Initial Report: Mitsui O.S.K. Lines (9104:JT), 115% 5-yr Potential Upside (VIP SEA, Fabian VERA)

As Asia thirsts for LNG, read about how Fabian discovered this hidden gem in the energy supply chain.

LinkedIn | Fabian VERA

Executive summary

Decarbonization in Asia region and beyond makes consumers shift from traditional oil and gas to renewable sources of energy, and among those is LNG. To supply it, a steady player in the maritime transportation business as Mitsui O.S.K. Lines becomes paramount to deliver this commodity. In the near term, the current sustainability wave is going to drive reasonable profit margins for operations to coexist. In the long term, growth as a function of need for LNG is going to be a catalyst for a sustainable future.

Investment theses

The following report recommends a Buy on Mitsui O.S.K. Lines (9104 JT), MOL, based on the following investment thesis.

Asia thirst for LNG. – Current demand by 2033 is set for 73 million tons per year, making up of 12% of global market as LNG is highly energy-dense and it can be transported in a liquid state by occupying around 1/600th of its gaseous volume, and it is particularly valuable in areas where pipeline infrastructure is limited or nonexistent. This makes it more efficient for selected maritime transportation businesses to commute over long distances by sea or land, enabling the global trade of natural gas [1].

Growing Decarbonization. - LNG serves as a bridge between high-carbon fossil fuels and renewable energy sources. It has lower carbon dioxide (CO2) emissions and virtually no sulfur dioxide (SO2) emissions, contributing to improved air quality and reduced environmental impact as energy corporations have a continued focus on looking at profitable decarbonization with low-carbon molecular solutions [2].

Company Overview

Mitsui O.S.K. Lines (MOL) is a Japanese shipping company that is one of the largest in the world. With 140 years of history, MOL operates a fleet of approximately 800 vessels and transports a wide range of cargo, going from nearly 62 million tons of iron ore to 73 million tons of liquefied natural gas (LNG) on 3,200 voyages in 2022 alone.

History

Table 1. Brief history of Mitsui OKS Lines and its impact through the waves of time

Board of Directors

MOL assembles 39 directors and officers, of which only 4 are Independent Directors. Five of these 39 directors are available on Table 2.

Table 2.- Board of Directors highlighting the top 5 officers and available compensation

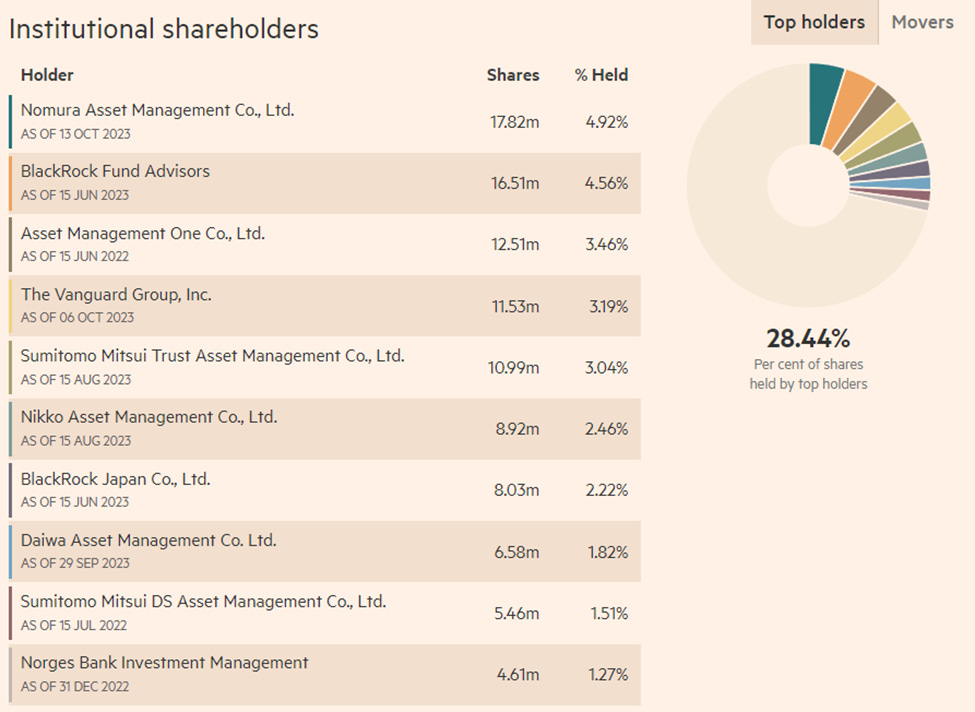

As for Institutional Shareholders, usual global players manifest at the top of Table 3. Yet, no majority voting rights are among them as their positions combine only 28.44% of available shares.

