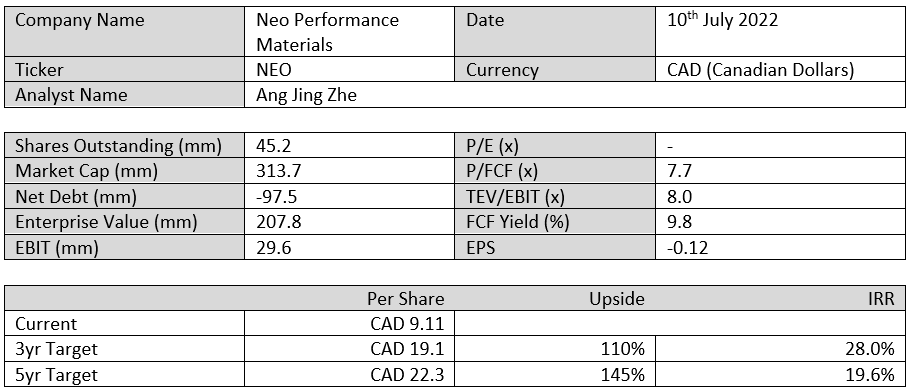

Initial Report: Neo Performance Materials (NEO), 145% 5-yr Potential Upside (EIP, Jingzhe ANG)

NEO’s business at current valuations looks very attractive. Let's look at Jingzhe's take on this rare earth supply chain company.

LinkedIn | Jingzhe ANG

Company History and Business Overview

Neo Performance Materials and MP Materials used to operate under the single entity, Molycorp, prior to the latter’s bankruptcy in 2015. While MP Materials purchased the mining assets (Mountain Pass mine), Neo Performance Materials acquired Molycorp’s downstream processing infrastructure. Listed on the Toronto Stock Exchange in 2017, NEO manufactures industrial materials such as magnetic powders, bonded magnets, specialty chemicals, and metals and alloys. Their products serve these key end markets - automobiles, factory automation (esp. semiconductors), water treatment and aerospace.

Their main strategy is to vertically integrate and establish an ex-China rare earth elements (REE) “mine to magnets” sustainable supply chain. NEO is currently the only company globally that operates dual supply chains both inside and outside of China for REE separation and REE advanced materials. Moreover, they operate the sole REE separation and rare metal processing facility in Europe, whilst also just starting construction of a sintered REE magnet manufacturing plant beside their existing Estonian facility, to begin production in 2025.

Business and Segments

NEO has 3 business segments – namely Magnequench, Chemical & Oxides, and Rare Metals. Crucially, all the segments contribute to modern technologies that enhance efficiency and sustainability – from REE magnets that power various motors crucial to the electrification process, to advanced industrial materials used in technologies that reduce air and water pollution.

Competitors, Customer Concentration and Competitive Advantage

Key competitors, customer concentration and competitive advantage of each business segment are as listed:

Growth Driver and Industry Outlook

NEO’s growth in the coming 3-5 years will be driven by the secular growth trends in the REE magnets industry – which are increasingly critical as the world continues embarking on electrification, renewable energy generation and continuous sourcing for more energy efficient components in advanced technological applications.

REE magnets are permanent magnets that exhibit the best size to strength ratio, and are indispensable for applications across industries who want to raise energy efficiency in a cost-effective manner

REE permanent magnets market projected to grow at a CAGR of 9% from 2023 to 2033

Inflection in demand for REE Neodymium (NdFeB) magnets projected in mid/later half of this decade, driven by end product usage in EVs and wind turbine generation

Source: NEO company investor presentation and annual information reports

Source: Shin-Etsu Chemicals Annual Report

Moreover, the current REE supply chain from mining to processing, separation and REE magnet manufacturing is simply untenable given China’s monopoly, particularly in the downstream value-added segments. With the increasing policy-driven implications of near-shoring of manufacturing capacity in the western bloc (EU and US), coupled with market cognisance over the importance of supply chain diversification (especially so in the REE industry which was victim to Chinese weaponization in 2010), ex-Chinese suppliers of REE value added products should easily enjoy favourable policy support and volume uptake.

Source: Energy Fuels Annual Report

Investment Thesis

NEO’s expansion to downstream, higher value-added segments of the REE value chain that serve end markets with secular growth trends (EVs and wind turbines in particular) will result in both sales growth and margin expansion. Historically, Magnequench has posted the best margins across all 3 segments -> majority are pass-through pricing contracts for this segment (margin spread should increase as sintered REE magnets are the highest performing magnets due to its highest energy density)

Context: Bonded REE magnets gives greater flexibility to shapes that can be made, are relatively easier and cheaper to make VS Sintered REE magnets that have the highest energy density but are more brittle and complex to make (used in high performance applications such as EV traction motors)

Management expects Phase I of new Estonian REE sintered magnet manufacturing capacity to be operational in 2025 to bring in $135-160mn of incremental revenue. Based on existing conversations with customers, significantly higher demand over Phase I capacity has prompted management to plan a Phase II (TBC) that would bring in an additional $203-240mn of incremental revenue.

Magnequench have the technical expertise to do so given their decades of experience and technological know-how in the adjacent bonded REE magnet market.

Global leader in Neodymium magnet powder production (50-55% market share), retaining monopoly in high end technological applications even with Chinese players cornering the market in low end segments ever since IP expired in 2014.

