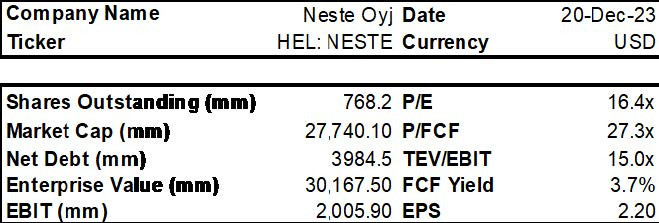

Initial Report: Neste Oyj (HEL: NESTE), 35% 5-yr Potential Upside (EIP, Valerie KANG)

Valerie believes that Neste's innovative and scalable strategies make it an undervalued asset with solid growth potential, making it a strong buy.

1. Key Summary

2. Company overview

Neste is a leading global production of sustainable aviation fuel, renewable diesel, and renewable feedstock solutions for polymer and chemical industries. Neste refines waste, residues, and innovative materials into renewable fuels and produces renewable feedstock for polymers and chemicals. It sells primarily domestically, exporting to North America and Europe. Operating over 1,000 gas stations across Finland, Estonia, Latvia, and Lithuania, it boasts a crude oil refining capacity of 10.5 million tons annually and produces about 3.3 million tons of renewable diesel yearly. While Finland constitutes the bulk of its sales, it serves global markets.

The company's strategy centers on renewable and circular solutions, future readiness, and enhancing competitiveness. It seeks to aid customers in cutting their GHG emissions by a minimum of 20 million tons of CO2 yearly by 2030. By that time, the company aims to establish three robust renewable sectors: Renewable Aviation, Renewable Polymers and Chemicals, and Renewable Road Transportation. To support this, it plans to expand production and raw material platforms, bolstered significantly through organic growth and acquisitions. The focus remains on scaling the company's global sourcing network and capabilities.

a. Business segments

Oil Products: This segment primarily deals with traditional petroleum-based products. It involves refining crude oil into various petroleum-based products like gasoline, diesel, jet fuel, and other chemicals. Neste's Oil Products segment encompasses the refining, marketing, and sale of these conventional oil-based products. The company refines oil in Finland and Bahrain, with a capacity of 15 million t/a. Customers include oil companies and firms marketing oil, fuels, and lubricants. The company’s major crude oil and fossil feedstock sources have been Russia, Norway, and Kazakhstan. At the start of the war in Ukraine,

Neste decided to stop using Russian crude oil entirely and started replacing it with other qualities. The last crude oil cargo with Russian origin was supplied to Neste in July 2022 and the supply contracts ended. Supply contracts for other fossil raw materials from Russia ended at the end of 2022.

Renewable Products: The Renewable Products segment focuses on producing renewable and sustainable alternatives to traditional petroleum-based fuels and chemicals. The 3 main renewable platforms include Renewable Aviation, Renewable Polymers and Chemicals and last but not least, Renewable Road Transportation. Neste is a pioneer in producing renewable diesel, aviation fuel, and renewable chemicals derived from renewable raw materials like waste fats, vegetable oils, and other sustainable feedstocks. This segment emphasizes developing and marketing renewable and low-carbon solutions that reduce greenhouse gas emissions and contribute to a more sustainable future. Neste produces Renewable Diesel in refineries located in Porvoo, Rotterdam, and Singapore, with a capacity of 2.4 million tons. This renewable diesel is sold as a component of bio and diesel fuel to corporate clients in Europe and North America.

Marketing & Services/ Oil Retail: This segment aims to enhance customers experience offers sustainable, low emission and digital solutions for the needs of consumers, companies and partners in Finland and in the Baltic countries. Neste operates about 1,000 service stations in the Baltic Sea region, serving as a key marketing channel for their cleaner products. This network is pivotal in achieving the company's strategic goal of becoming a leading provider of fuel solutions in the region.

b. Geographic Reach

The company production facilities in Finland (headquarters, Singapore, the Netherlands and Bahrain and its retail sales network in Finland, Estonia, Latvia and Lithuania.

c. Revenue drivers

Neste's operations span Oil Products (approx. 45% of sales), Renewable Products (nearly 35%), Marketing and Services (over 20%), and other sectors. Sales stem primarily from Finland (over 30%), North and South America (around 20%), and the Baltic Rim (about 10%).

d. Cost drivers

Feedstock (renewable raw materials) for production of renewable products (Renewable Products segment): Neste's cost drivers in 2022 were significantly influenced by the volatility in the feedstock market, particularly due to geopolitical events affecting vegetable oil prices. The war in Ukraine triggered shortages in rapeseed oil (RSO) and sunflower oil (SFO), compounded by low palm oil (PO) production in Malaysia. Export restrictions from Indonesia further tightened the market, causing unusually high prices until May, which eventually decreased towards the end of the year.

