Initial Report: Meituan (SEHK:3690), 25% 5-yr Potential Upside (China Tech Fund)

It's a beautiful buy

Introduction to the Next Gen China Tech Fund

About

The inception of China Tech Fund was the shared idea between Shinya and Max while having a discussion about the exciting opportunity of the Chinese listed shares in the United States and Hong Kong. During these past two years, the Chinese government executed a total crackdown into the technology and real estate sector causing a hard deleveraging and share liquidation by foreign investors all around the world. The Hang Seng Index (HSI) fell approximately 50% and foreign investors totally lost confidence investing in the Chinese market. With the tightening of financial markets all around the world due to persistent high inflation, China remains firm on the decision to lower interest rate; however financial and psychological repercussions remain and market participation is fearful of allocating capital. With the previous successful execution of the inception of China 101010 Fund during the severe bear market during 2011-2012 period in China, China Tech Fund’s goal is to also replicate the success by capitalizing on the rare contrarian opportunity to buy into the highest quality internet technology companies in China and hopefully with a long term perspective (10 years) and patience to successfully compound capital by beating the benchmark indexes.

LinkedIn | Max Tai

About the Business

Meituan (formerly known as Meituan-Dianping) is a Chinese shopping platform for locally found consumer products and retail services including entertainment, dining, delivery, travel and other services. Meituan has a strong market share of 67.3% (Year 2020) in the Chinese food delivery market and is a default search engine used by both locals and tourists in China.

Mission: We help people eat better, live better

Corporate Strategy: Shifting from a focus of “Food + Platform” to “Retail + Technology”

Revenue Breakdown

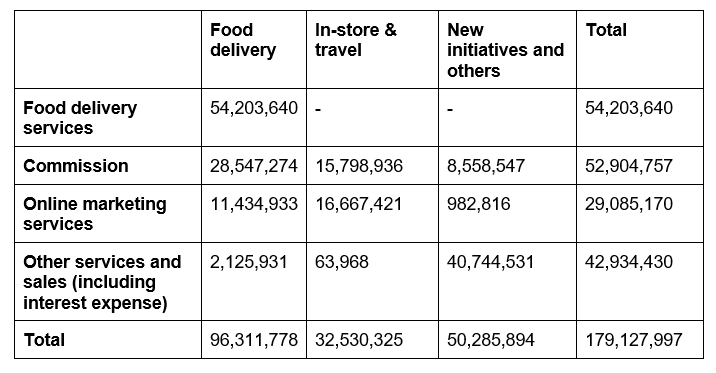

Overall, Meituan’s total revenue increased by 56% YoY to RMB179.1bn in 2021. Meituan’s largest source of revenue is from food delivery, with food delivery making up RMB 96bn of its total revenue in 2021. This is followed by new initiatives contributing a total of RMB 40bn, almost doubling from 2020’s corresponding revenue of RMB 27bn. Lastly, in-store and travel contributed a total of RMB 32bn to Meituan’s overall revenue.

Revenue Figures

In RMB thousands

Year Ended Dec 31, 2021

Profitability

Meituan has been experiencing negative net income since 2016 apart from 2019 and 2020. In 2021, Meituan experienced a total net loss of RMB 23.5bn. In addition, Meituan is also currently operating on a negative cashflow for both its investing and operating activities. However, this net loss can mainly be attributed to expanded investments by Meituan in the New Initiatives and Others segment, given that Meituan has already managed to achieve positive net income for both its Food Delivery and In-Store & Travel segments. In 2021, Meituan’s aggregate operating profit for these two segments have reached RMB20.3bn, up from RMB11.0bn in 2020.

We think that there is no huge concern regarding the net loss that Meituan is experiencing because Meituan has already achieved positive net income from its other revenue segments. This means that Meituan can easily attain overall positive net income by simply reducing the number of projects under its New Initiatives & Others segment. In addition, we strongly believe that Meituan is investing in the right kinds of projects that would be it at a good stead to capture more profits in the long run.

Investment Theses

Food Delivery

Meituan’s core business is in food delivery, given that it began with its food delivery business and currently is the dominant player in China’s food delivery market. However, the food delivery business only provides a 6.6% operating margin for Meituan, and we expect that Meituan will likely face increasing difficulties increasing its profits from this business segment due to regulatory intervention. Chinese authorities have ordered food delivery companies to improve the rights of food delivery couriers, meaning that Meituan would likely have to incur additional costs to provide better safety protection for its food delivery couriers. In addition, Chinese authorities have also indicated that food delivery companies should further reduce the service fees charged to restaurants, meaning that Meituan would likely face a decrease in its commission revenue from the food delivery segment.

However, we recognise that Meituan’s profitable food delivery business provides it with a strong competitive advantage. Firstly, given its food delivery business, Meituan is better able to carry out cross-bundling to provide other services such as in-store experiences and hotel-stay that are complementary. Secondly, Meituan’s dominance in the food delivery market provides it with a strong brand recall among consumers, making Meituan the first app to come to mind when consumers need something in their daily lives.

In addition, China, the market that Meituan operates in, has an extremely high population density, making it an extremely suitable one for food delivery services. Due to the high network of people in China, Meituan continues to face an increasing volume of orders. It should not be neglected as well that a huge number of Chinese consumers with increasing purchase power continue to seek for more and more convenience in their daily needs, and therefore, Meituan is likely to experience an increase in its frequency of orders as well, especially as Meituan expands into more forms of food selections such as milk tea and light snacks.