Table 3.- Percentage held by institutional shareholders and their day of allocation

Business segments

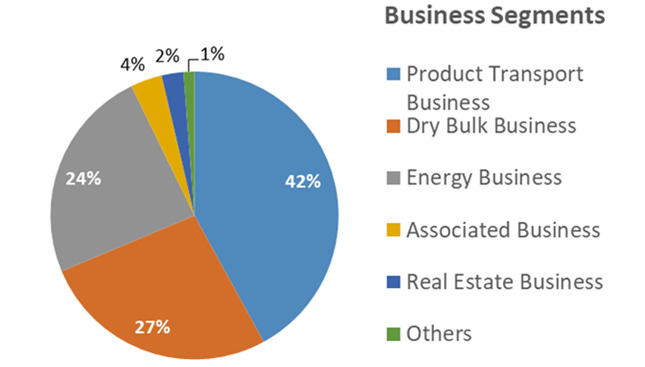

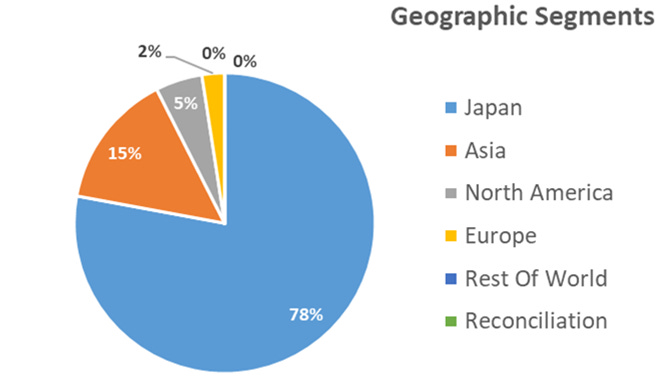

MOL operates their fleet of almost 800 vessels through the following four segments: Dry Bulk, Energy, Product Transport, Wellbeing and Lifestyle. The Dry Bulk segment manages 276 vessels that includes dry bulkers, oil tankers, LNG carriers, and car carriers. The Energy Transport segment covers 367 vessels made up of tankers, steaming coal carriers, LNG carriers and offshore business. The Product Transport segment comprises of 152 vessels in the shape of containerships, car carriers, and coastal Roll-on/Roll-off ‘RoRo’ ships. The Wellbeing and Lifestyle, as known as ‘Associated Businesses’ segment includes real estate, cruise ships, tugboats, and trading in the form of two LNG-fueled ferries, one of them under the name of ‘Sunflower Kurenal,’ and a cruise ship named ‘Nippon Maru.’ The Others segment handles ship maneuvering, management, shipping, finance, and shipbuilding. Percentage of segments and markets serviced are on display in Figures 1 and 2.

Figure 1. - Business Segments with respective percentages as of November 1(st), 2023

Figure 2. – Geographic Segments with respective percentage as of November 1(st), 2023

Revenue drivers

MOL revenue drivers are primarily tied to its various operational segments and the global shipping market. Here are some of its key revenue drivers:

Container Ship Business Segment: In fiscal year 2022, MOL earned the highest profit from its container ship business segment, amounting to approximately ¥620.17 billion [3].

Dry Bulk Carrier Segment: MOL operates in the dry bulk carrier segment, engaging in the operation of dry bulk carriers, which is a significant part of its international shipping business [4].

Maritime Transportation: Maritime transportation is one of the categories under which MOL operates as a substantial revenue driver [5].

Market Demand and Shipping Rates: The global demand for shipping services and the prevailing shipping rates significantly impact MOL's revenues. The company's revenue can fluctuate based on global economic conditions, trade volumes, and shipping rates. Below there are more detailed breakdown of its revenue sources:

Freight rates: In the fiscal year ended March 31, 2023, freight rates accounted for 62% of MOL's total revenue.