NEO is the only ex-China “mine-to-magnet” vertically integrated manufacturer post-completion of its Phase I sintered REE magnet manufacturing facility, and will enjoy government support (aligned with near-shoring of manufacturing) and certainty of volume uptake (need for supply chain diversification for automakers)

NEO is the first grant recipient of EU’s “Just Transition Fund”, with $18.7mn awarded to the construction of Phase I facility to offset 15-20% of Capex

Financials

NEO has a great balance sheet, with a net cash position of $97.5 million and total debt/ TTM EBITDA of 0.66x. Management is confident of sustaining an annual capex spend of between $8-10 million to support all existing operating segments including growth initiatives within the segment, not to mention favorable policy tailwinds in the form of western government support for establishing an ex-China REE supply chain which will continue to aid their capex requirements going forward

Received $25 million grant from EU’s Just Transition Fund for construction of REE sintered magnet manufacturing plant in Estonia which covers 20% of project costs.

In the complicated past 5 years of gradually moving away from declining end market applications (legacy core hard disk drive and optical disk drive business) of its main magnet business segment, coupled with extreme volatility in the REE metals market that impacted demand for REE oxides, and the more recent drawdown in the automobile markets, NEO has managed to retain a healthy revenue growth CAGR of 8.1% (above industrial metals average of 5-6% and substantially ahead of competitors such as Proterial with CAGR of 2.5%)

Valuation

NEO currently trades at 4.9x EV/EBITDA, which is below their past 5-yr average of 6.0x

Using lower end of management’s expected incremental revenues in the range of $135-160 million following the completion of Phase I of the Estonian REE sintered magnet manufacturing capacity in 2025 (just began construction) + Magnequench’s historical average EBITDA margin at around 13% + FY22 EBITDA (no growth in all other segments) + 6.0x EV/EBITDA yields 3-year TP of C$19.1, IRR of 28%.

Assuming Phase II of the Estonian REE sintered magnet manufacturing capacity is fully operational by 2027 (doubles Phase I capacity) and with the same set of assumptions, this yields 5-year TP of C$22.3, IRR of 19.6%.

ESG Considerations (Most Material)

Environmental (E) – Waste and Water Management

The REE industry is notorious for waste contamination and wastewater pollution. In this regard, NEO has been exceptional in its environmental management of existing operating facilities, with 0 non-compliance associated with water quality permits, standards and regulations in 2020 and 2021. Some awards of their operating facilities include:

Estonia REE and rare metal processing facility + Thailand REE magnets production plant awarded Gold Medal from Ecovadis for 2021 sustainability program (top 5% of all facilities globally)

REE magnet production plant in Tianjin China awarded silver medal from Ecovadis for 2021 sustainability program (top 25% of all facilities globally)

Environmental (E) – GHG Emissions

Processing and production of REE related products is energy intensive, and in this regard, NEO has been a standard setter in incorporating renewable energy sources into its production processes. For instance, the Estonia plant obtains 78% of its energy needs from renewable sources, with more than half of their total operational energy consumption in 2021 being obtained from renewable sources (28% steam/ other heating + 27% renewable)

Governance (G) – Compliance with Laws and Regulations

Given its diverse operational footprint and how diversified operations stand at the heart of its “mine to magnet strategy”, compliance with laws and regulations is critical for NEO to expand operations and gain new permits. NEO has a legal team in place that frequently assesses the risk of administrative or judicial sanctions for failure to comply with environmental laws and regulations. It recorded no instances of non-compliance with laws and regulations in 2021. Testament to their clean record is the speed at which the grant was given for the construction of the Phase I facility in Estonia.

Key Risks [Mitigation]

Geopolitical and Supply Chain Risks

As things stand currently, 30% of NEO’s LTM revenue is derived from China and more than 45% of the workforce is in China, which houses their only REE bonded magnet manufacturing facilities. Naturally, this points to the risk of supply chain concentration, in an industry that is prone to REE weaponization from Chinese dominance. Moreover, its operating Estonian plant gets most of its REE feedstock from a Russian supplier, which could lead to disruptions if sanctions pertaining to the war are expanded. [As the main business strategy of NEO continues to develop and play out, supply chain risk will naturally be mitigated as NEO is already the industry’s undisputed leader in carving a supply chain out of China’s REE monopoly, particularly in value added post-mining segments. They are also participating in additional REE feedstock initiatives – Greenland’s Sarfartoq Project, Australia’s Yangibana and Koppamurra Projects]

End Market Concentration

More than 50% of NEO’s revenue should be tied to the automobiles end market, given the use of magnetic powders in various small motor applications in ICE/ Hybrid/ EVs + substantial use of their Chemicals & Oxides product in auto emission catalysts. Such effective sectorial concentration results in high volatility of sales as the cycles turn. [NEO is working on better inventory management to reduce the lead-lag effect on their earnings, and with a more diversified supply chain and an establishment of their “mine-to-magnet” strategy, inventory management should improve with greater visibility across their sources and markets, helping to mitigate the follow-on effects of auto cycles.]

Conclusion

NEO’s business at current valuations looks very attractive, with short term underperformance impacted by aggressive inventory destocking in the key end markets which are experiencing cyclical downturns compounded by a weakening Chinese macro-outlook (automobiles and to a lesser extent, semiconductors, and industrial automation). Moreover, the lead-lag effect due to their inventory management exacerbates the effects of this cyclical downturn and may have contributed to further market mispricing, on top of minimal coverage. However, the medium to longer term prospect looks very bright for an already cash generative business. NEO are in the parallel processes of entering and establishing the first “mine-to-magnet” vertically integrated business based in Europe, which fits into the broader themes of supply chain diversification and de-globalisation (near-shoring of manufacturing capacity especially within the Western bloc EU/US), while its other products serve end markets with secular growth trends (eg. enhancing energy efficiency across multiple advanced technological applications).

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.