Initial Report: Ming Yuan Cloud (0909.HK), 116% 5-yr Potential Upside (China Tech Fund)

Read on to see what's flying with Ming Yuan...

Introduction to the Next Gen China Tech Fund

About

The inception of China Tech Fund was the shared idea between Shinya and Max while having a discussion about the exciting opportunity of the Chinese listed shares in the United States and Hong Kong. During these past two years, the Chinese government executed a total crackdown into the technology and real estate sector causing a hard deleveraging and share liquidation by foreign investors all around the world. The Hang Seng Index (HSI) fell approximately 50% and foreign investors totally lost confidence investing in the Chinese market. With the tightening of financial markets all around the world due to persistent high inflation, China remains firm on the decision to lower interest rate; however financial and psychological repercussions remain and market participation is fearful of allocating capital. With the previous successful execution of the inception of China 101010 Fund during the severe bear market during 2011-2012 period in China, China Tech Fund’s goal is to also replicate the success by capitalizing on the rare contrarian opportunity to buy into the highest quality internet technology companies in China and hopefully with a long term perspective (10 years) and patience to successfully compound capital by beating the benchmark indexes.

LinkedIn | Max Tai

Business Overview

Ming Yuan Cloud provides enterprise-grade SaaS products and enterprise resource planning (ERP) solutions for property developers and other industry participants in the real estate value chain in China, to help them achieve delicate and digitalized business operations – enabling their customers to carry out their businesses internally and with their business partners in a more efficient and intelligent manner.

Business Model

Ming Yuan Cloud has two main revenue streams – SaaS products and ERP solutions. Descriptions of their respective offerings can be found in the table below (Table 1). Notably, all of these offerings are based on its Skyline PaaS Platform that was launched in November 2020. The Skyline PaaS’ architecture of dual-mode IT, cloud native technology and hybrid cloud supports users in fully developing “user interface, business logic, and data services” through “nocode and low-code” methods, and significantly improves productivity through cross-platform portability for users.

Through its Skyline PaaS Platform, Ming Yuan Cloud can develop high-quality SaaS products and conduct iterative product upgrades in a short time, so as to cater for the changing customer demand and technological innovation.

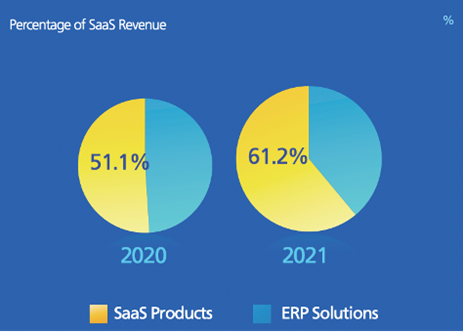

The revenue breakdown from the latest financial year is shown below (Figure 1). Business revenue from its SaaS segment as a proportion of total revenue has increased to 61.2%, from 51.1% contribution in the previous year.

Figure 1: Ming Yuan Cloud Annual Report

Industry Overview

Digitisation of Real Estate sector is central to the plans of the Chinese government, as the sector historically contributes about 10-15% to its overall GDP. In the 2016 to 2020 five year plan (FYP), CCP’s central committee promoted the Proptech industry, the first time in China’s history whereby the highest echelons of policymakers are conversing about the need to digitise construction, urban planning and property.

In preparation for the FYP, the CCP recommended the need to “Accelerate the completion of shortcomings in infrastructure, municipal engineering, agriculture and rural areas, public safety, ecological environmental protection, public health, material reserves, disaster prevention and mitigation, and people’s livelihood protection, promote enterprise equipment update and technological transformation, and expand investment in strategic emerging industries.”

Digital transformation of the real estate industry however, is still in the early stage of development. The market size of the real estate digitalization market was around 10 billion yuan in 2021 and is expected to grow slowly in the next three years. The CAGR from 2021 to 2024 is expected to be around 4.9% as per iResearch (Figure 2).

Figure 2: Industry CAGR from iResearch Consulting Group

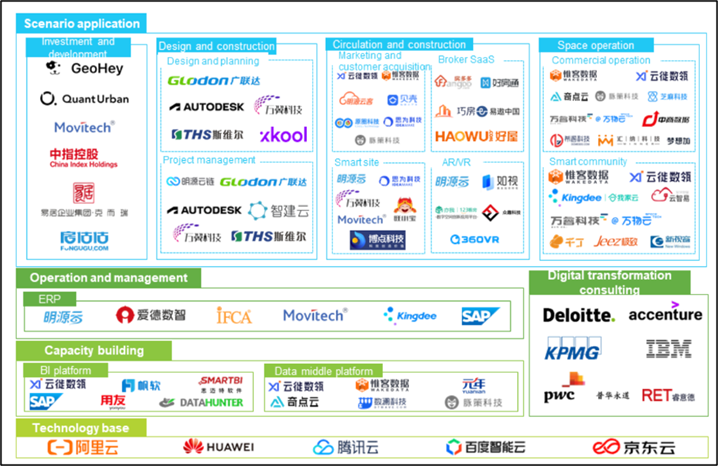

In the current real estate digitisation ecosystem, service providers can be broadly divided into the categories of technology foundation, capacity building, operation and management, scenario application, and digital transformation consulting (Figure 3).

Currently, the most urgent digitalisation demand/ pain point is the need for real estate companies to improve their customer acquisition efficiency (eg. circulation and transaction link). Digital tools helps reduce marketing costs and therefore, enable real estate companies to achieve better ROE with less investments. Thus, technologies that help companies enhance customer acquisition efficiency and improve customer experience are in hot demand.

