Initial Report: Major Drilling Group International (MDI), 148% 5-yr Potential Upside (EIP, Jingzhe ANG)

Jingzhe believes in the profitability of Major Drilling Group given its leading size as a contractor in the mining industry.

Major Drilling International (TSE: MDI)

Business Overview

MDI is a literal picks and shovels play on the mining upcycle (Gold & Copper majority), as one of the leading contractors providing specialised drilling services in the mining industry. They offer specialised drilling (65% revenue), underground drilling (24% revenue) and conventional drilling services (11% revenue). The business spans >20 countries with a fleet of >600 drills (~20% market share in a highly fragmented market). They have been around since 1980, and the initial 20 years were focused on international expansion of its conventional drilling services (establishing LATAM, African, Australian footprint). Since 2000 however, the strategy shifted to dominating specialised drilling, with the realisation that most ore bodies being discovered and explored will be from areas that are increasingly difficult to access. Specialised drilling (eg. deep-hole, directional) has higher barriers to entry given the higher complexity of equipment and trained personnel required in mobilisations to remote locations or high altitudes. They have conducted strategic acquisitions of specialised drilling firms from time to time to grow their presence in key markets.

Industry Analysis and Investment Thesis

Figure 1: Mineral exploration mining services key players as of FY 2018

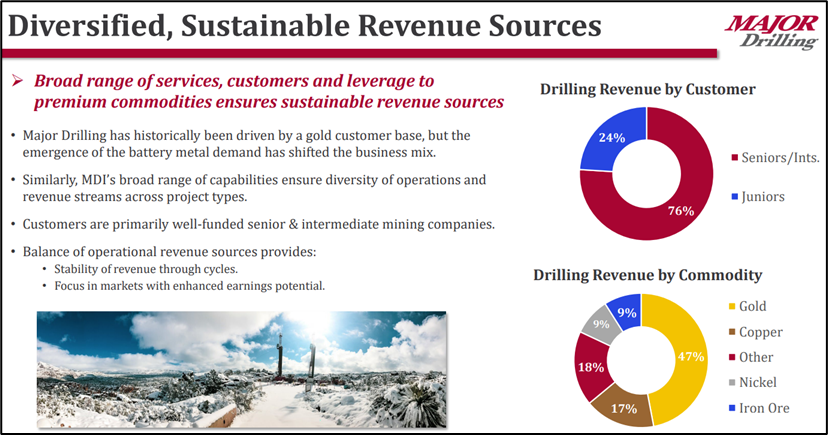

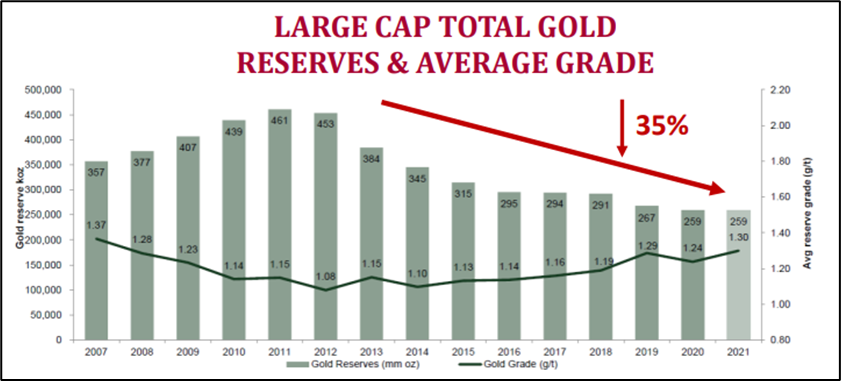

What I like about MDI’s business is that it has strong established relationships with the senior/intermediate miners (their exploration budget flows to MDI’s revenue) who contribute 76% of revenue. Gold and Copper (65% revenue) are the main commodity exposures, and these are set to benefit from greater exploration demand given the declining gold reserves that have yet to be replenished + precious metals price appreciation, and the growing supply gap for copper going into EV transition.

Recent share price and earnings have been depressed as exploration budgets for the intermediate/ senior are yet to fully ramp + junior exploration companies are funding constrained in a rising rate environment. I believe these are temporary headwinds and we are in the early stages of the exploration cycle (3 years in vs last cyclical upturn from 2004-2012), and the demand for gold and copper relative to the depleting reserves necessitate greater spending going forward.