Waste and residue feedstock prices followed a similar trajectory to vegetable oil prices. There was a notable increase in price of animal fat, notably in the US, due to increased demand from the Renewable Diesel sector. However, European AF prices saw a comparatively lesser increase as some sectors shifted to more cost-effective feedstocks. Used Cooking Oil (UCO) prices decreased, particularly in the EU, as large imports, notably from China, flooded the market in the latter part of the year.

Oil prices (Oil Products segment): Neste will require crude oil and fossil feedstock sources for this business segment. Hence, cost drivers is dependent on fluctuations in crude oil prices. Brent crude prices fluctuated drastically, ranging from $76/bbl to $138/bbl due to the Ukraine conflict and subsequent global economic concerns. Prices ended the year at $81/bbl, near the starting level.

Despite volatility, margins strengthened after the Ukraine conflict as refineries shifted away from Russian supply. High natural gas prices impacted refinery utilization but boosted product margins. Strong global fuel demand, especially for middle distillates, supported margins. Demand for Gasoline cracks were strong in the summer but decreased later due to high pump prices affecting demand. Diesel margins remained robust throughout the year due to tight availability in Europe, driven by the shift from natural gas to diesel in various sectors.

As Neste relies on natural gas, increased utility costs, especially for energy-intensive refining processes, can directly escalate Neste's operational expenses. Moreover, higher hydrogen prices, essential in refining processes, can add to the cost burden for Neste, impacting the economics of its refining operations.

3. ESG considerations

Neste places a significant emphasis on sustainability within its business operations, particularly noteworthy as it operates within challenging sectors like oil refining. This commitment is underscored by its exceptional ESG ratings in 2023 across various rating agencies, such as MSCI (AAA), S&P Global (76/100), and Refinitiv (78/100). Notably, Neste maintains consistently high ESG scores both over time and in comparison to industry peers, reflecting its sustained dedication to environmental, social, and governance principles.

a. Environmental

Climate Targets

To achieve carbon-neutral, nature-positive value chain by 2040, Neste plans to focus on its carbon footprint (reduce scopes 1–3 emissions) and handprint (help customers to reduce their GHG emissions with their renewable and circular products).

Footprint: The company aims to reduce emissions in their own production (scopes 1 and 2) by 50% by 2030 reach carbon-neutral production by 2035. Reduce the use phase emission intensity) of sold products by 50% by 2040 compared to 2020 levels (scope 3). Work with suppliers and partners to reduce emissions across their value chain (scope 3).

Handprint: Neste aims provide solutions to help cut customers’ GHG emissions by 20 million tons CO2e annually by 2030. By prioritizing cooperation and innovation, the company remains on track to meet these targets by 2022.

Biodiversity Targets

Neste aims to build a nature-positive value chain by 2040, prioritizing positive impacts on biodiversity over negative ones. The company has set ambitious goals in alignment with this vision:

By 2025, the company aims to generate net positive impacts (NPI) for biodiversity through new activities

By 2035, the company targets no net loss (NNL) of biodiversity stemming from all ongoing activities

Neste's engagement with SBTN signals their dedication to creating science-based targets for nature. Through active participation in the ‘Corporate Engagement Programme’, they strive to align their nature-related goals with SBTN's scientific methodologies, highlighting Neste's commitment to credible and rigorously grounded nature targets.

b. Social

The company has acknowledged the importance of fostering an equitable and inclusive value chain by 2030, prioritizing human rights as a cornerstone of their sustainability vision. This commitment aims to ensure that everyone operates within the value chain with dignity. Internally, Neste upholds this through dedicated policies, employee training, and incentivized learning. The company adheres to its Human Rights principle, outlining its responsibility and ongoing human rights due diligence, regularly updated and enforced. Their structured management process identifies, prevents, and addresses adverse human rights impacts. Continuous monitoring, transparent reporting, and communication demonstrate their commitment to effectively addressing these impacts.

c. Governance

The board of directors demonstrates a gender ratio of 3:1 (male to female), surpassing the average gender diversity in European companies, where approximately 27.3% of board members are female. However, there's a noticeable skew in age distribution, ranging from 50 to 67. Additionally, every board member holds either a university-level degree or a doctorate, reflecting their high level of competence. Among its executive committee there is a lack of gender diversity with a gender ratio of 5:1 (male to female). All senior management possess varied expertise which would enhance the breadth and depth of strategic decision-making within the company.