Logistics fees: Logistics fees accounted for 38% of MOL's total revenue in the fiscal year ended March 31, 2023.

Cost drivers

MOL cost drivers could be inferred from the nature of its operations and industry standards. Some potential drivers that become influential the most are:

Fuel Costs: A significant cost for shipping and logistics companies that fluctuates in global market conditions. A scenario analysis projects a cost of ¥40 billion of monetary impact if all vessels continue to use oil fuels by 2050 [6].

Operational and Transportation Costs: The cost of operating a fleet of vessels, including maintenance, repairs, and crew wages, as well as potential changes in marine cargo movements can represent an expense of around ¥10 billion by 2050 [6].

Transportation of Commodities: MOL transports a variety of commodities including resources, energy, raw materials, and finished products. The cost of handling and transporting different types of cargo, especially hazardous or perishable goods, can be higher [7].

Competitor analysis

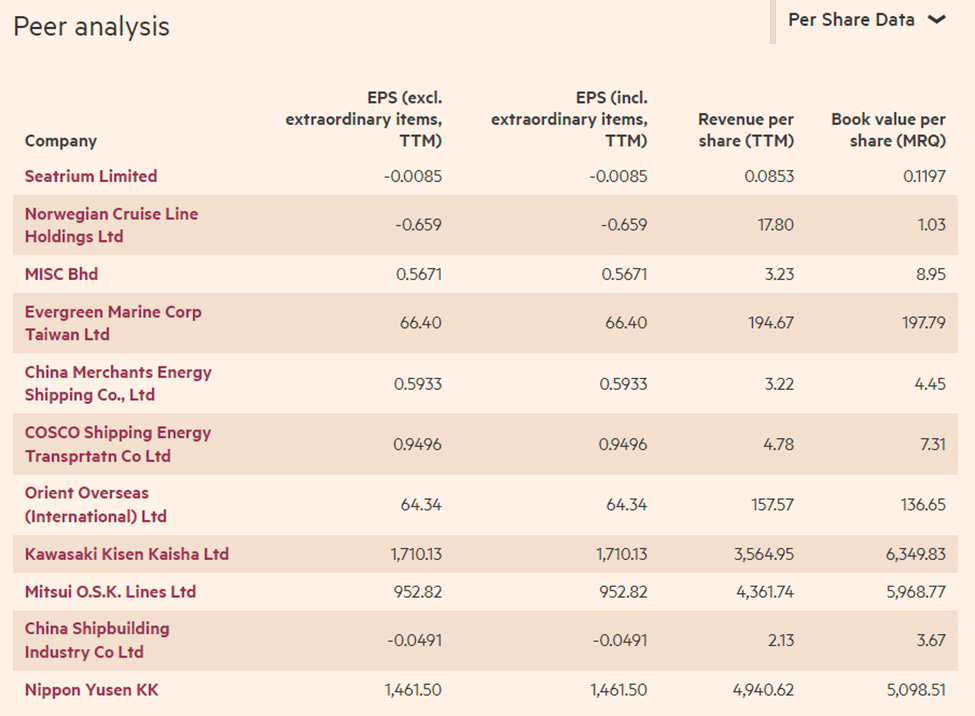

Ten players highlight a comparison on table 4 highlighting metrics like revenue per share and book value per share,

Table 4.- Player comparison with metrics of revenue and book value

Upon further review, the competitors with certain influence in the APAC region can be discussed on table 5,

Table 5.- Competitors Multiples of Mitsui O.S.K. Lines vis-à-vis its regional peers

Economic moat

The '7 Powers' framework by Hamilton Helmer provides a methodology for analyzing the enduring competitive advantages of companies. The powers identified in this framework are Scale Economics, Switching Costs, Cornered Resources, Counter Positioning, Branding, Network Effects, and Process Power [8]. Applying this framework to MOL offers insights into the company's strategic position within its industry.

Scale Economics: MOL, being one of the largest shipping companies globally, enjoys economies of scale in operations, procurement, and other areas, which lower per unit costs as output increases.

Switching Costs: The long-term contracts like the charter deal with JERA for a new-building LNG carrier, as mentioned in their recent press releases, might create a switching cost for customers [9].

