accounts amid an elevated rate environment. (Additionally, Lion must contribute to mandatory deposit insurance schemes, an extra cost of holding insured deposits.)

b. Interest in Debt Securities & Borrowings: Lion Finance also saw higher interest expenses on bonds and loans from other institutions. Outstanding debt securities jumped 161% YoY to GEL 1.08 billion

c. Cost of Funds: Overall, the group’s cost of funds was about 4.9% in the period. Notably, this funding cost is lower than peers – for example, TBC Bank’s cost of funding was 6.3% in late 2024, reflecting Lion Finance’s strong low-cost deposit franchise.

2. Transaction Expenses: These are the costs incurred to generate the group’s fee and commission revenues – for instance, payment processing fees, card network charges (Visa/Mastercard interchange fees), and other service provider costs tied to transactions. Lion Finance’s fee and commission expense was GEL 376 million in 2024, up 38% from 2023. This rise is in line with booming payments activity: fee income expanded 32% as the bank’s payments and digital services grew rapidly. Higher card issuance and ATM network costs, settlement fees, and merchant acquiring expenses contributed to the increase.

3. Cost of Goods and Services (Operational Costs): This category covers the direct costs of delivering banking services and running operations – essentially the “cost of sales” for financial services. It includes expenses for branch and ATM networks, customer support, and product distribution channels, as well as day-to-day operational expenditures. Lion Finance’s operating platform grew over the year (including Ameriabank’s operations), which drove up these costs: for example, salaries and benefits for front-line staff rose significantly (salary costs in 4Q24 were GEL 231 million, versus GEL 125 million in 4Q23)

Valuation

To determine a target price for Lion Finance Group, I used dividend discount model that incorporates dynamic growth rates and a weighted beta. Book value of equity was calculated based on the most recent earnings report as of FY24 and using the 9.0 announced dividends that the Group prides itself on.

The model begins with the actual net income figure for FY2024 as its foundation. From there I used an expected growth rate in earnings during a high-growth phase for 32%, accounting for its fast growing financials.

For the subsequent years, I implemented a more conservative 27% growth rate, accounting for potential market saturation and increased competition.

Discounted according to the subsequent years growth and into the present, with a cost of equity taken from the US Treasury 10-year bond yield and the FTSE returns to find the equity risk premium.

This allowed me to derive an intrinsic value per share by calculating the present value of terminal price with the the present value of dividends, to be £7,665.66, representing an upside of 38%. This was my conservative 3 year target price, as I do foresee the market to still underprice this stock.

Other Risks

1. Geopolitical Risks

Georgia has had issues with Russia, and they still have a dispute with two regions. This could be potentially dangerous for the company.

Georgia also has recently gone through elections, and there have been many protests about them. It could potentially lead to a worse economic environment to do business and could directly affect the broader economy.

1. In October 2024, mass demonstrations against alleged electoral fraud and the government's decision to postpone European Union accession talks until 2028

2. Georgian government enacted stringent laws in December 2024 that effectively criminalize even symbolic acts of protest, such as placing stickers on public property. These measures have been criticized for suppressing peaceful dissent and targeting journalists, human rights defenders, and political activists

Mitigation

1. Financial Support Initiatives: In December 2024, Lion Finance Group, in collaboration with TBC Bank, allocated GEL 5 million to assist citizens and small businesses impacted by the ongoing events. This fund aims to provide relief to those facing economic hardships due to unrest.

2. Public Endorsement of European Integration: The Group has publicly reaffirmed its commitment to Georgia's European path. In a statement, the Bank emphasized, "For Bank of Georgia, there is no alternative to European integration. Do not stop on the way to Europe." This declaration aligns the institution with the broader public sentiment favoring EU integration.

3. Operational Resilience Amidst Uncertainty: Despite the political challenges, Lion Finance Group has maintained robust operations. The company reported that the Georgian economy remained strong throughout the uncertainties, achieving a 9.5% economic growth in 2024. The Bank continues to operate as usual, with a baseline expectation of approximately 5% real GDP growth for 2025.

2. Economic and Currency Risks

The company does business mainly in GEL (Georgian Lari), AMD (Armenian Dram), and USD (US Dollar). However, the company trades in the UK. If the local currencies depreciate, that could affect earnings in GBP. Also, some loans are in USD, which could affect delinquency rates if the USD becomes stronger.

Mitigation

Both currencies, AMD and GEL have been good performers during 2024 compared to the USD. Currently, both countries have inflation of near 0.5%, while having interest rates of 8% and 6.75% for Georgia and Armenia, respectively. Also, international reserves in both countries remain high, supporting strong currencies.

Source: Lion Finance Group

Although Georgia may sound like an exotic country, it actually ranks the 53rd least corrupt nation, out of 180, for Trading Economics. As a reference, Italy is 52nd ranked, Spain currently holds 46th position, the US is 28th, and Mexico is 140th.

The GDP of both countries, Georgia and Armenia, has been growing rapidly, although it is still significantly lower on a per capita basis than Central and Eastern European countries, which shows that both economies still have plenty of room to grow.

Source: Lion Finance Group

3. Operational Risks

Credit Losses: As consumer loans make up the business of Lion Finance Group's loan portfolio, and business banking also offers unsecured loans, a rise in consumer credit losses could impact financial performance and investor sentiment

Mitigation

1. Lion Finance Group has demonstrated a robust credit profile, evidenced by recent upgrades and new ratings by rating agencies:

Source: Wall Street Prep

Moody's assigned Lion Finance's adjusted baseline credit ratings to high tier grade Ba2 with a stable outlook with its strong performance over the past 24 months.

Fitch upgraded Lion Finance its first international credit rating of BB (almost investment grade) with a stable outlook.

References:

https://www-statista-com.libproxy.smu.edu.sg/statistics/440866/population-growth-in-georgia/

https://ramad.bog.ge/s3/BogGroup/Lion-Finance-Group-PLC-4Q24-and-FY24-Results.pdf

https://ramad.bog.ge/s3/BogGroup/2024/05/44311-BOG-Annual-Report-2023-Web-1.pdf

https://lionfinancegroup.uk/leadership-and-governance/subsidiary-management/