Initial Report: Luckin Coffee Inc (LKNCY), 100% 5-yr Potential Upside (VIP GC, Jingxiang CHEN)

Jingxiang believes that Luckin has a large customer base and is able to establish strong brand presence and customer loyalty. It's future is shining indeed. Do you agree?

LinkedIn | Jingxiang CHEN

Company Overview

Luckin Coffee is the largest coffee chain in China by outlet. It has both self-operated stores as well as partnership stores over China. Built on the basis of a technology-driven new retail model, the stores mainly served as collection points for coffee deliveries through their proprietary mobile application as well as 3(rd) party platforms like Meituan or Ele.me.

Franchised stores (new retail partnership)

Franchised stores represent ~33%[1] of the total number of stores that Luckin have in China. According to data from its latest publicity drive to attract franchisee, we can see that Franchised stores cover the tier 2 and tier 3 cities in China, which is part of the sinking market. Given such aggressive expansion, it can be seen as a move for Luckin Coffee to further establish its brand presence and reinforce its brand power.

Luckin’s franchise agreement with[2]its partners is based on a model of tiered shared profits. Partners do not have to pay any initial fee. Gross profit from sales is then returned 100% to its franchisees. This is based on a tiered basis, ie if the Gross profit exceeds 20000RMB a month, the returned percentage decreases slowly. At >80000rmb, the returned profit is capped at 80%.

The franchise model shows Luckin’s determination to be a long-term business, as many other chains earn fast cash by charging an initial fee to its franchisees.

Industry Tailwind

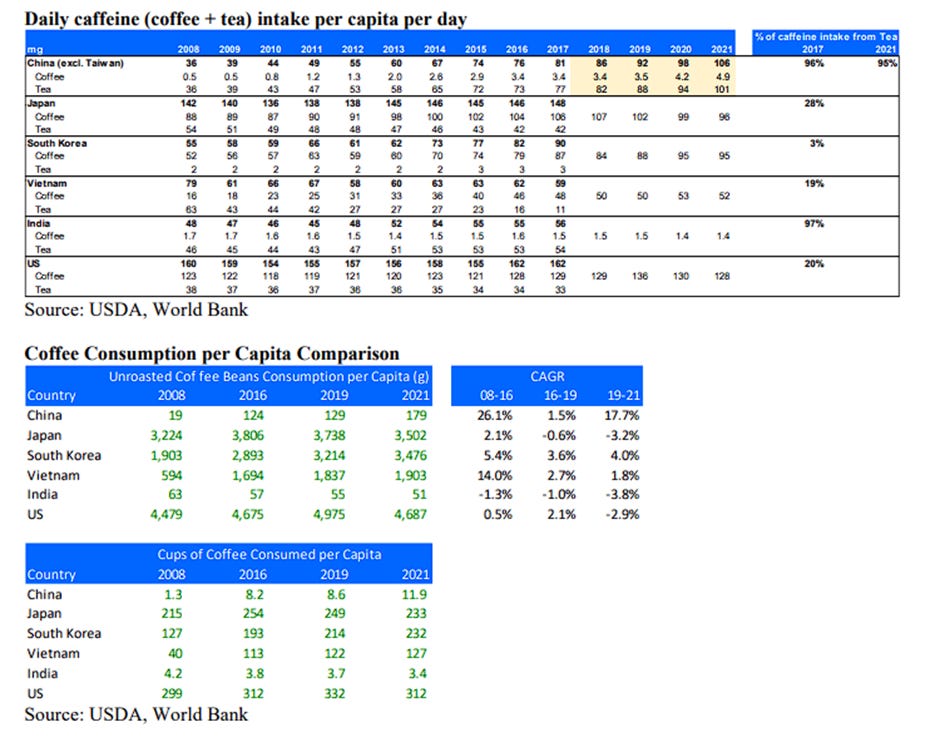

Luckin Cofee is considered to be in the Fresh ground coffee market. In the Chinese market, other players include Starbucks, Manner Coffee, Costa Coffee etc. Compared to supermarket coffee, Fresh ground coffee has the advantage of having fresher taste and ability to innovate new flavors. China’s market penetration of fresh ground coffee is far from that of a developed country. Per capita coffee consumption as well as daily caffeine intake per capita per day from Coffee lacks behind that of developed countries. However, with growing CAGR due to China’s rise as a developing country, we will see the coffee industry in China grow at a estimated CAGR of 27.2%[3]

Investment Thesis

Larger target audience market resulting from Product Innovation in beverage coffee

Coffee is a unique kind of beverage, in the sense that it is able to provide a productivity boost to its consumers through the caffeine intake. Caffeine has also been proven to be addictive, and generates repeat sales. However, as a large Tea consuming nation, China’s caffeine intake via coffee grew at a relatively slow pace. Even though coffee itself is addictive, its bitterness compared to Tea meant that many in China were unaccepting to its taste. This created a barrier for coffee makers in China to capture more target audiences. However, Luckin Coffee’s innovation into beverage coffee is able to reduce this barrier and increase China consumers’ willingness to try coffee products and subsequently treat it as a consumer staple.