Cornered Resource: MOL's strategic investments in clean energy projects like the joint venture with Ascension Clean Energy, the investment in Delfin Midstream Inc., and partnerships for the development of Liquefied Hydrogen Supply Chain could be seen as efforts to corner resources that are critical for the clean energy transition in maritime transportation [9] [10] [11].

Counter Positioning: MOL's various initiatives, like exploring the use of e-methanol, hydrogen-fueled vessels, and partnership for offshore wind and green hydrogen opportunities exhibit a strategy of counter positioning against traditional maritime operators by embracing cleaner and renewable energy technologies [9].

Branding: The introduction of new cruise line brand "MITSUI OCEAN CRUISES" and winning the Good Design Award 2023 for Japan's 1st LNG-fueled Ferries are steps towards building a strong brand that resonates with sustainability and innovation [9].

Network Effects: While not explicitly mentioned, the collaborations and Memorandum of Understandings with various organizations might help in creating a network that adds value to all the participants as more join the network.

Process Power: Initiatives like the introduction of training programs for SEP and SOV crew, establishment of Indonesian Seafarers Manning Company, and partnerships for development of CCS value chain reflect on process power by continuously improving and innovating the operational and managerial processes [9].

This analysis aligns with the recent developments and initiatives of MOL towards clean energy, sustainability, partnerships, and innovations, positioning itself for a resilient and sustainable future. While MOL has built substantial moats through its strategic initiatives, there could be potential weaknesses or challenges in maintaining or enhancing these moats over time. Let's delve into each power and identify possible weaknesses:

Market Volatility on scale economics. -Maritime transportation is subject to global economic conditions. Economic downturns or disruptions in trade can erode the benefits of scale economics.

Contractual Expirations on switching costs: Long-term contracts will eventually expire, and clients might re-evaluate their options which could potentially lower the switching costs.

Resource Scarcity for cornered resources: While investing in clean energy ventures is strategic, the scarcity and competition for clean energy resources could challenge MOL's cornering attempts.

Technological Advancements for Counter Positioning **: The pace of technological advancements in clean energy and maritime transportation could outpace MOL’s ability to adapt, potentially diluting the counter positioning advantage.

Brand Perception: Maintaining a strong brand in a traditional industry while transitioning towards sustainability can be challenging and may require substantial investment in marketing and public relations.

Competitive Collaborations on Network Effects: Other maritime operators might form similar or stronger networks, and the exclusivity or benefits of MOL's network might be challenged.

Operational Risks on Process Power: Maritime operations are subject to various risks including accidents, piracy, and regulatory compliance. These risks can potentially disrupt MOL’s processes and erode the process power advantage.

These weaknesses are hypothetical and contingent on various external and internal factors. Addressing these challenges requires a robust strategy, continuous innovation, and effective risk management practices to ensure the sustainability and enhancement of MOL's competitive moats.

ESG

Environmental

MOL has a mixed record on environmental issues. The company has made some progress in reducing its greenhouse gas emissions, but it still has a long way to go. MOL has also been involved in several oil spills, which have damaged the environment.

Greenhouse gas emissions: MOL has set a goal of reducing its greenhouse gas emissions by 30% by 2030 and by 50% by 2050. The company is investing in new technologies, such as LNG bunkering and offshore wind power, to help achieve these goals.

Oil spills: MOL has been involved in several oil spills, including MV Wakashio ran aground on a coral reef and spilled oil at the South of Mauritius on July 25, 2020. As consequence, MOL pledged ¥1 billion or ~US$9.37 million to the Mauritius Natural Environment Recovery Fund, MNERF, for the purpose of "funding environmental projects and support the local fishing community.” The president of MOL cited the payment as their "social responsibility" while apologizing for the damage as MOL expected that ship owner Nagashiki Shipping to contribute to MNERF [12].

Social

MOL has a good record on social issues. The company is committed to providing a safe and healthy working environment for its employees. MOL also supports a few social and community initiatives.

Employee relations: MOL has a strong commitment to employee safety and well-being. The company has a number of programs in place to prevent accidents and injuries, and it provides its employees with access to health care and other benefits.

Community involvement: MOL supports a number of social and community initiatives, including education, healthcare, and environmental protection. The company also provides disaster relief assistance when needed.

Governance

MOL has a strong corporate governance structure. The company has a board of directors that is composed of independent directors, and it has a number of committees that oversee various aspects of the company's operations.