Neste Group's Performance Management Process is integral to achieving its strategic goals and fostering a performance-driven culture. It involves evaluating financials and KPI-related data against the strategic objectives and business plans, steering necessary actions throughout the year. However, there's a lack of disclosure and breakdown regarding the specific KPIs tracked by senior management.

4. Competitor analysis

a. Economic moat

Neste's economic moats are multifaceted, encompassing its niche business with product diversification strategy, strong reputation, and steadfast focus on ESG principles. The company's specialization in renewable fuels and diversified portfolio across Oil Products, Renewable Fuels, and Marketing & Services creates a unique market presence, bolstering its competitive edge. Additionally, Neste's sterling reputation, built upon delivering quality products and ethical business practices, solidifies customer trust and acts as a barrier to potential competitors. Furthermore, its consistent high ESG ratings across various agencies signify its commitment to sustainable practices, attracting stakeholders inclined towards environmentally responsible investments and partnerships, further fortifying its market position.

5. Investment thesis

a. Emerging as a pioneering market leader in renewable fuels through ambitious energy expansion targets

Neste production capacity targets: Neste's current global production capacity of renewable products is 3.3 million tons annually. The Singapore refinery expansion effectively doubles Neste’s production capacity in the region. Coupled with growth initiatives in Singapore and Martinez, the company aims to elevate its total nameplate capacity of renewable products to 5.5 million tons by early 2024. Marathon Petroleum's former refinery in Martinez, California, has been repurposed into a renewable diesel production facility through its joint venture with Neste. Known as the Martinez Renewable Fuels Facility, it currently operates at a capacity of 260 million gallons per year. Further expansion is anticipated, with additional production capacity projected to be operational by the end of 2023, elevating the total capacity to approximately 730 million gallons per year of renewable fuels.

Global shift towards renewable energy solutions has propelled biofuels into the spotlight: The IEA projects a 28% increase, equal to 41 billion liters, in global biofuel demand from 2021 to 2026. Policies in the US and Europe are expected to nearly triple demand for renewable diesel, also known as hydrogenated vegetable oil (HVO) in Europe. However, uncertainties exist due to government responses to high feedstock prices, which might relax or delay biofuel blending mandates, potentially reducing demand. Yet, medium-term policy discussions in the US, Europe, India, and China suggest the potential for more than doubling biofuel demand growth in an accelerated scenario.

Potential for SAF in aviation industry: In 2021, member airlines of the International Air Transport Association (IATA) passed a resolution committing to achieve net zero carbon emissions by 2050. To realize this objective, IATA estimates that Sustainable Aviation Fuel (SAF) could potentially contribute around 65% of the necessary emissions reduction for aviation to attain net-zero status by 2050. The demand for SAF is soaring, with every drop of SAF manufactured has been purchased and utilized. In 2023, SAF contributed $756 million to a record-breaking fuel expenditure. Over 43 airlines have committed to utilizing approximately 16.25 billion liters (13Mt) of SAF in 2030, and new agreements continue to be announced frequently.

Neste’s on the move with SAF deals: The completion of Neste's sustainable aviation fuel (SAF) plant expansion in Singapore solidifies the country's position as the world's largest SAF producer. This facility, an expansion of Neste's existing renewable diesel plant in Singapore, now has the capability to produce an estimated 1 million metric tonnes of SAF. Moreover, Neste has secured contracts with several airlines for SAF. Boeing will purchase 5.6 million gallons (21.2 million litres) of blended SAF, Wizz Air has struck a deal for SAF, and Bell collaborates with Neste in testing SAF for helicopters. Neste and Viva Aerobus, the Mexican ultra low-cost carrier, have inked a new purchase agreement for one million liters (264,000 gallons) of Neste MY Sustainable Aviation Fuel™.

b. Robust research and development capabilities fortified by strategic partnerships, co-innovation, and ecosystem collaborations

Collaborating extensively with global universities and research centers like Aalto University, Åbo Akademi University, and VTT, Neste focuses on bolstering expertise in the Finnish chemical industry while driving growth in renewable products and low-carbon solutions. Emphasizing collaborative innovation, Neste engages with industrial technology partners and startups, leveraging their R&D and engineering proficiency to co-develop and commercialize groundbreaking innovations. Furthermore, the establishment of the Innovation Center in Singapore solidifies Neste's global R&D prowess, particularly targeting the burgeoning Asia-Pacific region's market. Recognizing the potential in ASEAN's abundant biomass resources, Neste eyes a stable biofuel feedstock supply, crucial for accommodating the region's burgeoning biofuel market growth as per the 7th ASEAN Energy Outlook (AEO7), which predicts a faster biofuel consumption growth rate (4.7%) than oil (4.4%), underlining the imperative to phase out fossil fuel-powered vehicles.