Meituan also demonstrates a clear understanding of the risks it currently faces in the food delivery businesses and has been actively investing in the relevant R&D to mitigate such risks. In response to increasing costs of hiring food delivery couriers, Meituan has been investing in drones for its food delivery services. In 2021, Meituan successfully made its first food delivery via drones to residents in Shenzhen. At the 2021 World Artificial Intelligence Conference (WAIC), Meituan also announced its intentions to kick off a drone logistics network pilot programme in Shanghai.

In-Store and Travel

This business segment covers in-store experiences including hotel-stay, leisure and entertainment, sports, elderly care and pet care. This demonstrates Meituan’s desire to expand beyond food delivery services to becoming an all-encompassing app, in alignment with its corporate strategy of “Retail + Technology”. Various marketing and promotional campaigns have also been carried out to increase the awareness among consumers of Meituan as the “go-to destination for local services” in China.

We believe that this business segment is a “cash cow” for Meituan. It has an extremely high operating margin of 43.3%, and it is a business segment that still has huge growth opportunity. Given that the penetration rate of service e-commerce in China is still quite low at only 3%, and Meituan is still deepening its penetration of in-store and travel services into lower-tier cities, we believe that this business segment will experience huge revenue growth in the future.

The online travel agencies (OTA) business model is also one that has proven to be a growth compounding one. This is because hotels usually operate with a low variable cost, meaning that the profit that comes with each additional room that they can rent out is very closely similar to the revenue of doing so. As such, hotels are very much willing to tap into the services of OTA and provide discounts in order to fill up their rooms as often as possible. In fact, with the strong network effect that Meituan has, Meituan has already managed to attain 80% of the OTA market share, making it such a strong player that it has become the go-to OTA for hotels.

A key example of the success of the OTA business model would be booking.com, whose stock price has grown from USD35.10 on 28 Dec 2001 to USD2044.85 on 9 May 2022:

We believe that Meituan has strong potential to become the equivalent of booking.com in China. The In-Store and Travel segment in Meituan is already generating positive profits at such a high margin with healthy year-on-year growth.

New Initiatives and Others

We are the most optimistic about Meituan Groceries. The grocery delivery market in China is currently under high competition with various companies cutting prices to gain market share. We believe that Meituan is well-poised to win in the grocery delivery market with its strong logistic infrastructure nationwide that is extremely efficient and more suitable for grocery shopping than Alibaba & Pinduoduo’s system. In addition, Meituan is already making profit in its other 2 core business segments of Food Delivery and In-Store & Travel, putting it in a good financial position to compete using price. With an estimate of Chinese online grocery sales hitting a starking RMB2.328tn in 2025, should Meituan end up emerging as the winner of the grocery delivery market in China, its growth opportunity would be enormous.

Risks

Compliance Risk

In a highly regulated market like China, Meituan faces a huge amount of compliance risk. In 2021, Meituan saw around $38.98 billion wiped off in value in merely 2 weeks because of its “choose one” behaviour towards its food merchants which led to regulatory scrutiny on “suspected monopolistic practices”. Apart from monopolistic practices, Meituan also faces a huge amount of risk in its food delivery business given that the Chinese government has been pushing for better rights for food delivery couriers.

However, we believe that this risk has been greatly mitigated with the recent announcement by the Chinese government during the period of Labour Day 2022 to stop its regulatory crackdown on Chinese technology companies. At the same time, Meituan has also been actively engaging in ESG practices such as through the Tongzhou (on the same boat) Project to better guarantee the rights and interests of food delivery couriers.

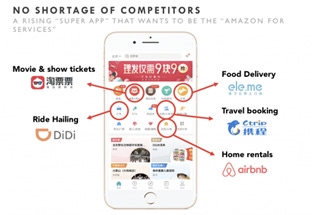

Market Competition and Innovation Risk

Meituan exists in a highly competitive market with rapid market changes. As of 2020, Meituan dominates the food delivery market in China with a 67.3% market share. However, it still faces strong competition from other food delivery providers such as Ele.me. Therefore, Meituan consistently spends a huge amount of cash in new initiatives.

While we do think that Meituan is heading in the right direction in investing in R&D, it is uncertain whether Meituan would succeed in its R&D. As of 2021, Meituan’s Return on Capital Employed (ROCE) is -0.13, and its New Initiatives & Others segment saw its operating margin decrease by 36.6 percentage points year over year. This signifies that Meituan still has not been able to generate positive EBIT from its new initiatives yet, and it is unclear whether this situation would improve in the upcoming years. Just recently in 2022, Meituan Select also withdrew from the Beijing market, despite the recent surge in consumer demand for grocery products in the city, which could potentially indicate a failure to capture the market.

Conclusion

Overall, we have strong conviction in Meituan as a high-growth stock. Meituan has strong existing capabilities in terms of its network effect and logistical advantage developed through its food delivery business. This puts Meituan in at an advantageous position to capture further market share and opportunities in its other business segments with high growth opportunities, in particular the In-Store & Travel and Grocery Delivery segments.

However, it is also extremely crucial that we regularly monitor Meituan to check on the execution of its New Initiatives. We need to ensure that Meituan cuts huge losses from its New Initiatives in time to avoid any potential cash flow issues. The progress of Meituan’s New Initiatives is also a good signal for us on Meituan’s growth potential, and is therefore a key evaluation factor to be considered.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.