MOL's board of directors is composed of 11 directors, including 7 independent directors as Table 2 shows at the beginning of this writing. The board is responsible for overseeing the company's overall strategy and performance.

Overall ESG Score

The company has made some progress on environmental issues, but it still has a long way to go. MOL has a good record on social issues, and it has a strong corporate governance structure.

Valuation

To find out the discount rate in our DCF model, we calculated the Weighted Average Cost of Capital for MOL. Using the public data from Yahoo Financials and Japan market factors, we arrive at a 3-year target price of ¥6,576 for a 69% upside from the current price of ¥3,883.00 and internal rate of return of 19.20% at the time of writing. The 5-year target price of ¥8,330.04 represents an 115% upside and 16.49% internal rate of return. It is worth discussing that a higher 5-yr IRR vis-à-vis a 3-yr IRR can manifest due to the complexity of projects and the prevalent market risk that is generally higher for longer-term investments. Accessory calculations of WACC and price projections on Table 6 and 7, and dynamic model upon request.

Table 6.- WACC calculation and assumptions given MOL local market conditions

Table 7.- DCF calculations with 3-yr & 5-yr target prices. Dynamic Model upon request

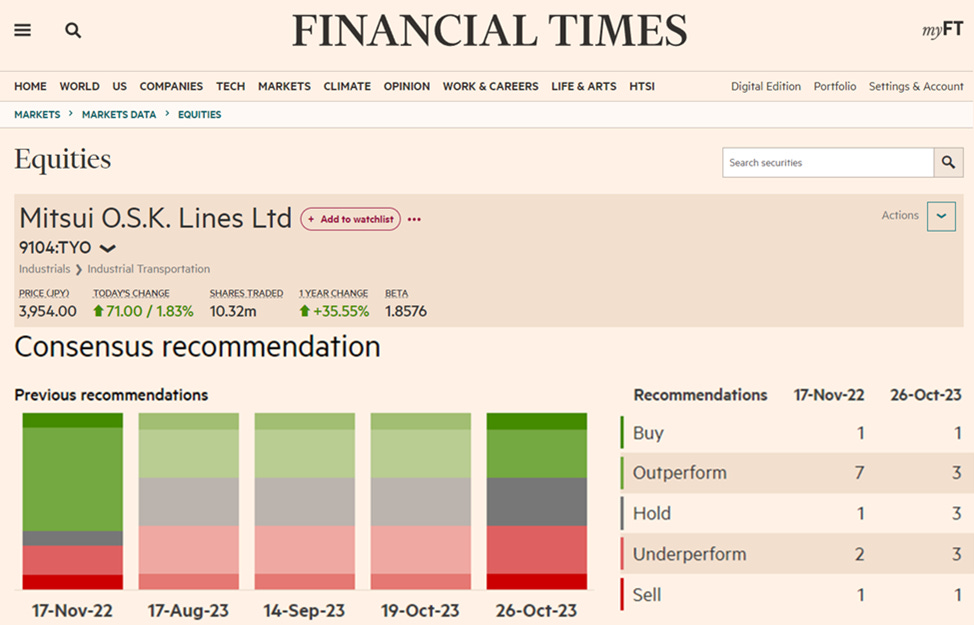

A corollary to this analysis is available on Figure 4 that shows a consensus recommendation dating back to November 2022, courtesy of Financial Times,

Figure 4.- Corollary comparison of consensus recommendations, courtesy of FT.com

Risks and mitigation

For MOL, let’s discuss through the following four lenses of Operational, Financial, External, and Strategic risks.

Operational Risks

Shipping Accidents: Robust safety protocols, continuous staff training, and investment in modern navigation and communication systems.

Environmental Compliance: Compliance with international maritime environmental regulations, investment in cleaner fuel technologies, and active engagement in industry sustainability initiatives.

Equipment Failures: Regular maintenance schedules, investment in modern and reliable equipment, and comprehensive insurance coverage.

Financial Risks

Fuel Price Volatility: Fuel hedging strategies, investment in fuel-efficient and alternative fuel technologies.

Currency Fluctuations: Hedging foreign exchange risk, diversifying operations across different geographical regions.

Credit Risk: Stringent credit assessments, diversified customer base, and insurance against credit defaults.

External Risks

Global Economic Conditions: Diversification of services and geographical operations, flexible business strategies to adapt to changing market conditions.