Financials

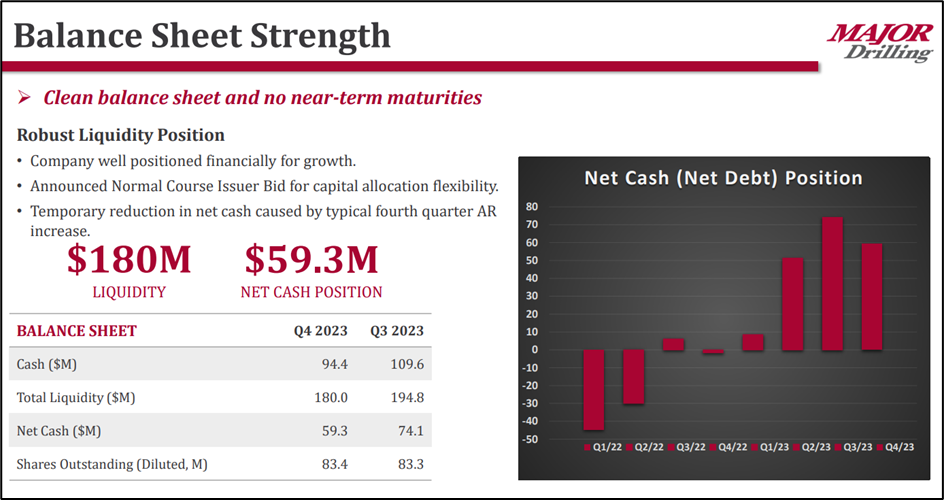

MDI has a great balance sheet which gives them great flexibility in capital allocation (CAD$87m net cash position), as management paid down debt rapidly over the last 2 years with the mining cycle ticking upwards. MDI also declared their first share buyback program in March 2023, authorised to purchase ~5% of outstanding shares. Moreover, MDI has also redeployed much of the remaining capital to upgrade existing drilling equipment in anticipation of growing customer demand, which leaves them with lots of dormant capacity to capture capex-light demand growth in the coming years (utilisation of rigs at 46% currently, peak utilisation in 2012 was ~70%). At CAD 9.2/share, MDI is trading at 4.3x EV/NTM EBITDA (5-yr average 6.4x), with 13.8% FCF Yield on EV. Valuation looks interesting given the short term headwinds, with the conservatively managed company helmed by experienced management set to benefit from the longer term exploration upcycle.

Figure 2: Company Financial Snapshot (in millions of CAD, except per share)

Valuation

MDI currently trades at 4.5x fwd EV/EBITDA (5-yr average 6.8x), and 10.2x fwd P/E (5-yr average 30.6x)

Assuming absolute revenue growth of 50% by FY+3 (increasing current fleet utilisation from 46% to 70%), 12% net income margin and an exit P/E of 10x (unchanged/no re-rating from today) this yields 3-year TP of CAD$14.6, IRR of 16%.

Assuming annual revenue growth of 10% in FY+4 and FY+5 (near peak mining upcycle), 14% net income margin (peak margins in last 2008 upcycle) and an exit P/E of 10x (unchanged/no re-rating from today) this yields 5-year TP of CAD$22.8, IRR of 20%.

Management Team

C-suite and senior management at MDI are highly experienced in the mining and drilling industry, and most have been with MDI over the last mining upcycle (2014-2012). They first turned MDI around 2000 where it was on the brink of bankruptcy and have been seasoned operators (been through a decade long boom and bust in precious metals mining), and have positioned the business opportunistically to capture the revenue surge as capital flows into the sector again at sustained metal prices.

ESG Considerations (Most Material)

Environmental (E) – Environmental Emissions

The mining services industry is critical to the energy transition given the green demand for metals such as copper (best conductor of electricity with no available substitutes, used extensively in transmission, transformers etc.), lithium (key component of EV batteries) and increasingly precious metals (eg. Silver usage in solar ribbons), which necessitates more exploration and development of mining projects to meet global demand. MDI is well positioned to benefit from energy transition tailwinds in this regard. Internally, MDI has delivered a 12% reduction in scope 1 & 2 Greenhouse Gas Emission Intensity (calendar 2021 vs 2022), whilst also adding their first EV pickup truck to the fleet.

Social (S) – Worker Health & Safety

MDI boasts industry leading safety records with over 1 year of 0 hours from lost time to injuries (LTI), given their focus on the safety culture. Their robust mine safety systems can only boost contract procurement from major miners (eg. Vale, Barrick Gold) who are themselves bound by more stringent ESG-related corporate regulations.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.