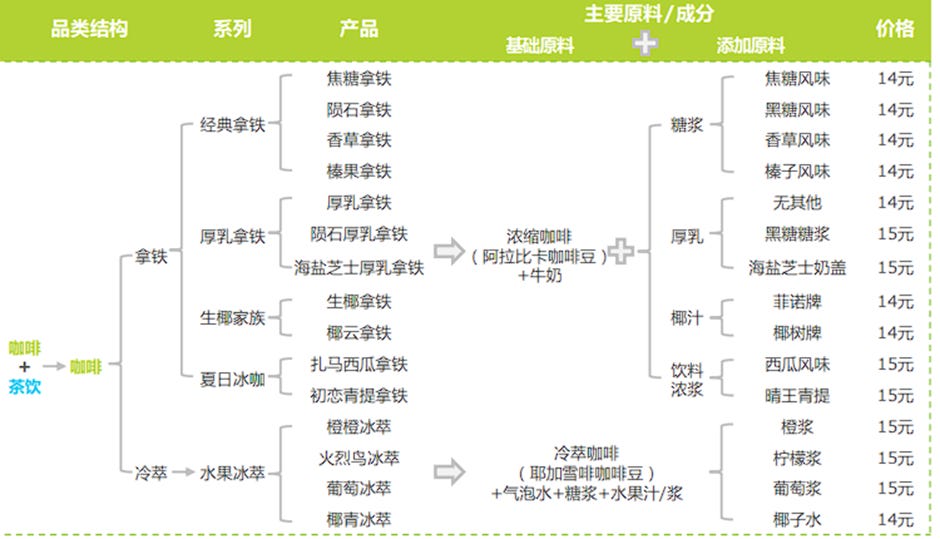

Beverage coffee is a new type of coffee that combines coffee with other more accepting tastes such as coconut, fruit juice, etc. A prime example would be Luckin coffee’s best seller 生椰拿铁, coconut latte, which managed to sell more than 300 million cups in 2 years.[4] Luckin has an extremely wide product lineup, introducing many seasonal products like watermelon latte etc.

The effect of the beveraged coffee strategy bears 2 fruits for Luckin. Firstly, consumers are introduced to coffee via their special lattes which do not have as strong taste like americano. Even non-coffee consumers can try these lattes and get hooked onto coffee products. These consumers then become repeat customers of Luckin. Secondly, beveraged coffee opens up a whole new market for Luckin, these special lattes now serve as alternatives to popular new tea beverages like HeyTea etc. This mean that Luckin Coffee can also be an impulsive purchase for consumers, thereby opening up its potential target audience market.

Strategic place of stores breeds customer loyalty for the long term

Luckin Coffee’s stores are placed in strategic locations to breed customer loyalty. In many universities in China, Luckin Coffee has a store within the campus. This helps them to secure brand loyalty from these university students who would later go on into the workforce. The 2nd most popular location for Luckin Coffee stores is near office buildings to cater to working adults, who are the biggest consumer of coffee.

Luckin’s Franchise strategy is also part of its long-term plan to establish Luckin as a long-term coffee brand. The sinking market of China is a key market that cannot be overlooked due to its large population. The success of Pinduoduo has shown that consumer brands in China should also focus on the tier 2 tier 3 cities who are more sensitive to price changes as well. Luckin Coffee has an advantage compared to competitors like Starbucks due to its cheaper pricing which is more acceptable for the sinking market. Thus, Luckin is poised to gain the first mover advantage in the sinking market and establish itself as the prominent coffee brand in China.

Risk

The most obvious and biggest risk with regards to Luckin would be its fraud investigation. In terms of accounting impact, it reached settlement with the SEC and the Chinese State Administration for Market Regulations and paid its fines already, so its reports would not be affected. Nonetheless, it is still pending outcome from the US DOJ as well as the Ministry of Finance of PRC, but I think that the effect would not be too substantial.

In terms of internal control, in Jan 2022, former management Lu Zhengyao and Qian Zhiya no longer have any interest in Luckin, Centurium capital, who was the pre-IPO investor is now the controlling shareholder of the company. The renewed directorship and management could mean a move away from its past. With this change, the new ownership also appointed new auditor BDO China to replace Centurion ZD. However, between 2020 – 2021 under the old ownership, there were frequent changes in auditors for Luckin, this might be a risk factor to look at.

Conclusion

Luckin Coffee is now the strongest coffee chain in China, with a large customer base owing to its beveraged coffee play, as well its potential to establish brand presence and customer loyalty as China move towards drinking more coffee. The extent of Luckin’s popularity can be summed up by 1 of my experience here. At 11.30am on a hot summer day, the Luckin Store in the Tsinghua campus informed me that they ran out of ice to serve more coffee. Despite its fraudulent past, its product’s strength and brand power remains, which are the key to winning and surviving the competitive consumer market in China. Thus, I believe in Luckin’s ability to turnover a new bean.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

[1] From earnings presentation

[2] https://www.sohu.com/a/676297180_121685565

[3] https://www.foodtalks.cn/news/31156

[4] Earnings presentation Q1 2023

This content is only supported in a Lark Docs