Trade Restrictions: Geographical diversification, active monitoring of international trade policies, and engagement in industry advocacy.

Competitive Pressure: Focus on specialized shipping services, long-term contracts, and strategic partnerships to ensure a steady stream of business.

Strategic Risks

Technological Disruptions: Investment in technology to improve operational efficiency, strategic partnerships with tech firms, and keeping abreast of industry technological advancements.

Reputational Risks: Maintaining high standards of corporate governance, transparency in operations, and active stakeholder engagement.

Climate Change Implications: Environmental sustainability initiatives, adaptation strategies to cope with changing weather patterns affecting shipping routes.

Conclusion

In conclusion, Mitsui O.S.K. Lines (MOL) demonstrates various elements of the 7 Powers framework in its strategic positioning within the maritime industry. It benefits from scale economies, network effects, and a strong brand, while also adapting to industry changes through counter positioning. I recommend that investors buy MOL stock for the long term as it is well-positioned to benefit from growth in the increasing demand for transporting LNG across APAC, and the current sustainability efforts across several markets.

Disclaimer

The information provided herein concerning Mitsui O.S.K. Lines, MOL, is for informational purposes only and is not intended to be, nor should it be construed or used as financial, legal, tax, or investment advice, nor should this information be used or considered as an offer to sell, or a solicitation of any offer to buy, any security or other financial instrument related to MOL. Past performance of MOL is not indicative of future results. Investments or strategies mentioned herein may not be suitable for all investors. The views and opinions expressed herein are those of the author and do not necessarily reflect the views of MOL, its management, or any other individual or entity. It is recommended that investors independently research and consider the risks involved before investing in MOL securities and consult with appropriate tax, legal, and/or financial advisors. Invest responsibly. Your discretion is advised.

References

[1] Southeast Asia is set to drive up demand for natural gas, https://www.cnbc.com/2023/10/03/southeast-asia-to-be-key-drivers-of-lng-market-by-end-of-decade.html

[2] Shell boss backs ‘leaner’ operation in defending renewables strategy shift, https://www.ft.com/content/37f2f393-4542-43b3-971d-75fe1acbfd97

[3] Financial Statement FY2022, https://www.mol.co.jp/en/ir/data/fs/pdf/fs_2023.pdf

[4] Revenue by segment courtesy of Statista, https://www.statista.com/statistics/1061935/mitsui-osk-lines-revenue-distribution-by-segment/#:~:text=Japan%20Survey%20time%20period%20fiscal,year%20Special%20properties%20consolidated%20figures

[5] MOL profile courtesy of Financial Times, https://markets.ft.com/data/equities/tearsheet/profile?s=9104:TYO#:~:text=Mitsui%20O,1%2C%20Toranomon

[6] MOL Report 2023, https://www.mol.co.jp/en/ir/data/annual/pdf/ar-e2023.pdf

[7] Costs by segments courtesy of GlobalData, https://www.globaldata.com/company-profile/mitsui-o-s-k-lines-ltd/analysis/#:~:text=Business%20Description%20Mitsui%20OSK%20Lines,coastal%20liners%2C%20and%20cruise%20ships

[8] 7 Powers: The Foundations of Business Strategy, https://blas.com/7-powers/#:~:text=7%20Powers%3A%20The%20Foundations%20of,is%20written%20by%20Blas%20Moros

[9] Mitsui Press Releases 2023, https://www.mol.co.jp/en/pr/2023.html

[10] Mitsui Financials by Yahoo, https://finance.yahoo.com/news/mitsui-o-k-lines-ltd-004000734.html#:~:text=BATON%20ROUGE%2C%20La,CHW%29%20today

[11] Delfin has agreement with Mitsui OSK, https://www.globenewswire.com/en/news-release/2023/06/08/2685156/0/en/Delfin-Enters-Strategic-Investment-Agreement-with-Mitsui-O-S-K-Lines.html#:~:text=HOUSTON%2C%20June%2008%2C%202023%20,%28%E2%80%9CMOL

[12] Japan Ship Operator pay over oil spill, https://www.washingtonpost.com/business/japan-ship-operator-to-pay-9m-over-mauritius-oil-spill/2020/09/11/a106b8fe-f410-11ea-8025-5d3489768ac8_story.html