Figure 3: Industry’s Ecosystem Map from iResearch Global Group

Investment Thesis

Ming Yuan Cloud has a strong and growing technological moat with its SaaS offerings based on its proprietary Skyline PaaS platform.

Consistent and increasing R&D spending to further enhance its suite of SaaS and ERP solutions offerings has seen high revenue growth rate and customer retention across all its SaaS products – especially its main revenue driver for SaaS (CRM Cloud) – even amidst a highly challenging year for China’s real estate market (Table 2).

The Skyline PaaS platform has made major breakthroughs and received a series of certifications and awards, including but not limited to:

Kunpeng Technology Certification of Huawei Cloud

Product Compatibility Certification of CECLOUD

CAICT Evaluation and Certification for Data Management Platforms at the national level

CAICT Evaluation and Certification for Business Intelligence (BI) Analytical Tools

"Innovation Award of 2021 Domestic Enterprise-grade PaaS Platform" by China Internet Weekly of Chinese Academy of Sciences

"Excellent Cloud Native Technology Partner Award" by Huawei Cloud

Ming Yuan Cloud has accelerated its transition to a pure SaaS business model with the early transition of its ERP solutions segment to a subscription-based model, and this will lead to stable and predictable revenue streams in the future.

It started the transition of ERP solutions to a subscription based model in advance in FY2021, and lowered the threshold for digital transformation to meet wider customer needs under industry adjustments.

Ming Yuan Cloud’s core revenue drivers – CRM cloud (46.9%) and ERP solutions (38.8%), are highly resilient in the face of China’s real estate troubles.

CRM cloud addresses the most urgent digitalisation demand in the real estate value chain by enhancing customer acquisition ability and transaction conversion efficiency of property developers.

ERP solutions could benefit from tighter regulations in the real estate sector as it helps property developers to effectively integrate and manage enterprise resources and optimize their core business processes. The digitisation in monitoring financial and operational performances should gain traction as developers are forced to tighten their belts.

Ming Yuan Cloud has amassed an attractive customer profile, and its Skyline PaaS platform would benefit from platform network effects that will help to attract more customers.

~95 of the top 100 property developers in China have been cooperating with them since 2018.

It has attained 44% annual growth in property developer customers in the last FY.

Ming Yuan Cloud makes the functions of its Skyline PaaS Platform available for IT teams of their customers and 3rd party partners, and encourages their partners to develop various innovative applications to customers and further expand their partners and technological ecosystem.

Financial Ratios

● Ming Yuan Cloud has maintained a consistently high gross profit margin at ~80% even as it grew its revenue at an average rate of 39.8% y-o-y in the past 4 years, implying the operational efficiency of the management in controlling its direct costs amidst aggressive growth

● However, selling costs and R&D costs have shown a marked increase over the past 5 years. Notably, SG&A expenses made up 87% of revenue in the past year, and this spike could be explained by ERP solutions’ transition to a subscription model as well as Ming Yuan Cloud’s entry into tier-3 and other lower tier cities.

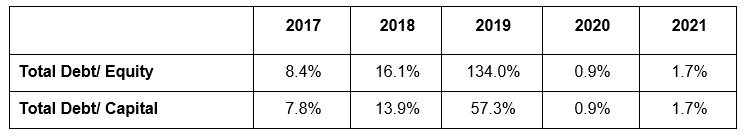

● Ming Yuan Cloud’s ability to meet short term obligations is extremely healthy, having paid off most of its debt in 2019 through issuance of new shares (caveat: shareholder dilution). Currently, its debt to capital is at a meagre 1.7% while its quick ratio is 6.7x – well above the 1.0x benchmark. This can be interpreted as a good sign given the increased scrutiny of the real estate sector and rising cost of debt as lenders to Chinese real estate businesses are increasingly cautious given the broader market conditions.

Profitability Analysis

Efficiency Analysis

Short Term Liquidity

Long Term Solvency

Valuation

Ming Yuan Cloud is trading at a sizable discount vis-à-vis their competitors within China, in terms of both historical and projected EV/Sales ratio. The average EV/EBITDA multiple of 16.9x for B2B SaaS companies was used to derive the 5-year target price of 2.04 USD (286% upside from last closing price of 0.53 USD as at 15/10/22) via DCF. The 5-year target price corresponds to a 3.3x EV/Sales ratio, which is still a conservative estimate based on the trading comparables of its peer group, with mean and median EV/Sales ratio ranging 4.0-7.0x.

Key Risk [Actions]

China’s Real Estate Woes

The liquidity crisis in the property sector headlined by Evergrande’s defaulting on its debt is set to slow the growth prospects for the sector in the short to medium term, and given that property sales, construction starts and the financial health of China’s property developers are central to Ming Yuan Cloud’s core services and offerings, this could have a crucial drag on its top line growth. [Closely monitor the revenue growth rate and customer account retention rates for its SaaS offerings, as well as SG&A/ Revenue trends going forward]

Risk of New Competitors

Ming Yuan Cloud operates across the real estate value chain, but individually, its products and offerings faces stiff competition from different competitors operating in the respective segments (see industry ecosystem mapping). Large ERP players such as Kingdee have also expanded offerings in the property sector. [Closely monitor the revenue growth rate of its two core offerings, and the gross profit margin over time, which will indicate its pricing power.]

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.