c. Diversified Portfolio across Oil Products, Renewable Fuels, and Marketing & Services, presents a compelling long-term investment opportunity

The Marketing & Services division serves as a comprehensive one-stop shop, offering a diverse range of customer-centric services to enhance convenience and experience. The brand's strength, coupled with an extensive station network in Finland and the Baltic countries, enables the provision of innovative solutions like Neste Charge and Neste MY Carbon Footprint service, creating added value for both individual and B2B customers.

Investment gap for sustainable fuels. McKinsey. 2021.

Moreover, Neste's strategic focus on sustainable transportation aligns with evolving market demands. According to a 2022 McKinsey report, even in a landscape where electric vehicles (EVs) dominate around 75% of total vehicle sales by 2030, achieving regulatory greenhouse gas (GHG) reduction targets in transportation necessitates a substantial contribution from sustainable fuels. The projected tripling of demand for sustainable fuels over the next two decades further substantiates this trend, highlighting the market's growing appetite for eco-friendly energy solutions.

Neste's proactive diversification into renewable energy, notably the marketing of nearly 100% renewable Vegetable-oil based Diesel (HVO), provides a hedge against fluctuations in oil prices. This capability strengthens the company's resilience against market volatility driven by crude oil dynamics. By capitalizing on renewable energy sources, Neste positions itself as a market leader in sustainable fuels, mitigating risks associated with traditional oil price fluctuations and bolstering its long-term investment attractiveness.

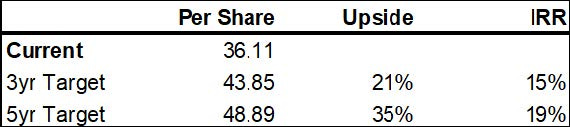

6. Valuation

By doing a simple DCF analysis, we observed that the company is currently undervalued. Some assumptions taken in this analysis include:

WACC of 10%

Revenue projection based on the assumption that Neste can keep its market share amidst the growing oil refinery and marketing industry

Perpetuity growth of 3%

The analysis led us to the implied share price of US$ 48.89/share, which represents +35.4% of the current share price of US$ 36.11/share.

7. Risks and mitigation

Vulnerability to oil market volatility: Neste's heavy reliance on robust refining margins within its Oil Products segment poses a significant risk. The company's current impressive EBITDA is primarily driven by these margins. Any downturn in oil market conditions, such as a reduction in refining margins, could substantially impact its profitability, potentially leading to a significant decline in earnings.

Neste's strategic diversification into sustainable solutions and digital services serves as an alternative revenue driver. This diversification strategy aims to offset potential losses stemming from crude oil price fluctuations. By expanding into sustainable solutions and leveraging digital services, Neste seeks to create additional revenue streams, reducing its dependency on the inherently volatile oil market and enhancing its resilience against market uncertainties.

Feedstock constraints for production of biofuels: Neste faces feedstock constraints in its production of biofuels, heavily reliant on the availability of sustainable feedstocks, which are presently scarce or unviable. R&D initiatives are necessary to explore and develop additional raw materials for biodiesel production, posing a challenge to the company's renewable business expansion.

Despite the constraints, Neste is rapidly scaling up operations to overcome capacity limitations, evident through upcoming Joint Ventures (JVs) and increased capacities scheduled for 2023. Leveraging incentives like the Biodiesel Tax Credit (BTC) and favourable RIN D4 prices in the US market enhances margins for Neste's sales. Additionally, the company's flexibility in sourcing, shifting between waste and palm oil, and its adept commercial positioning contribute to additional margins. This strategic approach allows Neste to mitigate feedstock-related risks and adapt to changing market conditions, supporting its sustainable biofuels production and business expansion.

8. Conclusion

Neste, a global leader in sustainable fuels, boasts strong refining and renewable diesel capacities, focusing on sustainability and aiding in reducing GHG emissions. Despite oil market volatility, its diversified portfolio across Oil Products, Renewable Fuels, and Marketing & Services presents a compelling long-term investment. However, risks like oil market dependence and feedstock constraints demand attention. Neste's innovative and scalable strategies make it an undervalued asset with solid growth potential, making it a strong buy.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.